Global X ETFs, a leading global provider of Exchange-Traded Funds

(ETFs), today announces the expansion of its European business with

the addition of seven new European UCITS ETFs, listed on London

Stock Exchange and Deutsche Börse Xetra. The new UCITS ETFs reflect

Global X’s strong commitment to the European market and the firm’s

latest move to offer investors around the world intelligent

investment solutions.

Global X, which announced its formal entrance to European

markets in December 2020, is adding to its existing thematic

offering of five UCITS ETFs with the following seven additional

thematic products:

|

Fund Name |

Ticker |

Index |

ExpenseRatio |

|

Global X Robotics & Artificial Intelligence UCITS ETF |

BOTZ |

Indxx Global Robotics & Artificial Intelligence Thematic v2

Index |

0.50 |

% |

|

Global X Cybersecurity UCITS ETF |

BUG |

Indxx Cybersecurity v2 Index |

0.50 |

% |

|

Global X CleanTech UCITS ETF |

CTEK |

Indxx Global CleanTech v2 Index |

0.50 |

% |

|

Global X Autonomous & Electric Vehicles UCITS ETF |

DRVE |

Solactive Autonomous & Electric Vehicles v2 Index |

0.50 |

% |

|

Global X E-commerce UCITS ETF |

EBIZ |

Solactive E-commerce v2 Index |

0.50 |

% |

|

Global X FinTech UCITS ETF |

FINX |

Indxx Global FinTech Thematic v2 Index |

0.60 |

% |

|

Global X Internet of Things UCITS ETF |

SNSR |

Indxx Global Internet of Things Thematic v2 Index |

0.60 |

% |

Luis Berruga, CEO, commented: “Over the past

several years, Global X has developed the infrastructure to be a

leading ETF issuer, not just in the US, but in key markets in

Europe and around the world. This latest launch is representative

of the firm’s rapid European growth and we’re thrilled to be able

to offer investors targeted exposure to companies around the world

driving long-term, paradigm-shifting themes in the form of 12 total

UCITS ETFs.”

“Digital transformation of the global economy continues to be a

major driver of change throughout the value chain, challenging

traditional investment frameworks. Accurately capturing firms

leading in disruptive themes requires a forward-looking investment

approach to identify the fast-growing trends of the next decade,”

said Rob Oliver, Head of Business Development in Europe. “Through

thematic investing, investors can gain targeted exposure to certain

disruptive themes like the Internet of Things (IoT), Robotics and

Artificial Intelligence (AI), E-Commerce, and 5G, and we expect to

see huge investment and advancements in these themes over the next

decade.”

Prospectuses and Key Investor Information

Documents (KIIDs) for these ETFs are available in English at

www.globalxetfs.eu.

This information is not intended to be

individual or personalised investment or tax advice and should not

be used for trading purposes. Please consult a financial advisor or

tax professional for more information regarding your investment

and/or tax situation.

Investing involves risk, including the possible

loss of principal.

Information provided by Global X Management

Company LLC (Global X ETFs or Global X).

This material has been approved as a financial promotion, for

the purposes of section 21 of the Financial Services Market Act

2000 (FSMA), by Resolution Compliance Limited, which is authorised

and regulated by the Financial Conduct Authority (FRN:574048).

Notes to Editors: Information on Individual

Products

BOTZ: Global X Robotics & Artificial Intelligence UCITS

ETF

The Global X Robotics & Artificial Intelligence UCITS ETF

(BOTZ), which follows the Indxx Global Robotics & Artificial

Intelligence Thematic v2 Index, seeks to invest in companies that

potentially stand to benefit from increased adoption of robotics

and artificial intelligence (AI). The fund includes companies

involved with industrial robotics and automation, non-industrial

robots, and autonomous vehicles. Trade conflicts and the Covid19

pandemic led companies to question their supply chain integrity.

Automation may be a catalyst in reshoring, allowing companies to

offset some of the manufacturing costs. Industrial robot sales grew

at a compound annual growth rate (CAGR) of 15% from 2013 to

2019.i

BUG: Global X Cybersecurity UCITS ETF

The Global X Cybersecurity UCITS ETF (BUG), tracks the Indxx

Cybersecurity v2 Index which seeks to invest in companies that

stand to benefit from the increased adoption of cybersecurity

technology. BUG includes companies whose principal business is in

the development and management of security protocols preventing

intrusion and attacks to systems, networks, applications,

computers, and mobile devices. Damages from global cybercrime could

cost US$6tr annually by 2021.ii Cybersecurity will be further

propelled by the growth of machine learning, cloud computing, and

the internet of things.

CTEK: Global X CleanTech UCITS ETF

The Global X CleanTech UCITS ETF (CTEK) tracks the Indxx Global

CleanTech v2 Index. CTEK seeks to invest in companies that stand to

benefit from the increased adoption of technologies that inhibit or

reduce negative environmental impacts. The fund includes companies

involved in renewable energy production, energy storage, smart grid

implementation, residential/commercial energy efficiency, and/or

the production and provision of pollution-reducing products and

solutions. The expansion of electric infrastructure and energy

efficiency technologies could reduce emissions by over 40% of what

is needed to keeping warming within tolerable levels.iii

DRVE: Global X Autonomous & Electric Vehicles UCITS ETF

The Global X Autonomous & Electric Vehicles UCITS ETF (DRVE)

provides exposure to autonomous vehicle technology, electric

vehicles (EV), and EV components and materials which are

transforming the automobile market. DRVE follows the Solactive

Autonomous & Electric Vehicles v2 Index. The fund includes

companies involved in the development of autonomous vehicle

software and hardware, as well as companies that produce EVs, EV

components such as lithium batteries, and critical EV materials

such as lithium and cobalt. With regulatory support, improved

battery technology and advancements in autonomous driving, analysts

estimate 250 million electric vehicles on the road by 2030.iv

EBIZ: Global X E-commerce UCITS ETF

Over the last two decades, e-commerce has emerged from a niche

model to a dominant shopping experience. The Global X E-commerce

UCITS ETF (EBIZ) provides exposures to companies positioned to

benefit from any increased adoption of E-commerce as a distribution

model. Tracking the Solactive E-commerce v2 Index, EBIZ invests in

companies whose principal business is in operating e-commerce

platforms, providing e-commerce software and services, and/or

selling goods and services online. The COVID-19 pandemic has

accelerated the adoption of online shopping among a broader range

of the population, becoming a safer shopping solution for many

consumers and expanded to product categories that historically

lagged in online sales, such as groceries and health care items,

providing a tailwind to the theme.

FINX: Global X FinTech UCITS ETF

The Global X FinTech UCITS ETF (FINX), which follows the Indxx

Global FinTech Thematic v2 Index, strives to invest in companies on

the leading edge of the emerging financial technology sector. The

financial services industry is in a state of transition as it moves

towards a more digital structure. According to a survey by PWC, 49%

of consumers now conduct their banking primarily on their desktop

or smartphone.v FINX targets companies that innovate and transform

established industries like insurance, investing, fundraising, and

third-party lending through unique mobile and digital

solutions.

SNSR: Global X Internet of Things UCITS ETF

The Internet of Things (IoT) refers to the tens of billions of

connected devices that can transmit and receive data over networks.

The Global X Internet of Things UCITS ETF (SNSR) seeks to invest in

companies that stand to potentially benefit from the broader

adoption of the Internet of Things (IoT), as enabled by

technologies such as WiFi, 5G telecommunications infrastructure,

and fiber optics. This includes the development and manufacturing

of semiconductors and sensors, integrated products and solutions,

and applications serving smart grids, smart homes, connected cars,

and the industrial internet. SNSR tracks the Indxx Global Internet

of Things Thematic v2 Index.

About Global X ETFs

Global X ETFs was founded in 2008. For more than a decade, our

mission has been empowering investors with unexplored and

intelligent solutions. Our product lineup features more than 80 ETF

strategies and over $40 billion in assets under management.vi While

we are distinguished for our Thematic Growth, Income and

International Access ETFs, we also offer Core, Commodity, Risk

Management, and Alpha funds to suit a wide range of investment

objectives. Explore our ETFs, research and insights, and more at

www.globalxetfs.eu.

Global X is a member of Mirae Asset Financial Group, a global

leader in financial services, with more than $620 billion in assets

under management worldwide.vii Mirae Asset has an extensive global

ETF platform ranging across the US, Brazil, Canada, Colombia,

Europe, Hong Kong, India, Japan, Korea, and Vietnam with over $70bn

in assets under management.viii

Media Contact

Matt Rogers, JPES

Partnersmatt.rogers@jpespartners.com +44 (0)20 7520 7620

i International Federation of Robotics, “Industrial Robots:

Robot Investment Reaches Record 16.5 billion USD,” Sep 18, 2019ii

Cybercrime Magazine, “Global Cybersecurity Spending Predicted To

Exceed $1 Trillion From 2017-2021,” Jun 10, 2019iii IRENA, “Global

Renewables Outlook: Energy Transformation 2050,” 2020.iv IEA,

“Global EV Outlook 2020,” Jun 9, 2020v PWC, “Digital Banking

Consumer Survey,” Jun 2018vi Global X, as of 10/21/21vii Mirae

Asset, as of June 2021viii Mirae Asset, as of 10/18/21

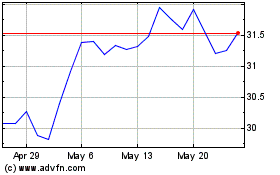

Global X Robotics & Arti... (NASDAQ:BOTZ)

Historical Stock Chart

From Feb 2025 to Mar 2025

Global X Robotics & Arti... (NASDAQ:BOTZ)

Historical Stock Chart

From Mar 2024 to Mar 2025