UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(RULE 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the

Securities Exchange Act of 1934

(Amendment No.

)

Filed by the Registrant x

Filed by a party other than the Registrant ¨

Check the appropriate box:

| ¨ | Preliminary

Proxy Statement |

| ¨ | Confidential,

for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ¨ | Definitive

Proxy Statement |

| x | Definitive

Additional Materials |

| ¨ | Soliciting

Material Pursuant to §240.14a-12 |

Cracker Barrel

Old Country Store, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement,

if Other Than The Registrant)

Payment of Filing Fee (Check the appropriate box):

| x |

No

fee required. |

| |

|

| ¨ |

Fee

paid previously with preliminary materials. |

| |

|

| ¨ |

Fee

computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

On

November 14, 2024, Cracker Barrel Old Country Store, Inc. distributed the following letter to shareholders.

November 14, 2024

Dear [Shareholder]:

We are the independent board members of Cracker

Barrel who are not being targeted in the proxy contest presently being conducted by Sardar Biglari and entities he controls.

As you are likely aware, Institutional Shareholder

Services (ISS) recently recommended that shareholders vote on Cracker Barrel’s “white” card and withhold votes from

Mr. Biglari and his nominee, Milena Alberti-Perez, and also consider withholding votes from two of the Company’s nominees,

Carl Berquist and Meg Crofton. We are writing to urge you to withhold on Ms. Alberti-Perez and Mr. Biglari, as recommended

by ISS, but not to withhold on Mr. Berquist and Ms. Crofton, which could work in Mr. Biglari’s favor

as the vote is counted. Instead, we urge you to vote FOR both Mr. Berquist and Ms. Crofton on Cracker Barrel’s

“white” card.

We believe that withholding votes from all four

nominees would amount to a functional abstention, and that letting the “chips fall where they may” at a critical time for

Cracker Barrel could produce unintended negative consequences.

Because Mr. Biglari controls over 9% of

Cracker Barrel’s stock, if shareholders heed ISS’ advice and withhold their votes against Mr. Biglari and Ms. Alberti-Perez

without affirmatively supporting ALL Cracker Barrel recommended nominees, there is a risk that Mr. Berquist and/or Ms. Crofton

will not be elected once the votes are tallied. In other words, withholding votes from all four contested candidates could facilitate

the election of Mr. Biglari and/or Ms. Alberti-Perez, both of whom ISS unambiguously recommended our shareholders should not

elect to our Board. We strongly believe that our shareholders should vote intentionally for the directors who best represent their interests,

rather than risk that the composition of the Board of Directors comes down to chance.

As we roll out Cracker Barrel’s recently

announced long-term strategic transformation plan, shareholders cannot afford to lose either Mr. Berquist or Ms. Crofton, who,

as we describe below, have driven change while also serving as a much-needed source of stability and institutional knowledge. And shareholders

certainly cannot afford to find that they have unintentionally replaced them with two nominees, Mr. Biglari and Ms. Alberti-Perez,

who ISS recommends shareholders affirmatively reject.

ISS Advises that Mr. Biglari and Ms. Alberti-Perez

Are Not Qualified for Substantive Reasons

We agree with ISS’ rejection of both Mr. Biglari

and his fellow nominee, Milena Alberti-Perez, on substantive grounds. In the case of Mr. Biglari, ISS cites his self-interested

and extremely poor corporate governance track record as the reason he should not be elected. In the Company’s public filings, we

have documented in great detail not only Mr. Biglari’s poor corporate governance track record but also how he has destroyed

shareholder value at other companies. In the case of Ms. Alberti-Perez, ISS cites her ignorance of Cracker Barrel and her lack

of preparation to become a director as disqualifying, particularly given her lack of relevant industry experience. We share these concerns

and believe that Ms. Alberti-Perez’s lack of experience with restaurants, hospitality, retail, or multi-unit consumer facing

businesses would introduce confusion in our boardroom if she were elected and complicate our ability to reinvigorate Cracker Barrel.

Mr. Berquist and Ms. Crofton are

the Wrong Targets

In contrast, ISS justifies potentially withholding

votes from the Company’s nominees, Mr. Berquist and Ms. Crofton, not for objective shortcomings, but essentially because

these directors have the longest tenure on the Board and therefore, in ISS’ view, bear the most responsibility for Cracker Barrel’s

post-pandemic underperformance. While we readily acknowledge our underperformance, withholding support for Mr. Berquist and Ms. Crofton

would amount to punishing the two directors who have, in fact, done the most to help us transform Cracker Barrel’s trajectory.

They are expert directors who have been on the Board only five and seven years respectively, and who have been in positions of Board

leadership for far shorter. Ms. Crofton became the chair of our Nominating and Corporate Governance Committee in November 2021

and Mr. Berquist became our independent Board Chair only in February 2024. They are the beginning of the “new guard”

and not the last remaining members of the “old guard”.

Mr. Berquist and Ms. Crofton have served

and continue to serve as change agents and deserve much of the credit for Cracker Barrel’s refreshed Board and the appointment

of our new CEO. In the spring of 2023, just eighteen months ago and the clearest point in time that ISS cites as the start of the Company’s

underperformance, Cracker Barrel had five directors with tenures of over 10 years. With Mr. Berquist’s support and

under Ms. Crofton’s leadership as the Chair of our Nominating and Corporate Governance Committee, over the past twelve months,

all five of those directors have left or will soon leave the Board. These individuals included our former Board Chair, our former

Compensation Committee Chair, and our former CEO. It is hard to imagine a greater level of commitment to change and accountability

than Mr. Berquist and Ms. Crofton have demonstrated over the past year. To withhold votes from them would be unjustified and

self-defeating.

Shareholders Should Not Risk a Functional

Abstention

Cracker Barrel is addressing its challenges by

focusing on satisfying shifting consumer trends and expectations, enhancing operational execution, and reinvigorating a 55-year-old brand

that holds deep emotional appeal for tens of millions of guests. Shareholders should not risk the loss of either Mr. Berquist’s

or Ms. Crofton’s experience in these realms merely because they are the longest serving members of our systematically refreshed

Board. Similarly, shareholders should not risk replacing Mr. Berquist and Ms. Crofton with an individual who has shown a track

record of subverting governance to his own ends, or an individual who has no demonstrated understanding of our company, our industry,

or consumer brands generally, and who did not even try to educate herself before interviewing to serve on Cracker Barrel’s Board.

We certainly do not believe shareholders should assume this risk unintentionally through a functional abstention.

For all of the above reasons we ask that you

affirmatively vote FOR Mr. Berquist and FOR Ms. Crofton to protect your investment and Cracker Barrel’s

future. We welcome any questions you might have and would be happy to provide any additional insight you might require. In the meantime,

thank you for your serious consideration of this important request and for your continued investment in Cracker Barrel.

Sincerely,

| /s/ Jody Bilney |

/s/ Gilbert Dávila |

/s/ John Garratt |

| |

|

|

| Jody Bilney |

Gilbert Dávila |

John Garratt |

| |

|

|

| /s/ Cheryl Henry |

/s/ Gisel Ruiz |

/s/ Darryl “Chip” Wade |

| |

|

|

| Cheryl Henry |

Gisel Ruiz |

Darryl “Chip” Wade |

###

Forward-Looking Statements

Except for specific historical

information, certain of the matters discussed in this filing may express or imply projections of items such as revenues or expenditures,

statements of plans and objectives or future operations or statements of future economic performance. These and similar statements regarding

events or results that Cracker Barrel Old Country Store, Inc. (“Cracker Barrel” or the “Company”) expects

will or may occur in the future are forward-looking statements concerning matters that involve risks, uncertainties and other factors

which may cause the actual results and performance of the Company to differ materially from those expressed or implied by such forward-looking

statements. All forward-looking information is provided pursuant to the safe harbor established under the Private Securities Litigation

Reform Act of 1995 and should be evaluated in the context of these risks, uncertainties and other factors. Forward-looking statements

generally can be identified by the use of forward-looking terminology such as “trends,” “assumptions,” “target,”

“guidance,” “outlook,” “opportunity,” “future,” “plans,” “goals,”

“objectives,” “expectations,” “near-term,” “long-term,” “projection,” “may,”

“will,” “would,” “could,” “expect,” “intend,” “estimate,” “anticipate,”

“believe,” “potential,” “regular,” “should,” “projects,” “forecasts,”

or “continue” (or the negative or other derivatives of each of these terms) or similar terminology.

The Company believes that the

assumptions underlying any forward-looking statements are reasonable; however, any of the assumptions could be inaccurate, and therefore,

actual results may differ materially from those projected in or implied by the forward-looking statements. In addition to the risks of

ordinary business operations, factors and risks that may result in actual results differing from this forward-looking information include,

but are not limited to risks and uncertainties associated with inflationary conditions with respect to the price of commodities, ingredients,

transportation, distribution and labor; disruptions to the Company’s restaurant or retail supply chain; the Company’s ability

to manage retail inventory and merchandise mix; the Company’s ability to sustain or the effects of plans intended to improve operational

or marketing execution and performance, including the Company’s strategic transformation plan; the effects of increased competition

at the Company’s locations on sales and on labor recruiting, cost, and retention; consumer behavior based on negative publicity

or changes in consumer health or dietary trends or safety aspects of the Company’s food or products or those of the restaurant

industry in general, including concerns about outbreaks of infectious disease; the effects of the Company’s indebtedness and associated

restrictions on the Company’s financial and operating flexibility and ability to execute or pursue its operating plans and objectives;

changes in interest rates, increases in borrowed capital or capital market conditions affecting the Company’s financing costs and

ability to refinance its indebtedness, in whole or in part; the Company’s reliance on a single distribution facility and certain

significant vendors, particularly for foreign-sourced retail products; information technology disruptions and data privacy and information

security breaches, whether as a result of infrastructure failures, employee or vendor errors or actions of third parties; the Company’s

compliance with privacy and data protection laws; changes in or implementation of additional governmental or regulatory rules, regulations

and interpretations affecting tax, health and safety, animal welfare, pensions, insurance or other undeterminable areas; the actual results

of pending, future or threatened litigation or governmental investigations; the Company’s ability to manage the impact of negative

social media attention and the costs and effects of negative publicity; the impact of activist shareholders; the Company’s ability

to achieve aspirations, goals and projections related to its environmental, social and governance initiatives; the Company’s ability

to enter successfully into new geographic markets that may be less familiar to it; changes in land, building materials and construction

costs; the availability and cost of suitable sites for restaurant development and the Company’s ability to identify those sites;

the Company’s ability to retain key personnel; the ability of and cost to the Company to recruit, train, and retain qualified hourly

and management employees; uncertain performance of acquired businesses, strategic investments and other initiatives that the Company

may pursue from time to time; the effects of business trends on the outlook for individual restaurant locations and the effect on the

carrying value of those locations; general or regional economic weakness, business and societal conditions and the weather impact on

sales and customer travel; discretionary income or personal expenditure activity of the Company’s customers; implementation of

new or changes in interpretation of existing accounting principles generally accepted in the United States of America (“GAAP”);

and other factors described from time to time in the Company’s filings with the Securities and Exchange Commission (the “SEC”),

press releases, and other communications. Any forward-looking statement made by the Company herein, or elsewhere, speaks only as of the

date on which made. The Company expressly disclaims any intent, obligation or undertaking to update or revise any forward-looking statements

made herein to reflect any change in the Company’s expectations with regard thereto or any change in events, conditions or circumstances

on which any such statements are based.

Important Additional Information and Where to Find

It

On October 9, 2024, Cracker

Barrel filed a definitive proxy statement on Schedule 14A (the “Proxy Statement”) and an accompanying WHITE proxy card in

connection with the solicitation of proxies for the 2024 Annual Meeting of Cracker Barrel shareholders (the “Annual Meeting”).

INVESTORS AND SHAREHOLDERS ARE STRONGLY ENCOURAGED TO READ THE PROXY STATEMENT (INCLUDING ANY AMENDMENTS OR SUPPLEMENTS THERETO) AND

OTHER RELEVANT DOCUMENTS FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY AS THEY CONTAIN OR WILL CONTAIN IMPORTANT INFORMATION. Shareholders

may obtain copies of these documents and other documents filed with the SEC by Cracker Barrel for no charge at the SEC’s website

at www.sec.gov. Copies will also be available at no charge in the Investors section of Cracker Barrel’s corporate website at www.

crackerbarrel.com.

Participants in the Solicitation

Cracker

Barrel, its directors and its executive officers will be participants in the solicitation of proxies from Cracker Barrel shareholders

in connection with the matters to be considered at the Annual Meeting. Information regarding the names of Cracker Barrel’s directors

and executive officers and certain other individuals and their respective interests in Cracker Barrel by security holdings or otherwise

is set forth in the Proxy Statement. To the extent holdings of such participants in Cracker Barrel’s securities have changed since

the amounts described in the Proxy Statement, such changes have been reflected on Initial Statements of Beneficial Ownership on Form 3,

Statements of Change in Ownership on Forms 4 or Annual Statement of Changes in Beneficial Ownership of Securities on Forms 5 filed with

the SEC. Copies of these documents are or will be available at no charge and may be obtained as described in the preceding paragraph.

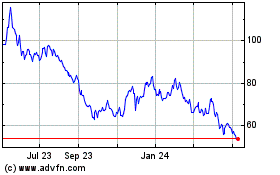

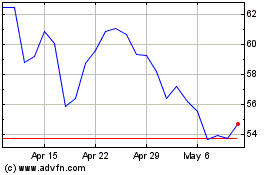

Cracker Barrel Old Count... (NASDAQ:CBRL)

Historical Stock Chart

From Oct 2024 to Nov 2024

Cracker Barrel Old Count... (NASDAQ:CBRL)

Historical Stock Chart

From Nov 2023 to Nov 2024