UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

SCHEDULE

14A

(Rule

14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☐

Filed by a Party other than the Registrant ☒

Check the appropriate box:

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☐ | Definitive Proxy Statement |

| ☒ | Definitive Additional Materials |

| ☐ | Soliciting Material Under § 240.14a-12 |

| CRACKER BARREL OLD COUNTRY STORE, INC. |

(Name of Registrant as Specified In Its Charter)

|

| |

BIGLARI CAPITAL CORP.

THE LION FUND II, L.P.

BIGLARI HOLDINGS INC.

FIRST GUARD INSURANCE COMPANY

SOUTHERN PIONEER PROPERTY AND CASUALTY INSURANCE COMPANY

BIGLARI REINSURANCE LTD.

BIGLARI INSURANCE GROUP INC.

SARDAR BIGLARI

MILENA ALBERTI-PEREZ

MICHAEL W. GOODWIN

|

(Name of Persons(s) Filing Proxy Statement, if other than the Registrant)

|

Payment of Filing Fee (Check all boxes that apply):

| ☐ | Fee paid previously with preliminary materials |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

Biglari Capital Corp.,

together with the other participants named herein (collectively, “Biglari”), has filed a definitive proxy statement and accompanying

GOLD universal proxy card with the Securities and Exchange Commission (the “SEC”) to be used to solicit votes for the

election of its highly-qualified director nominees at the 2024 annual meeting of shareholders (the “Annual Meeting”) of Cracker

Barrel Old Country Store, Inc., a Tennessee corporation (the “Company”).

Item 1: Biglari sent the following

email to shareholders of the Company:

Any firm that uses Biglari

Holdings’ governance profile as an excuse not to support Sardar Biglari’s candidacy is doing a disservice to Cracker Barrel

shareholders. The right governance requires a structure suitable for the particular needs of the business and the talents of management

involved. Biglari Holdings is a controlled company under NYSE listing rules, and its shareholders willingly tendered their

shares, resulting in its current governance structure. Subsequently, Mr. Biglari successfully turned around Steak n Shake and

generated significant returns for Biglari Holdings shareholders (see table below). Cracker Barrel has not accomplished the same. In any

case, this contest is about protecting the shareholders of Cracker Barrel, and not about Biglari Holdings.

Biglari Holdings Total

Shareholder Return has Outperformed Cracker Barrel over 1, 3 and 5-year periods.

|

Total Shareholder Return as

of 11/12/2024

(Source: Factset) |

|

|

| |

1-year |

3-year |

5-year |

| Biglari Holdings |

43.2% |

33.5% |

84.6% |

| Cracker Barrel |

(28.1%) |

(62.7%) |

(65.5%) |

Item 2: On the evening

of November 13, 2024, Biglari issued the following press release and letter to the Company’s shareholders. A copy of the letter

to shareholders is also attached hereto as Exhibit 1:

Biglari Capital Corp.

Issues Letter to Shareholders of Cracker Barrel Old Country Store, Inc.

San Antonio, TX, Nov. 13,

2024 /PRNewswire/ -- Biglari Capital Corp. today issued the following letter to shareholders of Cracker Barrel Old Country Store, Inc.

(NASDAQ: CBRL). See below for the shareholder letter in its original form.

Dear Shareholders of Cracker Barrel

Old Country Store Inc.:

If you had $100 in Cracker Barrel

stock in January 2019, five years later it is worth about $30. Therefore, there is just $30 to go before the entire investment is lost.

Our group had approximately $350

million in the stock five years ago; it is now worth around $100 million. Your investment and ours are in the same boat.

This election should be simple.

It is about voting for Milena Alberti-Perez and myself instead of two directors, Carl Berquist and Meg Crofton, who have overseen a loss

of about 70% during their tenures as board members. There is no one on the Board or management team who has successfully turned around

a restaurant chain. (In fact, there are scarce few executives in the country who have successfully turned around a restaurant chain.)

I would be the only one to have done so if elected. And if we were on the Board, we would hold a minority position; so we ask, what is

the downside?

Despite all of the Company's failures,

the board members are spending shareholders' money to defend themselves. They could have settled but they fear letting accountability

into the boardroom. They value collegiality over accountability. You and I should be concerned that they could lose our remaining investment.

Therefore, the consequences of this election are enormous.

Making no decision is bad enough,

but the kind of decisions the Board and management are making is actually worse. Recent managerial appointments are beyond comprehension.

For instance, there is a new chief strategy officer who has no restaurant background; his last post was chief strategy officer of a cannabis

company whose stock declined by over 85%.

The Company's big strategy to

turn itself around is to spend $700 million, or 70% of its market value, on store renovations and remodels. Before I knew of management's

plan, my advice to the CEO was that she should avoid falling into the textbook trap of overspending on cosmetic remodeling to stem guest

traffic declines, a mistake I have seen at many failing restaurant companies. The new CEO could use our help, since neither she nor anyone

else on the Board has ever turned around a restaurant chain.

Cracker Barrel Old Country Store

is a history-steeped place that channels Americana; there are a few brands like it, and none require wholesale changes to their aesthetic.

The day Cracker Barrel opened, it was already old - its theme derived from the 1920s. I am concerned that not only will the remodel not

work but it could actually damage the brand further. These decisions are taking us down the same path, I believe, as Ruby Tuesday, Red

Lobster, TGI Fridays, and the like. Let me make my position clear: The company's $700 million remodel plan will not work!

Why do we need your vote? Most

large active investors have stayed away from Cracker Barrel stock and many index funds now own it. Unfortunately, index funds do not have

the time to evaluate individual companies. Moreover, proxy advisory firms emphasize governance over shareholder returns. This approach

ignores the reality that most companies with a trillion-dollar market value have a poor governance record by their measure despite producing

excellent shareholder returns. To these advisory firms, I can only quote Samuel Johnson: "I have found you an argument; but I am

not obliged to find you an understanding." Any capitalist who uses his or her own money to own this stock would be displeased by

the current Board and would want board members with both experience and a significant ownership stake to help fix the Company.

We have had a 13-year investment

in the Cracker Barrel stock, and my prior predictions proved correct. I now believe there is a significant risk of a 50% loss or more

if we are not elected to the Board.

The best we can do is to make

sure we obtain the support of the investors who know and care about Cracker Barrel and its long-term performance, and want to make money

in the stock over time.

If you side with us, please be

sure to vote the GOLD card, checking the boxes for Sardar Biglari and Milena Alberti-Perez.

Sincerely,

/s/ Sardar Biglari

Sardar Biglari

Item 3: Also, on the evening of

November 13, 2024, Biglari posted the following material to www.enhancecrackerbarrel.com:

Item 4: On November 14, 2024, Biglari issued the following

press release:

Biglari Capital Responds to Cracker Barrel’s Preliminary Q1 2025

Announcement

San Antonio, TX, Nov. 14, 2024 /PRNewswire/ -- Biglari Capital Corp. today

issued the following response to Cracker Barrel Old Country Store, Inc.’s (NASDAQ: CBRL) first quarter 2025 earnings

announcement.

Cracker Barrel’s preliminary Q1 2025 earnings announcement reinforces

our concerns that the Company is on the wrong track.

The Company did not disclose the change in guest traffic, which continued to decline during the quarter.

The adjusted EBITDA margin in Q1 2025 was 5.4%, 70 bps lower than in Q1 2023, and similar to that in Q1 2024. Considering FY 2024 was

the worst year in Cracker Barrel’s history, the fact that Q1 2025 results are comparable to Q1 2024 performance suggests that the

transformation plan is not working.

Importantly, Cracker Barrel did not change its FY 2025 guidance. Management expects revenue and adjusted EBITDA in FY 2025 to be similar

to or lower than in FY 2024 (assuming the midpoint of guidance), despite opening two new Cracker Barrel stores and three to four new Maple

Street Biscuit units and making $160 million to $180 million in capital expenditures. If its transformation plan was succeeding, why didn’t

management raise its guidance?

The Board attempted to spin the bad news, saying, “Our fiscal year is off to a strong start…,” yet management did not

change its guidance. There is a lack of confidence on the part of analysts and the investing community regarding the $700 million transformation

plan.

The Q1 2025 results do not change the underlying concerns we have or the urgent need for change. Shareholders cannot afford to wait for

the Company to implode.

Cracker Barrel is in trouble if the incumbent Board is investing $180 million only to stay at par with FY 2024, which saw the worst performance

in company history.

Shareholders must act now to protect their investments. Vote “FOR” on the Gold proxy card to elect Sardar Biglari and Milena

Alberti-Perez to the Board.

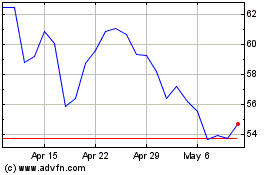

Cracker Barrel Old Count... (NASDAQ:CBRL)

Historical Stock Chart

From Oct 2024 to Nov 2024

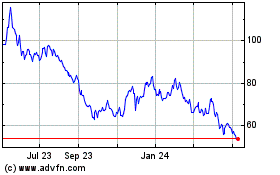

Cracker Barrel Old Count... (NASDAQ:CBRL)

Historical Stock Chart

From Nov 2023 to Nov 2024