EEW Renewables Ltd (“EEW”), a global developer in the renewable

energy industry, and Compass Digital Acquisition Corp. (Nasdaq:

CDAQ) (“CDAQ”), a special purpose acquisition company, announced

today the release of an investor webcast related to the proposed

business combination agreement (the “Business Combination

Agreement”) providing for the proposed business combination between

CDAQ and EEW (the “Proposed Business Combination”).

The investor webcast includes a presentation

from the EEW and CDAQ leadership teams. The presentation provides

the latest views on EEW’s renewable energy thesis, business model,

addressable market opportunity, market growth drivers, project

pipeline, financial outlook, and transaction overview.

Investors may access the webcast recording and

the investor presentation discussed on the webcast on the

respective EEW and CDAQ websites at

www.eewrenew.com/webcast and

https://compassdigitalspac.com/webcast.

Svante Kumlin, CEO of EEW,

commented: “Today’s presentation reaffirms our excitement

and vision for the future alongside CDAQ. This business combination

enables us to continue to grow and capitalize on our significant

existing project pipeline while generating clean and renewable

energy. We are excited to continue collaborating with the CDAQ team

and believe we are well-positioned to unlock new opportunities and

significant value for our shareholders moving forward.”

Thomas Hennessy, CEO of CDAQ,

added: “We remain fully committed to the proposed business

combination with EEW. The market opportunity continues to be

attractive, the regulatory environment in EEW’s geographies remains

supportive and EEW’s advanced-stage pipeline is expanding. We

believe that CDAQ is the ideal strategic and capital partner to

accelerate EEW's business plan. We are targeting a Q1 2025 business

combination closing, and we believe that this transaction with EEW

provides a compelling long-term opportunity for shareholders.”

On September 6, 2024, EEW and CDAQ announced

that they entered into a definitive business combination agreement

subject to customary closing conditions, including regulatory and

CDAQ stockholder approvals. The combined public company is expected

to list its common stock and warrants to purchase common stock on

Nasdaq, subject to approval of its listing application. The

Proposed Business Combination has been unanimously approved by the

Board of Directors of both EEW and CDAQ. The original announcement

can be read here.

About EEW Renewables

EEW was established by entrepreneur Svante

Kumlin. It stands as a prominent independent group dedicated to

developing renewable energy projects on a global scale.

Historically, EEW has concentrated on the development of large

scale solar photovoltaic (PV) projects. However, the company has

recently expanded its focus to include solar projects coupled with

battery energy storage systems (BESS). Moreover, EEW has an

approximate 40% ownership in EEW H2, which focuses on developing

green Hydrogen in Australia and North Africa.

For additional information, please

visit www.eewrenew.com

About Compass Digital Acquisition

Corp.

Compass Digital Acquisition Corp. is a blank

check company incorporated in the Cayman Islands on March 8, 2021.

CDAQ was formed for the purpose of effectuating a merger, capital

stock exchange, asset acquisition, stock purchase, reorganization

or other similar business combination with one or more businesses.

CDAQ is an early stage and emerging growth company and, as such, is

subject to all risks associated with early stage and emerging

growth companies.

For additional information, please

visit compassdigitalspac.com

Forward-Looking Statements

This press release contains certain

forward-looking statements within the meaning of the federal

securities laws with respect to the Proposed Business Combination

between EEW, CDAQ and the to be formed new public holding company

(“Pubco”), including statements regarding the benefits of the

Proposed Business Combination, the anticipated timing of the

completion of the Proposed Business Combination, the services

offered by EEW and the markets in which it operates, the expected

total addressable market for the services offered by EEW, the

sufficiency of the net proceeds of the Proposed Business

Combination to fund EEW’s operations and business plan and EEW’s

projected future results. These forward-looking statements

generally are identified by the words “believe,” “project,”

“expect,” “anticipate,” “estimate,” “intend,” “strategy,” “future,”

“opportunity,” “plan,” “may,” “should,” “will,” “would,” “will be,”

“will continue,” “will likely result,” and similar expressions.

Forward-looking statements are predictions, projections and other

statements about future events or conditions that are based on

current expectations and assumptions and, as a result, are subject

to risks and uncertainties. Many factors could cause actual future

events to differ materially from the forward-looking statements in

this document, including, but not limited to the following risks:

(i) the Proposed Business Combination may not be completed in a

timely manner or at all; (ii) the Proposed Business Combination may

not be completed by CDAQ’s business combination deadline, and CDAQ

may fail to obtain an extension of its business combination

deadline; (iii) the parties may fail to satisfy the conditions to

the consummation of the Proposed Business Combination, including

the adoption of the business combination agreement by the

shareholders of CDAQ, the satisfaction of the minimum trust account

amount following redemptions by CDAQ’s public shareholders,

retaining a minimum amount of available cash and the receipt of

certain governmental and regulatory approvals; (iv) an event,

change or other circumstance could occur that gives rise to the

termination of the business combination agreement; (v) the

announcement or pendency of the Proposed Business Combination could

adversely affect EEW’s business relationships, performance, and

business generally; (vi) the Proposed Business Combination could

disrupt EEW’s current plans and operations; (vii) legal proceedings

may be instituted against EEW, CDAQ, Pubco or others related to the

business combination agreement or the Proposed Business

Combination; (viii) Pubco may fail to meet Nasdaq Stock Exchange

listing standards at or following the consummation of the Proposed

Business Combination; (ix) the parties may not be able to recognize

the anticipated benefits of Proposed Business Combination, which

may be affected by a variety of factors, including changes in the

competitive and highly regulated industries in which EEW (and

following the Proposed Business Combination, Pubco) operates,

variations in performance across competitors and partners, changes

in laws and regulations affecting EEW’s business and the ability of

EEW and the post-combination company to retain its management and

key employees; (x) Pubco may not be able to implement business

plans, forecasts, and other expectations after the completion of

the Proposed Business Combination; (xi) EEW (and following the

Proposed Business Combination, Pubco) will need to raise additional

capital to execute its business plan, which may not be available on

acceptable terms or at all; (xii) Pubco may experience difficulties

in managing its growth and expanding operations; (xiii) Pubco may

suffer cyber security or foreign exchange losses; (xiv) a potential

public health crises may affect the business and results of

operations of EEW (and following the Proposed Business Combination,

Pubco) and the global economy generally; (xv) the effect of costs

related to the Proposed Business Combination; (xvi) EEW’s limited

operating history; (xvii) EEW depends on the sale of a small number

of projects in its portfolio; (xviii) to be successful, EEW must

continually source new projects, including the related properties

and grid capacity; (xix) the solar industry has historically been

cyclical and experienced periodic downturns; (xx) EEW’s expansion

into new lines of business involves inherent risks and may not be

successful; (xxi) EEW faces substantial competition in the markets

for renewable energy, and many of its competitors are better

established and have more resources; (xxii) EEW will need

additional funding to complete its business plan, and it may fail

to obtain this funding on reasonable sources or at all; (xxiii)

EEW’s projects are subject to substantial regulation; (xxiv) EEW

operates in many different jurisdictions and countries, which

exposes it to complexity and risk; and (xxv) the predicted growth

of renewable energy in general and solar energy in particular may

not materialize. The foregoing list of factors is not exhaustive.

You should carefully consider the foregoing factors and the other

risks and uncertainties described in the “Risk Factors” section of

CDAQ’s Quarterly Reports on Form 10-Q, the registration statement

on Form F-4 and proxy statement/prospectus that will be filed by

Pubco, and other documents filed by CDAQ and Pubco from time to

time with the SEC. These filings do or will identify and address

other important risks and uncertainties that could cause actual

events and results to differ materially from those contained in the

forward-looking statements. Forward-looking statements speak only

as of the date they are made. Readers are cautioned not to put

undue reliance on forward-looking statements, and EEW and CDAQ

assume no obligation and do not intend to update or revise these

forward-looking statements, whether as a result of new information,

future events, or otherwise. None of EEW, CDAQ or Pubco gives any

assurance that any of EEW, CDAQ or Pubco will achieve its

expectations.

Additional Information and Where to Find

It

This press release relates to the Proposed

Business Combination, but does not contain all the information that

should be considered concerning the Proposed Business Combination

and is not intended to form the basis of any investment decision or

any other decision in respect of the transaction. Pubco intends to

file with the Securities and Exchange Commission (the “SEC”) a

registration statement on Form F-4 relating to the transaction that

will include a proxy statement of CDAQ and a prospectus of Pubco.

When available, the definitive proxy statement/prospectus and other

relevant materials will be sent to all CDAQ shareholders as of a

record date to be established for voting on the Proposed Business

Combination. CDAQ and Pubco also will file other documents

regarding the Proposed Business Combination with the SEC. Before

making any voting decision, investors and securities holders of

CDAQ are urged to read the registration statement, the proxy

statement/prospectus and all other relevant documents filed or that

will be filed with the SEC in connection with the Proposed Business

Combination as they become available because they will contain

important information about CDAQ, EEW and the Proposed Business

Combination.

Investors and securities holders will be able to

obtain free copies of the proxy statement/prospectus and all other

relevant documents filed or that will be filed with the SEC by CDAQ

and Pubco through the website maintained by the SEC at www.sec.gov.

In addition, the documents filed by CDAQ and Pubco may be obtained

free of charge by contacting its Chief Financial Officer, Nick

Geeza, c/o Compass Digital Acquisition Corp., 195 US HWY 50, Suite

309, Zephyr Cove, NV, at (310) 954-9665.

Participants in the

Solicitation

EEW, CDAQ and Pubco and their respective

directors and executive officers may be deemed under SEC rules to

be participants in the solicitation of proxies of CDAQ’s

shareholders in connection with the Proposed Business Combination.

Investors and security holders may obtain more detailed information

regarding the names and interests of CDAQ’s directors and officers

in the Proposed Business Combination in CDAQ’s filings with the

SEC, including CDAQ’s final prospectus in connection with its

initial public offering, which was filed with the SEC on October

18, 2021 (the “IPO S-1”). To the extent that holdings of CDAQ’s

securities have changed from the amounts reported in CDAQ’s IPO

S-1, such changes have been or will be reflected on Statements of

Change in Ownership on Form 4 filed with the SEC. Information

regarding the persons who may, under SEC rules, be deemed

participants in the solicitation of proxies of CDAQ’s shareholders

in connection with the Proposed Business Combination will be set

forth in the proxy statement/prospectus on Form F-4 for the

Proposed Business Combination, which is expected to be filed by

Pubco with the SEC.

Investors, shareholders and other interested

persons are urged to read the proxy statement/prospectus and other

relevant documents that will be filed with the SEC carefully and in

their entirety when they become available because they will contain

important information about the Proposed Business Combination.

Investors, shareholders and other interested persons will be able

to obtain free copies of the proxy statement/prospectus and other

documents containing important information about EEW, CDAQ and

Pubco through the website maintained by the SEC at www.sec.gov.

Copies of the documents filed with the SEC that are referred to

herein can be obtained free of charge from the sources indicated

above.

No Offer or Solicitation

This press release is not a proxy statement or

solicitation of a proxy, consent or authorization with respect to

any securities or in respect of the Proposed Business Combination

and shall not constitute an offer to sell or a solicitation of an

offer to buy the securities of CDAQ, Pubco or EEW, nor shall there

be any sale of any such securities in any state or jurisdiction in

which such offer, solicitation, or sale would be unlawful prior to

registration or qualification under the securities laws of such

state or jurisdiction. No offer of securities shall be made except

by means of a prospectus meeting the requirements of Section 10 of

the Securities Act of 1933, as amended, or exemptions

therefrom.

Investor Relations Contact:

Gateway GroupCody Slach, Georg

Venturatos949-574-3860CDAQ@gateway-grp.com

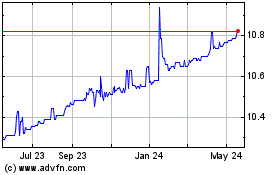

Compass Digital Acquisit... (NASDAQ:CDAQ)

Historical Stock Chart

From Dec 2024 to Jan 2025

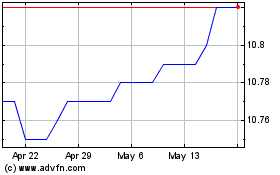

Compass Digital Acquisit... (NASDAQ:CDAQ)

Historical Stock Chart

From Jan 2024 to Jan 2025