false

0001737927

Canopy Growth Corp

00-0000000

0001737927

2024-12-09

2024-12-09

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported):

December 9, 2024

Canopy Growth Corporation

(Exact name of registrant as specified in its

charter)

| Canada |

|

001-38496 |

|

N/A |

(State

or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(IRS

Employer

Identification No.) |

1 Hershey Drive

Smiths Falls, Ontario |

K7A

0A8 |

| (Address of principal executive offices) |

(Zip Code) |

(855) 558-9333

(Registrant’s telephone number, including

area code)

Not Applicable

(Former name or former address, if changed

since last report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading

Symbol(s) |

|

Name of each exchange

on which registered |

| Common

Shares, no par value |

|

CGC |

|

Nasdaq

Global Select Market |

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities

Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate

by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial

accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

| Item 3.02 | Unregistered Sales of Equity Securities. |

As previously disclosed, Canopy Growth Corporation (the “Company”)

agreed to make a payment with a value of approximately US$19.5 million of the Company’s common shares (the “Bonus Payment

Canopy Shares”) to an eligible participant pursuant to the existing tax receivable bonus plans (as amended, the “Bonus Plans”)

of a subsidiary of Acreage Holdings, Inc. (“Acreage”). On December 9, 2024, in connection with the acquisition

of the outstanding shares of Acreage (the “Acreage Acquisition”) by Canopy USA, LLC (“Canopy USA”), the Company

satisfied this payment by issuing an aggregate of 5,118,426 Bonus Payment Canopy Shares to an eligible participant under the Bonus Plans.

The Bonus Payment Canopy Shares were issued in reliance on the exemption from securities registration

in Section 4(a)(2) under the Securities Act of 1933, as amended (the “Securities Act”).

On December 9, 2024, in connection with the Acreage Acquisition,

the Company entered into an agreement with Canopy USA, pursuant to which, on December 9, 2024, the Company issued 1,315,553 of its

common shares (at a price equal to $3.60 (the “Closing Price”) less a 7.5% discount) (the “Put Shares”) and 1,197,658

common share purchase warrants (each, a “Put Warrant”) to certain securityholders of Acreage (the “Put Holders”)

in order to satisfy an outstanding put liability. Each Put Warrant entitles the holder to acquire one common share of the Company at

an exercise price of $3.66 per common share until June 6, 2029. The Put Shares and the Put Warrants were issued

in reliance on the exemption from securities registration in Section 4(a)(2) under the Securities Act. The Company also

provided the Put Holders with customary registration rights.

In addition, in connection with the Acreage Acquisition, the Company

entered into certain transfer agreements with the vendors party thereto effective December 9, 2024, pursuant to which, among other

things, on December 9, 2024, Canopy USA exercised its right to acquire the minority interests in certain Acreage subsidiaries from

such vendors as contemplated in the constating documents of such subsidiaries and the Company will issue an aggregate of approximately

306,000 of its common shares to such vendors in accordance with the terms thereof. Such common shares of the Company were issued

in reliance on the exemption from securities registration in Section 4(a)(2) under the Securities Act.

| Item 7.01 | Regulation FD Disclosure. |

On

December 9, 2024, the Company issued a press release titled “Canopy Growth Confirms Canopy USA’s Completed Acquisition

of Acreage”, a copy of which is attached hereto as Exhibit 99.1 and is incorporated herein by reference.

The information set forth and incorporated by reference in Item 7.01

of this Current Report, including Exhibit 99.1 attached hereto, is being furnished and shall not be deemed “filed” for

purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject

to the liabilities of such section. The information set forth and incorporated by reference in

Item 7.01 of this Current Report, including Exhibit 99.1 attached hereto, shall not be incorporated by reference into any filing

under the Securities Act or the Exchange Act, regardless of any incorporation by reference language in any such filing.

| Item 9.01 | Financial Statements and Exhibits. |

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

CANOPY GROWTH

CORPORATION |

| |

|

|

| |

By: |

/s/ Judy Hong |

| |

|

Judy Hong |

| |

|

Chief Financial Officer |

Date: December 9, 2024

Exhibit 99.1

Canopy Growth and Acreage Confirm Canopy USA’s

Completed Acquisition of Acreage

Canopy USA is now positioned to consolidate

operations across its three business units – Wana, Jetty, and Acreage – realizing synergies, cost savings, and supporting

growth in state-legal markets across the U.S.

Through coverage of key market segments including

flower via Superflux, vape and concentrates via Jetty, edibles and beverages via Wana, and retail through The Botanist, Canopy USA is

well positioned to accelerate growth with an emphasis on the Midwestern and Northeastern U.S. markets

SMITHS

FALLS, ON, AND NEW YORK, NY December 9, 2024 - Canopy Growth Corporation (“Canopy Growth”) (TSX: WEED)

(NASDAQ: CGC) and Acreage Holdings, Inc. (“Acreage”) (CSE: ACRG.A.U, ACRG.B.U)(OTCQX: ACRHF, ACRDF) today confirmed

that Canopy USA, LLC (“Canopy USA”) has completed its acquisition (the “Acreage Acquisition”) of Acreage.

Canopy USA now owns 100% of the issued and outstanding shares of Acreage.

Together with the completed acquisition of 100%

of Wana Wellness, LLC, The CIMA Group, LLC and Mountain High Products, LLC (collectively, “Wana”), as announced on

October 9, 2024, and approximately 77% of the shares of Lemurian, Inc. (“Jetty”) as announced on June 4,

2024, Canopy USA is fulfilling its ambition of establishing a leading brand-focused cannabis company in the U.S.

“Completing the acquisition of Acreage marks

the final step in establishing Canopy USA as a unified platform which we believe offers significant upside as the Canopy USA portfolio

of brands can now capitalize on the rapidly expanding U.S. cannabis market, independent of the need for federal legalization,” said

David Klein, CEO, Canopy Growth and member of the Board of Managers of Canopy USA. “With a vertically integrated presence across

key U.S. states in the Midwest and Northeast, as well as licensing agreements which support asset-light operations in state-legal markets

nationally, Canopy USA is well positioned to demonstrate efficient growth ahead.”

“Together with Wana and Jetty, two highly

respected cannabis brands in the U.S., Acreage has an incredible opportunity to drive combined growth and innovation under Canopy USA,”

said Dennis Curran, CEO, Acreage. “With Acreage’s product portfolio, established retail presence, and production capabilities

across the Midwest and Northeast, this integration positions Acreage to expand its reach, better serve its customers, and deliver meaningful

value to the market. It is exciting to see the opportunities ahead and the shared vision under Canopy USA.”

The completed acquisitions of Acreage and Wana,

and approximately 77% of the shares of Jetty, are expected to enable Canopy USA to realize anticipated financial benefits, including revenue

growth and cost synergies, marketing efficiencies, and joint sales advantages across key cannabis product categories such as vapes, edibles,

and flower.

Overview of Canopy USA Strategy

| · | Fast Tracks Entry into the World’s Largest and Fastest Growing Cannabis Market: The U.S.

retail cannabis market is projected to be as high as approximately US$50 billion in 20261,

and this strategy aims to unlock the ability to capture share and return on investments made to date. |

| · | Establishes a Leading, Brand Focused Powerhouse: Canopy USA’s portfolio includes

some of the most recognized, iconic cannabis brands in the U.S. that we believe are ideally positioned in the fastest growing

categories, such as edibles, vapes, and flower. Canopy USA is expected to leverage the best of each brand’s offerings to accelerate

growth and market expansion across key U.S. states. |

| · | Financial Benefit via Revenue and Cost Synergies within Canopy USA: The combination

of U.S. cannabis assets is expected to generate revenue and cost synergies within Canopy USA by leveraging the brands, routes

to market and operations of the full U.S. cannabis ecosystem while eliminating redundancies across certain of the U.S. THC portfolio of

assets and the public company reporting costs of Acreage. |

| · | Highlights the Value of Canopy USA’s U.S. THC Assets: While Canopy Growth will not

consolidate the financial results of Canopy USA, Canopy Growth expects to begin to highlight the value of Canopy USA’s U.S.

THC assets to investors now that the Acreage Acquisition is complete. Canopy Growth now holds all of the issued and outstanding non-voting

shares in the capital of Canopy USA, representing approximately 84.4% of the issued and outstanding shares in Canopy USA on an as-converted

basis. |

Acreage Acquisition

In connection with the (i) arrangement agreement

dated April 18, 2019, as amended between Canopy Growth and Acreage and the amended and restated plan of arrangement in connection

therewith (the “Fixed Share Arrangement”); and (ii) arrangement agreement dated October 24, 2022, as amended,

among Canopy Growth, Acreage and Canopy USA, Canopy USA acquired all of the issued and outstanding Class D subordinate voting shares

of Acreage (the “Acreage Floating Shares”) on the terms and conditions set forth in the plan of arrangement in connection

therewith (the “Floating Share Acquisition”). Immediately following the completion of the Floating Share Acquisition,

Canopy USA acquired (the “Fixed Share Acquisition”) all of the issued and outstanding Class E subordinate voting

shares of Acreage (the “Acreage Fixed Shares”). As a result of these transactions Canopy USA acquired 100% of the issued

and outstanding shares of Acreage. Immediately prior to the completion of the Acreage Acquisition, Canopy USA did not own any shares of

Acreage.

In

accordance with the Floating Share Acquisition, registered holders of Acreage Floating Shares received 0.045 of a common share of Canopy

Growth (each whole share, a “Canopy Share”) for each Acreage Floating Share held by such holder of Acreage Floating

Shares. In connection with the Fixed Share Acquisition, each of the outstanding Acreage Fixed Shares was exchanged for a fraction of a

Canopy Share per Acreage Fixed Share, as adjusted pursuant to the terms and conditions set forth in the Fixed Share Arrangement.

In aggregate, Canopy Growth issued approximately 5.89 million Canopy Shares (with a value equal to approximately US$21.2 million) to former

Acreage shareholders, as well as approximately 306,000 Canopy Shares issuable in connection with Canopy USA’s acquisition of the

minority interests of certain subsidiaries of Acreage.

1 MJBiz market forecast of total US cannabis market by

2026, in USD currency.

As previously disclosed, Canopy Growth agreed

to make a payment with a value of approximately US$19.5 million in Canopy Shares (the “Bonus Payment Canopy Shares”)

to an eligible participant pursuant to the existing tax receivable bonus plans of a subsidiary of Acreage (as amended, the “Bonus

Plans”). Immediately prior to closing the Floating Share Acquisition, Canopy Growth satisfied this payment by issuing the Bonus

Payment Canopy Shares at a deemed price of US$3.82 per Bonus Payment Canopy Share (being the volume weighted average trading price of

the Canopy Shares on the Nasdaq during the 10 consecutive trading days ending on the second trading day prior to the closing date

of the Acreage Acquisition) to a participant under the Bonus Plans. Canopy Growth has also agreed to register the resale of the Bonus

Payment Canopy Shares under the Securities Act of 1933, as amended.

Immediately following the closing of the Acreage

Acquisition, Canopy Growth issued 1,315,553 Canopy Shares (at a price equal to the closing price of the Canopy Shares on the Nasdaq

immediately prior to the closing date of the Acreage Acquisition less a 7.5% discount) and 1,197,658 common share purchase warrants (each,

a “Warrant”) to certain securityholders of Acreage (the “Holders”) in order to satisfy an outstanding

put liability. Each Warrant entitles the holder to acquire one Canopy Share at an exercise price equal to the volume weighted average

trading price of the Canopy Shares on the Nasdaq during the five consecutive trading days immediately prior to the closing date of

the Acreage Acquisition until June 6, 2029. Canopy Growth has agreed to provide the Holders with customary registration rights.

Acreage will apply to cease to be a reporting

issuer in Canada and the Acreage shares are expected to be delisted from the Canadian Securities Exchange on or around December 9,

2024, which is expected to generate significant savings to Acreage and Canopy USA in respect of public company reporting costs.

Full details of the Acreage Acquisition are set

out in the proxy statement and management information circular of Acreage dated August 17, 2020 and the proxy statement and management

information circular of Acreage dated February 14, 2023 (the “Proxy Statement”), copies of which can be found

under Acreage’s profile on SEDAR+ at www.sedarplus.ca. A copy of the early warning report of Canopy USA in connection with the Acreage

Acquisition will be filed under Acreage’s profile on SEDAR+ and can be obtained by contacting Corey Sheahan, Executive Vice President,

General Counsel and Secretary at (646) 600-9181 or at Canopy USA’s head office located at 501 South Cherry St., Denver, CO 80246.

A

letter of transmittal with respect to the Fixed Share Acquisition and the Floating Share Acquisition has been mailed to registered

Acreage shareholders. The letters of transmittal have been filed by Acreage under Acreage’s profile on SEDAR+ at www.sedarplus.ca and with the U.S. Securities and Exchange Commission through EDGAR at www.sec.gov/edgar.

All registered Acreage shareholders with physical

certificate(s) are required to send their certificate(s) representing their Acreage Fixed Shares and/or Acreage Floating Shares

with a completed letter of transmittal to Canopy Growth’s transfer agent, Odyssey Trust Company (“Odyssey”),

in accordance with the instructions provided in the applicable letter of transmittal. Acreage shareholders who hold their Acreage Fixed

Shares and/or Acreage Floating Shares through a broker or other intermediary and do not have Acreage shares registered in their name do

not need to complete the applicable letter(s) of transmittal. Such shareholders of Acreage should contact their broker or other intermediary.

All registered Acreage shareholders with DRS statement(s) representing their Acreage Floating Shares will automatically be sent DRS

statement(s) representing their Canopy Shares by Odyssey without needing to complete a letter of transmittal.

As

a result of the labour dispute at Canada Post, registered Acreage shareholders are encouraged to contact Odyssey with any questions by

email at shareholders@odysseytrust.com in the event that registered Acreage shareholders have not received copies of their

DRS statement(s) or certificate(s) representing their Canopy Shares following the closing of the Acreage Acquisition and completion

and delivery of their letter of transmittal to Odyssey.

Advisors and Counsel

Cassels Brock & Blackwell LLP and Paul

Hastings LLP acted as Canadian and U.S. legal counsel, respectively, to Canopy Growth. Greenhill & Co. Canada Ltd. acted as financial

advisors to Canopy Growth.

DLA Piper (Canada) LLP and Cozen O’Connor

acted as Canadian and U.S. legal counsel, respectively, to Acreage. Canaccord Genuity Corp. and Eight Capital acted as financial advisors

to Acreage.

###

Canopy Growth Contact Details:

Nik Schwenker

Vice President, Communications

Nik.Schwenker@canopygrowth.com

Tyler Burns

Director, Investor Relations

Tyler.Burns@canopygrowth.com

About Canopy Growth

Canopy Growth is a world leading cannabis company

dedicated to unleashing the power of cannabis to improve lives.

Through an unwavering commitment to our consumers,

Canopy Growth delivers innovative products with a focus on premium and mainstream cannabis brands including Doja, 7ACRES, Tweed, and Deep

Space, in addition to category defining vaporizer technology made in Germany by Storz & Bickel.

Canopy Growth has also established a comprehensive

ecosystem to realize the opportunities presented by the U.S. THC market through an unconsolidated, non-controlling interest in Canopy

USA. Canopy USA has closed the acquisitions of approximately 77% of the shares of Jetty, 100% of Wana and 100% of Acreage, a vertically

integrated multi-state cannabis operator with principal operations in densely populated states across the Northeast and Midwest. Jetty

owns and operates Jetty Extracts, a California-based producer of high-quality cannabis extracts and pioneer of clean vape technology,

and Wana is a leading North American edibles brand.

Beyond its world-class products, Canopy Growth

is leading the industry forward through a commitment to social equity, responsible use, and community reinvestment – pioneering

a future where cannabis is understood and welcomed for its potential to help achieve greater well-being and life enhancement.

For more information visit www.canopygrowth.com.

About Acreage

Acreage is a multi-state operator of cannabis

cultivation and retailing facilities in the U.S., including its national retail store brand, The Botanist. With its principal

address in New York City, Acreage’s wide range of national and regionally available cannabis products include the award-winning

brands The Botanist and Superflux, the Prime medical brand in Pennsylvania, and others.

Acreage has focused on building and scaling operations to create a seamless, consumer-focused, branded experience. Learn more at www.acreageholdings.com.

References to information included on, or accessible

through, the Canopy Growth or Acreage website do not constitute incorporation by reference of the information contained at or available

through such websites, and you should not consider such information to be part of this press release.

Forward-Looking Statements

This

news release contains “forward-looking statements” within the meaning of the United States Private Securities Litigation Reform

Act of 1995 and “forward-looking information” within the meaning of applicable Canadian securities legislation. Often, but

not always, forward-looking statements and information can be identified by the use of words such as “plans”, “expects”

or “does not expect”, “is expected”, “estimates”, “intends”, “anticipates”

or “does not anticipate”, or “believes”, or variations of such words and phrases or state that certain actions,

events or results “may”, “could”, “would”, “might” or “will” be taken, occur

or be achieved. Forward-looking statements or information involve known and unknown risks, uncertainties and other factors which may cause

the actual results, performance or achievements of Canopy Growth, Canopy USA, Acreage or their respective subsidiaries to be materially

different from any future results, performance or achievements expressed or implied by the forward-looking statements or information contained

in this news release. Examples of such statements and uncertainties include statements with respect to the expected size of the U.S. cannabis

market; statements with respect to the Canopy Growth’s ability to execute on its strategies, including its strategy to accelerate

entry into the U.S. cannabis industry, capitalize on the opportunity for growth in the U.S. cannabis sector and the anticipated benefits

of such strategy, including the ability to generate revenues and cost synergies, marketing efficiencies, and joint sales advantages; expectations

regarding the potential success of, and the costs and benefits associated with Canopy USA; the timing of, and Canopy Growth’s ability

to, highlight the value of Canopy USA’s U.S. THC assets; the anticipated date the Acreage shares will be delisted from the Canadian

Securities Exchange; the filing of an early warning report by Canopy USA on Acreage’s SEDAR+ profile; and expectations for other

economic, business, and/or competitive factors.

Risks, uncertainties and other factors involved

with forward-looking information or statements could cause actual events, results, performance, prospects and opportunities to differ

materially from those expressed or implied by such forward-looking information, including negative operating cash flow; uncertainty of

additional financing; use of proceeds; volatility in the price of the Canopy Shares; expectations regarding future investment, growth

and expansion of operations; regulatory and licensing risks; changes in general economic, business and political conditions, including

changes in the financial and stock markets and the impacts of increased rates of inflation; legal and regulatory risks inherent in the

cannabis industry, including the global regulatory landscape and enforcement related to cannabis; additional dilution; political risks

and risks relating to regulatory change; risks relating to anti-money laundering laws; compliance with extensive government regulation

and the interpretation of various laws regulations and policies; public opinion and perception of the cannabis industry; and such other

risks contained in the public filings of Canopy Growth and Acreage filed with Canadian securities regulators and available under each

of Canopy Growth’s and Acreage’s profiles on SEDAR+ at www.sedarplus.ca and with the Securities and Exchange Commission through

EDGAR at www.sec.gov/edgar, including under the heading “Risk Factors” in Canopy Growth’s and Acreage’s respective

annual report on Form 10-K for the year ended March 31, 2024 and December 31, 2023, respectively, and their subsequently

filed quarterly reports on Form 10-Q and the Proxy Statement.

In respect of the forward-looking statements and

information, Canopy Growth and Acreage have provided such statements and information in reliance on certain assumptions that they believe

are reasonable at this time. Although Canopy Growth and Acreage believe that the assumptions and factors used in preparing the forward-looking

information or forward-looking statements in this news release are reasonable, undue reliance should not be placed on such information

or statements and no assurance can be given that such events will occur in the disclosed time frames or at all. Should one or more of

the foregoing risks or uncertainties materialize, or should assumptions underlying the forward-looking information or statements prove

incorrect, actual results may vary materially from those described herein as intended, planned, anticipated, believed, estimated or expected.

Although Canopy Growth and Acreage have attempted to identify important risks, uncertainties and factors which could cause actual results

to differ materially, there may be others that cause results not to be as anticipated, estimated or intended. The forward-looking information

and forward-looking statements included in this news release are made as of the date of this news release and neither Canopy Growth nor

Acreage undertake any obligation to publicly update such forward-looking information or forward-looking statements to reflect new information,

subsequent events or otherwise unless required by applicable securities laws.

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

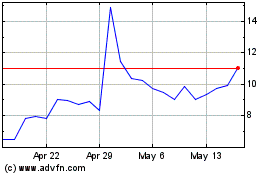

Canopy Growth (NASDAQ:CGC)

Historical Stock Chart

From Jan 2025 to Feb 2025

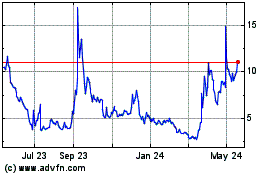

Canopy Growth (NASDAQ:CGC)

Historical Stock Chart

From Feb 2024 to Feb 2025