Colliers’ 2025 Global Investor Outlook reveals renewed investor optimism in commercial real estate as pricing stabilizes

20 November 2024 - 12:00PM

Leading global diversified professional services company Colliers

released its 2025 Global Investor Outlook, revealing renewed

investor optimism and confidence that the commercial property

market has moved past an inflection point following two years of

muted transactions. On the back of subsiding inflation, lower

interest rates, an improved economic outlook and expansive

fundraising, Colliers anticipates a new market environment to

emerge, more diverse – by asset class and investor base – than the

one it replaced.

Some uncertainties remain, including a potential

resurgence in inflation that changes the direction or tempo of rate

cuts, a lack of inventory and low levels of new supply, and

regulations that can complicate market liquidity on a more nuanced

basis. While recent elections in major economies such as the UK and

U.S. have provided more clarity around policies, lingering

geopolitical tensions require a prudent approach to 2025

investments.

“We are seeing signs of positive momentum, with

stronger sentiment growing as asset values stabilize. Stronger

fundraising, including a return of core capital, will take time to

flow through into deal volumes, though it is a strong indicator

that more activity will hit the market soon,” said Luke Dawson,

Head of Global Capital Markets for Colliers. “In conversations with

investors around the world, now is the time to be laying the

groundwork for the next few years of growth as the transactional

market moves off the bottom of the cycle.”

Broad interest in all asset classes, though

preferences are shifting

Underlying fundamentals are improving across all

sectors. As high-profile, global firms lead the return-to-office

charge, prime urban office assets are attracting renewed interest,

while secondary assets and locations are witnessing value-add

strategies play out for redevelopment and renovation. A large

number of offices purchased in the last 12 months have been

acquired for redevelopment into higher quality, more sustainable

offices to match elevated standards required by occupiers.

Similar to the bifurcation in office assets,

industrial and logistics (I&L) assets continue to be a major

investment theme, though flight to quality has also emerged in the

sector. Many investors now seek assets that have solid

sustainability credentials and modern features that tenants

demand.

Driven by increasing disposable incomes and leisure

travel, more investors are exploring hotels and shopping centres in

strategic locations. Alternatives such as cold storage and senior

housing continue to be subject to intense competition, given the

scarcity of investible product. In particular, investors are

chasing data centres due to the boom in artificial intelligence,

but the sizeable energy needs of such facilities are running into

supply and planning constraints in some markets.

“Where there is tight inventory, limited new

development opportunity or high costs for ground-up construction,

investors should consider value-add or opportunistic properties in

well-located areas and take a redevelopment approach to support

demand,” added Dawson.

Increased private wealth investments marks

shift from credit to equity

Colliers expects private investors, especially

family offices and private equity funds, to be among the more

active buyers in 2025. As interest rates escalated, they stepped in

amid the pullback by credit-backed investors. Even as the market

recovers and monetary easing assists debt-backed participants, more

private generational wealth is likely to expand into real estate.

Colliers also predicts a pivot back to equity-focused strategies as

debt becomes more accessible and investors reallocate capital to

traditional equity structures like joint ventures,

recapitalizations, and M&A.

“Family offices and private wealth are expanding

and bolstering the commercial real estate investor base because

they often have access to more nimble and versatile capital,” said

Damian Harrington, Head of Research for Colliers’ Global Capital

Markets platform and EMEA. “As they continue to grow and diversify

their portfolios, they – like all investors – must stay informed of

market conditions and regulatory changes impacting real estate:

ranging from residential rent caps and utility provision, to

planning policies that would impact construction. Successfully

entering new markets or niches often requires expert advisers who

can help you navigate the market and explore innovative

structures.”

Regional highlights:

- APAC: Rate cuts are

expected to drive transaction volumes, with high interest in

logistics, multifamily, and office sectors.

- EMEA: Demand for

high-quality office and logistics assets is growing, with a notable

return of shopping centres and tourism-driven hotel

investments.

- U.S.: Declining

rates and stabilized vacancies in multifamily and industrial

segments are likely to drive investment.

- Canada: Domestic

institutions are returning, with a continued focus on industrial

and a cautious optimism for office markets.

About Colliers

Colliers (NASDAQ, TSX: CIGI) is a leading global

diversified professional services company, specializing in

commercial real estate services, engineering consultancy and

investment management. With operations in 70 countries, our 22,000

enterprising professionals provide exceptional service and expert

advice to clients. For nearly 30 years, our experienced leadership

– with substantial inside ownership – has consistently delivered

approximately 20% compound annual investment returns for

shareholders. With annual revenues exceeding $4.5 billion and $99

billion of assets under management, Colliers maximizes the

potential of property, infrastructure and real assets to accelerate

the success of our clients, investors and people. Learn more at

corporate.colliers.com, X @Colliers or LinkedIn.

Media ContactAndrea CheungSenior

Manager, Global Integrated

Communicationsandrea.cheung@colliers.com416-324-6402

A photo accompanying this announcement is available

at https://www.globenewswire.com/NewsRoom/AttachmentNg/e3836929-978d-4fcb-b158-031e67473ace

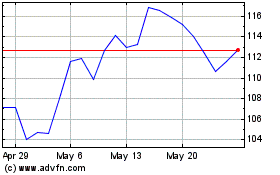

Colliers (NASDAQ:CIGI)

Historical Stock Chart

From Oct 2024 to Nov 2024

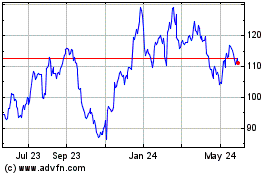

Colliers (NASDAQ:CIGI)

Historical Stock Chart

From Nov 2023 to Nov 2024