CMCT Announces Actions to Accelerate Focus Towards Premier Multifamily Assets

16 September 2024 - 10:00PM

Business Wire

The Board of Directors Declares $0.04 Per

Share Quarterly Common Dividend Payable in Common Stock

CMCT Announces Steps to Strengthen Balance

Sheet and Improve Liquidity

CMCT (NASDAQ: CMCT and TASE: CMCT) announced today actions to

accelerate the transition of its focus towards premier multifamily

assets from traditional office assets and strengthen its balance

sheet and liquidity.

The Company has previously targeted a capital structure

consisting of approximately 40% common equity, 30% preferred equity

and 30% debt. The recent decline in real estate values,

particularly in the Bay Area and the office market in general, has

resulted in a lower than targeted common equity ratio. CMCT

recently explored the sale of several high-quality assets to

improve its common equity ratio. The offer CMCT received reflected

what the Company believed to be the fair value of these assets, but

the buyer was unable to close. As a result of this and the recent

decline in interest rates, CMCT has decided to shift its focus to

refinancing rather than a sale of these assets. The Company intends

to place property-level financing on several assets and use part of

the proceeds to fully repay its recourse corporate-level credit

facility. The Company plans to invest any remaining proceeds, along

with proceeds from any future potential asset sales, principally in

premier multifamily properties.

As part of its program to improve its common equity ratio, the

Company is suspending its Series A1 Preferred Stock offering and

announcing the redemption of approximately 2.2 million shares of

Series A Preferred Stock and approximately 2.6 million shares of

Series A1 Preferred Stock, with the redemption price to be paid in

shares of common stock in accordance with the terms of the Series A

Preferred Stock and Series A1 Preferred Stock, respectively. The

Company is also shifting the payment schedule of its quarterly

dividend from monthly to quarterly for all its series of

outstanding preferred stock. The Company’s previously declared

dividends on its preferred stock for the third quarter of 2024 will

continue to be paid out monthly in September and October as

previously announced.

The Company believes these actions will strengthen its balance

sheet, improve liquidity and accelerate the transition towards

premier multifamily properties. These actions should also better

position the Company to take advantage of opportunities that are

expected to arise in a recovering real estate market.

Common Stock Dividend Declaration

The Company further announced that its Board of Directors has

declared a quarterly dividend of $0.04 per share of common stock,

payable in shares of common stock. The dividend will be paid on

October 8, 2024 to stockholders of record at the close of business

on September 25, 2024. The number of shares of common stock payable

will be determined using the closing price of the common stock on

September 13, 2024.

ABOUT CMCT

Creative Media & Community Trust Corporation (“CMCT”) is a

real estate investment trust that owns, operates and develops

premier multifamily and creative office assets in vibrant

communities throughout the United States. CMCT is a leader in

creative office, acquiring and developing properties catering to

rapidly growing industries such as technology, media and

entertainment. CMCT applies the expertise of CIM Group Management,

LLC to the acquisition, development, and operation of top-tier

multifamily properties situated in dynamic markets with similar

business and employment characteristics to its creative office

investments. CMCT also owns one hotel in Northern California and a

lending platform that originates loans under the Small Business

Administration’s 7(a) loan program. CMCT is operated by affiliates

of CIM Group, L.P., a vertically-integrated owner and operator of

real assets with multi-disciplinary expertise and in-house

research, acquisition, credit analysis, development, finance,

leasing, and onsite property management capabilities.

(www.creativemediacommunity.com).

FORWARD-LOOKING STATEMENTS

This press release contains certain “forward-looking statements”

within the meaning of Section 27A of the Securities Act of 1933, as

amended, and Section 21E of the Securities Exchange Act of 1934, as

amended, which are intended to be covered by the safe harbors

created thereby. Such forward-looking statements can be identified

by the use of forward-looking terminology such as “may,” “will,”

“project,” “target,” “expect,” “intend,” “might,” “believe,”

“anticipate,” “estimate,” “could,” “would,” “continue,” “pursue,”

“potential,” “forecast,” “seek,” “plan,” “should,” or “goal” or the

negative thereof or other variations or similar words or phrases.

Such forward-looking statements also include, among others,

statements about CMCT’s plans and objectives, including the planned

transition towards premier multifamily properties and the

acceleration of those plans and the strengthening of its balance

sheet and improved liquidity and its ability to secure property

level financing and repay in full its corporate-level credit

facility. Such forward-looking statements are based on particular

assumptions that management of CMCT has made in light of its

experience, as well as its perception of expected future

developments and other factors that it believes are appropriate

under the circumstances. Forward-looking statements are necessarily

estimates reflecting the judgment of CMCT’s management and involve

a number of risks and uncertainties that could cause actual results

to differ materially from those suggested by the forward-looking

statements. These risks and uncertainties include those associated

with (i) its ability to successfully identify and acquire or

develop premier multifamily properties or secure property-level

financing, in each case on acceptable terms or at all, and its

ability to sell additional assets on acceptable terms or at all,

(ii) the timing, form, and operational effects of CMCT’s

development activities, (iii) the ability of CMCT to raise in place

rents to existing market rents and to maintain or increase

occupancy levels, (iv) fluctuations in market rents, (v) the

effects of inflation and continuing higher interest rates on the

operations and profitability of CMCT and (vi) general economic,

market and other conditions. Additional important factors that

could cause CMCT’s actual results to differ materially from CMCT’s

expectations are discussed in “Item 1A—Risk Factors” of CMCT’s

Annual Report on Form 10-K for the year ended December 31, 2023

filed with the Securities and Exchange Commission on March 29,

2024. The forward-looking statements included herein are based on

current expectations and there can be no assurance that these

expectations will be attained. Assumptions relating to the

foregoing involve judgments with respect to, among other things,

future economic, competitive and market conditions and future

business decisions, all of which are difficult or impossible to

predict accurately and many of which are beyond CMCT’s control.

Although we believe that the assumptions underlying the

forward-looking statements are reasonable, any of the assumptions

could be inaccurate and, therefore, there can be no assurance that

the forward-looking statements expressed or implied herein will

prove to be accurate. In light of the significant uncertainties

inherent in the forward-looking statements expressed or implied

herein, the inclusion of such information should not be regarded as

a representation by CMCT or any other person that CMCT’s objectives

and plans will be achieved. Readers are cautioned not to place

undue reliance on forward-looking statements. Forward-looking

statements speak only as of the date they are made. CMCT does not

undertake to update them to reflect changes that occur after the

date they are made, except as may be required by applicable

securities laws.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240916589153/en/

Media Relations: Karen Diehl Diehl Communications

310-741-9097 karen@diehlcommunications.com or Investor

Relations: Steve Altebrando, 646-652-8473

shareholders@creativemediacommunity.com

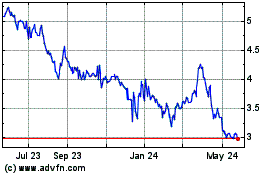

Creative Media and Commu... (NASDAQ:CMCT)

Historical Stock Chart

From Oct 2024 to Nov 2024

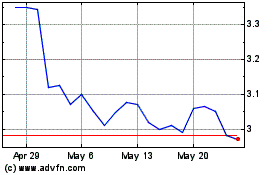

Creative Media and Commu... (NASDAQ:CMCT)

Historical Stock Chart

From Nov 2023 to Nov 2024