Cohu Completes Acquisition of Tignis

08 January 2025 - 8:05AM

Business Wire

Cohu, Inc. (NASDAQ: COHU), a global supplier of equipment and

services optimizing semiconductor manufacturing yield and

productivity, today announced the completion of its previously

disclosed acquisition of Tignis, Inc. (“Tignis”), a provider of

artificial intelligence (AI) process control and analytics-based

monitoring software.

The terms of the transaction, which are not material to Cohu’s

financials, are not being disclosed. The acquisition was funded

with cash on hand.

About Cohu:

Cohu (NASDAQ: COHU) is a global technology leader supplying

test, automation, inspection and metrology products and services to

the semiconductor industry. Cohu’s differentiated and broad product

portfolio enables optimized yield and productivity, accelerating

customers’ manufacturing time-to-market. Additional information can

be found at www.cohu.com.

Forward-Looking Statements:

Certain statements contained in this release and accompanying

materials may be considered forward-looking statements within the

meaning of the U.S. Private Securities Litigation Reform Act of

1995, including statements regarding success or contribution of

M&A transactions and any other statements that are predictive

in nature and depend upon or refer to future events or conditions;

and/or include words such as “may,” “will,” “should,” “would,”

“expect,” “anticipate,” “plan,” “likely,” “believe,” “estimate,”

“project,” “intend,” and/or other similar expressions among others.

Statements that are not historical facts are forward-looking

statements. Forward-looking statements are based on current beliefs

and assumptions that are subject to risks and uncertainties and are

not guarantees of future performance. Any third-party industry

analyst forecasts quoted are for reference only and Cohu does not

adopt or affirm any such forecasts.

Actual results and future business conditions could differ

materially from those contained in any forward-looking statement as

a result of various factors, including, without limitation: new

product investments and product enhancements which may not be

commercially successful; the semiconductor industry is seasonal,

cyclical, volatile and unpredictable; recent erosion in mobile,

automotive and industrial market sales; our ability to manage and

deliver high quality products and services; failure of sole source

contract manufacturer or our ability to manage third-party raw

material, component and/or service providers; ongoing inflationary

pressures on material and operational costs coupled with rising

interest rates; economic recession; the semiconductor industry is

intensely competitive, subject to rapid technological changes, and

experiences consolidation of key customers for semiconductor test

equipment; a limited number of customers account for a substantial

percentage of net sales; significant exports to foreign countries

with economic and political instability and competition from a

number of Asia-based manufacturers; our relationships with

customers may deteriorate; loss of key personnel; risks of using

artificial intelligence within Cohu’s product developments and

business; reliance on foreign locations and geopolitical

instability in such locations critical to Cohu and its customers;

natural disasters, war and climate-related changes, including

related economic impacts; levels of debt; access to sufficient

capital on reasonable or favorable terms; foreign operations and

related currency fluctuations; required or desired accounting

charges and the cost or effectiveness of accounting controls;

instability of financial institutions where we maintain cash

deposits and potential loss of uninsured cash deposits; significant

goodwill and other intangibles as percentage of our total assets;

increasingly restrictive trade and export regulations impacting our

ability to sell products, specifically within China; risks

associated with acquisitions, investments and divestitures such as

integration and synergies; constraints related to corporate

governance structures; share repurchases and related impacts;

financial or operating results that are below forecast or credit

rating changes impacting our stock price or financing ability;

law/regulatory changes and including environmental or tax law

changes; significant volatility in our stock price; the risk of

cybersecurity breaches; enforcing or defending intellectual

property claims or other litigation.

These and other risks and uncertainties are discussed more fully

in Cohu’s filings with the SEC, including our most recent Form 10-K

and Form 10-Q, and the other filings made by Cohu with the SEC from

time to time, which are available via the SEC’s website at

www.sec.gov. Except as required by applicable law, Cohu does not

undertake any obligation to revise or update any forward-looking

statement, or to make any other forward-looking statements, whether

as a result of new information, future events or otherwise.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250107991345/en/

Investor Contact: Cohu, Inc. Jeffrey D. Jones, 858-848-8106

Investor Relations

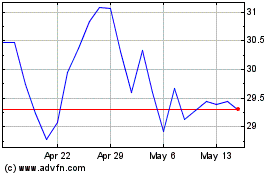

Cohu (NASDAQ:COHU)

Historical Stock Chart

From Jan 2025 to Feb 2025

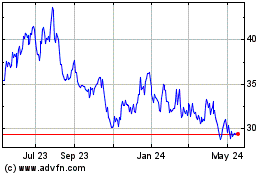

Cohu (NASDAQ:COHU)

Historical Stock Chart

From Feb 2024 to Feb 2025