false0001743759Corsair Gaming, Inc.00017437592025-02-122025-02-12

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): February 12, 2025 |

CORSAIR GAMING, INC.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Delaware |

001-39533 |

82-2335306 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

115 N. McCarthy Boulevard |

|

|

Milpitas, California |

|

95035 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: (510) 657-8747 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Common Stock, $0.0001 par value per share |

|

CRSR |

|

The Nasdaq Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition

On February 12, 2025, Corsair Gaming, Inc. (“Corsair” or the “Company”) issued a press release announcing its financial results for the fiscal quarter and full year ended December 31, 2024. The full text of the press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K. A presentation regarding the Company’s fiscal quarter and full year ended December 31, 2024 is furnished as Exhibit 99.2 hereto.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

The information in this Current Report on Form 8-K and Exhibit 99.1 and Exhibit 99.2 attached hereto shall not be deemed to be “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of Sections 11 and 12(a)(2) of the Securities Act of 1933, as amended. The information contained herein and in the accompanying exhibits shall not be incorporated by reference into any filing with the U.S. Securities and Exchange Commission made by Corsair Gaming, Inc., whether made before or after the date hereof, regardless of any general incorporation language in such filing.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

CORSAIR GAMING, INC. |

|

|

|

|

Date: February 12, 2025 |

|

By: |

/s/ Michael G. Potter |

|

|

|

Michael G. Potter |

|

|

|

Chief Financial Officer (Principal Financial Officer and Principal Accounting Officer) |

Corsair Gaming Reports Fourth Quarter and

Full Year 2024 Financial Results

Delivers Solid Q4 Revenue and EBITDA Results Led by Strong YoY Growth in Gaming and Creator Segment

MILPITAS, CA, February 12, 2025 – Corsair Gaming, Inc. (Nasdaq: CRSR) (“Corsair” or the “Company”), a leading global provider and innovator of high-performance products for gamers, streamers, content-creators, and gaming PC builders, today announced financial results for the fourth quarter and full year ended December 31, 2024, as well as guidance for the full year 2025.

Fourth Quarter 2024 Select Financial Metrics

•Net revenue was $413.6 million compared to $417.3 million in the fourth quarter of 2023, with strong growth in the Gamer and Creator Peripherals segment and the as expected softness in component sales in anticipation of Nvidia announcing new GPU cards at CES.

•Gamer and Creator Peripherals segment net revenue was $169.6 million compared to $136.8 million in the fourth quarter of 2023 with some additional revenue coming from the Company’s recent Fanatec acquisition. Gaming Components and Systems segment net revenue was $244.1 million compared to $280.5 million in the fourth quarter of 2023.

•Net income attributable to common shareholders was $1.3 million, or net income of $0.01 per diluted share, compared to a net income of $6.2 million, or net income of $0.06 per diluted share, in the fourth quarter of 2023.

•Adjusted net income was $24.8 million, or net income of $0.23 per diluted share, compared to adjusted net income of $23.2 million, or net income of $0.22 per diluted share, in the fourth quarter of 2023.

•Adjusted EBITDA was $33.1 million, compared to $33.7 million for the fourth quarter of 2023.

•Cash and restricted cash was $109.6 million as of December 31, 2024.

Full Year 2024 Select Financial Metrics

•Net revenue was $1,316.4 million in 2024 compared to $1,459.9 million in 2023. Gamer and Creator Peripherals segment net revenue was $472.7 million in 2024 compared to $394.9 million in 2023, while Gaming Components and Systems segment net revenue was $843.7 million in 2024 compared to $1,065.0 million in 2023.

•Net loss attributable to common shareholders was $99.2 million, or a net loss of $0.95 per diluted share for the full year 2024, compared to net income of $3.2 million, or net income of $0.03 per diluted share for the full year 2023.

•Adjusted net loss was $2.7 million, or a net loss of $0.03 per diluted share for the full year 2024, compared to adjusted net income of $58.3 million, or net income of $0.55 per diluted share for the full year 2023.

•Adjusted EBITDA was $54.7 million in 2024, compared to $95.1 million for the full year 2023.

Definitions of the non-GAAP financial measures used in this press release and reconciliations of such measures to their nearest GAAP equivalents are included below under the heading “Use and Reconciliation of Non-GAAP Financial Measures.”

Andy Paul, Chief Executive Officer of Corsair, stated, “We closed on a strong note, exceeding Q4 expectations for revenue and adjusted EBITDA after a challenging year. Our higher margin Gamer and Creator Peripherals segment grew by 20% for the full year. Highlights of the growth came from the continued growing demand for our Stream Deck and other Elgato products, which are steadily gaining acceptance as standard peripherals for the desktops of younger generations. We continued to gain momentum with many positive product reviews and high-profile accolades on our recent new peripheral products. This included our K65 wireless keyboard winning best gaming keyboard at The New York Times’ WireCutter. Our K65 was also selected by Apple along with our M75 mouse as gaming peripherals for sale in their stores. Lastly, our newest acquisition, Fanatec had its first meaningful revenue in Q4. The gross profit from our Gamer and Creator Peripherals segment now exceeds the margins from our Gaming Components and Systems segment. We plan to drive continued organic growth combined with additional M&A activity in high value peripherals.”

“As expected, new GPU cards were announced by Nvidia at CES in January. While we saw an increase in sales activity in December as enthusiasts started to plan new Gaming PC builds, we expect the real rebound of the component business will start in the first half of 2025 as these new GPU cards start to ship in volume.”

“The integration of our latest acquisition, Fanatec, is going well. Fanatec is widely recognized as the global leader in high end components for Sim Racing. Sales there have rebounded led by our commitment to product performance and customer support. We started shipments of our new Sim Racing chassis, the ClubSport GT, as well as our new flagship Bentley wheel. We see this category as high growth and expect to be shipping components and kits this year into retailers and integrators to gain incremental revenue and efficiencies over the historical direct to consumer model that was used at Fanatec before we acquired it.”

“Looking ahead, we’re very optimistic about the future, backed by our continued investments in innovation, strategic acquisitions, and market expansion. With the launch of new high-performance GPU cards, we expect 2025 to be a growth year for high end PC builds. We are now five years out from the COVID spending bulge, which creates a huge white space for upgrades. I’m confident that 2025 will mark the start of a new sustained growth phase for the company as we focus on building value for all shareholders. This is reflected in our outlook, which includes an over 60% increase in EBITDA at the midpoint of our annual guidance.”

Michael G. Potter, Chief Financial Officer of Corsair, stated, “We ended the year in a strong financial position, with balanced inventory levels in both the channel and our warehouses. During 2024, we continued to reduce debt and completed two M&A transactions with the purchase of Fanatec and the increased investment into Elgato’s supply chain. We believe the better results in Q4 have positioned us to support healthier demand, further growth and debt reduction in 2025.”

Financial Outlook

The full year 2025 outlook information provided below is based on Corsair’s current estimates and is not a guarantee of future performance. These statements are forward-looking and actual results may differ materially. Refer to the “Forward-Looking Statements” section below for information on the factors that could cause Corsair’s actual results to differ materially from these forward-looking statements.

For the full year 2025, Corsair expects revenue growth to improve through the coming year, with a further improvement in adjusted EBITDA led by an additional improvement in margin, and a rebound in demand for the Company’s high-performance gear for gamers, streamers, content-creators and gaming PC builders:

•Net revenue to be in the range of $1.4 billion to $1.6 billion.

•Adjusted operating income to be in the range of $67 million to $87 million.

•Adjusted EBITDA to be in the range of $80 million to $100 million.

Certain non-GAAP measures included in our financial outlook were not reconciled to the comparable GAAP financial measures because the GAAP measures are not accessible on a forward-looking basis. We are unable to reconcile these forward-looking non-GAAP financial measures to the most directly comparable GAAP measures without unreasonable efforts because we are currently unable to predict with a reasonable degree of certainty the type and extent of certain items that would be expected to impact GAAP measures for these periods but would not impact the non-GAAP measures. Such items may include stock-based compensation charges, amortization, and other items. The unavailable information could have a significant impact on our GAAP financial results.

The foregoing forward-looking statements reflect our expectations as of today's date. Given the number of risk factors, uncertainties and assumptions discussed below, actual results may differ materially. We do not intend to update our financial outlook until our next quarterly results announcement.

Recent Developments

•Selected by Apple for stores and online. Corsair’s award-winning K65 Wireless keyboard was specifically selected by Apple along with Corsair’s M75 Gaming mouse as one of the preferred devices used to game on a Mac and is now available in Apple stores, with both the PC and Mac versions available at major online stores and through selected resellers.

•VENGEANCE powered by NVIDIA. Corsair’s award-winning VENGEANCE Gaming PCs now feature the potentially game-changing performance, efficiency, and AI-powered graphics of NVIDIA GeForce RTX 50 Series graphics cards. Delivering an enormous advancement in performance, efficiency, and AI-powered graphics, these systems are backed by Corsair’s two-year warranty, providing peace of mind with reliable support and guaranteed quality.

•Showcased innovative hardware at CES 2025. In addition to all-new hardware such as the XENEON EDGE 14.5″ Touchscreen, EX400U USB4 External SSD, DOMINATOR TITANIUM Wave Accessory Kit, and Corsair Custom Lab memory, updates were featured to Corsair’s distinguished RMe and HXi power supplies featuring boosted capabilities for next-gen GPUs.

•Fanatec revolutionizes Sim racing: Corsair’s Fanatec unveiled the ClubSport GT Cockpit, an innovative and robust racing chassis that delivers a highly immersive sim racing experience. Built for both seasoned professionals and enthusiastic newcomers, the ClubSport GT Cockpit offers incredible adjustability, stability, and comfort, helping sim racers to perform at their very best.

•Inked Squid Game promotional tie-in with Netflix, Xbox and SCUF. Fans of the global sensation Squid Game were given the chance to have teamed up to offer fans an exciting way to immerse themselves in the Squid Game universe, win coveted gaming gear and participate in themed contests through a joint collaboration between Netflix, Xbox and Corsair’s SCUF Gaming.

Conference Call and Webcast Information

Corsair will host a conference call to discuss the fourth quarter and full year 2024 financial results today at 2:00 p.m. Pacific Time. The conference call will be accessible on Corsair’s Investor Relations website at https://ir.corsair.com, or by dialing 1-844-481-2518 (USA) or 1-412-317-0546 (International) with conference ID 10195932. A replay will be available approximately 3 hours after the live call ends on

Corsair’s Investor Relations website, or through February 19, 2025 by dialing 1-844-512-2921 (USA) or 1-412-317-6671 (International), with passcode 10195932.

About Corsair Gaming

Corsair (Nasdaq: CRSR) is a leading global developer and manufacturer of high-performance products and technology for gamers, content creators, and PC enthusiasts. From award-winning PC components and peripherals to premium streaming equipment and smart ambient lighting, Corsair delivers a full ecosystem of products that work together to enable everyone, from casual gamers to committed professionals, to perform at their very best. Corsair also sells products under its Fanatec brand, the leading end-to-end premium Sim Racing product line; Elgato brand, which provides premium studio equipment and accessories for content creators; SCUF Gaming brand, which builds custom-designed controllers for competitive gamers; Drop, the leading community-driven mechanical keyboard brand; and ORIGIN PC brand, a builder of custom gaming and workstation desktop PCs.

Forward-Looking Statements

This press release contains express and implied forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, including, but not limited to, statements regarding the Company’s financial outlook for the full year 2025; market headwinds and tailwinds, including its expectations regarding the gaming market’s continued growth; new product launches, the entry into new product categories and demand for new products; the Company’s ability to successfully close and integrate acquisitions and expectations regarding the growth of these acquisitions as well as their estimated impact on the Company’s financial results in future periods and the size of markets and segments in the future. Forward-looking statements are based on our management’s beliefs, as well as assumptions made by, and information currently available to them. Because such statements are based on expectations as to future financial and operating results and are not statements of fact, actual results may differ materially from those projected. Factors which may cause actual results to differ materially from current expectations include, but are not limited to: the Company’s limited operating history, which makes it difficult to forecast the Company’s future results of operations; current macroeconomic conditions, including the impacts of high inflation and risk of recession, on demand for our products, consumer confidence and financial markets generally; the Company’s ability to build and maintain the strength of the Company’s brand among gaming and streaming enthusiasts and ability to continuously develop and successfully market new products and improvements to existing products; the introduction and success of new third-party high-performance computer hardware, particularly graphics processing units and central processing units as well as sophisticated new video games; fluctuations in operating results; the loss or inability to attract and retain key management; the impacts from geopolitical events and unrest; delays or disruptions at the Company or third-parties’ manufacturing and distribution facilities; and the other factors described under the heading “Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2024 to be filed with the Securities and Exchange Commission (“SEC”) and our subsequent filings with the SEC. All forward-looking statements reflect our beliefs and assumptions only as of the date of this press release. We undertake no obligation to update forward-looking statements to reflect future events or circumstances. Our results for the quarter ended December 31, 2024 are also not necessarily indicative of our operating results for any future periods.

Use and Reconciliation of Non-GAAP Financial Measures

To supplement the financial results presented in accordance with GAAP, this earnings release presents certain non-GAAP financial information, including adjusted operating income (loss), adjusted net income (loss), adjusted net income (loss) per diluted share and adjusted EBITDA. These are important financial

performance measures for us, but are not financial measures as defined by GAAP. The presentation of this non-GAAP financial information is not intended to be considered in isolation of or as a substitute for, or superior to, the financial information prepared and presented in accordance with GAAP.

We use adjusted operating income (loss), adjusted net income (loss), adjusted net income (loss) per share and adjusted EBITDA to evaluate our operating performance and trends and make planning decisions. We believe that these non-GAAP financial measures help identify underlying trends in our business that could otherwise be masked by the effect of the expenses and other items that we exclude in such non-GAAP measures. Accordingly, we believe that these non-GAAP financial measures provide useful information to investors and others in understanding and evaluating our operating results, enhancing the overall understanding of our past performance and future prospects, and allowing for greater transparency with respect to the key financial metrics used by our management in our financial and operational decision-making. We also present these non-GAAP financial measures because we believe investors, analysts and rating agencies consider it useful in measuring our ability to meet our debt service obligations.

Our use of these terms may vary from that of others in our industry. These non-GAAP financial measures should not be considered as an alternative to net revenue, operating income (loss), net income (loss), cash provided by operating activities, or any other measures derived in accordance with GAAP as measures of operating performance or liquidity. Reconciliations of these measures to the most directly comparable GAAP financial measures are presented in the attached schedules.

We calculate these non-GAAP financial measures as follows:

•Adjusted operating income (loss), non-GAAP, is determined by adding back to GAAP operating income (loss), the impact from amortization, stock-based compensation, one-time costs related to legal and other matters, acquisition and related integration costs, restructuring and other charges, and acquisition accounting impact related to recognizing acquired inventory at fair value.

•Adjusted net income (loss), non-GAAP, excludes the impact from amortization, stock-based compensation, one-time costs related to legal and other matters, acquisition and related integration costs, restructuring and other charges, acquisition accounting impact related to recognizing acquired inventory at fair value and the bargain purchase gain on business acquisition, as well as the related tax effects of each of these adjustments.

•Adjusted net income (loss) per diluted share, non-GAAP, is determined by dividing adjusted net income (loss), non-GAAP by the respective weighted average shares outstanding, inclusive of the impact of other dilutive securities.

•Adjusted EBITDA excludes the impact from amortization, stock-based compensation, one-time costs related to legal and other matters, depreciation, interest expense, net, acquisition and related integration costs, restructuring and other charges, acquisition accounting impact related to recognizing acquired inventory at fair value, and the bargain purchase gain on business acquisition, and tax expense (benefit).

We encourage investors and others to review our financial information in its entirety, not to rely on any single financial measure and to view these non-GAAP financial measures in conjunction with the related GAAP financial measures.

|

|

Investor Relations Contact: Ronald van Veen ir@corsair.com 510-578-1407 |

Media Contact: Timothy Biba tbiba@soleburystrat.com 203-428-3222 |

Corsair Gaming, Inc.

Condensed Consolidated Statements of Operations

(Unaudited, in thousands, except per share amounts)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended

December 31, |

|

|

Years Ended

December 31, |

|

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

Net revenue |

|

$ |

413,623 |

|

|

$ |

417,286 |

|

|

$ |

1,316,379 |

|

|

$ |

1,459,875 |

|

Cost of revenue |

|

|

305,411 |

|

|

|

314,612 |

|

|

|

988,782 |

|

|

|

1,099,612 |

|

Gross profit |

|

|

108,212 |

|

|

|

102,674 |

|

|

|

327,597 |

|

|

|

360,263 |

|

Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

Sales, general and administrative |

|

|

85,331 |

|

|

|

73,831 |

|

|

|

310,008 |

|

|

|

285,313 |

|

Product development |

|

|

16,958 |

|

|

|

16,719 |

|

|

|

67,543 |

|

|

|

65,261 |

|

Total operating expenses |

|

|

102,289 |

|

|

|

90,550 |

|

|

|

377,551 |

|

|

|

350,574 |

|

Operating income (loss) |

|

|

5,923 |

|

|

|

12,124 |

|

|

|

(49,954 |

) |

|

|

9,689 |

|

Other (expense) income: |

|

|

|

|

|

|

|

|

|

|

|

|

Interest expense |

|

|

(3,069 |

) |

|

|

(4,351 |

) |

|

|

(13,207 |

) |

|

|

(17,420 |

) |

Interest income |

|

|

327 |

|

|

|

1,645 |

|

|

|

3,347 |

|

|

|

6,839 |

|

Other (expense) income, net |

|

|

43 |

|

|

|

(1,261 |

) |

|

|

(1,844 |

) |

|

|

(2,587 |

) |

Total other expense, net |

|

|

(2,699 |

) |

|

|

(3,967 |

) |

|

|

(11,704 |

) |

|

|

(13,168 |

) |

Income (loss) before income taxes |

|

|

3,224 |

|

|

|

8,157 |

|

|

|

(61,658 |

) |

|

|

(3,479 |

) |

Income tax (expense) benefit |

|

|

(496 |

) |

|

|

(581 |

) |

|

|

(21,736 |

) |

|

|

2,442 |

|

Net income (loss) |

|

|

2,728 |

|

|

|

7,576 |

|

|

|

(83,394 |

) |

|

|

(1,037 |

) |

Less: Net income attributable to noncontrolling interest |

|

|

442 |

|

|

|

595 |

|

|

|

1,787 |

|

|

|

1,553 |

|

Net income (loss) attributable to Corsair Gaming, Inc. |

|

$ |

2,286 |

|

|

$ |

6,981 |

|

|

$ |

(85,181 |

) |

|

$ |

(2,590 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Calculation of net income (loss) per share attributable to common stockholders of Corsair Gaming, Inc.: |

|

|

|

|

|

|

|

|

|

|

|

|

Net income (loss) attributable to Corsair Gaming, Inc. |

|

$ |

2,286 |

|

|

$ |

6,981 |

|

|

$ |

(85,181 |

) |

|

$ |

(2,590 |

) |

Change in redemption value of redeemable noncontrolling interest |

|

|

(950 |

) |

|

|

(758 |

) |

|

|

(13,994 |

) |

|

|

5,777 |

|

Net income (loss) attributable to common stockholders of Corsair Gaming, Inc. |

|

$ |

1,336 |

|

|

$ |

6,223 |

|

|

$ |

(99,175 |

) |

|

$ |

3,187 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income (loss) per share attributable to common stockholders of Corsair Gaming, Inc.: |

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

$ |

0.01 |

|

|

$ |

0.06 |

|

|

$ |

(0.95 |

) |

|

$ |

0.03 |

|

Diluted |

|

$ |

0.01 |

|

|

$ |

0.06 |

|

|

$ |

(0.95 |

) |

|

$ |

0.03 |

|

Weighted-average common shares outstanding: |

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

|

104,731 |

|

|

|

103,058 |

|

|

|

104,164 |

|

|

|

102,482 |

|

Diluted |

|

|

105,943 |

|

|

|

106,220 |

|

|

|

104,164 |

|

|

|

106,276 |

|

Corsair Gaming, Inc.

Segment Information

(Unaudited, in thousands, except percentages)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended

December 31, |

|

|

Years Ended

December 31, |

|

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

Net revenue: |

|

|

|

|

|

|

|

|

|

|

|

|

Gamer and Creator Peripherals |

|

$ |

169,561 |

|

|

$ |

136,828 |

|

|

$ |

472,729 |

|

|

$ |

394,881 |

|

Gaming Components and Systems |

|

|

244,062 |

|

|

|

280,458 |

|

|

|

843,650 |

|

|

|

1,064,994 |

|

Memory |

|

|

126,276 |

|

|

|

145,485 |

|

|

|

429,916 |

|

|

|

517,416 |

|

Other Components |

|

|

117,786 |

|

|

|

134,973 |

|

|

|

413,734 |

|

|

|

547,578 |

|

Total Net Revenue |

|

$ |

413,623 |

|

|

$ |

417,286 |

|

|

$ |

1,316,379 |

|

|

$ |

1,459,875 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gross Profit: |

|

|

|

|

|

|

|

|

|

|

|

|

Gamer and Creator Peripherals |

|

$ |

63,919 |

|

|

$ |

50,897 |

|

|

$ |

182,293 |

|

|

$ |

132,982 |

|

Gaming Components and Systems |

|

|

44,293 |

|

|

|

51,777 |

|

|

|

145,304 |

|

|

|

227,281 |

|

Memory |

|

|

19,290 |

|

|

|

19,656 |

|

|

|

57,179 |

|

|

|

77,436 |

|

Other Components |

|

|

25,003 |

|

|

|

32,121 |

|

|

|

88,125 |

|

|

|

149,845 |

|

Total Gross Profit |

|

$ |

108,212 |

|

|

$ |

102,674 |

|

|

$ |

327,597 |

|

|

$ |

360,263 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gross Margin: |

|

|

|

|

|

|

|

|

|

|

|

|

Gamer and Creator Peripherals |

|

|

37.7 |

% |

|

|

37.2 |

% |

|

|

38.6 |

% |

|

|

33.7 |

% |

Gaming Components and Systems |

|

|

18.1 |

% |

|

|

18.5 |

% |

|

|

17.2 |

% |

|

|

21.3 |

% |

Total Gross Margin |

|

|

26.2 |

% |

|

|

24.6 |

% |

|

|

24.9 |

% |

|

|

24.7 |

% |

Corsair Gaming, Inc.

Condensed Consolidated Balance Sheets

(Unaudited, in thousands)

|

|

|

|

|

|

|

|

|

|

|

December 31,

2024 |

|

|

December 31,

2023 |

|

|

|

|

|

|

|

|

Assets |

|

|

|

|

|

|

Current assets: |

|

|

|

|

|

|

Cash and restricted cash |

|

$ |

109,385 |

|

|

$ |

178,325 |

|

Accounts receivable, net |

|

|

218,648 |

|

|

|

253,268 |

|

Inventories |

|

|

259,979 |

|

|

|

240,172 |

|

Prepaid expenses and other current assets |

|

|

35,376 |

|

|

|

39,824 |

|

Total current assets |

|

|

623,388 |

|

|

|

711,589 |

|

Restricted cash, noncurrent |

|

|

246 |

|

|

|

239 |

|

Property and equipment, net |

|

|

29,742 |

|

|

|

32,212 |

|

Goodwill |

|

|

354,222 |

|

|

|

354,705 |

|

Intangible assets, net |

|

|

164,319 |

|

|

|

188,009 |

|

Other assets |

|

|

63,912 |

|

|

|

70,709 |

|

Total assets |

|

$ |

1,235,829 |

|

|

$ |

1,357,463 |

|

Liabilities |

|

|

|

|

|

|

Current liabilities: |

|

|

|

|

|

|

Debt maturing within one year, net |

|

$ |

12,229 |

|

|

$ |

12,190 |

|

Accounts payable |

|

|

207,215 |

|

|

|

239,957 |

|

Other liabilities and accrued expenses |

|

|

176,869 |

|

|

|

166,340 |

|

Total current liabilities |

|

|

396,313 |

|

|

|

418,487 |

|

Long-term debt, net |

|

|

161,310 |

|

|

|

186,006 |

|

Deferred tax liabilities |

|

|

7,379 |

|

|

|

17,395 |

|

Other liabilities, noncurrent |

|

|

51,375 |

|

|

|

41,595 |

|

Total liabilities |

|

|

616,377 |

|

|

|

663,483 |

|

Temporary equity |

|

|

|

|

|

|

Redeemable noncontrolling interest |

|

|

15,149 |

|

|

|

15,937 |

|

Permanent equity |

|

|

|

|

|

|

Corsair Gaming, Inc. stockholders’ equity: |

|

|

|

|

|

|

Common stock and additional paid-in capital |

|

|

667,627 |

|

|

|

630,652 |

|

Retained earnings (Accumulated deficit) |

|

|

(58,765 |

) |

|

|

40,410 |

|

Accumulated other comprehensive loss |

|

|

(4,559 |

) |

|

|

(3,487 |

) |

Total Corsair Gaming, Inc. stockholders’ equity |

|

|

604,303 |

|

|

|

667,575 |

|

Nonredeemable noncontrolling interest |

|

|

— |

|

|

|

10,468 |

|

Total permanent equity |

|

|

604,303 |

|

|

|

678,043 |

|

Total liabilities, temporary equity and permanent equity |

|

$ |

1,235,829 |

|

|

$ |

1,357,463 |

|

Corsair Gaming, Inc.

Condensed Consolidated Statements of Cash Flows

(Unaudited, in thousands)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended

December 31, |

|

|

Years Ended

December 31, |

|

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

Cash flows from operating activities: |

|

|

|

|

|

|

|

|

|

|

|

|

Net income (loss) |

|

$ |

2,728 |

|

|

$ |

7,576 |

|

|

$ |

(83,394 |

) |

|

$ |

(1,037 |

) |

Adjustments to reconcile net income (loss) to net cash provided by operating activities: |

|

|

|

|

|

|

|

|

|

|

|

|

Stock-based compensation |

|

|

7,466 |

|

|

|

7,628 |

|

|

|

30,591 |

|

|

|

30,873 |

|

Depreciation |

|

|

3,955 |

|

|

|

3,194 |

|

|

|

13,449 |

|

|

|

12,210 |

|

Amortization |

|

|

9,866 |

|

|

|

9,483 |

|

|

|

38,448 |

|

|

|

38,488 |

|

Bargain purchase gain on business acquisition |

|

|

(2,581 |

) |

|

|

— |

|

|

|

(2,581 |

) |

|

|

— |

|

Deferred income taxes, net of valuation allowance |

|

|

(1,350 |

) |

|

|

1,392 |

|

|

|

11,416 |

|

|

|

(6,332 |

) |

Other |

|

|

2,872 |

|

|

|

1,770 |

|

|

|

5,661 |

|

|

|

4,942 |

|

Changes in operating assets and liabilities: |

|

|

|

|

|

|

|

|

|

|

|

|

Accounts receivable |

|

|

(41,973 |

) |

|

|

384 |

|

|

|

32,285 |

|

|

|

(17,686 |

) |

Inventories |

|

|

27,884 |

|

|

|

(4,018 |

) |

|

|

18,315 |

|

|

|

(39,470 |

) |

Prepaid expenses and other assets |

|

|

5,681 |

|

|

|

6,453 |

|

|

|

5,897 |

|

|

|

1,902 |

|

Accounts payable |

|

|

21,809 |

|

|

|

23,863 |

|

|

|

(39,507 |

) |

|

|

62,150 |

|

Other liabilities and accrued expenses |

|

|

19,198 |

|

|

|

(632 |

) |

|

|

5,297 |

|

|

|

3,792 |

|

Net cash provided by operating activities |

|

|

55,555 |

|

|

|

57,093 |

|

|

|

35,877 |

|

|

|

89,153 |

|

Cash flows from investing activities: |

|

|

|

|

|

|

|

|

|

|

|

|

Acquisition of businesses, net of cash acquired |

|

|

— |

|

|

|

— |

|

|

|

(43,131 |

) |

|

|

(14,220 |

) |

Purchase of property and equipment |

|

|

(1,498 |

) |

|

|

(1,977 |

) |

|

|

(9,849 |

) |

|

|

(12,761 |

) |

Purchase of intangible asset |

|

|

— |

|

|

|

— |

|

|

|

(100 |

) |

|

|

— |

|

Purchase price adjustment related to business acquisition |

|

|

— |

|

|

|

— |

|

|

|

1,041 |

|

|

|

— |

|

Payment of bridge loan origination costs |

|

|

(666 |

) |

|

|

— |

|

|

|

(666 |

) |

|

|

— |

|

Net cash used in investing activities |

|

|

(2,164 |

) |

|

|

(1,977 |

) |

|

|

(52,705 |

) |

|

|

(26,981 |

) |

Cash flows from financing activities: |

|

|

|

|

|

|

|

|

|

|

|

|

Repayment of debt and debt issuance costs |

|

|

(3,750 |

) |

|

|

(24,750 |

) |

|

|

(25,000 |

) |

|

|

(41,000 |

) |

Borrowings from line of credit |

|

|

3,500 |

|

|

|

— |

|

|

|

25,000 |

|

|

|

— |

|

Repayment of line of credit |

|

|

(3,500 |

) |

|

|

— |

|

|

|

(25,000 |

) |

|

|

— |

|

Purchase of additional ownership interest |

|

|

— |

|

|

|

— |

|

|

|

(19,750 |

) |

|

|

— |

|

Payment of other offering costs |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(497 |

) |

Proceeds from issuance of shares through employee equity incentive plans |

|

|

267 |

|

|

|

659 |

|

|

|

5,377 |

|

|

|

7,449 |

|

Payment of taxes related to net share settlement of equity awards |

|

|

(11 |

) |

|

|

(91 |

) |

|

|

(573 |

) |

|

|

(1,409 |

) |

Dividend paid to noncontrolling interest |

|

|

(570 |

) |

|

|

— |

|

|

|

(5,792 |

) |

|

|

(980 |

) |

Payment of deferred and contingent consideration |

|

|

— |

|

|

|

— |

|

|

|

(4,942 |

) |

|

|

(950 |

) |

Net cash used in financing activities |

|

|

(4,064 |

) |

|

|

(24,182 |

) |

|

|

(50,680 |

) |

|

|

(37,387 |

) |

Effect of exchange rate changes on cash |

|

|

(1,302 |

) |

|

|

(140 |

) |

|

$ |

(1,425 |

) |

|

$ |

(281 |

) |

Net increase (decrease) in cash and restricted cash |

|

|

48,025 |

|

|

|

30,794 |

|

|

|

(68,933 |

) |

|

|

24,504 |

|

Cash and restricted cash at the beginning of the period |

|

|

61,606 |

|

|

|

147,770 |

|

|

|

178,564 |

|

|

|

154,060 |

|

Cash and restricted cash at the end of the period |

|

$ |

109,631 |

|

|

$ |

178,564 |

|

|

$ |

109,631 |

|

|

$ |

178,564 |

|

Corsair Gaming, Inc.

GAAP to Non-GAAP Reconciliations

Non-GAAP Operating Income Reconciliations

(Unaudited, in thousands, except percentages)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended

December 31, |

|

|

Years Ended

December 31, |

|

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

Operating Income (loss) - GAAP |

|

$ |

5,923 |

|

|

$ |

12,124 |

|

|

$ |

(49,954 |

) |

|

$ |

9,689 |

|

Amortization |

|

|

9,865 |

|

|

|

9,483 |

|

|

|

38,448 |

|

|

|

38,488 |

|

Stock-based compensation |

|

|

7,466 |

|

|

|

7,628 |

|

|

|

30,591 |

|

|

|

30,873 |

|

Acquisition and related integration costs |

|

|

2,471 |

|

|

|

1,401 |

|

|

|

7,131 |

|

|

|

3,561 |

|

One-time costs related to legal and other matters |

|

|

31 |

|

|

|

— |

|

|

|

7,530 |

|

|

|

— |

|

Restructuring and other costs |

|

|

1,789 |

|

|

|

595 |

|

|

|

6,724 |

|

|

|

1,304 |

|

Acquisition accounting impact related to recognizing acquired inventory at fair value |

|

|

4,180 |

|

|

|

561 |

|

|

|

5,253 |

|

|

|

1,521 |

|

Adjusted Operating Income - Non-GAAP |

|

$ |

31,725 |

|

|

$ |

31,792 |

|

|

$ |

45,723 |

|

|

$ |

85,436 |

|

As a % of net revenue - GAAP |

|

|

1.4 |

% |

|

|

2.9 |

% |

|

|

-3.8 |

% |

|

|

0.7 |

% |

As a % of net revenue - Non-GAAP |

|

|

7.7 |

% |

|

|

7.6 |

% |

|

|

3.5 |

% |

|

|

5.9 |

% |

Corsair Gaming, Inc.

GAAP to Non-GAAP Reconciliations

Non-GAAP Net Income (Loss) and Net Income (Loss) Per Share Reconciliations

(Unaudited, in thousands, except per share amounts)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended

December 31, |

|

|

Years Ended

December 31, |

|

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

Net income (loss) attributable to common stockholders of Corsair Gaming, Inc. (1) |

|

$ |

1,336 |

|

|

$ |

6,223 |

|

|

$ |

(99,175 |

) |

|

$ |

3,187 |

|

Less: Change in redemption value of redeemable noncontrolling interest |

|

|

(950 |

) |

|

|

(758 |

) |

|

|

(13,994 |

) |

|

|

5,777 |

|

Net income (loss) attributable to Corsair Gaming, Inc. |

|

|

2,286 |

|

|

|

6,981 |

|

|

|

(85,181 |

) |

|

|

(2,590 |

) |

Add: Net income attributable to noncontrolling interest |

|

|

442 |

|

|

|

595 |

|

|

|

1,787 |

|

|

|

1,553 |

|

Net Income (loss) - GAAP |

|

|

2,728 |

|

|

|

7,576 |

|

|

|

(83,394 |

) |

|

|

(1,037 |

) |

Adjustments: |

|

|

|

|

|

|

|

|

|

|

|

|

Amortization |

|

|

9,865 |

|

|

|

9,483 |

|

|

|

38,448 |

|

|

|

38,488 |

|

Stock-based compensation |

|

|

7,466 |

|

|

|

7,628 |

|

|

|

30,591 |

|

|

|

30,873 |

|

Acquisition and related integration costs |

|

|

2,471 |

|

|

|

1,401 |

|

|

|

7,131 |

|

|

|

3,561 |

|

One-time costs related to legal and other matters |

|

|

31 |

|

|

|

— |

|

|

|

7,530 |

|

|

|

— |

|

Restructuring and other costs |

|

|

1,789 |

|

|

|

595 |

|

|

|

6,724 |

|

|

|

1,304 |

|

Acquisition accounting impact related to recognizing acquired inventory at fair value |

|

|

4,180 |

|

|

|

561 |

|

|

|

5,253 |

|

|

|

1,521 |

|

Bargain purchase gain on business acquisition |

|

|

(2,581 |

) |

|

|

— |

|

|

|

(2,581 |

) |

|

|

— |

|

Non-GAAP income tax adjustment |

|

|

(1,129 |

) |

|

|

(4,052 |

) |

|

|

(12,446 |

) |

|

|

(16,404 |

) |

Adjusted Net Income (loss) - Non-GAAP |

|

$ |

24,820 |

|

|

$ |

23,192 |

|

|

$ |

(2,744 |

) |

|

$ |

58,306 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Diluted net income (loss) per share: |

|

|

|

|

|

|

|

|

|

|

|

|

GAAP |

|

$ |

0.01 |

|

|

$ |

0.06 |

|

|

$ |

(0.95 |

) |

|

$ |

0.03 |

|

Adjusted, Non-GAAP |

|

$ |

0.23 |

|

|

$ |

0.22 |

|

|

$ |

(0.03 |

) |

|

$ |

0.55 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average common shares outstanding - Diluted: |

|

|

|

|

|

|

|

|

|

|

|

|

GAAP |

|

|

105,943 |

|

|

|

106,220 |

|

|

|

104,164 |

|

|

|

106,276 |

|

Adjusted, Non-GAAP |

|

|

105,943 |

|

|

|

106,220 |

|

|

|

104,164 |

|

|

|

106,276 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1) Numerator for calculating net income (loss) per share-GAAP |

|

|

|

|

|

|

|

|

|

|

|

|

Corsair Gaming, Inc.

GAAP to Non-GAAP Reconciliations

Adjusted EBITDA Reconciliations

(Unaudited, in thousands, except percentages)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended

December 31, |

|

|

Years Ended

December 31, |

|

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

Net Income (loss) - GAAP |

|

$ |

2,728 |

|

|

$ |

7,576 |

|

|

$ |

(83,394 |

) |

|

$ |

(1,037 |

) |

Amortization |

|

|

9,865 |

|

|

|

9,483 |

|

|

|

38,448 |

|

|

|

38,488 |

|

Stock-based compensation |

|

|

7,466 |

|

|

|

7,628 |

|

|

|

30,591 |

|

|

|

30,873 |

|

Depreciation |

|

|

3,955 |

|

|

|

3,194 |

|

|

|

13,449 |

|

|

|

12,210 |

|

Interest expense, net of interest income |

|

|

2,742 |

|

|

|

2,706 |

|

|

|

9,860 |

|

|

|

10,581 |

|

Acquisition and related integration costs |

|

|

2,471 |

|

|

|

1,401 |

|

|

|

7,131 |

|

|

|

3,561 |

|

One-time costs related to legal and other matters |

|

|

31 |

|

|

|

— |

|

|

|

7,530 |

|

|

|

— |

|

Restructuring and other costs |

|

|

1,789 |

|

|

|

595 |

|

|

|

6,724 |

|

|

|

1,304 |

|

Acquisition accounting impact related to recognizing acquired inventory at fair value |

|

|

4,180 |

|

|

|

561 |

|

|

|

5,253 |

|

|

|

1,521 |

|

Bargain purchase gain on business acquisition |

|

|

(2,581 |

) |

|

|

— |

|

|

|

(2,581 |

) |

|

|

— |

|

Income tax (benefit) expense |

|

|

496 |

|

|

|

581 |

|

|

|

21,736 |

|

|

|

(2,442 |

) |

Adjusted EBITDA - Non-GAAP |

|

$ |

33,142 |

|

|

$ |

33,725 |

|

|

$ |

54,747 |

|

|

$ |

95,059 |

|

Adjusted EBITDA margin - Non-GAAP |

|

|

8.0 |

% |

|

|

8.1 |

% |

|

|

4.2 |

% |

|

|

6.5 |

% |

February 12, 2025 Q4 AND FY2024 UPDATE Exhibit 99.2

Forward Looking Statements�This presentation contains express and implied forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, including, but not limited to, statements regarding the Company’s financial outlook for the full year 2025; market headwinds and tailwinds, including its expectations regarding the gaming market’s continued growth; new product launches, the entry into new product categories and demand for new products; the Company’s ability to successfully close and integrate acquisitions and expectations regarding the growth of these acquisitions as well as their estimated impact on the Company’s financial results in future periods and the size of markets and segments in the future. Forward-looking statements are based on our management’s beliefs, as well as assumptions made by, and information currently available to them. Because such statements are based on expectations as to future financial and operating results and are not statements of fact, actual results may differ materially from those projected. Factors which may cause actual results to differ materially from current expectations include, but are not limited to: the Company’s limited operating history, which makes it difficult to forecast the Company’s future results of operations; current macroeconomic conditions, including the impacts of high inflation and risk of recession, on demand for our products, consumer confidence and financial markets generally; the Company’s ability to build and maintain the strength of the Company’s brand among gaming and streaming enthusiasts and ability to continuously develop and successfully market new products and improvements to existing products; the introduction and success of new third-party high-performance computer hardware, particularly graphics processing units and central processing units as well as sophisticated new video games; fluctuations in operating results; the loss or inability to attract and retain key management; the impacts from geopolitical events and unrest; delays or disruptions at the Company or third-parties’ manufacturing and distribution facilities; and the other factors described under the heading “Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2024 to be filed with the Securities and Exchange Commission (“SEC”) and our subsequent filings with the SEC. All forward-looking statements reflect our beliefs and assumptions only as of the date of this press release. We undertake no obligation to update forward-looking statements to reflect future events or circumstances. Our results for the quarter ended December 31, 2024 are also not necessarily indicative of our operating results for any future periods. Non-GAAP Financial Measures�Included in this presentation are certain non-GAAP financial measures, including Adjusted Operating Income (Loss), Adjusted EBITDA, Adjusted EBITDA Margin, Adjusted Net Income (Loss) and Adjusted Net Earnings (Loss) Per Share, which are not recognized under the generally accepted accounting principles (“GAAP”) in the United States and designed to complement the financial information presented in accordance with GAAP in the United States because management believes such measures are useful to investors. The non-GAAP measures have limitations as analytical tools and you should not consider them in isolation of, or as an alternative to, measures prepared in accordance with U.S. GAAP. The non-GAAP measures used by the Company may differ from the non-GAAP measures used by other companies. The Company urges you to review the reconciliation of its non-GAAP financial measures to the most directly comparable U.S. GAAP financial measures set forth in the Appendix to this presentation, and not to rely on any single financial measure to evaluate the Company's business. Market & Industry Data�This presentation also contains estimates and other statistical data made by independent parties and by the Company relating to the Company’s industry, the Company’s business and the market for the Company’s products and its future growth. This data involves a number of assumptions and limitations, and you are cautioned not to give undue weight to such estimates. In addition, projections, assumptions, and estimates of the Company’s future performance and the future performance of the market for its products are necessarily subject to a high degree of uncertainty and risk. DISCLAIMER

OUR COMPANY CORSAIR is a leading global provider of high-performance gear and technology for gamers, content creators, and PC enthusiasts. Founded in 1994, the company offers a diverse range of products, including gaming peripherals, PC components, streaming equipment, custom-built gaming PCs, SIM racing gear, and gaming furniture. Recognized for its expertise and quality, CORSAIR consistently delivers cutting-edge solutions that enhance gaming, racing, and creative experiences. The CORSAIR premium brand portfolio includes: DROP — a D2C platform for keyboards and audiophile gear ELGATO — studio equipment and software for content creators FANATEC — premium SIM racing hardware ORIGIN PC — high-end custom gaming and workstation PCs SCUF Gaming — custom controllers for competitive gamers With a strong commitment to performance and reliability, CORSAIR is a trusted name in the tech industry, catering to the needs of both amateur and professional users worldwide.

OUR PRODUCTS CORSAIR products allow our customers to stream, game, work, and perform better. For 30+ years we’ve provided high-quality gaming and enthusiast lifestyle products to an expanding group of modern users and age groups.

GENERAL UPDATE

NVIDIA GEFORCE RTX 50-SERIES IS HERE Nvidia announced their new GeForce Graphics cards at CES 2025. Top tier 5090 and 5080 GPU shipments started January 30th. Growth in the self-built PC components category is expected to be driven by a 5-year consumer refresh cycle since the COVID lockdown period, fueled by the latest GPU launches.

CORSAIR + FANATEC FANATEC is widely recognized as a global leader in high-end components for Sim Racing. After 3 months joining together CORSAIR and FANATEC, we are making amazing progress. We believe we are well on the way to add new retail partners and Value-Added Resellers to drive growth. We started shipments of our new Sim Racing chassis, the Club sport GT, as well as our new flagship Bentley wheel, with many more exciting products expected to come. UNLOCKING GROWTH IN A RAPIDLY EXPANDING MARKET

SOLID GROWTH FROM OUR CREATOR AND GAMER PERIPHERALS SEGMENT CORSAIR received the Best Keyboard Award for 2025 from both The New York Times’ Wirecutter and PC World for CORSAIR’s �K65 Wireless keyboard for gaming and overall usage. CORSAIR is recognized as one of the Top 10 tech companies according to PC Mag’s Best Brands Index Top 10, with the highest Net Promoter Score of any top 25 gaming peripheral brand. "CORSAIR's new accessory refresh gives Mac users the perfect excuse to never use a magic mouse or magic keyboard again."��PC GAMER�— James Bentley "Anyone who wants a high-quality keyboard with tons of options for customization, both hardware and software, will be pleased with this design." BEST GAMING KEYBOARDS 2025�PC WORLD�— Michael Crider "The best option for Mac Users" BEST GAMING KEYBOARDS 2025�THE NEW YORK TIMES / Wirecutter�— Haley Perry "The best gaming keyboard" BEST GAMING KEYBOARDS 2025�THE NEW YORK TIMES / Wirecutter�— Haley Perry CORSAIR is identified as one of the TOP TEN BEST BRANDS for 2025, awarded by PC MAG "The Stream Deck is an excellent piece of hardware—attractive, simple to use, and makes streaming (or even recording game video) much less arduous. ��Whether a hobbyist or a mid-grade professional, I think it could be a valuable tool in anyone’s streaming kit."��PC World�— Hayden Dingman RECENT TESTIMONIALS

CORSAIR GAMING PERIPHERALS SELECTED BY APPLE The K65 Wireless keyboard was specifically selected by Apple along with CORSAIR’s M75 Gaming mouse as one of the preferred devices used to game on a Mac and is available in Apple stores, with the PC version available at major online stores and through selected resellers.

CUSTOMIZATION We see customers leaning towards personal expression and customization. Launched in Q3’24, our CORSAIR Custom Lab (CCL) brings customization capabilities with a built-to-order business model. In Q4, we further expanded our CORSAIR Custom Lab capabilities and expect to offer DRAM Memory through our CCL program as well.

OUR GAMER AND CREATOR PERIPHERALS SEGMENT CONTINUES TO IMPROVE WITH 20% FULL YEAR GROWTH AND GROWTH IN GROSS MARGIN % * Q4 results include the impact of a $4.2M inventory FMV adjustment from the purchase of the FANATEC business.� Without that adjustment, gross profit would have been $68.1M and gross margin 40.2%

FINANCIAL RESULTS

Q4 2024 AND FY2024 RESULTS(1) Strong finish to the year with Q4 EBITDA numbers above latest expectations. Full year results impacted mostly by Nvidia GPU launch in Q1’25 occurring much later than was expected and softer than expected consumer spending on Gaming Systems. Overall margins continue to grow as Gamer and Creator Peripherals segment grows. (1) See appendix for reconciliation of non-GAAP metrics to most comparable GAAP metrics. ($ in millions except EPS and percentages) Q4'24 Q4'23 Y/Y FY24 FY23 Net Revenue $413.6 $417.3 -0.9% $1,316.4 $1,459.9 Gross Profit $108.2 $102.7 5.4% $327.6 $360.3 Gross Margin 26.2% 24.6% 160 bps 24.9% 24.7% Operating Income (Loss) $5.9 $12.1 -51.1% ($50.0) $9.7 Adjusted Operating Income $31.7 $31.8 -0.2% $45.7 $85.4 Net Income (Loss) Attributable to Common Stockholders $1.3 $6.2 -78.5% ($99.2) $3.2 Earnings (Loss) per Share (Diluted) $0.01 $0.06 -83.3% $(0.95) $0.03 Adjusted Net Income (Loss) $24.8 $23.2 7.0% ($2.7) $58.3 Adjusted Earnings (Loss) per Share (Diluted) $0.23 $0.22 4.5% $(0.03) $0.55 Adjusted EBITDA $33.1 $33.7 -1.7% $54.7 $95.1

Q4 2024 AND FY2024 SEGMENT RESULTS GAMING COMPONENTS AND SYSTEMS Q4 2024 AND FY2024 RESULTS ($ in millions except percentages) Q4'24 Q4'23 Y/Y FY24 FY23 Y/Y Net Revenue $244.1 $280.5 -13.0% $843.7 $1,065.0 -20.8% % of Total Net Revenue 59.0% 67.2% -820 bps 64.1% 73.0% -890 bps Gross Profit $44.3 $51.8 -14.5% $145.3 $227.3 -36.1% Gross Margin 18.1% 18.5% -40 bps 17.2% 21.3% -410 bps GAMER AND CREATOR PERIPHERALS Q4 2024 AND FY2024 RESULTS* ($ in millions except percentages) Q4'24 Q4'23 Y/Y FY24 FY23 Y/Y Net Revenue $169.6 $136.8 23.9% $472.7 $394.9 19.7% % of Total Net Revenue 41.0% 32.8% 820 bps 35.9% 27.0% 890 bps Gross Profit $63.9 $50.9 25.6% $182.3 $133.0 37.1% Gross Margin 37.7%* 37.2% 50 bps 38.6% 33.7% 490 bps Gaming Components and Systems segment impacted by later than expected GPU launch and soft consumer spending both in Q4 and for full year. Gamer and Creator Peripherals segment continues to grow both in revenue and margins. First full quarter of FANATEC revenue in Q4. * Q4'24 results include the impact of a $4.2M inventory FMV adjustment from the purchase of the FANATEC business. Without that adjustment, gross profit would have been $68.1M and gross margin 40.2%.

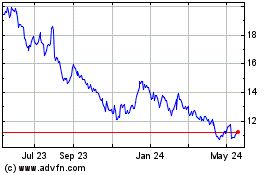

REVENUE BY SEGMENT Gaming Components and Systems Gamer and Creator Peripherals REVENUE

GAAP SEGMENT GROSS MARGIN % * Q4 24 results include the impact of a $4.2M inventory FMV adjustment from the purchase of the FANATEC business.� Without that adjustment, gross profit for the Gamer & Creator Peripherals would have been $68.1M and gross margin 40.2%

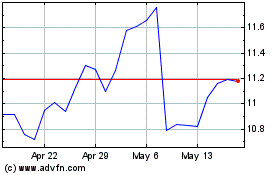

ADJUSTED EBITDA(1) (1) See appendix for reconciliation of non-GAAP metrics to most comparable GAAP metrics.

FINANCIAL GUIDANCE(1) (1) Given the number of risk factors, uncertainties and assumptions, many of which are discussed in slide 2, actual results may differ materially. We do not intend to update our financial outlook until our next quarterly results announcement. Estimates should not be viewed as a substitute for our full annual financial statement and are not necessarily indicative of the results to be expected for any future period. Certain non-GAAP measures included in our financial outlook were not reconciled to the comparable GAAP financial measures because the GAAP measures are not accessible on a forward-looking basis. We are unable to reconcile these forward-looking into non-GAAP measures to the most directly comparable GAAP measures without unreasonable effort because we are currently unable to predict with a reasonable degree of certainty the type and extent of certain items that would be expected to impact GAAP measures for this period but would not impact the non-GAAP measures. Such items may include stock-based compensation charges, public offering related charges, depreciation and amortization, and other items. The unavailable information could have a significant impact on our GAAP financial results. Financial Metrics 2025 Guidance Net Revenue $1.40-1.60 billion Adjusted Operating Income $67-87 million Adjusted EBITDA $80-100 million

CASH AND DEBT SUMMARY ($ in millions) December 31, 2024 Cash (Excluding restricted cash) $107.0 Term Loan (face value) $174.0 Total Debt $174.0 Net Debt $67.0

APPENDIX

USE OF NON-GAAP FINANCIAL MEASURES To supplement the financial results presented in accordance with GAAP, this presentation includes certain non-GAAP financial information, including Adjusted Operating Income (Loss), Adjusted EBITDA, Adjusted EBITDA Margin, Adjusted Net Income (Loss) and Adjusted Net Earnings (Loss) Per Share. These are important financial performance measures for us but are not financial measures as defined by GAAP. The presentation of this non-GAAP financial information is not intended to be considered in isolation of or as a substitute for, or superior to, the financial information prepared and presented in accordance with GAAP. We use these non-GAAP financial measures to evaluate our operating performance and trends and make planning decisions. We believe that these non-GAAP financial measures help identify underlying trends in our business that could otherwise be masked by the effect of the expenses and other items that we exclude in such non-GAAP financial measures. Accordingly, we believe that these non-GAAP financial provide useful information to investors and others in understanding and evaluating our operating results, enhancing the overall understanding of our past performance and future prospects, and allowing for greater transparency with respect to the key financial metrics used by our management in our financial and operational decision-making. We also present these non-GAAP financial measures because we believe investors, analysts and rating agencies consider them useful in measuring our ability to meet our debt service obligations. Our use of these terms may vary from that of others in our industry. These non-GAAP financial measures should not be considered as an alternative to revenues, operating income, net income, cash provided by operating activities or any other measures derived in accordance with GAAP as measures of operating performance or liquidity. Reconciliations of these measures to the most directly comparable GAAP financial measures are presented in the appendix. We encourage investors and others to review our financial information in its entirety, not to rely on any single financial measure and to view these non-GAAP financial measures in conjunction with the related GAAP financial measures.

GAAP TO NON-GAAP RECONCILIATIONS Non-GAAP Operating Income Reconciliations (Unaudited, in thousands, except percentages) Three Months Ended�December 31, Years Ended�December 31, 2024 2023 2024 2023 Operating Income (loss) - GAAP $ 5,923 $ 12,124 $ (49,954 ) $ 9,689 Amortization 9,865 9,483 38,448 38,488 Stock-based compensation 7,466 7,628 30,591 30,873 Acquisition and related integration costs 2,471 1,401 7,131 3,561 One-time costs related to legal and other matters 31 — 7,530 — Restructuring and other costs 1,789 595 6,724 1,304 Acquisition accounting impact related to recognizing acquired inventory at fair value 4,180 561 5,253 1,521 Adjusted Operating Income - Non-GAAP $ 31,725 $ 31,792 $ 45,723 $ 85,436 As a % of net revenue - GAAP 1.4 % 2.9 % -3.8 % 0.7 % As a % of net revenue - Non-GAAP 7.7 % 7.6 % 3.5 % 5.9 %

Non-GAAP Net Income (Loss) and Net Income (Loss) Per Share Reconciliations (Unaudited, in thousands, except per share amounts) GAAP TO NON-GAAP RECONCILIATIONS Three Months Ended�December 31, Years Ended�December 31, 2024 2023 2024 2023 Net income (loss) attributable to common stockholders of Corsair Gaming, Inc. (1) $ 1,336 $ 6,223 $ (99,175 ) $ 3,187 Less: Change in redemption value of redeemable noncontrolling interest (950 ) (758 ) (13,994 ) 5,777 Net income (loss) attributable to Corsair Gaming, Inc. 2,286 6,981 (85,181 ) (2,590 ) Add: Net income attributable to noncontrolling interest 442 595 1,787 1,553 Net Income (loss) - GAAP 2,728 7,576 (83,394 ) (1,037 ) Adjustments: Amortization 9,865 9,483 38,448 38,488 Stock-based compensation 7,466 7,628 30,591 30,873 Acquisition and related integration costs 2,471 1,401 7,131 3,561 One-time costs related to legal and other matters 31 — 7,530 — Restructuring and other costs 1,789 595 6,724 1,304 Acquisition accounting impact related to recognizing acquired inventory at fair value 4,180 561 5,253 1,521 Bargain purchase gain on business acquisition (2,581 ) — (2,581 ) — Non-GAAP income tax adjustment (1,129 ) (4,052 ) (12,446 ) (16,404 ) Adjusted Net Income (loss) - Non-GAAP $ 24,820 $ 23,192 $ (2,744 ) $ 58,306 Diluted net income (loss) per share: GAAP $ 0.01 $ 0.06 $ (0.95 ) $ 0.03 Adjusted, Non-GAAP $ 0.23 $ 0.22 $ (0.03 ) $ 0.55 Weighted average common shares outstanding - Diluted: GAAP 105,943 106,220 104,164 106,276 Adjusted, Non-GAAP 105,943 106,220 104,164 106,276 (1) Numerator for calculating net income (loss) per share-GAAP

Adjusted EBITDA Reconciliations (Unaudited, in thousands, except percentages) GAAP TO NON-GAAP RECONCILIATIONS Three Months Ended�December 31, Years Ended�December 31, 2024 2023 2024 2023 Net Income (loss) - GAAP $ 2,728 $ 7,576 $ (83,394 ) $ (1,037 ) Amortization 9,865 9,483 38,448 38,488 Stock-based compensation 7,466 7,628 30,591 30,873 Depreciation 3,955 3,194 13,449 12,210 Interest expense, net of interest income 2,742 2,706 9,860 10,581 Acquisition and related integration costs 2,471 1,401 7,131 3,561 One-time costs related to legal and other matters 31 — 7,530 — Restructuring and other costs 1,789 595 6,724 1,304 Acquisition accounting impact related to recognizing acquired inventory at fair value 4,180 561 5,253 1,521 Bargain purchase gain on business acquisition (2,581 ) — (2,581 ) — Income tax (benefit) expense 496 581 21,736 (2,442 ) Adjusted EBITDA - Non-GAAP $ 33,142 $ 33,725 $ 54,747 $ 95,059 Adjusted EBITDA margin - Non-GAAP 8.0 % 8.1 % 4.2 % 6.5 %

v3.25.0.1

Document And Entity Information

|

Feb. 12, 2025 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Feb. 12, 2025

|

| Entity Registrant Name |

Corsair Gaming, Inc.

|

| Entity Central Index Key |

0001743759

|

| Entity Emerging Growth Company |

false

|

| Entity File Number |

001-39533

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Tax Identification Number |

82-2335306

|

| Entity Address, Address Line One |

115 N. McCarthy Boulevard

|

| Entity Address, City or Town |

Milpitas

|

| Entity Address, State or Province |

CA

|

| Entity Address, Postal Zip Code |

95035

|

| City Area Code |

(510)

|

| Local Phone Number |

657-8747

|

| Entity Information, Former Legal or Registered Name |

Not Applicable

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, $0.0001 par value per share

|

| Trading Symbol |

CRSR

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |