Cirrus Logic, Inc. (NASDAQ: CRUS) today posted on its website at

investor.cirrus.com the quarterly Shareholder Letter that contains

the complete financial results for the third quarter of fiscal year

2025, which ended December 28, 2024, as well as the company’s

current business outlook.

“Cirrus Logic delivered revenue significantly above the top end

of our guidance range in the December quarter as shipments into

smartphones exceeded our expectations,” said John Forsyth, Cirrus

Logic president and chief executive officer. “During the quarter,

we experienced strong demand for our smartphone audio components,

including our latest-generation custom boosted amplifier and first

22-nanometer smart codec. Additionally, we gained momentum in our

laptop business as we were featured as part of the Intel Arrow Lake

reference design, began sampling our latest amplifier and codec

specifically designed for laptops, and expanded our breadth of

content across a variety of devices. With a compelling roadmap of

products and a proven track record of execution, we believe Cirrus

Logic is well-positioned to grow long-term shareholder value.”

Reported Financial Results – Third Quarter FY25

- Revenue of $555.7 million;

- GAAP and non-GAAP gross margin of 53.6 percent;

- GAAP operating expenses of $152.0 million and non-GAAP

operating expenses of $129.2 million; and

- GAAP earnings per share of $2.11 and non-GAAP earnings per

share of $2.51.

A reconciliation of GAAP to non-GAAP financial information is

included in the tables accompanying this press release.

Business Outlook – Fourth Quarter FY25

- Revenue is expected to range between $350 million and $410

million;

- GAAP gross margin is forecasted to be between 51 percent and 53

percent; and

- Combined GAAP R&D and SG&A expenses are anticipated to

range between $141 million and $147 million, including

approximately $20 million in stock-based compensation expense and

$2 million in amortization of acquired intangibles, resulting in a

non-GAAP operating expense range between $119 million and $125

million.

Cirrus Logic will host a live Q&A session at 5 p.m. EST

today to discuss its financial results and business outlook.

Participants may listen to the conference call on the investor

relations website at investor.cirrus.com. A replay of the webcast

can be accessed on the Cirrus Logic website approximately two hours

following its completion or by calling (609) 800-9909 or toll-free

at (800) 770-2030 (Access Code: 95424).

About Cirrus Logic, Inc.

Cirrus Logic is a leader in low-power, high-precision

mixed-signal processing solutions that create innovative user

experiences for the world’s top mobile and consumer applications.

With headquarters in Austin, Texas, Cirrus Logic is recognized

globally for its award-winning corporate culture.

Cirrus Logic, Cirrus and the Cirrus Logic logo are registered

trademarks of Cirrus Logic, Inc. All other company or product names

noted herein may be trademarks of their respective holders.

Use of non-GAAP Financial Information

To supplement Cirrus Logic's financial statements presented on a

GAAP basis, the company has provided non-GAAP financial

information, including non-GAAP net income, diluted earnings per

share, operating income and profit, operating expenses, gross

margin and profit, tax expense, tax expense impact on earnings per

share, effective tax rate, free cash flow, and free cash flow

margin. A reconciliation of the adjustments to GAAP results is

included in the tables below. Non-GAAP financial information is not

meant as a substitute for GAAP results but is included because

management believes such information is useful to our investors for

informational and comparative purposes. In addition, certain

non-GAAP financial information is used internally by management to

evaluate and manage the company. The non-GAAP financial information

used by Cirrus Logic may differ from that used by other companies.

These non-GAAP measures should be considered in addition to, and

not as a substitute for, the results prepared in accordance with

GAAP.

Safe Harbor Statement

Except for historical information contained herein, the matters

set forth in this news release contain forward-looking statements

including our statement about our belief that we are

well-positioned to grow long-term shareholder value; and our

estimates for the fourth quarter fiscal year 2025 revenue, gross

margin, combined research and development and selling, general and

administrative expense levels, stock-based compensation expense,

and amortization of acquired intangibles. In some cases,

forward-looking statements are identified by words such as

“expect,” “anticipate,” “target,” “project,” “believe,” “goals,”

“opportunity,” “estimates,” “intend,” and variations of these types

of words and similar expressions. In addition, any statements that

refer to our plans, expectations, strategies, or other

characterizations of future events or circumstances are

forward-looking statements. These forward-looking statements are

based on our current expectations, estimates, and assumptions and

are subject to certain risks and uncertainties that could cause

actual results to differ materially, and readers should not place

undue reliance on such statements. These risks and uncertainties

include, but are not limited to, the following: the level and

timing of orders and shipments during the fourth quarter of fiscal

year 2025, customer cancellations of orders, or the failure to

place orders consistent with forecasts, along with the risk factors

listed in our Form 10-K for the year ended March 30, 2024 and in

our other filings with the Securities and Exchange Commission,

which are available at www.sec.gov. The foregoing information

concerning our business outlook represents our outlook as of the

date of this news release, and we expressly disclaim any obligation

to update or revise any forward-looking statements, whether as a

result of new developments or otherwise.

Summary Financial Data Follows:

CONSOLIDATED CONDENSED

STATEMENT OF OPERATIONS

(in thousands, except per

share data; unaudited)

Three Months Ended

Nine Months Ended

Dec. 28,

Sep. 28,

Dec. 30,

Dec. 28,

Dec. 30,

2024

2024

2023

2024

2023

Q3'25

Q2'25

Q3'24

Q3'25

Q3'24

Audio

$

346,272

$

316,588

$

378,597

$

881,830

$

857,258

High-Performance Mixed-Signal

209,466

225,269

240,387

589,791

559,805

Net sales

555,738

541,857

618,984

1,471,621

1,417,063

Cost of sales

257,951

259,267

301,520

702,319

693,616

Gross profit

297,787

282,590

317,464

769,302

723,447

Gross margin

53.6

%

52.2

%

51.3

%

52.3

%

51.1

%

Research and development

112,976

112,925

112,672

331,264

323,092

Selling, general and administrative

39,042

37,813

37,604

113,625

107,306

Restructuring costs

—

—

(360

)

—

1,959

Total operating expenses

152,018

150,738

149,916

444,889

432,357

Income from operations

145,769

131,852

167,548

324,413

291,090

Interest income

8,146

8,134

4,889

24,482

13,218

Other income (expense)

(214

)

19

(337

)

1,414

(30

)

Income before income taxes

153,701

140,005

172,100

350,309

304,278

Provision for income taxes

37,696

37,865

33,377

90,069

74,548

Net income

$

116,005

$

102,140

$

138,723

$

260,240

$

229,730

Basic earnings per share

$

2.19

$

1.92

$

2.57

$

4.89

$

4.22

Diluted earnings per share:

$

2.11

$

1.83

$

2.50

$

4.69

$

4.09

Weighted average number of shares:

Basic

53,081

53,275

54,016

53,263

54,449

Diluted

55,076

55,800

55,592

55,529

56,160

Prepared in accordance with

Generally Accepted Accounting Principles

RECONCILIATION BETWEEN GAAP

AND NON-GAAP FINANCIAL INFORMATION

(in thousands, except per

share data; unaudited)

(not prepared in accordance

with GAAP)

Non-GAAP financial information is not

meant as a substitute for GAAP results, but is included because

management believes such information is useful to our investors for

informational and comparative purposes. In addition, certain

non-GAAP financial information is used internally by management to

evaluate and manage the company. As a note, the non-GAAP financial

information used by Cirrus Logic may differ from that used by other

companies. These non-GAAP measures should be considered in addition

to, and not as a substitute for, the results prepared in accordance

with GAAP.

Three Months Ended

Nine Months Ended

Dec. 28,

Sep. 28,

Dec. 30,

Dec. 28,

Dec. 30,

2024

2024

2023

2024

2023

Net Income Reconciliation

Q3'25

Q2'25

Q3'24

Q3'25

Q3'24

GAAP Net Income

$

116,005

$

102,140

$

138,723

$

260,240

$

229,730

Amortization of acquisition

intangibles

1,647

1,864

1,972

5,483

6,312

Stock-based compensation expense

20,823

22,447

23,067

64,655

67,113

Lease impairment

661

—

—

1,680

—

Restructuring costs

—

—

(360

)

—

1,959

Acquisition-related costs

—

—

—

—

4,105

Adjustment to income taxes

(827

)

(1,162

)

(2,769

)

(6,094

)

(9,001

)

Non-GAAP Net Income

$

138,309

$

125,289

$

160,633

$

325,964

$

300,218

Earnings Per Share Reconciliation

GAAP Diluted earnings per share

$

2.11

$

1.83

$

2.50

$

4.69

$

4.09

Effect of Amortization of acquisition

intangibles

0.03

0.04

0.04

0.10

0.11

Effect of Stock-based compensation

expense

0.38

0.40

0.41

1.16

1.20

Effect of Lease impairment

0.01

—

—

0.03

—

Effect of Restructuring costs

—

—

(0.01

)

—

0.04

Effect of Acquisition-related costs

—

—

—

—

0.07

Effect of Adjustment to income taxes

(0.02

)

(0.02

)

(0.05

)

(0.11

)

(0.16

)

Non-GAAP Diluted earnings per

share

$

2.51

$

2.25

$

2.89

$

5.87

$

5.35

Operating Income Reconciliation

GAAP Operating Income

$

145,769

$

131,852

$

167,548

$

324,413

$

291,090

GAAP Operating Profit

26.2

%

24.3

%

27.1

%

22.0

%

20.5

%

Amortization of acquisition

intangibles

1,647

1,864

1,972

5,483

6,312

Stock-based compensation expense -

COGS

351

355

395

972

1,041

Stock-based compensation expense -

R&D

14,498

15,844

16,771

46,105

48,195

Stock-based compensation expense -

SG&A

5,974

6,248

5,901

17,578

17,877

Lease impairment

661

—

—

1,680

—

Restructuring costs

—

—

(360

)

—

1,959

Acquisition-related costs

—

—

—

—

4,105

Non-GAAP Operating Income

$

168,900

$

156,163

$

192,227

$

396,231

$

370,579

Non-GAAP Operating Profit

30.4

%

28.8

%

31.1

%

26.9

%

26.2

%

Operating Expense Reconciliation

GAAP Operating Expenses

$

152,018

$

150,738

$

149,916

$

444,889

$

432,357

Amortization of acquisition

intangibles

(1,647

)

(1,864

)

(1,972

)

(5,483

)

(6,312

)

Stock-based compensation expense -

R&D

(14,498

)

(15,844

)

(16,771

)

(46,105

)

(48,195

)

Stock-based compensation expense -

SG&A

(5,974

)

(6,248

)

(5,901

)

(17,578

)

(17,877

)

Lease impairment

661

—

—

1,680

—

Restructuring costs

—

—

360

—

(1,959

)

Acquisition-related costs

—

—

—

—

(4,105

)

Non-GAAP Operating Expenses

$

129,238

$

126,782

$

125,632

$

374,043

$

353,909

Gross Margin/Profit Reconciliation

GAAP Gross Profit

$

297,787

$

282,590

$

317,464

$

769,302

$

723,447

GAAP Gross Margin

53.6

%

52.2

%

51.3

%

52.3

%

51.1

%

Stock-based compensation expense -

COGS

351

355

395

972

1,041

Non-GAAP Gross Profit

$

298,138

$

282,945

$

317,859

$

770,274

$

724,488

Non-GAAP Gross Margin

53.6

%

52.2

%

51.4

%

52.3

%

51.1

%

Three Months Ended

Nine Months Ended

Dec. 28,

Sep. 28,

Dec. 30,

Dec. 28,

Dec. 30,

2024

2024

2023

2024

2023

Effective Tax Rate Reconciliation

Q3'25

Q2'25

Q3'24

Q3'25

Q3'24

GAAP Tax Expense

$

37,696

$

37,865

$

33,377

$

90,069

$

74,548

GAAP Effective Tax Rate

24.5

%

27.0

%

19.4

%

25.7

%

24.5

%

Adjustments to income taxes

827

1,162

2,769

6,094

9,001

Non-GAAP Tax Expense

$

38,523

$

39,027

$

36,146

$

96,163

$

83,549

Non-GAAP Effective Tax Rate

21.8

%

23.8

%

18.4

%

22.8

%

21.8

%

Tax Impact to EPS Reconciliation

GAAP Tax Expense

$

0.68

$

0.68

$

0.60

$

1.62

$

1.33

Adjustments to income taxes

0.02

0.02

0.05

0.11

0.16

Non-GAAP Tax Expense

$

0.70

$

0.70

$

0.65

$

1.73

$

1.49

CONSOLIDATED CONDENSED BALANCE

SHEET

(in thousands;

unaudited)

Dec. 28,

Mar. 30,

Dec. 30,

2024

2024

2023

ASSETS

Current assets

Cash and cash equivalents

$

526,444

$

502,764

$

483,931

Marketable securities

37,535

23,778

32,842

Accounts receivable, net

261,943

162,478

217,269

Inventories

275,558

227,248

256,675

Prepaid wafers

66,113

86,679

84,854

Other current assets

82,857

103,245

109,814

Total current Assets

1,250,450

1,106,192

1,185,385

Long-term marketable securities

252,594

173,374

70,260

Right-of-use lease assets

129,597

138,288

140,993

Property and equipment, net

163,837

170,175

167,579

Intangibles, net

23,957

29,578

31,677

Goodwill

435,936

435,936

435,936

Deferred tax asset

40,895

48,649

34,116

Long-term prepaid wafers

23,020

60,750

73,492

Other assets

42,954

68,634

77,675

Total assets

$

2,363,240

$

2,231,576

$

2,217,113

LIABILITIES AND STOCKHOLDERS' EQUITY

Current liabilities

Accounts payable

$

77,907

$

55,545

$

56,231

Accrued salaries and benefits

48,029

47,612

44,352

Lease liability

21,858

20,640

19,906

Other accrued liabilities

63,119

62,596

58,105

Total current liabilities

210,913

186,393

178,594

Non-current lease liability

124,622

134,576

138,415

Non-current income taxes

43,401

52,013

52,247

Other long-term liabilities

21,506

41,580

47,097

Total long-term liabilities

189,529

228,169

237,759

Stockholders' equity:

Capital stock

1,840,791

1,760,701

1,735,824

Accumulated earnings

124,101

58,916

66,633

Accumulated other comprehensive loss

(2,094

)

(2,603

)

(1,697

)

Total stockholders' equity

1,962,798

1,817,014

1,800,760

Total liabilities and stockholders'

equity

$

2,363,240

$

2,231,576

$

2,217,113

Prepared in accordance with

Generally Accepted Accounting Principles

CONSOLIDATED CONDENSED

STATEMENT OF CASH FLOWS

(in thousands;

unaudited)

Three Months Ended

Dec. 28,

Dec. 30,

2024

2023

Q3'25

Q3'24

Cash flows from operating activities:

Net income

$

116,005

$

138,723

Adjustments to reconcile net income to net

cash provided by operating activities:

Depreciation and amortization

12,824

12,732

Stock-based compensation expense

20,823

23,067

Deferred income taxes

8,379

9,723

Loss on retirement or write-off of

long-lived assets

369

10

Other non-cash charges

(379

)

668

Restructuring costs

—

(360

)

Net change in operating assets and

liabilities:

Accounts receivable, net

62,155

54,048

Inventories

(3,793

)

72,257

Prepaid wafers

20,411

15,596

Other assets

1,720

17,973

Accounts payable and other accrued

liabilities

(21,556

)

(32,123

)

Income taxes payable

1,630

1,378

Net cash provided by operating

activities

218,588

313,692

Cash flows from investing activities:

Maturities and sales of available-for-sale

marketable securities

12,423

5,176

Purchases of available-for-sale marketable

securities

(44,868

)

(32,334

)

Purchases of property, equipment and

software

(6,687

)

(9,813

)

Net cash used in investing activities

(39,132

)

(36,971

)

Cash flows from financing activities:

Net proceeds from the issuance of common

stock

378

50

Repurchase of stock to satisfy employee

tax withholding obligations

(29,112

)

(13,722

)

Repurchase and retirement of common

stock

(70,037

)

(56,923

)

Net cash used in financing activities

(98,771

)

(70,595

)

Net increase in cash and cash

equivalents

80,685

206,126

Cash and cash equivalents at beginning of

period

445,759

277,805

Cash and cash equivalents at end of

period

$

526,444

$

483,931

Prepared in accordance with

Generally Accepted Accounting Principles

RECONCILIATION BETWEEN GAAP

AND NON-GAAP FINANCIAL INFORMATION

(in thousands;

unaudited)

Free cash flow, a non-GAAP financial

measure, is GAAP cash flow from operations (or cash provided by

operating activities) less capital expenditures. Capital

expenditures include purchases of property, equipment and software

as well as investments in technology, as presented within our GAAP

Consolidated Condensed Statement of Cash Flows. Free cash flow

margin represents free cash flow divided by revenue.

Twelve Months Ended

Three Months Ended

Dec. 28,

Dec. 28,

Sep. 28,

Jun. 29,

Mar. 30,

2024

2024

2024

2024

2024

Q3'25

Q3'25

Q2'25

Q1'25

Q4'24

Net cash provided by operating activities

(GAAP)

$

484,506

$

218,588

$

8,231

$

87,161

$

170,526

Capital expenditures

(27,267

)

(6,687

)

(2,740

)

(10,145

)

(7,695

)

Free Cash Flow (Non-GAAP)

$

457,239

$

211,901

$

5,491

$

77,016

$

162,831

Cash Flow from Operations as a

Percentage of Revenue (GAAP)

26

%

39

%

2

%

23

%

46

%

Capital Expenditures as a Percentage of

Revenue (GAAP)

1

%

1

%

1

%

3

%

2

%

Free Cash Flow Margin

(Non-GAAP)

25

%

38

%

1

%

21

%

44

%

RECONCILIATION BETWEEN GAAP

AND NON-GAAP FINANCIAL INFORMATION

(in millions;

unaudited)

(not prepared in accordance

with GAAP)

Q4 FY25

Guidance

Operating Expense Reconciliation

GAAP Operating Expenses

$141 - 147

Stock-based compensation expense

(20)

Amortization of acquisition

intangibles

(2)

Non-GAAP Operating Expenses

$119 - 125

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250204408544/en/

Investor Contact: Chelsea Heffernan Vice President,

Investor Relations Cirrus Logic, Inc. (512) 851-4125

Investor@cirrus.com

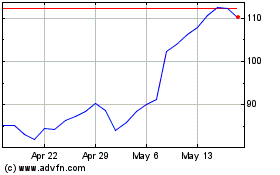

Cirrus Logic (NASDAQ:CRUS)

Historical Stock Chart

From Jan 2025 to Feb 2025

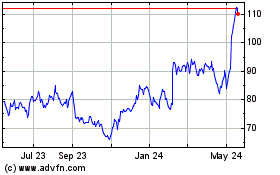

Cirrus Logic (NASDAQ:CRUS)

Historical Stock Chart

From Feb 2024 to Feb 2025