As filed with the Securities and Exchange Commission

on November 21, 2024

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE TO

Tender Offer

Statement Under Section 14(d)(1) or 13(e)(1)

of the Securities

Exchange Act of 1934

Amendment No. 2

THE HERZFELD CARIBBEAN BASIN FUND, INC.

(Name of Subject Company (Issuer))

The Herzfeld Caribbean Basin Fund, Inc.

(Name of Filing Person (Issuer))

Common Stock, par value $0.001

(Title of Class of Securities)

42804T106

(CUSIP Number of Securities)

Thomas K. Morgan

The Herzfeld Caribbean Basin Fund, Inc.

119 Washington Avenue, Suite 504

Miami Beach, Florida 33139

Telephone: (305) 777-1660

(Name, Address and Telephone Number of Person Authorized

to

Receive Notices and Communications on Behalf of the Person(s) Filing Statement)

With a Copy to:

John P. Falco, Esq.

Troutman Pepper Hamilton

Sanders LLP

3000 Two Logan Square

| 18th & Arch Streets

Philadelphia, PA 19103

Telephone: (215) 981-4659

| ☐ |

Check the box if the filing relates solely to preliminary communications made before the commencement of a tender offer. |

Check the appropriate boxes below to designate any transactions to

which the statement relates:

| |

☐ |

Third-party tender offer subject to Rule 14d-1. |

| |

☒ |

Issuer tender offer subject to Rule 13e-4. |

| |

☐ |

Going-private transaction subject to Rule 13e-3. |

| |

☐ |

Amendment to Schedule 13D under Rule 13d-2. |

| |

☐ |

Check the following box if the filing is a final amendment reporting the results of the tender offer. |

This Amendment No. 2 (“Amendment No.

2”) amends and supplements the Tender Offer Statement on Schedule TO originally filed by The Herzfeld Caribbean Basin Fund,

Inc. (the “Fund”) with the Securities and Exchange Commission on October 15, 2024 (“Schedule TO”). The

Schedule TO relates to the offer by the Fund to purchase for cash up to 5% or 827,416 shares of its outstanding common stock, with

par value of $0.001 (the “Shares”), upon the terms and subject to the conditions set forth in the Fund’s Offer to

Purchase dated October 15, 2024 (the “Offer to Purchase”) and the related Letter of Transmittal (the “Letter of

Transmittal,” which, together with the Offer to Purchase, set forth the terms that constitute the “Offer”), both

of which are attached to Schedule TO as Exhibits (a)(1)(i) and (a)(1)(ii), respectively.

This Amendment No. 2 is being filed to report the

final results of the Offer and is intended to satisfy the reporting requirements of Rule 13e-4(c)(4) promulgated under the Securities

Exchange Act of 1934, as amended. Only those items amended are reported in this Amendment No. 2. The information set forth in Schedule

TO is incorporated herein by reference, except that such information is hereby amended and supplemented to the extent amended and supplemented

by the exhibit filed herewith.

You should read this Amendment No. 2 together with Schedule TO, and all exhibits attached thereto, including

the Offer to Purchase and the Letter of Transmittal, as each may have been amended or supplemented from time to time.

ITEM 11. ADDITIONAL INFORMATION.

Item 11 is hereby amended and supplemented by adding at the end thereof

the following text:

“On November 21, 2024, the Fund issued a press release announcing

the final results of the Offer, which expired on November 15, 2024 at 5:00 p.m. Eastern Time. A copy of the press release is filed as

Exhibit (a)(5)(iv) to this Schedule TO and is incorporated herein by reference.”

ITEM 12. EXHIBITS.

Item 12 of Schedule TO is hereby amended and supplemented

to add the following exhibit:

(a)(5)(iv) Press Release dated November 21, 2024*

SIGNATURE

After due inquiry and to the best of my knowledge

and belief, I certify that the information set forth in this statement is true, complete and correct.

| |

The Herzfeld Caribbean Basin Fund, Inc. |

|

| |

|

|

| By: |

/s/ Erik M. Herzfeld |

|

| Name: |

Erik M. Herzfeld |

|

| Title: |

President |

|

Dated as of: November 21, 2024

EXHIBIT INDEX

| Exhibit |

Description |

| (a)(5)(iv) |

Press Release dated November 21, 2024 |

The Herzfeld Caribbean Basin Fund, Inc. SC TO-IA

Exhibit (a)(5)(iv)

The Herzfeld Caribbean Basin Fund, Inc.

ANNOUNCES FINAL TENDER OFFER RESULTS

MIAMI BEACH, FLORIDA, November 21, 2024 — Thomas

J. Herzfeld Advisors, Inc., an SEC-registered investment adviser, and The Herzfeld Caribbean Basin Fund, Inc. (Nasdaq: CUBA) (the “Fund”)

today announced the final results of the Fund’s cash tender offer to purchase up to 5% of its outstanding common shares at 97.5%

of the Fund’s net asset value (“NAV”) as of the close of ordinary trading on the NASDAQ Capital Market (the “NASDAQ”)

on November 15, 2024, the expiration date (the “Tender Offer”).

The table below shows the final results for the Fund:

Tender Offer

Amount |

Shares

Properly Tendered |

Shares

to be Purchased |

Pro-Ration

Factor* |

Purchase Price of

Properly Tendered Shares** |

Number of Outstanding

Common Shares after

Giving Effect to Tender Offer |

| Up

to 5% or 827,416 shares |

11,685,770 |

827,416 |

7.08052% |

$3.2273 |

15,720,897 |

* The number of common shares to be purchased divided by the number

of common shares properly tendered. The pro-ration factor is subject to rounding adjustment to avoid the purchase of fractional shares.

** Equal to 97.5% of the Fund’s NAV per share as of the close of

ordinary trading on the NASDAQ on November 15, 2024 (the date the Tender Offer expired).

Under the terms and conditions of the Fund’s

Tender Offer, if the number of common shares properly tendered exceeds the number of common shares offered to purchase, the Fund will

purchase common shares properly tendered on a pro-rata basis (disregarding fractional shares). As indicated above, the Fund will purchase

7.08052% of the common shares properly tendered. The Fund will purchase the common shares accepted for payment as promptly as practicable.

EQ Fund Solutions, LLC is the information agent for

the Offer. Shareholders with questions may call EQ Fund Solutions, LLC at (877) 536-1555.

About Thomas J. Herzfeld Advisors, Inc.

Thomas J. Herzfeld Advisors, Inc., founded in 1984,

is an SEC registered investment advisor, specializing in investment analysis and account management in closed-end funds. The Firm also

specializes in investment in the Caribbean Basin. The HERZFELD/CUBA division of Thomas J. Herzfeld Advisors, Inc. serves as the investment

advisor to The Herzfeld Caribbean Basin Fund, Inc. a publicly traded closed-end fund (NASDAQ: CUBA).

More information about the advisor can be found at www.herzfeld.com.

Past performance is no guarantee of future performance.

An investment in the Fund is subject to certain risks, including market risk. In general, shares of closed-end funds often trade at a

discount from their net asset value and at the time of sale may be trading on the exchange at a price which is more or less than the

original purchase price or the net asset value. There can be no assurance that any Share repurchases will reduce or eliminate the discount

of the Fund’s market price to the Fund’s net asset value per share. An investor should carefully consider the Fund’s

investment objective, risks, charges and expenses. Please read the Fund’s disclosure documents before investing.

Forward-Looking Statements

This press release, and other statements

that Thomas J. Herzfeld Advisors, Inc. (“TJHA”) or the Fund may make, may contain forward looking statements within the meaning

of the Private Securities Litigation Reform Act, with respect to the Fund’s or TJHA’s future financial or business performance,

strategies or expectations. Forward-looking statements are typically identified by words or phrases such as “trend,” “potential,”

“opportunity,” “pipeline,” “believe,” “comfortable,” “expect,” “anticipate,”

“current,” “intention,” “estimate,” “position,” “assume,” “outlook,”

“continue,” “remain,” “maintain,” “sustain,” “seek,” “achieve,”

and similar expressions, or future or conditional verbs such as “will,” “would,” “should,” “could,”

“may” or similar expressions. TJHA and the Fund caution that forward-looking statements are subject to numerous assumptions,

risks and uncertainties, which change over time. Forward-looking statements speak only as of the date they are made, and TJHA and the

Fund assume no duty to and do not undertake to update forward-looking statements. Actual results could differ materially from those anticipated

in forward-looking statements and future results could differ materially from historical performance. With respect to the Fund, the following

factors, among others, could cause actual events to differ materially from forward-looking statements or historical performance: (1)

changes and volatility in political, economic or industry conditions, particularly with respect to Cuba and other Caribbean Basin countries,

the interest rate environment, foreign exchange rates or financial and capital markets, which could result in changes in demand for the

Fund or in the Fund’s net asset value; (2) the relative and absolute investment performance of the Fund and its investments; (3)

the impact of increased competition; (4) the unfavorable resolution of any legal proceedings; (5) the extent and timing of any distributions

or share repurchases; (6) the impact, extent and timing of technological changes; (7) the impact of legislative and regulatory actions

and reforms, including the Dodd-Frank Wall Street Reform and Consumer Protection Act, and regulatory, supervisory or enforcement actions

of government agencies relating to the Fund or TJHA, as applicable; (8) terrorist activities, international hostilities and natural disasters,

which may adversely affect the general economy, domestic and local financial and capital markets, specific industries or TJHA or the

Fund; (9) TJHA’s and the Fund’s ability to attract and retain highly talented professionals; (10) the impact of TJHA electing

to provide support to its products from time to time; and (11) the impact of problems at other financial institutions or the failure

or negative performance of products at other financial institutions; and (12) the effects of an epidemic, pandemic or public health emergency,

including without limitation, COVID-19. Annual and Semi-Annual Reports and other regulatory filings of the Fund with the SEC are accessible

on the SEC’s website at www.sec.gov and on TJHA’s website at www.herzfeld.com/cuba, and may discuss these or other factors

that affect the Fund. The information contained on TJHA’s website is not a part of this press release.

Contact:

Tom Morgan

Chief Compliance Officer

Thomas J. Herzfeld Advisors, Inc.

1-305-777-1660

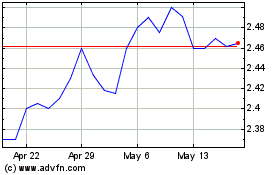

Herzfeld Caribbean Basin (NASDAQ:CUBA)

Historical Stock Chart

From Jan 2025 to Feb 2025

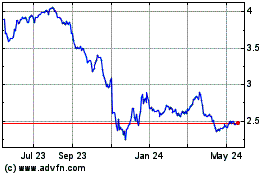

Herzfeld Caribbean Basin (NASDAQ:CUBA)

Historical Stock Chart

From Feb 2024 to Feb 2025