Form NPORT-P - Monthly Portfolio Investments Report on Form N-PORT (Public)

28 November 2024 - 8:39AM

Edgar (US Regulatory)

| |

|

|

| |

|

|

| Herzfeld Caribbean Basin Fund, Inc. |

|

|

| Schedule of Investments as of September 30, 2024 (Unaudited) |

|

| |

|

|

| Shares or Principal Amount |

Description |

Fair Value |

| |

|

|

| Common Stocks – |

99.06% - of net assets |

|

| |

|

|

| Airlines – 2.75% |

|

|

| 15,250 |

Copa Holdings, S.A. |

1,431,060 |

| Banking and Finance – 21.22% |

|

|

| 70,089 |

Banco Latinoamericano de Comercio Exterior, S.A. |

2,277,192 |

| 170,000 |

Evermore Bank1 |

2,040,000 |

| 16,956 |

Evertec, Inc. |

574,639 |

| 88,690 |

First BanCorp. (Puerto Rico) |

1,877,567 |

| 53,454 |

OFG Bancorp |

2,401,154 |

| 18,598 |

Popular, Inc. |

1,864,821 |

| Communications – 0.76% |

|

|

| 10,698 |

América Móvil, S.A.B. de C.V. Class B ADR |

175,019 |

| 209,144 |

América Móvil, S.A.B. de C.V. |

171,773 |

| 479,175 |

Fuego Enterprises, Inc.*1 |

4,792 |

| 207,033 |

Grupo Radio Centro S.A.B. de C.V.* |

42,063 |

| Construction and Related – 16.56% |

|

|

| 155,581 |

Cemex, S.A.B. de C.V. ADR* |

949,044 |

| 20 |

Ceramica Carabobo Class A ADR*1 |

- |

| 3,840 |

Martin Marietta Materials, Inc. |

2,066,880 |

| 34,872 |

MasTec, Inc.* |

4,292,743 |

| 5,219 |

Vulcan Materials Company |

1,306,994 |

| Food, Beverages, and Tobacco – 4.97% |

|

|

| 652,525 |

Becle, S.A.B. de C.V. |

1,027,442 |

| 18,900 |

Fomento Económico Mexicano, S.A.B. de C.V. Series UBD |

186,360 |

| 13,899 |

Fomento Económico Mexicano, S.A.B. de C.V. ADR |

1,371,970 |

| Housing – 3.41% |

|

|

| 9,450 |

Lennar Corporation |

1,771,686 |

| Investment Companies – 0.05% |

|

|

| 70,000 |

Waterloo Investment Holdings Ltd.*1 |

24,500 |

| Leisure – 26.84% |

|

|

| 82,700 |

Carnival Corporation* |

1,528,296 |

| 243,207 |

Norwegian Cruse Line Holdings Ltd.* |

4,988,176 |

| 94,570 |

OneSpaWorld Holdings Ltd.* |

1,561,351 |

| 202,058 |

Playa Hotels and Resorts N.V.* |

1,565,950 |

| 24,348 |

Royal Caribbean Cruises Ltd. |

4,318,361 |

| Machinery – 0.90% |

|

|

| 392,076 |

Grupo Rotoplas S.A.B. de C.V. |

468,986 |

| Mining – 1.27% |

|

|

| 117,872 |

Grupo México, S.A.B. de C.V. Series B |

658,570 |

| Oil & Gas Services & Equipment – 4.53% |

|

|

| 129,000 |

SBM Offshore N.V. |

2,354,203 |

| Real Estate Owners & Developers – 2.51% |

|

|

| 48,412 |

Corporacion Inmobilaria Vesta SAB de CV ADR |

1,304,219 |

| Retail – 2.54% |

|

|

| 14,270 |

Grupo Elektra, S.A.B. de C.V. Series CPO |

684,906 |

| 210,222 |

Wal-Mart de México, S.A.B. de C.V. Series V |

634,360 |

|

| Transportation Infrastructure – 1.51% |

|

|

| 2,775 |

Grupo Aeroportuario ADR |

784,659 |

| Trucking and Marine Freight – 0.83% |

|

|

| 137 |

Seaboard Corporation |

429,769 |

| Utilities – 7.60% |

|

|

| 23,200 |

Caribbean Utilies Ltd. Class A |

324,800 |

| 6,092 |

Consolidated Water Company Ltd. |

153,579 |

| 700 |

Cuban Electric Company*1 |

- |

| 26,697 |

NextEra Energy, Inc. |

2,256,697 |

| 133,602 |

New Fortress Energy, Inc., Class A |

1,214,442 |

| Other – 0.81% |

|

|

| 55,921 |

Margo Caribe, Inc.* |

419,408 |

| 79 |

Siderurgica Venezolana Sivensa, S.A. Series B*1 |

- |

| |

|

|

| |

|

|

| Total common stocks |

(cost $36,004,407) |

51,508,431 |

| |

|

|

| Bonds – 0% of net assets |

|

|

| 165,000 |

Republic of Cuba - 4.5%, 1977 - in default*1 |

- |

| Total bonds |

(cost $63,038) |

- |

| |

|

|

| Rights – 0% of net assets2 |

|

|

| 23,200 |

Caribbean Utilities Rights, expiring 10/31/2024 |

232 |

| Total rights |

(cost $792) |

232 |

| |

|

|

| Money Market Funds – 0.81% |

|

|

| 423,635 |

Federated Hermes Government Obligations Fund, |

|

| |

Institutional Class, 4.79%3 |

423,635 |

| |

|

|

| Total money market funds |

(cost $423,635) |

423,635 |

| |

|

|

| Total investments |

(cost $36,491,872) – 99.87% of net assets |

51,932,298 |

| |

|

|

| Other assets in excess of liabilities - |

0.13% of net assets |

67,708 |

| |

|

|

| Net assets - |

100% |

52,000,006 |

| |

|

|

| |

|

|

| 1 Securities have been fair valued in good faith, by the Adviser as "valuation designee", using fair value |

|

| methodology approved by the Board of Directors. Fair valued securities comprised 3.98% of net assets. |

|

| 2 Rounds to less than 0.05%. |

|

|

| 3 Rate disclosed is the seven day effective yield as of September 30, 2024. |

|

| * Non-income producing |

|

|

| |

|

|

| |

|

|

| See accompanying notes to the financial statements. |

|

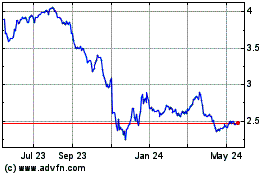

Herzfeld Caribbean Basin (NASDAQ:CUBA)

Historical Stock Chart

From Dec 2024 to Jan 2025

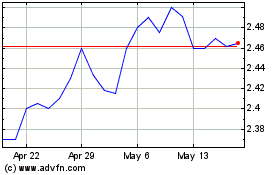

Herzfeld Caribbean Basin (NASDAQ:CUBA)

Historical Stock Chart

From Jan 2024 to Jan 2025