FALSE000091577900009157792024-11-192024-11-190000915779us-gaap:CommonStockMember2024-11-192024-11-190000915779us-gaap:PreferredStockMember2024-11-192024-11-19

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): November 19, 2024

Daktronics, Inc.

(Exact Name of Registrant as Specified in Charter)

| | | | | | | | |

South Dakota | 001-38747 | 46-0306862 |

(State or Other Jurisdiction of Incorporation) | (Commission File Number) | (I.R.S. Employer Identification No.) |

201 Daktronics Drive

Brookings, SD 57006

(Address of Principal Executive Offices Zip Code)

(605) 692-0200

(Registrant's Telephone Number, Including Area Code)

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

Securities registered or to be registered pursuant to Section 12(b) of the Act: | | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, No Par Value | DAKT | Nasdaq Global Select Market |

| Preferred Stock Purchase Rights | DAKT | Nasdaq Global Select Market |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Section 1 - Registrant's Business and Operations

Item 1.01 Entry into a Material Definitive Agreement

Effective on November 19, 2024, the Board of Directors (the “Board”) of Daktronics, Inc. (the “Company”), approved the Second Amendment to Rights Agreement, dated as of November 19, 2024 (the “Second Amendment”), by and between the Company and Equiniti Trust Company, LLC, as rights agent (the “Rights Agent”). The Second Amendment amends the Rights Agreement, dated as of November 16, 2018 (the “Original Rights Agreement”), by and between the Company and the Rights Agent, as amended by the First Amendment to Rights Agreement, dated as of November 19, 2021 (the “First Amendment,” and collectively with the Original Rights Agreement and the Second Amendment, the “Rights Agreement”). The Board intends to submit the Rights Agreement to shareholders for ratification at the Company’s upcoming annual meeting of shareholders.

The Second Amendment extends the “Final Expiration Date” (as that term is defined in the Rights Agreement) of the rights (the “Rights”) from the close of business on November 19, 2024 to the close of business on November 19, 2025. Accordingly, the Rights, which are not exercisable until the “Distribution Date” (as that term is defined in the Rights Agreement), will expire upon the earlier of: (i) the close of business on November 19, 2025; (ii) the time at which the Rights are redeemed under the Rights Agreement; (iii) the time at which the Rights are exchanged under the Rights Agreement; and (iv) the time at which the Rights are terminated upon the closing of any merger or other acquisition transaction involving the Company and a person pursuant to a merger or other acquisition agreement that has been approved by the Board before such person has become an “Acquiring Person” (as that term is defined in the Rights Agreement). The Second Amendment also changes the “Exercise Price” (as that term is defined in the Rights Agreement) to $40.00 per Right.

The Second Amendment provides for the addition of the defined terms “Triggering Percentage,” which is defined to mean 15%, and “13G Triggering Percentage,” which is defined to mean 20%. The Second Amendment changes the Triggering Percentage to become an Acquiring Person to 15% (or 20% in the case of 13G Investors (as that term is defined in the Rights Agreement)). Any existing shareholder or group that beneficially owns the Triggering Percentage (or the 13G Triggering Percentage in the case of 13G Investors) or more of the Company’s common stock as of the date of the Second Amendment will be grandfathered at its current ownership level.

In all other material respects, the Original Rights Agreement, as amended by the First Amendment, remains in full force and effect.

The foregoing description of the material terms of the Rights Agreement does not purport to be complete and is qualified in its entirety by reference to the full text of: (i) the Articles of Amendment to the Amended and Restated Articles of Incorporation of Daktronics, Inc., dated November 16, 2018, which is incorporated by reference as Exhibit 3.1 to this Current Report on Form 8-K (this “Report”); (ii) the Original Rights Agreement, which is incorporated by reference as Exhibit 4.1 to this Report; (iii) the First Amendment, which is incorporated by reference as Exhibit 4.2 to this Report; and (iv) the Second Amendment, a copy of which is attached hereto as Exhibit 4.3 and incorporated herein by reference. In addition, the description of the Original Rights Agreement set forth in Item 1.01 of the Current Report on Form 8‑K of the Company dated November 16, 2018 is incorporated into this Item 1.01 by reference, and the description of the First Amendment set forth in Item 1.01 of the Current Report on Form 8-K of the Company dated November 19, 2021 is incorporated into this Item 1.01 by reference.

Section 3 - Securities an Trading Markets

Item 3.03 Material Modification to Rights of Security Holders.

The information set forth in Item 1.01 of this Current Report on Form 8-K is incorporated herein by reference.

Section 7 - Regulation FD

Item 7.01 Regulation FD Disclosure.

On November 20, 2024, the Company issued a press release announcing the adoption of the Second Amendment. A copy of the press release is attached hereto as Exhibit 99.1 and is incorporated herein by reference.

In accordance with General Instruction B.2 of the form of Current Report on Form 8‑K, the information in the foregoing paragraph, including Exhibit 99.1, is furnished and shall not be deemed to be “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall such information, including Exhibit 99.1, be deemed incorporated by reference into any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such filing.

Section 9 - Financial Statements and Exhibits

Item 9.01 Financial Statements and Exhibits.

(d)Exhibits. The following exhibits are filed or furnished, as applicable, as part of this Report:

| | | | | | | | |

| | |

| | |

| | |

| | |

| | |

| 104 | | Cover page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| DAKTRONICS, INC. |

| | |

| By: /s/ Sheila M. Anderson |

| | Sheila M. Anderson, Chief Financial Officer |

Date: November 20, 2024 | | (Principal Financial Officer and Principal Accounting Officer) |

EXHIBIT INDEX

| | | | | | | | |

| Exhibit No. | | Description |

| | |

| | |

| | |

| | |

| | |

| 104 | | Cover page Interactive Data File (embedded within the Inline XBRL document) |

SECOND AMENDMENT TO RIGHTS AGREEMENT

This Second Amendment to Rights Agreement, dated as of November 19, 2024 (this “Amendment”), is by and between Daktronics, Inc., a South Dakota corporation (the “Company”), and Equiniti Trust Company, LLC (as successor-in-interest to Equiniti Trust Company) (the “Rights Agent”).

WITNESSETH:

WHEREAS, the Company and the Rights Agent executed and entered into that certain Rights Agreement, dated as of November 16, 2018 (the “Original Rights Agreement”), under which the Board authorized and declared a dividend distribution of one preferred share purchase Right for each share of Common Stock that was paid to holders of record of Common Stock issued and outstanding at the Close of Business on November 19, 2018 and also authorized the issuance of one Right for each share of Common Stock that became outstanding between the Record Date (whether originally issued or from the Company’s treasury) and the earlier of the Distribution Date, the Redemption Date, and the Final Expiration Date, each Right representing the right to purchase one one-thousandth (subject to adjustment) of one share of Preferred Stock, all upon the terms, and subject to the conditions, set forth in the Original Rights Agreement;

WHEREAS, the Company and the Rights Agent executed and entered into that certain First Amendment to Rights Agreement, dated as of November 19, 2021 (the “First Amendment”), which amended the Original Rights Agreement as follows: (i) Section 7(a) was amended to extend the Final Expiration Date from November 19, 2021 to November 19, 2024; and (ii) Section 7(b) was amended to change the initial Exercise Price for each one one-thousandth of a share of Preferred Stock pursuant to the exercise of a Right from $25.00 to $20.00;

WHEREAS, Section 27 of the Original Rights Agreement provides that the Company may, and the Rights Agent shall, if the Company so directs, supplement or amend any provision of the Rights Agreement without the approval of any holders of the Rights including, without limitation, to shorten or lengthen any period under the Original Rights Agreement;

WHEREAS, the Company has determined that it is necessary or desirable, in the interests of the Company and the holders of the Rights, to amend the Original Rights Agreement, as amended by the First Amendment (collectively, the “Agreement”), as provided herein; and

WHEREAS, all acts and things necessary to make this Amendment a valid agreement according to its terms have been done and performed, and the execution and delivery of this Amendment by the Company and the Rights Agent have been in all respects authorized by the Company and the Rights Agent.

NOW, THEREFORE, in consideration of the premises and the mutual agreements hereinafter set forth, and for other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the Company and the Rights Agent hereby agree as follows:

1.Amendment to Section 1(a) of the Agreement. Section 1(a) of the Agreement is hereby amended and restated in its entirety as follows:

(a)“Acquiring Person” means any Person which, together with all of its Related Persons, is the Beneficial Owner of the Triggering Percentage or more of the shares of Common Stock of the Company then outstanding, but excluding (i) the Exempt Persons and (ii) any Grandfathered Persons.

Notwithstanding anything in this Agreement to the contrary, no Person shall become an “Acquiring Person”:

(i)solely as the result of an acquisition of shares of Common Stock by the Company which, by reducing the number of shares of Common Stock outstanding, increases the percentage of the shares of Common Stock Beneficially Owned by such Person, together with all of its Related Persons, to the Triggering Percentage or more of the shares of Common Stock of the Company then outstanding; provided, however, that if a Person, together with all of its Related Persons, becomes the Beneficial Owner of the Triggering Percentage or more of the shares of Common Stock of the Company then outstanding by reason of share acquisitions by the Company and, on or after the date of such share acquisitions by the Company, becomes the Beneficial Owner of any additional shares of Common Stock of the Company (other than pursuant to a dividend or distribution paid or made by the Company on the outstanding Common Stock or pursuant to a split or subdivision of the outstanding shares of Common Stock), then such Person shall be deemed to be an “Acquiring Person” unless, upon becoming the Beneficial Owner of such additional shares of Common Stock, such Person, together with all of its Related Persons, does not Beneficially Own the Triggering Percentage or more of the shares of Common Stock then outstanding;

(ii)if (A) the Board determines, in its sole discretion, that such Person has become an “Acquiring Person” inadvertently (including, without limitation, because (1) such Person was unaware that it Beneficially Owned a percentage of the then outstanding Common Stock that would otherwise cause such Person to be an “Acquiring Person”; or (2) such Person was aware of the extent of its Beneficial Ownership of Common Stock but had no actual knowledge of the consequences of such Beneficial Ownership under this Agreement); and (B) such Person divests as promptly as practicable (as determined by the Board) a sufficient number of shares of Common Stock so that such Person would no longer be an “Acquiring Person”;

(iii)solely as a result of any unilateral grant of any security by the Company, or through the exercise of any options, warrants, rights or similar interests (including, without limitation, restricted stock) granted by the Company to its directors, officers and employees; provided, however, that if a Person, together with all of its Related Persons,

becomes the Beneficial Owner of the Triggering Percentage or more of the shares of Common Stock of the Company then outstanding by reason of a unilateral grant of a security by the Company, or through the exercise of any options, warrants, rights or similar interests (including, without limitation, restricted stock) granted by the Company to its directors, officers and employees, then such Person shall nevertheless be deemed to be an “Acquiring Person” if, subject to Section 1(a)(ii), such Person, together with all of its Related Persons, thereafter becomes the Beneficial Owner of any additional shares of Common Stock (unless upon becoming the Beneficial Owner of additional shares of Common Stock, such Person, together with all of its Related Persons, does not Beneficially Own the Triggering Percentage or more of the Common Stock then outstanding), except as a result of (A) a dividend or distribution paid or made by the Company on the outstanding Common Stock or a split or subdivision of the outstanding Common Stock; or (B) the unilateral grant of a security by the Company, or through the exercise of any options, warrants, rights or similar interest (including, without limitation, restricted stock) granted by the Company to its directors, officers and employees;

(iv)by means of share purchases or issuances (including, without limitation, debt to equity exchanges), directly from the Company or indirectly through an underwritten offering of the Company, in a transaction approved by the Board; provided, however, that a Person shall be deemed to be an “Acquiring Person” if such Person (A) is or becomes the Beneficial Owner of the Triggering Percentage or more of the shares of Common Stock then outstanding after such transaction and (B) after such transaction, becomes the Beneficial Owner of any additional shares of Common Stock without the prior written consent of the Company and then Beneficially Owns the Triggering Percentage or more of the shares of Common Stock then outstanding;

(v)if such Person is a bona fide swaps dealer who has become an “Acquiring Person” as a result of its actions in the ordinary course of its business that the Board determines, in its sole discretion, were taken without the intent or effect of evading or assisting any other Person to evade the purposes and intent of this Agreement, or otherwise seeking to control or influence the management or policies of the Company;

(vi)as the result of an acquisition of shares of Common Stock pursuant to a Qualifying Offer; or

(vii)any Person which, together with all of its Related Persons, is the Beneficial Owner of shares of Common Stock representing less than the 13G Triggering Percentage of the Common Stock then outstanding, and that is entitled to file, and files (or has filed), a statement on Schedule 13G pursuant to Rule 13d-1(b) or Rule 13d-1(c) under the Exchange Act Regulations as in effect at the time of the public announcement of the declaration of the Rights with respect to the Common Stock Beneficially Owned by such Person (but for the avoidance of doubt, not any Person who files on Schedule

13G pursuant to any other provision of Rule 13d-1) (a “13G Investor”); provided, that a Person who was deemed a 13G Investor shall no longer be deemed such if it either (A) files a statement on Schedule 13D pursuant to Rule 13d-1(a), 13d-1(e), 13d-1(f) or 13d-1(g) of the Exchange Act Regulations as in effect at the time of the public announcement of the declaration of the Rights with respect to the Common Stock Beneficially Owned by such Person, or (B) becomes no longer entitled to file a statement on Schedule 13G pursuant to the requirements of Rule 13d-1(b) or otherwise (the earlier to occur of (A) and (B), a “13D Event”), and such Person shall be deemed an Acquiring Person if it is the Beneficial Owner of the Triggering Percentage or more of the shares of Common Stock then outstanding at any point from and after the time of the 13D Event; provided, however, such Person shall not be an Acquiring Person if (A) on the first Business Day after the 13D Event such Person notifies the Company of its intent to reduce its Beneficial Ownership to below the Triggering Percentage as promptly as practicable and (B) such Person reduces its Beneficial Ownership to below the Triggering Percentage of the shares of Common Stock then outstanding as promptly as practicable (but in any event not later than ten calendar days after such 13D Event); provided, further, that such Person shall become an “Acquiring Person” if after reducing its Beneficial Ownership to below the Triggering Percentage, it subsequently becomes the Beneficial Owner of the Triggering Percentage or more of the shares of Common Stock of the Company then outstanding or if, prior to reducing its Beneficial Ownership to below the Triggering Percentage, it increases (or makes any offer or takes any other action that would increase) its Beneficial Ownership of the then outstanding Common Stock above the lowest Beneficial Ownership of such Person at any time during such ten calendar day period.

2.Amendment to Section 1(y) of the Agreement. Section 1(y) of the Agreement is hereby amended and restated in its entirety as follows:

(y) “Distribution Date” means the earlier of (i) the Close of Business on the tenth Business Day after the Stock Acquisition Date (or, if the tenth Business Day after the Stock Acquisition Date occurs before the Record Date, the Close of Business on the Record Date) and (ii) the Close of Business on the tenth Business Day (or, if such tenth Business Day occurs before the Record Date, the Close of Business on the Record Date), or such later date as may be determined by the Board, in its sole discretion, before such time any Person becomes an Acquiring Person, after the date of the commencement by any Person (other than any Exempt Person) of, or of the first public announcement of the intention of any Person (other than any Exempt Person) to commence, a tender or exchange offer the consummation of which would result in such Person becoming the Beneficial Owner of the Triggering Percentage or more of the outstanding shares of Common Stock.

3.Amendment to Section 1(am) of the Agreement. Section 1(am) of the Agreement is hereby amended and restated in its entirety as follows:

(am) “Grandfathered Person” means any Person which, together with all of its Related Persons, was, as of November 19, 2024, the Beneficial Owner of the Triggering Percentage (or the 13G Triggering Percentage in the case of a 13G Investor) or more of the shares of Common Stock of the Company then outstanding. A Person ceases to be a “Grandfathered Person” if and when (i) such Person becomes the Beneficial Owner of less than the Triggering Percentage of the shares of Common Stock of the Company then outstanding; or (ii) such Person increases its Beneficial Ownership of shares of Common Stock of the Company to an amount equal to or greater than the greater of (A) the Triggering Percentage (or the 13G Triggering Percentage in the case of a 13G Investor) of the shares of Common Stock of the Company then outstanding and (B) the sum of (1) the lowest Beneficial Ownership of such Person as a percentage of the shares of Common Stock of the Company outstanding as of any time from and after the public announcement of this Agreement (other than as a result of an acquisition of shares of Common Stock by the Company) plus (2) one share of Common Stock of the Company. The foregoing definition shall grandfather the security or instrument underlying such Beneficial Ownership only in the type and form as of November 19, 2024 and shall not grandfather any subsequent change, modification, swap or exchange of such security or instrument into a different type or form of security or instrument (unless such exchange is contemplated explicitly by the terms of such security or instrument). For the avoidance of doubt, the swap or exchange of contracts for differences for shares of Common Stock or other equity securities of the Company shall not be grandfathered under this Agreement.

4.Amendment to Section 1(bs) of the Agreement. Section 1(bs) of the Agreement is hereby amended and restated in its entirety as follows:

(bs) “Triggering Percentage” means 15%.

5.Amendment to Section 1(bt) of the Agreement. Section 1(bt) of the Agreement is hereby amended and restated in its entirety as follows:

(bt) “Trust” has the meaning set forth in Section 24(d).

6.Addition of Section 1(bu) to the Agreement. The following Section 1(bu) is hereby added to the Agreement:

(bu) “Trust Agreement” has the meaning set forth in Section 24(d).

7.Addition of Section 1(bv) of the Agreement. The following Section 1(bv) is hereby added to the Agreement:

(bv) “13D Event” has the meaning set forth in Section 1(a)(vii).

8.Addition of Section 1(b)(w) of the Agreement. The following Section 1(bw) is hereby added to the Agreement:

(bw) “13G Investor” has the meaning set forth in Section 1(a)(vii).

9.Addition of Section 1(b)(x) of the Agreement. The following Section 1(bx) is hereby added to the Agreement:

(bx) “13G Triggering Percentage” means 20%.

10.Amendment to Section 7(a) of the Agreement. Section 7(a) of the Agreement is hereby amended and restated in its entirety as follows:

(a) Subject to Section 7(e), the registered holder of any Rights Certificate may exercise the Rights evidenced thereby (except as otherwise provided herein including, without limitation, the restrictions on exercisability set forth in Sections 9(c), 11(a)(iii) and 23(a)), in whole or in part, at any time after the Distribution Date upon surrender of the Rights Certificate, with the form of election to purchase and the certificate on the reverse side thereof properly completed and duly executed, to the Rights Agent at the office of the Rights Agent designated for such purpose, together with payment of the Exercise Price for each one one-thousandth of a share of Preferred Stock (or Common Stock, other securities, cash or other assets, as the case may be) as to which the Rights are exercised, at or before the earliest of (i) the Close of Business on November 19, 2025 (the “Final Expiration Date”); (ii) the time at which the Rights are redeemed pursuant to Section 23 (the “Redemption Date”); (iii) the time at which the Rights are exchanged pursuant to Section 24 (the “Exchange Date”); or (iv) the closing of any merger or other acquisition transaction involving the Company pursuant to an agreement of the type described in Section 1(i)(ii)(A)(4) and Section 13(f) at which time the Rights are terminated; (the earliest of (i), (ii), (iii) and (iv) being herein referred to as the “Expiration Date”).

11.Amendment to Section 7(b) of the Agreement. Section 7(b) of the Agreement is hereby amended and restated in its entirety as follows:

(b) Each Right shall entitle the registered holder thereof to purchase one one-thousandth of a share of Preferred Stock of the Company. The Exercise Price for each one one-thousandth of a share of Preferred Stock of the Company pursuant to the exercise of a Right initially shall be $40.00, which shall be subject to adjustment from time to time as provided in Sections 11 and 13, and payable in lawful money of the United States in accordance with paragraph (c) of this Section 7.

12.Capitalized Terms. Capitalized terms used but not defined in this Amendment shall have the respective meanings given to them in the Agreement.

13.Effect of Amendment. It is the intent of the Company and the Rights Agent that this Amendment constitutes an amendment of the Agreement as contemplated by Section 27 thereof. Except as expressly provided in this Amendment, the terms of the Agreement remain

in full force and effect. Unless the context clearly provides otherwise, any reference to this “Agreement” or the “Rights Agreement” shall be deemed to be a reference to the Original Rights Agreement, as amended by the First Amendment and this Amendment.

14.Benefits of this Amendment. Nothing in this Amendment shall be construed to give to any Person other than the Company, the Rights Agent, and the registered holders of the Rights Certificates (and, prior to the Distribution Date, the holders of the shares of Common Stock) any legal or equitable right, remedy, or claim under this Amendment; and this Amendment shall be for the sole and exclusive benefit of the Company, the Rights Agent, and the registered holders of the Rights Certificates (and, prior to the Distribution Date, the holders of the shares of Common Stock).

15.Severability. If any term, provision, covenant, or restriction of this Amendment is held by a court of competent jurisdiction or other authority to be invalid, void, or unenforceable, the remainder of the terms, provisions, covenants, and restrictions of this Amendment shall remain in full force and effect and shall in no way be affected, impaired, or invalidated.

16.Governing Law. This Amendment shall be deemed to be a contract made under the laws of the State of South Dakota (other than its conflicts of law provisions) and for all purposes shall be governed by and construed in accordance with the laws of such State applicable to contracts to be made and performed entirely within such State.

17.Counterparts. This Amendment may be executed in any number of counterparts, and each of such counterpart shall for all purposes be deemed to be an original, and all such counterparts shall together constitute but one and the same instrument. A signature to this Amendment transmitted electronically shall have the same authority, effect, and enforceability as an original signature.

18.Descriptive Headings. Descriptive headings of the Sections of this Amendment are inserted for convenience only and shall not control or affect the meaning or construction of any of the provisions hereof.

[Signature pages follow.]

IN WITNESS WHEREOF, the parties hereto have caused this Amendment to be duly executed as of the day and year first above written.

Daktronics, Inc., as the Company

By: /s/ Sheila M. Anderson

Sheila M. Anderson

Chief Financial Officer

IN WITNESS WHEREOF, the parties hereto have caused this Amendment to be duly executed as of the day and year first above written.

Equiniti Trust Company, LLC, as the Rights Agent

By: /s/ Andrea Severson

Andrea Severson

Senior Vice President

Daktronics, Inc. Amends and Extends Shareholder Rights Agreement

BROOKINGS, S.D., Nov. 20, 2024 (GLOBE NEWSWIRE) -- Daktronics, Inc. (“Daktronics” or the “Company”) (NASDAQ-DAKT), the leading U.S.-based designer and manufacturer of best-in-class dynamic video communication displays and control systems for customers worldwide, today announced that its Board of Directors (the “Board”) has approved an amendment (the “Second Amendment”) to the Company’s existing Shareholder Rights Agreement (the “Rights Agreement”), pursuant to which the expiration date of the Rights Agreement was extended to November 19, 2025, the exercise price was changed to $40.00, and the beneficial ownership threshold at which the rights become exercisable was changed to 15% (or 20% in the case of a passive, “13G Investor,” as defined in the Rights Agreement).

As noted in the Company’s press release dated November 8, 2024, the Board has determined that it is in the best interests of the Company and its common shareholders to exercise the Company’s right to convert an initial $7 million in face value of the $25 million senior second lien secured promissory note (the “Convertible Note”) held by Alta Fox Capital Management, LLC (together with its affiliates, “Alta Fox”) into approximately 1.1 million shares of the Company’s common stock. Giving effect to the conversion, Alta Fox would beneficially own approximately 6% of the Company’s outstanding shares, based on its most recent disclosure to the Company.

The Company has engaged in good faith with Alta Fox regarding Alta Fox’s desire to accelerate the repayment of the Convertible Note as an alternative to the forced conversion of the Convertible Note. In its most recent proposal, Alta Fox demanded that Daktronics pay Alta Fox $79 million – more than three times the face value of the Convertible Note and approximately one-and-a-half times its Black-Scholes value – to retire the Convertible Note. The Board rejected Alta Fox’s proposal as not in the best interests of the Company and its common shareholders and notified Alta Fox of its intention to exercise the Company’s right to force the conversion of the Convertible Note to minimize the dilution and cost to the Company’s shareholders. Alta Fox has now threatened to nominate candidates for the Board. Because Daktronics’ Articles of Incorporation and South Dakota law mandate cumulative voting in the election of directors, a shareholder who also owns debt, like Alta Fox – whose interests may not be aligned with other Daktronics shareholders – may be able to make Board composition changes even without broad shareholder support.

In extending the expiration date of the Rights Agreement, the Board considered the risk that Alta Fox, by virtue of its significant ownership position, may seek to take actions to advance its interests as a large debtholder, including influencing the composition of the Board, at the expense of common shareholders. The extension of the Rights Agreement reflects the Board’s continued commitment to protecting the interests of the Company’s shareholders. The Rights Agreement has not been adopted in response to any specific takeover bid or any similar proposal.

The Rights Agreement applies equally to all current and future shareholders and is not intended to deter offers or preclude the Board from considering offers that are fair and otherwise in the best interest of the Company’s shareholders.

Under the Rights Agreement, the “Rights” (as defined in the Rights Agreement) will become exercisable if a person or group acquires beneficial ownership of 15% (or 20% in the case of a “13G Investor”) or more of Daktronics outstanding common stock without the prior approval of the Board. Any existing shareholders with beneficial ownership of Daktronics stock above the applicable triggering ownership threshold as of the date of the Second Amendment are grandfathered at their current ownership levels so the Rights are not triggered by their current ownership of shares but they are not permitted to increase their ownership without triggering the Rights Agreement. The Board intends to submit the Rights Agreement to shareholders for ratification at the Company’s upcoming annual meeting of shareholders.

At this time, Daktronics shareholders are not required to take any action.

A copy of the Second Amendment and a summary of the Second Amendment will be contained in a Current Report on Form 8-K filed by the Company with the U.S. Securities and Exchange Commission (the “SEC”) (the “Form 8-K”). The Second Amendment should be read together with the Rights Agreement and the Form 8-K.

About Daktronics

Daktronics has strong leadership positions in, and is the world's largest supplier of, large-screen video displays, electronic scoreboards, LED text and graphics displays, and related control systems. The Company excels in the control of display systems, including those that require integration of multiple complex displays showing real-time information, graphics, animation, and video. Daktronics designs, manufactures, markets and services display systems for customers around the world in four domestic business units: Live Events, Commercial, High School Park and Recreation, and Transportation, and one International business unit. For more information, visit the Company's website at: www.daktronics.com.

Safe Harbor Statement

Cautionary Notice: In addition to statements of historical fact, this news release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 and is intended to enjoy the protection of that Act. Readers are cautioned not to place undue reliance on forward-looking statements, which are often characterized by terminology such as “may,” “will,” “should,” “expects,” “plans,” “anticipates,” “believes,” “estimates,” “predicts,” “potential,” “continue,” or “intend,” by the negative of these terms or other comparable terminology, or by discussions of strategy, plans, or intentions. These forward-looking statements reflect the Company's current expectations or beliefs concerning future events. The Company cautions that these and similar statements involve risk and uncertainties which could cause actual results to differ materially from our expectations, including, but not limited to, changes in economic and market conditions, management of growth, timing and magnitude of future contracts and orders, fluctuations in margins, the introduction of new products and technology, the impact of adverse weather conditions, increased regulation, and other risks described in the Company's SEC filings, including its Annual Report on Form 10-K for its 2024 fiscal year. Forward-looking statements are made in the context of information available as of the date stated. The Company undertakes no obligation to update or revise such statements to reflect new circumstances or unanticipated events as they occur except as may be required by applicable law.

For more information contact:

INVESTOR RELATIONS:

Sheila M. Anderson, Chief Financial Officer

Tel (605) 692-0200

Email investor@daktronics.com

Alliance Avisors IR

Carolyn Capaccio / Jody Burfening

DAKTIRTeam@lhai.com

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_PreferredStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

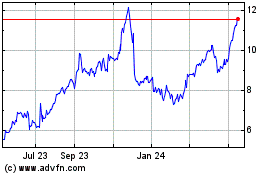

Daktronics (NASDAQ:DAKT)

Historical Stock Chart

From Oct 2024 to Nov 2024

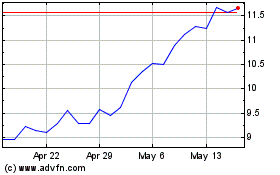

Daktronics (NASDAQ:DAKT)

Historical Stock Chart

From Nov 2023 to Nov 2024