Daktronics, Inc. Amends and Extends Shareholder Rights Agreement

21 November 2024 - 1:00AM

Daktronics, Inc. (“Daktronics” or the “Company”) (NASDAQ-DAKT), the

leading U.S.-based designer and manufacturer of best-in-class

dynamic video communication displays and control systems for

customers worldwide, today announced that its Board of Directors

(the “Board”) has approved an amendment (the “Second Amendment”) to

the Company’s existing Shareholder Rights Agreement (the “Rights

Agreement”), pursuant to which the expiration date of the Rights

Agreement was extended to November 19, 2025, the exercise price was

changed to $40.00, and the beneficial ownership threshold at which

the rights become exercisable was changed to 15% (or 20% in the

case of a passive, “13G Investor,” as defined in the Rights

Agreement).

As noted in the Company’s press release dated

November 8, 2024, the Board has determined that it is in the best

interests of the Company and its common shareholders to exercise

the Company’s right to convert an initial $7 million in face value

of the $25 million senior second lien secured promissory note (the

“Convertible Note”) held by Alta Fox Capital Management, LLC

(together with its affiliates, “Alta Fox”) into approximately 1.1

million shares of the Company’s common stock. Giving effect to the

conversion, Alta Fox would beneficially own approximately 6% of the

Company’s outstanding shares, based on its most recent disclosure

to the Company.

The Company has engaged in good faith with Alta

Fox regarding Alta Fox’s desire to accelerate the repayment of the

Convertible Note as an alternative to the forced conversion of the

Convertible Note. In its most recent proposal, Alta Fox demanded

that Daktronics pay Alta Fox $79 million – more than three times

the face value of the Convertible Note and approximately

one-and-a-half times its Black-Scholes value – to retire the

Convertible Note. The Board rejected Alta Fox’s proposal as not in

the best interests of the Company and its common shareholders and

notified Alta Fox of its intention to exercise the Company’s right

to force the conversion of the Convertible Note to minimize the

dilution and cost to the Company’s shareholders. Alta Fox has now

threatened to nominate candidates for the Board. Because

Daktronics’ Articles of Incorporation and South Dakota law mandate

cumulative voting in the election of directors, a shareholder who

also owns debt, like Alta Fox – whose interests may not be aligned

with other Daktronics shareholders – may be able to make Board

composition changes even without broad shareholder support.

In extending the expiration date of the Rights

Agreement, the Board considered the risk that Alta Fox, by virtue

of its significant ownership position, may seek to take actions to

advance its interests as a large debtholder, including influencing

the composition of the Board, at the expense of common

shareholders. The extension of the Rights Agreement reflects the

Board’s continued commitment to protecting the interests of the

Company’s shareholders. The Rights Agreement has not been adopted

in response to any specific takeover bid or any similar

proposal.

The Rights Agreement applies equally to all

current and future shareholders and is not intended to deter offers

or preclude the Board from considering offers that are fair and

otherwise in the best interest of the Company’s shareholders.

Under the Rights Agreement, the “Rights” (as

defined in the Rights Agreement) will become exercisable if a

person or group acquires beneficial ownership of 15% (or 20% in the

case of a “13G Investor”) or more of Daktronics outstanding common

stock without the prior approval of the Board. Any existing

shareholders with beneficial ownership of Daktronics stock above

the applicable triggering ownership threshold as of the date of the

Second Amendment are grandfathered at their current ownership

levels so the Rights are not triggered by their current ownership

of shares but they are not permitted to increase their ownership

without triggering the Rights Agreement. The Board intends to

submit the Rights Agreement to shareholders for ratification at the

Company’s upcoming annual meeting of shareholders.

At this time, Daktronics shareholders are not

required to take any action.

A copy of the Second Amendment and a summary of

the Second Amendment will be contained in a Current Report on Form

8-K filed by the Company with the U.S. Securities and Exchange

Commission (the “SEC”) (the “Form 8-K”). The Second Amendment

should be read together with the Rights Agreement and the Form

8-K.

About Daktronics

Daktronics has strong leadership positions in,

and is the world's largest supplier of, large-screen video

displays, electronic scoreboards, LED text and graphics displays,

and related control systems. The Company excels in the control of

display systems, including those that require integration of

multiple complex displays showing real-time information, graphics,

animation, and video. Daktronics designs, manufactures, markets and

services display systems for customers around the world in four

domestic business units: Live Events, Commercial, High School Park

and Recreation, and Transportation, and one International business

unit. For more information, visit the Company's website at:

www.daktronics.com.

Safe Harbor Statement

Cautionary Notice: In addition to statements of

historical fact, this news release contains forward-looking

statements within the meaning of the Private Securities Litigation

Reform Act of 1995 and is intended to enjoy the protection of that

Act. Readers are cautioned not to place undue reliance on

forward-looking statements, which are often characterized by

terminology such as “may,” “will,” “should,” “expects,” “plans,”

“anticipates,” “believes,” “estimates,” “predicts,” “potential,”

“continue,” or “intend,” by the negative of these terms or other

comparable terminology, or by discussions of strategy, plans, or

intentions. These forward-looking statements reflect the Company's

current expectations or beliefs concerning future events. The

Company cautions that these and similar statements involve risk and

uncertainties which could cause actual results to differ materially

from our expectations, including, but not limited to, changes in

economic and market conditions, management of growth, timing and

magnitude of future contracts and orders, fluctuations in margins,

the introduction of new products and technology, the impact of

adverse weather conditions, increased regulation, and other risks

described in the Company's SEC filings, including its Annual Report

on Form 10-K for its 2024 fiscal year. Forward-looking statements

are made in the context of information available as of the date

stated. The Company undertakes no obligation to update or revise

such statements to reflect new circumstances or unanticipated

events as they occur except as may be required by applicable

law.

For more information

contact:

INVESTOR RELATIONS:Sheila M. Anderson, Chief Financial

OfficerTel (605) 692-0200Investor@daktronics.com

Alliance Advisors IRCarolyn Capaccio / Jody

BurfeningDAKTIRTeam@lhai.com

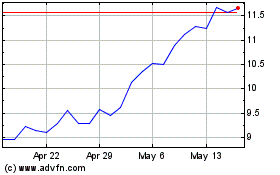

Daktronics (NASDAQ:DAKT)

Historical Stock Chart

From Oct 2024 to Nov 2024

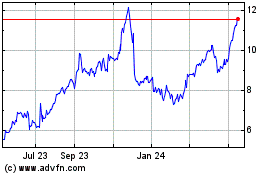

Daktronics (NASDAQ:DAKT)

Historical Stock Chart

From Nov 2023 to Nov 2024