EUROPE MARKETS: European Markets Slide As German Factory Woe Adds To China Trade Slump

08 March 2019 - 9:37PM

Dow Jones News

By Emily Horton

Europe's indexes fell on Friday, after economic slowdown fears

were compounded by data showing a slump in Chinese exports.

Disappointing figures from Germany's manufacturing sector added

to the gloom, a day after the European Central Bank announced cuts

to its growth forecast.

How are markets performing?

The Stoxx Europe 600 , fell by 0.6% to 371.73 after finishing

down 0.4% on Thursday evening.

The U.K.'s FTSE 100 was the region's top decliner, tumbling 0.8%

to 7,103.59, while Germany's DAX (DAX) fell 0.6% to 11,450.11.

France's CAC 40 dropped by 0.4% to 5,245.39 and Italy's FTSE MIB

index fell by 0.6% to 20,587.64, while Spain's IBEX 35 tumbled 0.8%

to 20,607.86.

The pound was up, fetching $1.3095 from $1.3083, while the euro

climbed to $1.1208 from $1.1194 late in New York on Thursday.

What's driving the markets?

Official data released on Friday showed that China's exports

fell almost 21% last month

(http://www.marketwatch.com/story/china-exports-plummeted-20-in-february-2019-03-07),

reinforcing investor fears that a broader global economic slowdown

won't be softened by any trade deal reached between the U.S. and

China.

Asian markets tumbled

(http://www.marketwatch.com/story/asian-markets-sink-on-trade-deal-worries-weak-china-export-data-2019-03-07)

on the news, sending the Nikkei225 in to its worst weekly

performance since December and causing European markets to open

sharply lower.

German factory data for January also showed another heavy

decline

(http://www.marketwatch.com/story/german-manufacturing-orders-plunge-in-january-2019-03-08),

falling 2.6%, just a day after the European Central Bank cut its

growth forecast and launched new measures to stimulate a dwindling

economy.

"Chinese exports saw their biggest fall in three years in

February amid the trade war with the U.S.nd German industrial

orders fell by their steepest amount in seven months in January. It

is understandable why investors have been so worried about the

outlook for global growth when you see figures like these," says

Russ Mould, investment director at AJ Bell said in a client

note.

What stocks are active?

Deutsche Bank AG (DBK.XE) has reportedly

(https://www.bloomberg.com/news/articles/2019-03-08/deutsche-bank-commerzbank-merger-talks-are-said-to-intensify)

intensified its merger talks with Commerzbank AG (CBK.XE). The

former's shares fell 0.6% while Commerzbank's rose 0.3%.

After Volkswagen AG (VOW.XE)announced plans to cut an additional

5,000 administrative jobs by 2023

(http://www.marketwatch.com/story/volkswagen-to-cut-5000-jobs-by-2023-report-2019-03-08),

the car manufacturer fell by 1.5%.

(END) Dow Jones Newswires

March 08, 2019 05:22 ET (10:22 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

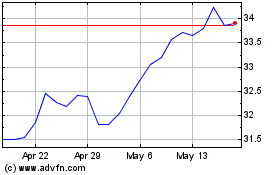

Global X Funds Global X ... (NASDAQ:DAX)

Historical Stock Chart

From Nov 2024 to Dec 2024

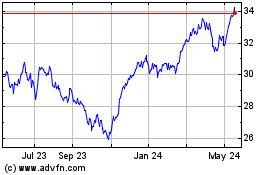

Global X Funds Global X ... (NASDAQ:DAX)

Historical Stock Chart

From Dec 2023 to Dec 2024