EUROPE MARKETS: European Markets Slide As German Factory Woe Adds To China Trade Slump

09 March 2019 - 3:44AM

Dow Jones News

By Emily Horton

Banks, oil majors under pressure

Europe's indexes fell on Friday, after economic slowdown fears

were compounded by data showing a slump in Chinese exports.

Disappointing figures from Germany's manufacturing sector added

to the gloom, a day after the European Central Bank announced cuts

to its growth forecast. And then weak U.S. jobs data compounded

worries for investors.

How did markets perform?

The Stoxx Europe 600 fell 0.9% to 370.92 after finishing down

0.4% on Thursday evening.

The U.K.'s FTSE 100 slipped 0.5% to 7,120.28, while Germany's

DAX (DAX) fell 0.5% to 11,454.

France's CAC 40 dropped by 0.6% and Italy's FTSE MIB index fell

by 1%, while Spain's IBEX 35 tumbled 1.2%.

The British pound last bought $1.3058, versus $1.3083 late

Thursday, while the euro climbed to $1.1230 from $1.1194 late in

New York on Thursday.

What's driving the markets?

Official data released on Friday showed that China's exports

fell almost 21% last month

(http://www.marketwatch.com/story/china-exports-plummeted-20-in-february-2019-03-07),

reinforcing investor fears that a broader global economic slowdown

won't be softened by any trade deal reached between the U.S. and

China.

Asian markets tumbled

(http://www.marketwatch.com/story/asian-markets-sink-on-trade-deal-worries-weak-china-export-data-2019-03-07)

on the news, sending the China stocks to their worst one-day

performance since October, causing European markets to open sharply

lower.

German factory data for January also showed another heavy

decline

(http://www.marketwatch.com/story/german-manufacturing-orders-plunge-in-january-2019-03-08),

falling 2.6%, just a day after the European Central Bank cut its

growth forecast and launched new measures to stimulate a dwindling

economy.

"Chinese exports saw their biggest fall in three years in

February amid the trade war with the U.S.nd German industrial

orders fell by their steepest amount in seven months in January. It

is understandable why investors have been so worried about the

outlook for global growth when you see figures like these," says

Russ Mould, investment director at AJ Bell said in a client

note.

Added pressure came from U.S. jobs data. U.S. jobs data revealed

the weakest growth in 17 months

(http://www.marketwatch.com/story/us-adds-meager-20000-jobs-in-february-to-mark-smallest-increase-in-17-months-2019-03-08).

What stocks are active?

Deutsche Bank AG (DBK.XE) has reportedly

(https://www.bloomberg.com/news/articles/2019-03-08/deutsche-bank-commerzbank-merger-talks-are-said-to-intensify)

intensified its merger talks with Commerzbank AG (CBK.XE). The

former's shares fell 0.9% while Commerzbank's dropped 1.6%.

Heavyweight oil majors logged sharp losses, tracking a plunge in

the price of oil

(http://www.marketwatch.com/story/oil-slumps-as-china-data-underline-global-growth-worries-2019-03-08)

(http://www.marketwatch.com/story/oil-slumps-as-china-data-underline-global-growth-worries-2019-03-08),

which was weighed by global growth worries. Royal Dutch Shell PLC

(RDSA.LN) (RDSA.LN) and BP PLC (BP.LN) (BP.LN)(BP.LN) fell over 1%

each.

After Volkswagen AG (VOW.XE)announced plans to cut an additional

5,000 administrative jobs by 2023

(http://www.marketwatch.com/story/volkswagen-to-cut-5000-jobs-by-2023-report-2019-03-08),

the car manufacturer fell by 1.7%.

(END) Dow Jones Newswires

March 08, 2019 11:29 ET (16:29 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

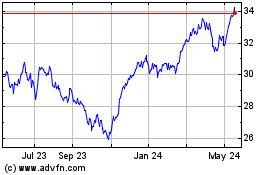

Global X Funds Global X ... (NASDAQ:DAX)

Historical Stock Chart

From Nov 2024 to Dec 2024

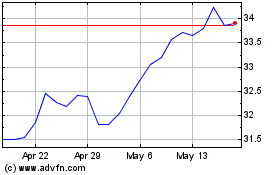

Global X Funds Global X ... (NASDAQ:DAX)

Historical Stock Chart

From Dec 2023 to Dec 2024