EUROPE MARKETS: Oil, Luxury Goods Drive Rebound For Europe Stocks

14 May 2019 - 10:53PM

Dow Jones News

By Dave Morris

European equities caught a break following Monday's sharp

declines, with a relief rally driven by a mix of commodity and drug

companies.

How did markets perform?

The Stoxx 600 rose 0.7% Tuesday to 375.3, after sinking 1.2%

Monday.

The U.K.'s FTSE 100 jumped 0.9% to 7,231.69, more than erasing

Monday's loss of 0.6%.

The pound was flat at $1.2946. On Monday, it was down 0.4%.

In Germany, the DAX (DAX) climbed 0.6% to 11,942.5. It slumped

1.5% Monday.

France's CAC 40 gained 1.2% to 5,325.05, after declining 1.2%

Monday.

Italy's FTSE MIB moved up 0.8% to 20,746.11. On Monday, it lost

1.4%.

What's moving the markets?

Investors licked their wounds after a bruising selloff Monday,

using the opportunity to pick up oversold commodity and financial

stocks, with oil major BP (BP.LN) up 1.6%, and luxury fashion house

LVMH Moet Hennessey Louis Vuitton up 2.7%.

Oil prices gained Tuesday after a new report of alleged attacks

(http://www.marketwatch.com/story/oil-prices-gain-as-more-alleged-attacks-on-saudi-production-reported-2019-05-14)

on major Saudi facilities, which triggered supply concerns and

pushed up prices.

There was little optimism on U.S.-China trade talks, after China

announced up to $60 billion in fresh tariffs in retaliation for

those announced by U.S. President Donald Trump earlier this month.

However, U.S. stock futures rose after Trump said that the success

or failure of the talks could be assessed in three to four weeks,

but that he was upbeat they would succeed.

In economic data, the U.K.'s unemployment rate fell to its

lowest level since 1974

(http://www.marketwatch.com/story/uk-jobless-rate-hits-lowest-since-1974-2019-05-14).

The jobless rate in the first quarter of 2019 was 3.8% according to

the Office for National Statistics, which was less than predicted

at 3.9%.

Which stocks are active?

Bayer AG (BAYN.XE) took a further hit when a jury awarded a

California couple $2.1 billion

(http://www.marketwatch.com/story/california-jury-awards-couple-2-billion-in-latest-roundup-herbicide-defeat-for-bayer-2019-05-13)

after finding that its Roundup weedkiller caused their cancer. The

shares fell 2.7% on the decision, leaving shares down 46.5% over

the past 12 months.

Metro Bank PLC (MTRO.LN) investors took some slight comfort in

Tuesday trading as shares rebounded 6%. They plunged nearly 11%

Monday after the FT reported the challenger bank was planning to

sell over GBP1 billion worth of the loan book

(https://www.ft.com/content/0cf6b3a0-7255-11e9-bf5c-6eeb837566c5)

at the center of controversy over an accounting error. The upstart

lender also fended off rumors on social media of runs on the bank

by customers, adding insult to injury. Even after Tuesday's

recovery, the shares remain down 70% on the year.

Vodafone Group PLC (VOD.LN) slipped after a loss as its dividend

cut, which was expected after media reports indicated it could be

slashed by 50%, came in at 40% instead

(http://www.marketwatch.com/story/vodafone-cuts-dividend-after-swinging-to-2019-loss-2019-05-14).

Shares swooned 5.2% Monday, and another 2.7% on Tuesday.

(END) Dow Jones Newswires

May 14, 2019 08:38 ET (12:38 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

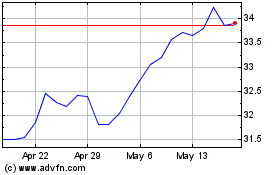

Global X Funds Global X ... (NASDAQ:DAX)

Historical Stock Chart

From Nov 2024 to Dec 2024

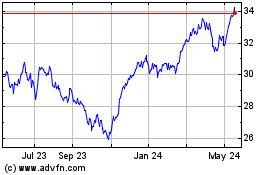

Global X Funds Global X ... (NASDAQ:DAX)

Historical Stock Chart

From Dec 2023 to Dec 2024