EUROPE MARKETS: Trade Tensions Weigh On Europe With Tech, Apparel Makers Down

20 May 2019 - 11:22PM

Dow Jones News

By Dave Morris

Ryanair shares drop after profit warning

European stocks stumbled Monday as trade tensions kicked off the

week, dragging global markets lower, with technology and apparel

makers under pressure on the continent.

How did markets perform?

The Stoxx 600 was down 1.3% to 376.59, after falling 0.4%

Friday.

Italy's FTSE MIB plunged 2.8% amid increased political tensions,

after Deputy Prime Minister Matteo Salvini led a rally Saturday

ahead of European elections, vowing to take on the region's

mainstream leaders.

The U.K.'s FTSE 100 fell 0.9% to 7,282.65. On Friday it had

edged down 0.1%.

The pound reversed course and gained 0.2% to $1.2743 after

falling 0.4% Friday.

In Germany, the DAX (DAX) declined 1.8% to 12,013.75, adding to

its woes Friday when it swooned 0.6%.

France's CAC 40 fell 1.8% to 5,340.72. On Friday it moved down

0.2%.

What's moving the markets?

(http://www.marketwatch.com/story/oil-prices-rise-on-signs-opec-may-extend-output-cuts-2019-05-20)Shares

of chip makers were under pressure as U.S. technology companies

have begun to comply with the White House's ban

(http://www.marketwatch.com/story/google-xilinx-begin-to-comply-with-trump-ban-on-huawei-2019-05-20)

on China's Huawei Technologies Inc. Shares of Infineon Technologies

Inc. (IFX.XE) slid nearly 5% after the German chip group said it

was also cooperating. The company said "the great majority" of

products Infineon delivers to Huawei are "not subject to U.S.

export control law restrictions, therefore those shipments will

continue."

Market Snapshot:Stocks poised to start the week lower as trade

tensions persist

(http://www.marketwatch.com/story/stocks-poised-to-start-the-week-lower-as-trade-tensions-persist-2019-05-20)

(http://www.marketwatch.com/story/stocks-poised-to-start-the-week-lower-as-trade-tensions-persist-2019-05-20)U.S.

President Donald Trump said concessions in negotiations could not

be "50-50" because trade practices by China had historically

damaged the U.S. There is currently no timeline for the two sides

to resume talks. The U.S. appears to have shifted focus to other

areas such as trade with Canada and Mexico, agreeing Friday to

exempt the two countries from steel and aluminum tariffs.

(http://www.marketwatch.com/story/oil-prices-rise-on-signs-opec-may-extend-output-cuts-2019-05-20)Sunday's

meeting of the Organization of the Petroleum Exporting Countries

(OPEC) sent oil prices higher

(http://www.marketwatch.com/story/oil-prices-rise-on-signs-opec-may-extend-output-cuts-2019-05-20)

after Saudi Energy Minister Khalid al-Falih said efforts to shrink

crude inventories could continue into the second half of 2019. But

prices came off earlier highs on concerns there wasn't full

consensus on that.

Brent crude oil was up 0.4% to $72.54 a barrel, while West Texas

Intermediate (WTI) rose 0.3% to $62.92 a barrel.

Writing in the Sunday Times, U.K. Prime Minister Theresa May

said she hoped to get a Brexit deal through Parliament on her

fourth attempt by making what she called a "new and improved"

offer. The move eliminates the prospect of indicative votes, but

critics warned that the gambit would fail unless there were

significant changes, none of which May mentioned in her

article.

Which stocks are active?

Ryanair Group Holdings PLC (RYAAY) dropped 3% after warning that

the grounding

(http://www.marketwatch.com/story/ryanair-warns-of-profit-hit-over-737-max-grounding-2019-05-20)

of Boeing's 737 MAX jets would have a negative impact on the coming

year's results. The company reported full year earnings to March 31

showing pretax profits fell 30% year over year. It cited fuel and

staff costs as factors in the decline.

Russ Mould, investment director at AJ Bell, said: "The silver

lining to this thick cloud is that its peer group are facing

exactly the same pressures and many operators have far less secure

balance sheets than Ryanair."

Deutsche Bank AG (DBK.XE) was down 3% after UBS analysts

downgraded the shares from neutral to sell. They cited factors such

as heavy competition in its home market of Germany and limited

strategic options, given the collapse of merger talks with

Commerzbank AG and a lack of compelling alternatives.

Other European chipmakers also came under pressure, with ams AG

(AMS.EB) dropping 11%, STMicroelectronics NV (STM.FR) (STM.FR) down

8% and ASML Holding NV.

Luxury-goods makers, many of whom count China as a key market,

were also down, with LVMH Moet Hennessey (LVMUY) dropping nearly

3%.

(END) Dow Jones Newswires

May 20, 2019 09:07 ET (13:07 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

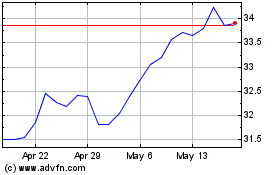

Global X Funds Global X ... (NASDAQ:DAX)

Historical Stock Chart

From Jan 2025 to Feb 2025

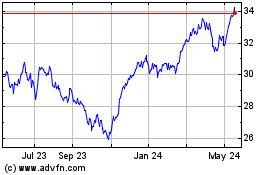

Global X Funds Global X ... (NASDAQ:DAX)

Historical Stock Chart

From Feb 2024 to Feb 2025