Third quarter Net Revenue of $379.9 million,

Organic Revenue increases 3.5%

Krispy Kreme, Inc. (NASDAQ: DNUT) (“Krispy Kreme”, “KKI”, or the

“Company”) today reported financial results for the quarter ended

September 29, 2024.

Third Quarter Highlights (vs Q3

2023)

- Net revenue of $379.9 million

- Organic revenue grew 3.5% to $376.4 million

- GAAP net income of $37.6 million, linked to the sale of a

majority ownership stake of Insomnia Cookies ($39.6 million net

income attributable to KKI)

- Adjusted EBITDA of $34.7 million

- GAAP operating cash flow of $3.3 million

- Global Points of Access (“POA”) increased 2,417, or 18.0%, to

15,811

“Krispy Kreme delivered a seventeenth consecutive quarter of

year-over-year organic sales growth driven by increased Delivered

Fresh Daily and digital sales,” said Josh Charlesworth, CEO.

“Consumers ask us every day, ‘When can you bring Krispy Kreme to

my town?’ hence our strategy of making our fresh doughnuts more

available around the world. The successful start of our nationwide

U.S. rollout at McDonald’s, which began in Chicago in October and

continues next week across Ohio and Indiana, is a major milestone

on this journey, and we now expect to be delighting Krispy Kreme’s

fans with our melt-in-your-mouth doughnuts fresh daily in nearly

2,000 McDonald’s restaurants by the end of 2024.”

“Now well into my first year as CEO, we have streamlined and

focused our business with the sale of our majority stake in

Insomnia Cookies complete and the acceleration of our US DFD

expansion underway. To better align our talent and our capital to

our business priorities, we are now restructuring our management

teams to concentrate on maximizing our profitable expansion of the

U.S. while focusing international efforts on the wider adoption of

our capital-light franchise model. With our resources prioritized

to the things that matter most, I believe that these changes will

result in a bigger and better Krispy Kreme,” Charlesworth

continued.

Financial Highlights

Quarter Ended

$ in millions, except per share data

September 29, 2024

October 1, 2023

Change

GAAP:

Net revenue

$

379.9

$

407.4

(6.8

)%

Operating loss

$

(16.0

)

$

(2.1

)

nm

Operating loss margin

(4.2

)%

(0.5

)%

(370) bps

Net income/(loss)

$

37.6

$

(40.3

)

nm

Net income/(loss) attributable to

KKI

$

39.6

$

(40.5

)

nm

Diluted income/(loss) per share

$

0.23

$

(0.24

)

$

0.47

Non-GAAP (1):

Organic revenue

$

376.4

$

363.8

3.5

%

Adjusted net (loss)/income,

diluted

$

(2.5

)

$

4.4

nm

Adjusted EBITDA

$

34.7

$

43.7

(20.7

)%

Adjusted EBITDA margin

9.1

%

10.7

%

(160) bps

Adjusted diluted (loss)/income per

share

$

(0.01

)

$

0.03

$

(0.04

)

Notes:

(1)

Non-GAAP figures – please refer to

Reconciliation of Non-GAAP Financial Measures.

Key Operating Metrics

Quarter Ended

$ in millions

September 29, 2024

October 1, 2023

Change

Global Points of Access

15,811

13,394

18.0

%

Sales per Hub (U.S.) TTM

$

4.9

$

4.8

2.1

%

Sales per Hub (International)

TTM

$

10.1

$

9.9

2.0

%

Digital Sales as a Percent of Doughnut

Shop Sales

15.5

%

12.6

%

290 bps

Third Quarter 2024 Consolidated Results

(vs Q3 2023)

Krispy Kreme’s third-quarter results reflect the sale of a

majority ownership stake of Insomnia Cookies. The business is now

fully focused on its core strategy of producing, selling and

distributing fresh doughnuts daily and executing on its profitable

U.S. growth strategy and capital light international model. Net

revenue was $379.9 million in Q3 2024, a decline of 6.8%, compared

to $407.4 million in the same quarter last year. GAAP Net Income

was $37.6 million, including the gain on divestiture of a

controlling interest in Insomnia Cookies, compared to prior year

net loss of $40.3 million. GAAP diluted earnings per share was

$0.23, compared to a loss of $0.24 in the same quarter last

year.

Total company organic revenue grew 3.5% compared to the same

quarter in the prior year. Delivered Fresh Daily (“DFD”) sales and

digital sales both grew 15%, more than offsetting expected consumer

softness in U.S. Retail and the U.K.

Adjusted EBITDA was $34.7 million, a decline of 20.7% largely

driven by the sale of a majority ownership stake in Insomnia

Cookies. Adjusted EBITDA margin declined 160 bps to 9.1%, due to

underperformance in the U.K. and incremental vehicle accident

claims costs in the U.S. Adjusted Net Loss, diluted was $2.5

million in the quarter. Adjusted Diluted EPS declined to $(0.01)

from $0.03 in the same quarter last year.

Third Quarter 2024 Segment Results (vs

Q3 2023)

U.S.: In the U.S. segment, net revenue declined $31.8

million, or 12.2%, driven by the $43.5 million impact associated

with the sale of a majority ownership stake of Insomnia Cookies in

July 2024. Organic revenue growth of $5.5 million, or 2.5%, was

driven by a 14% increase in Points of Access and a 21% increase in

digital channel revenues.

U.S. Adjusted EBITDA decreased $8.3 million, or 37.5%, with

margin declining 250 basis points to 6.1%, due to incremental

vehicle accident claims costs and McDonald’s start-up costs,

partially offset by pricing and productivity benefits from the

Company’s Hub and Spoke model. Following successful pilots with a

third-party logistics partner in Los Angeles and Washington, DC,

the Company launched an RFP on October 9th with several national

and regional carriers for daily delivery of fresh doughnuts to

grocers, convenience stores, quick service restaurants, and

others.

International: In the International segment, net revenue

grew $4.6 million, or 3.7%, with organic revenue growth of $5.3

million or 4.2%, driven by Canada, Japan, and Australia, which more

than offset underperformance in the U.K.

International segment Adjusted EBITDA margin improved

sequentially despite the seasonally weaker quarter as actions taken

to reduce costs delivered improved results. Year over year,

Adjusted EBITDA decreased $2.2 million, or 8.7%, with a margin

decline of 240 basis points to 17.4%, primarily due to pressure in

the U.K. where we have welcomed a new management team focused on

improving the business.

Market Development: In the Market Development segment,

net revenue declined $0.3 million, or approximately 1.5%, due to

the $2.1 million impact of franchise acquisitions in the third

quarter of fiscal 2024. Market Development organic revenue grew

$1.8 million, or approximately 8.6%, with a new market opening in

Morocco alongside continued growth in France, Turkey, and

Ecuador.

Market Development Adjusted EBITDA grew $1.5 million, or 14.8%,

with margin expansion of 770 basis points delivering Adjusted

EBITDA margins of 54.2%, driven by royalty flow through and savings

in SG&A.

Balance Sheet and Capital

Expenditures

During the third quarter of 2024, Operating Cash Flow was $3.3

million. The Company invested $26.1 million, or 6.9% of net

revenue, in capital expenditures, driven primarily by the

investments in the Hub and Spoke model for the U.S. expansion of

the DFD network. During the quarter, the Company received $117.6

million in net proceeds from the divestiture of Insomnia Cookies

and $45.0 million from the repayment of an intercompany loan due

from Insomnia Cookies, which was used to reduce long term debt.

2024 Financial Guidance

We are adjusting our full year guide to reflect the third

quarter results, the acceleration of our expansion with McDonald’s,

and the completion of the Insomnia Cookies transaction in July

2024:

- Net Revenue of $1,650 to $1,685 million

- Organic Revenue growth of +5% to +7%

- Adjusted EBITDA of $205 to $210 million

- Adjusted Diluted EPS of $0.18 to $0.22

- Income Tax rate between 28% and 30%

- Capital Expenditures of 7% to 8% of net revenue

- Interest Expense, net of $55 million to $60 million

Definitions

The following definitions apply to terms used throughout this

press release:

- Global Points of Access: Reflects all locations at which

fresh doughnuts or cookies can be purchased. We define global

points of access to include all Hot Light Theater Shops, Fresh

Shops, Carts and Food Trucks, DFD Doors and Cookie Shops, at both

Company-owned and franchise locations as of the end of the

applicable reporting period. We monitor Global Points of Access as

a metric that informs the growth of our omni-channel presence over

time and believe this metric is useful to investors to understand

our footprint in each of our segments.

- Hubs: Reflects locations where fresh doughnuts are

produced and processed for sale at any point of access. We define

Hubs to include self-sustaining Hot Light Theater Shops and

Doughnut Factories, at both Company-owned and franchise locations

as of the end of the applicable reporting period.

- Sales Per Hub: Sales per Hub equals Fresh Revenues from

Hubs with Spokes, divided by the average number of Hubs with Spokes

at the end of each of the five most recent quarters.

- Fresh Revenues from Hubs with Spokes: Fresh Revenues

include product sales generated from our Doughnut Shop business

(including digital), as well as DFD sales, but excluding sales from

Branded Sweet Treats. It also excludes all Insomnia Cookies

revenues as the measure is focused on the Krispy Kreme business.

Fresh Revenues from Hubs with Spokes equals the Fresh Revenues

derived from those Hubs currently producing product for other

shops, Carts and Food Trucks, and/or DFD doors, but excluding Fresh

Revenues derived from those Hubs not currently producing product

for other shops, Carts and Food Trucks, and/or DFD doors.

- Free Cash Flow: Defined as cash provided by operating

activities less purchases of property and equipment.

Conference Call

Krispy Kreme will host a public conference call at 8:30 AM

Eastern Time today to discuss its results for the third quarter of

2024. The conference call can be accessed by dialing 1 (800)

715-9871 and entering the conference ID 1277949. International

participants can access the call via the corresponding number

listed HERE and entering the conference ID 1277949. To listen to

the live audio webcast and Q&A, visit the Krispy Kreme investor

relations website at investors.krispykreme.com. A replay and

transcript of the webcast will be available on the website within

24 hours after the call. Krispy Kreme’s earnings press release and

related materials will also be available on the investor relations

section of the Company’s website.

About Krispy Kreme

Headquartered in Charlotte, N.C., Krispy Kreme is one of the

most beloved and well-known sweet treat brands in the world. Our

iconic Original Glazed® doughnut is universally recognized for its

hot-off-the-line, melt-in-your-mouth experience. Krispy Kreme

operates in 40 countries through its unique network of fresh

doughnut shops, partnerships with leading retailers, and a rapidly

growing digital business with more than 15,500 fresh points of

access. Our purpose of touching and enhancing lives through the joy

that is Krispy Kreme guides how we operate every day and is

reflected in the love we have for our people, our communities and

the planet. Connect with Krispy Kreme Doughnuts at

www.KrispyKreme.com, or on one of its many social media channels,

including www.Facebook.com/KrispyKreme and

www.X.com/KrispyKreme.

Cautionary Note Regarding

Forward-Looking Statements

This press release contains forward-looking statements that

involve risks and uncertainties. The words “continue,” “towards,”

“expect,” “outlook,” “guidance,” “explore,” or similar words, or

the negative of these words, identify forward-looking statements.

Such forward-looking statements are based on certain assumptions

and estimates that we consider reasonable but are subject to

various risks and uncertainties relating to our operations,

financial results, financial conditions, business, prospects,

growth strategy and liquidity. Accordingly, there are, and may be,

important factors that could cause our actual results to differ

materially from those indicated in these statements. The inclusion

of this forward-looking information should not be regarded as a

representation by us that the future plans, estimates or

expectations contemplated by us will be achieved. Our actual

results could differ materially from the forward-looking statements

included herein. Factors that could cause actual results to differ

from those expressed in forward-looking statements include, without

limitation, the risks and uncertainties described under the

headings “Cautionary Note Regarding Forward-Looking Statements” and

“Risk Factors” in our Annual Report on Form 10-K for the year ended

December 31, 2023, filed by us with the Securities and Exchange

Commission (“SEC”) and described in the other filings we make from

time to time with the SEC. We believe that these factors include,

but are not limited to, the impact of pandemics, changes in

consumer preferences, the impact of inflation, and our ability to

execute on our omni-channel business strategy. These

forward-looking statements are made only as of the date of this

document, and we do not undertake any obligation, other than as may

be required by applicable law, to update or revise any

forward-looking or cautionary statement to reflect changes in

assumptions, the occurrence of events, unanticipated or otherwise,

or changes in future operating results over time or otherwise.

Non-GAAP Measures

This press release includes certain non-GAAP financial measures

including organic revenue growth, Adjusted EBITDA, Adjusted Net

Income, Diluted, Adjusted Diluted EPS, Net Debt, Fresh Revenue from

Hubs with Spokes and Sales per Hub, which differ from results using

U.S. Generally Accepted Accounting Principles (“GAAP”). These

non-GAAP financial measures are not universally consistent

calculations, limiting their usefulness as comparative measures.

Other companies may calculate similarly titled financial measures

differently than we do or may not calculate them at all.

Additionally, these non-GAAP financial measures are not

measurements of financial performance under GAAP. In order to

facilitate a clear understanding of our consolidated historical

operating results, you should examine our non-GAAP financial

measures in conjunction with our historical consolidated financial

statements and notes thereto filed with the SEC. See

“Reconciliation of Non-GAAP Financial Measures” below for

reconciliations of our non-GAAP financial measures to the

comparable GAAP measures.

To the extent that the Company provides guidance, it does so

only on a non-GAAP basis. The Company does not provide

reconciliations of such forward-looking non-GAAP measures to GAAP

due to the inability to predict the amount and timing of impacts

outside of the Company’s control on certain items, such as net

income and other charges reflected in our reconciliation of

historic numbers, the amount of which, based on historical

experience, could be significant.

Krispy Kreme, Inc.

Condensed Consolidated

Statements of Operations (Unaudited)

(in thousands, except per

share amounts)

Quarter Ended

Three Quarters Ended

September 29, 2024 (13

weeks)

October 1, 2023 (13

weeks)

September 29, 2024 (39

weeks)

October 1, 2023 (39

weeks)

Net revenues

Product sales

$

370,662

$

398,745

$

1,233,585

$

1,209,767

Royalties and other revenues

9,205

8,622

27,789

25,432

Total net revenues

379,867

407,367

1,261,374

1,235,199

Product and distribution costs

95,840

101,353

310,701

330,292

Operating expenses

192,027

195,380

609,726

575,953

Selling, general and administrative

expense

71,110

68,305

207,150

192,355

Marketing expenses

10,680

12,478

35,211

32,101

Pre-opening costs

619

1,059

2,691

2,927

Other income, net

(5,781

)

(1,102

)

(6,430

)

(6,051

)

Depreciation and amortization expense

31,376

32,007

99,562

89,142

Operating (loss)/income

(16,004

)

(2,113

)

2,763

18,480

Interest expense, net

16,280

12,807

44,468

36,858

Gain on divestiture of Insomnia

Cookies

(87,128

)

—

(87,128

)

—

Other non-operating (income)/expense,

net

(407

)

971

1,115

3,031

Income/(loss) before income

taxes

55,251

(15,891

)

44,308

(21,409

)

Income tax expense

17,679

24,367

18,330

17,121

Net income/(loss)

37,572

(40,258

)

25,978

(38,530

)

Net (loss)/income attributable to

noncontrolling interest

(1,991

)

199

440

2,005

Net income/(loss) attributable to

Krispy Kreme, Inc.

$

39,563

$

(40,457

)

$

25,538

$

(40,535

)

Net income/(loss) per share:

Common stock — Basic

$

0.23

$

(0.24

)

$

0.15

$

(0.24

)

Common stock — Diluted

$

0.23

$

(0.24

)

$

0.15

$

(0.24

)

Weighted average shares

outstanding:

Basic

169,596

168,224

169,125

168,183

Diluted

171,486

168,224

171,384

168,183

Krispy Kreme, Inc.

Condensed Consolidated Balance

Sheets

(in thousands, except per

share data)

As of

(Unaudited) September 29,

2024

December 31,

2023

ASSETS

Current assets:

Cash and cash equivalents

$

25,410

$

38,185

Restricted cash

474

429

Accounts receivable, net

62,019

59,362

Inventories

31,486

34,716

Taxes receivable

19,406

15,526

Prepaid expense and other current

assets

25,531

25,363

Total current assets

164,326

173,581

Property and equipment, net

489,782

538,220

Goodwill

1,060,393

1,101,939

Other intangible assets, net

831,735

946,349

Operating lease right of use asset,

net

409,425

456,964

Investments in unconsolidated entities

91,033

2,806

Other assets

18,430

20,733

Total assets

$

3,065,124

$

3,240,592

LIABILITIES AND SHAREHOLDERS’

EQUITY

Current liabilities:

Current portion of long-term debt

$

47,577

$

54,631

Current operating lease liabilities

45,767

50,365

Accounts payable

123,125

156,488

Accrued liabilities

119,832

134,005

Structured payables

139,170

130,104

Total current liabilities

475,471

525,593

Long-term debt, less current portion

804,638

836,615

Noncurrent operating lease liabilities

406,726

454,583

Deferred income taxes, net

119,291

123,925

Other long-term obligations and deferred

credits

49,858

36,093

Total liabilities

1,855,984

1,976,809

Commitments and contingencies

Shareholders’ equity:

Common stock, $0.01 par value; 300,000

shares authorized as of both September 29, 2024 and December 31,

2023; 169,799 and 168,628 shares issued and outstanding as of

September 29, 2024 and December 31, 2023, respectively

1,698

1,686

Additional paid-in capital

1,460,416

1,443,591

Shareholder note receivable

(1,924

)

(3,850

)

Accumulated other comprehensive

(loss)/income, net of income tax

(9,276

)

7,246

Retained deficit

(271,238

)

(278,990

)

Total shareholders’ equity attributable

to Krispy Kreme, Inc.

1,179,676

1,169,683

Noncontrolling interest

29,464

94,100

Total shareholders’ equity

1,209,140

1,263,783

Total liabilities and shareholders’

equity

$

3,065,124

$

3,240,592

Krispy Kreme, Inc.

Condensed Consolidated

Statements of Cash Flows (Unaudited)

(in thousands)

Three Quarters Ended

September 29, 2024 (39

weeks)

October 1, 2023 (39

weeks)

CASH FLOWS PROVIDED BY OPERATING

ACTIVITIES:

Net income/(loss)

$

25,978

$

(38,530

)

Adjustments to reconcile net income/(loss)

to net cash provided by operating activities:

Depreciation and amortization expense

99,562

89,142

Deferred and other income taxes

(22

)

12,634

Loss on extinguishment of debt

—

472

Impairment and lease termination

charges

368

7,711

Loss/(gain) on disposal of property and

equipment

470

(168

)

Gain on divestiture of Insomnia

Cookies

(87,128

)

—

Gain on remeasurement of equity method

investment

(5,579

)

—

Gain on sale-leaseback

—

(9,646

)

Share-based compensation

24,603

17,821

Change in accounts and notes receivable

allowances

433

504

Inventory write-off

1,731

10,522

Settlement of interest rate swap

derivatives

—

7,657

Amortization related to settlement of

interest rate swap derivatives

(5,910

)

(7,334

)

Other

263

566

Change in operating assets and

liabilities, excluding business acquisitions and divestitures, and

foreign currency translation adjustments

(35,982

)

(47,319

)

Net cash provided by operating

activities

18,787

44,032

CASH FLOWS PROVIDED BY/(USED FOR)

INVESTING ACTIVITIES:

Purchase of property and equipment

(86,877

)

(88,605

)

Proceeds from sale-leaseback

—

10,025

Acquisition of shops and franchise rights

from franchisees, net of cash acquired

(26,612

)

—

Purchase of equity method investment

(3,506

)

—

Net proceeds from divestiture of Insomnia

Cookies

117,646

—

Principal payment received from loan to

Insomnia Cookies

45,000

—

Disbursement for loan receivable

(1,086

)

—

Other investing activities

180

222

Net cash provided by/(used for)

investing activities

44,745

(78,358

)

CASH FLOWS (USED FOR)/PROVIDED BY

FINANCING ACTIVITIES:

Proceeds from the issuance of debt

490,000

1,044,698

Repayment of long-term debt and lease

obligations

(545,692

)

(965,250

)

Payment of financing costs

—

(5,000

)

Proceeds from structured payables

298,551

145,099

Payments on structured payables

(264,346

)

(159,571

)

Payment of contingent consideration

related to a business combination

—

(925

)

Capital contribution by shareholders, net

of loans issued

919

631

Proceeds from sale of noncontrolling

interest in subsidiary

364

—

Distribution to shareholders

(17,743

)

(17,657

)

Payments for repurchase and retirement of

common stock

(4,366

)

(1,609

)

Distribution to noncontrolling

interest

(35,035

)

(12,883

)

Net cash (used for)/provided by

financing activities

(77,348

)

27,533

Effect of exchange rate changes on cash,

cash equivalents and restricted cash

1,086

(2,796

)

Net decrease in cash, cash equivalents and

restricted cash

(12,730

)

(9,589

)

Cash, cash equivalents and restricted cash

at beginning of period

38,614

35,730

Cash, cash equivalents and restricted

cash at end of period

$

25,884

$

26,141

Net cash provided by operating

activities

$

18,787

$

44,032

Less: Purchase of property and

equipment

(86,877

)

(88,605

)

Free cash flow

$

(68,090

)

$

(44,573

)

Krispy Kreme, Inc. Reconciliation of

Non-GAAP Financial Measures (Unaudited) (in thousands,

except per share amounts)

We define “Adjusted EBITDA” as earnings before interest expense,

net, income tax expense, and depreciation and amortization, with

further adjustments for share-based compensation, certain strategic

initiatives, acquisition and integration expenses, and other

certain non-recurring, infrequent or non-core income and expense

items. Adjusted EBITDA is a principal metric that management uses

to monitor and evaluate operating performance and provides a

consistent benchmark for comparison across reporting periods.

We define “Adjusted Net Income, Diluted” as net loss

attributable to common shareholders, adjusted for interest expense,

share-based compensation, certain strategic initiatives,

acquisition and integration expenses, amortization of

acquisition-related intangibles, the tax impact of adjustments, and

other certain non-recurring, infrequent or non-core income and

expense items. “Adjusted EPS” is Adjusted Net Income, Diluted

converted to a per share amount.

Adjusted EBITDA, Adjusted Net Income, Diluted, and Adjusted EPS

have certain limitations, including adjustments for income and

expense items that are required by GAAP. In evaluating these

non-GAAP measures, you should be aware that in the future we will

incur expenses that are the same as or similar to some of the

adjustments in this presentation, such as share-based compensation.

Our presentation of Adjusted EBITDA, Adjusted Net Income, Diluted,

and Adjusted EPS should not be construed to imply that our future

results will be unaffected by any such adjustments. Management

compensates for these limitations by relying on our GAAP results in

addition to using Adjusted EBITDA, Adjusted Net Income, Diluted,

and Adjusted EPS supplementally.

Quarter Ended

Three Quarters Ended

(in thousands)

September 29, 2024

October 1, 2023

September 29, 2024

October 1, 2023

Net income/(loss)

$

37,572

$

(40,258

)

$

25,978

$

(38,530

)

Interest expense, net

16,280

12,807

44,468

36,858

Income tax expense

17,679

24,367

18,330

17,121

Depreciation and amortization expense

31,376

32,007

99,562

89,142

Share-based compensation

9,969

7,452

24,603

17,821

Employer payroll taxes related to

share-based compensation

49

96

299

310

Gain on divestiture of Insomnia

Cookies

(87,128

)

—

(87,128

)

—

Other non-operating (income)/expense, net

(1)

(407

)

971

1,115

3,031

Strategic initiatives (2)

11,426

5,895

20,434

23,841

Acquisition and integration expenses

(3)

1,938

49

3,037

479

New market penetration expenses (4)

156

678

1,194

1,013

Shop closure expenses/(income), net

(5)

21

(449

)

788

356

Restructuring and severance expenses

(6)

631

552

769

2,799

Gain on remeasurement of equity method

investment (7)

(5,579

)

—

(5,579

)

—

Gain on sale-leaseback

—

—

—

(9,646

)

Other (8)

716

(426

)

(257

)

2,888

Adjusted EBITDA

$

34,699

$

43,741

$

147,613

$

147,483

Quarter Ended

Three Quarters Ended

(in thousands)

September 29, 2024

October 1, 2023

September 29, 2024

October 1, 2023

Segment Adjusted EBITDA:

U.S.

$

13,922

$

22,258

$

89,206

$

88,878

International

22,779

24,961

64,970

68,645

Market Development

11,271

9,816

36,046

31,862

Corporate

(13,273

)

(13,294

)

(42,609

)

(41,902

)

Total Adjusted EBITDA

$

34,699

$

43,741

$

147,613

$

147,483

Quarter Ended

Three Quarters Ended

(in thousands, except per share

amounts)

September 29, 2024

October 1, 2023

September 29, 2024

October 1, 2023

Net income/(loss)

$

37,572

$

(40,258

)

$

25,978

$

(38,530

)

Share-based compensation

9,969

7,452

24,603

17,821

Employer payroll taxes related to

share-based compensation

49

96

299

310

Gain on divestiture of Insomnia

Cookies

(87,128

)

—

(87,128

)

—

Other non-operating (income)/expense, net

(1)

(407

)

971

1,115

3,031

Strategic initiatives (2)

11,426

5,895

20,434

23,841

Acquisition and integration expenses

(3)

1,938

49

3,037

479

New market penetration expenses (4)

156

678

1,194

1,013

Shop closure expenses/(income) (5)

21

(449

)

788

356

Restructuring and severance expenses

(6)

631

552

769

2,799

Gain on remeasurement of equity method

investment (7)

(5,579

)

—

(5,579

)

—

Gain on sale-leaseback

—

—

—

(9,646

)

Other (8)

716

(426

)

(257

)

2,888

Amortization of acquisition related

intangibles (9)

7,780

7,386

22,597

22,027

Loss on extinguishment of 2019 Facility

(10)

—

—

—

472

Tax impact of adjustments (11)

20,766

22,694

13,765

8,574

Tax specific adjustments (12)

(2,395

)

(28

)

(3,210

)

(2,343

)

Net loss/(income) attributable to

noncontrolling interest

1,991

(199

)

(440

)

(2,005

)

Adjusted net (loss)/income attributable

to common shareholders - Basic

$

(2,494

)

$

4,413

$

17,965

$

31,087

Additional income attributed to

noncontrolling interest due to subsidiary potential common

shares

(4

)

(7

)

(28

)

(14

)

Adjusted net (loss)/income attributable

to common shareholders - Diluted

$

(2,498

)

$

4,406

$

17,937

$

31,073

Basic weighted average common shares

outstanding

169,596

168,224

169,125

168,183

Dilutive effect of outstanding common

stock options, RSUs, and PSUs

—

2,421

2,259

2,249

Diluted weighted average common shares

outstanding

169,596

170,645

171,384

170,432

Adjusted net (loss)/income per share

attributable to common shareholders:

Basic

$

(0.01

)

$

0.03

$

0.11

$

0.18

Diluted

$

(0.01

)

$

0.03

$

0.10

$

0.18

(1)

Primarily foreign translation gains and

losses in each period.

(2)

The quarter and three quarters ended

September 29, 2024 consist primarily of costs associated with the

divestiture of the Insomnia Cookies business, preparing for the

McDonald’s U.S. expansion, and global transformation (with these

three specific initiatives aggregating to approximately $11.3

million and $20.0 million for the quarter and three quarters ended

September 29, 2024, respectively). The quarter and three quarters

ended October 1, 2023 consist primarily of costs associated with

global transformation and U.S. initiatives such as the decision to

exit the Branded Sweet Treats business, including property, plant

and equipment impairments, inventory write-offs, employee

severance, and other related costs.

(3)

Consists of acquisition and

integration-related costs in connection with the Company’s business

and franchise acquisitions, including legal, due diligence, and

advisory fees incurred in connection with acquisition and

integration-related activities for the applicable period.

(4)

Consists of start-up costs associated with

entry into new countries for which the Company’s brands have not

previously operated, including Brazil and Spain.

(5)

Includes lease termination costs,

impairment charges, and loss on disposal of property, plant and

equipment. The quarter and three quarters ended October 1, 2023

include gains related to the termination of leases at certain

Krispy Kreme shops in the U.S. where the Company had already

recognized impairment of the corresponding right of use assets in a

prior period.

(6)

The quarter and three quarters ended

September 29, 2024 consists primarily of costs associated with the

restructuring of the KK U.K. executive team. The quarter and three

quarters ended October 1, 2023 consists primarily of costs

associated with restructuring of the global executive team.

(7)

Consists of a gain related to the

remeasurement of the equity method investments in KremeWorks USA,

LLC and KremeWorks Canada, L.P. to fair value immediately prior to

the acquisition of the shops.

(8)

The quarter and three quarters ended

September 29, 2024 and October 1, 2023 consist primarily of legal

and other regulatory expenses incurred outside the ordinary course

of business. The three quarters ended September 29, 2024 also

include a gain from insurance proceeds received related to a shop

in the U.S. that was destroyed and subsequently rebuilt.

(9)

Consists of amortization related to

acquired intangible assets as reflected within depreciation and

amortization in the Condensed Consolidated Statements of

Operations.

(10)

Includes interest expenses related to

unamortized debt issuance costs from the 2019 Facility associated

with extinguished lenders as a result of the March 2023 debt

refinancing.

(11)

Tax impact of adjustments calculated

applying the applicable statutory rates. The quarter and three

quarters ended September 29, 2024 and October 1, 2023 also include

the impact of disallowed executive compensation expense.

(12)

The quarter and three quarters ended

September 29, 2024 consist of the recognition of previously

unrecognized tax benefits unrelated to ongoing operations, a

discrete tax benefit unrelated to ongoing operations, the release

of valuation allowances on state net operating losses associated

with the divestiture of Insomnia Cookies, and the effect of various

tax law changes on existing temporary differences. The quarter and

three quarters ended October 1, 2023 consist of the recognition of

a previously unrecognized tax benefit unrelated to ongoing

operations, the effect of tax law changes on existing temporary

differences, and a discrete tax benefit unrelated to ongoing

operations.

Krispy Kreme, Inc.

Segment Reporting

(Unaudited)

(in thousands, except

percentages or otherwise stated)

Quarter Ended

Three Quarters Ended

September 29, 2024

October 1, 2023

September 29, 2024

October 1, 2023

Net revenues:

U.S.

$

228,376

$

260,177

$

813,615

$

808,938

International

130,697

126,077

380,716

358,653

Market Development

20,794

21,113

67,043

67,608

Total net revenues

$

379,867

$

407,367

$

1,261,374

$

1,235,199

Q3 2024 Organic Revenue - QTD

(in thousands, except

percentages)

U.S.

International

Market Development

Total Company

Total net revenues in third quarter of

fiscal 2024

$

228,376

$

130,697

$

20,794

$

379,867

Total net revenues in third quarter of

fiscal 2023

260,177

126,077

21,113

407,367

Total Net Revenues Growth

(31,801

)

4,620

(319

)

(27,500

)

Total Net Revenues Growth %

-12.2

%

3.7

%

-1.5

%

-6.8

%

Less: Impact of Insomnia Cookies

divestiture

(43,531

)

—

—

(43,531

)

Adjusted net revenues in third quarter of

fiscal 2023

216,646

126,077

21,113

363,836

Adjusted net revenue growth

11,730

4,620

(319

)

16,031

Impact of acquisitions

(6,228

)

(1,108

)

2,127

(5,209

)

Impact of foreign currency translation

—

1,770

—

1,770

Organic Revenue Growth

$

5,502

$

5,282

$

1,808

$

12,592

Organic Revenue Growth %

2.5

%

4.2

%

8.6

%

3.5

%

Q3 2024 Organic Revenue - YTD

(in thousands, except

percentages)

U.S.

International

Market Development

Total Company

Total net revenues in first three quarters

of fiscal 2024

$

813,615

$

380,716

$

67,043

$

1,261,374

Total net revenues in first three quarters

of fiscal 2023

808,938

358,653

67,608

1,235,199

Total Net Revenues Growth

4,677

22,063

(565

)

26,175

Total Net Revenues Growth %

0.6

%

6.2

%

-0.8

%

2.1

%

Less: Impact of shop optimization program

closures

(463

)

—

—

(463

)

Less: Impact of Branded Sweet Treats

exit

(5,853

)

—

—

(5,853

)

Less: Impact of Insomnia Cookies

divestiture

(43,531

)

—

—

(43,531

)

Adjusted net revenues in first three

quarters of fiscal 2023

759,091

358,653

67,608

1,185,352

Adjusted net revenue growth

54,524

22,063

(565

)

76,022

Impact of acquisitions

(6,228

)

(1,108

)

2,127

(5,209

)

Impact of foreign currency translation

—

1,338

—

1,338

Organic Revenue Growth

$

48,296

$

22,293

$

1,562

$

72,151

Organic Revenue Growth %

6.4

%

6.2

%

2.3

%

6.1

%

Q3 2023 Organic Revenue - QTD

(in thousands, except

percentages)

U.S.

International

Market Development

Total Company

Total net revenues in third quarter of

fiscal 2023

$

260,177

$

126,077

$

21,113

$

407,367

Total net revenues in third quarter of

fiscal 2022

246,830

107,585

23,107

377,522

Total Net Revenues Growth

13,347

18,492

(1,994

)

29,845

Total Net Revenues Growth %

5.4

%

17.2

%

-8.6

%

7.9

%

Less: Impact of shop optimization program

closures

(3,096

)

—

—

(3,096

)

Less: Impact of Branded Sweet Treats

exit

(9,035

)

—

—

(9,035

)

Adjusted net revenues in third quarter of

fiscal 2022

234,699

107,585

23,107

365,391

Adjusted net revenue growth

25,478

18,492

(1,994

)

41,976

Impact of acquisitions

(1,575

)

—

457

(1,118

)

Impact of foreign currency translation

—

(5,912

)

—

(5,912

)

Organic Revenue Growth

$

23,903

$

12,580

$

(1,537

)

$

34,946

Organic Revenue Growth %

10.2

%

11.7

%

-6.7

%

9.6

%

Q3 2023 Organic Revenue - YTD

(in thousands, except

percentages)

U.S.

International

Market Development

Total Company

Total net revenues in first three quarters

of fiscal 2023

$

808,938

$

358,653

$

67,608

$

1,235,199

Total net revenues in first three quarters

of fiscal 2022

739,414

322,636

63,249

1,125,299

Total Net Revenues Growth

69,524

36,017

4,359

109,900

Total Net Revenues Growth %

9.4

%

11.2

%

6.9

%

9.8

%

Less: Impact of shop optimization program

closures

(9,613

)

—

—

(9,613

)

Less: Impact of Branded Sweet Treats

exit

(15,736

)

—

—

(15,736

)

Adjusted net revenues in first three

quarters of fiscal 2022

714,065

322,636

63,249

1,099,950

Adjusted net revenue growth

94,873

36,017

4,359

135,249

Impact of acquisitions

(7,678

)

—

2,227

(5,451

)

Impact of foreign currency translation

—

(118

)

—

(118

)

Organic Revenue Growth

$

87,195

$

35,899

$

6,586

$

129,680

Organic Revenue Growth %

12.2

%

11.1

%

10.4

%

11.8

%

Trailing Four Quarters

Ended

Fiscal Year Ended

(in thousands, unless otherwise

stated)

September 29,

2024

December 31,

2023

January 1, 2023

U.S.:

Revenues

$

1,109,621

$

1,104,944

$

1,010,250

Non-Fresh Revenues (1)

(3,857

)

(9,416

)

(38,380

)

Fresh Revenues from Insomnia Cookies and

Hubs without Spokes (2)

(360,354

)

(399,061

)

(404,430

)

Sales from Hubs with Spokes

745,410

696,467

567,440

Sales per Hub (millions)

4.9

4.9

4.5

International:

Sales from Hubs with Spokes (3)

$

511,694

$

489,631

$

435,651

Sales per Hub (millions) (4)

10.1

10.0

9.7

(1)

Includes the exited Branded Sweet Treats

business revenues as well as licensing royalties from customers for

use of the Krispy Kreme brand.

(2)

Includes Insomnia Cookies revenues

(through the date of the divestiture) and Fresh Revenues generated

by Hubs without Spokes.

(3)

Total International net revenues is equal

to Fresh Revenues from Hubs with Spokes for that business

segment.

(4)

International Sales per Hub comparative

data has been restated in constant currency based on current

exchange rates.

Krispy Kreme, Inc.

Global Points of Access

(Unaudited)

Global Points of

Access

Quarter Ended

Fiscal Year Ended

September 29, 2024

October 1, 2023

December 31, 2023

U.S.:

Hot Light Theater Shops

236

229

229

Fresh Shops

71

65

70

Cookie Bakeries (3)

—

249

267

DFD Doors (2)

7,711

6,506

6,808

Total

8,018

7,049

7,374

International:

Hot Light Theater Shops

48

45

44

Fresh Shops

508

479

483

Carts, Food Trucks, and Other (1)

17

16

16

DFD Doors

4,867

3,588

3,977

Total

5,440

4,128

4,520

Market Development:

Hot Light Theater Shops

110

113

116

Fresh Shops

1,059

920

968

Carts, Food Trucks, and Other (1)

30

29

30

DFD Doors

1,154

1,155

1,139

Total

2,353

2,217

2,253

Total Global Points of Access (as

defined)

15,811

13,394

14,147

Total Hot Light Theater Shops

394

387

389

Total Fresh Shops

1,638

1,464

1,521

Total Cookie Bakeries (3)

—

249

267

Total Shops

2,032

2,100

2,177

Total Carts, Food Trucks, and

Other

47

45

46

Total DFD Doors

13,732

11,249

11,924

Total Global Points of Access (as

defined)

15,811

13,394

14,147

(1)

Carts and Food Trucks are non-producing,

mobile (typically on wheels) facilities without walls or a door

where product is received from a Hot Light Theater Shop or Doughnut

Factory. Other includes a vending machine. Points of Access in this

category are primarily found in international locations in

airports, train stations, etc.

(2)

Includes over 160 McDonald’s shops located

in Louisville and Lexington, Kentucky and the surrounding area as

of June 30, 2024.

(3)

Reflects the divestiture of Insomnia

Cookies during the quarter ended September 29, 2024.

Krispy Kreme, Inc.

Global Hubs

(Unaudited)

Hubs

Quarter Ended

Fiscal Year Ended

September 29, 2024

October 1, 2023

December 31, 2023

U.S.:

Hot Light Theater Shops (1)

230

222

220

Doughnut Factories

6

4

4

Total

236

226

224

Hubs with Spokes

152

148

149

Hubs without Spokes

84

78

75

International:

Hot Light Theater Shops (1)

39

36

36

Doughnut Factories

14

14

14

Total

53

50

50

Hubs with Spokes

53

50

50

Market Development:

Hot Light Theater Shops (1)

108

109

112

Doughnut Factories

26

23

23

Total

134

132

135

Total Hubs

423

408

409

(1)

Includes only Hot Light Theater Shops and

excludes Mini Theaters. A Mini Theater is a Spoke location that

produces some doughnuts for itself and also receives doughnuts from

another producing location.

Krispy Kreme, Inc.

Net Debt and Leverage

(Unaudited)

(in thousands, except leverage

ratio)

September 29, 2024

December 31, 2023

Current portion of long-term debt

$

47,577

$

54,631

Long-term debt, less current portion

804,638

836,615

Total long-term debt, including debt

issuance costs

852,215

891,246

Add back: Debt issuance costs

3,584

4,371

Total long-term debt, excluding debt

issuance costs

855,799

895,617

Less: Cash and cash equivalents

(25,410

)

(38,185

)

Net debt

$

830,389

$

857,432

Adjusted EBITDA - trailing four

quarters

211,754

211,624

Net leverage ratio

3.9

x

4.1

x

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241106595255/en/

Investor Relations

ir@krispykreme.com

Financial Media Edelman

Smithfield for Krispy Kreme, Inc. Ashley Firlan & Ashna Vasa

KrispyKremeIR@edelman.com

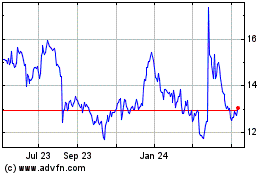

Krispy Kreme (NASDAQ:DNUT)

Historical Stock Chart

From Jan 2025 to Feb 2025

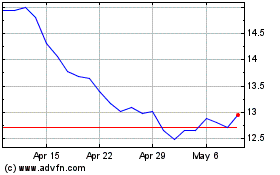

Krispy Kreme (NASDAQ:DNUT)

Historical Stock Chart

From Feb 2024 to Feb 2025