UNITED STATES SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

Form 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 OF

THE SECURITIES EXCHANGE ACT OF 1934

For the Quarter Ended December 31, 2023

Commission File Number 1-14840

AMDOCS LIMITED

Hirzel House, Smith Street,

St. Peter Port, Island of Guernsey, GY1 2NG

Amdocs, Inc.

625 Maryville Centre Drive, Suite 200 Saint Louis, Missouri 63141

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

FORM 20-F ☑ FORM 40-F ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ☐

Indicate by check mark whether the registrant by furnishing the information contained in this form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934:

YES ☐ NO ☑

If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): 82- _______

AMDOCS LIMITED

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

FOR THE QUARTER ENDED DECEMBER 31,

2023

INDEX

This report on Form 6-K shall be incorporated by reference into any Registration Statement filed by the Registrant that by its terms automatically incorporates the Registrant's filings and submissions with the SEC under Sections 13(a), 13(c) or 15(d) of the Securities Exchange Act of 1934.

PART I FINANCIAL INFORMATION

Item 1. Financial Statements

AMDOCS LIMITED

CONSOLIDATED BALANCE SHEETS

(dollar and share amounts in thousands, except per share data)

|

|

|

|

|

|

|

|

|

|

|

As of |

|

|

|

December 31,

2023 |

|

|

September 30,

2023 |

|

|

|

(Unaudited) |

|

|

|

|

ASSETS |

|

|

|

|

|

|

Current assets: |

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

382,885 |

|

|

$ |

520,080 |

|

Short-term interest-bearing investments |

|

|

218,043 |

|

|

|

222,451 |

|

Accounts receivable, net |

|

|

1,029,294 |

|

|

|

944,477 |

|

Prepaid expenses and other current assets |

|

|

215,914 |

|

|

|

224,622 |

|

Total current assets |

|

|

1,846,136 |

|

|

|

1,911,630 |

|

Property and equipment, net |

|

|

776,629 |

|

|

|

790,923 |

|

Lease assets |

|

|

163,181 |

|

|

|

160,938 |

|

Goodwill |

|

|

2,836,030 |

|

|

|

2,749,041 |

|

Intangible assets, net |

|

|

204,562 |

|

|

|

181,539 |

|

Other noncurrent assets |

|

|

645,128 |

|

|

|

631,582 |

|

Total assets |

|

$ |

6,471,666 |

|

|

$ |

6,425,653 |

|

LIABILITIES AND EQUITY |

|

|

|

|

|

|

Current liabilities: |

|

|

|

|

|

|

Accounts payable |

|

$ |

278,627 |

|

|

$ |

293,344 |

|

Accrued expenses and other current liabilities |

|

|

749,882 |

|

|

|

634,742 |

|

Accrued personnel costs |

|

|

216,037 |

|

|

|

214,695 |

|

Lease liabilities |

|

|

41,361 |

|

|

|

39,960 |

|

Deferred revenue |

|

|

149,826 |

|

|

|

170,634 |

|

Total current liabilities |

|

|

1,435,733 |

|

|

|

1,353,375 |

|

Deferred income taxes and taxes payable |

|

|

198,577 |

|

|

|

252,609 |

|

Lease liabilities |

|

|

117,155 |

|

|

|

121,654 |

|

Long-term debt, net of unamortized debt issuance costs |

|

|

645,844 |

|

|

|

645,696 |

|

Other noncurrent liabilities |

|

|

472,004 |

|

|

|

485,387 |

|

Total liabilities |

|

|

2,869,313 |

|

|

|

2,858,721 |

|

Equity: |

|

|

|

|

|

|

Amdocs Limited Shareholders' equity: |

|

|

|

|

|

|

Preferred Shares — Authorized 25,000 shares; £0.01 par value; 0 shares issued

and outstanding |

|

|

— |

|

|

|

— |

|

Ordinary Shares — Authorized 700,000 shares; £0.01 par value; 287,379 and 286,330 issued and 116,502 and 117,348 outstanding, respectively |

|

|

4,584 |

|

|

|

4,571 |

|

Additional paid-in capital |

|

|

4,294,652 |

|

|

|

4,244,256 |

|

Treasury stock, at cost 170,877 and 168,982 ordinary shares, respectively |

|

|

(7,379,838 |

) |

|

|

(7,221,313 |

) |

Accumulated other comprehensive loss |

|

|

(6,452 |

) |

|

|

(53,272 |

) |

Retained earnings |

|

|

6,646,799 |

|

|

|

6,549,517 |

|

Total Amdocs Limited Shareholders' equity |

|

|

3,559,745 |

|

|

|

3,523,759 |

|

Noncontrolling interests |

|

|

42,608 |

|

|

|

43,173 |

|

Total equity |

|

|

3,602,353 |

|

|

|

3,566,932 |

|

Total liabilities and equity |

|

$ |

6,471,666 |

|

|

$ |

6,425,653 |

|

The accompanying notes are an integral part of these consolidated financial statements.

AMDOCS LIMITED

CONSOLIDATED STATEMENTS OF INCOME (UNAUDITED)

(dollar and share amounts in thousands, except per share data)

|

|

|

|

|

|

|

|

|

|

|

Three months ended

December 31, |

|

|

|

2023 |

|

|

2022 |

|

Revenue |

|

$ |

1,245,199 |

|

|

$ |

1,185,720 |

|

Operating expenses: |

|

|

|

|

|

|

Cost of revenue |

|

|

812,744 |

|

|

|

756,849 |

|

Research and development |

|

|

89,207 |

|

|

|

95,726 |

|

Selling, general and administrative |

|

|

142,504 |

|

|

|

143,222 |

|

Amortization of purchased intangible assets and other |

|

|

16,410 |

|

|

|

15,313 |

|

Restructuring charges |

|

|

— |

|

|

|

24,536 |

|

|

|

|

1,060,865 |

|

|

|

1,035,646 |

|

Operating income |

|

|

184,334 |

|

|

|

150,074 |

|

Interest and other expense, net |

|

|

(9,778 |

) |

|

|

(4,963 |

) |

Income before income taxes |

|

|

174,556 |

|

|

|

145,111 |

|

Income tax expense |

|

|

25,834 |

|

|

|

15,239 |

|

Net income |

|

$ |

148,722 |

|

|

$ |

129,872 |

|

Net income attributable to noncontrolling interests |

|

|

757 |

|

|

|

205 |

|

Net income attributable to Amdocs Limited |

|

$ |

147,965 |

|

|

$ |

129,667 |

|

Basic earnings per share attributable to Amdocs Limited |

|

$ |

1.27 |

|

|

$ |

1.07 |

|

Diluted earnings per share attributable to Amdocs Limited |

|

$ |

1.26 |

|

|

$ |

1.07 |

|

Cash dividends declared per ordinary share |

|

$ |

0.435 |

|

|

$ |

0.395 |

|

The accompanying notes are an integral part of these consolidated financial statements.

AMDOCS LIMITED

CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (UNAUDITED)

(dollar amounts in thousands)

|

|

|

|

|

|

|

|

|

|

|

Three months ended

December 31, |

|

|

|

2023 |

|

|

2022 |

|

Net income |

|

$ |

148,722 |

|

|

$ |

129,872 |

|

Other comprehensive income, net of tax: |

|

|

|

|

|

|

Net change in fair value of cash flow hedges(1) |

|

|

42,146 |

|

|

|

11,193 |

|

Net change in fair value of available-for-sale securities(2) |

|

|

4,674 |

|

|

|

2,147 |

|

Other comprehensive income, net of tax |

|

|

46,820 |

|

|

|

13,340 |

|

Comprehensive income |

|

$ |

195,542 |

|

|

$ |

143,212 |

|

Comprehensive income attributable to noncontrolling interests |

|

|

757 |

|

|

|

205 |

|

Comprehensive income attributable to Amdocs Limited |

|

$ |

194,785 |

|

|

$ |

143,007 |

|

(1)Net of tax of $2,825 and $563 for the three months ended December 31, 2023 and 2022, respectively.

(2)No tax impact for the three months ended December 31, 2023 and 2022.

The accompanying notes are an integral part of these consolidated financial statements.

AMDOCS LIMITED

CONSOLIDATED STATEMENTS OF CHANGES IN EQUITY (UNAUDITED)

(dollar and share amounts in thousands, except per share data)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Ordinary Shares |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Shares |

|

|

Amount |

|

|

Additional

Paid-in

Capital |

|

|

Treasury

Stock |

|

|

Accumulated

Other

Comprehensive

Loss (1) |

|

|

Retained

Earnings |

|

|

Total

Amdocs

Limited

Shareholders’

Equity |

|

|

Non-

controlling

Interests (2) |

|

|

Total

Equity |

|

Balance as of September 30, 2023 |

|

|

117,348 |

|

|

$ |

4,571 |

|

|

$ |

4,244,256 |

|

|

$ |

(7,221,313 |

) |

|

$ |

(53,272 |

) |

|

$ |

6,549,517 |

|

|

$ |

3,523,759 |

|

|

$ |

43,173 |

|

|

$ |

3,566,932 |

|

Comprehensive income: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

147,965 |

|

|

|

147,965 |

|

|

|

757 |

|

|

|

148,722 |

|

Other comprehensive income |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

46,820 |

|

|

|

— |

|

|

|

46,820 |

|

|

|

— |

|

|

|

46,820 |

|

Comprehensive income |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

194,785 |

|

|

|

757 |

|

|

|

195,542 |

|

Employee stock options exercised |

|

|

74 |

|

|

|

1 |

|

|

|

4,349 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

4,350 |

|

|

|

— |

|

|

|

4,350 |

|

Repurchase of shares |

|

|

(1,895 |

) |

|

|

— |

|

|

|

— |

|

|

|

(158,525 |

) |

|

|

— |

|

|

|

— |

|

|

|

(158,525 |

) |

|

|

— |

|

|

|

(158,525 |

) |

Cash dividends declared ($0.435 per ordinary share) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(50,683 |

) |

|

|

(50,683 |

) |

|

|

— |

|

|

|

(50,683 |

) |

Issuance of restricted stock, net of forfeitures |

|

|

700 |

|

|

|

9 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

9 |

|

|

|

— |

|

|

|

9 |

|

Employee share purchase plan |

|

|

275 |

|

|

|

3 |

|

|

|

19,967 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

19,970 |

|

|

|

— |

|

|

|

19,970 |

|

Equity-based compensation expense related to employees |

|

|

— |

|

|

|

— |

|

|

|

26,080 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

26,080 |

|

|

|

— |

|

|

|

26,080 |

|

Distribution to noncontrolling interests (2) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(1,322 |

) |

|

|

(1,322 |

) |

Balance as of December 31, 2023 |

|

|

116,502 |

|

|

$ |

4,584 |

|

|

$ |

4,294,652 |

|

|

$ |

(7,379,838 |

) |

|

$ |

(6,452 |

) |

|

$ |

6,646,799 |

|

|

$ |

3,559,745 |

|

|

$ |

42,608 |

|

|

$ |

3,602,353 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Ordinary Shares |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Shares |

|

|

Amount |

|

|

Additional

Paid-in

Capital |

|

|

Treasury

Stock |

|

|

Accumulated

Other

Comprehensive

(Loss) (1) |

|

|

Retained

Earnings |

|

|

Total

Amdocs

Limited

Shareholders’

Equity |

|

|

Non-

controlling

Interests |

|

|

Total

Equity |

|

Balance as of September 30, 2022 |

|

|

120,842 |

|

|

$ |

4,548 |

|

|

$ |

4,105,900 |

|

|

$ |

(6,731,789 |

) |

|

$ |

(72,476 |

) |

|

$ |

6,211,586 |

|

|

$ |

3,517,769 |

|

|

$ |

42,509 |

|

|

$ |

3,560,278 |

|

Comprehensive income: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

129,667 |

|

|

|

129,667 |

|

|

|

205 |

|

|

|

129,872 |

|

Other comprehensive loss |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

13,340 |

|

|

|

— |

|

|

|

13,340 |

|

|

|

— |

|

|

|

13,340 |

|

Comprehensive income |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

143,007 |

|

|

|

205 |

|

|

|

143,212 |

|

Employee stock options exercised |

|

|

247 |

|

|

|

3 |

|

|

|

14,590 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

14,593 |

|

|

|

— |

|

|

|

14,593 |

|

Repurchase of shares |

|

|

(1,183 |

) |

|

|

— |

|

|

|

— |

|

|

|

(100,021 |

) |

|

|

— |

|

|

|

— |

|

|

|

(100,021 |

) |

|

|

— |

|

|

|

(100,021 |

) |

Cash dividends declared ($0.395 per ordinary share) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(47,635 |

) |

|

|

(47,635 |

) |

|

|

— |

|

|

|

(47,635 |

) |

Issuance of restricted stock, net of forfeitures |

|

|

682 |

|

|

|

8 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

8 |

|

|

|

— |

|

|

|

8 |

|

Equity-based compensation expense related to employees |

|

|

— |

|

|

|

— |

|

|

|

19,490 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

19,490 |

|

|

|

— |

|

|

|

19,490 |

|

Balance as of December 31, 2022 |

|

|

120,588 |

|

|

$ |

4,559 |

|

|

$ |

4,139,980 |

|

|

$ |

(6,831,810 |

) |

|

$ |

(59,136 |

) |

|

$ |

6,293,618 |

|

|

$ |

3,547,211 |

|

|

$ |

42,714 |

|

|

$ |

3,589,925 |

|

____________

(1)As of December 31, 2023 and 2022, accumulated other comprehensive loss is comprised of unrealized (gain) loss on derivatives, net of tax, of $(7,469) and $20,650 unrealized loss on short-term interest-bearing investments, net of tax, of $11,529 and $35,387, and unrealized loss on defined benefit plan, net of tax, of $2,392 and $3,099, respectively.

(2)Starting fiscal year 2023, the Company distributes earnings to the noncontrolling interests, for further details please refer to Note 2, “A summary of Significant Accounting Policies “, in the Company’s Annual Report on Form 20-F for the fiscal year 2023.

The accompanying notes are an integral part of these consolidated financial statements.

AMDOCS LIMITED

CONSOLIDATED STATEMENTS OF CASH FLOWS (UNAUDITED)

(dollar amounts in thousands)

|

|

|

|

|

|

|

|

|

|

|

Three months ended

December 31, |

|

|

|

2023 |

|

|

2022 |

|

Cash Flow from Operating Activities: |

|

|

|

|

|

|

Net income |

|

$ |

148,722 |

|

|

$ |

129,872 |

|

Reconciliation of net income to net cash provided by operating activities: |

|

|

|

|

|

|

Depreciation, amortization and impairment |

|

|

45,861 |

|

|

|

61,071 |

|

Amortization of debt issuance cost |

|

|

149 |

|

|

|

145 |

|

Equity-based compensation expense |

|

|

26,080 |

|

|

|

19,490 |

|

Deferred income taxes |

|

|

(6,683 |

) |

|

|

(16,973 |

) |

Loss from short-term interest-bearing investments |

|

|

548 |

|

|

|

639 |

|

Net changes in operating assets and liabilities, net of amounts acquired: |

|

|

|

|

|

|

Accounts receivable, net |

|

|

(66,657 |

) |

|

|

(197,381 |

) |

Prepaid expenses and other current assets |

|

|

4,452 |

|

|

|

16,069 |

|

Other noncurrent assets |

|

|

(10,538 |

) |

|

|

(848 |

) |

Lease assets and liabilities, net |

|

|

(5,340 |

) |

|

|

(1,251 |

) |

Accounts payable, accrued expenses and accrued personnel |

|

|

95,787 |

|

|

|

82,136 |

|

Deferred revenue |

|

|

(25,930 |

) |

|

|

(6,194 |

) |

Income taxes payable, net |

|

|

(18,066 |

) |

|

|

(11,242 |

) |

Other noncurrent liabilities |

|

|

(5,998 |

) |

|

|

7,693 |

|

Net cash provided by operating activities |

|

|

182,387 |

|

|

|

83,226 |

|

Cash Flow from Investing Activities: |

|

|

|

|

|

|

Purchase of property and equipment, net (1) |

|

|

(43,743 |

) |

|

|

(33,703 |

) |

Proceeds from sale of short-term interest-bearing investments |

|

|

8,534 |

|

|

|

3,734 |

|

Net cash paid for business acquisitions |

|

|

(77,329 |

) |

|

|

- |

|

Other |

|

|

928 |

|

|

|

(835 |

) |

Net cash used in investing activities |

|

|

(111,610 |

) |

|

|

(30,804 |

) |

Cash Flow from Financing Activities: |

|

|

|

|

|

|

Repurchase of shares |

|

|

(158,525 |

) |

|

|

(100,021 |

) |

Proceeds from employee stock option exercises |

|

|

4,428 |

|

|

|

14,589 |

|

Payments of dividends |

|

|

(51,053 |

) |

|

|

(47,735 |

) |

Distribution to noncontrolling interests |

|

|

(1,322 |

) |

|

|

- |

|

Payment of contingent consideration from a business acquisition |

|

|

(1,500 |

) |

|

|

(453 |

) |

Net cash used in financing activities |

|

|

(207,972 |

) |

|

|

(133,620 |

) |

Net decrease in cash and cash equivalents |

|

|

(137,195 |

) |

|

|

(81,198 |

) |

Cash and cash equivalents at beginning of period |

|

|

520,080 |

|

|

|

573,377 |

|

Cash and cash equivalents at end of period |

|

$ |

382,885 |

|

|

$ |

492,179 |

|

Supplementary Cash Flow Information |

|

|

|

|

|

|

Cash paid for: |

|

|

|

|

|

|

Income taxes, net of refunds (2) |

|

$ |

51,255 |

|

|

$ |

42,366 |

|

Interest (3) |

|

|

12,055 |

|

|

|

8,308 |

|

(1)The amounts under "Purchase of property and equipment, net”, include immaterial proceeds from sale of property and equipment for the three months ended December 31, 2023, and no proceeds for the three months ended December 31, 2022.

(2)For Further details, see also Note 11.

(3)The amounts under “Interest” include payments of interest to financial institution, tax authorities and other.

The accompanying notes are an integral part of these consolidated financial statements.

AMDOCS LIMITED

NOTES TO UNAUDITED CONSOLIDATED FINANCIAL STATEMENTS

(dollar and share amounts in thousands, except per share data or as otherwise disclosed)

1.Nature of Entity and Basis of Presentation

Amdocs Limited (the “Company”) is a leading provider of software and services to communications, entertainment and media service providers of all sizes throughout the world. The Company and its consolidated subsidiaries operate in one segment and design, develop, market, support, implement and operate its open and modular cloud portfolio.

The Company is a Guernsey limited company, which directly or indirectly holds numerous subsidiaries around the world, the vast majority of which are wholly-owned. The majority of the Company’s customers are in North America, Europe, Asia-Pacific and the Latin America region. The Company’s main development facilities are located in Brazil, Canada, Cyprus, India, Ireland, Israel, Mexico, the Philippines, the United Kingdom and the United States.

The unaudited consolidated financial statements of the Company have been prepared in accordance with U.S. generally accepted accounting principles, or GAAP and are denominated in U.S. dollars.

In the opinion of the Company’s management, all adjustments considered necessary for a fair presentation of the unaudited interim consolidated financial statements have been included herein and are of a normal recurring nature. The preparation of financial statements during interim periods requires management to make numerous estimates and assumptions that impact the reported amounts of assets, liabilities, revenue and expenses. Estimates and assumptions are reviewed periodically and the effect of revisions is reflected in the results of operations for the interim periods in which changes are determined to be necessary.

The results of operations for the interim periods presented herein are not necessarily indicative of the results to be expected for the full fiscal year. These statements do not include all information and footnotes necessary for a complete presentation of financial position, results of operations and cash flows in conformity with GAAP. These statements should be read in conjunction with the Company’s consolidated financial statements for the fiscal year ended September 30, 2023, set forth in the Company’s Annual Report on Form 20-F filed on December 13, 2023 with the U.S. Securities and Exchange Commission, or the SEC. There have been no material changes to the Company’s significant accounting policies from its Annual Report on Form 20-F for the fiscal year ended September 30, 2023.

Reclassification

From time to time, certain immaterial amounts in prior year financial statements may be reclassified to conform to the current year presentation.

2.Recent Accounting Standards

On December 14, 2023, the Financial Accounting Standards Board (“FASB”) issued Accounting Standards Update (“ASU”) No. 2023-09, “Improvements to Income Tax Disclosures”, which requires disclosure of disaggregated income taxes paid, prescribes standard categories for the components of the effective tax rate reconciliation, and modifies other income tax-related disclosures. This ASU will be effective for the Company's annual report for fiscal year 2026 and allows adoption on a prospective basis, with a retrospective option. This ASU will only have an impact on the Company's income tax disclosures. The Company is currently evaluating the impact of the adoption on its consolidated financial statements.

In November 2023, the FASB issued ASU No. 2023-07, Segment Reporting (Topic 280), “Improvements to Reportable Segment Disclosures,” which enhances the disclosures required for operating segments in the annual and interim consolidated financial statements. This ASU will be effective for the Company's annual report for fiscal year 2025 and for interim period reporting beginning in fiscal year 2026 on a retrospective basis with early adoption permitted. The Company is currently evaluating the impact of the adoption on its consolidated financial statements.

In March 2020, the FASB, issued ASU No. 2020-04, “Reference Rate Reform: Facilitation of the Effects of Reference Rate Reform on Financial Reporting.” The ASU provides temporary optional expedients and exceptions on certain contract modifications, hedge relationships and other transactions that reference London Inter-Bank Offered Rate (“LIBOR”) or other reference rates expected to be discontinued due to the reference rate reform. This ASU is effective as of March 12, 2020 through December 31, 2024. The Company expects that the adoption of this ASU will not have a material impact on its consolidated financial statements.

AMDOCS LIMITED

NOTES TO UNAUDITED CONSOLIDATED FINANCIAL STATEMENTS

(dollar and share amounts in thousands, except per share data or as otherwise disclosed)

3.Adoption of New Accounting Standards

In August 2021, the FASB, issued ASU No. 2021-08, “Business Combinations (Topic 805): Accounting for Contract Assets and Contract Liabilities from Contracts with Customers.” The ASU requires companies to apply ASC 606 to recognize and measure contract assets and contract liabilities from contracts with customers acquired in a business combination. As of October 1, 2023, the Company prospectively adopted this ASU and there was immaterial impact on the Company’s consolidated financial statements.

During the three months ended December 31, 2023, the Company completed the acquisition of Astadia, which specializes in mainframe-to-cloud migration and modernization, for an aggregate net consideration of approximately $75,000 in cash, and a potential for additional consideration which may be paid later based on achievement of certain performance metrics. In allocating the total consideration based on the preliminary estimated fair values for Astadia, the Company recorded $88,845 of goodwill, $27,677 of customer relationships to be amortized over approximately six years, $8,001 of core technology to be amortized over approximately four years, and $1,784 of trademark to be amortized over approximately three years.

Contract Balances

The following table provides information about accounts receivable, both billed and unbilled and deferred revenue:

|

|

|

|

|

|

|

|

|

|

|

As of |

|

|

|

December 31,

2023 |

|

|

September 30,

2023 |

|

Accounts receivable - billed (net of allowances for credit losses of $21,752

and $19,801 as of December 31, 2023 and September 30, 2023, respectively) |

|

$ |

747,421 |

|

|

$ |

732,979 |

|

Accounts receivable – unbilled (current) |

|

$ |

281,873 |

|

|

$ |

211,498 |

|

Accounts receivable – unbilled (non-current) |

|

$ |

32,310 |

|

|

$ |

45,176 |

|

Total Accounts receivable - unbilled |

|

$ |

314,183 |

|

|

$ |

256,674 |

|

Deferred revenue (current) |

|

$ |

(149,826 |

) |

|

$ |

(170,634 |

) |

Deferred revenue (non-current) |

|

$ |

(658 |

) |

|

$ |

(805 |

) |

Total Deferred revenue |

|

$ |

(150,484 |

) |

|

$ |

(171,439 |

) |

Revenue recognized during the three months ended December 31, 2023, which was included in deferred revenue (current) as of September 30, 2023 was $116,112. Revenue recognized during the three months ended December 31, 2022, which was included in deferred revenue (current) as of September 30, 2022 was $187,655.

As of December 31, 2023, the aggregate amount of the transaction price allocated to remaining performance obligations that are unsatisfied or partially unsatisfied was approximately $5.5 billion. Remaining performance obligations include the remaining non-cancelable, committed and fixed portion of these contracts for their entire duration and therefore it is not comparable to what the Company considers to be next 12 months backlog. Given the profile of contract terms, the majority of this amount is expected to be recognized as revenue over the next three years.

Disaggregation of Revenue

The Company considers information that is regularly reviewed by its chief operating decision makers in evaluating financial performance to disaggregate revenue.

The following tables provide details of revenue by nature of activities and by geography:

Revenue by nature of activities

|

|

|

|

|

|

|

|

|

|

|

Three months ended

December 31, |

|

|

|

2023 |

|

|

2022 |

|

Managed services arrangements |

|

$ |

722,459 |

|

|

$ |

699,826 |

|

Others |

|

|

522,740 |

|

|

|

485,894 |

|

Total |

|

$ |

1,245,199 |

|

|

$ |

1,185,720 |

|

AMDOCS LIMITED

NOTES TO UNAUDITED CONSOLIDATED FINANCIAL STATEMENTS

(dollar and share amounts in thousands, except per share data or as otherwise disclosed)

Geographic Information

|

|

|

|

|

|

|

|

|

|

|

Three months ended

December 31, |

|

|

|

2023 |

|

|

2022 |

|

North America (mainly United States) |

|

$ |

838,135 |

|

|

$ |

812,690 |

|

Europe |

|

|

181,420 |

|

|

|

168,666 |

|

Rest of the world |

|

|

225,644 |

|

|

|

204,364 |

|

Total |

|

$ |

1,245,199 |

|

|

$ |

1,185,720 |

|

The Company accounts for certain assets and liabilities at fair value. Fair value is the price that would be received from selling an asset or that would be paid to transfer a liability in an orderly transaction between market participants at the measurement date. When determining the fair value measurements for assets and liabilities required or permitted to be recorded at fair value, the Company considers the principal or most advantageous market in which it would transact and it considers assumptions that market participants would use when pricing the asset or liability.

The hierarchy below lists three levels of fair value based on the extent to which inputs used in measuring fair value are observable in the market. The Company categorizes each of its fair value measurements in one of these three levels based on the lowest level input that is significant to the fair value measurement in its entirety.

The three levels of inputs that may be used to measure fair value are as follows:

Level 1: Quoted prices in active markets for identical assets or liabilities;

Level 2: Observable inputs other than quoted prices included in Level 1, such as quoted prices for similar assets or liabilities in active markets, quoted prices for identical or similar assets or liabilities in markets with insufficient volume or infrequent transactions (less active markets), or other inputs that are observable (model-derived valuations in which significant inputs are observable) or can be derived principally from, or corroborated by, observable market data; and

Level 3: Unobservable inputs that are supported by little or no market activity that is significant to the fair value of the assets or liabilities.

The following tables present the Company's assets and liabilities measured at fair value on a recurring basis as of December 31, 2023 and September 30, 2023:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

As of December 31,2023 |

|

|

|

Level 1 |

|

|

Level 2 |

|

|

Level 3 |

|

|

Total |

|

Available-for-sale securities: |

|

|

|

|

|

|

|

|

|

|

|

|

Money market funds |

|

$ |

198,091 |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

198,091 |

|

Corporate bonds |

|

|

— |

|

|

|

145,618 |

|

|

|

— |

|

|

|

145,618 |

|

U.S. government treasuries |

|

|

42,131 |

|

|

|

— |

|

|

|

— |

|

|

|

42,131 |

|

Supranational and sovereign debt |

|

|

— |

|

|

|

17,260 |

|

|

|

— |

|

|

|

17,260 |

|

Asset backed obligations |

|

|

— |

|

|

|

5,816 |

|

|

|

— |

|

|

|

5,816 |

|

Municipal bonds |

|

|

— |

|

|

|

7,218 |

|

|

|

— |

|

|

|

7,218 |

|

Total available-for-sale securities |

|

|

240,222 |

|

|

|

175,912 |

|

|

|

— |

|

|

|

416,134 |

|

Equity Investments |

|

|

— |

|

|

|

— |

|

|

|

46,451 |

|

|

|

46,451 |

|

Derivative financial instruments, net |

|

|

— |

|

|

|

10,036 |

|

|

|

— |

|

|

|

10,036 |

|

Other liabilities |

|

|

— |

|

|

|

— |

|

|

|

(61,761 |

) |

|

|

(61,761 |

) |

Total |

|

$ |

240,222 |

|

|

$ |

185,948 |

|

|

$ |

(15,310 |

) |

|

$ |

410,860 |

|

AMDOCS LIMITED

NOTES TO UNAUDITED CONSOLIDATED FINANCIAL STATEMENTS

(dollar and share amounts in thousands, except per share data or as otherwise disclosed)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

As of September 30, 2023 |

|

|

|

Level 1 |

|

|

Level 2 |

|

|

Level 3 |

|

|

Total |

|

Available-for-sale securities: |

|

|

|

|

|

|

|

|

|

|

|

|

Money market funds |

|

$ |

308,354 |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

308,354 |

|

Corporate bonds |

|

|

— |

|

|

|

150,310 |

|

|

|

— |

|

|

|

150,310 |

|

U.S. government treasuries |

|

|

41,138 |

|

|

|

— |

|

|

|

— |

|

|

|

41,138 |

|

Supranational and sovereign debt |

|

|

— |

|

|

|

16,792 |

|

|

|

— |

|

|

|

16,792 |

|

Asset backed obligations |

|

|

— |

|

|

|

7,115 |

|

|

|

— |

|

|

|

7,115 |

|

Municipal bonds |

|

|

— |

|

|

|

7,096 |

|

|

|

— |

|

|

|

7,096 |

|

Total available-for-sale securities |

|

|

349,492 |

|

|

|

181,313 |

|

|

|

— |

|

|

|

530,805 |

|

Equity Investments |

|

|

— |

|

|

|

— |

|

|

|

47,985 |

|

|

|

47,985 |

|

Derivative financial instruments, net |

|

|

— |

|

|

|

(36,832 |

) |

|

|

— |

|

|

|

(36,832 |

) |

Other liabilities |

|

|

— |

|

|

|

— |

|

|

|

(24,627 |

) |

|

|

(24,627 |

) |

Total |

|

$ |

349,492 |

|

|

$ |

144,481 |

|

|

$ |

23,358 |

|

|

$ |

517,331 |

|

Available-for-sale securities that are classified as Level 2 assets are priced using observable data that may include quoted market prices for similar instruments, market dealer quotes, market spreads, non-binding market prices that are corroborated by observable market data and other observable market information. The Company’s derivative instruments are classified as Level 2 as they represent foreign currency forward and option contracts valued primarily based on observable inputs including forward rates and yield curves. The Company did not have any transfers between Level 1 and Level 2 fair value measurements during the three months ended December 31, 2023. Level 3 liabilities relate to certain acquisition-related liabilities, which were generally valued using a Monte-Carlo simulation model and based on estimates of potential pay-out scenarios, valued every quarter. These liabilities were included in both accrued expenses and other current liabilities and other noncurrent liabilities as of December 31, 2023 and September 30, 2023. The increase in Level 3 liabilities was primarily attributable to changes recorded against goodwill in connection with the recent acquisition, partially offset by payments of certain acquisition-related liabilities and changes in the fair value recorded in the consolidated statement of income during the three months ended December 31, 2023.

Fair Value of Financial Instruments

The carrying amounts of cash and cash equivalents, accounts receivable, accounts payable, accrued expenses and other current liabilities, accrued personnel costs approximate their fair value because of the relatively short maturity of these items, for the fair value of the Senior Notes, see Note 14.

7.Available-For-Sale Securities

Available-for-sale securities consist of the following interest-bearing investments:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

As of December 31,2023 |

|

|

|

Amortized

Cost |

|

|

Gross

Unrealized

Gains |

|

|

Gross

Unrealized

Losses |

|

|

Fair Value |

|

Money market funds |

|

$ |

198,091 |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

198,091 |

|

Corporate bonds |

|

|

152,650 |

|

|

|

— |

|

|

|

7,032 |

|

|

|

145,618 |

|

U.S. government treasuries |

|

|

44,831 |

|

|

|

— |

|

|

|

2,700 |

|

|

|

42,131 |

|

Supranational and sovereign debt |

|

|

18,565 |

|

|

|

— |

|

|

|

1,305 |

|

|

|

17,260 |

|

Asset backed obligations |

|

|

6,022 |

|

|

|

— |

|

|

|

206 |

|

|

|

5,816 |

|

Municipal bonds |

|

|

7,504 |

|

|

|

— |

|

|

|

286 |

|

|

|

7,218 |

|

Total(1) |

|

$ |

427,663 |

|

|

$ |

— |

|

|

$ |

11,529 |

|

|

$ |

416,134 |

|

(1)Available-for-sale securities with maturities longer than 90 days from the date of acquisition were classified as short-term interest-bearing investments and available-for-sale securities with maturities of 90 days or less from the date of acquisition were included in cash and cash equivalents on the Company’s balance sheet. As of December 31, 2023, $218,043 of securities were classified as short-term interest-bearing investments and $198,091 of securities were classified as cash and cash equivalents.

AMDOCS LIMITED

NOTES TO UNAUDITED CONSOLIDATED FINANCIAL STATEMENTS

(dollar and share amounts in thousands, except per share data or as otherwise disclosed)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

As of September 30, 2023 |

|

|

|

Amortized

Cost |

|

|

Gross

Unrealized

Gains |

|

|

Gross

Unrealized

Losses |

|

|

Fair Value |

|

Money market funds |

|

$ |

308,354 |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

308,354 |

|

Corporate bonds |

|

|

160,370 |

|

|

|

— |

|

|

|

10,060 |

|

|

|

150,310 |

|

U.S. government treasuries |

|

|

44,782 |

|

|

|

— |

|

|

|

3,644 |

|

|

|

41,138 |

|

Supranational and sovereign debt |

|

|

18,566 |

|

|

|

— |

|

|

|

1,774 |

|

|

|

16,792 |

|

Asset backed obligations |

|

|

7,423 |

|

|

|

— |

|

|

|

308 |

|

|

|

7,115 |

|

Municipal bonds |

|

|

7,513 |

|

|

|

— |

|

|

|

417 |

|

|

|

7,096 |

|

Total(1) |

|

$ |

547,008 |

|

|

$ |

— |

|

|

$ |

16,203 |

|

|

$ |

530,805 |

|

(1)Available-for-sale securities with maturities longer than 90 days from the date of acquisition were classified as short-term interest- bearing investments and available-for-sale securities with maturities of 90 days or less from the date of acquisition were included in cash and cash equivalents on the Company’s consolidated balance sheets. As of September 30, 2023, $222,451 of securities were classified as short-term interest-bearing investments and $308,354 of securities were classified as cash and cash equivalents.

As of December 31, 2023, the unrealized losses attributable to the Company’s available-for-sale securities were primarily due to credit spreads and interest rate movements. The securities that have unrealized losses as of December 31, 2023 also had unrealized losses as of December 31, 2022. The Company assessed whether such unrealized losses for the investments in its portfolio were caused by expected credit losses. Based on this assessment, the Company did not recognize any credit losses in the three months ended December 31, 2023 and 2022. Realized gains and losses on short-term interest-bearing investments are included in earnings and are determined based on specific identification method. The Company does not intend to sell these investments. In addition, it is more likely than not that the Company will not be required to sell them before recovery of the amortized cost basis, which may be at maturity.

As of December 31, 2023, the Company’s available-for-sale securities had the following maturity dates:

|

|

|

|

|

|

|

Market Value |

|

Due within one year |

|

$ |

257,895 |

|

1 to 2 years |

|

|

102,411 |

|

2 to 3 years |

|

|

55,828 |

|

|

|

$ |

416,134 |

|

8.Derivative Financial Instruments

The Company’s risk management strategy includes the use of derivative financial instruments to reduce the volatility of earnings and cash flows associated with changes in foreign currency exchange rates. The Company does not enter into derivative transactions for trading purposes.

The Company’s derivatives expose it to credit risks from possible non-performance by counterparties. The Company utilizes standard counterparty master netting agreements that net certain foreign currency transactions in the event of the insolvency of one of the parties to the transaction. These master netting arrangements permit the Company to net amounts due from the Company to a counterparty with amounts due to the Company from the same counterparty. Although all of the Company’s recognized derivative assets and liabilities are subject to enforceable master netting arrangements, the Company has elected to present these assets and liabilities on a gross basis. Taking into account the Company’s right to net certain gains with losses, the maximum amount of loss due to credit risk that the Company would incur if all counterparties to the derivative financial instruments failed completely to perform, according to the terms of the contracts, based on the gross fair value of the Company’s derivative contracts that are favorable to the Company, was approximately $19,116 as of December 31, 2023. The Company has limited its credit risk by entering into derivative transactions exclusively with investment-grade rated financial institutions and monitors the creditworthiness of these financial institutions on an ongoing basis.

The Company classifies cash flows from its derivative transactions as cash flows from operating activities in the consolidated statements of cash flows.

AMDOCS LIMITED

NOTES TO UNAUDITED CONSOLIDATED FINANCIAL STATEMENTS

(dollar and share amounts in thousands, except per share data or as otherwise disclosed)

The table below presents the total volume or notional amounts of the Company’s derivative instruments as of December 31, 2023. Notional values are in U.S. dollars and are translated and calculated based on forward rates as of December 31, 2023 for forward contracts.

|

|

|

|

|

|

|

Notional Value* |

|

Foreign exchange contracts |

|

$ |

2,222,280 |

|

* Gross notional amounts do not quantify risk or represent assets or liabilities of the Company but are used in the calculation of settlements under the contracts.

The Company records all derivative instruments on the consolidated balance sheets at fair value. For further information, please see Note 6 to the consolidated financial statements. The fair value of the open foreign exchange contracts recorded as an asset or a liability by the Company on its consolidated balance sheets as of December 31, 2023 and September 30, 2023, is as follows:

|

|

|

|

|

|

|

|

|

|

|

As of |

|

|

|

December 31,

2023 |

|

|

September 30,

2023 |

|

Derivatives designated as hedging instruments |

|

|

|

|

|

|

Prepaid expenses and other current assets |

|

$ |

2,481 |

|

|

$ |

968 |

|

Other noncurrent assets |

|

|

16,150 |

|

|

|

331 |

|

Accrued expenses and other current liabilities |

|

|

(11,169 |

) |

|

|

(32,295 |

) |

Other noncurrent liabilities |

|

|

(527 |

) |

|

|

(7,050 |

) |

|

|

|

6,935 |

|

|

|

(38,046 |

) |

Derivatives not designated as hedging instruments |

|

|

|

|

|

|

Prepaid expenses and other current assets |

|

|

16,937 |

|

|

|

10,586 |

|

Accrued expenses and other current liabilities |

|

|

(13,836 |

) |

|

|

(9,372 |

) |

|

|

|

3,101 |

|

|

|

1,214 |

|

Net fair value |

|

$ |

10,036 |

|

|

$ |

(36,832 |

) |

Cash Flow Hedges

In order to reduce the impact of changes in foreign currency exchange rates on its results, the Company enters into foreign currency exchange forward and option contracts to purchase and sell foreign currencies to hedge a significant portion of its foreign currency net exposure resulting from revenue and expense transactions denominated in currencies other than the U.S. dollar. The Company designates these contracts for accounting purposes as cash flow hedges. The Company currently hedges its exposure to the variability in future cash flows for a maximum period of approximately three years. A significant portion of the forward contracts outstanding as of December 31, 2023 is scheduled to mature within the next 12 months.

The effective portion of the gain or loss on the derivative instruments is initially recorded as a component of other comprehensive income, net, a separate component of equity, and subsequently reclassified into earnings in the same line item as the related forecasted transaction and in the same period or periods during which the hedged exposure affects earnings. The cash flow hedges are evaluated for effectiveness quarterly. As the critical terms of the forward contract or option and the hedged transaction are matched at inception, the hedge effectiveness is assessed generally based on changes in the fair value for cash flow hedges, as compared to the changes in the

AMDOCS LIMITED

NOTES TO UNAUDITED CONSOLIDATED FINANCIAL STATEMENTS

(dollar and share amounts in thousands, except per share data or as otherwise disclosed)

fair value of the cash flows associated with the underlying hedged transactions. Hedge ineffectiveness, if any, is recognized immediately in interest and other expense, net.

The effect of the Company's cash flow hedging instruments in the consolidated statements of income for the three months ended December 31, 2023 and 2022, respectively, which partially offsets the foreign currency impact from the underlying exposures, is summarized as follows:

|

|

|

|

|

|

|

|

|

|

|

Losses Reclassified from |

|

|

|

Accumulated Other Comprehensive Loss (Effective Portion) |

|

|

|

Three months ended December 31, |

|

|

|

2023 |

|

|

2022 |

|

Line item in consolidated statements of income: |

|

|

|

|

|

|

Revenue |

|

$ |

355 |

|

|

$ |

815 |

|

Cost of revenue |

|

|

(6,130 |

) |

|

|

(7,212 |

) |

Research and development |

|

|

(2,040 |

) |

|

|

(2,007 |

) |

Selling, general and administrative |

|

|

(2,096 |

) |

|

|

(1,965 |

) |

Total |

|

$ |

(9,911 |

) |

|

$ |

(10,369 |

) |

The activity related to the changes in net unrealized gains (losses) on cash flow hedges recorded in accumulated other comprehensive loss, net of tax, is as follows:

|

|

|

|

|

|

|

|

|

|

|

Three months ended December 31, |

|

|

|

2023 |

|

|

2022 |

|

|

|

|

|

|

|

|

Net unrealized losses on cash flow hedges, net of tax, beginning of period |

|

$ |

(34,677 |

) |

|

$ |

(46,580 |

) |

Changes in fair value of cash flow hedges, net of tax |

|

|

32,854 |

|

|

|

1,367 |

|

Reclassification of net losses into earnings, net of tax |

|

|

9,292 |

|

|

|

9,826 |

|

Net unrealized gains (losses) on cash flow hedges, net of tax, end of period |

|

$ |

7,469 |

|

|

$ |

(35,387 |

) |

Net gains from cash flow hedges recognized in other comprehensive income, net were $35,060 and $1,387, or $32,854 and $1,367 net of taxes, during the three months ended December 31, 2023 and 2022, respectively.

Of the net unrealized gains related to derivatives designated as cash flow hedges and recorded in accumulated other comprehensive loss as of December 31, 2023, a net loss of $8,359 will be reclassified into earnings within the next 12 months and will partially offset the foreign currency impact from the underlying exposures. The amount ultimately realized in earnings will likely differ due to future changes in foreign exchange rates.

The ineffective portion of the change in fair value of a cash flow hedge, including the time value portion excluded from effectiveness testing for the three months ended December 31, 2023 and 2022, was not material.

Other Risk Management Derivatives

The Company also enters into foreign currency exchange forward and option contracts that are not designated as hedging instruments under hedge accounting and are used to reduce the impact of foreign currency on certain balance sheet exposures and certain revenue and expense transactions.

These instruments are generally short-term in nature, with typical maturities of less than 12 months, and are subject to fluctuations in foreign exchange rates.

AMDOCS LIMITED

NOTES TO UNAUDITED CONSOLIDATED FINANCIAL STATEMENTS

(dollar and share amounts in thousands, except per share data or as otherwise disclosed)

The effect of the Company's derivative instruments not designated as hedging instruments in the consolidated statements of income for the three months ended December 31, 2023 and 2022, respectively, which partially offsets the foreign currency impact from the underlying exposure, is summarized as follows:

|

|

|

|

|

|

|

|

|

|

|

Losses Recognized in Income |

|

|

|

Three months ended December 31, |

|

|

|

2023 |

|

|

2022 |

|

Line item in consolidated statements of income: |

|

|

|

|

|

|

Cost of revenue |

|

$ |

2,935 |

|

|

$ |

1,232 |

|

Research and development |

|

|

850 |

|

|

|

174 |

|

Selling, general and administrative |

|

|

944 |

|

|

|

260 |

|

Interest and other expense, net |

|

|

(6,134 |

) |

|

|

(11,408 |

) |

Income taxes |

|

|

(617 |

) |

|

|

(204 |

) |

Total |

|

$ |

(2,022 |

) |

|

$ |

(9,946 |

) |

9.Accrued Expenses and Other Current Liabilities

Accrued expenses and other current liabilities consist of the following:

|

|

|

|

|

|

|

|

|

|

|

As of |

|

|

|

December 31,

2023 |

|

|

September 30,

2023 |

|

Ongoing accrued expenses (1) |

|

$ |

361,315 |

|

|

$ |

277,037 |

|

Project-related provisions |

|

|

52,686 |

|

|

|

55,569 |

|

Dividends payable |

|

|

50,683 |

|

|

|

51,053 |

|

Taxes payable (2) |

|

|

78,424 |

|

|

|

47,470 |

|

Derivative instruments |

|

|

25,005 |

|

|

|

41,667 |

|

Other (1) |

|

|

181,769 |

|

|

|

161,946 |

|

Accrued expenses and other current liabilities |

|

$ |

749,882 |

|

|

$ |

634,742 |

|

(1) Certain amounts were reclassified from "other" to "ongoing accrued expenses" to conform the prior period to the current year presentation.

(2) For further details, please see Note 11 to the consolidated financial statements.

As of December 31, 2022, the Company incurred restructuring charges of $24,536, primarily associated with alignment of the Company’s workforce around its global site strategy, as well as the optimization of the Company’s hybrid work model. These charges were paid or adjusted as of September 30, 2023. On August 2, 2023, the Company announced it is taking proactive and appropriate measures to optimize expenditures and resource allocation in response to the prevailing level of economic uncertainty and industry pressure. These measures include, among others, a workforce reduction aligned with the Company’s global site strategy and work model. During the fourth quarter of fiscal year 2023, the Company incurred restructuring charges of $46,365, primarily associated with employees' severance expenses and exit charges associated with office space reductions. As of December 31, 2023, the majority of charges were paid. The Company expects to pay the vast majority of the remaining amount in fiscal year 2024.

The provision for income tax expense for the following periods consisted of:

|

|

|

|

|

|

|

|

|

|

|

Three months ended December 31, |

|

|

|

2023 |

|

|

2022 |

|

Current |

|

$ |

32,517 |

|

|

$ |

32,212 |

|

Deferred |

|

|

(6,683 |

) |

|

|

(16,973 |

) |

Income tax expense |

|

$ |

25,834 |

|

|

$ |

15,239 |

|

AMDOCS LIMITED

NOTES TO UNAUDITED CONSOLIDATED FINANCIAL STATEMENTS

(dollar and share amounts in thousands, except per share data or as otherwise disclosed)

The Company's effective income tax rate varied from the statutory Guernsey tax rate as follows for the following periods:

|

|

|

|

|

|

|

|

|

|

|

Three months ended

December 31, |

|

|

|

2023 |

|

|

2022 |

|

Statutory Guernsey tax rate |

|

|

0 |

% |

|

|

0 |

% |

Foreign taxes (1) |

|

|

14.8 |

|

|

|

10.5 |

|

Effective income tax rate |

|

|

14.8 |

% |

|

|

10.5 |

% |

As a Guernsey company subject to a corporate tax rate of zero percent, the Company's overall effective tax rate is attributable to foreign taxes. The change in rate is primarily driven by discrete items in the respective period presented as outlined below.

(1)Foreign taxes for the three months ended December 31, 2023:

Foreign taxes in the three months ended December 31, 2023 included a benefit of $54,667 relating primarily to release of gross unrecognized tax benefits due to settlements of tax audits, and expiration of the periods set forth in statutes of limitations in certain jurisdictions. The majority of the release was offset by an increase in taxes payable and tax payments, and, as a result, a net benefit of $20,880 was included within income tax expense for the period.

(1)Foreign taxes for the three months ended December 31, 2022:

Foreign taxes in the three months ended December 31, 2022 included a recognition of tax benefit of $8,566 resulting from internal structural changes in certain jurisdictions in which the Company operates.

Foreign taxes in the three months ended December 31, 2022 also included a benefit of $3,747 relating to release of gross unrecognized tax benefits due to settlements of tax audits and expiration of the periods set forth in statutes of limitations in certain jurisdictions.

Foreign taxes in the three months ended December 31, 2022 also included a benefit of $3,666 relating to changes in tax regulations in certain jurisdictions.

As previously disclosed in the Company’s Annual Report on Form 20-F for fiscal year 2022, our primary Israeli subsidiary has elected, during fiscal year 2022, to pay the reduced corporate tax on all of its “previously exempt earnings” based on a temporary order of the Israeli budget law. Following this election, payment of this tax, was made during the three months ended December 31, 2022. The impact of this election on income taxes was already reflected in prior periods.

As of December 31, 2023, deferred tax assets of $69,305, derived primarily from tax credits, net capital and operating loss carry forwards related to some of the Company's subsidiaries, were offset by valuation allowances due to the uncertainty of realizing tax benefit for such credits and losses.

The total amount of gross unrecognized tax benefits, which includes interest and penalties, was $154,276 as of December 31, 2023, all of which would affect the effective tax rate if realized.

As of December 31, 2023, the Company had accrued $25,854 in income taxes payable for interest and penalties relating to unrecognized tax benefits.

The Company is currently under tax audit in several jurisdictions for the tax years 2007 and onwards. Timing of the resolution of audits is highly uncertain and therefore, as of December 31, 2023, the Company cannot estimate the change in unrecognized tax benefits resulting from these audits within the next 12 months.

AMDOCS LIMITED

NOTES TO UNAUDITED CONSOLIDATED FINANCIAL STATEMENTS

(dollar and share amounts in thousands, except per share data or as otherwise disclosed)

The following table sets forth the computation of basic and diluted earnings per share:

|

|

|

|

|

|

|

|

|

|

|

Three months ended

December 31, |

|

|

|

2023 |

|

|

2022 |

|

Numerator: |

|

|

|

|

|

|

Net income attributable to Amdocs Limited |

|

$ |

147,965 |

|

|

$ |

129,667 |

|

Net income attributable to Amdocs Limited and dividends

attributable to participating restricted stock |

|

|

(2,679 |

) |

|

|

(2,014 |

) |

Numerator for basic earnings per common share |

|

$ |

145,286 |

|

|

$ |

127,653 |

|

Undistributed income allocated to participating restricted stock |

|

|

1,759 |

|

|

|

1,274 |

|

Undistributed income reallocated to participating restricted stock |

|

|

(1,748 |

) |

|

|

(1,265 |

) |

Numerator for diluted earnings per common share |

|

$ |

145,297 |

|

|

$ |

127,662 |

|

Denominator: |

|

|

|

|

|

|

Weighted average number of shares outstanding - basic |

|

|

116,841 |

|

|

|

120,652 |

|

Weighted average number of participating restricted stock |

|

|

(2,115 |

) |

|

|

(1,874 |

) |

Weighted average number of common shares - basic |

|

$ |

114,726 |

|

|

|

118,778 |

|

Effect of dilutive equity-based compensation awards |

|

|

695 |

|

|

|

848 |

|

Weighted average number of common shares - diluted |

|

|

115,421 |

|

|

|

119,626 |

|

Basic earnings per common share attributable to Amdocs Limited |

|

$ |

1.27 |

|

|

$ |

1.07 |

|

Diluted earnings per common share attributable to Amdocs Limited |

|

$ |

1.26 |

|

|

$ |

1.07 |

|

For the three months ended December 31, 2023 and 2022, 21 and 12 shares, respectively, on a weighted average basis, were attributable to antidilutive outstanding equity-based compensation awards. Shares attributable to antidilutive outstanding stock equity-based compensation awards were not included in the calculation of diluted earnings per share.

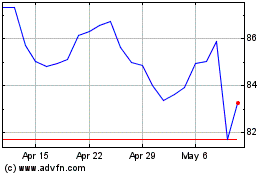

From time to time, the Company’s Board of Directors can adopt share repurchase plans authorizing the repurchase of the Company’s outstanding ordinary shares. On May 12, 2021, the Company’s Board of Directors adopted a share repurchase plan for the repurchase of up to a $1.0 billion of the Company’s outstanding ordinary shares with no expiration date. The May 2021 plan permits the Company to purchase our ordinary shares in the open market or through privately negotiated transactions at times and prices that the Company considers appropriate. On August 2, 2023, the Company’s Board of Directors adopted a share repurchase plan for the repurchase of up to an additional $1.1 billion of the Company’s outstanding ordinary shares with no expiration date. The August 2023 plan permits the Company to purchase our ordinary shares in the open market or through privately negotiated transactions at times and prices that the Company considers appropriate. In the three months ended December 31, 2023, the Company completed the repurchase of the remaining authorized amount of ordinary shares under the May 2021 plan and initiated repurchases of the Company’s outstanding ordinary shares pursuant to the August 2023 plan. In the three months ended December 31, 2023, the Company repurchased 1,895 ordinary shares at an average price of $83.65 per share (excluding broker and transaction fees). As of December 31, 2023, the Company had remaining authority to repurchase up to $942,169 of its outstanding ordinary shares under the August 2023 plan.

14.Financing Arrangements

In December 2011, the Company entered into an unsecured $500,000 five-year revolving credit facility with a syndicate of banks (the “Revolving Credit Facility”). In December 2014, December 2017 and March 2021, the Revolving Credit Facility was amended and restated to, among other things, extend the maturity date of the facility to December 2019, December 2022 and March 2026, respectively. As of December 31, 2023, the Company was in compliance with the financial covenants and had no outstanding borrowings under the Revolving Credit Facility.

In June 2020, the Company issued an aggregate principal amount of $650,000 in Senior Notes that will mature in June 2030 and bear interest at a fixed rate of 2.538 percent per annum (the “Senior Notes”). The interest is payable semi-annually in June and December of each year, commencing in December 2020. The Company incurred issuance costs of $6,121 in relation with the Senior Notes, which are being amortized to interest expenses over the term of the Senior Notes using the effective interest rate. The Senior Notes are senior unsecured obligations of the Company and rank equally in right of payment with all existing and future senior indebtedness of the Company, including any indebtedness the Company may incur from time to time under the Revolving Credit Facility.

AMDOCS LIMITED

NOTES TO UNAUDITED CONSOLIDATED FINANCIAL STATEMENTS

(dollar and share amounts in thousands, except per share data or as otherwise disclosed)