Filed

pursuant to Rule 424(b)(5)

Registration

No. 333-259295

Prospectus

Supplement

(To

Prospectus Dated September 14, 2021)

EASTSIDE

DISTILLING, INC.

92,815

Shares of Common Stock

349,227

Pre-Funded Warrants to Purchase Shares of Common Stock

349,227

Shares of Common Stock underlying the Pre-Funded Warrants

We

are offering 92,815 shares of our common stock, par value $0.0001 per share, at an offering price of $1.00 per share and pre-funded warrants

to purchase up to 349,227 shares of common stock, in lieu of shares of common stock at an offering price of $0.9999 to a certain institutional

investor, pursuant to this prospectus supplement and accompanying base prospectus. Each pre-funded warrant will have an exercise price

of $0.0001 per share, will be exercisable upon issuance and may be exercised at any time until all of the pre-funded warrants are exercised

in full.

We

have entered into a letter agreement (the “Placement Agreement”) with Joseph Gunnar & Co., LLC (“Joseph Gunnar”

or the “placement agent”) to act as our exclusive placement agent in connection with the securities offered by this prospectus

supplement and the accompanying prospectus. The placement agent has no obligation to buy any of the securities from us or to arrange

for the purchase or sale of any specific number or dollar amount of securities. We have agreed to pay the placement agent the placement

agent fees set forth in the table below, which assumes that we sell all of the securities we are offering. See “Plan of Distribution”

beginning on page S-9 of this prospectus supplement for more information regarding these arrangements.

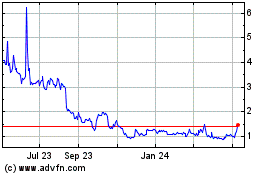

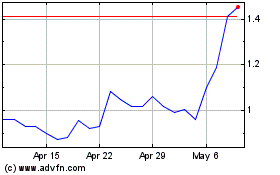

Our

common stock is traded on The Nasdaq Capital Market under the symbol “EAST.” The last reported sale price of our common stock

on The Nasdaq Capital Market on September 5, 2024 was $1.44 per share.

We

are currently subject to General Instruction I.B.6 of Form S-3, which limits the amounts of securities that we may sell under the registration

statement of which the prospectus supplement and the prospectus form a part. The aggregate market value of our outstanding common stock

held by non-affiliates pursuant to General Instruction I.B.6 of Form S-3, or public float, is $1,535,666, which is based on 1,279,722

shares of our outstanding common stock held by non-affiliates as of the date of this prospectus, at a price of $1.20 per share, which

was the last reported sale price of our common stock on the NASDAQ Capital Market on July 12, 2024. Pursuant to General Instruction I.B.6

of Form S-3, in no event will we sell shares pursuant to this prospectus supplement with a value of more than one-third of the aggregate

market value of our common stock held by non-affiliates in any 12-month period. During the present calendar month and the preceding 12

calendar months, we have sold no securities pursuant to General Instruction I.B.6 of Form S-3.

Investing

in our securities involves a high degree of risk. Before making an investment decision, you should review and carefully consider all

of the information set forth in this prospectus supplement, the accompanying prospectus and the documents incorporated by reference in

this prospectus supplement. See “Risk Factors” on page S-5 of this prospectus supplement, page 7 of the prospectus and under

similar headings in the other documents that are incorporated by reference into this prospectus supplement and the accompanying prospectus.

Neither

the Securities and Exchange Commission (the “SEC”) nor any state securities commission has approved or disapproved of these

securities or determined if this prospectus supplement or the accompanying prospectus is truthful or complete. Any representation to

the contrary is a criminal offense.

| | |

Per Share | | |

Per Pre-Funded Warrant | | |

Total | |

| Offering price | |

$ | 1.00 | | |

$ | 0.9999 | | |

$ | 442,007.07 | |

| Placement agent commissions (1) | |

$ | 0.09 | | |

$ | 0.09 | | |

$ | 39,780.63 | |

| Proceeds, before expenses, to us (2) | |

$ | 0.91 | | |

$ | 0.9099 | | |

$ | 402,226.44 | |

| (1)

|

We

have agreed to pay the Placement Agent a total cash fee equal to 9% of the gross proceeds of the offering. See “Plan of Distribution”

for a description of the compensation payable to the placement agent. |

| (2) |

The

amount of the offering proceeds to us presented in these tables do not give effect to any exercise of the pre-funded warrants being

issued in this offering. |

The

delivery to purchasers of the securities in this offering is expected to be made on or about September 6, 2024, subject to satisfaction

of certain customary closing conditions.

JOSEPH

GUNNAR & CO., LLC

The

date of this prospectus supplement is September 5, 2024.

TABLE

OF CONTENTS

ABOUT

THIS PROSPECTUS SUPPLEMENT

This

document is in two parts. The first part is this prospectus supplement, which describes the specific terms of this offering and also

adds to and updates information contained in the accompanying prospectus and the documents incorporated by reference into this prospectus

supplement and the accompanying prospectus. The second part, the accompanying prospectus dated September 14, 2021, included in our registration

statement on Form S-3 (File No. 333-59295), along with the general documents incorporated by referenced therein gives more general information

about securities we may offer from time to time, some of which does not apply to this offering. This prospectus supplement and the accompanying

prospectus incorporate by reference important business and financial information about us that is not included in or delivered with this

prospectus supplement and the accompanying prospectus.

You

should rely only on the information we have provided or incorporated by reference in this prospectus supplement or in the accompanying

prospectus. If information in this prospectus supplement is inconsistent with the accompanying prospectus, you should rely on this prospectus

supplement. We have not, and Joseph Gunnar has not, authorized anyone to provide you with different information. No dealer, salesperson

or other person is authorized to give any information or to represent anything not contained in or incorporated by reference into this

prospectus supplement or the accompanying prospectus. You must not rely on any unauthorized information or representation.

We

are offering to sell and seeking offers to buy our Securities only in jurisdictions where offers and sales are permitted. You should

assume that the information in this prospectus supplement and accompanying prospectus is accurate only as of the dates on the front of

the respective document and that any information we have incorporated by reference is accurate only as of the date of the document incorporated

by reference. Our business, financial condition, results of operations and prospects may have changed since those dates. Neither this

prospectus supplement nor the accompanying prospectus constitutes an offer, or a solicitation on our behalf or on behalf of the placement

agent, to subscribe for and purchase any of the Securities and may not be used for or in connection with an offer or solicitation by

anyone in any jurisdiction in which such an offer or solicitation is not authorized or to any person to whom it is unlawful to make such

an offer or solicitation.

You

should read this prospectus supplement, the accompanying prospectus and the documents incorporated by reference in this prospectus supplement

and the accompanying prospectus when making your investment decision.

Unless

the context requires otherwise, references in this prospectus supplement to “Eastside Distilling,” “the Company,”

“we,” “us” and “our” refer to Eastside Distilling, Inc. and its subsidiaries.

SPECIAL

NOTE REGARDING FORWARD-LOOKING STATEMENTS

This

prospectus supplement, the accompanying prospectus and the documents incorporated by reference into this prospectus contain certain “forward-looking

statements” within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995.

The forward-looking statements describe our expectations for the future, and are generally preceded by words indicating anticipation

or speculation, such as “intend,” “plan,” “believe,” and the like. Such statements about the future

are subject to a multitude of risks and uncertainties that could cause future circumstances, events or results to differ materially from

those projected in the forward-looking statements. Risks and uncertainties that may cause actual results to differ from our expectations

include, but are not limited to, the Company’s ability to execute its business model and strategic plan, the Company’s ability

to obtain capital, and the Company’s ability to withstand competitive pressures. Detailed discussion of the risks that may interfere

with our plans can be found in the Risk Factors section of the Company’s annual report on Form 10-K for the year ended December

31, 2023, which is available on our website as well as on the SEC’s EDGAR website. The Form 10-K for the year ended December 31,

2023, is among the documents incorporated by reference into this prospectus supplement. You should also consider carefully the risks

described in any subsequent reports we file after the date of this prospectus supplement, which reports shall be incorporated by reference

in this prospectus supplement in their entirety.

Although

we believe the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, level of

activity, performance or achievements. Any forward-looking statement made by us in this prospectus supplement or the accompanying prospectus

is based only on information currently available to us and speaks only as of the date on which it is made. We undertake no obligation

to publicly update any forward-looking statement, whether as a result of new information, future developments or otherwise. However,

you should carefully review the risk factors set forth in other reports or documents we file from time to time with the SEC.

PROSPECTUS

SUPPLEMENT SUMMARY

This

summary highlights selected information contained elsewhere in this prospectus supplement, in the accompanying prospectus or in documents

incorporated by reference. This summary does not contain all of the information that you should consider before making an investment

decision. This prospectus supplement and the accompanying prospectus include or incorporate by reference information about this offering,

our business and our financial and operating data. You should carefully read the entire prospectus supplement, the accompanying prospectus,

including under the sections titled “Risk Factors” included therein, and the documents incorporated by reference into this

prospectus supplement and the accompanying prospectus, before making an investment decision. The occurrence of any of these risks might

cause you to lose all or part of your investment in the offered securities.

Our

Company

Eastside

Distilling, Inc. operate in three segments. Our Craft Canning + Printing (“Craft C+P”) segment provides digital can printing

and canning services to the craft beverage industry in Washington and Oregon. In addition to mobile co-packing services we offer co-packing

services from a single fixed site in Portland, Oregon. Our Spirits segment manufactures, blends, bottles, markets and sells a wide variety

of alcoholic beverages under recognized brands in 30 U.S. states. Our corporate segment consists of key accounting personnel and corporate

expenses such as public company and board costs, as well as interest on debt.

Craft

C+P primarily services the craft beer, cider and kombucha beverage segments. Craft C+P offers digital can printing to customers and co-packing

services, as well as operates mobile lines in Seattle and Spokane, Washington; and Portland, Oregon. Our spirits brands span several

alcoholic beverage categories, including whiskey, vodka, rum and tequila. We sell our products on a wholesale basis to distributors through

open states, and brokers in control states.

Our

strategy has been to utilize our public company stature to our advantage and position to expand our two distinct businesses – Craft

C+P and Spirits. Our Craft C+P subsidiary aims to grow and vertically integrate its business to expand its product offerings and improve

its competitive position. Our spirits portfolio is to be positioned as a leading regional craft spirits provider that develops brands,

expands geographic presence growing revenue and cash flow.

On

September 4, 2024 we entered into a Merger Agreement (the “Merger Agreement”) with Beeline Financial Holdings, Inc.

(“Beeline”) and East Acquisition, Inc. Beeline is a privately-held mortgage technology company that operates an end-to-end,

all-digital, AI-enhanced platform for homeowners and property investors. The Merger Agreement contemplates that, upon satisfaction of

conditions stated in the Merger Agreement, Beeline will be merged into a subsidiary of the Company, and the capital stock of Beeline

will be converted into common stock and convertible preferred stock of Eastside that will equal on a fully-diluted basis 82.5% of the

post-merger capital stock of Eastside. One of the conditions precedent to closing of the merger with Beeline will be completion of a

refinancing described in a Debt Exchange Agreement dated September 4, 2024 among the Company and eight investors in the Company. Among

the exchanges that will occur upon closing of the Debt Exchange Agreement will be the transfer of Craft C+P to the investors in satisfaction

of debt and surrender of equity.

Corporate

Information

Our

executive offices are located at 2321 NE Argyle Street, Suite D, Portland, Oregon 97211. Our telephone number is (971) 888-4264 and our

internet address is www.eastsidedistilling.com.

The

information contained on our website is not incorporated by reference into this prospectus, and you should not consider any information

contained on, or that can be accessed through, our website as part of this prospectus or in deciding whether to purchase our securities.

Our common stock is listed on The Nasdaq Capital Market under the symbol “EAST”.

THE

OFFERING

| Securities

offered |

|

92,815

shares of our common stock. |

| |

|

|

| Pre-Funded

Warrants |

|

We

are also offering 349,227 pre-funded warrants to purchase up to 349,227 shares of our common stock, exercisable at an exercise price

of $0.0001 per share, to the purchaser whose purchase of common stock in this offering would otherwise result in the purchaser, together

with its affiliates and certain related parties, beneficially owning more than 4.99% (or, at the election of the purchaser, 9.99%)

of our outstanding common stock immediately following the consummation of this offering. The purchase price of each pre-funded warrant

is equal to the price per share of common stock being sold in this offering minus $0.0001. The pre-funded warrants will be immediately

exercisable and may be exercised at any time until exercised in full. See “Description of Pre-Funded Warrants.” This

prospectus supplement also relates to the offering of the shares of common stock issuable upon the exercise of such pre-funded warrants.

|

| |

|

|

| Common

stock to be outstanding prior to this offering |

|

1,763,489

shares of common stock |

| |

|

|

| Common

stock to be outstanding immediately after this offering (1) |

|

1,856,304

shares of common stock. |

| |

|

|

| Use

of proceeds |

|

We

currently expect to use the net proceeds from this offering for working capital and general corporate purposes. See “Use of

Proceeds” on page S-6. |

| |

|

|

| Nasdaq

Capital Market Symbol |

|

“EAST” |

| |

|

|

| Risk

Factors |

|

An

investment in our company involves a high degree of risk. Please refer to the sections titled “Risk Factors,” “Special

Note Regarding Forward-Looking Statements” and other information included or incorporated by reference in this prospectus supplement

and the accompanying prospectus for a discussion of factors you should carefully consider before investing our securities. |

(1)

The number of shares of common stock to be outstanding after sale of all shares offered is based on 1,763,489 shares of common

stock outstanding as of September 5, 2024, which excludes the following outstanding derivative securities:

| |

● |

349,227

Per-Funded Warrants to purchase 349,227 shares of common stock for $0.0001 per share; |

| |

● |

2,500,000

shares of Series D Preferred Stock convertible into 40,322 shares of common stock; |

| |

● |

200,000

shares of Series C Preferred Stock convertible into 1,839,344 shares of common stock; and |

| |

● |

Warrants

or Options to purchase a total of 197,954 shares of common stock, each such instrument having a conversion price in excess of $20

per share of common stock. |

RISK

FACTORS

Investing

in our securities involves a high degree of risk. Before deciding whether to invest in our securities, you should carefully consider

the risk factors described below and the risk factors incorporated by reference in this prospectus supplement, including under the heading

“Risk Factors” contained in our Annual Report on Form 10-K, as updated by our subsequent filings under the Securities Exchange

Act of 1934, as amended (the “Exchange Act”), each of which is incorporated by reference in this prospectus supplement in

its entirety, together with other information in this prospectus supplement, and the information and documents incorporated by reference

in this prospectus supplement, and any issuer free writing prospectus supplement that we have authorized for use in connection with this

offering. The risks and uncertainties described in the filings referenced above and described below are in addition to risks that apply

to most businesses and are not the only risks we face. Additional risks and uncertainties that are not presently known to us or that

we currently deem immaterial may also affect our business. If any of these known or unknown risks or uncertainties is actually realized,

our business, financial condition, results of operations and/or liquidity could be materially and adversely affected. In that event,

the market price for our common stock will likely decline and you may lose all or part of your investment.

Resales

of our common stock in the public market as a result of this offering may cause its market price to fall.

We

will issue common stock from time to time in connection with this offering. Purchasers may immediately resell the shares in the public

market. In addition, the pendency of this offering could result in resales of our common stock by our current stockholders concerned

about the potential dilution of their holdings. If, for either of these reasons, stockholders sell substantial amounts of our common

stock in the public market following this offering, the market price of our common stock could fall.

You

will experience immediate and substantial dilution in the net tangible book value of the common stock you purchase in this offering and

we may issue additional equity or convertible debt securities in the future, which may result in additional dilution to investors.

The

offering price of the securities in this offering will exceed the net tangible book value per share of our outstanding common stock prior

to this offering. After giving effect to the sale of 92,815 shares of common stock in this offering and assuming the exercise of 349,227

pre-funded warrants sold in this offering, deducting commissions and estimated aggregate offering expenses payable by us, you will experience

immediate dilution of $3.87 per share, representing the difference between the assumed offering price of $1.00 per share and our as adjusted

net tangible book value per share. See the section below entitled “Dilution” for a more detailed illustration of the dilution

you would incur if you participate in this offering.

Furthermore,

to the extent we need to raise additional capital in the future and we issue additional shares of common stock or securities convertible

or exchangeable for our common stock, our then-existing stockholders may experience dilution and the new securities may have rights senior

to those of our common stock offered in this offering.

Our

management will have broad discretion over the use of any net proceeds from this offering; you may not agree with how we use the proceeds;

and the proceeds may not be invested successfully.

Our

management will have broad discretion as to the use of any net proceeds from this offering and could use them for purposes other than

those contemplated at the time of this offering. Accordingly, you will be relying on the judgment of our management with regard to the

use of any proceeds from the sale of the Securities in this offering, and you will not have the opportunity, as part of your investment

decision, to assess whether the proceeds are being used appropriately. It is possible that the proceeds will be invested in a way that

does not yield a favorable, or any, return for Eastside Distilling.

The

pre-funded warrants are speculative in nature and holders of the pre-funded warrants will have no rights as stockholders until such holders

exercise their pre-funded warrants and acquire shares of our common stock.

Except

as otherwise provided in the pre-funded warrants, until holders of the pre-funded warrants acquire our common stock upon exercise of

the pre-funded warrants s, holders of the pre-funded warrants will have no rights with respect to our common stock underlying such pre-funded

warrants. Upon exercise of the pre-funded warrants, the holders will be entitled to exercise the rights of a stockholder of our common

stock only as to matters for which the record date occurs after the exercise date.

Moreover,

following this offering, the market value of the pre-funded warrants is uncertain. There can be no assurance that the market price of

our common stock will ever equal or exceed the price of the pre-funded warrants, and, consequently, whether it will ever be profitable

for investors to exercise their pre-funded warrants.

USE

OF PROCEEDS

We

estimate that the net proceeds from the sale of our common stock and pre-funded warrants in this offering will be approximately $0.37

million, after deducting placement agent fees and estimated offering expenses payable by us. We will receive nominal proceeds, if any,

from the exercise of the pre-funded warrants.

We

will retain broad discretion over the use of the net proceeds from the sale of the securities offered hereby. We currently intend to

use the net proceeds from this offering, if any, for working capital and general corporate purposes. The amount and timing of these expenditures

will depend on a number of factors, such as the timing, scope, progress and results of our product development efforts, the timing and

progress of our marketing efforts and the competitive environment for our product candidates. Pending the application of the net proceeds,

we intend to invest the net proceeds in interest-bearing accounts and short-term marketable securities.

DILUTION

If

you invest in our securities, you will experience immediate and substantial dilution to the extent of the difference between the public

offering price of our common stock and the adjusted net tangible book value per share of our common stock immediately after the offering.

Our

net tangible book value as of June 30, 2024, was a deficit of approximately ($6.732) million or ($3.82) per share of common stock. Our

net tangible book value is determined by subtracting our total tangible assets less our liabilities, and dividing this amount by the

number of shares of common stock outstanding. Dilution with respect to net tangible book value per share represents the difference between

the amount per share paid by purchasers of shares of common stock in this offering and the net tangible book value per share of our common

stock immediately after this offering.

After

giving effect to the sale of 92,815 shares of common stock and 349,227 pre-funded warrants in this offering at an offering price of $1.00

per share of common stock and $0.9999 per pre-funded warrant, and after deducting underwriting discounts and estimated offering expenses

payable by us, our net tangible book value as of June 30, 2024 would have been approximately $6.34 million, or $2.87 per share of common

stock. This represents an immediate increase in net tangible book value of $0.95 per share to existing stockholders and an immediate

dilution of $3.87 per share to new investors purchasing Securities in this offering at the assumed public offering price. The following

table illustrates this dilution on a per share basis:

| Public offering price per share | |

| | |

| $ |

1.00 |

|

| Net tangible book value per share as of June 30, 2024 | |

$ | (3.82 | ) |

|

|

|

|

| Increase in book value per share attributable to this offering | |

$ | 0.95 | |

|

|

|

|

| Adjusted net tangible book value per share after giving effect to this offering | |

| | |

| $ |

(2.87) |

|

| Dilution in net tangible book value per share to new investors in this offering | |

| | |

| $ |

3.87 |

|

The

above discussion and table are based on 1,763,489 shares of our common stock outstanding as of June 30, 2024. That figure excludes the

following outstanding derivative securities:

| |

● |

2,500,000

shares of Series D Preferred Stock convertible into 40,322 shares of common stock; |

| |

● |

200,000

shares of Series C Preferred Stock convertible into 1,839,344 shares of common stock; and |

| |

● |

Warrants

or Options to purchase a total of 197,954 shares of common stock, each such instrument having a conversion price in excess of $20

per share of common stock. |

DESCRIPTION

OF THE PRE-FUNDED WARRANTS

The

following summary of certain terms and provisions of the pre-funded warrants that are being offered hereby is not complete and is subject

to, and qualified in its entirety by the provisions of, the pre-funded warrants. You should carefully review the terms and provisions

of the form of the pre-funded warrant for a complete description of the terms and conditions of the pre-funded warrants.

The

term “pre-funded” refers to the fact that the purchase price of our common stock in this offering includes almost the entire

exercise price that will be paid under the pre-funded warrants, except for a nominal remaining exercise price of $0.9999. The purpose

of the pre-funded warrants is to enable a certain investor that may have restrictions on their ability to beneficially own more than

4.99% (or, upon election of the holder, 9.99%) of our outstanding common stock following the consummation of this offering the opportunity

to make an investment in the Company without triggering their ownership restrictions, by receiving pre-funded warrants in lieu of our

common stock which would result in such ownership of more than 4.99% (or 9.99%), and receive the ability to exercise their option to

purchase the shares underlying the pre-funded warrants at such nominal price at a later date.

Duration

and Exercise Price. The pre-funded warrants offered hereby will entitle the holder thereof to purchase up to an aggregate of 349,227

shares of our common stock at an exercise price of $0.0001 per share, commencing immediately on the date of issuance until exercised

in full. The pre-funded warrants will be issued separately from the common stock and may be transferred separately immediately thereafter.

Exercisability.

The pre-funded warrants will be exercisable, at the option of each holder, in whole or in part, by delivering to us a duly executed exercise

notice accompanied by payment in full for the number of shares of common stock purchased upon such exercise (except in the case of a

cashless exercise as discussed below). A holder (together with its affiliates) may not exercise any portion of such holder’s warrants

to the extent that the holder would own more than 4.99% (or, at the election of the holder, 9.99%) of our outstanding shares of common

stock immediately after exercise, except that upon notice from the holder to us, the holder may increase or decrease the amount of ownership

of outstanding shares of common stock after exercising the holder’s pre-funded warrants up to 9.99% of the number of shares of

common stock outstanding immediately after giving effect to the exercise, as such percentage ownership is determined in accordance with

the terms of the pre-funded warrants, provided that any increase in this limitation shall not be effective until 61 days after notice

to us.

Cashless

Exercise. In lieu of making the cash payment otherwise contemplated to be made to us upon the exercise of a pre-funded warrant in

payment of the aggregate exercise price, the holder may elect instead to receive upon such exercise (either in whole or in part) the

net number of shares of common stock determined according to a formula set forth in the pre-funded warrant.

Exercise

Price Adjustment. The exercise price of the pre-funded warrants is subject to appropriate adjustment in the event of certain stock

dividends and distributions, stock splits, stock combinations, reclassifications or similar events affecting our common stock.

Fundamental

Transaction. In the event of any fundamental transaction, as described in the pre-funded warrants and generally including any merger

with or into another entity, sale of all or substantially all of our assets, tender offer or exchange offer, reclassification of our

shares of common stock or acquisition of more than 50% of the voting power represented by our common stock, then upon any subsequent

exercise of a pre-funded warrant, the holder will have the right to receive as alternative consideration, for each share of common stock

that would have been issuable upon such exercise immediately prior to the occurrence of such fundamental transaction, the number of shares

of common stock of the successor or acquiring corporation or of our Company, if it is the surviving corporation, and any additional consideration

receivable upon or as a result of such transaction by a holder of the number of shares of common stock for which the pre-funded warrant

is exercisable immediately prior to such event.

Transferability.

In accordance with its terms and subject to applicable laws, a pre-funded warrant may be transferred at the option of the holder upon

surrender of the pre-funded warrant to us together with the appropriate instruments of transfer and payment of funds sufficient to pay

any transfer taxes (if applicable).

Fractional

Shares. No fractional shares of common stock will be issued upon the exercise of the pre-funded warrants. Rather, the number of shares

of common stock to be issued will, at our election, either be rounded up to the nearest whole number or we will pay a cash adjustment

in respect of such final fraction in an amount equal to such fraction multiplied by the exercise price.

Exchange

Listing. There is no established trading market for the pre-funded warrants, and we do not expect a market to develop. In addition,

we do not intend to apply for the listing of the pre-funded warrants on any national securities exchange or other trading market. Without

an active trading market, the liquidity of the pre-funded warrants will be limited.

Rights

as a Stockholder. Except as otherwise provided in the pre-funded warrants or by virtue of such holder’s ownership of shares

of our common stock, the holder of a pre-funded warrant does not have the rights or privileges of a holder of our common stock, including

any voting rights, until the holder exercises the pre-funded warrant.

PLAN

OF DISTRIBUTION

Pursuant

to the Placement Agreement, dated September 5, 2024, we have engaged the placement agent to act as our exclusive placement agent, on

a reasonable best efforts basis, in connection with this offering. Under the terms of the Placement Agreement, Joseph Gunnar is not purchasing

the securities offered by us in this offering, and is not required to sell any specific number or dollar amount of securities, but will

assist us in this offering on a reasonable best-efforts basis. The terms of this offering were subject to market conditions and negotiations

between us, Joseph Gunnar and prospective investors. Joseph Gunnar will have no authority to bind us by virtue of the Placement Agreement.

Joseph Gunnar may engage sub-agents or selected dealers to assist with this offering. We may not sell the entire amount of the share

of our common stock or pre-funded warrants offered pursuant to this prospectus supplement.

On

September 5, 2024, we entered into a securities purchase agreement directly with the investor in connection with this offering for the

sale of an aggregate of 92,815 shares of common stock at an offering price of $1.00 per share and pre-funded warrants to purchase up

to 349,227 shares of common stock at an offering price of $0.9999 per pre-funded warrant (exercisable for common stock at an exercise

price of $0.0001 per share of common stock) pursuant to this prospectus supplement and the accompanying prospectus.

We

expect to deliver the shares of our common stock and pre-funded warrants being offered pursuant to this prospectus supplement on or about

September 6, 2024.

Fees

and Expenses

The

following table shows the total placement agent cash fees we will pay in connection with the sale of the securities in this offering.

| | |

Per

Share | | |

Per Pre-Funded Warrant | | |

Total | |

| Offering price | |

$ | 1.00 | | |

$ | 0.9999 | | |

$ | 442,007.07 | |

| Placement agent commissions (1) | |

$ | 0.09 | | |

$ | 0.09 | | |

$ | 39,780.63 | |

| Proceeds, before expenses, to us (2) | |

$ | 0.91 | | |

$ | 0.9099 | | |

$ | 402,226.44 | |

| (1)

|

We

have agreed to pay the Placement Agent a total cash fee equal to 9% of the gross proceeds of the offering. See “Plan of Distribution”

for a description of the compensation payable to the placement agent. |

| (2) |

The

amount of the offering proceeds to us presented in these tables do not give effect to any exercise of the pre-funded warrants being

issued in this offering. |

We

have also agreed to reimburse the placement agent for all travel and other out-of-pocket expenses incurred, including the reasonable

fees, costs and disbursements of its legal counsel in respect of the offering of $10,000.

Indemnification

We

have agreed to indemnify the placement agent and specified other persons against certain liabilities relating to or arising out of the

placement agent’s activities under the placement agency agreement and to contribute to payments that the placement agent may be

required to make in respect of such liabilities.

Regulation

M

The

placement agent may be deemed to be an underwriter within the meaning of Section 2(a)(11) of the Securities Act of 1933, as amended (the

“Securities Act”) and any commissions received by it and any profit realized on the resale of the securities sold by it while

acting as principal might be deemed to be underwriting discounts or commissions under the Securities Act. As an underwriter, the placement

agent would be required to comply with the requirements of the Securities Act and the Exchange Act, including, without limitation, Rule

415(a)(4) under the Securities Act and Rule 10b-5 and Regulation M under the Exchange Act. These rules and regulations may limit the

timing of purchases and sales of shares of common stock and warrants by the placement agent acting as principal. Under these rules and

regulations, the placement agent:

| |

● |

may

not engage in any stabilization activity in connection with our securities; and |

| |

● |

may

not bid for or purchase any of our securities or attempt to induce any person to purchase any of our securities, other than as permitted

under the Exchange Act, until it has completed its participation in the distribution. |

From

time to time, Joseph Gunnar may provide in the future various advisory, investment and commercial banking and other services to us in

the ordinary course of business, for which they have received and may continue to receive customary fees and commissions. However, except

as disclosed in this prospectus supplement, we have no present arrangements with Joseph Gunnar for any further services.

LEGAL

MATTERS

The

validity of the issuance of the securities offered hereby will be passed upon for us by Robert Brantl, Esq. Tuckahoe, New York. Joseph

Gunnar & Co., LLC is being represented in connection with this offering by Sichenzia Ross Ference Carmel LLP, New York, New York.

EXPERTS

Our

consolidated financial statements incorporated in this prospectus by reference to our Annual Report on Form 10-K for the year ended December

31, 2023 have been audited by M&K CPAS, PLLC, independent registered public accounting firm, to the extent indicated in its report

thereon. Such consolidated financial statements are incorporated by reference into this prospectus supplement in reliance upon such report

given on the authority of such firm as experts in accounting and auditing.

WHERE

YOU CAN FIND MORE INFORMATION

We

file reports, proxy statements and other information with the SEC. The SEC maintains a web site that contains reports, proxy and information

statements and other information about issuers, such as us, who file electronically with the SEC. The address of that website is http://www.sec.gov.

Our

web site address is www.eastsidedistilling.com. The information on our web site, however, is not, and should not be deemed to

be, a part of this prospectus supplement.

This

prospectus supplement and the accompanying prospectus are part of a registration statement that we filed with the SEC and do not contain

all of the information in the registration statement. The full registration statement on Form S-3, and the exhibits thereto, may be obtained

from the SEC or from us, as provided below. Statements in this prospectus or any prospectus supplement about these documents are summaries

and each statement is qualified in all respects by reference to the document to which it refers. You should refer to the actual documents

for a more complete description of the relevant matters. You may inspect a copy of the registration statement through the SEC’s

website, as provided above.

INFORMATION

INCORPORATED BY REFERENCE

We

are incorporating by reference into this prospectus supplement and the accompanying prospectus certain information that we file with

the SEC, which means that we are disclosing important information to you by referring you to those documents. The information incorporated

by reference is deemed to be part of this prospectus supplement and accompanying prospectus, except for information incorporated by reference

that is superseded by information contained in this prospectus supplement and accompanying prospectus. This prospectus supplement and

accompanying prospectus incorporate by reference the documents set forth below that we have previously filed with the SEC:

| |

● |

the

description of our common stock contained in our registration statement on Form 8-A filed with the SEC on August 8, 2017, including

any amendments or reports filed for the purposes of updating this description; |

| |

● |

our

Annual Report on Form 10-K for the year ended December 31, 2023, filed with the SEC on April 1, 2024, and Amendment No. 1 to our

Annual Report on Form 10-K for the year ended December 31, 2023, filed with the SEC on April 30, 2024; |

| |

● |

our

Quarterly Report on Form 10-Q for the quarter ended March 31, 2024, filed with the SEC on May 13, 2024, and our Quarterly Report

on Form 10-Q for the quarter ended June 30, 2024, filed with the SEC on August 14, 2024; and |

| |

● |

our

Current Reports on Form 8-K filed with the SEC on January 4, 2024, January 26, 2024, March 11, 2024, April 10, 2024, May 21, 2024,

June 5, 2024, July 10, 2024, August 16, 2024, September 4, 2024 and September 5, 2024 (except for such portions of our Current Reports

filed pursuant to Item 2.02 or Item 7.01 of such report, which shall not be deemed incorporated by reference herein). |

We

also incorporate by reference all documents we file in the future pursuant to Section 13(a), 13(c), 14 or 15(d) of the Exchange Act after

the date of this prospectus supplement and until we file a post-effective amendment that indicates the termination of the offering of

the securities made by this prospectus supplement and accompanying prospectus. These documents include periodic reports, such as Annual

Reports on Form 10-K, Quarterly Reports on Form 10-Q and Current Reports on Form 8-K (except, in any such case, the portions furnished

and not filed pursuant to Item 2.02, Item 7.01 or otherwise), as well as any proxy statements.

We

will provide to each person, including any beneficial owner, to whom this prospectus supplement and accompanying prospectus are delivered,

without charge, upon written or oral request, a copy of any or all of the documents referred to above. You may request a copy of these

filings at no cost, by writing to or telephoning us at the following address:

Eastside

Distilling, Inc.

2321

NE Argyle Street, Unit D

Portland,

Oregon 97211

971-888-4264

Attn:

Investor Relations

Exhibits

to the filings will not be sent, however, unless those exhibits have specifically been incorporated by reference in this prospectus supplement

or the accompanying prospectus.

PROSPECTUS

Eastside

Distilling, Inc.

Common

Stock

Preferred

Stock

Warrants

We

may offer and sell any combination of common stock, preferred stock or warrants, either individually or in units, with a total value

of up to $20,000,000.

This

prospectus provides a general description of securities we may offer and sell from time to time. Each time we sell those securities,

we will provide their specific terms in a supplement to this prospectus. The prospectus supplement may also add, update or change information

contained in this prospectus. You should read this prospectus and the applicable prospectus supplement carefully before you invest in

any securities. This prospectus may not be used to consummate a sale of securities unless accompanied by the applicable prospectus supplement.

We

may offer and sell these securities, from time to time, to or through one or more underwriters, dealers and agents, or directly to purchasers,

on a continuous or delayed basis, at prices and on other terms to be determined at the time of offering. If we use agents, underwriters

or dealers to sell the securities, we will name them and describe their compensation in a prospectus supplement.

Our

common stock is currently traded on the NASDAQ Capital Market under the trading symbol “EAST.” On September __, 2021 the

reported closing sale price for our common stock was $____.

As

of August 30, 2021, the aggregate market value of our outstanding common stock held by non-affiliates, or public float, was $32,956,409,

which was calculated based on 11,209,663 shares outstanding held by non-affiliates and a per share closing price of $2.94 reported on

the NASDAQ Capital Market on that date. We have not offered any securities pursuant to General Instruction I.B.6 of Form S-3 during the

prior 12 calendar months ending on and including the date of this prospectus. Pursuant to General Instruction I.B.6, in no event will

we sell securities registered on this registration statement with a value exceeding more than one-third of our public float in any 12-month

period if our public float remains below $75 million.

Purchase

of our common stock involves substantial risk. Prior to making a decision about investing in our securities, please review the

section entitled “Risk Factors,” which appears on page 7 of this prospectus, and the section entitled “Risk

Factors,” which begins on page 14 of our Annual Report on Form 10-K, as filed with the Securities and Exchange Commission on

March 31, 2021.

Neither

the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed

upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The

date of this prospectus is September 14, 2021

You

should rely only on the information contained or incorporated by reference in this prospectus. We have not authorized anyone to provide

you with information different from that contained in this prospectus. We are not making an offer to sell these securities in any jurisdiction

where the offer or sale is not permitted. The information contained in this prospectus is accurate only as of the date of this prospectus.

TABLE

OF CONTENTS

ABOUT

THIS PROSPECTUS

This

prospectus is part of a registration statement that we filed with the Securities and Exchange Commission (the “Commission”)

using a “shelf” registration process. Under this shelf registration process, from time to time, we may sell any combination

of the securities described in this prospectus in one or more offerings, up to a total dollar amount of $20,000,000. We have provided

to you in this prospectus a general description of the securities we may offer. Each time we sell securities under this shelf registration

process, we will provide a prospectus supplement that will contain specific information about the terms of the offering. We may also

authorize one or more free writing prospectuses to be provided to you that may contain material information relating to these offerings.

We may also add, update or change in the prospectus supplement or free writing prospectus any of the information contained in this prospectus.

To the extent there is a conflict between the information contained in this prospectus and the prospectus supplement or free writing

prospectus, you should rely on the information in the prospectus supplement or free writing prospectus, as applicable; provided that,

if any statement in one of these documents is inconsistent with a statement in another document having a later date — for example,

a document incorporated by reference in this prospectus or any prospectus supplement — the statement in the document having the

later date modifies or supersedes the earlier statement. You should read both this prospectus and any prospectus supplement together

with additional information described under the next heading “Where You Can Find More Information.”

We

have not authorized any dealer, salesman or other person to give any information or to make any representations other than those contained

or incorporated by reference in this prospectus and the accompanying prospectus supplement. You must not rely upon any information or

representation not contained or incorporated by reference in this prospectus or the accompanying prospectus supplement. This prospectus

and the accompanying supplement to this prospectus do not constitute an offer to sell or the solicitation of an offer to buy any securities

other than the registered securities to which they relate, nor do this prospectus and the accompanying supplement to this prospectus

constitute an offer to sell or the solicitation of an offer to buy securities in any jurisdiction to any person to whom it is unlawful

to make such offer or solicitation in such jurisdiction. You should not assume that the information contained in this prospectus and

the accompanying prospectus supplement is accurate on any date subsequent to the date set forth on the front cover of this document or

that any information we have incorporated by reference is correct on any date subsequent to the date of the document incorporated by

reference, even though this prospectus and any accompanying prospectus supplement is delivered or securities sold on a later date.

We

have proprietary rights to trademarks, trade names and service marks appearing in this prospectus that are important to our business.

Solely for convenience, the trademarks, trade names and service marks may appear in this prospectus without the ® and TM symbols,

but any such references are not intended to indicate, in any way, that we forgo or will not assert, to the fullest extent under applicable

law, our rights or the rights of the applicable licensors to these trademarks, trade names and service marks. All trademarks, trade names

and service marks appearing in this prospectus are the property of their respective owners. We do not intend our use or display of other

parties’ trademarks, trade names or service marks to imply, and such use or display should not be construed to imply, a relationship

with, or endorsement or sponsorship of us by, these other parties.

THIS

PROSPECTUS MAY NOT BE USED TO OFFER AND SELL SECURITIES UNLESS IT IS ACCOMPANIED BY A PROSPECTUS SUPPLEMENT.

WHERE

YOU CAN FIND MORE INFORMATION

We

file reports, proxy statements and other information with the SEC. The SEC maintains a web site that contains reports, proxy and information

statements and other information about issuers, such as us, who file electronically with the SEC. The address of that website is http://www.sec.gov.

Our

web site address is www.eastsidedistilling.com. The information on our web site, however, is not, and should not be deemed to

be, a part of this prospectus.

This

prospectus and any prospectus supplement are part of a registration statement that we filed with the SEC and do not contain all of the

information in the registration statement. The full registration statement may be obtained from the SEC or us, as provided below. Documents

establishing the terms of the offered securities are or may be filed as exhibits to the registration statement or documents incorporated

by reference in the registration statement. Statements in this prospectus or any prospectus supplement about these documents are summaries

and each statement is qualified in all respects by reference to the document to which it refers. You should refer to the actual documents

for a more complete description of the relevant matters. You may inspect a copy of the registration statement through the SEC’s

website, as provided above.

INCORPORATION

OF CERTAIN INFORMATION BY REFERENCE

The

SEC’s rules allow us to “incorporate by reference” information into this prospectus, which means that we can disclose

important information to you by referring you to another document filed separately with the SEC. The information incorporated by reference

is deemed to be part of this prospectus, and subsequent information that we file with the SEC will automatically update and supersede

that information. Any statement contained in this prospectus or a previously filed document incorporated by reference will be deemed

to be modified or superseded for purposes of this prospectus to the extent that a statement contained in this prospectus or a subsequently

filed document incorporated by reference modifies or replaces that statement.

This

prospectus and any accompanying prospectus supplement incorporate by reference the documents set forth below that have previously been

filed with the SEC (other than Current Reports or portions thereof furnished under Item 2.02 or Item 7.01 of Form 8–K):

| |

● |

the

description of our common stock contained in our registration statement on Form 8-A filed with the SEC on August 8, 2017, including

any amendments or reports filed for the purposes of updating this description; |

| |

|

|

| |

● |

our

Annual Report on Form 10-K for the year ended December 31, 2020 filed with the SEC on March 31, 2021, and Amendment No. 1 to our

Annual Report on Form 10-K for the year ended December 31, 2020 filed with the SEC on April 30, 2021; |

| |

|

|

| |

● |

our

Quarterly Report on Form 10-Q for the quarter ended March 31, 2021 filed with the SEC on May 13, 2021, and our Quarterly Report on

Form 10-Q for the quarter ended June 30, 2021 filed with the SEC on August 12, 2021; and |

| |

|

|

| |

● |

our

Current Reports on Form 8-K filed with the SEC on January 22, 2021, February 8, 2021 (except for Item 7.01 of such report, which

shall not be deemed incorporated by reference herein), February 16, 2021(except for Item 7.01 of such report, which shall not be

deemed incorporated by reference herein), February 17, 2021 (except for Item 7.01 of such report, which shall not be deemed incorporated

by reference herein), March 26, 2021, April 23, 2021(except for Item 7.01 of such report, which shall not be deemed incorporated

by reference herein), May 18, 2021, August 5, 2021 (except for Item 7.01 of such report, which shall not be deemed incorporated by

reference herein), August 16, 2021 (except for Item 7.01 of such report, which shall not be deemed incorporated by reference herein),

and August 20, 2021. |

All

reports and other documents we subsequently file pursuant to Section 13(a), 13(c), 14 or 15(d) of the Securities Exchange Act of 1934,

as amended, which we refer to as the “Exchange Act” in this prospectus, prior to the termination of this offering, including

all such documents we may file with the SEC after the date of the initial registration statement and prior to the effectiveness of the

registration statement, but excluding any information furnished to, rather than filed with, the SEC, will also be incorporated by reference

into this prospectus and deemed to be part of this prospectus from the date of the filing of such reports and documents.

You

may obtain a free copy of any of the filings that are incorporated by reference in this prospectus by writing or by telephoning us at

the following address or telephone number:

Eastside

Distilling, Inc.

8911

NE Marx Drive, Suite A2

Portland,

Oregon 97220

971-888-4264

Attn:

Amy Brassard

Exhibits

to the filings will not be sent, however, unless those exhibits have specifically been incorporated by reference in this prospectus or

any accompanying prospectus supplement.

Any

statement contained in a document incorporated or deemed to be incorporated by reference in this prospectus will be deemed modified,

superseded or replaced for purposes of this prospectus to the extent that a statement contained in this prospectus or in any subsequently

filed document that also is or is deemed to be incorporated by reference in this prospectus modifies, supersedes or replaces such statement.

Any statement so modified, superseded or replaced, will not be deemed, except as so modified, superseded or replaced, to constitute a

part of this prospectus.

DISCLOSURE

REGARDING FORWARD-LOOKING STATEMENTS

This

prospectus and the documents incorporated by reference into this prospectus contain certain “forward-looking statements”

within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995. The forward-looking

statements describe our expectations for the future, and are generally preceded by words indicating anticipation or speculation. Such

statements are subject to a multitude of risks and uncertainties that could cause future circumstances, events or results to differ materially

from those projected in the forward-looking statements. Risks and uncertainties that may cause actual results to differ from our expectations

include, but are not limited to, the Company’s ability to execute its business model and strategic plan, the Company’s ability

to obtain capital, and the Company’s ability to withstand competitive pressures. Detailed discussion of the risks that may interfere

with our plans can be found in the Risk Factors section of the Company’s annual report on Form 10-K for the year ended December

31, 2020, which is available on our website as well as on the SEC’s EDGAR website.

summary

As

used in this prospectus, the terms “we,” “our” and “us” refers to Eastside Distilling, Inc. and its

subsidiaries.

Business

Overview

Eastside

Distilling, Inc. manufactures, acquires, blends, bottles, imports, markets and sells a wide variety of alcoholic beverages under recognized

brands. We employ 74 people in the United States.

Our

brands span several alcoholic beverage categories, including whiskey, vodka, gin, rum, tequila and Ready-to-Drink (“RTD”).

We sell our products on a wholesale basis to distributors in open states and brokers in control states. We also operate a mobile craft

canning and bottling business (“Craft C+B”) that primarily services the craft beer and craft cider industries. Craft C+B

operates 13 mobile lines in Seattle, Washington; Portland, Oregon; and Denver, Colorado.

The

impact of the COVID-19 pandemic had a significant effect on each business unit. Craft Canning revenue has grown due to the incremental

demand for packaging stimulated by the shift in on-premise beer sales from kegs to cans. Revenue from the spirits portfolio has decreased

due to mandated lockdowns and other related restrictions, including a decrease in sales volume in on-premise accounts.

Principal

Spirits Brands and Products

| |

● |

Hue-Hue

(pronounced “way-way”) Coffee Rum – cold-brewed free-trade, single-origin Arabica coffee beans grown at the

Finca El Paternal Estate in Huehuetenango, Guatemala are sourced and then lightly roasted through Portland Roasting Company. The

concentrated brew is blended with premium silver rum and a trace amount of Demerara sugar, giving our Hue-Hue a natural, deep, smooth

richness. |

| |

|

|

| |

● |

Azuñia

Tequila – estate-crafted, smooth, clean craft tequila with authentic flavor from the local terroir. It is the exclusive

export of Agaveros Unidos de Amatitán and the second generation, family-owned-and-operated Rancho Miravalle estate, which

has created tequila for over 20 years. Made with 100% pure Weber Blue Agave grown in dedicated fields of the Tequila Valley, it is

harvested by hand and roasted in traditional clay hornos, then finished with a natural, open-air fermentation process and bottled

on-site in small batches using a consistent process to deliver field-to-bottle quality. |

| |

● |

Portland

Potato Vodka – Portland’s award-winning premium craft vodka. The key to producing our vodka is to distill it four

times. While most vodka is made from grain used in whiskey, we use potatoes and natural spring water sourced from the state of Oregon. |

| |

|

|

| |

● |

Burnside

Whiskey –We source the best ingredients available to produce Burnside Whiskey. We develop each blend using the various

qualities of Quercus Garryana, the native Oregon Oak. |

| |

|

|

| |

● |

Eastside

Brands – We make the unique by blending the unusual. These are high-quality, craft-inspired, artisanal spirits, produced

in limited editions. Each Eastside-branded product carries its own peculiar balance of age and innovation, craftsmanship and curiosity,

creativity and restraint. |

Principal

Services Provided by Craft Canning and Bottling

Canning

| |

● |

Flexible

packaging options in multiple sizes |

| |

● |

Nitrogen

dosing: specialized equipment allowing for packaging of still products in addition to carbonated beverages |

| |

● |

Velcorin:

specialized equipment that supports microbial control |

| |

● |

Label

application capabilities |

| |

● |

Mobility

packaging for clients at their production facilities |

| |

● |

Full-service

packaging provider |

Bottling

| |

● |

Supplies

all needed packaging, and has the ability to package in two primary bottle sizes |

| |

● |

Specialized

packaging and quality control equipment |

Eastside

Distilling is unique in several specific areas: (1) we do not function as a traditional craft distillery with store fronts relying on

local sales; (2) we are diversified, with significant revenue streams from both our craft spirits division and from our canning and bottling

division, and (3) we have a diversified portfolio of spirits brands. We are similar to other craft distillers in that (1) we have concentrated

local volume, (2) we produce small batches and remain within the volume definition of “Craft”, and (3) our brands achieve

success through differentiation, discovery and distribution.

The

U.S. spirits marketplace is occupied by large multi-national conglomerates with substantially more resources than Eastside Distilling.

However, we can use our small size to be fast, focused and flexible in our strategy. Our underlying strength is our ability to scale

operations while maintaining customer loyalty. If we were to attempt to compete with the biggest brands in the most expensive venues,

we would most likely fail for want of the necessary underlying brand equity.

We

will seek to utilize our public company stature to our advantage and position our spirits portfolio as a leading tier 2 spirits provider

that develops brands, expands geographic presence and positions for either a sale to the tier 1 suppliers or continued ownership with

growth in revenue and cash flow. At the same time, we will look to grow, and vertically integrate, our Craft Canning portfolio.

Available

Information

Our

executive offices are located at 8911 NE Marx Drive, Suite A2, Portland, Oregon 97220. Our telephone number is (971) 888-4264 and our

internet address is www.eastsidedistilling.com. The information contained on our website

is not incorporated by reference into this prospectus, and you should not consider any information contained on, or that can be accessed

through, our website as part of this prospectus or in deciding whether to purchase our securities. Our common stock is listed on the

Nasdaq Capital Market under the symbol “EAST”.

RISK

FACTORS

Investment

in any securities offered pursuant to this prospectus and the applicable prospectus supplement involves risks. Before investing in any

of our securities, you should carefully consider the risks, uncertainties and assumptions discussed under Item 1A, “Risk Factors,”

in our Annual Report on Form 10-K for the fiscal year ended December 31, 2020, which is incorporated herein by reference. You should

also carefully consider the risk factors and other information contained in the applicable prospectus supplement and any applicable free

writing prospectus before acquiring any of such securities. The realization of any of these risks might cause you to lose all or part

of your investment in the offered securities.

USE

OF PROCEEDS

We

will retain broad discretion over the use of the net proceeds from the sale of the securities offered hereby. Unless otherwise indicated

in any prospectus supplement, we intend to use the net proceeds from the sale of securities under this prospectus for general corporate

purposes, which may include research and development, capital expenditures, working capital and general and administrative expenses.

We may also use a portion of the net proceeds to acquire or invest in businesses and products that are complementary to our own, although

we have no current plans, commitments or agreements with respect to any acquisitions as of the date of this prospectus.

PLAN

OF DISTRIBUTION

We

may sell the securities covered by this prospectus to one or more underwriters for public offering and sale by them, and may also sell

the securities to investors directly or through agents. We will name any underwriter or agent involved in the offer and sale of securities

in the applicable prospectus supplement. We have reserved the right to sell or exchange securities directly to investors on our own behalf

in jurisdictions where we are authorized to do so. We may distribute the securities from time to time in one or more transactions:

| |

● |

at

a fixed price or prices, which may be changed; |

| |

● |

at

market prices prevailing at the time of sale; |

| |

● |

at

prices related to such prevailing market prices; or |

We

may solicit directly offers to purchase the securities being offered by this prospectus. We may also designate agents to solicit offers

to purchase the securities from time to time. We will name in a prospectus supplement any agent involved in the offer or sale of our

securities. Unless otherwise indicated in a prospectus supplement, an agent will be acting on a best efforts basis, and a dealer will

purchase securities as a principal for resale at varying prices to be determined by the dealer.

If

we utilize an underwriter in the sale of the securities being offered by this prospectus, we will execute an underwriting agreement with

the underwriter at the time of sale and we will provide the name of any underwriter in the prospectus supplement that the underwriter

will use to make resales of the securities to the public. In connection with the sale of the securities, we, or the purchasers of securities

for whom the underwriter may act as agent, may compensate the underwriter in the form of underwriting discounts or commissions. The underwriter

may sell the securities to or through dealers, and those dealers may receive compensation in the form of discounts, concessions or commissions

from the underwriters or commissions from the purchasers for whom they may act as agent.

We

will describe in the applicable prospectus supplement any compensation we pay to underwriters, dealers or agents in connection with the

offering of the securities, and any discounts, concessions or commissions allowed by underwriters to participating dealers. Underwriters,

dealers and agents participating in the distribution of the securities may be deemed to be underwriters within the meaning of the Securities

Act, and any discounts and commissions received by them and any profit realized by them on resale of the securities may be deemed to

be underwriting discounts and commissions. We may enter into agreements to indemnify underwriters, dealers and agents against civil liabilities,

including liabilities under the Securities Act, and to reimburse them for certain expenses. We may grant underwriters who participate

in the distribution of our securities under this prospectus an option to purchase additional securities to cover any over-allotments

in connection with the distribution.

Any

common stock that we offer under this prospectus will be listed on the NASDAQ Capital Market, but any other securities may or may not

be listed on a national securities exchange. To facilitate the offering of securities, certain persons participating in the offering

may engage in transactions that stabilize, maintain or otherwise affect the price of the securities. This may include over-allotments

or short sales of the securities, which involves the sale by persons participating in the offering of more securities than we sold to

them. In these circumstances, these persons would cover such over-allotments or short positions by making purchases in the open market

or by exercising their over-allotment option. In addition, these persons may stabilize or maintain the price of the securities by bidding

for or purchasing securities in the open market or by imposing penalty bids, whereby selling concessions allowed to dealers participating

in the offering may be reclaimed if securities sold by them are repurchased in connection with stabilization transactions. The effect

of these transactions may be to stabilize or maintain the market price of the securities at a level above that which might otherwise

prevail in the open market. These transactions may be discontinued at any time.

We

may enter into derivative transactions with third parties, or sell securities not covered by this prospectus to third parties in privately

negotiated transactions. If the applicable prospectus supplement so indicates, in connection with those derivatives, the third parties

may sell securities covered by this prospectus and the applicable prospectus supplement, including short sale transactions. If so, the

third party may use securities pledged by us or borrowed from us or others to settle those sales or to close out any related open borrowings

of stock, and they may use securities received from us in settlement of those derivatives to close out any related open borrowings of

stock. The third party in these sale transactions will be an underwriter and will be identified in the applicable prospectus supplement

or in a post-effective amendment to the registration statement relating to this prospectus. In addition, we may otherwise loan or pledge

securities to a financial institution or other third party that in turn may sell the securities short using this prospectus. The financial

institution or other third party may transfer its economic short position to investors in our securities or in connection with a concurrent

offering of other securities.

To

the extent required pursuant to Rule 424(b) of the Securities Act, or other applicable rule, we will file a prospectus supplement to

describe the terms of any offering of our securities covered by this prospectus. The prospectus supplement will disclose:

| |

● |

The

terms of the offer; |

| |

● |

The

names of any underwriters, including any managing underwriters, as well as any dealers or agents; |

| |

● |

The

purchase price of the securities to be sold by us; |

| |

● |

Any

delayed delivery arrangements; |

| |

● |

Any

underwriting discounts, commissions or other items constituting underwriters’ compensation and any commissions paid to agents;

and |

| |

● |

Other

facts material to the transaction. |

We

will bear substantially all of the costs, expenses and fees in connection with the registration of our securities under this prospectus.

The underwriters, dealers and agents may engage in transactions with us, or perform services for us, in the ordinary course of business

for which they will receive compensation.

DESCRIPTION

OF CAPITAL STOCK

General

As

of the date of this prospectus, our authorized capital stock consists of 135,000,000 shares. Those shares consist of 35,000,000 shares

of common stock, par value of $0.0001 per share, and 100,000,000 shares of preferred stock, par value of $0.0001 per share. The only

equity securities currently outstanding are 13,317,577 shares of common stock. Our common stock is traded on the NASDAQ Capital Market

under the symbol “EAST”.

The

following description summarizes the material terms of our capital stock. This summary is, however, subject to the provisions of our

certificate of incorporation and bylaws. For greater detail about our capital stock, please refer to our certificate of incorporation

and bylaws.

Common

Stock

Each

holder of common stock is entitled to one vote for each share held on all matters to be voted upon by the stockholders. At any meeting

of the stockholders, a quorum as to any matter shall consist of a majority of the votes entitled to be cast on the matter, except where

a larger quorum is required by law.

Holders

of our common stock are entitled to receive dividends declared by our board of directors out of funds legally available for the payment

of dividends, subject to the rights, if any, of preferred stockholders. In the event of our liquidation, dissolution or winding up, holders

of common stock are entitled to share ratably in all of our assets remaining after we pay our liabilities and distribute the liquidation

preference of any then outstanding preferred stock. The rights, preferences and privileges of holders of common stock are subject to,

and may be adversely affected by, the rights of holders of any series of preferred stock that we may designate and issue in the future.

Holders of common stock have no preemptive or other subscription or conversion rights. There are no redemption or sinking fund provisions

applicable to the common stock.

The

transfer agent and registrar for our common stock is Transfer Online, Inc. 512 SE Salmon Street, Portland, Oregon 97214 (Telephone: (503)

227-2950).

Preferred

Stock

The

board of directors has the authority, without stockholder approval, subject to limitations prescribed by law, to provide for the issuance

of the shares of preferred stock in one or more series, and by filing a certificate pursuant to the applicable law of the State of Nevada,

to establish from time to time the number of shares to be included in each such series, and to fix the designation, powers, preferences

and rights of the shares of each series and the qualifications, limitations or restrictions, including, but not limited to, the following:

| |

● |

the

number of shares constituting that series; |

| |

|

|

| |

● |

dividend

rights and rates; |

| |

|

|

| |

● |

voting

rights; |

| |

|

|

| |

● |

conversion

terms; |

| |

|

|

| |

● |

rights

and terms of redemption (including sinking fund provisions); and |

| |

|

|

| |

● |

rights

of the series in the event of liquidation, dissolution or winding up. |

All

shares of preferred stock offered hereby will, when issued, be fully paid and nonassessable and will not have any preemptive or similar

rights. Our board of directors could authorize the issuance of shares of preferred stock with terms and conditions that could have the

effect of discouraging a takeover or other transaction that might involve a premium price for holders of the shares or which holders

might believe to be in their best interests.

We

will set forth in a prospectus supplement relating to the series of preferred stock being offered the following items:

| |

● |

the

title and stated value of the preferred stock; |

| |

● |

the

number of shares of the preferred stock offered, the liquidation preference per share and the offering price of the preferred stock; |

| |

● |

the