false

0001534708

0001534708

2024-11-22

2024-11-22

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

PURSUANT

TO SECTION 13 OR 15(d) OF THE

SECURITIES

EXCHANGE ACT OF 1934

Date

of Report (Date of earliest event reported): November 22, 2024

EASTSIDE

DISTILLING, INC.

(Exact

name of registrant as specified in its charter)

| Nevada |

|

001-38182 |

|

20-3937596 |

(State

or other jurisdiction

of

incorporation) |

|

(Commission

File

Number) |

|

(IRS

Employer

Identification

No.) |

755

Main Street, Building 4, Suite 3

Monroe,

Connecticut 06468

(Address

of principal executive offices)

(Zip

Code)

Registrant’s

telephone number, including area code: (484) 800-9154

Securities

registered pursuant to Section 12(b) of the Act:

| Common

Stock, $0.0001 par value |

|

EAST |

|

The

Nasdaq Stock Market LLC |

| (Title

of Each Class) |

|

(Trading

Symbol) |

|

(Name

of Each Exchange on Which Registered) |

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (CFR §230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (CFR §240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item

1.01. Entry into a Material Definitive Agreement.

On

November 22 and November 25, 2024, Eastside Distilling, Inc. (“Eastside”) entered into Securities Purchase Agreements (the

“Purchase Agreements”) with four accredited investors (the “Investors”) for the sale by Eastside of units of

securities consisting of a total of 686,273 shares (the “Shares”) of Eastside’s common stock, par value $0.0001 per

share, and Redeemable Common Stock Purchase Warrants to purchase a total of 343,313 shares of common stock (the “Warrants”)

in a registered direct offering (the “Offering”) at a purchase price of $510 for each “Unit” consisting of 1,000

Shares and a Warrant to purchase 500 Shares. The gross proceeds to Eastside from the Offering were $350,000, before deducting the expenses

of the Offering.

Each

Warrant is exercisable to purchase Shares at a price per share of $0.65 (as adjusted equitably from time to time in accordance with the

terms thereof). In lieu of making the cash payment otherwise contemplated to be made upon exercise of the Warrant, the Holder may elect

instead to receive upon such exercise (either in whole or in part) the net number of shares of common stock determined according to a

cashless exercise formula set forth in the Warrant. The Warrants may be exercised after the shareholders of Eastside approve an increase

in the authorized shares of Eastside common stock (the “Shareholder Approval”). The Holder’s ability to exercise a

Warrant will terminate on the later of (a) the third anniversary of the issue date for the Warrant or (b) the first anniversary of the

Shareholder Approval. The holder of a Warrant is prohibited from exercising such warrants to the extent that such exercise would result

in the number of shares of common stock beneficially owned by such holder and its affiliates exceeding 4.99% or 9.99% (at the election

of the Investor) of the total number of shares of common stock outstanding immediately after giving effect to the exercise. If the market

price of Eastside common stock exceeds 175% of the Warrant exercise price for a period of 20 consecutive trading days, Eastside Distilling

may call the Warrants for redemption at a nominal sum in twenty days, during which period the Holders may exercise the Warrants.

The

Offering of the Units was made pursuant to a shelf registration statement on Form S-3 (File No. 333-282095) (the “Registration

Statement”), which was declared effective by the Securities and Exchange Commission on October 2, 2024.

Item 9.01. Financial Statements and Exhibits.

(d)

Exhibits

| Exhibit |

|

Description |

| 4.1 |

Form of Warrant |

| 104 |

Cover

page interactive data file (embedded within the iXBRL document) |

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

Date:

November 26, 2024

| |

EASTSIDE

DISTILLING, INC. |

| |

|

|

| |

By:

|

/s/

Geoffrey Gwin |

| |

|

Geoffrey

Gwin |

| |

|

Chief

Executive Officer |

Exhibit

4.1

REDEEMABLE

COMMON STOCK PURCHASE WARRANT

EASTSIDE

DISTILLING, inc.

| Warrant

Shares: _______ |

Issue

Date: November 22, 2024 |

Initial

Exercise Price: $0.65

THIS

REDEEMABLE COMMON STOCK PURCHASE WARRANT (the “Warrant”) certifies that, for value received, _____________ or its

assigns (the “Holder”) is entitled, upon the terms and subject to the limitations on exercise and the conditions hereinafter

set forth, at any time on or after the Shareholder Approval Date (defined below) and on or prior to the later of (a) the close of business

on the third anniversary of the Issue Date or (b) the first anniversary of the Shareholder Approval Date (the “Termination Date”)

but not thereafter, to subscribe for and purchase from Eastside Distilling, Inc., a Nevada corporation (the “Company”),

up to the number of Warrant Shares recited above. The purchase price of one share of Common Stock under this Warrant shall be equal to

the Exercise Price recited above, as adjusted pursuant to Section 2 below. Capitalized words and phrases have the meanings set forth

in that certain Securities Purchase Agreement dated as of the Issue Date by and between the Company and the Holder.

Section

1. Exercise.

a)

Shareholder Approval Date. The Company shall provide each shareholder entitled to vote at a special meeting of shareholders of

the Company (the “Shareholder Meeting”), which shall be promptly called and held not later than 150 days after the

date of Issue of this Warrant (the “Shareholder Meeting Deadline”), a proxy statement. The proxy statement shall solicit

each of the Company’s shareholder’s affirmative vote at the Shareholder Meeting for approval of a resolution providing for

an increase in the Company’s authorized Common Stock to a number that is no less than 130% of the number sufficient to permit the

exercise of this and the other Warrants of this class as well as the conversion or exercise, as applicable, of all other outstanding

derivative securities issued by the Company (such affirmative approval being referred to herein as the “Shareholder Approval”,

and the date such Shareholder Approval is obtained, the “Shareholder Approval Date”), and the Company shall use its

reasonable best efforts to solicit its shareholders’ approval of such resolution and to cause the Board of Directors of the Company

to recommend to the shareholders that they approve such resolution. The Company shall be obligated to seek to obtain the Shareholder

Approval by the Shareholder Meeting Deadline. If, despite the Company’s reasonable best efforts the Shareholder Approval is not

obtained on or prior to the Shareholder Meeting Deadline, the Company shall cause an additional Shareholder Meeting to be held on or

prior to 240 days after the date of issue of this Warrant. If, despite the Company’s reasonable best efforts the Shareholder Approval

is not obtained after such subsequent shareholder meetings, the Company shall cause an additional Shareholder Meeting to be held semi-annually

thereafter until such Shareholder Approval is obtained.

b)

Exercise for Cash. Exercise of the purchase rights represented by this Warrant may be made, in whole or in part, at any time or

times on or after the Issue Date and on or before the Termination Date by delivery to the Company (or such other office or agency of

the Company as it may designate by notice in writing to the registered Holder at the address of the Holder appearing on the books of

the Company) of:

| |

i. |

a

duly executed facsimile copy (or e-mail attachment) of the Notice of Exercise in the form annexed hereto; and |

| |

ii. |

within

one (1) Business Day following the date of exercise as aforesaid, the aggregate Exercise Price for the shares specified in the applicable

Notice of Exercise by wire transfer or cashier’s check drawn on a United States bank unless the cashless exercise procedure

specified in Section 1(c) below is specified in the applicable Notice of Exercise. |

Notwithstanding

anything herein to the contrary, the Holder shall not be required to physically surrender this Warrant to the Company until the Holder

has purchased all of the Warrant Shares available hereunder and the Warrant has been exercised in full, in which case, the Holder shall

surrender this Warrant to the Company for cancellation within three (3) Business Days of the date the final Notice of Exercise is delivered

to the Company. The Holder and the Company shall maintain records showing the number of Warrant Shares purchased and the date of such

purchases. The Company shall deliver any objection to any Notice of Exercise within two (2) Business Days of receipt of such notice.

The Holder and any assignee, by acceptance of this Warrant, acknowledge and agree that, by reason of the provisions of this paragraph,

following the purchase of a portion of the Warrant Shares hereunder, the number of Warrant Shares available for purchase hereunder at

any given time may be less than the amount stated on the face hereof.

c)

Cashless Exercise. If at the time of exercise hereof, the Common Stock is listed for trading on a public market, then this Warrant

may also be exercised, in whole or in part, at such time by means of a “cashless exercise” in which the Holder shall be entitled

to receive a number of Warrant Shares equal to the quotient obtained by dividing [(A-B) (X)] by (A), where:

| |

(A)

= |

the

VWAP on the Business Day immediately preceding the date on which Holder elects to exercise this Warrant by means of a “cashless

exercise,” as set forth in the applicable Notice of Exercise; |

| |

|

|

| |

(B)

= |

the

Exercise Price of this Warrant, as adjusted hereunder; and |

| |

|

|

| |

(X)

= |

the

number of Warrant Shares that would be issuable upon exercise of this Warrant in accordance with the terms of this Warrant if such

exercise were by means of a cash exercise rather than a cashless exercise. |

d)

Mechanics of Exercise.

i.

Delivery of Warrant Shares Upon Exercise. The Company shall cause the Warrant Shares purchased hereunder to be transmitted by

the Transfer Agent to the Holder by delivery of certificates registered in the Company’s share register in the name of the Holder

or its designee, for the number of Warrant Shares to which the Holder is entitled pursuant to such exercise to the address specified

by the Holder in the Notice of Exercise by the date that is three (3) Business Day after the delivery to the Company of the Notice of

Exercise (such date, the “Warrant Share Delivery Date”). The Warrant Shares shall be deemed to have been issued, and

Holder or any other person so designated to be named therein shall be deemed to have become a holder of record of such shares for all

purposes, as of the date the Warrant has been exercised, with payment to the Company of the Exercise Price (or by cashless exercise,

if permitted) and all taxes required to be paid by the Holder, if any, having been paid.

ii.

Rescission Rights. If the Company fails to cause the Transfer Agent to transmit to the Holder the Warrant Shares pursuant to Section

1(d)(i) by the Warrant Share Delivery Date, then the Holder will have the right to rescind such exercise.

iii.

No Fractional Shares or Scrip. No fractional shares or scrip representing fractional shares shall be issued upon the exercise

of this Warrant. As to any fraction of a share which the Holder would otherwise be entitled to purchase upon such exercise, the Company

shall, at its election, either pay a cash adjustment in respect of such final fraction in an amount equal to such fraction multiplied

by the Exercise Price or round up to the next whole share.

iv.

Charges, Taxes and Expenses. Issuance of Warrant Shares shall be made without charge to the Holder for any issue or transfer tax

or other incidental expense in respect of the issuance of such Warrant Shares, all of which taxes and expenses shall be paid by the Company,

and such Warrant Shares shall be issued in the name of the Holder or in such name or names as may be directed by the Holder; provided,

however, that in the event Warrant Shares are to be issued in a name other than the name of the Holder, this Warrant when surrendered

for exercise shall be accompanied by the Assignment Form attached hereto duly executed by the Holder and the Company may require, as

a condition thereto, delivery of an opinion of counsel satisfactory to the Company regarding compliance with applicable laws regarding

transfer of securities. The Company shall pay all Transfer Agent fees required for processing of any Notice of Exercise.

e)

Holder’s Exercise Limitations. The Company shall not effect any exercise of this Warrant, and a Holder shall not have the

right to exercise any portion of this Warrant, pursuant to Section 1 or otherwise, to the extent that after giving effect to such issuance

after exercise as set forth on the applicable Notice of Exercise, the Holder (together with the Holder’s Affiliates, and any other

Persons acting as a group together with the Holder or any of the Holder’s Affiliates (such Persons, “Attribution Parties”)),

would beneficially own in excess of the Beneficial Ownership Limitation (as defined below). For purposes of the foregoing sentence, the

number of Common Stock beneficially owned by the Holder and its Affiliates and Attribution Parties shall include the number of Common

Stock issuable upon exercise of this Warrant with respect to which such determination is being made, but shall exclude the number of

Common Stock which would be issuable upon (i) exercise of the remaining, non-exercised portion of this Warrant beneficially owned by

the Holder or any of its Affiliates or Attribution Parties and (ii) exercise or conversion of the unexercised or non-converted portion

of any other securities of the Company (including, without limitation, any other Common Stock Equivalents) subject to a limitation on

conversion or exercise analogous to the limitation contained herein beneficially owned by the Holder or any of its Affiliates or Attribution

Parties. Except as set forth in the preceding sentence, for purposes of this Section 1(e), beneficial ownership shall be calculated in

accordance with Section 13(d) of the Exchange Act and the rules and regulations promulgated thereunder, it being acknowledged by the

Holder that the Company is not representing to the Holder that such calculation is in compliance with Section 13(d) of the Exchange Act

and the Holder is solely responsible for any schedules required to be filed in accordance therewith. To the extent that the limitation

contained in this Section 1(e) applies, the determination of whether this Warrant is exercisable (in relation to other securities owned

by the Holder together with any Affiliates and Attribution Parties) and of which portion of this Warrant is exercisable shall be in the

sole discretion of the Holder, and the submission of a Notice of Exercise shall be deemed to be the Holder’s determination of whether

this Warrant is exercisable (in relation to other securities owned by the Holder together with any Affiliates and Attribution Parties)

and of which portion of this Warrant is exercisable, in each case subject to the Beneficial Ownership Limitation, and the Company shall

have no obligation to verify or confirm the accuracy of such determination. In addition, a determination as to any group status as contemplated

above shall be determined in accordance with Section 13(d) of the Exchange Act and the rules and regulations promulgated thereunder.

For purposes of this Section 1(e), in determining the number of outstanding Common Stock, a Holder may rely on the number of outstanding

Common Stock as reflected in (A) the Company’s most recent periodic or annual report filed with the Commission, as the case may

be, (B) a more recent public announcement by the Company or (C) a more recent written notice by the Company or the Transfer Agent setting

forth the number of Common Stock outstanding. Upon the written or oral request of a Holder, the Company shall within one Trading Day

confirm orally and in writing to the Holder the number of Common Stock then outstanding. In any case, the number of outstanding Common

Stock shall be determined after giving effect to the conversion or exercise of securities of the Company, including this Warrant, by

the Holder or its Affiliates or Attribution Parties since the date as of which such number of outstanding Common Stock was reported.

The “Beneficial Ownership Limitation” shall be 4.99% of the number of shares of the Common Stock outstanding immediately

after giving effect to the issuance of Common Stock issuable upon exercise of this Warrant. The Holder, upon notice to the Company, may

increase or decrease the Beneficial Ownership Limitation provisions of this Section 1(e), provided that the Beneficial Ownership Limitation

in no event exceeds 9.99% of the number of shares of the Common Stock outstanding immediately after giving effect to the issuance of

Common Stock upon exercise of this Warrant held by the Holder and the provisions of this Section 1(e) shall continue to apply. Any increase

in the Beneficial Ownership Limitation will not be effective until the 61st day after such notice is delivered to the Company.

The provisions of this Section 1(e) shall be construed and implemented in a manner otherwise than in strict conformity with the terms

of this Section 1(e) to correct this paragraph (or any portion hereof) which may be defective or inconsistent with the intended Beneficial

Ownership Limitation herein contained or to make changes or supplements necessary or desirable to properly give effect to such limitation.

The limitations contained in this paragraph shall apply to a successor holder of this Warrant.

Section

2. Certain Adjustments.

a)

Stock Dividends and Splits. If the Company, at any time while this Warrant is outstanding: (i) pays a stock dividend or otherwise

makes a distribution or distributions on shares of its Common Stock or any other equity or equity equivalent securities payable in shares

of Common Stock (which, for avoidance of doubt, shall not include any shares of Common Stock issued by the Company upon exercise of this

Warrant), (ii) subdivides outstanding shares of Common Stock into a larger number of shares, (iii) combines (including by way of reverse

stock split) outstanding shares of Common Stock into a smaller number of shares, or (iv) issues by reclassification of shares of the

Common Stock any shares of capital stock of the Company, then in each case the Exercise Price shall be multiplied by a fraction of which

the numerator shall be the number of shares of Common Stock (excluding treasury shares, if any) outstanding immediately before such event

and of which the denominator shall be the number of shares of Common Stock outstanding immediately after such event, and the number of

shares issuable upon exercise of this Warrant shall be proportionately adjusted such that the aggregate Exercise Price of this Warrant

shall remain unchanged. Any adjustment made pursuant to this Section 2(a) shall become effective immediately after the record date for

the determination of stockholders entitled to receive such dividend or distribution and shall become effective immediately after the

effective date in the case of a subdivision, combination or re-classification.

b)

Fundamental Transaction. If, at any time while this Warrant is outstanding, (i) the Company, directly or indirectly, in one or

more related transactions effects any merger or consolidation of the Company with or into another entity, (ii) the Company, directly

or indirectly, effects any sale, lease, license, assignment, transfer, conveyance or other disposition of all or substantially all of

its assets in one or a series of related transactions, (iii) any, direct or indirect, purchase offer, tender offer or exchange offer

(whether by the Company or another Person) is completed pursuant to which holders of Common Stock are permitted to sell, tender or exchange

their shares for other securities, cash or property and has been accepted by the holders of 50% or more of the outstanding Common Stock,

(iv) the Company, directly or indirectly, in one or more related transactions effects any reclassification, reorganization or recapitalization

of the Common Stock or any compulsory share exchange pursuant to which the Common Stock is effectively converted into or exchanged for

other securities, cash or property, or (v) the Company, directly or indirectly, in one or more related transactions consummates a stock

or share purchase agreement or other business combination (including, without limitation, a reorganization, recapitalization, spin-off

or scheme of arrangement) with another Person or group of Persons whereby such other Person or group acquires more than 50% of the outstanding

shares of Common Stock (not including any shares of Common Stock held by the other Person or other Persons making or party to, or associated

or affiliated with the other Persons making or party to, such stock or share purchase agreement or other business combination) (each

a “Fundamental Transaction”), then, upon any subsequent exercise of this Warrant, the Holder shall have the right

to receive, for each Warrant Share that would have been issuable upon such exercise immediately prior to the occurrence of such Fundamental

Transaction, at the option of the Holder, the number of shares of Common Stock of the successor or acquiring corporation or of the Company,

if it is the surviving corporation, and any additional consideration (the “Alternate Consideration”) receivable as

a result of such Fundamental Transaction by a holder of the number of shares of Common Stock for which this Warrant is exercisable immediately

prior to such Fundamental Transaction. The Company shall cause any successor entity in a Fundamental Transaction in which the Company

is not the survivor (the “Successor Entity”) to assume in writing all of the obligations of the Company under this

Warrant in accordance with the provisions of this Section 2(b) pursuant to written agreements in form and substance reasonably satisfactory

to the Holder and approved by the Holder (without unreasonable delay) prior to such Fundamental Transaction and shall, at the option

of the Holder, deliver to the Holder in exchange for this Warrant a security of the Successor Entity evidenced by a written instrument

substantially similar in form and substance to this Warrant which is exercisable for a corresponding number of shares of capital stock

of such Successor Entity (or its parent entity) equivalent to the shares of Common Stock acquirable and receivable upon exercise of this

Warrant (without regard to any limitations on the exercise of this Warrant) prior to such Fundamental Transaction, and with an exercise

price which applies the exercise price hereunder to such shares of capital stock (but taking into account the relative value of the shares

of Common Stock pursuant to such Fundamental Transaction and the value of such shares of capital stock, such number of shares of capital

stock and such exercise price being for the purpose of protecting the economic value of this Warrant immediately prior to the consummation

of such Fundamental Transaction), and which is reasonably satisfactory in form and substance to the Holder. Upon the occurrence of any

such Fundamental Transaction, the Successor Entity shall succeed to, and be substituted for (so that from and after the date of such

Fundamental Transaction, the provisions of this Warrant and the other Transaction Documents referring to the “Company” shall

refer instead to the Successor Entity), and may exercise every right and power of the Company and shall assume all of the obligations

of the Company under this Warrant and the other Transaction Documents with the same effect as if such Successor Entity had been named

as the Company herein.

c)

Notice to Holder.

i.

Adjustment to Exercise Price. Whenever the Exercise Price is adjusted pursuant to any provision of this Section 2, the Company

shall promptly deliver to the Holder a notice setting forth the Exercise Price after such adjustment and any resulting adjustment to

the number of Warrant Shares and setting forth a brief statement of the facts requiring such adjustment.

ii.

Notice to Allow Exercise by Holder. If (A) the Company shall declare a dividend (or any other distribution in whatever form) on

the Common Stock, (B) the Company shall declare a special nonrecurring cash dividend on or a redemption of the Common Stock, (C) the

Company shall authorize the granting to all holders of the Common Stock rights or warrants to subscribe for or purchase any shares of

capital stock of any class or of any rights, (D) the approval of any stockholders of the Company shall be required in connection with

any reclassification of the Common Stock, any consolidation or merger to which the Company is a party, any sale or transfer of all or

substantially all of the assets of the Company, or any compulsory share exchange whereby the Common Stock is converted into other securities,

cash or property, or (E) the Company shall authorize the voluntary or involuntary dissolution, liquidation or winding up of the affairs

of the Company, then, in each case, the Company shall cause to be mailed to the Holder at its last address as it shall appear upon the

Warrant Register of the Company, at least 20 calendar days prior to the applicable record or effective date hereinafter specified, a

notice stating (x) the date on which a record is to be taken for the purpose of such dividend, distribution, redemption, rights or warrants,

or if a record is not to be taken, the date as of which the holders of the Common Stock of record to be entitled to such dividend, distributions,

redemption, rights or warrants are to be determined or (y) the date on which such reclassification, consolidation, merger, sale, transfer

or share exchange is expected to become effective or close, and the date as of which it is expected that holders of the Common Stock

of record shall be entitled to exchange their shares of the Common Stock for securities, cash or other property deliverable upon such

reclassification, consolidation, merger, sale, transfer or share exchange; provided that the failure to mail such notice or any defect

therein or in the mailing thereof shall not affect the validity of the corporate action required to be specified in such notice.

Section

3. Call for Redemption.

a) For

purposes hereof, a “Trading Market” shall mean a national securities exchange, as defined by the Securities and Exchange

Commission, or the automated quotation system of a registered securities association. For purposes hereof, an “Active Trading

Market” means a Trading Market on which the average daily trading volume for the Company’s Common Stock exceeds Fifty

Thousand Dollars ($50,000).

b)

At any time after the Shareholder Approval Date, the Company may, on twenty (20) days prior written notice (including by electronic transmission),

redeem all outstanding Warrants at a price of one cent ($.01) per Warrant; provided, however, that before the notice of redemption can

be sent, the daily high bid price for the Common Stock on an Active Trading Market must exceed 175% of the Warrant Exercise Price for

twenty (20) consecutive Trading Days ending no more than one (1) day prior to date on which the notice of redemption is sent. On the

date of redemption specified in the notice of redemption, the Company shall send the redemption price by ACH to the account recorded

in the Company’s records for each Warrant Holder then listed on the Warrant Register, and the Warrant registered in the name of

that Holder shall be, by that sending, terminated.

Section

4. Transfer of Warrant.

a)

Transferability. This Warrant and all rights hereunder are transferable, in whole or in part, upon surrender of this Warrant at

the principal office of the Company or its designated agent, together with a written assignment of this Warrant substantially in the

form attached hereto duly executed by the Holder or its agent or attorney and funds sufficient to pay any transfer taxes payable upon

the making of such transfer. The request for assignment shall be accompanied by an opinion of counsel satisfactory to the Company regarding

compliance with applicable laws regarding transfer of securities. Upon such delivery, the Company shall execute and deliver a new Warrant

or Warrants in the name of the assignee or assignees, as applicable, and in the denomination or denominations specified in such instrument

of assignment, and shall issue to the assignor a new Warrant evidencing the portion of this Warrant not so assigned, and this Warrant

shall promptly be cancelled.

b)

Warrant Register. The Company shall register this Warrant, upon records to be maintained by the Company for that purpose (the

“Warrant Register”), in the name of the record Holder hereof from time to time. The Company may deem and treat the

registered Holder of this Warrant as the absolute owner hereof for the purpose of any exercise hereof or any distribution to the Holder,

and for all other purposes, absent actual notice to the contrary.

Section

5. Miscellaneous.

a)

No Rights as Stockholder Until Exercise. This Warrant does not entitle the Holder to any voting rights, dividends or other rights

as a stockholder of the Company prior to the exercise hereof as set forth in Section 1(d)(i), except as expressly set forth in Section

2.

b)

Loss, Theft, Destruction or Mutilation of Warrant. The Company covenants that upon receipt by the Company of evidence reasonably

satisfactory to it of the loss, theft, destruction or mutilation of this Warrant, and in case of loss, theft or destruction, of indemnity

or security reasonably satisfactory to it, and upon surrender and cancellation of such Warrant, if mutilated, the Company will make and

deliver a new Warrant or stock certificate of like tenor and dated as of such cancellation, in lieu of such Warrant or stock certificate.

c)

Jurisdiction and Venue. All questions concerning the construction, validity, enforcement and interpretation of this Warrant shall

be determined in accordance with the provisions of the Securities Purchase Agreement between the Company and the Holder, pursuant to

which the Warrant was issued to the Holder (the “Securities Purchase Agreement”).

d)

Notices. Any notice, request or other document required or permitted to be given or delivered to the Holder by the Company shall

be delivered in accordance with the notice provisions of the Securities Purchase Agreement.

e)

Successors and Assigns. Subject to applicable securities laws, this Warrant and the rights and obligations evidenced hereby shall

inure to the benefit of and be binding upon the successors and permitted assigns of the Company and the successors and permitted assigns

of Holder. The provisions of this Warrant are intended to be for the benefit of any Holder from time to time of this Warrant and shall

be enforceable by the Holder or holder of Warrant Shares.

IN

WITNESS WHEREOF, the Company has caused this Warrant to be executed by its officer thereunto duly authorized as of the date first above

indicated.

| |

EASTSIDE

DISTILLING, inc. |

| |

|

| |

By: |

|

| |

Name: |

Geoffrey

Gwin |

| |

Title: |

Chief

Executive Officer |

NOTICE

OF EXERCISE

To: eastside

distilling, inc.

(1)

The undersigned hereby elects to purchase ________ Warrant Shares of the Company pursuant to the terms of the attached Warrant (only

if exercised in full), and tenders herewith payment of the exercise price in full, together with all applicable transfer taxes, if any.

(2)

Payment shall take the form of (check applicable box):

[ ] in lawful money of the United States; or

[ ] if permitted, the cancellation of such number of Warrant Shares as is necessary, in accordance with the formula set forth in subsection

1(b), to exercise this Warrant with respect to the maximum number of Warrant Shares purchasable pursuant to the cashless exercise procedure

set forth in subsection 1(b).

(3)

Please issue said Warrant Shares in the name of the undersigned or in such other name as is specified below:

_______________________________

[SIGNATURE

OF HOLDER]

Name

of Investing Entity: ________________________________________________________________________

Signature

of Authorized Signatory of Investing Entity: __________________________________________________

Name

of Authorized Signatory: ____________________________________________________________________

Title

of Authorized Signatory: _____________________________________________________________________

Date:

_________________________________________________________________________________________

ASSIGNMENT

FORM

(To

assign the foregoing Warrant, execute this form and supply required information. Do not use this form to purchase shares.)

FOR

VALUE RECEIVED, the foregoing Warrant and all rights evidenced thereby are hereby assigned to

| Name: |

|

| |

(Please

Print) |

| Address: |

|

| |

(Please

Print) |

| Dated:

_______________ __, ______ |

|

| |

|

| Holder’s

Signature:__________________________ |

|

| |

|

| Holder’s

Address: __________________________ |

|

v3.24.3

Cover

|

Nov. 22, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Nov. 22, 2024

|

| Entity File Number |

001-38182

|

| Entity Registrant Name |

EASTSIDE

DISTILLING, INC.

|

| Entity Central Index Key |

0001534708

|

| Entity Tax Identification Number |

20-3937596

|

| Entity Incorporation, State or Country Code |

NV

|

| Entity Address, Address Line One |

755

Main Street

|

| Entity Address, Address Line Two |

Building 4

|

| Entity Address, Address Line Three |

Suite 3

|

| Entity Address, City or Town |

Monroe

|

| Entity Address, State or Province |

CT

|

| Entity Address, Postal Zip Code |

06468

|

| City Area Code |

(484)

|

| Local Phone Number |

800-9154

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Trading Symbol |

EAST

|

| Security Exchange Name |

NASDAQ

|

| Title of 12(g) Security |

Common

Stock, $0.0001 par value

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 3 such as an Office Park

| Name: |

dei_EntityAddressAddressLine3 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(g) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection g

| Name: |

dei_Security12gTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

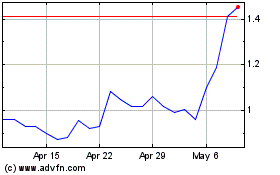

Eastside Distilling (NASDAQ:EAST)

Historical Stock Chart

From Nov 2024 to Dec 2024

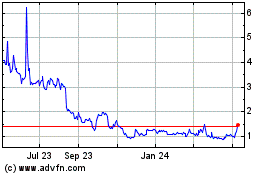

Eastside Distilling (NASDAQ:EAST)

Historical Stock Chart

From Dec 2023 to Dec 2024