false

0000827871

0000827871

2024-09-27

2024-09-27

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE

COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13

or 15(d)

of the Securities Exchange

Act of 1934

Date of Report (Date

of earliest event reported): September 27, 2024

Eagle

Pharmaceuticals, Inc.

(Exact Name of Registrant

as Specified in its Charter)

| Delaware |

001-36306 |

20-8179278 |

| (State

or Other Jurisdiction |

(Commission |

(IRS Employer |

| of Incorporation) |

File Number) |

Identification No.) |

50

Tice Boulevard, Suite 315

Woodcliff Lake, NJ |

|

07677 |

| (Address of Principal Executive Offices) |

|

(Zip Code) |

Registrant’s telephone

number, including area code: (201) 326-5300

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

¨ Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨ Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨ Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨ Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

symbol(s) |

|

Name

of each exchange on which registered |

| Common

Stock, par value $0.001 per share |

|

EGRX |

|

The

Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities

Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ¨

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act. ¨

| Item 2.02 | Results of Operations and Financial Condition. |

The information appearing below under Item

4.02 is incorporated herein by reference.

| Item 3.01 | Notice of Delisting

or Failure to Satisfy a Continued Listing Rule or Standard; Transfer of Listing. |

Due to the matters described in Item 4.02 below, on October 1, 2024,

Eagle Pharmaceuticals, Inc. (the “Company”) notified the hearings panel (the “Panel”) of The Nasdaq Stock Market

LLC (“Nasdaq”) that the Company did not anticipate filing its previously anticipated comprehensive Annual Report on Form

10-K for the period ended December 31, 2023, including restated financial information for the period ended June 30, 2023, financial information

for the period ended September 30, 2023 and financial statements for the period ended December 31, 2023,

a separate Quarterly Report on Form 10-Q for the period ended March 31, 2024, or a separate Quarterly

Report on Form 10-Q for the period ended June 30, 2024 by the dates required to regain compliance with Nasdaq Listing Rule 5250(c)(1) (the “Listing Rule”).

On October 1, 2024, the Company received a notice from

the Panel stating that it had determined to delist the Company’s common stock from Nasdaq and, effective at the open of business

on October 3, 2024, to suspend trading of the Company’s common stock on Nasdaq, as a result of the Company’s failure to comply

with the terms of the previously disclosed extension granted by the Panel to regain compliance with the Listing Rule. Nasdaq will complete

the delisting by filing a Form 25 Notification of Delisting with the U.S. Securities and Exchange Commission (“SEC”) after

applicable appeal periods have lapsed, which will remove the Company’s securities from listing and registration on Nasdaq. The Company

has not requested that the Nasdaq Listing and Hearing Review Council review the Panel’s decision.

Following the suspension of trading

in the Company’s common stock on Nasdaq, the Company expects that its common stock will be eligible for trading on the OTC Expert

Market. As a result of the foregoing, the price of the Company’s common stock will likely be adversely affected and there will be

a decrease in the liquidity of the Company’s common stock.

| Item 4.02 | Non-Reliance on Previously Issued Financial Statements or a Related Audit Report or Completed Interim Review. |

On

September 27, 2024, the Audit Committee (the “Audit Committee”) of the Board of Directors of the Company, based on the recommendation of, and after consultation with, the

Company’s management, concluded that revenue previously recognized related to a sale of PEMFEXY in the second quarter

of 2022 did not meet certain criteria of Financial Accounting Standards Board Accounting Standards Codification Topic 606 – Revenue

from Contracts with Customers, when originally recorded. The Company previously recognized revenue upon delivery to a wholesale

customer but has now determined that revenue from this transaction should be deferred and recognized in later periods to the extent

certain criteria have been achieved. As a result, the Audit Committee determined that the Company’s audited financial

statements for the fiscal year ended December 31, 2022, and unaudited financial statements for the quarters ended June 30,

2022, September 30, 2022, and March 31, 2023 (collectively, the “Non-Reliance Period”), as previously filed

with the SEC, should no longer be relied upon and should be restated. The

Company’s management and the Audit Committee have discussed the matters disclosed in this current report on Form 8-K with

Ernst & Young LLP (“EY”), the Company’s independent registered public accounting firm.

As previously disclosed, the Company has been

preparing a restatement of its financial statements for the three and six months ended June 30, 2023. In addition, as previously

disclosed, the Company’s review and preparation of its financial statements for the quarter ended September 30, 2023, the year

ended December 31, 2023 and the quarters ended March 31, 2024 and June 30, 2024 have been delayed and remain ongoing. At

this time, the Company has not fully completed its review, and the evaluation of financial statement impacts is ongoing and subject to

change.

As a result of the foregoing, the Company

expects to conclude that one or more material weaknesses related to the foregoing matters existed in the Company’s internal control

over financial reporting and that the Company’s disclosure controls and procedures were not effective for each of the fiscal periods

within the Non-Reliance Period, and as of September 30, 2023 and December 31, 2023. In addition, as previously disclosed, the

Company has identified material weaknesses in its internal control over financial reporting that existed as of June 30, 2023 and

concluded that the Company’s disclosure controls and procedures were ineffective as of June 30, 2023. The Company is continuing

to evaluate its internal control over financial reporting and its remediation plan with respect thereto.

The Company is completing its review of the foregoing matters and any

other potential items for correction as needed. The Company has not yet determined the impact in each quarter and will re-evaluate the net revenue recognized related to certain sales of PEMFEXY, beginning

in the second quarter of 2022 and through the Non-Reliance Period. Any previously issued or filed reports, press releases, earnings

releases, stockholder communications, investor presentations or other communications describing the Company’s financial statements,

financial results and other related financial information covering the Non-Reliance Period and any information related to the foregoing

matters, should no longer be relied upon.

The foregoing expectations are based on preliminary information and

subject to change in connection with the completion of the reporting process, review and preparation of the restatement and preparation

of the Company's financial statements, and actual results may vary significantly from the foregoing expectations.

Review of Financing and Other Alternatives

The Company has commenced a review process to evaluate a range of potential

financing and other alternatives to strengthen its liquidity position and capital structure.

There is no deadline or definitive timetable for the completion

of this process, and there can be no assurance as to its outcome. The Company does not intend to disclose or comment on further

developments with respect to this process unless and until it determines that further disclosure is required by law or it otherwise

deems appropriate.

Third Amended and Restated Credit Agreement

In addition, under the terms of the Third

Amended and Restated Credit Agreement, dated November 1, 2022, among the Company, the lenders party thereto (the “Lenders”)

and JPMorgan Chase Bank, N.A., as administrative agent (the “Administrative Agent”), as amended by that certain Limited Waiver

and First Amendment Agreement to the Third Amended and Restated Credit Agreement, dated as of January 12, 2024, as further amended

by that certain Second Amendment to Third Amended and Restated Credit Agreement, dated as of February 29, 2024, as further amended

by that certain Third Amendment to Third Amended and Restated Credit Agreement, dated as of May 14, 2024, and as further amended

by that certain Limited Waiver and Fourth Amendment to Third Amended and Restated Credit Agreement, dated as of August 26, 2024 (as

so amended, the “Credit Agreement”), the Company was required to, among other things, deliver to the Administrative Agent

and the Lenders, by not later than September 30, 2024, (a) annual audited financial statements for the fiscal year ended

December 31, 2023, reported on by the Company’s independent public accountant (without a “going concern” or like

qualification or exception and without any qualification or exception as to the scope of such audit) to the effect that such consolidated

financial statements present fairly in all material respects the financial condition and results of operations of the Company and its

consolidated subsidiaries in accordance with GAAP, (b) restated quarterly financial statements for the fiscal quarter ended June 30,

2023, (c) quarterly financial statements for the fiscal quarters ended September 30, 2023, March 31, 2024, and June 30,

2024 and (d) concurrently with delivery of each of the financial statements referred to in the foregoing clauses (a) through

(c), a certificate by one of its officers that such financial statements present fairly in all material respects the financial condition

and results of operations of the Company and its consolidated subsidiaries in accordance with GAAP for the respective fiscal period (clauses

(a)-(d), the “Existing Reporting Requirements”). As a result of the matters described in Item 4.02 above, the Company is not

able to satisfy the Existing Reporting Requirements, which such failure constitutes an event of default under the Credit Agreement.

Further,

in connection with the non-reliance determination described in Item 4.02, the Company has concluded that the financial statements for

the fiscal periods within the Non-Reliance Period previously delivered to the Administrative Agent and the Lenders did not present

fairly in all material respects the financial condition and results of operations of the Company and its consolidated subsidiaries for

the reasons described above and were not prepared in accordance with GAAP, which gave rise to an event of default under the Credit Agreement.

During the continuance of an event of default,

the Administrative Agent may, with the consent of the required Lenders, and shall, at the request of the required Lenders, by notice to

the Company, terminate undrawn commitments, declare the loans then outstanding to be due and payable in full and/or exercise other remedies

available to it, among other things. In addition, the Company’s obligations under the Credit Agreement are secured by a pledge of

substantially all of the Company’s and its subsidiaries assets. If the Company is unable to pay its obligations, the Administrative

Agent on behalf of the Lenders could proceed to protect and enforce their rights under the Credit Agreement, including by foreclosure

on the assets securing the Company’s obligations under the Credit Agreement. If certain bankruptcy related events of default specified

in the Credit Agreement occur, the commitments will be terminated and the obligations of the Company under the Credit Agreement will become

due and payable automatically without any action by the Administrative Agent or the Lenders. The foregoing would materially and adversely

affect the Company’s business and financial condition.

The Company is in discussions with the Lenders

regarding the foregoing matters. However, there can be no assurance as to the manner in which these matters will be resolved.

Forward-Looking Statements

This

current report on Form 8-K contains “forward-looking statements” within the meaning of the Private Securities

Litigation Reform Act of 1995, as amended, and other securities law. Forward-looking statements are statements that are not

historical facts. Words and phrases such as “anticipated,” “forward,” “will,”

“would,” “could,” “may,” “intend,” “remain,” “regain,”

“maintain,” “potential,” “prepare,” “expected,” “believe,”

“plan,” “seek,” “continue,” “goal,” “estimate,” and similar expressions

are intended to identify forward-looking statements. These statements include, but are not limited to, statements with respect to:

the expected adjustments to the Company’s financial statements, including the impact of adjustments on the Company’s

financial statements; the expected restatement of financial statements; the time and effort required to complete the Company’s

financial statements; expectations with respect to filings with the SEC and the timing and content thereof; expectations with

respect to the Company’s internal control over financial reporting and disclosure controls and procedures and related

remediation; the potential for additional adjustments to the Company’s financial statements; expectations with respect to the Company's stock exchange

listing and matters related thereto, including the suspension and delisting process and the expectation for the Company's common

stock to trade on the OTC Expert Market; expectations regarding the

Company’s process to review potential financing and other alternatives, including the types of arrangements or transactions,

if any, that the Company may determine to pursue, the scope and timing of such review process, the potential value of any such

arrangements or transactions and the outcome of such review process; the Company’s expectations with respect to its events of default under the Credit

Agreement and potential resolution related thereto; and the potential actions that the Administrative Agent on behalf of the lenders

could take to protect and enforce their rights under the Credit Agreement. All of such statements are subject to certain risks and

uncertainties, many of which are difficult to predict and generally beyond the Company’s control, which could cause actual

results to differ materially from those expressed in, or implied or projected by, the forward-looking information and statements.

Such risks and uncertainties include, but are not limited to: the completion of the review and preparation of the

Company’s financial information and internal control over financial reporting and disclosure controls and procedures and the

timing thereof; the discovery of additional information; further delays in the Company’s financial reporting, including as a

result of unanticipated factors; the Company’s ability to obtain resolution with respect to the events of default under its

Credit Agreement; the Company's ability to obtain financing and the timing and potential terms thereof; whether the objectives of

the review of potential financing and other alternatives process will be achieved, the terms, structure, benefits and costs of any

arrangement or transaction resulting therefrom, and whether any transaction will be consummated at all; the risk that the review of

potential financing and other alternatives and its announcement could have an adverse effect on the ability of the Company to retain

customers and retain and hire key personnel and maintain relationships with customers, suppliers, employees, shareholders and other

relationships and on its operating results and business generally; the risk that the review of potential financing and other

alternatives could divert the attention and time of the Company’s management; the costs resulting from the review of potential

financing and other alternatives; the risk of the Company potentially seeking protection under bankruptcy laws; the

anticipated suspension and delisting of the Company’s common stock from Nasdaq; the possibility that the Company will be

unable to re-list its common stock on the Nasdaq or other exchange and thereafter continue to comply therewith; the anticipated

eligibility for trading of the Company’s common stock on the OTC Expert Market and the limitations on trading of the

Company’s common stock related thereto; the impact on the price of the Company’s common stock and the Company’s

reputation; the Company’s ability to remediate material weaknesses in its internal control over financial reporting; the

Company’s ability to recruit and hire a new Chief Executive Officer and new Chief Financial Officer and retain key personnel;

the ability of the Company to realize the anticipated benefits of its plan designed to improve operational efficiencies and realign

its sales and marketing expenditures and the impacts thereof; the Company’s reliance on third parties to manufacture

commercial supplies of its products and clinical supplies of its product candidates; the

impacts of geopolitical factors such as the conflicts between Russia and Ukraine and Hamas and Israel; delay in or failure to obtain

regulatory approval of the Company’s or its partners’ product candidates and successful compliance with Federal Drug

Administration, European Medicines Agency and other governmental regulations applicable to product approvals; changes in the

regulatory environment; the uncertainties and timing of the regulatory approval process; whether the Company can successfully market

and commercialize its products; the success of the Company's relationships with its partners; the outcome of litigation and other

legal proceedings and the risk of additional litigation and legal proceedings, including with respect to the matters referenced

herein; the strength and enforceability of the Company’s intellectual property rights or the rights of third parties;

competition from other pharmaceutical and biotechnology companies and competition from generic entrants into the market; unexpected

safety or efficacy data observed during clinical trials; clinical trial site activation or enrollment rates that are lower than

expected; the risks inherent in drug development and in conducting clinical trials; risks inherent in estimates or judgments

relating to the Company’s critical accounting policies, or any of the Company’s estimates or projections, which may

prove to be inaccurate; unanticipated factors in addition to the foregoing that may impact the Company’s financial and

business projections and may cause the Company’s actual results and outcomes to materially differ from its estimates and

projections; and those risks and uncertainties identified in the “Risk Factors” sections of the Company’s Annual

Report on Form 10-K for the year ended December 31, 2022, filed with the SEC on March 23, 2023, the

Company’s Quarterly

Reports on Form 10-Q for the quarter ended March 31, 2023, filed with the SEC on May 9, 2023, and for the quarter

ended June 30, 2023, filed with the SEC on August 8, 2023, and its subsequent filings with the SEC. Readers are

cautioned not to place undue reliance on these forward-looking statements. All forward-looking statements contained in this current

report on Form 8-K speak only as of the date on which they were made. Except to the extent required by law, the Company

undertakes no obligation to update such statements to reflect events that occur or circumstances that exist after the date on which

they were made.

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| Date: October 2, 2024 |

|

| |

EAGLE PHARMACEUTICALS, INC. |

| |

|

| |

By: |

/s/ Michael Graves |

| |

|

Michael Graves |

| |

|

Interim Principal Executive Officer |

v3.24.3

Cover

|

Sep. 27, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Sep. 27, 2024

|

| Entity File Number |

001-36306

|

| Entity Registrant Name |

Eagle

Pharmaceuticals, Inc.

|

| Entity Central Index Key |

0000827871

|

| Entity Tax Identification Number |

20-8179278

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

50

Tice Boulevard

|

| Entity Address, Address Line Two |

Suite 315

|

| Entity Address, City or Town |

Woodcliff Lake

|

| Entity Address, State or Province |

NJ

|

| Entity Address, Postal Zip Code |

07677

|

| City Area Code |

201

|

| Local Phone Number |

326-5300

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common

Stock, par value $0.001 per share

|

| Trading Symbol |

EGRX

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

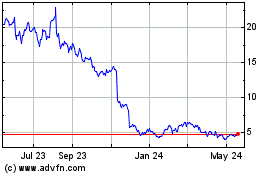

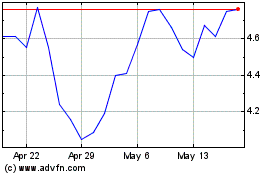

Eagle Pharmaceuticals (NASDAQ:EGRX)

Historical Stock Chart

From Oct 2024 to Nov 2024

Eagle Pharmaceuticals (NASDAQ:EGRX)

Historical Stock Chart

From Nov 2023 to Nov 2024