As filed with the Securities

and Exchange Commission on May 31, 2024

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM SD

(SPECIALIZED DISCLOSURE REPORT)

EMCORE CORPORATION

(Exact name of registrant as specified in its

charter)

| | |

|

| New

Jersey | |

001-36632 |

| | |

|

| (State

or other jurisdiction of incorporation) | |

(Commission

file number) |

| | |

|

| 450

Clark Dr., Budd Lake, NJ 08728 | |

07828 |

| | |

|

| (Address

of principle executive offices) | |

(Zip

code) |

| |

|

Ryan Hochgesang

VP, General Counsel

(626) 293-3400

(Name and telephone number, including area code,

of the person to contact in connection with this report)

Check the appropriate box to indicate the rule pursuant to which

the form is being filed:

| x |

Rule 13p-1 under the Securities Exchange

Act (17 CFR 240.13p-1) for the reporting period from January 1 to December 31, 2023. |

| ¨ |

Rule 13q-1 under the Securities Exchange

Act (17 CFR 240.13p-1) for the fiscal year ended December 31, 2023. |

INFORMATION TO BE INCLUDED

IN THIS REPORT

SECTION 1 - CONFLICT MINERALS DISCLOSURE

Item 1.01 Conflict Minerals Disclosure and Report

In accordance with the disclosure

requirements promulgated by the U.S. Securities and Exchange Commission, EMCORE Corporation has prepared a Conflict Minerals Report for

the calendar year ended December 31, 2023. The Conflict Minerals Report is publicly available at the following Internet website:

http://www.emcore.com/our-company/quality-management/supply-chain-management/.

Item 1.02 Exhibit

The Conflict Minerals Report required by Item 1.01 is provided

as Exhibit 1.01 to this Form SD.

SECTION 2 - Resource

Extraction Issuer Disclosure

Item 2.01 Resource Extraction Issuer Disclosure and

Report

Not applicable.

SECTION 3 – EXHIBITS

Item 3.01 Exhibits

The following Exhibit is filed as part of this report.

Exhibit 1.01 - Conflict Minerals Report

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934,

the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

EMCORE CORPORATION |

| Dated: May 31, 2024 |

|

|

| |

By: |

/s/ Tom Minichiello |

| |

Name: |

Tom Minichiello |

| |

Title: |

Chief Financial Officer |

| |

EMCORE Corporation

Form SD-2023

Exhibit 1.01

Conflict Minerals Report

Conflict Minerals Disclosure

I. Introduction

EMCORE Corporation is providing this

Conflict Minerals Report (“CMR”) for the calendar year ended December 31, 2023, as an exhibit to Form SD, pursuant

to Rule 13p-1 under the Securities Exchange Act of 1934 (the “Rule”), as amended. The Rule requires disclosure of

certain information when a company manufactures or contracts to manufacture a product and any “conflict mineral” specified

in the Rule is necessary for the functionality or production of such product. Conflict Minerals are defined by paragraph (d)(3) of

Form SD as columbite-tantalite (coltan), cassiterite, gold, wolframite, or their derivatives, which are limited to tantalum, tin,

and tungsten, or any other mineral or its derivatives determined by the U.S. Secretary of State to be financing conflict in the Covered

Countries (collectively, “Conflict Minerals” or “3TG”). The “Covered Countries” for purposes of the

Rule and this CMR are the Democratic Republic of the Congo (“DRC”) and any country that shares an internationally recognized

border with the DRC.

As used in this document, “EMCORE,”

the “Company” and the words "we," "our," and "us" refer to EMCORE Corporation and its subsidiaries.

II. Overview

Company Profile

We are a leading provider of inertial

navigation products for the aerospace and defense markets and have also been a manufacturer of lasers and optical subsystems for use in

the Cable TV (“CATV”) industry. We leverage industry-leading Photonic Integrated Chip (PIC), Quartz MEMS, and Lithium Niobate

chip-level technology to deliver state-of-the-art component and system-level products across our end-market applications. Over the last

five years, we have expanded our scale and portfolio of inertial sensor products through the acquisitions of Systron Donner Inertial, Inc.

in June 2019, the Space and Navigation business of L3Harris Technologies, Inc. in April 2022, and the FOG and Inertial

Navigation Systems business of KVH Industries, Inc. in August 2022. We have vertically-integrated manufacturing capability at

our facilities in Budd Lake, NJ, Concord, CA, Tinley Park, IL, and Alhambra, CA. Our manufacturing facilities maintain ISO 9001 quality

management certification, and we are AS9100 aerospace quality certified at our facilities in Budd Lake and Concord. These facilities support

our vertically-integrated manufacturing strategy for quartz, FOG, and Ring Laser Gyro products for navigation systems.

As described in this CMR, certain of

our operations manufacture, or contract to manufacture, products that contain 3TGs that are necessary to the functionality or production

of those products. However, we do not directly source 3TGs from mines, smelters or refiners. We believe that, in most cases, we are several

steps removed in the supply chain from these market participants, limiting our influence over their sourcing. We must therefore rely on

our direct suppliers to provide information regarding the origin of necessary 3TGs that are included in our products, including sources

of 3TGs that are supplied to them by sub-tier suppliers.

Conflict Minerals Policy

We are committed to responsible sourcing

from our suppliers and each supplier is required to provide information about their Conflict Minerals programs and sourcing practices

related to 3TGs by submitting a CMRT (as defined below). At our request, each of our suppliers shall permit us to assess its practices

and procedures and shall provide us with any information reasonably requested. In addition, each supplier agrees to provide information

to us necessary for us to comply with our Conflict Minerals reporting requirements, including without limitation information under the

Responsible Minerals Initiative’s (“RMI”) Conflict Minerals Reporting Template (“CMRT”). Our Conflict Minerals

Policy is available on our corporate website at http://emcore.com/our-company/quality-management/supply-chain-management/.

III. Reasonable

Country of Origin Inquiry Information

We have conducted a good faith reasonable

country of origin inquiry (“RCOI”) to determine whether the 3TGs included in and necessary to the functionality of our products

described under “Product Description” in Section V below originated in the Covered Countries or came from recycled or

scrap sources. We engaged a leading 3TGs data management consultant (the “Consultant”) to assist us in conducting this RCOI.

We utilized a software-as-a-service (SaaS) platform provided by the Consultant to complete and track supplier communications, as well

as allow suppliers to upload completed CMRTs for validation, assessment and management. The platform also provides functionality that

meets the OECD Guidance (as defined below) process expectations by evaluating the quality of each supplier response and assigning a health

score based on the supplier’s declaration of process engagement. Additionally, the metrics provided in this report, as well as the

step-by-step process for supplier engagement and upstream due diligence investigations performed, are managed through this platform.

The use of the CMRT allowed for some

elimination of Irrelevant suppliers. We also periodically reviewed the supplier list to ensure that irrelevant or “out of scope”

suppliers were removed from the survey process. Our program continues to include automated data validation on all submitted CMRTs. The

goal of data validation is to increase the accuracy of submissions and identify any contradictory answers in the CMRT. This data validation

is based on questions within the declaration tab of the CMRT which helps to identify areas that require further classification or risk

assessment, as well as understand the due diligence efforts of the Tier 1 suppliers. The results of this data validation contribute to

the program’s health assessment and are shared with the suppliers to ensure they understand areas that require clarification or

improvement.

All submitted forms are accepted and

classified as valid or invalid so that data is still retained. Suppliers are contacted in regard to invalid forms and are encouraged to

submit a valid form. Suppliers are also provided with guidance on how to correct these validation errors in the form of feedback to their

CMRT submission, training courses and direct engagement help through the Consultant’s multilingual Supplier Experience team. Since

some suppliers may remain unresponsive to feedback, we track program gaps to account for future improvement opportunities. As of May 14,

2024, there were three invalid supplier submissions that could not be corrected.

The Consultant compared the list of smelters

and refiners provided in our suppliers’ responses to the lists of smelters maintained by the RMI and, if a supplier indicated that

a facility was certified as conflict-free, confirmed that the facility was listed on RMI’s list of validated conflict free smelters

and refiners of 3TGs.

To the extent applicable, our RCOI utilized

the same processes and procedures for our due diligence described in Section IV below. This RCOI process included conducting an inquiry

of our direct suppliers using a mechanism common in the technology industry: the CMRT version 6.01. Based on the results of our RCOI,

we are required to exercise due diligence on the source and chain of custody of the necessary 3TGs contained in our products. Our due

diligence efforts are discussed further in Section IV of this CMR.

IV. Due

Diligence Process and Measures Performed

Based on the results of our RCOI, the

Consultant engaged by us also assisted us in conducting due diligence on the source and chain of custody of 3TGs in our products. Our

due diligence measures are designed to attempt to ascertain the facilities used to process any 3TGs in our products, the country of origin

of any 3TGs in our products and the mine(s) or location of origin with the greatest possible specificity.

The design of our due diligence system,

its conformity with an internationally-recognized due diligence framework, and a description of the measures we have undertaken to exercise

our due diligence, are detailed below.

Our due diligence measures have been

designed to conform in all material respects to the internationally- recognized due diligence guidance of the Organization for Economic

Co-operation and Development (“OECD”) Due Diligence Guidance for Responsible Supply Chain of Minerals from Conflict- Affected

and High-Risk Areas (Second Edition), and its related supplements. This OECD guidance (the “OECD Guidance”) is the only

due diligence framework recognized by the Securities and Exchange Commission (“SEC”) to date. The OECD Guidance stresses five

main areas of due diligence design, detailed below in IV(a) – (e).

Due diligence requires our necessary

reliance on data provided by direct suppliers and third-party audit programs. There is a risk of incomplete or inaccurate data as the

process cannot fully be owned by us. However, through continued outreach and process validation, this aligns with industry standards and

market expectations for downstream companies’ due diligence.

a. Establish Strong Company

Management Systems

First, we have assigned a Director of

Supply Chain Management to (i) manage the 3TGs compliance program, (ii) liaise with the Consultant, (iii) conduct reviews

of collected data, and (iv) make decisions regarding the due diligence program, including risk mitigation. Second, we have requested

that suppliers of goods incorporated into our products provide us with CMRTs for their products (see below, Section IV(b &

c)). Third, our position statement with respect to 3TGs, which is located on our website (https://emcore.com/our-company/quality-management/supply-chain-management/),

encourages our suppliers to source responsibly, through their sub-suppliers and on down through their own supply chains. In this position

statement, we encourage our suppliers and their sub suppliers to use smelters or refiners ( “SORs”) that are conformant to

assessment protocols for conflict-free sourcing wherever possible. Using its Responsible Minerals Assurance Process (“RMAP”)

audit program, the RMI, an organization founded by members of the Electronic Industry Citizen Coalition (“EICC”), and the

Global e-Sustainability Initiative (“GeSI”), is taking action to address responsible sourcing, using independent third-party

audits to identify SORs that have systems in place to assure sourcing of only conflict-free materials.

We also leverage the Consultant’s

managed services in order to work with dedicated program specialists who support our Conflict Minerals program. We communicate regularly

with the Consultant’s team in order to receive updates on program status. Each member of the Consultant’s customer success

team is trained in Conflict Minerals compliance and understands the intricacies of the CMRT and Conflict Minerals reporting, as well as

Section 1502 of the Dodd-Frank Act.

Grievance Mechanisms

We established multiple longstanding

grievance mechanisms whereby employees and suppliers can report violations of our policies, including with respect to Conflict Minerals.

Suppliers and others outside of EMCORE may contact our Conflict Minerals team to communicate with us, including to report grievances.

In addition, our employees may anonymously report suspected violations using our anonymous ethics hotline, either via our website at https://emcore.ethicspoint.com

or by calling 1-833-626-1524 in the United States, or with the associated country code outside the United States.

Maintain Records

We have adopted a policy to retain relevant

Conflict Minerals related documentation for a period of 5 years, including supplier responses to CMRTs, and implemented this policy through

the Consultant. The Consultant stores all of the information and findings from this process in a database that can be audited by

internal or external parties.

b. Identify

and Assess Risk in the Supply Chain

To obtain chain of custody declarations

from our suppliers, we utilize the CMRT described above. This CMRT is distributed to all of our suppliers, with regular and persistent

follow-ups (“Escalations”), to ensure maximum compliance and feedback. The CMRT includes questions on (i) the use and

origin of 3TGs in our components, (ii) supplier engagement with their sub-tier suppliers, and (iii) smelters and points of

origin of the constituent 3TGs. The Consultant provides suppliers with guidance and requirements to prepare them ahead of time for full

compliance in completing the CMRT, our principal information-gathering step on the origin, source and chain of custody of 3TGs contained

in components and materials supplied to us. This kit includes materials to educate suppliers about the SEC rule on 3TGs, responsible

supply chain management, and a letter that suppliers can use if they need to request information from their sub-tier suppliers.

The CMRT responses are only a first step in

our engagement with suppliers. The responses from suppliers are then individually validated and examined both for completeness and

any internal inconsistencies between the data they provide. Any of these issues are resolved with our suppliers by phone and email.

This follow-up to incomplete or invalid information is described further in Section IV(c), below.

To the extent that a completed response

identified a smelter or refiner, the Consultant determined if the smelter had been audited against a standard in conformance with the

OECD Guidance, such as the Responsible Minerals Assurance Process (“RMAP”). We do not have a direct relationship with smelters

and refiners and do not perform direct audits of these entities within the supply chain. SORs that have completed an RMAP audit are considered

to be DRC-conflict free. In cases where the SORs’ due diligence practices have not been audited against the RMAP standard or they

are considered non-conformant by RMAP, follow-ups are made to suppliers reporting those facilities. SORs are then assessed for the potential

for sourcing risk. We also attempted to ascertain whether the smelter or refiner information provided was specific to the products supplied

to us to determine whether the identified SORs are in our supply chain.

Each facility that meets the RMI definition

of a smelter or refiner of a 3TGs mineral is assessed according to red flag indicators defined in the OECD Guidance. The Consultant uses

numerous factors to determine the level of risk that each smelter poses to the supply chain by identifying red flags. These factors include:

| · | Geographic proximity to the Covered Countries; |

| · | Known mineral source country of origin; |

| · | Credible evidence of unethical or conflict sourcing; and |

| · | Peer assessments conducted by credible third-party sources. |

As part of our risk management plan under

the OECD Guidance, when facilities with red flags were reported on a CMRT by one of the suppliers surveyed, risk mitigation activities

are initiated. Through the Consultant’s software, submissions that include any smelters of concern immediately produce a receipt

instructing the supplier to take their own risk mitigation actions, including submission of a product specific CMRT to better identify

the connection to products that they supply to us, and escalating up to removal of these red flag smelters from their supply chain. In

addition, suppliers are guided to the educational materials on mitigating the risks identified through the data collection process.

c. Design

and Implement a Strategy to Respond to Identified Risks

As outlined above, we have developed

processes for Escalations and supplier engagement. This allows us to direct needed questions and follow-up to suppliers based on their

varying responses to the CMRT. Escalations are used when, among other issues, suppliers are late in responding, have incomplete information,

provide feedback inconsistent with prior responses, or when other issues are identified. An Escalation may include individual written

requests for information, conference calls and meetings. Each Escalation is dated and tagged in our data management system for a variety

of further actions. These actions might include direct supplier contact through our business channels, changes of scope of the diligence

request, reformatting supplier responses into the correct format, time extensions for delayed responses, follow-up with alternative contacts

in the supplying organization, or the dropping of outdated component parts from our products list.

d. Carry

Out Independent Third-Party Audit of Supply Chain Due Diligence at Identified Points in the Supply Chain

Because we do not source 3TG directly

from SORs, we rely on third parties, including the RMI, to coordinate and conduct third-party audits of these facilities. We utilize the

published results of these third-party audits to determine whether a specified smelter or refiner processes 3TG that directly or indirectly

finances or benefits armed groups. The Consultant also directly contacts smelters and refiners that are not currently enrolled in the

RMAP to encourage their participation and gather information regarding each facilities’ sourcing practices on behalf of its compliance

partners.

e. Report

on Supply Chain Due Diligence

This CMR is available under “Quality

Management” and “Supply Chain Management” in the “Company” section of our website at https://emcore.com/our-company/quality-management/supply-chain-management/.

We will file a Form SD (and CMRs, as necessary) with the SEC on an annual basis, pursuant to the Rule.

V. Due

Diligence Results

| a. | Supply Chain Outreach Results |

Supply chain outreach is required to

identify the upstream sources of origin of tin, tantalum, tungsten and gold. Following the industry standard process, CMRTs are sent to

and requested from Tier 1 suppliers, who are expected to follow this process until the smelter and refiner sources are identified. As

of May 14, 2024, there were 368 suppliers in scope of the Conflict Minerals program and 261 provided a completed CMRT. Our total

response rate for this reporting year was 71%.

b. Upstream

Data Transparency

All smelters and refiners listed by suppliers

in completed CMRTs, which appear on the RMI-maintained smelters list, are attached in Appendix A. As is a common practice when requests

are sent upstream in the supply chain, those who purchase materials from smelters may not be able to discern exactly which companies’

product lines the materials may end up in. As a result, those providing the smelters and refiners have the practice of listing all smelters

and refiners they may purchase from within the reporting period. Therefore, the SORs (as sources) listed in Appendix A are likely to be

more comprehensive than the list of SORs which actually processed the 3TGs contained in our products.

Although the potential for over-reporting

is understood, we have taken measures to validate these sources of origin against validated audit programs intended to verify the material

types and mine sources of origin for these smelters and refiners. Suppliers that identified these specific SORs of concern on their CMRT

were contacted in accordance with the OECD Guidance to inform them of the potential for risk, and to evaluate whether or not these SORs

could be connected to our products. The suppliers were asked to complete a user-defined or product-level CMRT specific to the materials,

products or piece parts purchased by us, rather than a company-level CMRT, to better identify the connection to products that they supply

to us. Other suppliers were evaluated internally to determine if they were in fact still active suppliers. If not, they were removed from

the scope of data collection.

c. Countries

of Origin

Appendix B includes an aggregated list of countries

of origin from which the reported facilities collectively source 3TGs, based on information provided through the CMRT data collection

process, from direct smelter outreach and the RMAP. As mentioned in the above section, it is understood that many responses may provide

more data than can be directly linked to products sold by us. Therefore, Appendix B may contain more countries than those that our products

are being sourced from. We have taken, or intend to take, the following steps to improve the due diligence conducted to further mitigate

any risk that the necessary 3TGs in our products could benefit armed groups in the DRC or adjoining countries:

| · | Continue to evaluate upstream sources through a broader set of tools to evaluate risk. These include, but are not limited to: |

| o | Using a comprehensive smelter and refiner library with detailed status and notes for each listing. |

| o | Scanning for credible media on each smelter and refiner to flag risk issues. |

| o | Comparing the list of smelters and refiners against government watch and denied parties lists. |

| · | Engage with suppliers more closely and provide more information and training resources regarding responsible sourcing of 3TGs. |

| · | Encourage suppliers to have due diligence procedures in place for their supply chains to improve the content of the responses from

such suppliers. |

| · | Continue to include a Conflict Minerals flow-down clause in new or renewed supplier contracts, as well as included in the terms and

conditions of each purchase order issued. |

| · | Following the OECD Guidance process, increase the emphasis on clean and validated smelter and refiner information from the supply

chain through feedback and detailed smelter analysis. |

d. Smelter &

Refiner Risk Evaluation

Understanding the risks associated with

the smelters and refiners potentially providing material into our supply chain is an important part of the due diligence process. Through

the Consultant, comprehensive and ongoing analysis is conducted by the Consultant’s smelter library manager to assess sourcing risk.

This information is used to:

| · | Provide suppliers with feedback. |

| · | Determine the effectiveness of our overall program. |

| · | Conduct outreach to smelters, refiners and their respective associations. |

| · | Provide detailed analysis in this report. |

The following risk categories are used

for smelter evaluation and risk determination:

| o | Whether the mineral originated from or has been transported through a conflict-affected area as defined by Section 1502 of the

Dodd-Frank Act (the DRC and its nine adjoining countries: Angola, Burundi, Central African Republic, Republic of the Congo, Rwanda, South

Sudan, Tanzania, Uganda, and Zambia). |

| o | Whether the refiner’s due diligence practices have been audited against a standard in conformance with the OECD Guidance. |

| o | The Consultant relies on the RMI audit standard, including cross-recognition of the London Bullion Market Association (“LBMA”)

Good Delivery Program and the Responsible Jewelry Council Chain of Custody Certification, which are developed according to global standards,

including the OECD Guidance. |

| o | Whether evidence of any other red flag that is supported by credible sources has been identified. |

VI. Product

Description; Processing Facilities

Product Description – Our business is of a broad

portfolio of compound semiconductor-based products for the aerospace and defense markets and, previously and historically, the Broadband

market.

· Inertial Navigation

Products

These include products ranging from tactical to navigational

grade gyros (including fiber optics gyroscopes, ring laser gyroscopes and Quartz MEMS gyroscopes), accelerometers, IMU and INS that

have broad application within the aerospace and defense markets, including guidance, navigation, control, pointing, and stabilization

applications in commercial and military aircraft, unmanned aerial systems, unmanned autonomous vehicles, land vehicles, precision guided

weapons, and industrial and marine.

· Defense Optoelectronics

Products

These included transmitters, receivers, subsystems, and systems

that transport ultra-broadband, wideband radio frequency and microwave signals between satellite hub equipment and antenna dishes, with

applications including satellite antenna remoting and signal distribution, inter- and intra-facility links, site diversity systems, high-performance

supertrunking links, electronic warfare systems, and radar testing. These product families were sold in connection with the sale of our

Defense Optoelectronics business to Ortel LLC in October 2023.

· Cable TV Lasers

and Transmitters Products

These included forward and return-path 1310 nm and 1550 nm

distributed feedback analog lasers, optical receivers optimized for CATV, data over cable service interface specification 3.1 and wireless,

broadband photodiodes used in forward-and return-path broadband, subassembly components, analog fiber-optic transmitters, quadrature amplitude

modulation transmitters, and CATV fiber amplifiers. These product families were sold in connection with the sale of our CATV business

to Ortel LLC in October 2023.

· Optical

Sensing Products

These included narrow linewidth 1310 and 1550 nm DFB lasers

optimized for Light Detecting and Ranging (“LiDAR”) and distributed sensing applications and a continuous wavelength, coherent

optical source laser for frequency modulation continuous wavelength (“FMCW”) sensing LiDAR applications. These product families

were sold in connection with the sale of our optical sensing business to Ortel LLC in October 2023.

· Data Center Chips

These included custom chip devices tailored to specific customer

requirements and applications for linear, coherent laser sources. These product families were sold in connection with the sale of our

Chips business to HieFo Corporation in April 2024.

Processing Facilities – Based on our RCOI or

due diligence process, as applicable, and the information received from our suppliers, the facilities listed on Appendix A were identified

by our suppliers as the smelters and refiners that processed the 3TG present in and necessary to the functionality of products manufactured

by us in the calendar year ended December 31, 2023.

Due to our position in the supply chain,

which we discuss above, we rely on our suppliers for accurate smelter and refiner information. Our due diligence measures cannot provide

adequate certainty regarding the source and chain of custody of the necessary 3TGs contained in our in-scope products. The information

from our suppliers is still evolving and may contain company level declarations. As such, this smelter list is presented in good faith

as the best information we have to date. This list may contain smelters that are not in our supply chain and there may be other smelters

not yet identified in our due diligence process. We will continue to update the list as our information and the relevant third-party data

from RMI, LBMA, and RJC improves.

VII. Future

Due Diligence

We will continue to communicate our expectations

and information requirements to our direct suppliers. Over time, we anticipate that the amount of information globally on the traceability

and sourcing of the necessary 3TGs in our products will increase and improve our knowledge. We will continue to make inquiries to our

direct suppliers and undertake additional risk assessments when potentially relevant changes in facts or circumstances are identified.

If we become aware of a supplier whose due diligence needs improvement, we may continue the trade relationship while that supplier improves

its compliance program. We expect our suppliers to take similar measures with their suppliers to ensure alignment throughout the supply

chain.

In addition to those above, we will undertake the following

steps during the next compliance period:

| · | Continue to collect responses from suppliers using the most

recent revision of the CMRT. |

| · | Engage with suppliers that did not provide a response in

2023 or provided incomplete responses to help with our data collections for 2023. |

| · | Monitor and track performance of risk mitigation efforts. |

| · | Compare and validate RCOI results to information collected

via independent conflict-free smelter validation programs such as the RMI. |

Appendix A

Smelter and Refiner Information

| Metal |

Standard Smelter Name |

Smelter ID |

RMI Audit Status* |

| Tantalum |

5D Production OU |

CID003926 |

Outreach Required |

| Gold |

8853 S.p.A. |

CID002763 |

Non Conformant |

| Tungsten |

A.L.M.T. Corp. |

CID000004 |

Conformant |

| Gold |

ABC Refinery Pty Ltd. |

CID002920 |

Outreach Required |

| Gold |

Abington Reldan Metals, LLC |

CID002708 |

Conformant |

| Tungsten |

ACL Metais Eireli |

CID002833 |

Non Conformant |

| Gold |

Advanced Chemical Company |

CID000015 |

Active |

| Gold |

African Gold Refinery** |

CID003185 |

RMI Due Diligence Review - Unable to Proceed |

| Gold |

Agosi AG |

CID000035 |

Conformant |

| Gold |

Aida Chemical Industries Co., Ltd. |

CID000019 |

Conformant |

| Gold |

Al Etihad Gold Refinery DMCC |

CID002560 |

Non Conformant |

| Tungsten |

Albasteel Industria e Comercio de Ligas Para Fundicao Ltd. |

CID003427 |

Non Conformant |

| Gold |

Albino Mountinho Lda. |

CID002760 |

Outreach Required |

| Gold |

Alexy Metals |

CID003500 |

Non Conformant |

| Gold |

Almalyk Mining and Metallurgical Complex (AMMC) |

CID000041 |

Conformant |

| Tin |

Alpha |

CID000292 |

Conformant |

| Tantalum |

AMG Brasil |

CID001076 |

Conformant |

| Tin |

An Vinh Joint Stock Mineral Processing Company |

CID002703 |

Outreach Required |

| Gold |

AngloGold Ashanti Corrego do Sitio Mineracao |

CID000058 |

Conformant |

| Gold |

Argor-Heraeus S.A. |

CID000077 |

Conformant |

| Tungsten |

Artek LLC |

CID003553 |

RMI Due Diligence Review - Unable to Proceed |

| Gold |

Asahi Pretec Corp. |

CID000082 |

Conformant |

| Gold |

Asahi Refining Canada Ltd. |

CID000924 |

Conformant |

| Gold |

Asahi Refining USA Inc. |

CID000920 |

Conformant |

| Gold |

Asaka Riken Co., Ltd. |

CID000090 |

Conformant |

| Tungsten |

Asia Tungsten Products Vietnam Ltd. |

CID002502 |

Conformant |

| Gold |

Atasay Kuyumculuk Sanayi Ve Ticaret A.S. |

CID000103 |

Outreach Required |

| Gold |

AU Traders and Refiners |

CID002850 |

Non Conformant |

| Gold |

Augmont Enterprises Private Limited |

CID003461 |

Non Conformant |

| Gold |

Aurubis AG |

CID000113 |

Conformant |

| Tin |

Aurubis Beerse |

CID002773 |

Conformant |

| Tin |

Aurubis Berango |

CID002774 |

Conformant |

| Gold |

Bangalore Refinery |

CID002863 |

Active |

| Gold |

Bangko Sentral ng Pilipinas (Central Bank of the Philippines) |

CID000128 |

Conformant |

| Gold |

Boliden AB |

CID000157 |

Conformant |

| Gold |

C. Hafner GmbH + Co. KG |

CID000176 |

Conformant |

| Gold |

Caridad |

CID000180 |

Outreach Required |

| Gold |

CCR Refinery - Glencore Canada Corporation |

CID000185 |

Conformant |

| Gold |

Cendres + Metaux S.A. |

CID000189 |

Non Conformant |

| Gold |

CGR Metalloys Pvt Ltd. |

CID003382 |

Outreach Required |

| Tin |

Chenzhou Yunxiang Mining and Metallurgy Co., Ltd. |

CID000228 |

Conformant |

| Tin |

Chifeng Dajingzi Tin Industry Co., Ltd. |

CID003190 |

Conformant |

| Gold |

Chimet S.p.A. |

CID000233 |

Conformant |

| Tungsten |

China Molybdenum Tungsten Co., Ltd. |

CID002641 |

Conformant |

| Tin |

China Tin Group Co., Ltd. |

CID001070 |

Conformant |

| Tungsten |

Chongyi Zhangyuan Tungsten Co., Ltd. |

CID000258 |

Conformant |

| Gold |

Chugai Mining |

CID000264 |

Conformant |

| Tungsten |

CNMC (Guangxi) PGMA Co., Ltd. |

CID000281 |

Outreach Required |

| Gold |

Coimpa Industrial LTDA |

CID004010 |

Conformant |

| Tin |

CRM Fundicao De Metais E Comercio De Equipamentos Eletronicos Do Brasil Ltda |

CID003486 |

Conformant |

| Tin |

CRM Synergies |

CID003524 |

Conformant |

| Tungsten |

Cronimet Brasil Ltda |

CID003468 |

Conformant |

| Tin |

CV Ayi Jaya |

CID002570 |

Conformant |

| Tin |

CV Venus Inti Perkasa |

CID002455 |

Conformant |

| Tantalum |

D Block Metals, LLC |

CID002504 |

Conformant |

| Gold |

Daye Non-Ferrous Metals Mining Ltd. |

CID000343 |

Outreach Required |

| Gold |

Degussa Sonne / Mond Goldhandel GmbH |

CID002867 |

Outreach Required |

| Gold |

Dijllah Gold Refinery FZC |

CID003348 |

Outreach Required |

| Tin |

Dongguan CiEXPO Environmental Engineering Co., Ltd. |

CID003356 |

Non Conformant |

| Tungsten |

DONGKUK INDUSTRIES CO., LTD. |

CID004060 |

Outreach Required |

| Gold |

Dongwu Gold Group |

CID003663 |

Outreach Required |

| Gold |

Dowa |

CID000401 |

Conformant |

| Tin |

Dowa |

CID000402 |

Conformant |

| Tin |

DS Myanmar |

CID003831 |

Conformant |

| Gold |

DSC (Do Sung Corporation) |

CID000359 |

Conformant |

| Gold |

Eco-System Recycling Co., Ltd. East Plant |

CID000425 |

Conformant |

| Gold |

Eco-System Recycling Co., Ltd. North Plant |

CID003424 |

Conformant |

| Gold |

Eco-System Recycling Co., Ltd. West Plant |

CID003425 |

Conformant |

| Tin |

Electro-Mechanical Facility of the Cao Bang Minerals & Metallurgy Joint Stock Company |

CID002572 |

Non Conformant |

| Tin |

EM Vinto |

CID000438 |

Conformant |

| Gold |

Emerald Jewel Industry India Limited (Unit 1) |

CID003487 |

Outreach Required |

| Gold |

Emerald Jewel Industry India Limited (Unit 2) |

CID003488 |

Outreach Required |

| Gold |

Emerald Jewel Industry India Limited (Unit 3) |

CID003489 |

Outreach Required |

| Gold |

Emerald Jewel Industry India Limited (Unit 4) |

CID003490 |

Outreach Required |

| Gold |

Emirates Gold DMCC |

CID002561 |

Non Conformant |

| Tin |

Estanho de Rondonia S.A. |

CID000448 |

Conformant |

| Tantalum |

F&X Electro-Materials Ltd. |

CID000460 |

Conformant |

| Tin |

Fabrica Auricchio Industria e Comercio Ltda. |

CID003582 |

Conformant |

| Tin |

Fenix Metals |

CID000468 |

Conformant |

| Gold |

Fidelity Printers and Refiners Ltd. |

CID002515 |

RMI Due Diligence Review - Unable to Proceed |

| Tantalum |

FIR Metals & Resource Ltd. |

CID002505 |

Conformant |

| Gold |

Fujairah Gold FZC |

CID002584 |

Outreach Required |

| Tungsten |

Fujian Xinlu Tungsten Co., Ltd. |

CID003609 |

Conformant |

| Tungsten |

Ganzhou Jiangwu Ferrotungsten Co., Ltd. |

CID002315 |

Conformant |

| Tungsten |

Ganzhou Seadragon W & Mo Co., Ltd. |

CID002494 |

Conformant |

| Tin |

Gejiu City Fuxiang Industry and Trade Co., Ltd. |

CID003410 |

Outreach Required |

| Tin |

Gejiu Kai Meng Industry and Trade LLC |

CID000942 |

Non Conformant |

| Tin |

Gejiu Non-Ferrous Metal Processing Co., Ltd. |

CID000538 |

Conformant |

| Tin |

Gejiu Yunxin Nonferrous Electrolysis Co., Ltd. |

CID001908 |

Non Conformant |

| Tin |

Gejiu Zili Mining And Metallurgy Co., Ltd. |

CID000555 |

Non Conformant |

| Gold |

GG Refinery Ltd. |

CID004506 |

Active |

| Gold |

GGC Gujrat Gold Centre Pvt. Ltd. |

CID002852 |

Non Conformant |

| Tantalum |

Global Advanced Metals Aizu |

CID002558 |

Conformant |

| Tantalum |

Global Advanced Metals Boyertown |

CID002557 |

Conformant |

| Tungsten |

Global Tungsten & Powders LLC |

CID000568 |

Conformant |

| Gold |

Gold by Gold Colombia |

CID003641 |

Conformant |

| Gold |

Gold Coast Refinery |

CID003186 |

Outreach Required |

| Gold |

Gold Refinery of Zijin Mining Group Co., Ltd. |

CID002243 |

Conformant |

| Gold |

Great Wall Precious Metals Co., Ltd. of CBPM |

CID001909 |

Outreach Required |

| Tin |

Guangdong Hanhe Non-Ferrous Metal Co., Ltd. |

CID003116 |

Conformant |

| Gold |

Guangdong Jinding Gold Limited |

CID002312 |

Outreach Required |

| Tantalum |

Guangdong Rising Rare Metals-EO Materials Ltd. |

CID000291 |

Conformant |

| Tungsten |

Guangdong Xianglu Tungsten Co., Ltd. |

CID000218 |

Conformant |

| Gold |

Guoda Safina High-Tech Environmental Refinery Co., Ltd. |

CID000651 |

Outreach Required |

| Tungsten |

H.C. Starck Tungsten GmbH |

CID002541 |

Conformant |

| Gold |

Hangzhou Fuchunjiang Smelting Co., Ltd. |

CID000671 |

Outreach Required |

| Tungsten |

HANNAE FOR T Co., Ltd. |

CID003978 |

Outreach Required |

| Gold |

Heimerle + Meule GmbH |

CID000694 |

Conformant |

| Tantalum |

Hengyang King Xing Lifeng New Materials Co., Ltd. |

CID002492 |

Conformant |

| Gold |

Heraeus Germany GmbH Co. KG |

CID000711 |

Conformant |

| Gold |

Heraeus Metals Hong Kong Ltd. |

CID000707 |

Conformant |

| Tungsten |

Hubei Green Tungsten Co., Ltd. |

CID003417 |

Conformant |

| Tin |

HuiChang Hill Tin Industry Co., Ltd. |

CID002844 |

Conformant |

| Gold |

Hunan Chenzhou Mining Co., Ltd. |

CID000767 |

Outreach Required |

| Tungsten |

Hunan Chenzhou Mining Co., Ltd. |

CID000766 |

Conformant |

| Gold |

Hunan Guiyang yinxing Nonferrous Smelting Co., Ltd. |

CID000773 |

Outreach Required |

| Tungsten |

Hunan Jintai New Material Co., Ltd. |

CID000769 |

Non Conformant |

| Tungsten |

Hunan Shizhuyuan Nonferrous Metals Co., Ltd. Chenzhou Tungsten Products Branch |

CID002513 |

Conformant |

| Gold |

HwaSeong CJ CO., LTD. |

CID000778 |

Communication Suspended - Not Interested |

| Tungsten |

Hydrometallurg, JSC |

CID002649 |

RMI Due Diligence Review - Unable to Proceed |

| Gold |

Industrial Refining Company |

CID002587 |

Non Conformant |

| Gold |

Inner Mongolia Qiankun Gold and Silver Refinery Share Co., Ltd. |

CID000801 |

Conformant |

| Gold |

International Precious Metal Refiners |

CID002562 |

Outreach Required |

| Gold |

Ishifuku Metal Industry Co., Ltd. |

CID000807 |

Conformant |

| Gold |

Istanbul Gold Refinery |

CID000814 |

Conformant |

| Gold |

Italpreziosi |

CID002765 |

Conformant |

| Gold |

JALAN & Company |

CID002893 |

Outreach Required |

| Gold |

Japan Mint |

CID000823 |

Conformant |

| Tungsten |

Japan New Metals Co., Ltd. |

CID000825 |

Conformant |

| Tungsten |

Jiangwu H.C. Starck Tungsten Products Co., Ltd. |

CID002551 |

Conformant |

| Gold |

Jiangxi Copper Co., Ltd. |

CID000855 |

Conformant |

| Tantalum |

Jiangxi Dinghai Tantalum & Niobium Co., Ltd. |

CID002512 |

Conformant |

| Tungsten |

Jiangxi Gan Bei Tungsten Co., Ltd. |

CID002321 |

Conformant |

| Tungsten |

Jiangxi Minmetals Gao'an Non-ferrous Metals Co., Ltd. |

CID002313 |

Communication Suspended - Not Interested |

| Tin |

Jiangxi New Nanshan Technology Ltd. |

CID001231 |

Conformant |

| Tungsten |

Jiangxi Tonggu Non-ferrous Metallurgical & Chemical Co., Ltd. |

CID002318 |

Conformant |

| Tantalum |

Jiangxi Tuohong New Raw Material |

CID002842 |

Conformant |

| Tungsten |

Jiangxi Xinsheng Tungsten Industry Co., Ltd. |

CID002317 |

Conformant |

| Tungsten |

Jiangxi Yaosheng Tungsten Co., Ltd. |

CID002316 |

Conformant |

| Tantalum |

JiuJiang JinXin Nonferrous Metals Co., Ltd. |

CID000914 |

Conformant |

| Tantalum |

Jiujiang Tanbre Co., Ltd. |

CID000917 |

Conformant |

| Tantalum |

Jiujiang Zhongao Tantalum & Niobium Co., Ltd. |

CID002506 |

Conformant |

| Tungsten |

JSC "Kirovgrad Hard Alloys Plant" |

CID003408 |

RMI Due Diligence Review - Unable to Proceed |

| Gold |

JSC Ekaterinburg Non-Ferrous Metal Processing Plant |

CID000927 |

RMI Due Diligence Review - Unable to Proceed |

| Gold |

JSC Novosibirsk Refinery |

CID000493 |

RMI Due Diligence Review - Unable to Proceed |

| Gold |

JSC Uralelectromed |

CID000929 |

RMI Due Diligence Review - Unable to Proceed |

| Gold |

JX Nippon Mining & Metals Co., Ltd. |

CID000937 |

Conformant |

| Gold |

K.A. Rasmussen |

CID003497 |

Outreach Required |

| Gold |

Kaloti Precious Metals |

CID002563 |

RMI Due Diligence Review - Unable to Proceed |

| Gold |

Kazakhmys Smelting LLC |

CID000956 |

Outreach Required |

| Gold |

Kazzinc |

CID000957 |

Conformant |

| Tantalum |

KEMET de Mexico |

CID002539 |

Conformant |

| Tungsten |

Kenee Mining Corporation Vietnam |

CID004619 |

Active |

| Tungsten |

Kennametal Fallon |

CID000966 |

Conformant |

| Tungsten |

Kennametal Huntsville |

CID000105 |

Conformant |

| Gold |

Kennecott Utah Copper LLC |

CID000969 |

Conformant |

| Gold |

KGHM Polska Miedz Spolka Akcyjna |

CID002511 |

Conformant |

| Gold |

Kojima Chemicals Co., Ltd. |

CID000981 |

Conformant |

| Gold |

Korea Zinc Co., Ltd. |

CID002605 |

Conformant |

| Gold |

Kundan Care Products Ltd. |

CID003463 |

Outreach Required |

| Gold |

Kyrgyzaltyn JSC |

CID001029 |

Non Conformant |

| Gold |

Kyshtym Copper-Electrolytic Plant ZAO |

CID002865 |

RMI Due Diligence Review - Unable to Proceed |

| Gold |

L'azurde Company For Jewelry |

CID001032 |

RMI Due Diligence Review - Unable to Proceed |

| Tungsten |

Lianyou Metals Co., Ltd. |

CID003407 |

Conformant |

| Tungsten |

Lianyou Resources Co., Ltd. |

CID004397 |

Conformant |

| Gold |

Lingbao Gold Co., Ltd. |

CID001056 |

Outreach Required |

| Gold |

Lingbao Jinyuan Tonghui Refinery Co., Ltd. |

CID001058 |

Outreach Required |

| Tungsten |

LLC Vostok |

CID003643 |

RMI Due Diligence Review - Unable to Proceed |

| Gold |

L'Orfebre S.A. |

CID002762 |

Conformant |

| Gold |

LS-NIKKO Copper Inc. |

CID001078 |

Conformant |

| Gold |

LT Metal Ltd. |

CID000689 |

Conformant |

| Tin |

Luna Smelter, Ltd. |

CID003387 |

Conformant |

| Gold |

Luoyang Zijin Yinhui Gold Refinery Co., Ltd. |

CID001093 |

Outreach Required |

| Tin |

Ma'anshan Weitai Tin Co., Ltd. |

CID003379 |

Non Conformant |

| Tin |

Magnu's Minerais Metais e Ligas Ltda. |

CID002468 |

Conformant |

| Tin |

Malaysia Smelting Corporation (MSC) |

CID001105 |

Conformant |

| Tin |

Malaysia Smelting Corporation Berhad (Port Klang) |

CID004434 |

In Communication |

| Tungsten |

Malipo Haiyu Tungsten Co., Ltd. |

CID002319 |

Conformant |

| Gold |

Marsam Metals |

CID002606 |

Non Conformant |

| Tungsten |

Masan High-Tech Materials |

CID002543 |

Conformant |

| Gold |

Materion |

CID001113 |

Conformant |

| Tantalum |

Materion Newton Inc. |

CID002548 |

Conformant |

| Gold |

Matsuda Sangyo Co., Ltd. |

CID001119 |

Conformant |

| Gold |

MD Overseas |

CID003548 |

Outreach Required |

| Tin |

Melt Metais e Ligas S.A. |

CID002500 |

Non Conformant |

| Gold |

Metal Concentrators SA (Pty) Ltd. |

CID003575 |

Conformant |

| Tin |

Metallic Resources, Inc. |

CID001142 |

Conformant |

| Gold |

Metallix Refining Inc. |

CID003557 |

Outreach Required |

| Tantalum |

Metallurgical Products India Pvt., Ltd. |

CID001163 |

Conformant |

| Gold |

Metalor Technologies (Hong Kong) Ltd. |

CID001149 |

Conformant |

| Gold |

Metalor Technologies (Singapore) Pte., Ltd. |

CID001152 |

Conformant |

| Gold |

Metalor Technologies (Suzhou) Ltd. |

CID001147 |

Conformant |

| Gold |

Metalor Technologies S.A. |

CID001153 |

Conformant |

| Gold |

Metalor USA Refining Corporation |

CID001157 |

Conformant |

| Gold |

Metalurgica Met-Mex Penoles S.A. De C.V. |

CID001161 |

Conformant |

| Tantalum |

Mineracao Taboca S.A. |

CID001175 |

Conformant |

| Tin |

Mineracao Taboca S.A. |

CID001173 |

Conformant |

| Tin |

Mining Minerals Resources SARL |

CID004065 |

Conformant |

| Tin |

Minsur |

CID001182 |

Conformant |

| Gold |

Mitsubishi Materials Corporation |

CID001188 |

Conformant |

| Tin |

Mitsubishi Materials Corporation |

CID001191 |

Conformant |

| Gold |

Mitsui Mining and Smelting Co., Ltd. |

CID001193 |

Conformant |

| Tantalum |

Mitsui Mining and Smelting Co., Ltd. |

CID001192 |

Conformant |

| Gold |

MKS PAMP SA |

CID001352 |

Conformant |

| Gold |

MMTC-PAMP India Pvt., Ltd. |

CID002509 |

Conformant |

| Gold |

Modeltech Sdn Bhd |

CID002857 |

Non Conformant |

| Tin |

Modeltech Sdn Bhd |

CID002858 |

Non Conformant |

| Tungsten |

Moliren Ltd. |

CID002845 |

RMI Due Diligence Review - Unable to Proceed |

| Gold |

Morris and Watson |

CID002282 |

Outreach Required |

| Gold |

Moscow Special Alloys Processing Plant |

CID001204 |

RMI Due Diligence Review - Unable to Proceed |

| Gold |

Nadir Metal Rafineri San. Ve Tic. A.S. |

CID001220 |

Conformant |

| Tungsten |

Nam Viet Cromit Joint Stock Company |

CID004034 |

Outreach Required |

| Gold |

Navoi Mining and Metallurgical Combinat |

CID001236 |

Conformant |

| Tin |

Nghe Tinh Non-Ferrous Metals Joint Stock Company |

CID002573 |

Outreach Required |

| Gold |

NH Recytech Company |

CID003189 |

Conformant |

| Tungsten |

Niagara Refining LLC |

CID002589 |

Conformant |

| Gold |

Nihon Material Co., Ltd. |

CID001259 |

Conformant |

| Tantalum |

Ningxia Orient Tantalum Industry Co., Ltd. |

CID001277 |

Conformant |

| Tin |

Novosibirsk Tin Combine |

CID001305 |

RMI Due Diligence Review - Unable to Proceed |

| Tantalum |

NPM Silmet AS |

CID001200 |

Conformant |

| Tungsten |

NPP Tyazhmetprom LLC |

CID003416 |

RMI Due Diligence Review - Unable to Proceed |

| Tin |

O.M. Manufacturing (Thailand) Co., Ltd. |

CID001314 |

Conformant |

| Tin |

O.M. Manufacturing Philippines, Inc. |

CID002517 |

Conformant |

| Gold |

Ogussa Osterreichische Gold- und Silber-Scheideanstalt GmbH |

CID002779 |

Conformant |

| Gold |

Ohura Precious Metal Industry Co., Ltd. |

CID001325 |

Conformant |

| Gold |

OJSC "The Gulidov Krasnoyarsk Non-Ferrous Metals Plant" (OJSC Krastsvetmet) |

CID001326 |

RMI Due Diligence Review - Unable to Proceed |

| Tungsten |

OOO “Technolom” 1 |

CID003614 |

RMI Due Diligence Review - Unable to Proceed |

| Tungsten |

OOO “Technolom” 2 |

CID003612 |

RMI Due Diligence Review - Unable to Proceed |

| Tin |

Operaciones Metalurgicas S.A. |

CID001337 |

Conformant |

| Gold |

Pease & Curren |

CID002872 |

Communication Suspended - Not Interested |

| Gold |

Penglai Penggang Gold Industry Co., Ltd. |

CID001362 |

Outreach Required |

| Tungsten |

Philippine Chuangxin Industrial Co., Inc. |

CID002827 |

Conformant |

| Gold |

Planta Recuperadora de Metales SpA |

CID002919 |

Conformant |

| Tin |

Pongpipat Company Limited |

CID003208 |

Outreach Required |

| Tantalum |

PowerX Ltd. |

CID004054 |

Conformant |

| Tin |

Precious Minerals and Smelting Limited |

CID003409 |

Active |

| Gold |

Prioksky Plant of Non-Ferrous Metals |

CID001386 |

RMI Due Diligence Review - Unable to Proceed |

| Gold |

PT Aneka Tambang (Persero) Tbk |

CID001397 |

Conformant |

| Tin |

PT Aries Kencana Sejahtera |

CID000309 |

Conformant |

| Tin |

PT Artha Cipta Langgeng |

CID001399 |

Conformant |

| Tin |

PT ATD Makmur Mandiri Jaya |

CID002503 |

Conformant |

| Tin |

PT Babel Inti Perkasa |

CID001402 |

Conformant |

| Tin |

PT Babel Surya Alam Lestari |

CID001406 |

Conformant |

| Tin |

PT Bangka Prima Tin |

CID002776 |

Conformant |

| Tin |

PT Bangka Serumpun |

CID003205 |

Conformant |

| Tin |

PT Bangka Tin Industry |

CID001419 |

Active |

| Tin |

PT Belitung Industri Sejahtera |

CID001421 |

Conformant |

| Tin |

PT Bukit Timah |

CID001428 |

Conformant |

| Tin |

PT Cipta Persada Mulia |

CID002696 |

Conformant |

| Tin |

PT Menara Cipta Mulia |

CID002835 |

Conformant |

| Tin |

PT Mitra Stania Prima |

CID001453 |

Conformant |

| Tin |

PT Mitra Sukses Globalindo |

CID003449 |

Conformant |

| Tin |

PT Panca Mega Persada |

CID001457 |

Outreach Required |

| Tin |

PT Premium Tin Indonesia |

CID000313 |

Conformant |

| Tin |

PT Prima Timah Utama |

CID001458 |

Conformant |

| Tin |

PT Putera Sarana Shakti (PT PSS) |

CID003868 |

Conformant |

| Tin |

PT Rajawali Rimba Perkasa |

CID003381 |

Conformant |

| Tin |

PT Rajehan Ariq |

CID002593 |

Conformant |

| Tin |

PT Refined Bangka Tin |

CID001460 |

Conformant |

| Tin |

PT Sariwiguna Binasentosa |

CID001463 |

Conformant |

| Tin |

PT Stanindo Inti Perkasa |

CID001468 |

Conformant |

| Tin |

PT Sukses Inti Makmur |

CID002816 |

Conformant |

| Tin |

PT Timah Nusantara |

CID001486 |

Conformant |

| Tin |

PT Timah Tbk Kundur |

CID001477 |

Conformant |

| Tin |

PT Timah Tbk Mentok |

CID001482 |

Conformant |

| Tin |

PT Tinindo Inter Nusa |

CID001490 |

Conformant |

| Tin |

PT Tirus Putra Mandiri |

CID002478 |

Communication Suspended - Not Interested |

| Tin |

PT Tommy Utama |

CID001493 |

Conformant |

| Gold |

PX Precinox S.A. |

CID001498 |

Conformant |

| Gold |

QG Refining, LLC |

CID003324 |

Outreach Required |

| Tantalum |

QuantumClean |

CID001508 |

Conformant |

| Gold |

Rand Refinery (Pty) Ltd. |

CID001512 |

Conformant |

| Gold |

Refinery of Seemine Gold Co., Ltd. |

CID000522 |

Outreach Required |

| Gold |

REMONDIS PMR B.V. |

CID002582 |

Conformant |

| Tantalum |

Resind Industria e Comercio Ltda. |

CID002707 |

Conformant |

| Tin |

Resind Industria e Comercio Ltda. |

CID002706 |

Conformant |

| Tantalum |

RFH Yancheng Jinye New Material Technology Co., Ltd. |

CID003583 |

Conformant |

| Gold |

Royal Canadian Mint |

CID001534 |

Conformant |

| Tin |

Rui Da Hung |

CID001539 |

Conformant |

| Gold |

SAAMP |

CID002761 |

Non Conformant |

| Gold |

Sabin Metal Corp. |

CID001546 |

Communication Suspended - Not Interested |

| Gold |

Safimet S.p.A |

CID002973 |

Non Conformant |

| Gold |

SAFINA A.S. |

CID002290 |

Conformant |

| Gold |

Sai Refinery |

CID002853 |

Outreach Required |

| Gold |

Sam Precious Metals |

CID003666 |

Outreach Required |

| Gold |

Samduck Precious Metals |

CID001555 |

Non Conformant |

| Gold |

Samwon Metals Corp. |

CID001562 |

Communication Suspended - Not Interested |

| Gold |

SEMPSA Joyeria Plateria S.A. |

CID001585 |

Conformant |

| Gold |

Shandong Gold Smelting Co., Ltd. |

CID001916 |

Conformant |

| Gold |

Shandong Humon Smelting Co., Ltd. |

CID002525 |

Outreach Required |

| Gold |

Shandong Tiancheng Biological Gold Industrial Co., Ltd. |

CID001619 |

Outreach Required |

| Gold |

Shandong Zhaojin Gold & Silver Refinery Co., Ltd. |

CID001622 |

Conformant |

| Gold |

Shenzhen CuiLu Gold Co., Ltd. |

CID002750 |

Outreach Required |

| Gold |

Shenzhen Zhonghenglong Real Industry Co., Ltd. |

CID002527 |

Outreach Required |

| Tungsten |

Shinwon Tungsten (Fujian Shanghang) Co., Ltd. |

CID004430 |

Conformant |

| Gold |

Shirpur Gold Refinery Ltd. |

CID002588 |

Outreach Required |

| Gold |

Sichuan Tianze Precious Metals Co., Ltd. |

CID001736 |

Conformant |

| Gold |

Singway Technology Co., Ltd. |

CID002516 |

Non Conformant |

| Gold |

SOE Shyolkovsky Factory of Secondary Precious Metals |

CID001756 |

RMI Due Diligence Review - Unable to Proceed |

| Gold |

Solar Applied Materials Technology Corp. |

CID001761 |

Conformant |

| Tantalum |

Solikamsk Magnesium Works OAO |

CID001769 |

RMI Due Diligence Review - Unable to Proceed |

| Gold |

Sovereign Metals |

CID003383 |

Outreach Required |

| Gold |

State Research Institute Center for Physical Sciences and Technology |

CID003153 |

Outreach Required |

| Gold |

Sudan Gold Refinery |

CID002567 |

Outreach Required |

| Gold |

Sumitomo Metal Mining Co., Ltd. |

CID001798 |

Conformant |

| Gold |

SungEel HiMetal Co., Ltd. |

CID002918 |

Conformant |

| Gold |

Super Dragon Technology Co., Ltd. |

CID001810 |

Outreach Required |

| Tin |

Super Ligas |

CID002756 |

Conformant |

| Gold |

T.C.A S.p.A |

CID002580 |

Conformant |

| Tin |

Takehara PVD Materials Plant / PVD Materials Division of MITSUI MINING & SMELTING CO., LTD. |

CID004403 |

Active |

| Tantalum |

Taki Chemical Co., Ltd. |

CID001869 |

Conformant |

| Gold |

Tanaka Kikinzoku Kogyo K.K. |

CID001875 |

Conformant |

| Tantalum |

TANIOBIS Co., Ltd. |

CID002544 |

Conformant |

| Tantalum |

TANIOBIS GmbH |

CID002545 |

Conformant |

| Tantalum |

TANIOBIS Japan Co., Ltd. |

CID002549 |

Conformant |

| Tantalum |

TANIOBIS Smelting GmbH & Co. KG |

CID002550 |

Conformant |

| Tungsten |

TANIOBIS Smelting GmbH & Co. KG |

CID002542 |

Conformant |

| Tantalum |

Telex Metals |

CID001891 |

Conformant |

| Tin |

Thaisarco |

CID001898 |

Conformant |

| Tin |

Tin Smelting Branch of Yunnan Tin Co., Ltd. |

CID002180 |

Conformant |

| Tin |

Tin Technology & Refining |

CID003325 |

Conformant |

| Gold |

Tokuriki Honten Co., Ltd. |

CID001938 |

Conformant |

| Gold |

Tongling Nonferrous Metals Group Co., Ltd. |

CID001947 |

Outreach Required |

| Gold |

TOO Tau-Ken-Altyn |

CID002615 |

Conformant |

| Gold |

Torecom |

CID001955 |

Conformant |

| Tungsten |

Tungsten Vietnam Joint Stock Company |

CID003993 |

Conformant |

| Tin |

Tuyen Quang Non-Ferrous Metals Joint Stock Company |

CID002574 |

Outreach Required |

| Tantalum |

Ulba Metallurgical Plant JSC |

CID001969 |

Conformant |

| Gold |

Umicore Precious Metals Thailand |

CID002314 |

Non Conformant |

| Gold |

Umicore S.A. Business Unit Precious Metals Refining |

CID001980 |

Conformant |

| Tungsten |

Unecha Refractory metals plant |

CID002724 |

Non Conformant |

| Gold |

United Precious Metal Refining, Inc. |

CID001993 |

Conformant |

| Gold |

Valcambi S.A. |

CID002003 |

Conformant |

| Tin |

VQB Mineral and Trading Group JSC |

CID002015 |

Outreach Required |

| Gold |

WEEEREFINING |

CID003615 |

Conformant |

| Gold |

Western Australian Mint (T/a The Perth Mint) |

CID002030 |

Conformant |

| Tin |

White Solder Metalurgia e Mineracao Ltda. |

CID002036 |

Conformant |

| Gold |

WIELAND Edelmetalle GmbH |

CID002778 |

Conformant |

| Tungsten |

Wolfram Bergbau und Hutten AG |

CID002044 |

Conformant |

| Tungsten |

Xiamen Tungsten (H.C.) Co., Ltd. |

CID002320 |

Conformant |

| Tungsten |

Xiamen Tungsten Co., Ltd. |

CID002082 |

Conformant |

| Tantalum |

XIMEI RESOURCES (GUANGDONG) LIMITED |

CID000616 |

Conformant |

| Tantalum |

XinXing HaoRong Electronic Material Co., Ltd. |

CID002508 |

Conformant |

| Gold |

Yamakin Co., Ltd. |

CID002100 |

Conformant |

| Tantalum |

Yanling Jincheng Tantalum & Niobium Co., Ltd. |

CID001522 |

Conformant |

| Gold |

Yokohama Metal Co., Ltd. |

CID002129 |

Conformant |

| Tungsten |

YUDU ANSHENG TUNGSTEN CO., LTD. |

CID003662 |

Outreach Required |

| Tin |

Yunnan Chengfeng Non-ferrous Metals Co., Ltd. |

CID002158 |

Conformant |

| Gold |

Yunnan Copper Industry Co., Ltd. |

CID000197 |

Outreach Required |

| Tin |

Yunnan Yunfan Non-ferrous Metals Co., Ltd. |

CID003397 |

Conformant |

| Gold |

Zhongyuan Gold Smelter of Zhongjin Gold Corporation |

CID002224 |

Conformant |

* The

information in this column is based on smelter or refiner information made publicly available by RMI as of May 14, 2024. The terms

used have the following meanings:

| · | “Conformant” means that a smelter or refiner participates in and has been listed as “Conformant” to the assessment

protocols of the Responsible Minerals Assurance Process (“RMAP”). |

| · | “Non-Conformant” means that a smelter’s or refiner’s systems, processes and practices materially deviate from

the requirements of the Standard, or the auditee refuses to participate in the assessment process or does not provide adequate access

to facilities to complete the assessment. |

| · | “Active” means that the facility is in one of the stages of the audit cycle, anywhere from completion of the necessary

documents to scheduling the audit date to enacting corrective actions in the post-audit phase. |

| · | “Not Enrolled” refers to smelters that are not currently participating in the RMAP. Included in this category are facilities

that the RMI is currently reaching out to, those that are communicating with the RMI regarding participation in an audit, those that have

refused to participate, and those that have not completed the mandatory annual re-audit and those that failed to meet the assessment protocols

to pass as audit. The following sub-statuses roll up into the “Not Enrolled” category; “Communication Suspended –

Not Interested”; “Due Diligence Vetting Process”; “In Communication”; “Outreach Required”; and

“RMI Due Diligence Review – Unable to Proceed”. |

** Certain

suppliers reported the presence of this entity that was sanctioned by the United States Department of Treasury, Office of Foreign Assets

Control on March 17, 2022, specifically, CID003185 - African Gold Refinery (“AGR”). Because of the over-reporting nature

of the industry CMRT information collection process, and the nature of the supply chains and goods, we are unable to confirm AGR was or

is active in our supply chain.

| · | APPENDIX B - Countries of Origin |

The information provided in this Appendix is based

on the information collected from our suppliers and is provided in good faith. We will continue to update it as our due diligence process

and third-party data evolves.

| Albania |

| Andorra |

| Angola |

| Argentina |

| Armenia |

| Australia |

| Austria |

| Azerbaijan |

| Belarus |

| Belgium |

| Benin |

| Bermuda |

| Bolivia (Plurinational State of) |

| Brazil |

| Bulgaria |

| Burkina Faso |

| Burundi |

| Cambodia |

| Canada |

| Central African Republic |

| Chile |

| China |

| Colombia |

| Congo |

| Cyprus |

| DRC or an adjoining country (Covered Countries) |

| Djibouti |

| Dominica |

| Dominican Republic |

| Ecuador |

| Egypt |

| El Salvador |

| Eritrea |

| Estonia |

| Ethiopia |

| Fiji |

| Finland |

| France |

| Georgia |

| Germany |

| Ghana |

| Guam |

| Guatemala |

| Guinea |

| Guyana |

| Honduras |

| Hong Kong |

| Hungary |

| India |

| Indonesia |

| Ireland |

| Israel |

| Italy |

| Ivory Coast |

| Japan |

| Jersey |

| Kazakhstan |

| Kenya |

| Korea, Republic Of |

| Kyrgyzstan |

| Liberia |

| Liechtenstein |

| Lithuania |

| Luxembourg |

| Madagascar |

| Malaysia |

| Mali |

| Mauritania |

| Mexico |

| Mongolia |

| Morocco |

| Mozambique |

| Myanmar |

| Namibia |

| Netherlands |

| New Zealand |

| Nicaragua |

| Niger |

| Nigeria |

| Norway |

| Oman |

| Panama |

| Papua New Guinea |

| Peru |

| Philippines |

| Poland |

| Portugal |

| Russian Federation |

| Rwanda |

| Saudi Arabia |

| Senegal |

| Sierra Leone |

| Singapore |

| Slovakia |

| Solomon Islands |

| South Africa |

| South Sudan |

| Spain |

| Sudan |

| Suriname |

| Sweden |

| Switzerland |

| Taiwan |

| Tajikistan |

| Tanzania |

| Thailand |

| Togo |

| Turkey |

| Uganda |

| United Arab Emirates |

| United Kingdom |

| USA |

| Uzbekistan |

| Vietnam |

| Zambia |

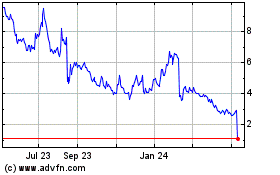

EMCORE (NASDAQ:EMKR)

Historical Stock Chart

From Feb 2025 to Mar 2025

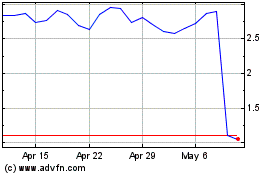

EMCORE (NASDAQ:EMKR)

Historical Stock Chart

From Mar 2024 to Mar 2025