FALSE000143486800014348682024-11-072024-11-07

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported): November 7, 2024

Esperion Therapeutics, Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Delaware | | 001-35986 | | 26-1870780 |

(State or other jurisdiction of

incorporation) | | (Commission File Number) | | (I.R.S. Employer

Identification No.) |

3891 Ranchero Drive, Suite 150

Ann Arbor, MI

(Address of principal executive offices)

Registrant’s telephone number, including area code: (734) 887-3903

Not Applicable

Former name or former address, if changed since last report

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol | | Name of each exchange on which registered |

| Common Stock, par value $0.001 per share | | ESPR | | NASDAQ Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 or Rule 12b-2 of the Securities Exchange Act of 1934.

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition.

On November 7, 2024, Esperion Therapeutics, Inc. issued a press release announcing its financial results for the three and nine months ended September 30, 2024 (the “Press Release”). A copy of the Press Release is furnished herewith as Exhibit 99.1.

The information set forth under Item 2.02 and in Exhibit 99.1 attached hereto is intended to be furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934 or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, except as expressly set forth by specific reference in such filing.

Item 9.01. Financial Statements and Exhibits.

| | | | | | | | |

| Exhibit No. | | Description |

| | |

| | |

| | |

| 104 | | The cover page from this Current Report on Form 8-K, formatted in Inline XBRL. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| Date: November 7, 2024 | Esperion Therapeutics, Inc. |

| |

| By: | /s/ Sheldon L. Koenig |

| | Sheldon L. Koenig |

| | President and Chief Executive Officer |

Esperion Reports Third Quarter 2024 Financial Results and Provides a Business Update

– Total Revenue Increased 52% Year-over-Year to $51.6 Million with

U.S. Net Product Revenue of $31.1 Million, Representing 53% Growth –

– Total Retail Prescription Equivalents Increased 12% and New to Brand Prescriptions Grew 18% from Second Quarter –

– October 2024 Total Retail Prescription Equivalents Increased 17% and New to Brand Prescriptions Grew 20% Compared to First Four Weeks of Q3 2024 –

– Conference Call and Webcast Today at 8:00 a.m. ET –

ANN ARBOR, Mich., November 7, 2024 (GLOBE NEWSWIRE) – Esperion (NASDAQ: ESPR) today reported financial results for the third quarter ended September 30, 2024, and provided a business update.

“The year to date has been transformational for Esperion. We successfully expanded our product labels, scaled up our commercial team and launched new indications, which have driven double-digit prescription growth every quarter since receiving the new outcome labels. In addition, we substantially strengthened our balance sheet by monetizing the European royalties on our bempedoic acid product sales and allocated the proceeds for the early, discounted payoff and termination of a previous revenue interest facility,” stated Sheldon Koenig, President and CEO of Esperion. “We are confident the advances we made in the third quarter with contracted payers and our innovative outreach to healthcare providers has strengthened our foundation for future growth as we continue to build a sustainable biopharmaceutical company and deliver preventative and life-saving medicines to patients worldwide.”

“We continue to be impressed with and encouraged by the strong adoption and growing product revenue our European partner, Daichi Sankyo Europe (DSE), is generating across Europe bringing the LDL-C lowering benefits of NILEMDO® (bempedoic acid) and NUSTENDI® (bempedoic acid and ezetimibe) to patients at risk for cardiovascular events and expect these successes to be a proxy for the substantial market opportunity in the U.S.,” added Koenig. “We also have a significant market opportunity in Japan where our partner, Otsuka Pharmaceutical, is advancing toward filing for regulatory approval of our bempedoic acid product by the end of 2024 with approval and pricing anticipated in 2025.”

Third Quarter 2024 Key Accomplishments and Recent Highlights

Advanced US Commercialization Initiatives

•Updated utilization management criteria for over 165 million lives now aligned to our new labels across Commercial, Medicare and Medicaid payers.

◦New additions to Medicare formularies at Optum/United AARP and CVS/SilverScript coupled with Humana provides access to more than 65% of Medicare insured lives and more than 92% of commercially insured lives.

•With key restrictions and access barriers reduced, including prior authorization in some cases, physicians can now prescribe NEXLETOL® (bempedoic acid) and NEXLIZET ® (bempedoic acid and ezetimibe) with increased confidence, positioning the products for higher sales growth in the upcoming quarters and beyond.

•As a result of the combined marketing, managed care and sales initiatives, the Company achieved approximately 18% growth in new to brand prescription and increased total retail prescription equivalents by approximately 12% compared to the second quarter, and now has more than 23,500 healthcare practitioners in Q3 2024 writing scripts for NEXLETOL and NEXLIZET.

◦Building on this foundation, the fourth quarter has shown continued strength as October 2024 total retail prescription equivalents grew 17% and new to brand prescriptions increased 20% compared with the first four weeks of the third quarter of 2024.

Significant International Progress

•DSE continued to drive significant prescription growth in Europe during the third quarter, as reflected in the approximately 19% sequential increase in royalty revenue to $8.9 million based on European sales of NILEMDO and NUSTENDI.

•Otsuka Pharmaceutical remains on track to file a New Drug Application (NDA) in Japan by the end of the year, with approval and National Health Insurance (NHI) pricing anticipated in 2025.

•Daichi Sankyo Limited, Co., our partner for certain Asian regions, received regulatory approval to market NILEMDO in Taiwan.

•New Drug Applications in Canada are planned for November 2024, with potential submissions and/or partnerships in Australia and Israel expected in the first half of 2025.

Publications and Presentations

•Announced a bolus of data in support of the benefits of bempedoic acid to reduce LDL-C and cardiovascular risk will be presented at the upcoming American Heart Association Scientific Sessions taking place from November 16-18, 2024, in Chicago. The following data will be presented:

▪An oral, featured presentation in the Late Breaker/Featured Science track titled “Bempedoic Acid and Limb Outcomes in Statin-Intolerant Patients with Peripheral Artery Disease: New insights from the CLEAR Outcomes Trial” explores the impact of bempedoic acid on reduction of major adverse limb events in patients with peripheral artery disease;

▪A poster presentation titled, “Statin Intolerance due to Muscle Symptoms Affects Management of Patients: Insights from the CLEAR Outcomes Trial,” evaluated whether there were differences in statin intolerance symptom history and whether this influenced the clinical course during the CLEAR Outcomes study;

▪A poster presentation titled, “Liver Steatosis and Liver Fibrosis Predict Major Adverse Cardiovascular Events in the CLEAR Outcomes Trial,” evaluates whether liver steatosis or liver fibrosis are associated with cardiovascular (CV) outcomes in CLEAR Outcomes, and if so, whether bempedoic acid treatment reduces observed increases in CV risk; and

▪A poster presentation titled, “Effectiveness of Lipid-lowering Therapy with Bempedoic Acid plus Ezetimibe in a Real-world Cohort,” evaluates the effectiveness of bempedoic acid and ezetimibe on LDL-C reduction below 100 mg/dL using real-world data.

•Continued to publish a growing body of clinical and scientific data in support of the cardiovascular risk reduction benefits of bempedoic acid.

▪DSE reported final, two-year, real-world results from the MILOS German cohort at DGK Herztage 2024 in Hamburg, Germany. The data demonstrated a strong increase in the achievement of LDL-C goals with the addition of bempedoic acid.

Third Quarter and YTD 2024 Financial Results

Revenue

•Total revenue for the three and nine months ended September 30, 2024, was $51.6 million and $263.2 million, respectively, compared to $34.0 million and $84.1 million for the comparable periods in 2023, an increase of 52% and 213%, respectively.

•U.S. net product revenue for the three and nine months ended September 30, 2024, was $31.1 million and $84.2 million, respectively, compared to $20.3 million and $57.6 million for the comparable periods in 2023, an increase of approximately 53% and 46%, respectively, driven by retail prescription growth of 44% and 43%.

•Collaboration revenue for the three and nine months ended September 30, 2024, was $20.5 million and $179.0 million, compared to $13.7 million and $26.5 million for the comparable periods in 2023, an increase of approximately 50% and 575%, respectively, driven by increases in royalty sales within our partner territories, product sales to our collaboration partners from our supply agreements, and revenue recognized from our Settlement Agreement with DSE in the first half of 2024.

R&D Expenses

•Research and development expenses for the three and nine months ended September 30, 2024, were $10.4 million and $35.3 million, compared to $14.9 million and $68.4 million for the comparable periods in 2023, a decrease of 30% and 48%, respectively.

◦The decrease is primarily related to the close-out of our CLEAR Outcomes study.

Selling, General and Administrative (SG&A) Expenses

•Selling, general and administrative expenses for the three and nine months ended September 30, 2024, were $40.0 million and $126.1 million, compared to $33.2 million and $97.1 million for the comparable periods in 2023, an increase of 20% and 30%, respectively.

◦The increase is primarily related to the ramp up of our sales force associated with our commercial launch in addition to bonus payments and promotional costs.

Net Loss. The Company had net losses of $29.5 million and $30.4 million for the three and nine months ended September 30, 2024, compared to net losses of $41.3 million and $152.9 million for the comparable periods in 2023, respectively.

Loss Per Share. Basic and diluted net losses per share was $0.15 for the third quarter ended September 30, 2024, and $0.17 for the nine months ended September 30, 2024, compared to basic and diluted net losses per share of $0.37 and $1.53, for the comparable periods in 2023, respectively.

Cash and Cash Equivalents. As of September 30, 2024, cash and cash equivalents totaled $144.7 million compared to $82.2 million as of December 31, 2023.

The Company ended the third quarter 2024 with approximately 195.4 million shares of common stock outstanding, excluding 2.0 million treasury shares to be purchased in the prepaid forward transaction as part of the convertible debt financing.

2024 Financial Outlook

The Company reiterates its full year 2024 operating expense guidance, which is expected to be approximately $225 million to $245 million, including $20 million in non-cash expenses related to stock compensation.

Conference Call and Webcast Information

Esperion will host a conference call and webcast at 8:00 a.m. ET to discuss these financial results and business progress. Please click here to pre-register to participate in the conference call and obtain your dial in number and PIN.

A live audio webcast can be accessed on the investor and media section of the Esperion website at esperion.com/investor-relations/events. Access to the webcast replay will be available approximately two hours after completion of the call and will be archived on the Company's website for approximately 90 days.

INDICATION

NEXLIZET and NEXLETOL are indicated:

•The bempedoic acid component of NEXLIZET and NEXLETOL is indicated to reduce the risk of myocardial infarction and coronary revascularization in adults who are unable to take recommended statin therapy (including those not taking a statin) with:

◦established cardiovascular disease (CVD), or

◦at high risk for a CVD event but without established CVD.

•As an adjunct to diet:

◦NEXLIZET, alone or in combination with other LDL-C lowering therapies, to reduce LDL-C in adults with primary hyperlipidemia, including HeFH.

◦NEXLETOL, in combination with other LDL-C lowering therapies, or alone when concomitant LDL-C lowering therapy is not possible, to reduce LDL-C in adults with primary hyperlipidemia, including HeFH.

IMPORTANT SAFETY INFORMATION

NEXLIZET and NEXLETOL are contraindicated in patients with a prior hypersensitivity to bempedoic acid or ezetimibe or any of the excipients. Serious hypersensitivity reactions including anaphylaxis, angioedema, rash, and urticaria have been reported.

Hyperuricemia: Bempedoic acid, a component of NEXLIZET and NEXLETOL, may increase blood uric acid levels, which may lead to gout. Hyperuricemia may occur early in treatment and persist throughout treatment, returning to baseline following discontinuation of treatment. Assess

uric acid levels periodically as clinically indicated. Monitor for signs and symptoms of hyperuricemia, and initiate treatment with urate-lowering drugs as appropriate.

Tendon Rupture: Bempedoic acid, a component of NEXLIZET and NEXLETOL, is associated with an increased risk of tendon rupture or injury. Tendon rupture may occur more frequently in patients over 60 years of age, in those taking corticosteroid or fluoroquinolone drugs, in patients with renal failure, and in patients with previous tendon disorders. Discontinue NEXLIZET or NEXLETOL at the first sign of tendon rupture. Consider alternative therapy in patients who have a history of tendon disorders or tendon rupture.

The most common adverse reactions in the primary hyperlipidemia trials of bempedoic acid, a component of NEXLIZET and NEXLETOL, in ≥2% of patients and greater than placebo were upper respiratory tract infection, muscle spasms, hyperuricemia, back pain, abdominal pain or discomfort, bronchitis, pain in extremity, anemia, and elevated liver enzymes.

Adverse reactions reported in ≥2% of patients treated with ezetimibe (a component of NEXLIZET) and at an incidence greater than placebo in clinical trials were upper respiratory tract infection, diarrhea, arthralgia, sinusitis, pain in extremity, fatigue, and influenza.

In the primary hyperlipidemia trials of NEXLIZET, the most commonly reported adverse reactions (incidence ≥3% and greater than placebo) observed with NEXLIZET, but not observed in clinical trials of bempedoic acid or ezetimibe, were urinary tract infection, nasopharyngitis, and constipation.

The most common adverse reactions in the cardiovascular outcomes trial for bempedoic acid, a component of NEXLIZET and NEXLETOL, at an incidence of ≥2% and 0.5% greater than placebo were hyperuricemia, renal impairment, anemia, elevated liver enzymes, muscle spasms, gout, and cholelithiasis.

Discontinue NEXLIZET or NEXLETOL when pregnancy is recognized unless the benefits of therapy outweigh the potential risks to the fetus. Because of the potential for serious adverse reactions in a breast-fed infant, breastfeeding is not recommended during treatment with NEXLIZET or NEXLETOL.

Report pregnancies to Esperion Therapeutics, Inc. Adverse Event reporting line at 1-833-377-7633.

Please see full Prescribing Information for NEXLIZET and NEXLETOL.

Esperion Therapeutics

At Esperion, we discover, develop, and commercialize innovative medicines to help improve outcomes for patients with or at risk for cardiovascular and cardiometabolic diseases. The status quo is not meeting the health needs of millions of people with high cholesterol – that is why our team of passionate industry leaders is breaking through the barriers that prevent patients from reaching their goals. Providers are moving toward reducing LDL-cholesterol levels as low as possible, as soon as possible; we provide the next steps to help get patients there. Because when it comes to high cholesterol, getting to goal is not optional. It is our life’s work. For more information, visit esperion.com and esperionscience.com and follow us on X at twitter.com/EsperionInc.

Forward-Looking Statements

This press release contains forward-looking statements that are made pursuant to the safe harbor provisions of the federal securities laws, including statements regarding marketing strategy and commercialization plans, current and planned operational expenses, future operations, commercial products, clinical development, including the timing, designs and plans for the CLEAR Outcomes study and its results, plans for potential future product candidates, financial condition and outlook, including expected cash runway, and other statements containing the words “anticipate,” “believe,” “estimate,” “expect,” “intend,” “may,” “plan,” “predict,” “project,” “suggest,” “target,” “potential,” “will,” “would,” “could,” “should,” “continue,” and similar expressions. Any express or implied statements contained in this press release that are not statements of historical fact may be deemed to be forward-looking statements. Forward-looking statements involve risks and uncertainties that could cause Esperion’s actual results to differ significantly from those projected, including, without limitation, the net sales, profitability, and growth of Esperion’s commercial products, clinical activities and results, supply chain, commercial development and launch plans, the outcomes and anticipated benefits of legal proceedings and settlements, and the risks detailed in Esperion’s filings with the Securities and Exchange Commission. Any forward-looking statements contained in this press release speak only as of the date hereof, and Esperion disclaims any obligation or undertaking to update or revise any forward-looking statements contained in this press release, other than to the extent required by law.

Esperion Contact Information:

Investors:

Alina Venezia

investorrelations@esperion.com

(734) 887-3903

Media:

Tiffany Aldrich

corporateteam@esperion.com

(616) 443-8438

Esperion Therapeutics, Inc.

Balance Sheet Data

(In thousands)

(Unaudited)

| | | | | | | | | | | | | | |

| | September 30, 2024 | | December 31, 2023 |

| Cash and cash equivalents | | $ | 144,717 | | | $ | 82,248 | |

| Working capital | | 141,682 | | | 44,841 | |

| Total assets | | 314,114 | | | 205,796 | |

| Royalty sale liability | | 290,623 | | | — | |

| Revenue interest liability | | — | | | 274,778 | |

| Convertible notes, net of issuance costs | | 262,922 | | | 261,596 | |

| Common stock | | 195 | | | 118 | |

| Accumulated deficit | | (1,579,711) | | | (1,549,284) | |

| Total stockholders' deficit | | (370,209) | | | (454,994) | |

Esperion Therapeutics, Inc.

Statement of Operations

(In thousands, except share and per share data)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

September 30, | | Nine Months Ended

September 30, |

| 2024 | | 2023 | | 2024 | | | | | 2023 |

| Revenues: | | | | | | | | | | |

| Product sales, net | $ | 31,106 | | | $ | 20,251 | | | $ | 84,164 | | | | | | $ | 57,575 | |

| Collaboration revenue | 20,526 | | | 13,718 | | | 179,037 | | | | | | 26,509 | |

| Total Revenues | 51,632 | | | 33,969 | | | 263,201 | | | | | | 84,084 | |

| | | | | | | | | | |

| Operating expenses: | | | | | | | | | | |

| Cost of goods sold | 17,286 | | | 13,377 | | | 42,970 | | | | | | 31,815 | |

| Research and development | 10,397 | | | 14,885 | | | 35,261 | | | | | | 68,365 | |

| Selling, general and administrative | 39,975 | | | 33,240 | | | 126,148 | | | | | | 97,100 | |

| Total operating expenses | 67,658 | | | 61,502 | | | 204,379 | | | | | | 197,280 | |

| | | | | | | | | | |

| Income (loss) from operations | (16,026) | | | (27,533) | | | 58,822 | | | | | | (113,196) | |

| | | | | | | | | | |

| Interest expense | (15,082) | | | (14,995) | | | (42,829) | | | | | | (43,919) | |

| Loss on extinguishment of debt | — | | | — | | | (53,235) | | | | | | — | |

| Other income, net | 1,584 | | | 1,278 | | | 6,815 | | | | | | 4,211 | |

| Net loss | $ | (29,524) | | | $ | (41,250) | | | $ | (30,427) | | | | | | $ | (152,904) | |

| | | | | | | | | | |

| Net loss per common share - basic and diluted | $ | (0.15) | | | $ | (0.37) | | | $ | (0.17) | | | | | | $ | (1.53) | |

| | | | | | | | | | |

| Weighted-average shares outstanding - basic and diluted | 194,930,830 | | | 111,869,478 | | | 184,366,434 | | | | | | 99,973,647 | |

Cover Page

|

Nov. 07, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Nov. 07, 2024

|

| Entity Registrant Name |

Esperion Therapeutics, Inc.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-35986

|

| Entity Tax Identification Number |

26-1870780

|

| Entity Address, Address Line One |

3891 Ranchero Drive

|

| Entity Address, Address Line Two |

Suite 150

|

| Entity Address, City or Town |

Ann Arbor

|

| Entity Address, State or Province |

MI

|

| Entity Address, Postal Zip Code |

48108

|

| City Area Code |

734

|

| Local Phone Number |

887-3903

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, par value $0.001 per share

|

| Trading Symbol |

ESPR

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity Central Index Key |

0001434868

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

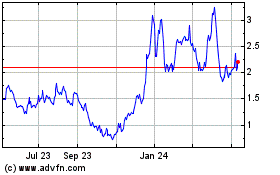

Esperion Therapeutics (NASDAQ:ESPR)

Historical Stock Chart

From Dec 2024 to Jan 2025

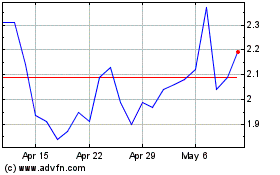

Esperion Therapeutics (NASDAQ:ESPR)

Historical Stock Chart

From Jan 2024 to Jan 2025