Esperion (NASDAQ: ESPR) today announced that it has closed on a

series of financing transactions that will support the Company’s

repayment of a portion of its existing $265 million convertible

debt facility. The transactions included a $150 million senior

secured term loan facility (the “Loan”) led by funds managed by

Athyrium Capital Management, LP (“Athyrium”) and joined by funds

managed by HealthCare Royalty (“HCRx”), and issuance of new $100

million Convertible Notes (the “New Notes”) to accredited

investors. The Company expects to use the proceeds from the Loan

and approximately $60 million of the proceeds from subscription for

the New Notes to repay $210 million of the existing convertible

debt with the remaining approximately $40 million of the proceeds

to be allocated as operating cash.

“We are delighted to have the support of the Athyrium and HCRx

teams, as they are well-regarded healthcare specialist investors,

who share our commitment to bringing potentially life-saving new

medicines to the patients who need them. Throughout 2024, our team

has been focused on strengthening our balance sheet with a series

of transformational transactions that provide us with increased

operational and financial flexibility to build and expand our

business globally,” stated Sheldon Koenig, President and CEO of

Esperion. “By strategically implementing these financial

transactions, we have successfully restructured 80% of our existing

debt with a new maturity date that delays repayment out five years

or more. This approach not only strengthens our balance sheet but

also allows us to focus on growing revenue of our bempedoic acid

products, NEXLETOL® (bempedoic acid) and NEXLIZET ® (bempedoic acid

and ezetimibe) in order to maintain our commitment to delivering

long-term value to our investors."

J. Wood Capital Advisors LLC acted as financial advisor and

Gibson, Dunn & Crutcher LLP served as legal advisor to the

Company on the transaction.

$150 Million Senior Secured Term Loan Credit Facility

Led by Athyrium Capital Management and Joined by HealthCare

Royalty

The Credit Agreement provides for a $150,000,000 term loan,

which was drawn in full at closing. Proceeds from the Loan will be

used to repay a portion of the outstanding obligations under the

Company’s existing $265 million aggregate principal amount 4.00%

Convertible Senior Subordinated Notes due November 2025 (the

“Existing Notes”) and to pay fees and expenses incurred in

connection with entry into the Credit Agreement and the New Notes

transactions. The Loan will bear interest at an annual rate of

9.75% if paid in cash and 11.75% if paid in-kind.

“Our investment underscores our confidence in Esperion’s ability

to execute its strategy across key areas of the business important

for long-term success and value creation,” said Laurent D.

Hermouet, Partner at Athyrium. “We are thrilled to leverage our

extensive investment experience in the healthcare sector by

partnering with Esperion to support the development and

commercialization of their innovative therapies, aimed at improving

outcomes for patients with or at risk of cardiovascular and

cardiometabolic diseases.”

New $100 Million Convertible Note

The New Notes will represent the senior unsecured obligations of

Esperion and will pay interest semi-annually in arrears on each

June 15 and December 15, commencing on June 15, 2025, at a rate of

5.75% per annum. The New Notes will mature on June 15, 2030 (the

“Maturity Date”), unless earlier converted, redeemed or

repurchased. Holders will have the right to convert their notes

only upon the occurrence of certain events or after March 15, 2030.

Esperion will have the right to elect to settle conversions by

paying or delivering, as applicable, cash, shares of its common

stock or a combination of cash and shares of its common stock. The

initial conversion rate is 326.7974 shares of common stock per

$1,000 principal amount of notes, which represents an initial

conversion price of approximately $3.06 per share of common stock.

The conversion rate and conversion price will be subject to

adjustment upon the occurrence of certain events. The indenture

governing the New Notes includes certain restrictive covenants that

limits Esperion’s ability to incur additional indebtedness, subject

to certain exceptions.

INDICATION NEXLIZET and NEXLETOL are

indicated:

- The bempedoic acid component of NEXLIZET and NEXLETOL is

indicated to reduce the risk of myocardial infarction and coronary

revascularization in adults who are unable to take recommended

statin therapy (including those not taking a statin) with:

- established cardiovascular disease (CVD), or

- at high risk for a CVD event but without established CVD.

- As an adjunct to diet:

- NEXLIZET, alone or in combination with other LDL-C lowering

therapies, to reduce LDL-C in adults with primary hyperlipidemia,

including HeFH.

- NEXLETOL, in combination with other LDL-C lowering therapies,

or alone when concomitant LDL-C lowering therapy is not possible,

to reduce LDL-C in adults with primary hyperlipidemia, including

HeFH.

IMPORTANT SAFETY INFORMATIONNEXLIZET and

NEXLETOL are contraindicated in patients with a prior

hypersensitivity to bempedoic acid or ezetimibe or any of the

excipients. Serious hypersensitivity reactions including

anaphylaxis, angioedema, rash, and urticaria have been

reported.

Hyperuricemia: Bempedoic acid, a component of NEXLIZET and

NEXLETOL, may increase blood uric acid levels, which may lead to

gout. Hyperuricemia may occur early in treatment and persist

throughout treatment, returning to baseline following

discontinuation of treatment. Assess uric acid levels periodically

as clinically indicated. Monitor for signs and symptoms of

hyperuricemia, and initiate treatment with urate-lowering drugs as

appropriate.

Tendon Rupture: Bempedoic acid, a component of NEXLIZET and

NEXLETOL, is associated with an increased risk of tendon rupture or

injury. Tendon rupture may occur more frequently in patients over

60 years of age, in those taking corticosteroid or fluoroquinolone

drugs, in patients with renal failure, and in patients with

previous tendon disorders. Discontinue NEXLIZET or NEXLETOL at the

first sign of tendon rupture. Consider alternative therapy in

patients who have a history of tendon disorders or tendon

rupture.

The most common adverse reactions in the primary hyperlipidemia

trials of bempedoic acid, a component of NEXLIZET and NEXLETOL, in

≥2% of patients and greater than placebo were upper respiratory

tract infection, muscle spasms, hyperuricemia, back pain, abdominal

pain or discomfort, bronchitis, pain in extremity, anemia, and

elevated liver enzymes.

Adverse reactions reported in ≥2% of patients treated with

ezetimibe (a component of NEXLIZET) and at an incidence greater

than placebo in clinical trials were upper respiratory tract

infection, diarrhea, arthralgia, sinusitis, pain in extremity,

fatigue, and influenza.

In the primary hyperlipidemia trials of NEXLIZET, the most

commonly reported adverse reactions (incidence ≥3% and greater than

placebo) observed with NEXLIZET, but not observed in clinical

trials of bempedoic acid or ezetimibe, were urinary tract

infection, nasopharyngitis, and constipation.

The most common adverse reactions in the cardiovascular outcomes

trial for bempedoic acid, a component of NEXLIZET and NEXLETOL, at

an incidence of ≥2% and 0.5% greater than placebo were

hyperuricemia, renal impairment, anemia, elevated liver enzymes,

muscle spasms, gout, and cholelithiasis.

Discontinue NEXLIZET or NEXLETOL when pregnancy is recognized

unless the benefits of therapy outweigh the potential risks to the

fetus. Because of the potential for serious adverse reactions in a

breast-fed infant, breastfeeding is not recommended during

treatment with NEXLIZET or NEXLETOL.

Report pregnancies to Esperion Therapeutics, Inc. Adverse Event

reporting line at 1-833-377-7633.

Please see full Prescribing Information for NEXLIZET and

NEXLETOL.

About Esperion TherapeuticsAt Esperion, we

discover, develop, and commercialize innovative medicines to help

improve outcomes for patients with or at risk for cardiovascular

and cardiometabolic diseases. The status quo is not meeting the

health needs of millions of people with high cholesterol – that is

why our team of passionate industry leaders is breaking through the

barriers that prevent patients from reaching their goals. Providers

are moving toward reducing LDL-cholesterol levels as low as

possible, as soon as possible; we provide the next steps to help

get patients there. Because when it comes to high cholesterol,

getting to goal is not optional. It is our life’s work. For more

information, visit esperion.com and esperionscience.com. and follow

us on X at twitter.com/EsperionInc.

About Athyrium Capital Management Athyrium is a

specialized asset management company formed in 2008 to focus on

investment opportunities in the global healthcare sector. Athyrium

advises funds with over $4.6 billion in committed capital. The

Athyrium team has substantial investment experience across a wide

range of asset classes including public equity, private equity,

fixed income, royalties, and other structured securities. Athyrium

invests across all healthcare verticals including biopharma,

medical devices and products, healthcare focused services, and

healthcare information technology. For more information, please

visit www.athyrium.com.

About HealthCare RoyaltyHealthCare Royalty is a

leading royalty acquisition company focused on commercial or

near-commercial biopharmaceutical products. With offices in

Stamford, Conn., San Francisco, Boston and London, HCRx has

invested $5+ billion in over 85 biopharmaceutical products since

inception. For more information, visit https://www.hcrx.com.

HEALTHCARE ROYALTY® and HCRx® are registered trademarks of

HealthCare Royalty Management, LLC.

Forward-Looking StatementsThis press release

contains forward-looking statements that are made pursuant to the

safe harbor provisions of the federal securities laws, including

statements regarding marketing strategy and commercialization

plans, current and planned operational expenses, future operations,

commercial products, clinical development, including the timing,

designs and plans for the CLEAR Outcomes study and its results,

plans for potential future product candidates, financial condition

and outlook, including expected cash runway, and other statements

containing the words “anticipate,” “believe,” “estimate,” “expect,”

“intend,” “may,” “plan,” “predict,” “project,” “suggest,” “target,”

“potential,” “will,” “would,” “could,” “should,” “continue,” and

similar expressions. Any express or implied statements contained in

this press release that are not statements of historical fact may

be deemed to be forward-looking statements. Forward-looking

statements involve risks and uncertainties that could cause

Esperion’s actual results to differ significantly from those

projected, including, without limitation, the net sales,

profitability, and growth of Esperion’s commercial products,

clinical activities and results, supply chain, commercial

development and launch plans, the outcomes and anticipated benefits

of legal proceedings and settlements, and the risks detailed in

Esperion’s filings with the Securities and Exchange Commission. Any

forward-looking statements contained in this press release speak

only as of the date hereof, and Esperion disclaims any obligation

or undertaking to update or revise any forward-looking statements

contained in this press release, other than to the extent required

by law.

Esperion Contact Information:Investors: Alina

Veneziainvestorrelations@esperion.com (734) 887-3903

Media: Tiffany Aldrich corporateteam@esperion.com (616)

443-8438

Athyrium Contact Information:Courtney Paul(212)

402 6925

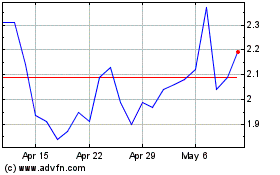

Esperion Therapeutics (NASDAQ:ESPR)

Historical Stock Chart

From Jan 2025 to Feb 2025

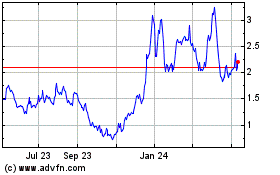

Esperion Therapeutics (NASDAQ:ESPR)

Historical Stock Chart

From Feb 2024 to Feb 2025