EyePoint Pharmaceuticals, Inc. (NASDAQ: EYPT), a company committed

to developing and commercializing innovative therapeutics to

improve the lives of patients with serious retinal diseases, today

announced the pricing of an underwritten public offering of

12,727,273 shares of its common stock at a public offering price of

$11.00 per share. The aggregate gross proceeds from this offering

are expected to be approximately $140.0 million, before deducting

underwriting discounts and commissions and other offering expenses

payable by EyePoint. All of the shares of common stock are being

sold by EyePoint. The closing of the offering is expected to occur

on or about October 31, 2024, subject to the satisfaction of

customary closing conditions. In addition, EyePoint has granted the

underwriters an option for a period of 30 days to purchase up to an

additional 1,909,090 shares of EyePoint’s common stock at the

public offering price, less underwriting discounts and commissions.

J.P. Morgan, Citigroup and Guggenheim Securities

are acting as joint book running managers for the offering. Baird,

Mizuho and Jones are acting as co-managers for the offering.

EyePoint intends to use the net proceeds that it

will receive from the offering to advance clinical development of

DURAVYU™ for wet age related macular degeneration (wet AMD) and

diabetic macular edema (DME), as well as support its earlier stage

pipeline development initiatives, and for general corporate

purposes.

The securities described above are being offered

by the Company pursuant to a shelf registration statement on Form

S-3 (No. 333-281391) previously filed with the Securities and

Exchange Commission (SEC) on August 8, 2024 and declared effective

by the SEC on August 16, 2024.

The securities are being offered by means of a

prospectus supplement and accompanying prospectus relating to the

offering that form a part of the registration statement. A

preliminary prospectus supplement relating to the offering was

filed with the SEC on October 28, 2024 and is available on the

SEC’s website at www.sec.gov. The final prospectus supplement

relating to and describing the terms of the offering will be filed

with the SEC and also will be available on the SEC’s website at

www.sec.gov. Before investing in the offering, you should read each

of the prospectus supplement and the accompanying prospectus

relating to the offering in their entirety as well as the other

documents that EyePoint has filed with the SEC that are

incorporated by reference in the prospectus supplement and the

accompanying prospectus relating to the offering, which provide

more information about EyePoint and the offering. Copies of the

final prospectus supplement, when available, and accompanying

prospectus relating to the offering may be obtained from J.P.

Morgan Securities LLC, c/o Broadridge Financial Solutions, 1155

Long Island Avenue, Edgewood, NY 11717, or by email at

prospectus-eq_fi@jpmchase.com and

postsalemanualrequests@broadridge.com; Citigroup, c/o Broadridge

Financial Solutions, 1155 Long Island Avenue, Edgewood, NY 11717,

or by telephone at (800) 831-9146; or Guggenheim Securities, LLC,

Attention: Equity Syndicate Department, 330 Madison Avenue, 8th

Floor, New York, NY 10017, by telephone at (212) 518-9544, or by

email at GSEquityProspectusDelivery@guggenheimpartners.com.

This press release shall not constitute an offer

to sell or the solicitation of an offer to buy any of the

securities described herein, nor shall there be any sale of these

securities in any state or jurisdiction in which such offer,

solicitation or sale would be unlawful prior to registration or

qualification under the securities laws of any such state or

jurisdiction.

About EyePoint

Pharmaceuticals

EyePoint Pharmaceuticals (Nasdaq: EYPT) is a

clinical-stage biopharmaceutical company committed to developing

and commercializing innovative therapeutics to help improve the

lives of patients with serious retinal diseases. The Company's

pipeline leverages its proprietary bioerodible Durasert E™

technology for sustained intraocular drug delivery. The Company’s

lead product candidate, DURAVYU™ (f/k/a EYP-1901), is an

investigational sustained delivery treatment for VEGF-mediated

retinal diseases combining vorolanib, a selective and

patent-protected tyrosine kinase inhibitor with bioerodible

Durasert E™. DURAVYU is presently in Phase 3 global, pivotal

clinical trials as a sustained delivery treatment for wet AMD, the

leading cause of vision loss among people 50 years of age and older

in the United States, and in a Phase 2 clinical trial in DME.

EyePoint expects full topline data from the Phase 2 clinical trial

in DME in Q1 2025 and topline data from both Phase 3 pivotal trials

in wet AMD in 2026.

Pipeline programs include EYP-2301, a TIE-2

agonist, razuprotafib, formulated in Durasert E™ to potentially

improve outcomes in serious retinal diseases. The proven Durasert®

drug delivery technology has been safely administered to thousands

of patient eyes across four U.S. FDA approved products. EyePoint

Pharmaceuticals is headquartered in Watertown, Massachusetts.

Vorolanib is licensed to EyePoint exclusively by

Equinox Sciences, a Betta Pharmaceuticals affiliate, for the

localized treatment of all ophthalmic diseases outside of China,

Macao, Hong Kong and Taiwan.

DURAVYU™ has been conditionally accepted by the

FDA as the proprietary name for EYP-1901. DURAVYU is an

investigational product; it has not been approved by the FDA. FDA

approval and the timeline for potential approval is uncertain.

SAFE HARBOR STATEMENTS UNDER THE PRIVATE

SECURITIES LITIGATION ACT OF 1995: To the extent any statements

made in this press release deal with information that is not

historical, these are forward-looking statements under the Private

Securities Litigation Reform Act of 1995. Such statements include,

but are not limited to, statements regarding the timing of the

closing of the offering, as well as the anticipated use of proceeds

for the offering, EyePoint’s clinical development plans and the

expected timing thereof; and other statements identified by words

such as “will,” “potential,” “could,” “can,” “believe,” “intends,”

“continue,” “plans,” “expects,” “anticipates,” “estimates,” “may,”

other words of similar meaning or the use of future dates.

Forward-looking statements by their nature address matters that

are, to different degrees, uncertain. Uncertainties and risks may

cause EyePoint’s actual results to be materially different than

those expressed in or implied by EyePoint’s forward-looking

statements. For EyePoint, this includes satisfaction of the

customary closing conditions of the offering; delays in obtaining

required stock exchange or other regulatory approvals; stock price

volatility and uncertainties relating to the financial markets, the

medical community and the global economy; the timing, progress and

results of the company’s clinical development activities;

uncertainties and delays relating to the design, enrollment,

completion, and results of clinical trials; unanticipated costs and

expenses; the company’s cash and cash equivalents may not be

sufficient to support its operating plan for as long as

anticipated; the risk that results of clinical trials may not be

predictive of future results, and interim and preliminary data are

subject to further analysis and may change as more data becomes

available; unexpected safety or efficacy data observed during

clinical trials; uncertainties related to the regulatory

authorization or approval process, and available development and

regulatory pathways for approval of the company’s product

candidates; changes in the regulatory environment; changes in

expected or existing competition; the success of current and future

license agreements; our dependence on contract research

organizations, and other outside vendors and service providers;

product liability; the impact of general business and economic

conditions; protection of our intellectual property and avoiding

intellectual property infringement; retention of key personnel;

delays, interruptions or failures in the manufacture and supply of

our product candidates; the availability of and the need for

additional financing; the company’s ability to obtain additional

funding to support its clinical development programs; uncertainties

regarding the timing and results of the August 2022 subpoena from

the U.S. Attorney’s Office for the District of Massachusetts;

uncertainties regarding the FDA warning letter pertaining to the

company’s Watertown, MA manufacturing facility; and other factors

described in our filings with the Securities and Exchange

Commission. More detailed information on these and additional

factors that could affect EyePoint’s actual results are described

in EyePoint’s filings with the SEC, including its Annual

Report on Form 10-K for the fiscal year ended December 31, 2023, as

revised or supplemented by its Quarterly Reports on Form 10-Q and

other documents filed with the SEC. All forward-looking statements

in this news release speak only as of the date of this news

release. EyePoint undertakes no obligation to update or revise any

forward-looking statement, whether as a result of new information,

future events or otherwise.

Investors:Christina

TartagliaPrecision AQ (formerly Stern IR)Direct:

212-698-8700christina.tartaglia@sternir.com

Media ContactAmy PhillipsGreen

Room CommunicationsDirect:

412-327-9499aphillips@greenroompr.com

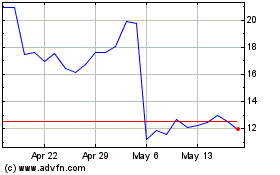

EyePoint Pharmaceuticals (NASDAQ:EYPT)

Historical Stock Chart

From Dec 2024 to Jan 2025

EyePoint Pharmaceuticals (NASDAQ:EYPT)

Historical Stock Chart

From Jan 2024 to Jan 2025