EyePoint Pharmaceuticals, Inc. (NASDAQ: EYPT), a company committed

to developing and commercializing innovative therapeutics to

improve the lives of patients with serious retinal diseases, today

announced financial results for the third quarter

ended September 30, 2024, and highlighted recent

corporate developments.

“We made tremendous progress across our pipeline in recent

months, including dosing the first patient in our first global

pivotal trial of DURAVYU™ in wet AMD and reading out interim

16-week data for our Phase 2 VERONA trial in DME,” said Jay Duker,

M.D., President and Chief Executive Officer of EyePoint. “Driven by

positive clinical data in two indications, along with growing

patient and investigator enthusiasm, we remain confident that

DURAVYU’s differentiated profile underscores its potential to be

the first sustained-release maintenance therapy in two significant

indications, positioning EyePoint as the leader in sustained ocular

drug delivery. This is an exciting time for EyePoint, and we

anticipate dosing the first patient in the second Phase 3 LUCIA

trial by the end of 2024. With a strong balance sheet and

compelling clinical data, we are well-positioned to continue

executing across our pipeline, working to bring our potentially

paradigm-shifting treatment to patients as fast as possible.”

R&D Highlights and Updates

- Announced positive interim 16-week

data for the ongoing open label Phase 2 VERONA clinical trial of

DURAVYU for diabetic macular edema (DME) in October. DURAVYU 2.7mg

demonstrated an early, sustained, and clinically meaningful

improvement in best-corrected visual acuity (BCVA) with a gain of

+8.9 letters compared to baseline versus +3.2 letters for

aflibercept control. DURAVYU 2.7mg also demonstrated concomitant

structural improvement with CST (central subfield thickness)

improvement of 68.1 microns versus 30.5 microns for aflibercept

control. Notably, both DURAVYU doses showed an immediate benefit

over aflibercept control in both BCVA and CST demonstrating the

differentiated drug release profile of DURAVYU with immediate

bioavailability. Additionally, a favorable safety and tolerability

profile continued for both DURAVYU arms. The Company expects to

report the full topline results in the first quarter of 2025, once

all patients complete the trial.

- Announced first patient dosed in the

Phase 3 LUGANO clinical trial of DURAVYUTM in wet age-related

macular degeneration (wet AMD). The second Phase 3 LUCIA pivotal

trial initiation is expected to have first patient dosing by end of

2024. The LUGANO and LUCIA clinical trials are designed for

potential global regulatory and commercial success with every

six-month re-dosing in both trials. With over 160 trial sites

committed and robust DAVIO 2 data, the company anticipates rapid

enrollment of both trials with topline data anticipated in

2026.

- Presented DAVIO 2 twelve-month data

at the American Academy of Ophthalmology (AAO) 2024 Subspecialty

Day in October, at the 24th EURetina Congress in September and the

Retina Society 57th Annual Meeting in September.

- Presented a comparison of tyrosine

kinase inhibitors being developed for intravitreal delivery at the

Retina Society 57th Annual Meeting in September, demonstrating the

differentiation of DURAVYU with immediate bioavailability and

controlled release via zero-order kinetics for at least six

months.

- Presented on sustained-release

vorolanib highlighting selective pan-VEGF receptor inhibition and

anti-angiogenic effects in VEGF-mediated ocular diseases at the

American Retina Forum (ARF) 2024 National Meeting in August

demonstrating the durable efficacy, reliable safety and reduced

injection burden of treatment with DURAVYU.

Recent Corporate Highlights

- Completed an underwritten public

offering with gross proceeds of $161.0 million in October. The

Company sold 14,636,363 shares of its common stock, which included

the exercise in full by the underwriters of their option to

purchase an additional 1,909,090 shares of common stock. The shares

of common stock were sold at a public offering price of $11.00 per

share.

- Announced the grand opening of

EyePoint’s Northbridge, MA manufacturing facility in October. The

40,000 square foot Good Manufacturing Process (cGMP) compliant

commercial manufacturing facility was built to meet U.S. FDA and

European Medicines Agency (EMA) and will support global

manufacturing across the Company’s portfolio, including lead

pipeline asset, DURAVYUTM upon potential regulatory approval.

- Announced the appointment of

esteemed industry leader Fred Hassan to the Company’s Board of

Directors in September.

Review of Results for the Third Quarter Ended September

30, 2024

For the third quarter ended September 30, 2024, total net

revenue was $10.5 million compared to $15.2 million for the quarter

ended September 30, 2023. Net product revenue for the third quarter

was $0.7 million, compared to net product revenues for the third

quarter ended September 30, 2023, of $0.8 million.

Net revenue from royalties and collaborations for the third

quarter ended September 30, 2024, totaled $9.9 million compared to

$14.4 million in the corresponding period in 2023. This decrease

was primarily driven by lower recognition of deferred revenue

related to the out-license of YUTIQ® product rights.

Operating expenses for the third quarter ended September 30,

2024, totaled $43.3 million versus $29.6 million in the prior year

period. This increase was primarily driven by (i) $5.4 million in

costs related to the DURAVYU™ Phase 3 clinical trials for wet AMD,

(ii) $3.8 million higher personnel expense for clinical and product

development, including $2.1 million of non-cash stock compensation,

(iii) $3 million in other R&D related expenses. Non-operating

income, net, totaled $3.4 million and net loss was $29.4 million,

or ($0.54) per share, compared to a net loss of $12.6 million, or

($0.33) per share, for the prior year period.

Cash and investments at September 30, 2024 totaled $253.8

million compared to $331.1 million at December 31, 2023.

Financial OutlookWe expect the cash, cash

equivalents and investments on September 30, 2024, along with the

net proceeds from the October $161.0 million equity financing will

enable us to fund operations into 2027.

About EyePoint Pharmaceuticals

EyePoint (Nasdaq: EYPT) is a clinical-stage biopharmaceutical

company committed to developing and commercializing innovative

therapeutics to help improve the lives of patients with serious

retinal diseases. The Company's pipeline leverages its proprietary

bioerodible Durasert E™ technology for sustained intraocular

drug delivery. The Company’s lead product candidate,

DURAVYU™ (f/k/a EYP-1901), is an investigational sustained

delivery treatment for VEGF-mediated retinal diseases combining

vorolanib, a selective and patent-protected tyrosine kinase

inhibitor with bioerodible Durasert E™. DURAVYU is presently in

Phase 3 global, pivotal clinical trials as a sustained delivery

treatment for wet age-related macular degeneration (wet AMD), the

leading cause of vision loss among people 50 years of age and older

in the United States, and in a Phase 2 clinical trial in

diabetic macular edema (DME). EyePoint expects full topline data

from the Phase 2 clinical trial in DME in Q1 2025 and topline data

from both Phase 3 pivotal trials in wet AMD in 2026.

Pipeline programs include EYP-2301, a TIE-2 agonist,

razuprotafib, formulated in Durasert E™ to potentially improve

outcomes in serious retinal diseases. The proven

Durasert® drug delivery technology has been safely

administered to thousands of patient eyes across

four U.S. FDA approved products. EyePoint

Pharmaceuticals is headquartered in Watertown,

Massachusetts.

Vorolanib is licensed to EyePoint exclusively by Equinox

Sciences, a Betta Pharmaceuticals affiliate, for the localized

treatment of all ophthalmic diseases outside

of China, Macao, Hong Kong and Taiwan.

DURAVYU™ has been conditionally accepted by the FDA as the

proprietary name for EYP-1901. DURAVYU is an investigational

product; it has not been approved by the FDA. FDA approval and the

timeline for potential approval is uncertain.

Forward Looking Statements

EYEPOINT PHARMACEUTICALS SAFE HARBOR STATEMENTS UNDER THE

PRIVATE SECURITIES LITIGATION ACT OF 1995: To the extent any

statements made in this press release deal with information that is

not historical, these are forward-looking statements under the

Private Securities Litigation Reform Act of 1995. Such statements

include, but are not limited to, statements regarding our

expectations regarding the timing and clinical development and

potential of DURAVYU in wet AMD and DME, including our expectations

regarding the announcement of full topline data from the VERONA

trial in the first quarter of 2025 and initiation of the LUGANO

trial and the LUCIA trial; the belief that the interim results from

the VERONA trial support DURAVYU’s potential to advance to

non-inferiority pivotal trials; our beliefs and expectations

regarding the anticipated full results from the VERONA trial; the

potential for DURAVYU 2.7mg to extend treatment intervals while

improving vision; the potential for DURAVYU to provide an immediate

benefit over aflibercept control in both BCVA and CST; our optimism

that that DURAVYU has the potential to shift the treatment paradigm

in DME and improve patient outcomes; our expectations regarding

clinical development of our other product candidates, including

EYP-2301; our business strategies and objectives; and other

statements identified by words such as “will,” “potential,”

“could,” “can,” “believe,” “intends,” “continue,” “plans,”

“expects,” “anticipates,” “estimates,” “may,” other words of

similar meaning or the use of future dates. Forward-looking

statements by their nature address matters that are, to different

degrees, uncertain. Uncertainties and risks may cause EyePoint’s

actual results to be materially different than those expressed in

or implied by EyePoint’s forward-looking statements. For EyePoint,

these risks and uncertainties include the timing, progress and

results of the company’s clinical development activities;

uncertainties and delays relating to the design, enrollment,

completion, and results of clinical trials; unanticipated costs and

expenses; the company’s cash and cash equivalents may not be

sufficient to support its operating plan for as long as

anticipated; the risk that results of clinical trials may not be

predictive of future results, and interim and preliminary data are

subject to further analysis and may change as more data becomes

available; unexpected safety or efficacy data observed during

clinical trials; uncertainties related to the regulatory

authorization or approval process, and available development and

regulatory pathways for approval of the company’s product

candidates; changes in the regulatory environment; changes in

expected or existing competition; the success of current and future

license agreements; our dependence on contract research

organizations, and other outside vendors and service providers;

product liability; the impact of general business and economic

conditions; protection of our intellectual property and avoiding

intellectual property infringement; retention of key personnel;

delays, interruptions or failures in the manufacture and supply of

our product candidates; the availability of and the need for

additional financing; the company’s ability to obtain additional

funding to support its clinical development programs; uncertainties

regarding the timing and results of the August 2022 subpoena from

the U.S. Attorney’s Office for the District of Massachusetts;

uncertainties regarding the FDA warning letter pertaining to the

company’s Watertown, MA manufacturing facility; and other factors

described in our filings with the Securities and Exchange

Commission. We cannot guarantee that the results and other

expectations expressed, anticipated or implied in any

forward-looking statement will be realized. A variety of factors,

including these risks, could cause our actual results and other

expectations to differ materially from the anticipated results or

other expectations expressed, anticipated or implied in our

forward-looking statements. Should known or unknown risks

materialize, or should underlying assumptions prove inaccurate,

actual results could differ materially from past results and those

anticipated, estimated or projected in the forward-looking

statements. You should bear this in mind as you consider any

forward-looking statements. Our forward-looking statements speak

only as of the dates on which they are made. EyePoint undertakes no

obligation to update or revise any forward-looking statement,

whether as a result of new information, future events, or

otherwise.

Investors:

Christina TartagliaPrecision AQ (formerly Stern IR)Direct:

212-698-8700christina.tartaglia@sternir.com

Media Contact:

Amy PhillipsGreen Room CommunicationsDirect:

412-327-9499aphillips@greenroompr.com

| |

| EYEPOINT

PHARMACEUTICALS, INC. AND SUBSIDIARIESCONDENSED

CONSOLIDATED BALANCE

SHEETS(Unaudited)(In

thousands) |

| |

| |

September 30, |

|

December 31, |

|

|

|

2024 |

|

2023 |

|

Assets |

|

|

|

|

|

Current assets: |

|

|

|

|

|

Cash and cash equivalents |

|

$ |

79,830 |

|

|

$ |

281,263 |

|

|

Marketable securities |

|

|

173,963 |

|

|

|

49,787 |

|

|

Accounts and other receivables, net |

|

|

378 |

|

|

|

805 |

|

|

Prepaid expenses and other current assets |

|

|

11,571 |

|

|

|

9,039 |

|

|

Inventory |

|

|

2,807 |

|

|

|

3,906 |

|

|

Total current assets |

|

|

268,549 |

|

|

|

344,800 |

|

|

Operating lease right-of-use assets |

|

|

21,405 |

|

|

|

4,983 |

|

|

Other assets |

|

|

10,963 |

|

|

|

5,401 |

|

|

Total assets |

|

$ |

300,917 |

|

|

$ |

355,184 |

|

|

Liabilities and stockholders' equity |

|

|

|

|

|

Current liabilities: |

|

|

|

|

|

Accounts payable and accrued expenses |

|

$ |

21,509 |

|

|

$ |

24,025 |

|

|

Deferred revenue |

|

|

25,996 |

|

|

|

38,592 |

|

|

Other current liabilities |

|

|

1,289 |

|

|

|

646 |

|

|

Total current liabilities |

|

|

48,794 |

|

|

|

63,263 |

|

|

Deferred revenue - noncurrent |

|

|

11,234 |

|

|

|

20,692 |

|

|

Operating lease liabilities - noncurrent |

|

|

21,922 |

|

|

|

4,906 |

|

|

Other noncurrent liabilities |

|

|

233 |

|

|

|

- |

|

|

Total liabilities |

|

|

82,183 |

|

|

|

88,861 |

|

|

|

|

|

|

|

|

Stockholders' equity: |

|

|

|

|

|

Capital |

|

|

1,049,180 |

|

|

|

1,007,605 |

|

|

Accumulated deficit |

|

|

(831,617 |

) |

|

|

(742,146 |

) |

|

Accumulated other comprehensive income |

|

|

1,171 |

|

|

|

864 |

|

|

Total stockholders' equity |

|

|

218,734 |

|

|

|

266,323 |

|

|

Total liabilities and stockholders' equity |

|

$ |

300,917 |

|

|

$ |

355,184 |

|

| |

|

$ |

— |

|

|

$ |

— |

|

| EYEPOINT

PHARMACEUTICALS, INC. AND SUBSIDIARIESCONDENSED

CONSOLIDATED STATEMENTS OF

OPERATIONSUnaudited(In thousands,

except per share data) |

|

|

| |

|

Three Months EndedSeptember 30, |

|

Nine Months EndedSeptember 30, |

|

|

|

2024 |

|

2023 |

|

2024 |

|

2023 |

|

Revenues: |

|

|

|

|

|

|

|

|

|

Product sales, net |

|

$ |

664 |

|

|

$ |

816 |

|

|

$ |

2,390 |

|

|

$ |

13,483 |

|

|

License and collaboration agreements |

|

|

9,561 |

|

|

|

14,137 |

|

|

|

27,906 |

|

|

|

17,768 |

|

|

Royalty income |

|

|

299 |

|

|

|

249 |

|

|

|

1,389 |

|

|

|

739 |

|

|

Total revenues |

|

|

10,524 |

|

|

|

15,202 |

|

|

|

31,685 |

|

|

|

31,990 |

|

|

Operating expenses: |

|

|

|

|

|

|

|

|

|

Cost of sales |

|

|

736 |

|

|

|

1,202 |

|

|

|

2,896 |

|

|

|

3,634 |

|

|

Research and development |

|

|

29,542 |

|

|

|

17,363 |

|

|

|

89,554 |

|

|

|

46,711 |

|

|

Sales and marketing |

|

|

24 |

|

|

|

479 |

|

|

|

80 |

|

|

|

11,504 |

|

|

General and administrative |

|

|

12,970 |

|

|

|

10,556 |

|

|

|

39,770 |

|

|

|

28,854 |

|

|

Total operating expenses |

|

|

43,272 |

|

|

|

29,600 |

|

|

|

132,300 |

|

|

|

90,703 |

|

|

Loss from operations |

|

|

(32,748 |

) |

|

|

(14,398 |

) |

|

|

(100,615 |

) |

|

|

(58,713 |

) |

|

Other income (expense): |

|

|

|

|

|

|

|

|

|

Interest and other income, net |

|

|

3,387 |

|

|

|

1,786 |

|

|

|

11,144 |

|

|

|

4,611 |

|

|

Interest expense |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

(1,247 |

) |

|

Loss on extinguishment of debt |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

(1,347 |

) |

|

Total other income, net |

|

|

3,387 |

|

|

|

1,786 |

|

|

|

11,144 |

|

|

|

2,017 |

|

|

Net loss |

|

$ |

(29,361 |

) |

|

$ |

(12,612 |

) |

|

$ |

(89,471 |

) |

|

$ |

(56,696 |

) |

|

Net loss per common share - basic and diluted |

|

$ |

(0.54 |

) |

|

$ |

(0.33 |

) |

|

$ |

(1.67 |

) |

|

$ |

(1.50 |

) |

|

Weighted average common shares outstanding - basic and diluted |

|

|

54,449 |

|

|

|

38,341 |

|

|

|

53,526 |

|

|

|

37,804 |

|

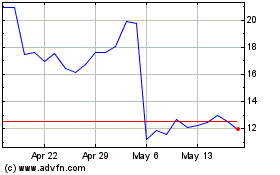

EyePoint Pharmaceuticals (NASDAQ:EYPT)

Historical Stock Chart

From Oct 2024 to Nov 2024

EyePoint Pharmaceuticals (NASDAQ:EYPT)

Historical Stock Chart

From Nov 2023 to Nov 2024