Form 8-K - Current report

19 September 2024 - 6:06AM

Edgar (US Regulatory)

false 0001650648 0001650648 2024-09-18 2024-09-18

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): September 18, 2024

4D Molecular Therapeutics, Inc.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

| Delaware |

|

001-39782 |

|

47-3506994 |

| (State or Other Jurisdiction of Incorporation) |

|

(Commission File Number) |

|

(IRS Employer Identification No.) |

|

|

|

| 5858 Horton Street #455 |

|

|

| Emeryville, California |

|

94608 |

| (Address of Principal Executive Offices) |

|

(Zip Code) |

Registrant’s Telephone Number, Including Area Code: (510) 505-2680

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

| Title of each class |

|

Trading

Symbol(s) |

|

Name of each exchange on which registered |

| Common Stock, $0.0001 par value per share |

|

FDMT |

|

Nasdaq Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

On September 18, 2024, 4D Molecular Therapeutics, Inc. (the “Company”) reported the longest interim follow-up data from its Phase 1/2 clinical trial (“PRISM”), which is evaluating clinical activity and safety of intravitreal 4D-150 in broad wet age-related macular degeneration (“wet AMD”). In addition, the Company also announced the study design for its planned Phase 3 clinical trial for 4D-150 for the treatment of wet AMD (“4FRONT”).

Interim Data from 4D-150 Phase 1/2 PRISM Study

PRISM is a randomized, controlled clinical trial evaluating 4D-150 in previously treated wet AMD patients with severe disease activity and high treatment burden.

As of the most recent cutoff date (September 3, 2024), interim results from PRISM include:

| |

• |

|

Robust and durable treatment burden reduction was observed in all PRISM populations studied with the planned Phase 3 dose of 3E10 vg/eye of 4D-150: |

| |

• |

|

Phase 1/2a Severe (n=24, through 52 weeks): (i) 83% overall reduction in annualized injections, (ii) 52% received 0 or 1 injection*; and (iii) 44% injection-free*. |

| |

• |

|

Phase 2b Broad (n=30, through 52 weeks): (i) 89% overall reduction in annualized injections; (ii) 80% received 0 or 1 injection*; and (iii) 70% injection-free*. |

| |

• |

|

Phase 2b Recently Diagnosed** (n=15, through 52 weeks): (i) 98% overall reduction in annualized injections; (ii) 100% received 0 or 1 injection*; and (iii) 87% injection-free*. |

| |

* |

Based on Kaplan-Meier method for calculating endpoint with follow-up through 52 weeks (Phase 1/2a) and variable follow-up through 32–52 weeks (Phase 2b). |

| |

** |

Defined as diagnosed ≤6 months. |

| |

• |

|

Central Subfield Thickness (“CST”): sustained anatomic control with fewer fluctuations. |

| |

• |

|

Mean best corrected visual acuity (“BCVA”): stable (Phase 1/2a) or sustained improved (Phase 2b). |

| |

• |

|

Safety data demonstrated that 4D-150 continues to be well tolerated with favorable safety profile: |

| |

• |

|

Rate of 4D-150 intraocular inflammation (“IOI”) was numerically similar to that reported for approved anti-VEGF agents. |

| |

• |

|

Wet AMD: (i) 2.8% (2 of 71) had 4D-150–related IOI at any timepoint (2 patients had transient 1+ vitreous cells); (ii) 99% (70 of 71) completed steroid prophylaxis taper on schedule; and (iii) 97% (69 of 71) remained off steroids completely. |

| |

• |

|

Diabetic Macular Edema (DME; SPECTRA trial): No patients treated at any dose (n=22) have experienced IOI events at any timepoint. |

| |

• |

|

No 4D-150–related hypotony, endophthalmitis, vasculitis, choroidal effusions or retinal artery occlusions were observed to date across both the wet AMD and the DME programs. |

4FRONT Wet AMD Planned Phase 3 Program Key Design Elements

The planned 4FRONT study will compare a single dose of 4D-150 3E10 vg/eye to on-label aflibercept 2mg Q8 weeks. The initiation of 4FRONT-1 clinical trial (N=500) is expected in the first quarter of 2025. The eligibility criteria for 4FRONT include: (i) that patients must be both recently diagnosed and treatment naïve wet AMD patients and (ii) randomization requires on study demonstration of aflibercept responsiveness.

4FRONT is expected to include two double-masked, randomized, controlled noninferiority trials. The primary endpoint is noninferiority in BCVA. 4FRONT will be sham controlled to support masking, and all patients will be randomized to receive 3 total loading doses per aflibercept label.

Supplemental aflibercept injection criteria for the 4D-150 arm will be optimized to help protect primary BCVA endpoint and to potentially maximize reduction of supplemental treatment burden, and no supplemental injections will be allowed in the control arm. The study design has been aligned with feedback from the U.S. Food and Drug Administration under RMAT designation, and alignment is ongoing with the European Medicines Agency under PRIME designation.

Forward-Looking Statements

This Current Report on Form 8-K contains forward-looking statements for purposes of the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Forward-looking statements include, but are not limited to, statements regarding the Company’s clinical development plans for 4D-150 and timing for the announcement of results from ongoing clinical trials. In some cases you can identify these statements by forward-looking words such as “may,” “will,” “continue,” “anticipate,” “intend,” “could,” “project,” “expect” or the negative or plural of these words or similar expressions. Forward-looking statements are not guarantees of future performance and are subject to risks and uncertainties that could cause actual results and events to differ materially from those anticipated, including risks and uncertainties that are described in greater detail in the section entitled “Risk Factors” in the Company’s most recent Quarterly Report on Form 10-Q as well as any subsequent filings with the Securities and Exchange Commission. The Company expressly disclaims any intent or obligation to update these forward-looking statements, except as required by law.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

4D MOLECULAR THERAPEUTICS, INC. |

|

|

|

|

| Date: |

|

September 18, 2024 |

|

By: |

|

/s/ Uneek Mehra |

|

|

|

|

|

|

Uneek Mehra Chief Financial and Business Officer |

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

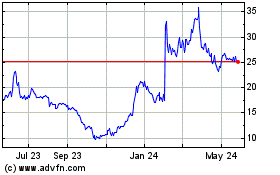

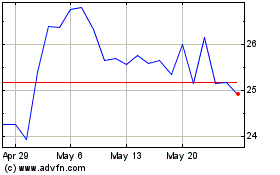

4D Molecular Therapeutics (NASDAQ:FDMT)

Historical Stock Chart

From Oct 2024 to Nov 2024

4D Molecular Therapeutics (NASDAQ:FDMT)

Historical Stock Chart

From Nov 2023 to Nov 2024