0000038725false00000387252025-02-182025-02-18

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 18, 2025

FRANKLIN ELECTRIC CO., INC.

(Exact name of registrant as specified in its charter) | | | | | | | | | | | | | | |

| Indiana | | 0-362 | | 35-0827455 |

| (State of incorporation) | | (Commission File Number) | | (IRS employer identification no.) |

| | | | | | | | |

| 9255 Coverdale Road | |

| Fort Wayne, | Indiana | 46809 |

| (Address of principal executive offices) | (Zip code) |

(260) 824-2900

(Registrant's telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | | | | |

| Common Stock, $0.10 par value | | FELE | | NASDAQ | Global Select Market |

| (Title of each class) | | (Trading symbol) | | (Name of each exchange on which registered) |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition

On February 18, 2025, Franklin Electric Co., Inc. issued a press release announcing its earnings for the fourth quarter of 2024. A copy of the release is furnished herewith as Exhibit 99.1 and is incorporated herein by reference. This Current Report on Form 8-K and the press release attached hereto are being furnished pursuant to Item 2.02 of Form 8-K.

Item 9.01. Financial Statements and Exhibits

(d) Exhibits:

| | | | | | | | |

| Exhibit Number | | Description |

| 99.1 | | |

| 101 | | Cover Page Interactive Data File - the cover page XBRL tags are embedded within the Inline XBRL document. |

| 104 | | The cover page from this Current Report on Form 8-K, formatted as Inline XBRL |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

FRANKLIN ELECTRIC CO., INC.

(Registrant)

| | | | | | | | | | | |

Date: February 18, 2025 | | By | /s/ Jeffery L. Taylor |

| | | Jeffery L. Taylor |

| | | Vice President, Chief Financial Officer |

| | | (Principal Financial and Accounting Officer) |

Exhibit 99.1

NEWS RELEASE FOR IMMEDIATE DISTRIBUTION

FRANKLIN ELECTRIC REPORTS FOURTH QUARTER 2024 AND FULL YEAR 2024 RESULTS

Fourth Quarter 2024 Highlights

•Consolidated net sales of $485.7 million, an increase of 3% to the prior year

•Energy Systems and Distribution net sales increased 5% and 6%, respectively, while Water Systems net sales were flat

•Operating income was $43.0 million with operating margin of 8.9%

•GAAP fully diluted earnings per share (EPS) was $0.72

Full Year 2024 Highlights

•Consolidated net sales of $2.0 billion, a decrease of 2% to the prior year

•Distribution net sales increased 2%, while Water Systems and Energy Systems net sales decreased 2% and 8%, respectively

•Operating income was $243.6 million with operating margin of 12.1%

•GAAP fully diluted earnings per share (EPS) was $3.86

•Cash flows from operating activities were $261.4 million

Fort Wayne, IN – February 18, 2025 – Franklin Electric Co., Inc. today announced its fourth quarter and full year financial results for fiscal year 2024.

Fourth quarter 2024 net sales were $485.7 million, compared to fourth quarter 2023 net sales of $473.0 million. Fourth quarter 2024 operating income was $43.0 million, compared to fourth quarter 2023 operating income of $50.8 million. Fourth quarter 2024 EPS was $0.72, versus EPS in the fourth quarter 2023 of $0.82.

Full year 2024 net sales were $2.0 billion, compared to full year 2023 net sales of $2.1 billion. Full year 2024 operating income was $243.6 million, compared to full year 2023 operating income of $262.4 million. Full year 2024 EPS was $3.86, versus EPS in the full year 2023 of $4.11.

“The fourth quarter marked a solid finish to a challenging year. Our results were driven by strong performance in our newly renamed Energy Systems segment. While we have worked through the elevated post-COVID backlogs at this time, underlying demand remains healthy, and we continue to execute on productivity initiatives as we align our businesses with the more normalized environment,” commented Joe Ruzynski, Franklin Electric’s CEO.

“Our resiliency is supported by the breadth of our global portfolio, which has proven to be a strategic asset as we closed out a year shaped by macroeconomic pressures. Order trends have improved, and with the support of a very healthy balance sheet, we are well-positioned to capitalize on opportunities in the year ahead. In 2025, our focus turns to driving revenue growth and margin expansion as we accelerate innovation and growth,” concluded Mr. Ruzynski.

Segment Summaries

Water Systems net sales were $279.6 million in the fourth quarter, flat compared to the fourth quarter 2023. Results were driven by higher sales of groundwater products, water treatment products and all other surface products. These sales increases were offset by lower sales of large dewatering pumps,

which had a record fourth quarter last year. Water Systems operating income in the fourth quarter 2024 was $35.6 million. Fourth quarter 2023 Water Systems operating income was $44.1 million.

Distribution net sales were $157.2 million, an increase of $9.2 million or 6 percent compared to the fourth quarter 2023. Sales increases were driven by higher volumes and the incremental impact from a recent acquisition. The Distribution segment operating income in the fourth quarter 2024 was $0.5 million. Fourth quarter 2023 Distribution operating income was $1.0 million.

Energy Systems net sales were $68.8 million in the fourth quarter 2024, an increase of $3.1 million or 5 percent compared to the fourth quarter 2023. Sales increases were driven by higher volumes and price realization. Energy Systems operating income in the fourth quarter 2024 was a record for any fourth quarter at $24.7 million. Fourth quarter 2023 Energy Systems operating income was $19.4 million. The Company has changed the name of the Fueling Systems segment to Energy Systems to reflect its diverse portfolio and growth strategy, as well as to better reflect the markets and customers served by the segment.

Cash Flow

The Company ended 2024 with a cash balance of $220.5 million, an increase of $135.5 million compared to the end of 2023. Net cash flows from operating activities for 2024 were $261.4 million versus $315.7 million in the same period in 2023. Cash flow in 2023 benefitted from actions the Company took to improve working capital including inventory reductions as its supply chain resiliency and lead times improved during the year.

2024 Guidance

The Company expects its full year 2025 sales including the impact of its recently announced acquisitions to be in the range of $2.09 billion to $2.15 billion and full year 2025 EPS to be in the range of $4.05 to $4.25.

Earnings Conference Call

A conference call to review earnings and other developments in the business will commence at 9:00 am ET. The fourth quarter 2024 earnings call will be available via a live webcast. The webcast will be available in a listen only mode by going to:

https://edge.media-server.com/mmc/p/9jnstij5

For those interested in participating in the question-and-answer portion of the call, please register for the call at the link below.

https://register.vevent.com/register/BI4b232e4ceea6435ba8f046e92e18e563

All registrants will receive dial-in information and a PIN allowing them to access the live call. It is recommended that you join 10 minutes prior to the event start (although you may register and dial in at any time during the call).

A replay of the conference call will be available from Tuesday, February 18, 2025, through 9:00 am ET on Tuesday, February 25, 2025, by visiting the listen-only webcast link above.

Forward Looking Statements

"Safe Harbor” Statement under the Private Securities Litigation Reform Act of 1995. Any forward-looking statements contained herein, including those relating to market conditions or the Company’s financial results, costs, expenses or expense reductions, profit margins, inventory levels, foreign currency translation rates, liquidity expectations, business goals and sales growth, involve risks and uncertainties, including but not limited to, risks and uncertainties with respect to general economic and currency conditions, various conditions specific to the Company’s business and industry, weather conditions, new housing starts, market demand, competitive factors, changes in distribution channels, supply constraints, effect of price increases, raw material costs, technology factors, integration of acquisitions, litigation, government and regulatory actions, the Company’s accounting policies, future trends, epidemics and pandemics, and other risks which are detailed in the Company’s Securities and Exchange Commission filings, included in Item 1A of Part I of the Company’s Annual Report on Form 10-K for the fiscal year ending December 31, 2023, Exhibit 99.1 attached thereto and in Item 1A of Part II of the Company’s Quarterly Reports on Form 10-Q. These risks and uncertainties may cause actual results to differ materially from those indicated by the forward-looking statements. All forward-looking statements made herein are based on information currently available, and the Company assumes no obligation to update any forward-looking statements.

About Franklin Electric

Franklin Electric is a global leader in the production and marketing of systems and components for the movement of water and energy. Recognized as a technical leader in its products and services, Franklin Electric serves customers around the world in residential, commercial, agricultural, industrial, municipal, and fueling applications. Franklin Electric is proud to be named in Newsweek’s lists of America’s Most Responsible Companies and Most Trustworthy Companies for 2024 and America’s Climate Leaders 2024 by USA Today.

Franklin Electric Contact:

Jeffery L. Taylor

Franklin Electric Co., Inc.

InvestorRelations@fele.com

| | | | | | | | | | | | | | | | | | | | | | | |

| FRANKLIN ELECTRIC CO., INC. AND CONSOLIDATED SUBSIDIARIES |

| CONDENSED CONSOLIDATED STATEMENTS OF INCOME |

| (Unaudited) |

| | | | | | | |

| (In thousands, except per share amounts) | | | | | | | |

| Fourth Quarter Ended | | Fiscal Year End |

| December 31, 2024 | | December 31, 2023 | | December 31, 2024 | | December 31, 2023 |

| | | | | | | |

| Net sales | $ | 485,745 | | | $ | 472,970 | | | $ | 2,021,341 | | | $ | 2,065,133 | |

| | | | | | | |

| Cost of sales | 321,505 | | | 312,961 | | | 1,304,061 | | | 1,368,125 | |

| | | | | | | |

| Gross profit | 164,240 | | | 160,009 | | | 717,280 | | | 697,008 | |

| | | | | | | |

| Selling, general, and administrative expenses | 117,846 | | | 108,825 | | | 470,136 | | | 433,476 | |

| | | | | | | |

| Restructuring expense | 3,360 | | | 356 | | | 3,499 | | | 1,091 | |

| | | | | | | |

| Operating income | 43,034 | | | 50,828 | | | 243,645 | | | 262,441 | |

| | | | | | | |

| Interest expense | (1,339) | | | (1,481) | | | (6,319) | | | (11,790) | |

| Other income, net | 630 | | | 1,831 | | | 1,339 | | | 3,696 | |

| Foreign exchange expense, net | (1,590) | | | (4,026) | | | (6,818) | | | (12,124) | |

| | | | | | | |

| Income before income taxes | 40,735 | | | 47,152 | | | 231,847 | | | 242,223 | |

| | | | | | | |

| Income tax expense | 6,443 | | | 8,322 | | | 50,238 | | | 47,489 | |

| | | | | | | |

| Net income | $ | 34,292 | | | $ | 38,830 | | | $ | 181,609 | | | $ | 194,734 | |

| | | | | | | |

| Less: Net income attributable to noncontrolling interests | (637) | | | (281) | | | (1,300) | | | (1,462) | |

| | | | | | | |

| Net income attributable to Franklin Electric Co., Inc. | $ | 33,655 | | | $ | 38,549 | | | $ | 180,309 | | | $ | 193,272 | |

| | | | | | | |

| Earnings per share: | | | | | | | |

| Basic | $ | 0.73 | | | $ | 0.83 | | | $ | 3.92 | | | $ | 4.17 | |

| Diluted | $ | 0.72 | | | $ | 0.82 | | | $ | 3.86 | | | $ | 4.11 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | | | | | |

| FRANKLIN ELECTRIC CO., INC. AND CONSOLIDATED SUBSIDIARIES |

| CONDENSED CONSOLIDATED BALANCE SHEETS |

| (Unaudited) |

| | | |

| (In thousands) | | | |

| December 31, 2024 | | December 31, 2023 |

| ASSETS | |

| | | |

| Cash and cash equivalents | $ | 220,540 | | | $ | 84,963 | |

| Receivables (net) | 226,826 | | | 222,418 | |

| Inventories | 483,875 | | | 508,696 | |

| Other current assets | 32,950 | | | 37,718 | |

| Total current assets | 964,191 | | | 853,795 | |

| | | |

| Property, plant, and equipment, net | 223,566 | | | 229,739 | |

| Lease right-of-use assets, net | 62,637 | | | 57,014 | |

| Goodwill and other assets | 570,212 | | | 587,574 | |

| Total assets | $ | 1,820,606 | | | $ | 1,728,122 | |

| | | |

| LIABILITIES AND EQUITY | | | |

| | | |

| Accounts payable | $ | 157,046 | | | $ | 152,419 | |

| Accrued expenses and other current liabilities | 139,989 | | | 104,949 | |

| Current lease liability | 18,878 | | | 17,316 | |

| Current maturities of long-term debt and short-term borrowings | 117,814 | | | 12,355 | |

| Total current liabilities | 433,727 | | | 287,039 | |

| | | |

| Long-term debt | 11,622 | | | 88,056 | |

| Long-term lease liability | 43,304 | | | 38,549 | |

| Income taxes payable non-current | — | | | 4,837 | |

| Deferred income taxes | 10,193 | | | 29,461 | |

| Employee benefit plans | 29,808 | | | 35,973 | |

| Other long-term liabilities | 22,118 | | | 33,914 | |

| | | |

| Redeemable noncontrolling interest | 1,224 | | | 1,145 | |

| | | |

| Total equity | 1,268,610 | | | 1,209,148 | |

| Total liabilities and equity | $ | 1,820,606 | | | $ | 1,728,122 | |

| | | |

| | | | | | | | | | | |

| FRANKLIN ELECTRIC CO., INC. AND CONSOLIDATED SUBSIDIARIES |

| CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS |

| (Unaudited) |

| Twelve Months Ended |

| (In thousands) | | | |

| | | |

| December 31, 2024 | | December 31, 2023 |

| Cash flows from operating activities: | | | |

| Net income | $ | 181,609 | | | $ | 194,734 | |

| Adjustments to reconcile net income to net cash flows from operating activities: | | | |

| Depreciation and amortization | 56,073 | | | 52,260 | |

| Non-cash lease expense | 21,438 | | | 18,852 | |

| Share-based compensation | 12,061 | | | 10,133 | |

| | | |

| Other | (13,327) | | | 10,259 | |

| Changes in assets and liabilities: | | | |

| Receivables | (17,045) | | | 19,150 | |

| Inventory | 10,889 | | | 48,176 | |

| Accounts payable and accrued expenses | 15,285 | | | (23,085) | |

| Operating leases | (21,129) | | | (18,874) | |

| Income taxes-U.S. Tax Cuts and Jobs Act | (3,870) | | (2,902) |

| Other | 19,369 | | | 7,007 | |

| | | |

| Net cash flows from operating activities | 261,353 | | | 315,710 | |

| | | |

| Cash flows from investing activities: | | | |

| Additions to property, plant, and equipment | (41,682) | | | (41,415) | |

| Proceeds from sale of property, plant, and equipment | 1,182 | | | 1,494 | |

| Acquisitions and investments | (5,201) | | | (34,831) | |

| Other investing activities | 73 | | | 463 | |

| | | |

| Net cash flows from investing activities | (45,628) | | | (74,289) | |

| | | |

| Cash flows from financing activities: | | | |

| Net change in debt | 29,235 | | | (115,529) | |

| Proceeds from issuance of common stock | 7,204 | | | 9,193 | |

| Purchases of common stock | (61,041) | | | (43,332) | |

| Dividends paid | (46,876) | | | (41,723) | |

| | | |

| Deferred payments for acquisitions | (2,591) | | | (802) | |

| | | |

| Net cash flows from financing activities | (74,069) | | | (192,193) | |

| | | |

| Effect of exchange rate changes on cash and cash equivalents | (6,079) | | | (10,055) | |

| Net change in cash and cash equivalents | 135,577 | | | 39,173 | |

| Cash and cash equivalents at beginning of period | 84,963 | | | 45,790 | |

| Cash and cash equivalents at end of period | $ | 220,540 | | | $ | 84,963 | |

| | | |

Key Performance Indicators: Net Sales Summary

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Net Sales For the Fourth Quarter |

| (in millions) | United States & Canada | Latin America | Europe, Middle East & Africa | Asia Pacific | Total Water | Energy** | Distribution | Other/Elims | Consolidated |

| Q4 2023 | $ | 161.2 | | $ | 46.6 | | $ | 45.5 | | $ | 26.3 | | $ | 279.6 | | $ | 65.7 | | $ | 148.0 | | $ | (20.3) | | $ | 473.0 | |

| Q4 2024 | $ | 158.5 | | $ | 44.3 | | $ | 49.7 | | $ | 27.1 | | $ | 279.6 | | $ | 68.8 | | $ | 157.2 | | $ | (19.9) | | $ | 485.7 | |

| Change | $ | (2.7) | | $ | (2.3) | | $ | 4.2 | | $ | 0.8 | | $ | — | | $ | 3.1 | | $ | 9.2 | | $ | 0.4 | | $ | 12.7 | |

| % Change | (2) | % | (5) | % | 9 | % | 3 | % | — | % | 5 | % | 6 | % | | 3 | % |

| | | | | | | | | |

| Foreign currency translation, net* | $ | (0.4) | | $ | (5.5) | | $ | (0.8) | | $ | (0.8) | | $ | (7.5) | | $ | — | | $ | — | | | $ | (7.5) | |

| % Change | — | % | (12) | % | (2) | % | (3) | % | (3) | % | — | % | — | % | | (2) | % |

| | | | | | | | | |

| Acquisitions | $ | 3.1 | | $ | — | | $ | — | | $ | — | | $ | 3.1 | | $ | — | | $ | 4.0 | | | $ | 7.1 | |

| % Change | 2 | % | — | % | — | % | — | % | 1 | % | — | % | 3 | % | | 2 | % |

| | | | | | | | | |

| Volume/Price | $ | (5.4) | | $ | 3.2 | | $ | 5.0 | | $ | 1.6 | | $ | 4.4 | | $ | 3.1 | | $ | 5.2 | | $ | 0.4 | | $ | 13.1 | |

| % Change | (3) | % | 7 | % | 11 | % | 6 | % | 2 | % | 5 | % | 4 | % | (2) | % | 3 | % |

| | | | | | | | | |

| |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Net Sales For the Full Year |

| (in millions) | United States & Canada | Latin America | Europe, Middle East & Africa | Asia Pacific | Total Water | Energy** | Distribution | Other/Elims | Consolidated |

FY 2023 | $ | 744.4 | | $ | 174.2 | | $ | 198.3 | | $ | 86.8 | | $ | 1,203.7 | | $ | 296.5 | | $ | 673.3 | | $ | (108.4) | | $ | 2,065.1 | |

FY 2024 | $ | 708.5 | | $ | 170.9 | | $ | 211.4 | | $ | 93.2 | | $ | 1,184.0 | | $ | 273.7 | | $ | 685.5 | | $ | (121.9) | | $ | 2,021.3 | |

| Change | $ | (35.9) | | $ | (3.3) | | $ | 13.1 | | $ | 6.4 | | $ | (19.7) | | $ | (22.8) | | $ | 12.2 | | $ | (13.5) | | $ | (43.8) | |

| % Change | (5) | % | (2) | % | 7 | % | 7 | % | (2) | % | (8) | % | 2 | % | | (2) | % |

| | | | | | | | | |

| Foreign currency translation | $ | (0.9) | | $ | (9.7) | | $ | (6.3) | | $ | (2.4) | | $ | (19.3) | | $ | — | | $ | — | | | $ | (19.3) | |

| % Change | — | % | (6) | % | (3) | % | (3) | % | (2) | % | — | % | — | % | | (1) | % |

| | | | | | | | | |

| Acquisitions | $ | 17.6 | | $ | — | | $ | — | | $ | — | | $ | 17.6 | | $ | — | | $ | 17.1 | | | $ | 34.7 | |

| % Change | 2 | % | — | % | — | % | — | % | 1 | % | — | % | 3 | % | | 2 | % |

| | | | | | | | | |

| Volume/Price | $ | (52.6) | | $ | 6.4 | | $ | 19.4 | | $ | 8.8 | | $ | (18.0) | | $ | (22.8) | | $ | (4.9) | | $ | (13.5) | | $ | (59.2) | |

| % Change | (7) | % | 4 | % | 10 | % | 10 | % | (1) | % | (8) | % | (1) | % | 12 | % | (3) | % |

| |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

*The Company has presented local currency price increases used to offset currency devaluation in the Argentina and Turkey hyperinflationary economies within the foreign currency translation, net row above.

** Recognizing the Company’s diverse portfolio and growth strategy, it renamed its Fueling Systems segment to Energy Systems to better reflect the markets and customers served by this business.

Key Performance Indicators: Operating Income and Margin Summary

| | | | | | | | | | | | | | | | | |

| Operating Income and Margins | | | | | |

| (in millions) | For the Fourth Quarter 2024 |

| Water | Energy | Distribution | Other/Elims | Consolidated |

| Operating Income/(Loss) | $ | 35.6 | | $ | 24.7 | | $ | 0.5 | | $ | (17.8) | | $ | 43.0 | |

| % Operating Income To Net Sales | 12.7 | % | 35.9 | % | 0.3 | % | | 8.9 | % |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| Operating Income and Margins | | | | | |

| (in millions) | For the Fourth Quarter 2023 |

| Water | Energy | Distribution | Other/Elims | Consolidated |

| Operating Income/(Loss) | $ | 44.1 | | $ | 19.4 | | $ | 1.0 | | $ | (13.7) | | $ | 50.8 | |

| % Operating Income To Net Sales | 15.8 | % | 29.5 | % | 0.7 | % | | 10.7 | % |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | | | | | | | | | | | | | |

| Operating Income and Margins | | | | | |

| (in millions) | For the Full Year of 2024 |

| Water | Energy | Distribution | Other/Elims | Consolidated |

| Operating Income/(Loss) | $ | 197.9 | | $ | 93.6 | | $ | 24.3 | | $ | (72.2) | | $ | 243.6 | |

| % Operating Income To Net Sales | 16.7 | % | 34.2 | % | 3.5 | % | | 12.1 | % |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| Operating Income and Margins | | | | | |

| (in millions) | For the Full Year of 2023 |

| Water | Energy | Distribution | Other/Elims | Consolidated |

| Operating Income/(Loss) | $ | 196.6 | | $ | 92.7 | | $ | 34.3 | | $ | (61.2) | | $ | 262.4 | |

| % Operating Income To Net Sales | 16.3 | % | 31.3 | % | 5.1 | % | | 12.7 | % |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

Cover

|

Feb. 18, 2025 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Feb. 18, 2025

|

| Entity Registrant Name |

FRANKLIN ELECTRIC CO., INC.

|

| Entity Incorporation, State or Country Code |

IN

|

| Entity File Number |

0-362

|

| Entity Tax Identification Number |

35-0827455

|

| Entity Address, Address Line One |

9255 Coverdale Road

|

| Entity Address, City or Town |

Fort Wayne,

|

| Entity Address, State or Province |

IN

|

| Entity Address, Postal Zip Code |

46809

|

| City Area Code |

260

|

| Local Phone Number |

824-2900

|

| Entity Information, Former Legal or Registered Name |

Not Applicable

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, $0.10 par value

|

| Trading Symbol |

FELE

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0000038725

|

| Amendment Flag |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

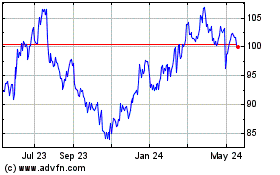

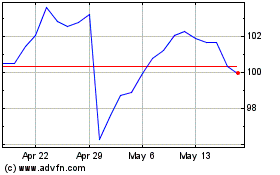

Franklin Electric (NASDAQ:FELE)

Historical Stock Chart

From Jan 2025 to Feb 2025

Franklin Electric (NASDAQ:FELE)

Historical Stock Chart

From Feb 2024 to Feb 2025