false000092129900009212992025-02-192025-02-19

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): February 19, 2025 |

FIBROGEN, INC.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Delaware |

001-36740 |

77-0357827 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

350 Bay Street Suite 100 #6009 |

|

San Francisco, California |

|

94133 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: 415 978-1200 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Common Stock, $0.01 par value |

|

FGEN |

|

The Nasdaq Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01 Entry into a Material Definitive Agreement

On February 19, 2025, FibroGen, Inc. (the “Company”, “we”, “us”, “our”, or “FibroGen”) entered into a share purchase agreement (the “Share Purchase Agreement”) with AstraZeneca Treasury Limited (“AstraZeneca”) pursuant to which we and our indirect subsidiary FibroGen China Anemia Holdings, Ltd. agreed to sell all of the issued and outstanding equity interests of FibroGen International (Hong Kong) Ltd. (“FibroGen International”) to AstraZeneca for an aggregate purchase price of approximately $160 million, comprised of $85 million in cash for the enterprise value of FibroGen International, plus an additional cash amount equal to the net cash held in China by FibroGen International and its subsidiaries, currently anticipated to be approximately $75 million, as of the closing. The transaction is expected to close by mid-2025, and is subject to customary closing conditions and closing deliverables, including receipt of regulatory approval from the China State Administration for Market Regulation. At the closing, we intend to repay our term loan facility with Morgan Stanley Tactical Value (approximately $80 million in total). The facility is filed as Exhibit 10.5 to our Quarterly Report on Form 10-Q for the quarter ended June 30, 2023, filed with the Securities and Exchange Commission on August 7, 2023.

AstraZeneca is our long-time commercialization partner for roxadustat in greater China and South Korea. Upon the closing, AstraZeneca will acquire all the rights to roxadustat in China, Hong Kong, and Macao, including rights to manufacture, develop, distribute, and commercialize roxadustat.

We will retain the rights to roxadustat in the United States, Canada, Mexico, and in all markets not held by AstraZeneca or licensed to Astellas Pharma Inc. Astellas is commercializing roxadustat (EvrenzoTM) in Europe and Japan to treat anemia under two development and commercialization license agreements: one for Japan, and one for Europe, the Commonwealth of Independent States, the Middle East and South Africa.

The net cash payable by AstraZeneca at the closing is subject to holdbacks of: (i) a $6.0 million hold back to offset final net cash adjustments which will be released following a customary adjustment process approximately 90 days post-closing (as such time may be extended for the parties to mutually agree upon final adjustments), and (ii) a $4.0 million hold back to satisfy any indemnity claims, which will be released, net of any claims paid or unresolved, nine months after the closing.

The Share Purchase Agreement includes customary representations and warranties, including fundamental representations and regulatory compliance provisions and other provisions relating to FibroGen International’s and its subsidiaries’ business. The representations, warranties, and covenants contained in the Share Purchase Agreement were made only for purposes of such agreement and as of specific dates, and were solely for the benefit of the parties to such agreement. The Share Purchase Agreement contains other customary provisions for transactions of this nature.

Pursuant to the Share Purchase Agreement AstraZeneca will purchase all of the issued and outstanding equity interests of FibroGen International from FibroGen China Anemia Holdings, Ltd. FibroGen International wholly owns FibroGen (China) Medical Technology Development Co., Ltd. which holds, among other assets, the roxadustat drug product manufacturing facility, roxadustat inventory and supply relationships, and 51.1% of Beijing Falikang Pharmaceutical Co., Ltd. (the roxadustat distribution joint venture currently owned 48.9% by AstraZeneca). On closing, FibroGen will assign to FibroGen International its entire right, title, and interest to certain patents, trademarks, and domain name registration related to FibroGen's roxadustat business in China, Hong Kong, and Macao.

AstraZeneca is purchasing certain transition support services from us to support the businesses of the in-scope companies (FibroGen International and its subsidiaries) pursuant to a transitional services agreement, which services will be provided for a maximum of 12 months post-closing.

The foregoing description of the Share Purchase Agreement is only a summary of the terms of, and is qualified in its entirety by reference to the full text of, the Share Purchase Agreement, which will be filed as an exhibit to the Company’s Quarterly Report on Form 10-Q for the quarter ended March 31, 2025. The approximately $75 million of cash held in China is only an estimate and could change materially before closing. We do not intend to update this estimate prior to closing and undue reliance should not be placed on this preliminary estimate. In addition, the total amount to be paid to Morgan Stanley Tactical Value is only our best estimate and includes principal, accrued and unpaid interest, and an applicable prepayment penalty, and could change materially before this term loan facility is paid off.

Item 2.02. Results of Operations and Financial Condition.

On February 20, 2025, we announced that as of December 31, 2024, we estimated that we had approximately $121.1 million in cash, cash equivalents, and accounts receivable.

This preliminary financial information is unaudited and is based on currently available information and does not present all necessary information for an understanding of our financial condition as of December 31, 2024 or our results of operations for the year ended December 31, 2024. This preliminary financial information has been prepared by, and is the responsibility of, our management. It is possible that we may identify items that require us to make adjustments to the financial information set forth above and those changes could be material. We do not intend to update this estimate prior to completion of our year-end audited financial statements. Accordingly, undue reliance should not be placed on this preliminary estimate and this estimate is not necessarily indicative of any future period.

The information in this Item 2.02 shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that Section or Sections 11 and 12(a)(2) of the Securities Act of 1933, as amended. The information contained in this Item 2.02 shall not be incorporated by reference into any filing with the U.S. Securities and Exchange Commission made by FibroGen, whether made before or after the date hereof, regardless of any general incorporation language in such filing.

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

Upon the closing of the sale of FibroGen International pursuant to the Share Purchase Agreement, Christine L. Chung, who currently serves as our Senior Vice President, China Operations, will cease employment with us. Ms. Chung is entitled to certain severance benefits pursuant to our executive officer change in control and severance agreement, which is filed as Exhibit 10.4 to our Quarterly Report on Form 10-Q for the quarter ended March 31, 2023, filed with the Securities and Exchange Commission on May 8, 2023.

Item 7.01. Regulation FD Disclosure.

A copy of the press release announcing the sale of FibroGen International pursuant to the Share Purchase Agreement and our estimated cash and cash equivalents as of December 31, 2024, is filed as Exhibit 99.1 to this Current Report on Form 8-K and incorporated herein by reference.

The information in Exhibit 99.1 shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that Section or Sections 11 and 12(a)(2) of the Securities Act of 1933, as amended. The information contained in Exhibit 99.1 shall not be incorporated by reference into any filing with the U.S. Securities and Exchange Commission made by FibroGen, whether made before or after the date hereof, regardless of any general incorporation language in such filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

FIBROGEN, INC. |

|

|

|

|

Date: |

February 20, 2025 |

By: |

/s/ John Alden |

|

|

|

John Alden

General Counsel |

Exhibit 99.1

FibroGen Announces the Sale of FibroGen China to AstraZeneca for

Approximately $160 Million

•Purchase price represents enterprise value of $85 million plus FibroGen net cash held in China at closing, currently estimated to be approximately $75 million

•Upon close, FibroGen will repay its term loan to Morgan Stanley Tactical Value, further simplifying the Company’s capital structure

oCompany’s cash runway extended into 2027

•Company to continue to advance its oncology pipeline, with the initiation of the Phase 2 monotherapy trial of FG-3246 in metastatic castration-resistant prostate cancer (mCRPC) in 2Q 2025

•Preliminary unaudited cash, cash equivalents, and accounts receivable of $121.1 million as of December 31, 2024

•FibroGen to host conference call and webcast presentation today at 8:30 AM ET

SAN FRANCISCO, February 20, 2025 (GLOBE NEWSWIRE) -- FibroGen, Inc. (NASDAQ: FGEN) today announced the sale of its China subsidiary to AstraZeneca for approximately $160 million.

“Today, we announced the sale of FibroGen China to AstraZeneca, our long-time strategic partner for roxadustat in China, bolstering our company on several fronts. It strengthens our financial position, meaningfully extending our cash runway into 2027, and enables us to continue progressing the clinical development program for FG-3246, our first-in-class, CD46 targeting antibody drug conjugate, and FG-3180, our companion PET imaging agent, in mCRPC,” said Thane Wettig, Chief Executive Officer of FibroGen. “After a thorough evaluation of alternatives, we believe selling our China operations and repaying our term loan is in the best interest of FibroGen’s stakeholders. We are grateful for our China colleagues, and in particular Christine Chung, our Head of China Operations, for their unwavering commitment to patients and successful commercialization of roxadustat in China. Now, we turn the page to the next exciting chapter for FibroGen.”

Under the terms of the agreement, FibroGen will receive an enterprise value of $85 million plus FibroGen net cash held in China at closing, currently estimated to be approximately $75 million, totaling approximately $160 million. The transaction is expected to close by mid-2025, pending customary closing conditions, including regulatory review in China. Following the close of the transaction, FibroGen will repay its term loan facility to investment funds managed by Morgan Stanley Tactical Value, further simplifying the Company’s capital structure. The combined transactions are expected to extend the Company’s cash runway into 2027.

Upon closing, AstraZeneca will obtain all rights to roxadustat in China. Roxadustat is the category leader in brand value share for the treatment of anemia in chronic kidney disease with a pending regulatory decision for chemotherapy-induced anemia.

FibroGen maintains its rights to roxadustat in the U.S. and in all markets not licensed to Astellas. The Company continues to evaluate a development plan for roxadustat in anemia associated with lower-risk myelodysplastic syndrome (LR-MDS), a high-value indication with significant unmet medical need. The Company is planning for an FDA meeting in the second quarter of 2025 to determine the potential next steps for the development program for roxadustat in the U.S.

In addition, FibroGen continues to advance the clinical development of its lead asset, FG-3246, and its companion PET imaging agent, FG-3180, with the initiation of the Phase 2 monotherapy trial of FG-3246 in patients with mCRPC expected in the second quarter of 2025.

BofA Securities, Inc. is acting as exclusive financial advisor and Ropes & Gray LLP is acting as legal advisor to FibroGen on this transaction.

Conference Call and Webcast Presentation

FibroGen management team will host a conference call and webcast presentation today, February 20, 2025 at 8:30 a.m. ET to discuss the sale of FibroGen China. A live Q&A session will follow the brief presentation. Interested parties may access a live audio webcast of the conference call here. To access the call by phone, please register here, and you will be provided with dial in details. A replay of the webcast will also be available for a limited time on the Events & Presentations page on FibroGen’s website.

About FibroGen

FibroGen, Inc. is a biopharmaceutical company focused on development of novel therapies at the frontiers of cancer biology and anemia. Roxadustat (爱瑞卓®, EVRENZOTM) is currently approved in China, Europe, Japan, and numerous other countries for the treatment of anemia in chronic kidney disease (CKD) patients on dialysis and not on dialysis. The Company continues to evaluate a development plan for roxadustat in anemia associated with lower-risk myelodysplastic syndrome (LR-MDS) in the U.S. FG-3246 (also known as FOR46), a first-in-class antibody-drug conjugate (ADC) targeting CD46 is in development for the treatment of metastatic castration-resistant prostate cancer. This program also includes the development of FG-3180, an associated CD46-targeted PET biomarker. For more information, please visit www.fibrogen.com.

Forward-Looking Statements

This release contains forward-looking statements regarding FibroGen’s strategy, future plans and prospects, including statements regarding its commercial products and clinical programs and those of its collaboration partners Fortis and UCSF. These forward-looking statements include, but are not limited to, statements regarding the net cash portion of the purchase price and closing of the sale of FibroGen China as well as the payoff of the Morgan Stanley Tactical Value term loan, use of proceeds, and statements regarding the expectation that cash, cash equivalents and accounts receivable will be sufficient to fund FibroGen’s operating plans into 2027, and statements about FibroGen’s plans and objectives. These forward-looking statements are typically identified by use of terms such as “may,” “will”, “should,” “on track,” “could,” “expect,” “plan,” “anticipate,” “believe,” “estimate,” “predict,” “potential,” “continue” and similar words, although some forward-looking statements are expressed differently. FibroGen’s actual results may differ materially from those indicated in these forward-looking statements due to risks and uncertainties related to the continued progress and timing of its various programs, including the enrollment and results from ongoing and potential future clinical trials, and other matters that are described in FibroGen’s Annual Report on Form 10-K for the fiscal year ended December 31, 2023, and our Quarterly Report on Form 10-Q for the quarter ended September 30, 2024, each as filed with the Securities and Exchange Commission (SEC), including the risk factors set forth therein. Investors are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this release, and FibroGen undertakes no obligation to update any forward-looking statement in this press release, except as required by law.

v3.25.0.1

Document And Entity Information

|

Feb. 19, 2025 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Feb. 19, 2025

|

| Entity Registrant Name |

FIBROGEN, INC.

|

| Entity Central Index Key |

0000921299

|

| Entity Emerging Growth Company |

false

|

| Entity File Number |

001-36740

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Tax Identification Number |

77-0357827

|

| Entity Address, Address Line One |

350 Bay Street

|

| Entity Address, Address Line Two |

Suite 100 #6009

|

| Entity Address, City or Town |

San Francisco

|

| Entity Address, State or Province |

CA

|

| Entity Address, Postal Zip Code |

94133

|

| City Area Code |

415

|

| Local Phone Number |

978-1200

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, $0.01 par value

|

| Trading Symbol |

FGEN

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

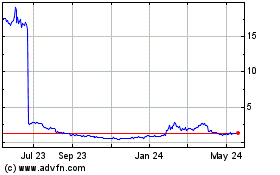

FibroGen (NASDAQ:FGEN)

Historical Stock Chart

From Feb 2025 to Mar 2025

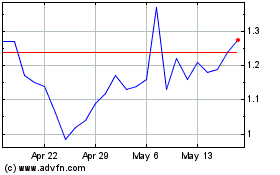

FibroGen (NASDAQ:FGEN)

Historical Stock Chart

From Mar 2024 to Mar 2025