Fluence Energy, Inc. (Nasdaq: FLNC) (“Fluence” or the “Company”), a

global market leader delivering intelligent energy storage,

operational services, and asset optimization software, today

announced that it has upsized and priced an offering of $350.0

million aggregate principal amount of 2.25% convertible senior

notes due 2030 (the “Notes”). The offering size was increased from

the previously announced offering size of $300.0

million aggregate principal amount of Notes. The issuance and

sale of the Notes are scheduled to settle on December 12, 2024,

subject to customary closing conditions. Fluence also granted the

initial purchasers of the Notes an option to purchase, for

settlement within a period of 13 days from, and including, the date

the Notes are first issued, up to an additional $50.0 million

aggregate principal amount of the Notes. The Notes are being

offered in a private offering that is exempt from the registration

requirements of the Securities Act of 1933, as amended (the

“Securities Act”), to persons reasonably believed to be qualified

institutional buyers pursuant to Rule 144A under the Securities

Act.

The Notes will be senior, unsecured obligations of

Fluence, will accrue interest payable semi-annually in arrears

and will mature on June 15, 2030, unless earlier repurchased,

redeemed or converted. Before March 15, 2030, noteholders will have

the right to convert their Notes in certain circumstances and

specified periods. From and after March 15, 2030, noteholders may

convert their Notes at any time at their election until the close

of business on the second scheduled trading day immediately before

the maturity date. Fluence will settle conversions by paying or

delivering, as applicable, cash, shares of its Class A common stock

(“Class A common stock”) or a combination of cash and shares of its

Class A common stock, at Fluence’s election. The initial conversion

rate is 46.8472 shares of Class A common stock per $1,000

principal amount of Notes, which represents an initial conversion

price of approximately $21.35 per share of Class A common stock and

approximately a 30% premium to the last reported sale price per

share of the Company's Class A common stock on December 10,

2024.The conversion rate and conversion price will be subject to

adjustment upon the occurrence of certain events.

In connection with the pricing of the Notes, the Company entered

into privately negotiated capped call transactions (the “capped

call transactions”) with certain of the initial purchasers and/or

their respective affiliates and other financial

institutions (the “counterparties”). The capped call

transactions will cover, subject to customary adjustments, the

number of shares of the Company’s Class A common stock that will

initially underlie the Notes. The cap price of the capped call

transactions will initially be approximately $28.74 per share,

which represents a premium of approximately 75% over the last

reported sale price per share of the Company’s Class A common stock

on December 10, 2024, and is subject to customary adjustments under

the terms of the capped call transactions.

The capped call transactions are generally expected to offset

the potential dilution to the Class A common stock and/or offset

any cash payments the Company is required to make in excess of the

principal amount of converted Notes, with such offset subject to a

cap, as the case may be, as a result of any conversion of the

Notes. If the initial purchasers exercise their option to purchase

additional Notes, the Company expects to enter into additional

capped call transactions with the counterparties.

The Notes will be redeemable, in whole or in part (subject to

certain partial redemption limitations), for cash at Fluence’s

option at any time, and from time to time, on or after December 20,

2027 and on or before the 50th scheduled trading day immediately

before the maturity date, but only if (i) the Notes are “freely

tradable”, and all accrued and unpaid additional interest, if any,

has been paid in full, as of the date of the related redemption

notice, and (ii) the last reported sale price per share of

Fluence’s Class A common stock exceeds 130% of the conversion price

for a specified period of time. The redemption price will be equal

to the principal amount of the Notes to be redeemed, plus accrued

and unpaid interest, if any, to, but excluding, the redemption

date.

If certain events that constitute a “fundamental change” occur,

then, subject to a limited exception, noteholders may require

Fluence to repurchase their Notes at a cash repurchase price equal

to the principal amount of the Notes to be repurchased, plus

accrued and unpaid interest, if any, to, but excluding, the

applicable repurchase date.

In connection with establishing their initial hedge of these

capped call transactions, the Company has been advised that the

counterparties (i) may enter into various over-the-counter

cash-settled derivative transactions with respect to the Class A

common stock and/or purchase the Class A common stock in secondary

market transactions concurrently with, or shortly after, the

pricing of the Notes; and (ii) may enter into or unwind various

over-the-counter derivatives and/or purchase the Class A common

stock in secondary market transactions following the pricing of the

Notes. These activities could have the effect of increasing or

preventing a decline in the price of the Class A common stock

concurrently with or following the pricing of the Notes and under

certain circumstances, could affect the ability to convert the

Notes.

In addition, the counterparties may modify or unwind their hedge

positions by entering into or unwinding various derivative

transactions and/or purchasing or selling the Class A common stock

or other securities of the Company in secondary market transactions

following the pricing of the Notes and prior to maturity of the

Notes (and are likely to do so (x) during any observation period

related to a conversion of the Notes or following any redemption or

fundamental change repurchase of the Notes, (y) following any other

repurchase of the Notes if the Company unwinds a corresponding

portion of the capped call transactions in connection with such

repurchase and (z) if the Company otherwise unwinds all or a

portion of the capped call transactions). The effect, if any, of

these transactions and activities on the market price of the Class

A common stock or the Notes will depend in part on market

conditions and cannot be ascertained at this time, but any of these

activities could adversely affect the value of the Class A common

stock and the value of the Notes, and potentially the value of the

consideration that a noteholder will receive upon the conversion of

the Notes and could affect a noteholder’s ability to convert the

Notes.

Fluence intends to utilize the net proceeds of the offering for

working capital needs, upgrading one of our battery cell production

lines from 305 amp hour cells to 530 amp hour cells, and general

corporate purposes. Fluence intends to transfer the remaining

net proceeds of this offering directly to purchase an intercompany

subordinated convertible promissory note issued by Fluence Energy,

LLC, the proceeds of which Fluence Energy, LLC intends to use for

general corporate purposes.

The offer and sale of the Notes and any shares of Class A common

stock issuable upon conversion of the Notes have not been, and will

not, be registered under the Securities Act or any other securities

laws, and the Notes and any such shares cannot be offered or sold

except to persons reasonably believed to be qualified institutional

buyers in reliance on the exemption from registration provided by

Rule 144A under the Securities Act.

This press release shall not constitute an offer to sell, or the

solicitation of an offer to buy, the Notes or any shares of Class A

common stock issuable upon conversion of the Notes, nor shall there

be any sale of the Notes or any such shares, in any state or

jurisdiction in which such offer, solicitation or sale would be

unlawful prior to registration or qualification under the

securities laws of any such state or jurisdiction. Any offers of

the Notes will be made only by means of a private offering

memorandum.

There can be no assurances that the offering of the Notes will

be completed as described herein or at all.

About Fluence:

Fluence Energy, Inc. (Nasdaq: FLNC) is a global market leader

delivering intelligent energy storage and optimization software for

renewables and storage. The Company's solutions and operational

services are helping to create a more resilient grid and unlock the

full potential of renewable portfolios. With gigawatts of projects

successfully contracted, deployed and under management across

nearly 50 markets, the Company is transforming the way we power our

world for a more sustainable future.

Cautionary Note Regarding Forward-Looking

Statements

The statements contained in this press release that are not

historical facts are forward-looking statements within the meaning

of Section 27A of the Securities Act of 1933, as amended, Section

21E of the Securities Exchange Act of 1934, as amended, and the

Private Securities Litigation Reform Act of 1995. In particular,

statements regarding our future results of operations and financial

position, operational performance, anticipated growth and business

strategy, future revenue recognition and estimated revenues, future

capital expenditures and debt service obligations, projected costs,

prospects, plans, and objectives of management for future

operations, including, among others, statements regarding expected

growth and demand for our energy storage solutions, services, and

digital application offerings, relationships with new and existing

customers and suppliers, introduction of new energy storage

solutions, services, and digital application offerings and adoption

of such offerings by customers, assumptions relating to the

Company’s tax receivable agreement, expectations relating to

backlog, pipeline, and contracted backlog, current expectations

relating to legal proceedings, and anticipated impact and benefits

from the Inflation Reduction Act of 2022 and related domestic

content guidelines on us and our customers as well as any other

proposed or recently enacted legislation, are forward-looking

statements. In some cases, you may identify forward-looking

statements by terms such as “may,” “will,” “should,” “expects,”

“plans,” “anticipates,” “could,” “seeks,” “intends,” “targets,”

“projects,” “contemplates,” “grows,” “believes,” “estimates,”

“predicts,” “potential”, “commits”, or “continue” or the negative

of these terms or other similar expressions. Accordingly, we

caution you that any such forward-looking statements are not

guarantees of future performance and are subject to risks,

assumptions, and uncertainties that are difficult to predict. Among

those risks and uncertainties are market conditions and the

consummation of the offering of the Notes and the consummation of

the capped calls transactions Although we believe that the

expectations reflected in these forward-looking statements are

reasonable as of the date made, actual results may prove to be

materially different from the results expressed or implied by the

forward-looking statements.

These forward-looking statements are subject to a number of

important factors that could cause actual results to differ

materially from those in the forward-looking statements, including,

but not limited to, our relatively limited operating and revenue

history as an independent entity and the nascent clean energy

industry; anticipated increasing expenses in the future and our

ability to maintain prolonged profitability; fluctuations of our

order intake and results of operations across fiscal periods;

potential difficulties in maintaining manufacturing capacity and

establishing expected mass manufacturing capacity in the future;

risks relating to delays, disruptions, and quality control problems

in our manufacturing operations; risks relating to quality and

quantity of components provided by suppliers; risks relating to our

status as a relatively low-volume purchaser as well as from

supplier concentration and limited supplier capacity; risks

relating to operating as a global company with a global supply

chain; changes in the cost and availability of raw materials and

underlying components; failure by manufacturers, vendors, and

suppliers to use ethical business practices and comply with

applicable laws and regulations; significant reduction in pricing

or order volume or loss of one or more of our significant customers

or their inability to perform under their contracts; risks relating

to competition for our offerings and our ability to attract new

customers and retain existing customers; ability to maintain and

enhance our reputation and brand recognition; ability to

effectively manage our recent and future growth and expansion of

our business and operations; our growth depends in part on the

success of our relationships with third parties; ability to attract

and retain highly qualified personnel; risks associated with

engineering and construction, utility interconnection,

commissioning and installation of our energy storage solutions and

products, cost overruns, and delays; risks relating to lengthy

sales and installation cycle for our energy storage solutions;

risks related to defects, errors, vulnerabilities and/or bugs in

our products and technology; risks relating to estimation

uncertainty related to our product warranties; fluctuations in

currency exchange rates; risks related to our current and planned

foreign operations; amounts included in our pipeline and contracted

backlog may not result in actual revenue or translate into profits;

risks related to acquisitions we have made or that we may pursue;

events and incidents relating to storage, delivery, installation,

operation, maintenance and shutdowns of our products; risks

relating to our impacts to our customer relationships due to events

and incidents during the project lifecycle of an energy storage

solution; actual or threatened health epidemics, pandemics or

similar public health threats; ability to obtain financial

assurances for our projects; risks relating to whether renewable

energy technologies are suitable for widespread adoption or if

sufficient demand for our offerings do not develop or takes longer

to develop than we anticipate; estimates on size of our total

addressable market; barriers arising from current electric utility

industry policies and regulations and any subsequent changes; risks

relating to the cost of electricity available from alternative

sources; macroeconomic uncertainty and market conditions; risk

relating to interest rates or a reduction in the availability of

tax equity or project debt capital in the global financial markets

and corresponding effects on customers’ ability to finance energy

storage systems and demand for our energy storage solutions;

reduction, elimination, or expiration of government incentives or

regulations regarding renewable energy; decline in public

acceptance of renewable energy, or delay, prevent, or increase in

the cost of customer projects; severe weather events; increased

attention to ESG matters; restrictions set forth in our current

credit agreement and future debt agreements; uncertain ability

to raise additional capital to execute on business opportunities;

ability to obtain, maintain and enforce proper protection for our

intellectual property, including our technology; threat of lawsuits

by third parties alleging intellectual property violations;

adequate protection for our trademarks and trade names; ability to

enforce our intellectual property rights; risks relating to our

patent portfolio; ability to effectively protect data integrity of

our technology infrastructure and other business systems; use of

open-source software; failure to comply with third party license or

technology agreements; inability to license rights to use

technologies on reasonable terms; risks relating to compromises,

interruptions, or shutdowns of our systems; changes in the global

trade environment; potential changes in tax laws or regulations;

risks relating to environmental, health, and safety laws and

potential obligations, liabilities and costs thereunder; failure to

comply with data privacy and data security laws, regulations and

industry standards; risks relating to potential future legal

proceedings, regulatory disputes, and governmental inquiries; risks

related to ownership of our Class A common stock; risks related to

us being a “controlled company” within the meaning of the NASDAQ

rules; risks relating to the terms of our amended and restated

certificate of incorporation and amended and restated bylaws; risks

relating to our relationship with our Founders and Continuing

Equity Owners; risks relating to conflicts of interest by our

officers and directors due to positions with Continuing Equity

Owners; risks related to short-seller activists; we depend on

distributions from Fluence Energy, LLC to pay our taxes and

expenses and Fluence Energy, LLC’s ability to make such

distributions may be limited or restricted in certain scenarios;

risks arising out of the Tax Receivable Agreement; unanticipated

changes in effective tax rates or adverse outcomes resulting from

examination of tax returns; risks relating to improper and

ineffective internal control over reporting to comply with

Sarbanes-Oxley Act; risks relating to changes in accounting

principles or their applicability to us; risks relating to

estimates or judgments relating to our critical accounting

policies; and the factors described under the headings Part I, Item

1A. “Risk Factors” and Item 7. “Management’s Discussion and

Analysis of Financial Condition and Results of Operations” in our

Annual Report on Form 10-K for the fiscal year ended September 30,

2024. If one or more events related to these or other risks or

uncertainties materialize, or if our underlying assumptions prove

to be incorrect, actual results may differ materially from what we

anticipate. Many of the important factors that will determine these

results are beyond our ability to control or predict. Accordingly,

you should not place undue reliance on any such forward-looking

statements. We qualify all forward-looking statements contained in

this press release by these cautionary statements. Any

forward-looking statement speaks only as of the date on which it is

made, and, except as otherwise required by law, we do not undertake

any obligation to publicly update or review any forward-looking

statement, whether as a result of new information, future

developments or otherwise. New factors emerge from time to time,

and it is not possible for us to predict which will arise. In

addition, we cannot assess the impact of each factor on our

business or the extent to which any factor, or combination of

factors, may cause actual results to differ materially from those

contained in any forward-looking statements.

Contacts:

Analyst

Lexington May, Vice President, Finance & Investor Relations

+1 713-909-5629

Email: InvestorRelations@fluenceenergy.com

Media

Email: media.na@fluenceenergy.com

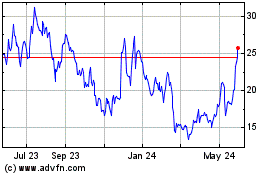

Fluence Energy (NASDAQ:FLNC)

Historical Stock Chart

From Nov 2024 to Dec 2024

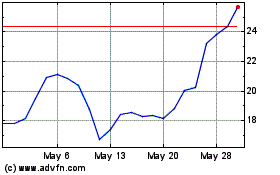

Fluence Energy (NASDAQ:FLNC)

Historical Stock Chart

From Dec 2023 to Dec 2024