FlexShopper Announces a Purchase Option for 91% of its Outstanding Series 2 Preferred Stock at a 50+% Discount to Liquidation Preference

28 October 2024 - 11:00PM

FlexShopper, Inc. (Nasdaq: FPAY), (“the Company”), a leading online

lease-to-own retailer and payment solutions provider, today

announced that it has entered into a purchase option agreement with

the majority holder of the Company’s Series 2 Preferred Stock (the

“Preferred Stock”), in which FlexShopper has the option to redeem

91% of FlexShopper’s Preferred Stock at a 50+% discount to the

second quarter of 2024 liquidation preference of approximately $43

million. The discount is based upon the date of repayment and the

option to purchase lasts for a one-year period. In addition,

further payments to the seller of the Preferred Stock may be

required based upon the purchase price in a change of control in

the next 12 months or patent settlement announcements in the next

24 months.

“We are excited to pursue options to redeem over 90% of our

outstanding Series 2 Preferred Stock at a significant discount to

its liquidation preference. We believe this opportunity will

enhance shareholder value by improving our cost of capital,

simplifying our capital structure and transferring $23 million of

equity value to our common shareholders, representing approximately

$1 per share. In addition, the redemption of our Series 2 Preferred

Stock at a 50%+ discount will be highly accretive to earnings and

will contribute approximately $4 million to annual operating

income,” said Russ Heiser, CEO of FlexShopper.

Expected Benefits of the Redemption of FlexShopper’s

Series 2 Preferred Stock owned by PIMCO:

Highly Accretive to Earnings. The Company

expects to save approximately $4 million in annual payment-in-kind

(PIK) dividends. As a result, FlexShopper expects the repurchase

transaction to be highly accretive to net income to common and

Preferred Series 1 shareholders once completed.

Material Discount in Liquidation Preference

Price: As part of the agreement, FlexShopper has the

option to repurchase its Series 2 Preferred Stock at a 50+%

discount to its liquidation preference. The current liquidation

preference, as of the end of the second quarter of 2024, is valued

at approximately $43 million, with an option to purchase at

approximately $20 million.

Increase in Common Equity Value: By redeeming

91% of the Preferred Stock, the approximately $23 million of

savings would benefit common shareholders. The savings are

equivalent to ~$1 per share in value, based on the Company’s share

count at June 30, 2024.

Illustrative Non-GAAP Changes in

FlexShopper’s Enterprise Value and Stock

Price Based on 91% Redemption of

FlexShopper’s Series 2 Preferred Stock

|

|

|

ActualValuation atJune

30,2024 |

|

|

Pro-formaValuation atJune

30,2024 |

|

|

Expectedchange ($) |

|

|

Expectedchange (%) |

|

|

Common Equity |

|

$ |

30,057,074 |

(1) |

|

$ |

52,917,027 |

(7) |

|

$ |

22,859,953 |

|

|

|

76 |

% |

| Net Debt |

|

$ |

132,086,383 |

(2) |

|

$ |

132,086,383 |

(2) |

|

|

- |

|

|

|

- |

|

| Series 1 Preferred Stock |

|

$ |

288,296 |

(3) |

|

$ |

288,296 |

(3) |

|

|

- |

|

|

|

- |

|

| Series 2 Preferred Stock |

|

$ |

47,301,212 |

(4) |

|

$ |

24,441,259 |

(8) |

|

$ |

(22,859,953 |

) |

|

|

(48 |

)% |

| Total Enterprise Value |

|

$ |

209,732,965 |

(5) |

|

$ |

209,732,965 |

(5) |

|

|

- |

|

|

|

- |

|

| Share

Price |

|

$ |

1.28 |

(6) |

|

$ |

2.25 |

(9) |

|

$ |

0.97 |

|

|

|

76 |

% |

|

(1) |

Common Shares Equivalent(1.1) times Actual Share Price at June

30, 2024. |

|

|

|

|

(1.1) |

Common shares outstanding at June 30, 2024 plus common shares

increased using the Treasury Stock Method upon exercise of

warrants, stock options and performance share units at June 30,

2024. |

|

|

|

|

(2) |

Short- and long-term loans minus cash at June 30, 2024. |

|

|

|

|

(3) |

Common shares upon conversion of Series 1 Preferred Stock at June

30, 2024 times Actual Share Price at June 30, 2024. |

|

|

|

|

(4) |

Series 2 Preferred Stock at liquidation preference at June 30, 2024

which includes the balance sheet amount and accrued dividends. |

|

|

|

|

(5) |

Actual Valuation at June 30, 2024 of Common Equity plus Actual

Valuation at June 30, 2024 of Net Debt plus Actual Valuation at

June 30, 2024 of Series 1 Preferred Stock plus Actual Valuation at

June 30, 2024 of Series 2 Preferred Stock. |

|

|

|

|

(6) |

Share Price of Common Stock at June 30, 2024. |

|

|

|

|

(7) |

Actual Valuation at June 30, 2024 of Total Enterprise Value minus

Pro-forma Valuation at June 30, 2024 of Series 2 Preferred Stock,

minus Pro-forma Valuation at June 30, 2024 of Series 1 Preferred

Stock, minus Pro-forma Valuation at June 30, 2024 of Net Debt. |

|

|

|

|

(8) |

Series 2 Preferred Stock, after the redemption of the Series 2

Preferred Stock owned by the majority holder, at liquidation

preference at June 30, 2024 plus the current purchase price per the

purchase option |

|

|

|

|

(9) |

Pro-forma Valuation at June 30, 2024 of Common Equity divided by

Common Shares Equivalent (as defined in 1.1) |

About FlexShopper

FlexShopper, Inc. is a leading national financial technology

company that offers innovative payment options to consumers.

FlexShopper provides a variety of flexible funding options for

underserved consumers through its direct-to-consumer online

marketplace at Flexshopper.com and in partnership with merchants

both online and at brick-and-mortar locations. FlexShopper’s

solutions are crafted to meet the needs of a wide range of consumer

segments through lease-to-own and lending products.

Forward-Looking Statements

All statements in this release that are not based on historical

fact are “forward-looking statements” within the meaning of Section

27A of the Securities Act of 1933 and Section 21E of the Securities

Exchange Act of 1934. Forward-looking statements, which are based

on certain assumptions and describe our future plans, strategies

and expectations, can generally be identified by the use of

forward-looking terms such as “believe,” “expect,” “may,” “will,”

“should,” “could,” “seek,” “intend,” “plan,” “goal,” “estimate,”

“anticipate,” or other comparable terms. Examples of

forward-looking statements include, among others, statements we

make regarding expectations of the redemption of over 90% of the

Company’s outstanding Series 2 Preferred Stock, the expectation

that the redemption of our Series 2 Preferred Stock would be highly

accretive to earnings or would improve our company’s share price,

lease originations, the expansion of our lease-to-own program;

expectations concerning our partnerships with retail partners;

investments in, and the success of, our underwriting technology and

risk analytics platform; our ability to collect payments due from

customers; expected future operating results and expectations

concerning our business strategy. Forward-looking statements

involve inherent risks and uncertainties which could cause actual

results to differ materially from those in the forward-looking

statements, as a result of various factors including, among others,

the following: our ability to obtain adequate financing to fund our

business operations in the future; the failure to successfully

manage and grow our FlexShopper.com e-commerce platform; our

ability to maintain compliance with financial covenants under our

credit agreement; our dependence on the success of our third-party

retail partners and our continued relationships with them; our

compliance with various federal, state and local laws and

regulations, including those related to consumer protection; the

failure to protect the integrity and security of customer and

employee information; and the other risks and uncertainties

described in the Risk Factors and in Management’s Discussion and

Analysis of Financial Condition and Results of Operations sections

of our Annual Report on Form 10-K and subsequently filed Quarterly

Reports on Form 10-Q. The forward-looking statements made in this

release speak only as of the date of this release,

and FlexShopper assumes no obligation to update any such

forward-looking statements to reflect actual results or changes in

expectations, except as otherwise required by law.

Contacts

For FlexShopper:Investor

Relationsir@flexshopper.com

Investor and Media Contact:Andrew Berger,

Managing DirectorSM Berger & Company, Inc.Tel: (216)

464-6400andrew@smberger.com

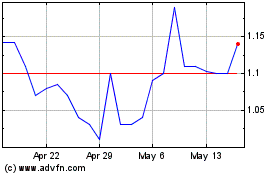

FlexShopper (NASDAQ:FPAY)

Historical Stock Chart

From Oct 2024 to Nov 2024

FlexShopper (NASDAQ:FPAY)

Historical Stock Chart

From Nov 2023 to Nov 2024