false

0001397047

0001397047

2024-10-25

2024-10-25

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

October 25, 2024

| FLEXSHOPPER, INC. |

| (Exact name of registrant as specified in its charter) |

| Delaware |

|

001-37945 |

|

20-5456087 |

(State or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

901 Yamato Road, Suite 260

Boca Raton, Florida |

|

33431 |

| (Address of Principal Executive Offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code:

(855) 353-9289

| N/A |

| (Former name or former address, if changed since last report.) |

Securities registered pursuant to Section 12(b)

of the Act:

|

Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Common Stock, par value $0.0001 per share |

|

FPAY |

|

The Nasdaq Stock Market LLC |

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General

Instruction A.2. below):

| ☐ | Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange

Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act. ☐

CURRENT REPORT ON FORM 8-K

FlexShopper, Inc. (the “Company”)

October 25, 2024

Item

1.01. Entry into a Material Definitive Agreement.

On October 25, 2024, the Company entered into a

Preferred Stock Purchase Option Agreement granting the Company the right at any time through October 25, 2025 to repurchase and cancel

20,000 shares of its series 2 convertible preferred stock, representing approximately 91% of the shares in such series, at varying purchase

prices below the then-current liquidation value of the series 2 convertible preferred stock, ranging from $20,250,000 to $22,500,000,

depending on when the Company exercises the option, from B2 FIE V LLC, which acquired the preferred stock in a private placement

in June 2016.

Each share of series 2 convertible preferred stock

is convertible into 266.2942 shares of the Company’s common stock or an aggregate of 5,325,888 shares of its common stock, based

on the series 2 convertible preferred stock issue price of $1,000 per share and conversion rate of $3.76 per share, and accrues dividends

through an increase in its liquidation preference at an annual rate equal to 10% of the original series 2 convertible preferred stock

issue price per share. The purchase price of the series 2 convertible preferred stock, which was negotiated between the parties, represents

approximately 50% of the current liquidation preference of the preferred stock, which was approximately $44.2 million as of September

30, 2024.

The terms of the preferred stock repurchase

provide that, if the Company exercises the option and within 12 months following the date of the Preferred Stock Purchase

Option Agreement, it completes a liquidity event or a change of control occurs, the Company would be required to make an

incremental “true-up” payment to B2 FIE V LLC. This payment would be in an amount equal to the difference between

the Company’s share price before the announcement of the liquidity event or change of control and the increased value of the

Company’s share price, if any, after announcing the transaction, applied to the number of repurchased preferred shares on an

as-if-converted to common stock basis. A discount of 8.3% is applied to this payment every 30-day period following the closing of

the preferred stock repurchase. Additionally, assuming the shares of series 2 preferred stock are repurchased, and the Company is

awarded monetary damages or a settlement award in connection with its patent infringement lawsuits, the Company would also be

required to pay a portion of those proceeds to B2 FIE V LLC. That portion would be determined by the increase in the value of the

Company’s share price, if any, after announcing the award as applied to the number of repurchased preferred shares on an

as-if-converted to common stock basis, provided that the Company is not required to pay B2 FIE V LLC more than $4.00 per share on

any share increase in value or 18% of the award.

The foregoing summary description of the Preferred

Stock Purchase Option Agreement is qualified by reference to the full text thereof, a copy of which is attached hereto as Exhibit 10.1

and incorporated herein in its entirety.

On October 25, 2024, the Company issued a press

release announcing its entry into the Preferred Stock Purchase Option Agreement,

a copy of which is attached hereto as Exhibit 99.1 and is incorporated in its entirety by reference.

Item

9.01. Financial Statements and Exhibits.

(d) Exhibits.

The exhibits listed in the following Exhibit Index are filed as part of this current report.

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| |

FLEXSHOPPER, INC. |

| |

|

| Dated: October 28, 2024 |

By: |

/s/ H. Russell Heiser Jr. |

| |

|

Name: |

H. Russell Heiser Jr. |

| |

|

Title: |

Chief Executive Officer |

2

Exhibit 10.1

FLEXSHOPPER, INC.

Preferred Stock Purchase Option Agreement

This Preferred Stock Purchase Option

Agreement (this “Agreement”) is made and entered on October 25, 2024 (the “Effective Date”),

by and among FlexShopper, Inc., a Delaware corporation (the

“Company”), and B2 FIE V LLC, a Delaware limited liability company (the “Investor”).

WHEREAS, the Investor

owns 20,000 shares (the “Shares”) of Series 2 Convertible Preferred Stock, par value $0.001 per share, of the Company

(the “Series 2 Preferred Stock”); and

WHEREAS, the Company

desires to have the right to purchase all, and not less than all, of the Shares, and the Investor desires to grant such right to the Company,

pursuant to the terms and conditions set forth herein.

NOW, THEREFORE, in

consideration of $100 paid by the Company to the Investor, and the mutual and dependent covenants and agreements hereinafter set forth,

the parties agree as follows:

1.

Grant of Purchase Option.

(a) Right

to Purchase. Subject to the terms and conditions of this Agreement, on or after the Effective Date until the one year anniversary

thereof, the Company shall have the right (the “Purchase Right”), but not the obligation, to cause the Investor to

sell all, and not less than all, of the Shares to the Company at the Purchase Price (as defined in Section 2 of this Agreement).

(b) Procedures.

(i) If

the Company desires to purchase the Shares pursuant to this Section 1, the Company shall deliver to the Investor a written, unconditional,

and irrevocable notice (the “Purchase Exercise Notice”) exercising the Purchase Right.

(ii) The

Investor shall at the closing of the purchase and sale of the Shares contemplated by the Purchase Exercise Notice (the “Purchase

and Sale Closing”), represent and warrant to the Company in the definitive purchase agreement (the “Purchase Agreement”)

attached hereto as Exhibit A and made a part hereof. From the date of this Agreement until the expiration of the Purchase Right,

the Investor agrees not to sell or otherwise directly or indirectly transfer the Shares to any other party (excluding entities within

its control, or under common control, which agree to the terms hereof).

(iii) Subject

to Section 1(c) below, the Purchase and Sale Closing shall take place no later than thirty

(30) days following receipt by the Investor of the Purchase Exercise Notice. The Company shall give the Investor at least ten (10) days’

written notice of the date of the Purchase and Sale Closing (the “Purchase Right Closing Date”).

(c) Consummation

of Sale. The Company shall pay the Purchase Price for the Shares by wire transfer of immediately available funds on the Purchase

Right Closing Date.

(d) Cooperation.

The Investor shall use commercially reasonable efforts to take any actions as may be reasonably necessary to consummate the sale contemplated

by this Section including, without limitation, entering into agreements and delivering certificates and instruments and consents as may

be deemed necessary or appropriate.

(e) Closing.

At the closing of any sale and purchase pursuant to this Section 1, the Investor shall deliver to the Company a certificate or certificates

representing the Shares to be sold (if any), accompanied by stock powers and all necessary stock transfer taxes paid and stamps affixed,

if necessary, against receipt of the Purchase Price.

(f) Release.

The Purchase Agreement shall provide for a customary mutual release between the Company and the Investor in form and substance mutually

satisfactory to the Company and the Investor.

2. Purchase

Price

(a) In

the event the Company exercises the Purchase Right hereunder, the purchase price per share at which the Investor shall be required to

sell the Shares (the “Purchase Price”) shall be equal to the Determined Value of the Shares as of the date of the Purchase

Exercise Notice.

(b) For

purposes of this Agreement, the term “Determined Value” shall mean:

(i) during

the first ninety (90) day period following the Effective Date (the “First Period”), $20,250,000 for the Shares;

(ii) during

the ninety (90) day period following the First Period (the “Second Period”), $21,125,000 for the Shares;

(iii) during

the ninety (90) day period following the Second Period (the “Third Period”), $21,700,000 for the Shares; and

(iv) after

the Third Period until the expiration of the Purchase Right, $22,500,000 for the Shares.

(c) From

and after the date hereof to the date that is twelve (12) months following the Effective Date, the Company shall pay or shall cause to

be paid on the later of (x) the date of the Purchase and Sale Closing and (y) the date of the closing of the Liquidity Transaction, in

the event that a Liquidity Transaction is entered into and consummated by the Company during such period, an amount in cash equal to the

sum of (A)(1) the Determined Value, and (2) 5,325,888 shares of Common Stock, par value of $0.0001 per share, of the Company, multiplied

by the difference between (x) the closing price per share of common stock of the Company the business day prior to announcing the Liquidity

Transaction, and (y) the closing price per share of common stock of the Company the business day of announcing the Liquidity Transaction,

multiplied by (B)(1) One, minus (2) 0.083 multiplied by the number of thirty (30) day periods following the Effective Date; provided

that no amount payable under this Section 2(c) shall be a negative number.

(d) For purposes

of this Agreement, the term “Liquidity Transaction” means a liquidity or change of control transaction, and the term

“Capital Raise Transaction” means a capital raise transaction from which the Company uses proceeds to purchase all

of the Shares.

(e) Patent

Infringement Litigation Award. If, within twenty-four (24) months following the Effective Date, (i) the Company consummates

the purchase of Shares pursuant to Section 1, and (ii) the Purchaser or its affiliate is awarded monetary damages or receives a

settlement award (the “Award”) in connection with any patent infringement lawsuit filed by Purchaser against

Upbound Group, Inc. (including its Acima subsidiaries), Katapult Holdings, Inc. and/or other companies alleging, among other things,

unauthorized use of Purchaser’s patented technologies, then Purchaser shall pay to Seller within five (5) business days of

date of receipt of such proceeds the Award Payment. “Award Payment” is equal to: (x) if the closing price per

share of common stock of the Company three business days after announcing the Award is less than $4.00, then the Award Payment is

$0, or (y) if the closing price per share of common stock of the Company three business days after announcing the Award is $4.00 or

greater, the award payment is 5,325,888 multiplied by the difference between (i) the closing price per share of common stock of the

Company the business day prior to announcing the Award, and (ii) the closing price per share of common stock of the Company three

business days after announcing the Award. Notwithstanding the foregoing, in no event shall the difference between subsections (y)(i)

and (ii) in the preceding sentence exceed $4.00 per share of common stock of the Company or the Award Payment exceed 18% of the

Award.

3. Notices.

All notices, requests, consents, claims, demands, waivers, and other communications hereunder shall be in writing and shall be deemed

to have been given (a) when delivered by hand (with written confirmation of receipt); (b) when received by the addressee if sent by a

nationally recognized overnight courier (receipt requested); (c) on the date sent by facsimile or email of a PDF document (with confirmation

of transmission) if sent during normal business hours of the recipient, and on the next business day if sent after normal business hours

of the recipient; or (d) on the third day after the date mailed, by certified or registered mail, return receipt requested, postage prepaid.

Such communications must be sent to the respective parties at the addresses indicated below (or at such other address for a party as shall

be specified in a notice given in accordance with this Section 3).

| If to the Company: |

|

FlexShopper, Inc. |

| |

|

901 Yamato Road, Suite 260 |

| |

|

Boca Raton, Florida 33431 |

| |

|

Attention: Mr. H. Russell Heiser Jr., CEO |

| |

|

E-mail: russ.heiser@flexshopper.com |

| |

|

|

| With a copy to (which shall not constitute notice): |

|

Olshan Frome Wolosky LLP |

| |

|

1325 Avenue of the Americas, 15th Floor |

| |

|

New York, New York 10019 |

| |

|

Attention: Spencer G. Feldman, Esq. |

| |

|

E-mail: sfeldman@olshanlaw.com |

| |

|

|

| If to the Investor: |

|

B2 FIE V LLC |

| |

|

Pacific Investment Management Company LLC |

| |

|

650 Newport Center Drive |

| |

|

Newport Beach, California 92660 |

| |

|

Attention: Denis Echtchenko and Sean Hinze |

| |

|

Email: Denis.Echtchenko@pimco.com; |

| |

|

Sean.Hinze@pimco.com |

4. Entire

Agreement. This Agreement constitutes the sole and entire agreement of the parties to this Agreement with respect to the

subject matter contained herein, and supersedes all prior and contemporaneous understandings and agreements, both written and oral, with

respect to such subject matter. In furtherance and not in limitation of the foregoing, in the event the Company proposes to enter into

a Liquidity Transaction or Capital Raise Transaction or the Purchase and Sale Closing occurs with respect to all of the outstanding Shares

of the Investor, the Investor waives with respect to such Liquidity Transaction, Capital Raise Transaction or Purchase and Sale Closing,

as applicable, any and all of its rights and obligations set forth in (a) Sections 3.2, 3.5 and 3.6 of the Investor Rights Agreement,

dated as of June 10, 2016, by and among the Company, Brad Bernstein and PIMCO, as amended, and (b) Sections 3, 4 and 5 of the Certificate

of Designations of the Company for Series 2 Convertible Preferred Stock, dated June 10, 2016.

5.

Successor and Assigns. This Agreement shall be binding upon and shall

inure to the benefit of the parties hereto and their respective successors and permitted assigns. Neither this Agreement nor any of the

rights of the parties hereunder may otherwise be transferred or assigned by any party hereto without the prior written consent of the

other parties; provided, however, that the Company may assign its rights or delegate its obligations hereunder without

such consent to an entity that acquires all or substantially all of the business or assets of the Company, whether by merger, reorganization,

acquisition or sale, or otherwise. Any attempted transfer or assignment in violation of this Section 5 shall be void.

6.

No Third-Party Beneficiaries. This Agreement is for the sole benefit of

the parties hereto and their respective successors and permitted assigns and nothing herein, express or implied, is intended to or shall

confer upon any other person any legal or equitable right, benefit, or remedy of any nature whatsoever, under or by reason of this Agreement.

7.

Amendment and Modification; Waiver. This Agreement may only be amended,

modified, or supplemented by an agreement in writing signed by each party hereto. No waiver by any party of any of the provisions hereof

shall be effective unless explicitly set forth in writing and signed by the party so waiving. Except as otherwise set forth in this Agreement,

no failure to exercise, or delay in exercising, any rights, remedy, power, or privilege arising from this Agreement shall operate or

be construed as a waiver thereof; nor shall any single or partial exercise of any right, remedy, power, or privilege hereunder preclude

any other or further exercise thereof or the exercise of any other right, remedy, power, or privilege.

8.

Severability. If any term or provision of this Agreement is invalid, illegal,

or unenforceable in any jurisdiction, such invalidity, illegality, or unenforceability shall not affect any other term or provision of

this Agreement or invalidate or render unenforceable such term or provision in any other jurisdiction. Upon such determination that any

term or other provision is invalid, illegal, or unenforceable, the parties hereto shall negotiate in good faith to modify this Agreement

so as to effect the original intent of the parties as closely as possible in a mutually acceptable manner in order that the transactions

contemplated hereby be consummated as originally contemplated to the greatest extent possible.

9.

Governing Law; Submission to Jurisdiction. This Agreement and any action

or dispute arising under or related in any way to this Agreement, the relationship of the parties hereto, the transactions leading to

this Agreement or contemplated hereby and/or the interpretation and enforcement of the rights and duties of the parties hereunder or

related in any way to the foregoing, shall be governed by and construed in accordance with the internal, substantive laws of the State

of New York applicable to agreements entered into and to be performed solely within such state without giving effect to the principles

of conflict of Laws thereof. EACH OF THE PARTIES TO THIS AGREEMENT HEREBY AGREES THAT JURISDICTION AND VENUE IN ANY SUIT, ACTION OR PROCEEDING

BROUGHT BY AY PARTY ARISING OUT OF OR RELATING TO THIS AGREEMENT (INCLUDING ANY SUIT, ACTION OR PROCEEDING SEEKING EQUITABLE RELIEF)

SHALL PROPERLY AND EXCLUSIVELY LIE IN THE COURT OF THE STATE OF NEW YORK SITTING IN NEW YORK COUNTY OR, TO THE EXTENT THE COURTS OF NEW

YORK DO NOT HAVE SUBJECT MATTER JURISDICTION, THE UNITED STATES DISTRICT COURT LOCATED IN NEW YORK CITY. EACH PARTY HERETO FURTHER AGREES

NOT TO BRING ANY SUCH SUIT, ACTION OR PROCEEDING IN ANY COURT OTHER THAN THE COURTS IDENTIFIED IN THE FOREGOING SENTENCE. BY EXECUTION

AND DELIVERY OF THIS AGREEMENT, EACH PARTY IRREVOCABLY SUBMITS TO THE JURISDICTION OF THE COURTS IN NEW YORK CITY FOR ITSELF AND IN RESPECT

OF ITS PROPERTY WITH RESPECT TO SUCH SUIT, ACTION OR PROCEEDING. THE PARTIES HERETO IRREVOCABLY AGREE THAT VENUE WOULD BE PROPER IN EACH

OF THE FOREGOING COURTS, AND HEREBY WAIVE ANY OBJECTION THAT ANY SUCH COURT IS AN IMPROPER OR INCONVENIENT FORUM FOR THE RESOLUTION OF

SUCH SUIT, ACTION OR PROCEEDING

10.

Waiver of Jury Trial. Each party irrevocably and unconditionally waives

any right it may have to a trial by jury in respect of any legal action arising out of or relating to this Agreement or the transactions

contemplated hereby. Each party to this Agreement certifies and acknowledges that (a) no representative of any other party has represented,

expressly or otherwise, that such other party would not seek to enforce the foregoing waiver in the event of a legal action; (b) such

party has considered the implications of this waiver; (c) such party makes this waiver voluntarily; and (d) such party has been induced

to enter into this Agreement by, among other things, the mutual waivers and certifications in this Section 10.

11.

Counterparts. This Agreement may be executed in counterparts, each of

which shall be deemed an original, but all of which shall together be deemed to be one and the same agreement. A signed copy of this

Agreement delivered by facsimile, email, or other means of electronic transmission shall be deemed to have the same legal effect as delivery

of an original signed copy of this Agreement.

12. No

Strict Construction. The parties to this Agreement have participated jointly in the negotiation and drafting of this Agreement.

In the event an ambiguity or question of intent or interpretation arises, this Agreement will be construed as if drafted jointly by the

parties, and no presumption or burden of proof will arise favoring or disfavoring any party by virtue of the authorship of any of the

provisions of this Agreement.

13. Expenses.

The Company shall reimburse the Investor and its affiliates for all reasonable and documented costs and expenses, including the fees and

expenses of the Investor’s legal counsel, incurred in connection with the transactions contemplated hereby and including such costs

and expenses incurred by the Investor and its affiliates, in each case, in the negotiation and execution of this Agreement and the Purchase

Agreement (if any) and, in each case, any other agreements or documents contemplated thereby or therewith. Such reimbursement shall not

exceed $35,000 in the aggregate. The Company shall pay such reimbursement on the earlier of the expiration of this Agreement or promptly

following the Purchase and Sale Closing.

14. Specific

Performance. The parties declare that it is impossible to measure in money the damages

that will accrue to a person having rights under this Agreement by reason of a failure of another to perform any obligation imposed by

the Agreement. Accordingly, if any person institutes an action or proceeding to enforce this Agreement by specific performance, any person

against whom the action or proceeding is brought hereby waives the claim or defense that the complaining party has an adequate remedy

at law, and no person shall in any action or proceeding put forward the claim or defense that an adequate remedy at law exists.

IN WITNESS WHEREOF, the parties

hereto have executed this Preferred Stock Purchase Option Agreement on the date first written above.

| |

COMPANY: |

| |

|

|

| |

FlexShopper, Inc. |

| |

|

|

| |

By: |

/s/ H. Russell Heiser, Jr. |

| |

|

Name: |

H. Russell Heiser, Jr. |

| |

|

Title: |

Chief Executive Officer |

| |

INVESTOR: |

| |

|

|

| |

B2 FIE V LLC |

| |

|

|

| |

By: |

/s/ Harin de Silva |

| |

|

Name: |

Harin de Silva |

| |

|

Title: |

Authorized Person |

[Signature Page to Purchase

Option Agreement]

Exhibit A

Form of Purchase Agreement

See attached.

FORM OF

STOCK PURCHASE AGREEMENT

THIS STOCK PURCHASE AGREEMENT

(this “Purchase Agreement”) is made as of the ___ day of ___________, 202___ by and between B2 FIE V LLC, a Delaware

limited liability company (the “Seller”), and FlexShopper, Inc., a Delaware

corporation (the “Purchaser”). Each of Seller and Purchaser are individually referred to as a “Party”

and collectively referred to as the “Parties”

WHEREAS, on October 25,

2024, the Seller and Purchaser entered into the Preferred Stock Purchase Option Agreement (the “Option Agreement”),

pursuant to which, among other things, Seller granted Purchaser the option to purchase 20,000 shares (the “Shares”)

of Series 2 Convertible Preferred Stock, par value $0.001 per share, of the Purchaser; and

WHEREAS, Pursuant

to Section 1 of the Option Agreement, Purchaser exercised its option to purchase the Shares, and now the parties desire to consummate

such purchase and sale of the Shares as set forth herein; and

NOW, THEREFORE, for

good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the parties hereby agree as follows:

1. Closing;

Delivery.

1.1. Closing

of Sale and Purchase of Shares. Subject to the terms and conditions of this Purchase Agreement, at the Closing (as defined below),

the Seller agrees to sell, and the Purchaser agrees to purchase from Seller, the Shares for the aggregate purchase price of $[___].

The Shares sold to the Purchaser pursuant to this Section 1 shall be referred to in this Purchase Agreement as the “Purchased

Shares.”

1.2. Subject

to the satisfaction or waiver of each condition to the Closing set forth in Section 4 and Section 5 hereof, the consummation of the purchase

and sale of the Purchased Shares shall take place, remotely via the electronic exchange of documents and signatures, at 10 a.m. Eastern

Time, on the date first written above, or at such other time and place as the Seller and the Purchaser mutually agree upon in writing

(email sufficient) (the “Closing”).

1.3. At

the Closing, the Purchaser shall make full payment of its respective Purchase Price therefor by wire transfer to a bank account designated

by the Seller. Upon receipt by Seller of the Purchaser’s Purchase Price at Closing, the Seller shall promptly take any and all

action necessary to cause legal and beneficial ownership of such Purchased Shares to be transferred from Seller to the Purchaser[, which

shall include, without limitation, Seller’s delivery of a certificate or certificates representing the Purchased Shares (if any),

or a lost stock affidavit in lieu thereof, in either case, accompanied by stock powers and all necessary stock transfer taxes paid and

stamps affixed, if necessary.

2. Representations

and Warranties of the Seller. The Seller hereby represents and warrants to the Purchaser that the following representations are true,

correct and complete as of the date of Closing except as otherwise indicated:

2.1. Authorization.

The Seller has all the necessary right, power and authority, without the necessity of any consent or approval of any other person or entity,

to enter into and perform its obligations under this Purchase Agreement, and has taken all necessary action to sell and transfer the Purchased

Shares to the Purchaser as contemplated by this Purchase Agreement.

2.2. Valid and Binding Obligation.

This Purchase Agreement constitutes the Seller’s valid and binding obligation, enforceable against it in accordance with the terms

of this Purchase Agreement, subject to applicable bankruptcy, insolvency, fraudulent conveyance, reorganization, moratorium and similar

laws affecting creditors’ rights generally and subject, as to enforceability, to general principles of equity.

2.3. No Encumbrances.

The Purchased Shares are free and clear of any and all mortgages, pledges, security interests, options, rights of first offer, encumbrances,

or other restrictions or limitations of any nature whatsoever other than those arising as a result of or under the terms of this Purchase

Agreement, the Option Agreement, the organizational documents of the Purchaser or pursuant to applicable securities laws.

2.4. Valid

Sale of Shares. The Seller is the sole legal and beneficial owner and holder of the Purchased Shares, having full right, title, and

interest in and to the Purchased Shares.

2.5. Non-Contravention.

The transfer of the Purchased Shares hereunder will not constitute a breach or violation of, or conflict with, any agreement, commitment

or other obligation to which the Seller is a party or by which it is bound in any way that materially and adversely affects the ability

of the Seller to consummate the transaction contemplated hereby.

3. Representations

and Warranties of the Purchaser. The Purchaser hereby represents and warrants to the Seller that the following representations are

true, correct and complete as of the date of Closing except as otherwise indicated:

3.1. Authorization.

The Purchaser has all the necessary right, power and authority, without the necessity of any consent or approval of any other person or

entity, to enter into and perform its obligations under this Purchase Agreement, and has taken all necessary action to consummate the

transactions contemplated by this Purchase Agreement.

3.2. Valid and Binding Obligation.

The Purchase Agreement constitutes the Purchaser’s valid and binding obligation, enforceable against it in accordance with the

terms of this Purchase Agreement, subject to applicable bankruptcy, insolvency, fraudulent conveyance, reorganization, moratorium and

similar laws affecting creditors’ rights generally and subject, as to enforceability, to general principles of equity.

3.3. Non-Contravention.

The transfer of the Purchased Shares hereunder will not constitute a breach or violation of, or conflict with, any agreement, commitment

or other obligation to which the Purchaser is a party or by which it is bound in any way that materially and adversely affects the ability

of the Purchaser to consummate the transactions contemplated hereby.

4. Conditions

to the Purchaser’s Obligations at Closing. The obligations of the Purchaser to purchase the Purchased Shares at the Closing,

are subject to the fulfillment, on or before the Closing, of each of the following conditions, unless otherwise waived:

4.1. Representations

and Warranties. The representations and warranties of the Seller contained in Section 2 shall be true and correct in all

material respects as of Closing.

4.2. Performance.

Seller shall have performed and complied with all covenants, agreements and obligations contained in this Purchase Agreement that are

required to be performed or complied with by Seller before Closing in all material respects.

5. Conditions

of the Seller’s Obligations at Closing. The obligations of Seller to sell the Purchased Shares to the Purchaser at Closing,

are subject to the fulfillment, on or before Closing, of each of the following conditions, unless otherwise waived:

5.1. Representations

and Warranties. The representations and warranties of the Purchaser contained in Section 3 shall be true and correct

in all material respects as of Closing.

5.2. Performance.

The Purchaser shall have performed and complied with all covenants, agreements and obligations contained in this Purchase Agreement that

are required to be performed or complied with by them on or before Closing in all material respects.

6. Indemnification.

6.1. Seller

will hold harmless and indemnify the Purchaser and its affiliates and their respective directors, officers, employees, consultants, financial

advisors, counsel, accountants and other agents (each, a “Purchaser Indemnitee”) from and against, and will compensate

and reimburse each of the Purchaser Indemnitees for any damages (including, but not limited to, any actual loss, liability, claim, damage,

deficiency, judgment, interest, fine, penalty, assessment, award, costs, reasonable attorneys’ fees or other expense) which are

suffered or incurred by any of the Purchaser Indemnitees or to which any of the Purchaser Indemnitees may otherwise become subject and

which arise from or as a result of any inaccuracy in or beach of any representation, warranty or covenant made by Seller in this Purchase

Agreement.

6.2. Purchaser

will hold harmless and indemnify the Seller and its affiliates and their respective directors, officers, employees, consultants, financial

advisors, counsel, accountants and other agents (each, a “Seller Indemnitee”) from and against, and will compensate

and reimburse each of the Seller Indemnitees for any damages (including, but not limited to, any actual loss, liability, claim, damage,

deficiency, judgment, interest, fine, penalty, assessment, award, costs, reasonable attorneys’ fees or other expense) which are

suffered or incurred by any of the Seller Indemnitees or to which any of the Seller Indemnitees may otherwise become subject and which

arise from or as a result of any inaccuracy in or beach of any representation, warranty or covenant made by Purchaser in this Purchase

Agreement.

7. Survival

of Representations and Warranties. The representations and warranties of the Seller and the Purchaser contained in or made pursuant

to this Purchase Agreement shall survive the Closing until the nine (9) month anniversary of the Closing, and shall in no way be affected

by any investigation or knowledge of the subject matter thereof made by or on behalf of the Purchaser or the Seller

8. Mutual

Release.

8.1. In

consideration of the covenants, agreements, and undertakings of the Parties under this Purchase Agreement, each Party, on behalf of itself

and its respective present and former parents, subsidiaries, affiliates, officers, directors, shareholders, members, managers, permitted

successors, and permitted assigns (collectively, “Releasors”) hereby releases, waives, and forever discharges the other

Party and its respective present and former, direct and indirect, parents, subsidiaries, affiliates, employees, officers, directors, shareholders,

members, managers, agents, representatives, permitted successors, and permitted assigns (collectively, “Releasees”)

of and from any and all actions, causes of action, suits, losses, liabilities, rights, debts, dues, sums of money, accounts, reckonings,

obligations, costs, expenses, liens, bonds, bills, specialties, covenants, contracts, controversies, agreements, promises, variances,

trespasses, damages, judgments, extents, executions, claims, and demands, of every kind and nature whatsoever, whether now known or unknown,

foreseen or unforeseen, matured or unmatured, suspected or unsuspected, in law, admiralty, or equity (collectively, “Claims”),

which any of such Releasors ever had, now have, or hereafter can, shall, or may have against any of such Releasees for, upon, or by reason

of any matter, cause, or thing whatsoever from the beginning of time through the date of this Purchase Agreement arising out of or relating

to Seller’s ownership of the Shares, except for any Claims relating to rights and obligations preserved by, created by, or otherwise

arising out of this Purchase Agreement.

8.2. Each

Party, on behalf of itself and each of its respective Releasors, understands that it may later discover Claims or facts that may be different

than, or in addition to, those that it or any other Releasor now knows or believes to exist regarding the subject matter of the release

contained in this Section 8, and which, if known at the time of signing this Purchase Agreement, may have materially affected this Purchase

Agreement and such Party’s decision to enter into it and grant the release contained in this Section 8. Nevertheless, the Releasors

intend to fully, finally and forever settle and release all Claims that now exist, may exist or previously existed, as set forth in the

release contained in this Section 8, whether known or unknown, foreseen or unforeseen, or suspected or unsuspected, and the release given

herein is and will remain in effect as a complete release, notwithstanding the discovery or existence of such additional or different

facts. The Releasors hereby waive any right or Claim that might arise as a result of such different or additional Claims or facts.

9. Miscellaneous.

9.1. The

following provisions in the Option Agreement are incorporated by reference herein, provided, however, reference in the Option Agreement

to the “Company” shall mean reference in this Purchase Agreement to “Purchaser,” reference in the Option Agreement

to the “Investor” shall mean reference in this Purchase Agreement to “Seller,” reference in the Option Agreement

to the “Agreement” shall mean reference in this Purchase Agreement to the “Purchase Agreement,” and, in all cases,

shall apply mutatis mutandis with respect to the subject matter of this Purchaser Agreement: Section 3 (Notices), Section

4 (Entire Agreement), Section 5 (Successors and Assigns), Section 6 (No Third Party Beneficiaries), Section 7 (Amendment

and Modification; Waiver), Section 8 (Severability), Section 9 (Governing Law; Submission to Jurisdiction), Section

10 (Waiver of Jury Trial), Section 11 (Counterparts), Section 12 (No Strict Construction), Section 13 (Expenses)

and Section 14 (Specific Performance).

9.2. For

the avoidance of doubt, Sections 4 and 13 of the Option Agreement shall not merge, be extinguished or otherwise affected by the delivery

and execution of this Purchase Agreement.

9.3. This

Agreement will constitute, and may be presented to the Purchaser’s transfer agent and registrar as, Seller’s irrevocable authorization

to transfer the record ownership of the Purchased Shares to the Purchaser on the books of the Purchaser.

IN WITNESS WHEREOF, the parties

have executed this Stock Purchase Agreement as of the date first written above.

| |

SELLER: |

| |

|

|

|

| |

B2 FIE V LLC |

| |

|

|

|

| |

By: |

|

| |

|

Name: |

|

| |

|

Title: |

|

| |

|

|

|

| |

PURCHASER: |

| |

|

|

|

| |

FlexShopper, Inc. |

| |

|

|

|

| |

By: |

|

| |

|

Name: |

|

| |

|

Title: |

|

A-5

Exhibit 99.1

FlexShopper Announces a Purchase Option for

91% of its

Outstanding Series 2 Preferred Stock at a 50+% Discount to Liquidation Preference

Transaction is expected to save FlexShopper

$23+ million, or ~$1 per share upon completion

BOCA RATON, Fla., October 28, 2024 (GLOBE NEWSWIRE) – FlexShopper,

Inc. (Nasdaq: FPAY), (“the Company”), a leading online lease-to-own retailer and payment solutions provider, today announced

that it has entered into a purchase option agreement with the majority holder of the Company’s Series 2 Preferred Stock (the “Preferred

Stock”), in which FlexShopper has the option to redeem 91% of FlexShopper’s Preferred Stock at a 50+% discount to the second

quarter of 2024 liquidation preference of approximately $43 million. The discount is based upon the date of repayment and the option to

purchase lasts for a one-year period. In addition, further payments to the seller of the Preferred Stock may be required based upon the

purchase price in a change of control in the next 12 months or patent settlement announcements in the next 24 months.

“We are excited to pursue options to redeem over 90% of our outstanding

Series 2 Preferred Stock at a significant discount to its liquidation preference. We believe this opportunity will enhance shareholder

value by improving our cost of capital, simplifying our capital structure and transferring $23 million of equity value to our common shareholders,

representing approximately $1 per share. In addition, the redemption of our Series 2 Preferred Stock at a 50%+ discount will be highly

accretive to earnings and will contribute approximately $4 million to annual operating income,” said Russ Heiser, CEO of FlexShopper.

Expected Benefits of the Redemption of FlexShopper’s Series

2 Preferred Stock owned by PIMCO:

Highly Accretive to Earnings. The Company expects to save approximately

$4 million in annual payment-in-kind (PIK) dividends. As a result, FlexShopper expects the repurchase transaction to be highly accretive

to net income to common and Preferred Series 1 shareholders once completed.

Material Discount in Liquidation Preference Price: As part of

the agreement, FlexShopper has the option to repurchase its Series 2 Preferred Stock at a 50+% discount to its liquidation preference.

The current liquidation preference, as of the end of the second quarter of 2024, is valued at approximately $43 million, with an option

to purchase at approximately $20 million.

Increase in Common Equity Value: By redeeming 91% of the Preferred

Stock, the approximately $23 million of savings would benefit common shareholders. The savings are equivalent to ~$1 per share in value,

based on the Company’s share count at June 30, 2024.

Illustrative Non-GAAP Changes in FlexShopper’s

Enterprise Value and Stock Price

Based on 91% Redemption of FlexShopper’s Series 2 Preferred Stock

| | |

Actual

Valuation at

June 30,

2024 | | |

Pro-forma

Valuation at

June 30,

2024 | | |

Expected

change ($) | | |

Expected

change (%) | |

| Common Equity | |

$ | 30,057,074 | (1) | |

$ | 52,917,027 | (7) | |

$ | 22,859,953 | | |

| 76 | % |

| Net Debt | |

$ | 132,086,383 | (2) | |

$ | 132,086,383 | (2) | |

| - | | |

| - | |

| Series 1 Preferred Stock | |

$ | 288,296 | (3) | |

$ | 288,296 | (3) | |

| - | | |

| - | |

| Series 2 Preferred Stock | |

$ | 47,301,212 | (4) | |

$ | 24,441,259 | (8) | |

$ | (22,859,953 | ) | |

| (48 | )% |

| Total Enterprise Value | |

$ | 209,732,965 | (5) | |

$ | 209,732,965 | (5) | |

| - | | |

| - | |

| Share Price | |

$ | 1.28 | (6) | |

$ | 2.25 | (9) | |

$ | 0.97 | | |

| 76 | % |

| (1) | Common Shares Equivalent (1.1) times Actual Share Price at June 30, 2024. |

| (1.1) | Common shares outstanding at June 30, 2024 plus common shares increased using the Treasury Stock Method upon exercise of warrants,

stock options and performance share units at June 30, 2024. |

| (2) | Short- and long-term loans minus cash at June 30, 2024. |

| (3) | Common shares upon conversion of Series 1 Preferred Stock at June 30, 2024 times Actual Share Price at June 30, 2024. |

| (4) | Series 2 Preferred Stock at liquidation preference at June 30, 2024 which includes the balance sheet amount and accrued dividends. |

| (5) | Actual Valuation at June 30, 2024 of Common Equity plus Actual Valuation at June 30, 2024 of Net Debt plus Actual Valuation at June

30, 2024 of Series 1 Preferred Stock plus Actual Valuation at June 30, 2024 of Series 2 Preferred Stock. |

| (6) | Share Price of Common Stock at June 30, 2024. |

| (7) | Actual Valuation at June 30, 2024 of Total Enterprise Value minus Pro-forma Valuation at June 30, 2024 of Series 2 Preferred Stock,

minus Pro-forma Valuation at June 30, 2024 of Series 1 Preferred Stock, minus Pro-forma Valuation at June 30, 2024 of Net Debt. |

| (8) | Series 2 Preferred Stock, after the redemption of the Series 2 Preferred Stock owned by the majority holder, at liquidation preference

at June 30, 2024 plus the current purchase price per the purchase option |

| (9) | Pro-forma Valuation at June 30, 2024 of Common Equity divided by Common Shares Equivalent (as defined in 1.1) |

About FlexShopper

FlexShopper, Inc. is a leading national financial

technology company that offers innovative payment options to consumers. FlexShopper provides a variety of flexible funding options for

underserved consumers through its direct-to-consumer online marketplace at Flexshopper.com and in partnership with merchants both online

and at brick-and-mortar locations. FlexShopper’s solutions are crafted to meet the needs of a wide range of consumer segments through

lease-to-own and lending products.

Forward-Looking Statements

All statements in this release that are not based on historical fact are

“forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities

Exchange Act of 1934. Forward-looking statements, which are based on certain assumptions and describe our future plans, strategies and

expectations, can generally be identified by the use of forward-looking terms such as “believe,” “expect,” “may,”

“will,” “should,” “could,” “seek,” “intend,” “plan,” “goal,”

“estimate,” “anticipate,” or other comparable terms. Examples of forward-looking statements include, among others,

statements we make regarding expectations of the redemption of over 90% of the Company’s outstanding Series 2 Preferred Stock, the

expectation that the redemption of our Series 2 Preferred Stock would be highly accretive to earnings or would improve our company’s

share price, lease originations, the expansion of our lease-to-own program; expectations concerning our partnerships with retail partners;

investments in, and the success of, our underwriting technology and risk analytics platform; our ability to collect payments due from

customers; expected future operating results and expectations concerning our business strategy. Forward-looking statements involve inherent

risks and uncertainties which could cause actual results to differ materially from those in the forward-looking statements, as a result

of various factors including, among others, the following: our ability to obtain adequate financing to fund our business operations in

the future; the failure to successfully manage and grow our FlexShopper.com e-commerce platform; our ability to maintain compliance with

financial covenants under our credit agreement; our dependence on the success of our third-party retail partners and our continued relationships

with them; our compliance with various federal, state and local laws and regulations, including those related to consumer protection;

the failure to protect the integrity and security of customer and employee information; and the other risks and uncertainties described

in the Risk Factors and in Management’s Discussion and Analysis of Financial Condition and Results of Operations sections of our

Annual Report on Form 10-K and subsequently filed Quarterly Reports on Form 10-Q. The forward-looking statements made in this release

speak only as of the date of this release, and FlexShopper assumes no obligation to update any such forward-looking statements

to reflect actual results or changes in expectations, except as otherwise required by law.

Contacts

For FlexShopper:

Investor Relations

ir@flexshopper.com

Investor and Media Contact:

Andrew Berger, Managing Director

SM Berger & Company, Inc.

Tel: (216) 464-6400

andrew@smberger.com

v3.24.3

Cover

|

Oct. 25, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Oct. 25, 2024

|

| Entity File Number |

001-37945

|

| Entity Registrant Name |

FLEXSHOPPER, INC.

|

| Entity Central Index Key |

0001397047

|

| Entity Tax Identification Number |

20-5456087

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

901 Yamato Road

|

| Entity Address, Address Line Two |

Suite 260

|

| Entity Address, City or Town |

Boca Raton

|

| Entity Address, State or Province |

FL

|

| Entity Address, Postal Zip Code |

33431

|

| City Area Code |

855

|

| Local Phone Number |

353-9289

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, par value $0.0001 per share

|

| Trading Symbol |

FPAY

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

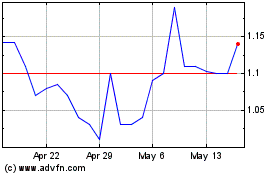

FlexShopper (NASDAQ:FPAY)

Historical Stock Chart

From Oct 2024 to Nov 2024

FlexShopper (NASDAQ:FPAY)

Historical Stock Chart

From Nov 2023 to Nov 2024