false000071780600007178062024-10-242024-10-24

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of report (Date of earliest event reported): October 24, 2024

|

|

|

|

First US Bancshares, Inc. |

|

(Exact Name of Registrant as Specified in Charter)

|

|

|

Delaware |

000-14549 |

63-0843362 |

(State or Other Jurisdiction of Incorporation) |

(Commission File Number) |

(IRS Employer Identification No.) |

3291 U.S. Highway 280

Birmingham, Alabama 35243

(Address of Principal Executive Offices, including Zip Code)

Registrant’s telephone number, including area code: (205) 582-1200

N/A

(Former Name or Former Address, if Changed Since Last Report)

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

Common Stock, $0.01 par value |

FUSB |

The Nasdaq Stock Market LLC |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§230.405 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

|

|

Item 7.01 |

Regulation FD Disclosure |

First US Bancshares, Inc. (“FUSB”) has prepared investor presentation materials, which are being furnished as Exhibit 99.1 to this report. These materials include, among other things, a review of financial results and trends through the period ended September 30, 2024. The materials are intended to be made available to shareholders, analysts and investors, including investor groups participating in forums such as sponsored investor conferences, during the quarter ending December 31, 2024, or until updated materials are furnished. A copy of the materials will be available on FUSB’s investor relations website, which may be accessed at firstusbank.com.

The information contained herein is being furnished pursuant to Item 7.01 of Form 8-K, “Regulation FD Disclosure.” This information shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or incorporated by reference into any filing under the Securities Act of 1933, as amended (the “Securities Act”), or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

|

|

Item 9.01 |

Financial Statements and Exhibits. |

The exhibit listed below in the Exhibit Index is being furnished pursuant to Regulation FD as part of this report and shall not be deemed to be “filed” for purposes of Section 18 of the Exchange Act or incorporated by reference into any filing under the Securities Act or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

Dated: October 24, 2024 |

FIRST US BANCSHARES, INC. |

|

|

|

|

By: |

/s/ Thomas S. Elley |

|

Name: |

Thomas S. Elley |

|

|

Senior Executive Vice President, Treasurer and Assistant Secretary, |

|

|

Chief Financial Officer and Principal Accounting Officer |

Investor Presentation As of September 30, 2024 Exhibit 99.1

Forward-Looking Statements This presentation of First US Bancshares, Inc. (“FUSB” or the “Company”) contains forward-looking statements, as defined by federal securities laws. Statements contained in this presentation that are not historical facts, including without limitation all statements relating to FUSB’s future financial and operational results, are forward-looking statements. These statements may address issues that involve significant risks, uncertainties, estimates and assumptions made by FUSB’s senior management. FUSB undertakes no obligation to update these statements following the date of this presentation, except as required by law. In addition, FUSB, through its senior management, may make from time to time forward-looking public statements concerning the matters described herein. Such forward-looking statements are necessarily estimates reflecting the best judgment of FUSB’s senior management based upon current information and involve a number of risks and uncertainties. Certain factors that could affect the accuracy of such forward-looking statements and cause actual results to differ materially from those projected in such forward-looking statements are identified in the public filings made by the Company with the SEC, and forward-looking statements contained in this presentation or in other public statements of the Company or its senior management should be considered in light of those factors. Such factors may include risks related to the Company's credit, including that if loan losses are greater than anticipated; the increased lending risks associated with commercial real estate lending; liquidity risks; the impact of national and local market conditions on the Company's business and operations; the rate of growth (or lack thereof) in the economy generally and in the Company’s service areas; strong competition in the banking industry; the impact of changes in interest rates and monetary policy on the Company’s performance and financial condition; the impact of technological changes in the banking and financial service industries and potential information system failures; cybersecurity and data privacy threats; the costs of complying with extensive governmental regulation; the impact of changing accounting standards and tax laws on the Company's allowance for credit losses and financial results; the possibility that acquisitions may not produce anticipated results and result in unforeseen integration difficulties; and other risk factors described from time to time in the Company’s public filings, including, but not limited to, the Company’s most recent Annual Report on Form 10-K. Relative to the Company’s dividend policy, the payment of cash dividends is subject to the discretion of the Board of Directors and will be determined in light of then-current conditions, including the Company’s earnings, leverage, operations, financial conditions, capital requirements and other factors deemed relevant by the Board of Directors. In the future, the Board of Directors may change the Company’s dividend policy, including the frequency or amount of any dividend, in light of then-existing conditions.

Presentation Disclosure This presentation has been prepared by FUSB solely for informational purposes based on its own information, as well as information from public sources. This presentation has been prepared to assist interested parties in making their own evaluation of FUSB and does not purport to contain all of the information that may be relevant. In all cases, interested parties should conduct their own investigation and analysis of FUSB and the information included in this presentation or other information provided by or on behalf of FUSB. This presentation does not constitute an offer to sell or a solicitation of an offer to buy any securities of FUSB by any person in any jurisdiction in which it is unlawful for such person to make such an offer or solicitation. Neither the SEC nor any state securities commission has approved or disapproved of the securities of FUSB or passed upon the accuracy or adequacy of this presentation. Any representation to the contrary is a criminal offense. Except as otherwise indicated, this presentation speaks as of the date indicated on the cover page. The delivery of this presentation shall not, under any circumstances, create any implication that there has been no change in the affairs of FUSB after such date. This presentation includes unaudited financial measures that have been prepared other than in accordance with generally accepted accounting principles in the United States (“non-GAAP financial measures”), including tangible book value per common share, return on average tangible common equity and tangible common equity to tangible assets. FUSB presents non-GAAP financial measures when it believes that the additional information is useful and meaningful to management and investors. Non-GAAP financial measures do not have any standardized meaning and, therefore, may not be comparable to similar measures presented by other companies. The presentation of non-GAAP financial measures is not intended to be a substitute for, and should not be considered in isolation from, the financial measures reported in accordance with GAAP. See the Appendix to this presentation for a reconciliation of certain non-GAAP financial measures to the comparable GAAP measures. Quarterly data presented herein have not been audited by FUSB’s independent registered public accounting firm.

Contents Corporate Profile 5 Strategic Focus 8 3Q2024 and Year-to-Date Highlights 11 Deposit Composition 12 Loan Portfolio Trends 13 Asset Quality Trends 17 Recent Financial Trends 19 5 Year Financial Trends 22 Risk Management – Capital, Liquidity and Market Sensitivity 25 Appendix: Non-GAAP Reconciliation 28

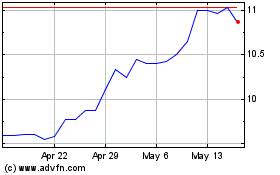

Company Founded: 1952 Headquarters: Birmingham, AL First US Bank: 15 Branches / 2 LPOs Total Assets: $1,100 million Total Loans: $803 million Total Deposits: $981 million Loans to Deposits: 82% Exchange: Nasdaq: FUSB Stock price: $11.05 Tangible BV: $15.92 per share (1) Price to TBV: 69% Market Cap: $63.2 million Annual Dividend: $0.20 Dividend Yield: 1.81% Information as of 9/30/2024 Calculations of tangible balances and measures are included in the Appendix.

Corporate Profile Senior Leadership Team James F. House President and Chief Executive Officer Veteran banker with SouthTrust Bank for 31 years Business consultant 2005 to 2009 focusing on management, investments, and commercial and consumer lending issues Florida Division President with BankTrust from 2009 to 2011 Tenure at FUSB began November 2011 Thomas S. Elley SEVP, Chief Financial Officer & Chief Investment Officer CPA holding various positions with Deloitte & Touche LLP over 13-year period Previous banking positions with Regions Financial Corp., Iberiabank Corp., and SouthTrust Bank Tenure at FUSB began October 2013 Veteran commercial banker with Regions Financial Corporation and AmSouth Bank for 20 years CPA Tenure at FUSB began July 2015 David P. McCullum SEVP, Senior Commercial Lending Executive Eric H. Mabowitz SEVP, Chief Risk, Compliance & CRA Officer Veteran Risk and Operations manager with 36 years of experience Previous banking positions with Premier Bank, First Community Bank, and Renasant Bank MBA Tenure at FUSB began March 2008 Phillip R. Wheat SEVP, Chief Information and Consumer Banking Officer Veteran IT and Operations manager with 34 years of experience Experienced in acquisitions, branding, cost mitigation, cyber security, and digital transformation Tenure at FUSB began April 2013 William C. Mitchell SEVP, Senior Consumer Lending Executive Veteran consumer lender with 37 years of lending experience CEO and President of Acceptance Loan Company, Inc. (Bank Subsidiary) from 2007 to 2019 Tenure at FUSB began May 1997

Corporate Profile�First US Bank – Branch and LPO Location Map Retail Banking Centers Loan Production Offices Retail Banking Center (Under Construction)

` PRIMARY GOALS Grow EPS, ROA and ROE Consistent, diversified loan and deposit growth Adherence to strong credit culture Effective expense control LENDING FOCUS EXPENSE CONTROL LONGER TERM GROWTH EFFORTS Adherence to commercial lending fundamentals: cash flow, debt service coverage and loan-to-value considerations Avoid speculative lending on land and development Maintain continuous loan review and loan grading system Consumer lending focused on higher credit scores and geographic and product diversification Strategic Focus Objective: Increase franchise value Maintain strong core deposit franchise while being responsive to the interest rate environment Expand use of current digital offerings among customer base to optimize branch footprint Improve efficiency through process improvement and scale Grow loan production offices to levels that support limited branching Leverage digital banking offerings to expanded customer base Consider acquisitions to enter new growth markets

Strategic Focus Building and Maintaining a Diversified Balance Sheet Loan Composition as of 9/30/2024 Deposit Composition as of 9/30/2024

Strategic Focus �A Favorable Geographic Footprint Potential Markets for Growth Alabama: Auburn Dothan Huntsville Montgomery Florida: Destin Panama City Pensacola Georgia: Athens Atlanta Augusta Columbus Macon Mississippi: Hattiesburg Jackson Meridian South Carolina: Greenville Tennessee: Memphis Nashville

Earnings Improvement Continues $.07 improvement in diluted EPS, comparing the nine months ended September 30, 2024, to the nine months ended September 30, 2023 3Q2024 diluted EPS of $0.36 ($.02 more than 2Q2024 and $.03 more than 3Q2023) Trailing 12 months diluted EPS increased to $1.40 as of September 30, 2024, compared to $1.37 as of June 30, 2024 Net interest margin compression of 9 basis points in 3Q2024, compared to 2Q2024 Margin of 3.60% in 3Q2024, compared to 3.69% in 2Q2024 and 3.79% in 3Q2023 3Q2024 margin compression driven by slowing gain accretion on terminated swaps, as well as accelerated fee amortization on called brokered CDs Replacement of called brokered CDs with lower-rate deposits expected to reduce interest expense over time Expense structure continues to benefit from prior strategic initiatives Year-to-date non-interest expense of $21.4 million as of September 30, 2024, compared to $21.7 million for same period of 2023 Year-to-date salaries and benefits expense decreased by 4.0%, compared to the same period of 2023 Additional year-to-date expense reduction from check fraud recovery and decreased collection expense Balance Sheet Trends Year-to-date loan decrease of $18.5 million, or 2.2% Decrease driven primarily by payoffs of construction loans, and to a lesser extent, reductions in consumer indirect and C&I Increase in nonperforming loans in 3Q2024 due to two loans that moved into nonaccrual status Year-to-date core deposit growth of $14.0 million, or 1.7% Deployed $27.5 million to investment portfolio during the nine months ended September 30, 2024, to capture higher yields Tangible book value of $15.92 as of September 30, 2024, a 10.0% year-to-date increase Accumulated Other Comprehensive Loss decrease of $3.0 million, or 45.9%, during the nine months ended September 30, 2024 Tangible common equity to tangible assets increased to 8.33% as of September 30, 2024, compared to 7.79% as of December 31, 2023 3Q2024 and Year-to-Date Highlights

Deposit Composition A Stable Core Deposit Base

Loan Portfolio Trends Quarterly Growth by Category

Loan Portfolio Trends Non-Residential CRE and Construction Portfolio Breakdown Non-Residential CRE Breakdown as of 9/30/2024 Construction Breakdown as of 9/30/2024 Non-owner occupied office consists of 22 loans with an average loan size of $1.7 million. The properties are located in Tuscaloosa, AL, Birmingham, AL, and Chattanooga, TN.

Loan Portfolio Trends Indirect Portfolio This portfolio segment includes loans secured by collateral purchased by consumers in retail stores with whom the Company has an established relationship to provide financing if applicable underwriting standards are met. The collateral securing these loans includes recreational vehicles, campers, boats, horse trailers and cargo trailers. Weighted average yield of 6.06% in 3Q2024 Weighted average credit score of 774 as of 9/30/24 Enhances geographic and collateral diversification of the loan portfolio Portfolio provides $165.2 million in readily available liquidity through pledging to Federal Reserve as of 9/30/24 Indirect Lending Currently Conducted in 17 States: Alabama Arkansas Florida Georgia Indiana Iowa Kansas Kentucky Mississippi Missouri Nebraska North Carolina Oklahoma South Carolina Tennessee Texas Virginia

Loan Portfolio Trends Indirect Portfolio Breakdown Indirect by Collateral as of 9/30/2024(1) Indirect by State as of 9/30/2024(1)(2) (1) Dollars in thousands (2) Represents state in which the participating dealer operates

Asset Quality Trends Annualized Net Charge-offs and ACL on Loans and Leases Note: While no portion of the allowance for credit losses (“ACL”) is in any way restricted to any individual loan or group of loans and the entire allowance is available to absorb losses from any and all loans, the table above shows an allocation of the allowance for credit losses as of the periods presented.

Asset Quality Trends Nonperforming Assets and Nonperforming Loans Nonperforming Assets (1) Nonperforming Loans (2) Nonperforming assets: nonaccrual loans and OREO Nonperforming loans: nonaccrual loans Note: The increase in both nonperforming assets and nonperforming loans in 3Q2024 resulted from two loans (from the C&I and 1-4 family residential categories) that moved into nonaccrual status.

Recent Financial Trends 5 Quarter Annualized Net Interest Margin Average rate including both interest-bearing and non-interest-bearing deposits Average rate on all interest-bearing liabilities and non-interest-bearing deposits

Recent Financial Trends Profitability Metrics – 5 Quarter Trend (1) Calculations of tangible balances and measures are included in the Appendix

Recent Financial Trends Balance Sheet Metrics – 5 Quarter Trend

5 Year Financial Trends Profitability Metrics Calculations of tangible balances and measures are included in the Appendix The amount presented for 2024 represents the trailing 12 months as of September 30, 2024

5 Year Financial Trends Balance Sheet Metrics

5 Year Financial Trends Share Price vs. Tangible Book Value (69% as of 09/30/2024)(1) (1) Calculations of tangible balances and measures are included in the Appendix

Risk Management Equity Capital – 5 Quarter Trend (1) Calculations of tangible balances and measures are included in the Appendix.

Risk Management Managing Liquidity and Investment Risk Summary of Securities Portfolio The portfolio is structured with relatively short expected average lives in order to enhance liquidity Weighted average book yield was 3.08% in 3Q2024 Expected average life of securities in the portfolio was 4.1 years 99.5% of the portfolio is available for sale; 0.5% is HTM Net unrealized loss (AFS and HTM) totals 3.2% of amortized cost and 4.7% of Tier 1 Capital Readily Available Liquidity Table below represents readily available sources of liquidity, including cash and cash equivalents, federal funds sold, securities purchased under reverse repurchase agreements, investment securities and other liquidity sources Non-GAAP measure that management views as beneficial to the overall understanding of the Company’s liquidity position – should be considered as a supplement to GAAP-based liquidity measures Calculations are intended to reflect minimum levels of liquidity readily available Compares favorably to estimated uninsured deposits: September 30, 2024: $233.4 million, or 23.8% of total deposits. December 31, 2023: $200.3 million, or 21.1% of total deposits.

Risk Management Interest Rate Sensitivity The following table summarizes the forecasted impact on net interest margin and net interest income using a base case scenario given immediate upward and downward shocks in interest rates of 100, 200 and 300 basis points (“bps”) based on forecasted assumptions of prepayment speeds, nominal interest rates and loan and deposit repricing rates. Estimates are as of September 30, 2024, and are based on economic conditions at that time, historical interest rate cycles and other factors deemed by management to be relevant. During 2Q2024, the Company acquired $50 million notional interest rate floors to improve positioning in downward interest rate scenarios.

Appendix Non-GAAP Reconciliations

Appendix Non-GAAP Reconciliation (dollars and shares in thousands, except per share data) (1) Calculation of Return on average tangible common equity (annualized) = ((net income (d) / number of days in period) * number of days in year) / average tangible shareholders’ equity (c)

Appendix Non-GAAP Reconciliation (dollars and shares in thousands, except per share data)

www.firstusbank.com Contact: Thomas S. Elley Chief Financial Officer telley@firstusbank.com 205.582.1200

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

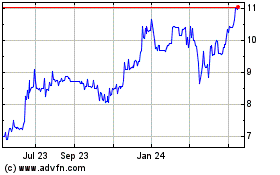

First US Bancshares (NASDAQ:FUSB)

Historical Stock Chart

From Oct 2024 to Nov 2024

First US Bancshares (NASDAQ:FUSB)

Historical Stock Chart

From Nov 2023 to Nov 2024