Liberty Media Corporation Announces Refinancing and Maturity Extension of Formula 1 Debt Facilities and Incremental Funding Related to MotoGP™ Acquisition

20 September 2024 - 10:15PM

Business Wire

Liberty Media Corporation (“Liberty”) (Nasdaq: FWONA, FWONK,

LLYVA, LLYVK) announced today that it closed the refinancing of the

first lien Term Loan B and the maturity extension of the first lien

Term Loan A and first lien revolving credit facility of certain

subsidiaries of Delta Topco Limited, the Liberty subsidiary which

holds all of its interests in Formula 1, on September 19, 2024.

Delta Topco Limited and its subsidiaries (“Formula 1”)

refinanced the previous $1,700 million Term Loan B with a maturity

of January 15, 2030 with a new $1,700 million Term Loan B with a

maturity of September 30, 2031 and extended the maturities of the

approximately $689 million Term Loan A and the $500 million

revolving credit facility from January 15, 2028 to September 30,

2029.

The margin for the Term Loan B has been reduced from 2.25% to

2.00% with the potential to permanently step down to 1.75% if

Formula 1’s net first lien leverage ratio is equal to or less than

3.75x on or following the earlier of (x) Liberty’s consummation of

the acquisition of Dorna Sports, S.L., the exclusive commercial

rights holder to the MotoGP™ World Championship (the “Dorna

Acquisition”) or (y) the termination of the Dorna Acquisition. The

margin for the Term Loan A and revolving credit facility is between

1.50% and 2.25% depending on Formula 1’s net first lien leverage

ratio. The reference rate for the Term Loan B, Term Loan A and

dollar borrowings under the first lien revolving credit facility is

Term SOFR. The Term Loan B, the Term Loan A and the revolving

credit facility remain non-recourse to Liberty Media. Formula 1,

together with the debt described herein, is attributed to the

Formula One Group tracking stock.

In connection with the transaction, Formula 1 also successfully

marketed an incremental $850 million of Term Loan B funding and

obtained an incremental $150 million of commitments to the newly

extended Term Loan A (collectively, the “Incremental Term Loans”).

The Incremental Term Loans will be used to fund a portion of the

Dorna Acquisition. The funding of the Incremental Term Loans are

conditioned upon the scheduled consummation of the Dorna

Acquisition which is expected to close by year-end 2024. Following

this transaction, all necessary debt funding related to the Dorna

Acquisition has been secured.

Forward-Looking Statements

This press release includes certain forward-looking statements

within the meaning of the Private Securities Litigation Reform Act

of 1995, including without limitation, statements about the funding

of the Incremental Term Loans and the consummation of the Dorna

Acquisition. These forward-looking statements involve many risks

and uncertainties that could cause actual results to differ

materially from those expressed or implied by such statements,

including, without limitation, the ability to fund the Incremental

Term Loans and consummate the Dorna Acquisition. These

forward-looking statements speak only as of the date of this press

release, and Liberty expressly disclaims any obligation or

undertaking to disseminate any updates or revisions to any

forward-looking statement contained herein to reflect any change in

its expectations with regard thereto or any change in events,

conditions or circumstances on which any such statement is based.

Please refer to the publicly filed documents of Liberty, including

the most recent Forms 10-K and 10-Q, for additional information

about Liberty and Formula 1 and about the risks and uncertainties

related to Liberty’s business (including Formula 1) which may

affect the statements made in this press release.

About Liberty Media Corporation

Liberty Media Corporation operates and owns interests in a broad

range of media, communications, sports and entertainment

businesses. Those businesses are attributed to two tracking stock

groups: the Formula One Group and the Liberty Live Group. The

businesses and assets attributed to the Formula One Group (NASDAQ:

FWONA, FWONK) include Liberty Media’s subsidiaries Formula 1 and

Quint, and other minority investments. The businesses and assets

attributed to the Liberty Live Group (NASDAQ: LLYVA, LLYVK) include

Liberty Media’s interest in Live Nation and other minority

investments.

About Formula 1

Formula 1® racing began in 1950 and is the world’s most

prestigious motor racing competition, as well as the world’s most

popular annual sporting series. Formula One World Championship

Limited is part of Formula 1® and holds the exclusive commercial

rights to the FIA Formula One World Championship™. Formula 1® is a

subsidiary of Liberty Media Corporation, attributed to the Formula

One Group tracking stock (NASDAQ: FWONA, FWONK). The F1 logo, F1

FORMULA 1 logo, FORMULA 1, F1, FIA FORMULA ONE WORLD CHAMPIONSHIP,

GRAND PRIX, PADDOCK CLUB and related marks are trademarks of

Formula One Licensing BV, a Formula 1 company. All rights

reserved.

For more information on Formula 1® visit www.formula1.com.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240919944512/en/

Liberty Media Corporation Shane Kleinstein, 720-875-5432

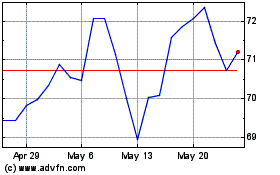

Liberty Media (NASDAQ:FWONK)

Historical Stock Chart

From Feb 2025 to Mar 2025

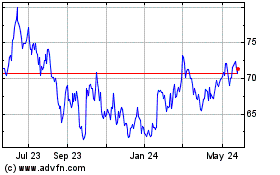

Liberty Media (NASDAQ:FWONK)

Historical Stock Chart

From Mar 2024 to Mar 2025