Shenandoah Telecommunications Company (“Shentel” or the “Company”)

(Nasdaq: SHEN) announced today it has entered into a definitive

agreement to acquire 100% of the equity interests in Horizon

Acquisition Parent LLC (“Horizon” or “Horizon Telcom”) for $385

million (the “Transaction”). Consideration will consist of $305

million in cash and $80 million of Shentel common stock.

Horizon is a leading commercial fiber provider

in Ohio and adjacent states serving national wireless providers,

carriers, enterprises, and government, education and healthcare

customers. Horizon’s unique 7,200 route-mile fiber network is the

largest and most dense network across its footprint with over 9,000

on-net locations. Approximately 64% of Horizon’s revenues are

derived from their commercial customers. Based in Chillicothe,

Ohio, Horizon was founded in 1895 as the incumbent local exchange

carrier (“ILEC”) in Ross County, Ohio and rapidly expanded its

fiber network over the past 14 years. Most recently, Horizon has

pursued a strategy of investing in Fiber-to-the-Home (“FTTH”) in

tier 3 & 4 markets in Ohio and currently passes 14,000 homes

and businesses with fiber in its ILEC market and 18,000 homes in

new, greenfield markets adjacent to its commercial fiber

network.

“The acquisition of Horizon is a transformative

transaction that we believe will allow us to accelerate our Fiber

First strategy by doubling the size of our commercial fiber

business and creating a new beachhead for our Glo Fiber business.

We now expect to pass 150,000 additional homes with fiber in

greenfield markets, targeting 600,000 total passings by the end of

2026,” said Shentel’s President and CEO, Christopher E. French. “We

are excited to combine Horizon’s robust fiber network and

commercial fiber business with our 9,000 route-mile, multi-state

fiber network and accelerate our Glo Fiber expansion. Horizon and

Shentel share a similar history and a passion for outstanding local

customer service while providing state-of-the-art technologies. We

believe our teams’ core competencies will complement one another,

translating to a stronger combined business.”

Horizon CEO, Jim Capuano, added “We are proud of

the success Horizon has experienced in partnership with Novacap and

GCM Grosvenor over the past five years building a leading broadband

company in Ohio. The transaction with Shentel creates an exciting

opportunity for our customers and the communities we serve to

continue to receive best-in-quality broadband service and an

opportunity for our employees to continue to be integral

contributors to a leading super-regional provider.”

Shentel will host a conference call and webcast at 8:30 A.M. ET

on Wednesday, October 25, 2023. The webcast and related materials

will be available on Shentel’s Investor Relations website at

https://investor.shentel.com/.

For Analysts, please register to dial-in at this

link.

Financial Information

- Horizon generated $64.7 million in revenues, $12.0 million in

net loss and $19.0 million in Horizon Adjusted EBITDA in

2022.1,2

- Shentel anticipates realizing $10 million in estimated annual

run-rate synergies3 within 18 months of closing the

transaction.

- Shentel anticipates realizing $16 million in present value of

tax benefits from utilization of $68 million in Horizon Net

Operating Loss and $18 million in deferred interest deduction

carryforwards.

- Horizon has been awarded over $57 million in grants from the

Ohio Broadband Authority and NTIA (“Government Grant Projects”) to

construct fiber to 2,500 unserved homes, expand its middle-mile

fiber network across eight underserved counties in Ohio, and

increase its network backbone capacity up to 400 Gbps. These

projects are expected to be completed by 2028.

______________________1 The financial results for Horizon in

this press release have been derived from audited financial

statements prepared by Horizon, without adjustment to conform to

the accounting principles and methodologies used by Shentel. The

accounting policies and methodologies used by Horizon differ in

certain respects from those used by Shentel, but Shentel does not

believe these differences are material.2 A reconciliation of

Horizon Net Income, the most directly comparable financial measure

calculated and reported in accordance with GAAP, to Horizon

Adjusted EBITDA and Horizon Adjusted EBITDA net of synergies can be

found at the end of this press release under the heading “Non-GAAP

Financial Measure.”3 Includes $9.6 million in run-rate operating

expense synergies and $0.6 million in capex synergies.

Transaction Details

- The Transaction is subject to

certain regulatory approvals and other customary closing conditions

and is expected to close in the first half of 2024.

- The purchase price, less present

value of tax benefits, represents:

- 12.9x 2022 Horizon Adjusted EBITDA

multiple net of synergies2

- Approximately $51,000 per fiber

route mile

Financing

- Shentel intends to fund the

Transaction with a combination of existing cash resources,

revolving credit facility capacity and an amended and upsized

credit facility. The Company has received $275 million in financing

commitments from CoBank, Bank of America, Citizens Bank, N.A., and

Fifth Third Bank, N.A..

- GCM Grosvenor (“GCM”), a selling

unit holder of Horizon, will exchange its equity interest in

Horizon for 4.08 million shares of Shentel common stock with an

aggregate value of $80 million based on a reference price of

$19.604 resulting in GCM owning approximately 7% of Shentel’s fully

diluted common shares after the transaction is closed.

- Shentel has entered into a 7%5

Participating Exchangeable Perpetual Preferred Stock (“Preferred

Stock”) investment agreement with Energy Capital Partners (“ECP”),

an existing Shentel shareholder and long-time infrastructure

investor, to provide $81 million of growth capital to fund the FTTH

network expansion, the Government Grant Projects and general

corporate purposes. The dividend can be paid in cash or in-kind at

the option of the Company. The Preferred Stock can be exchanged for

Shentel common stock at an exchange price of $24.50, a 25% premium

to the reference price of $19.604, under certain conditions as

outlined in the investment agreement. This financing is expected to

close in conjunction with the Transaction.

- The Company plans to raise

additional growth capital for the FTTH network expansion,

Government Grant Projects and general corporate purposes, which may

include exploring strategic alternatives for its tower

portfolio.

GCM Managing Director, James DiMola said, “We

are excited about the prospects of combining the Shentel and

Horizon businesses and see significant operational, strategic and

financial merit in the combination. The opportunity to participate

as a shareholder in Shentel’s growth strategy is highly attractive

and was critical to our support of the transaction.”

ECP Partner, Matt DeNichilo said, “We appreciate

the opportunity to increase our investment in and expand our

relationship with Shentel. We are long-term infrastructure

investors and are a supporter of the Company’s FTTH expansion

strategy. We believe the combination with Horizon will create

significant value for shareholders. We look forward to working with

the Shentel management team in executing their Fiber First

strategy.”

Other Information

- Rothschild & Co acted as sole

financial advisor to Shentel and Hunton Andrews Kurth LLP is acting

as its legal counsel.

- Bank Street Group LLC served as

exclusive financial advisor to Horizon and Baker Botts LLP is

acting as its legal counsel.

- Houlihan Lokey acted as financial

advisor to GCM Grosvenor and Greenberg Traurig, LLP is acting as

its legal counsel.

Call Webcast

Date: Wednesday, October 25,

2023Time: 8:30 A.M. ETListen via

Internet: https://investor.shentel.com/

A replay of the call will be available for a limited time on the

Investor Relations page of the Company’s website.

______________________4 Reference price of $19.60 was based on

the 30 day average VWAP following time Shentel entered into

exclusivity with Horizon.5 Dividend rate is subject to increase if

ECP’s Independent Director is not seated on Shentel’s Board after

the next annual meeting and the PIK dividend is subject to increase

after the fifth and seventh anniversaries of the closing date.

About Shenandoah

Telecommunications

Shenandoah Telecommunications Company (Shentel)

provides broadband services through its high speed,

state-of-the-art cable and fiber optic networks to customers in the

Mid-Atlantic United States. The Company’s services include:

broadband internet, video, and voice; fiber optic Ethernet,

wavelength and leasing; and tower colocation leasing. The Company

owns an extensive regional network with over 9,000 route miles of

fiber and over 220 macro cellular towers. For more information,

please visit www.shentel.com.

About Horizon TelcomHorizon is

a facilities-based fiber-optic broadband service provider based in

Ohio and Indiana with expanding services across the Midwest.

Operating 7,200 route miles of fiber, Horizon provides high-quality

and flexible connectivity solutions to residential, small to large

enterprise and wholesale carrier customers. The company’s extensive

network offers high-speed Ethernet, Dedicated Internet Access,

Hosted Voice and UCaaS, dark fiber, wavelength, data center

connectivity services and residential triple play services.

Horizon’s long-standing commitment to remarkable customer care

underscores its dedication to connecting its customers to their

worlds with cutting-edge technology. For more information about

Horizon’s brand promise, visit horizonconnects.com.

About GCM GrosvenorGCM Grosvenor (NASDAQ: GCMG)

is a global alternative asset management solutions provider with

approximately $76 billion in assets under management across private

equity, infrastructure, real estate, credit, and absolute return

investment strategies. The firm has specialized in alternatives for

more than 50 years and is dedicated to delivering value for clients

by leveraging its cross-asset class and flexible investment

platform. GCM Grosvenor’s experienced team of approximately 530

professionals serves a global client base of institutional and

high-net-worth investors. The firm is headquartered in Chicago,

with offices in New York, Toronto, London, Frankfurt, Tokyo, Hong

Kong, Seoul and Sydney. For more information, visit:

www.gcmgrosvenor.com.

About ECPEnergy Capital Partners (ECP), founded

in 2005, is a leading equity and credit investor across energy

transition, electrification and decarbonization infrastructure

assets, including power generation, renewables and storage

solutions, environmental infrastructure and digital infrastructure.

The ECP team, comprised of 86 people with over 800 years of

collective industry experience, deep expertise and extensive

relationships, has consummated more than 100 equity (representing

more than $50 billion of enterprise value) and over 20 credit

transactions since inception. For more information, visit

www.ecpgp.com.

This release contains forward-looking statements

about Shentel regarding, among other things, its business strategy,

its prospects and its financial position. These statements can be

identified by the use of forward-looking terminology such as

“believes,” “estimates,” “expects,” “intends,” “may,” “will,”

“plans,” “should,” “could,” or “anticipates” or the negative or

other variation of these or similar words, or by discussions of

strategy or risks and uncertainties. The forward-looking statements

are based upon management’s beliefs, assumptions and current

expectations and may include comments as to Shentel’s beliefs and

expectations as to future events and trends affecting its business

that are necessarily subject to uncertainties, many of which are

outside Shentel’s control. Although management believes that the

expectations reflected in the forward-looking statements are

reasonable, forward-looking statements are not, and should not be

relied upon as, a guarantee of future performance or results, nor

will they necessarily prove to be accurate indications of the times

at which such performance or results will be achieved, and actual

results may differ materially from those contained in or implied by

the forward-looking statements as a result of various factors. A

discussion of other factors that may cause actual results to differ

from management’s projections, forecasts, estimates and

expectations is available in Shentel’s filings with the Securities

and Exchange Commission, including our Annual Report on Form 10-K

for the year ended December 31, 2022 and our Quarterly Reports

on Form 10-Q. Those factors may include, among others, the ability

to obtain the required regulatory approvals and satisfy the closing

conditions required for the Transaction, Shentel's ability to

obtain the financing for the Transaction, the closing of the

Transaction may not occur on time or at all, the expected savings

and synergies from the Transaction may not be realized or may take

longer or cost more than expected to realize, changes in overall

economic conditions including rising inflation, regulatory

requirements, changes in technologies, changes in competition,

demand for our products and services, availability of labor

resources and capital, natural disasters, pandemics and outbreaks

of contagious diseases and other adverse public health

developments, such as COVID-19, and other conditions. The

forward-looking statements included are made only as of the date of

the statement. Shentel undertakes no obligation to revise or update

such statements to reflect current events or circumstances after

the date hereof, or to reflect the occurrence of unanticipated

events, except as required by law.

| CONTACT: |

| |

Shenandoah

Telecommunications Company |

| |

Jim Volk |

| |

Senior Vice President and Chief Financial Officer |

| |

540-984-5168 |

| |

Jim.Volk@emp.shentel.com |

| |

|

| |

|

Non-GAAP Financial Measure

Horizon Adjusted EBITDA

Shentel defines Horizon Adjusted EBITDA as net

income (loss) calculated in accordance with GAAP, adjusted for the

impact of depreciation and amortization, interest and loss on

extinguishment of debt, other expense (income), net, income tax

benefit, transaction, financing and restructuring fees, settlement

of legal dispute, stock-based compensation and shareholder

management fees. A reconciliation of net income (loss), which is

the most directly comparable GAAP financial measure, to Horizon

Adjusted EBITDA is provided below.

The financial results for Horizon in this press

release have been derived from audited financial statements

prepared by Horizon, without adjustment to conform to the

accounting principles and methodologies used by Shentel. The

accounting policies and methodologies used by Horizon differ in

certain respects from those by Shentel, but Shentel does not

believe these differences are material.

Shentel and Horizon believe that the

presentation of Horizon Adjusted EBITDA provides useful

supplemental information that is essential to a proper

understanding of the operating results of Horizon's businesses.

This non-GAAP performance measure should not be viewed as a

substitute for operating results determined in accordance with

GAAP, nor is it necessarily comparable to non-GAAP performance

measures that may be similarly named and presented by other

companies, including Shentel's calculation of Adjusted EBITDA.

Reconciliation of Horizon’s

| Year Ended December

31, 2022 |

|

|

| (in

thousands) |

|

|

|

Net income (loss) |

|

$ |

($12,038 |

) |

|

Depreciation and amortization |

|

|

14,293 |

|

|

Interest and Loss on extinguishment of debt |

|

|

18,835 |

|

|

Other expense (income), net |

|

|

(538 |

) |

|

Income tax benefit |

|

|

(3,420 |

) |

|

Transaction, financing and restructuring fees |

|

|

430 |

|

|

Settlement of legal dispute |

|

|

396 |

|

|

Stock-based compensation |

|

|

544 |

|

|

Shareholder management fees |

|

|

511 |

|

| Horizon Adjusted EBITDA |

|

|

19,013 |

|

|

Expected synergies6 |

|

|

9,600 |

|

| Horizon Adjusted EBITDA net of

synergies |

|

$ |

28,613 |

|

______________________6 The Company expects to realize synergy

savings in overlapping back-office systems and resources, as well

as excess office space, over the 18 months following

closing. The expected savings and synergies are a

forward-looking statement and may not be realized or may take

longer or cost more than expected to realize.

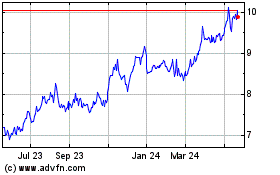

GCM Grosvenor (NASDAQ:GCMG)

Historical Stock Chart

From Dec 2024 to Jan 2025

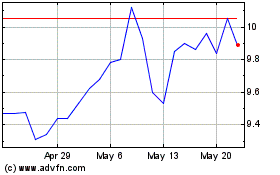

GCM Grosvenor (NASDAQ:GCMG)

Historical Stock Chart

From Jan 2024 to Jan 2025