CION Investments and GCM Grosvenor Announce SEC Effectiveness of the CION Grosvenor Infrastructure Fund

14 November 2024 - 1:15AM

Business Wire

CION Investments (CION), a leading alternative investment

solutions platform, and GCM Grosvenor, (NASDAQ: GCMG), a global

alternative asset management firm, are pleased to announce the CION

Grosvenor Infrastructure Fund (“CGIF” or “the Fund”) has been

declared effective by the SEC. CGIF has an innovative interval fund

structure that allows individual investors, through their financial

advisors, access to GCM Grosvenor’s institutional private

infrastructure platform.

The Fund expects to launch with approximately $300 million of

seed capital sourced from a major institutional investor. Before

commencing distribution, the Fund anticipates merging with a

seasoned portfolio of $220 million in committed net assets that is

broadly diversified and includes the traditional infrastructure

sectors of transportation, digital, energy and energy transition,

as well as new infrastructure sectors including supply chain and

logistics and infrastructure adjacencies. This seed portfolio is

expected to be accompanied by an additional cash commitment of

approximately $80 million.

CION and GCM Grosvenor believe infrastructure is a compelling

investment opportunity at the beginning of a multi-decade growth

cycle. Tremendous amounts of public and private investment capital

are necessary for infrastructure to successfully meet the upgrades

and buildouts required to keep pace with global climate,

demographic and technological change. This persistent, high demand

for investment capital creates an attractive long-term environment

for investment opportunities in infrastructure.

For investors, infrastructure can provide capital appreciation

and income and has distinct characteristics that can help them

construct portfolios with potential to meet long term goals.

These features can include transparent cash flows, high barriers

to entry, inflation protection potential, low correlations to other

private and public assets, and lower potential volatility.

Michael A. Reisner and Mark Gatto, co-CEOs of CION, said:

“Private assets have always been our focus, and we believe that

within private markets, infrastructure is in a particularly strong

position for growth. Infrastructure as an asset class is only a

couple decades old, and GCM Grosvenor was one of the first

institutional managers to see the potential in the opportunity. The

firm has built a strong track record, a differentiated and flexible

sourcing network, and has an approach to investment selection that

focuses on increasing alpha.”

Michael Sacks, Chairman and Chief Executive Officer of GCM

Grosvenor, said, “We believe that the infrastructure space presents

a compelling investment opportunity and that GCM Grosvenor’s

platform is uniquely positioned to deliver solutions for investors.

Our approach to infrastructure has consistently been about building

a well-diversified portfolio, across multiple factors including

geography, asset concentration, and sector exposure. We focus on

utilizing our powerful sourcing network to see, evaluate and

onboard infrastructure assets from multiple different fronts.”

ABOUT CION INVESTMENTS

CION Investments is a leading open-source provider of

alternative investments designed to redefine the way individual

investors can build their portfolios and meet their long-term

investment goals. CION Investments currently sponsors, among other

products, CION Investment Corporation (NYSE: CION), a leading

publicly listed business development company that currently manages

approximately $2 billion in assets, and also sponsors CION Ares

Diversified Credit Fund, a globally diversified interval fund that

currently manages approximately $6 billion in assets.

For more information, please visit www.cioninvestments.com.

ABOUT GCM GROSVENOR

GCM Grosvenor (Nasdaq: GCMG) is a global alternative asset

management solutions provider with approximately $80 billion in

assets under management across private equity, infrastructure, real

estate, credit, and absolute return investment strategies. The firm

has specialized in alternatives for more than 50 years and is

dedicated to delivering value for clients by leveraging its

cross-asset class and flexible investment platform. GCM Grosvenor’s

experienced team of approximately 550 professionals serves a global

client base of institutional and individual investors. The firm is

headquartered in Chicago, with offices in New York, Toronto,

London, Frankfurt, Tokyo, Hong Kong, Seoul and Sydney. For more

information, please visit: gcmgrosvenor.com.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241113023599/en/

For more information, please contact:

Susan Armstrong Head of Marketing E:

sarmstrong@cioninvestments.com

StreetCred PR E: cion@streetcredpr.com

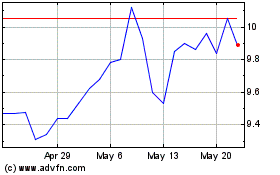

GCM Grosvenor (NASDAQ:GCMG)

Historical Stock Chart

From Nov 2024 to Dec 2024

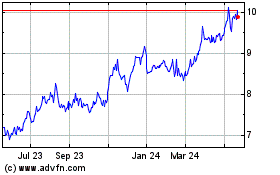

GCM Grosvenor (NASDAQ:GCMG)

Historical Stock Chart

From Dec 2023 to Dec 2024