Guardion Health Sciences, Inc. (Nasdaq: GHSI) (“Guardion” or the

“Company”), a clinical nutrition company that offers science-based,

clinically supported products designed for consumer ocular health,

today announced its financial results for the three months and six

months ended June 30, 2024, as described below. The Company also

provided an update to stockholders of significant recent

developments.

Recent Developments:

Sale of Viactiv® Brand and Business

On May 31, 2024, as previously disclosed

publicly, the Company completed the sale of all of the outstanding

equity interests of Activ Nutritional, LLC (“Activ”), which owns

the Viactiv® brand and business and was the wholly-owned subsidiary

of Viactiv Nutritionals, Inc., a wholly-owned subsidiary of the

Company, pursuant to an equity purchase agreement (the “Agreement”)

with Doctor’s Best Inc. The stockholders of the Company approved

the sale of Activ at a Special Meeting of Stockholders held on May

23, 2024.

Activ was sold for gross cash consideration of

$17,200,000. The Company received net cash proceeds of $16,250,000

at closing, with another $225,000 retained in a third-party escrow

account, to be released in accordance with the terms of the

Agreement.

The operations of Activ have been reported as

discontinued operations for all periods presented in the Company’s

condensed consolidated financial statements for the three months

and six months ended June 30, 2024 and 2023.

As a result of the sale of the Viactiv® brand

and business, the Company had minimal operations at June 30,

2024.

Stockholder Approval of Plan of Liquidation and

Dissolution

At the Special Meeting of Stockholders, which

was adjourned on May 23, 2024 and reconvened on May 31, 2024, the

stockholders approved the voluntary dissolution and liquidation of

the Company pursuant to a Plan of Liquidation and Dissolution,

which authorizes the Company to liquidate and dissolve in

accordance with its terms. However, such decision is subject to the

Company’s ability, in its sole discretion, to abandon or delay the

Plan of Liquidation and Dissolution in the event the Board of

Directors determines that another transaction would be in the best

interests of the Company’s stockholders. The Company is actively

reviewing alternative transaction proposals and expects to complete

this process during the quarter ending September 30, 2024.

These developments and strategies are the result

of a broad review of strategic alternatives by the Company’s Board

of Directors over the past year.

Liquidity and Business Plans

As of June 30, 2024, the Company had $14,822,826

of cash, and working capital (including cash) of $14,374,922. The

Board of Directors is continuing to evaluate whether or not to

declare, and the timing of, one or more cash distributions to the

Company’s stockholders in the near-term. The Company expects to

make this determination during the quarter ending September 30,

2024.

Financial highlights for the three

months ended June 30, 2024 include the following:

-

Total revenue for ocular products was $72,918 for the three months

ended June 30, 2024, as compared to $79,633 for the three months

ended June 30, 2023.

-

Gross profit (loss) was $36,346 for the three months ended June 30,

2024, as compared to $(6,941) for the three months ended June 30,

2023.

-

Gross margin for the three months ended June 30, 2024 was 49.8%, as

compared to (8.7)% for the three months ended June 30, 2023.

-

Total operating expenses for the three months ended June 30, 2024

were $1,417,672, as compared to $1,413,443 for the three months

ended June 30, 2023.

-

Loss from operations for the three months ended June 30, 2024 was

$(1,381,326), as compared to $(1,420,384) for the three months

ended June 30, 2023.

-

Loss from continuing operations was $(2,133,026) for the three

months ended June 30, 2024, as compared to $(1,580,150) for the

three months ended June 30, 2023.

-

Income from discontinued operations, including the gain on the sale

of discontinued operations of $12,742,385 in 2024, was $12,457,356

for the three months ended June 30, 2024, as compared to $407,739

for the three months ended June 30, 2023.

-

Net income for the three months ended June 30, 2024 was

$10,324,330, as compared to a net loss of $(1,172,411) for the

three months ended June 30, 2023.

Financial highlights for the six months

ended June 30, 2024 include the following:

-

Total revenue for ocular products was $154,037 for the six months

ended June 30, 2024, as compared to $173,874 for the six months

ended June 30, 2023.

-

Gross profit was $73,299 for the six months ended June 30, 2024, as

compared to $18,740 for the six months ended June 30, 2023

-

Total operating expenses for the six months ended June 30, 2024

were $2,855,944, as compared to $3,150,315 for the six months ended

June 30, 2023.

-

Loss from operations for the six months ended June 30, 2024 was

$(2,782,645), as compared to $(3,131,575) for the six months ended

June 30, 2023.

-

Loss from continuing operations was $(6,727,289) for the six months

ended June 30, 2024, as compared to $(1,294,242) for the six months

ended June 30, 2023.

-

Income from discontinued operations, including the gain on the sale

of discontinued operations of $12,742,385 in 2024, was $12,304,875

for the six months ended June 30, 2024, as compared to $654,922 for

the six months ended June 30, 2023.

-

Net income for the six months ended June 30, 2024 was $5,577,587,

as compared to a net loss of $(639,320) for the six months ended

June 30, 2023.

-

The Company had 1,284,156 shares of common stock issued and

outstanding at June 30, 2024.

Redemption of Warrants

The closing of the sale of Activ on May 31, 2024

represented a “Fundamental Transaction” pursuant to the terms of

the Company’s Series A Warrants. As a result, within 30 days after

the closing of the sale of Activ, each Series A Warrant holder had

the option to elect to have its Series A Warrants redeemed, in

whole or in part, for a cash payment based on a calculation of the

defined Black-Scholes value of each warrant as prescribed in the

Series A Warrant agreement. Accordingly, during June and July 2024,

the Company paid a total of $5,632,429 and $7,325, respectively, to

warrant holders who exercised their redemption rights, in the

settlement and redemption of 621,300 Series A warrants. At June 30,

2024, there were 68,800 Series A Warrants that were not redeemed

and remained outstanding.

In addition, 37,000 warrants were issued in

February 2022 to the placement agent that facilitated the February

2022 securities offering. The placement agent warrants had the same

“Fundamental Transaction” provisions as described above. The

Company paid the Black-Scholes value of the placement agent

warrants of $319,625 to the placement agent, which was recorded as

a cost related to the settlement of the warrants in the

accompanying condensed consolidated statement of operations for the

three months and six months ended June 30, 2024.

Financial Results

Additional information with respect to the

Company’s business, operations and financial condition as of June

30, 2024, and for the three months and six months ended June 30,

2024 and 2023, is contained in the Company’s Quarterly Report on

Form 10-Q for the quarterly period ended June 30, 2024, which has

been filed with the SEC and is available at www.sec.gov.

About Guardion Health Sciences,

Inc.

Guardion Health Sciences, Inc. (Nasdaq: GHSI) is

a clinical nutrition company that offers science-based, clinically

supported products designed for consumer ocular health. Information

and risk factors with respect to Guardion and its business may be

obtained in the Company’s filings with the SEC at www.sec.gov.

Forward-Looking Statements

The matters described herein may contain

“forward-looking statements” within the meaning of Section 27A of

the Securities Act of 1933, as amended, and Section 21E of the

Securities Exchange Act of 1934, as amended. These forward-looking

statements contain information about our expectations, beliefs,

plans or intentions regarding our product development and

commercialization efforts, research and development efforts,

business, financial condition, results of operations, strategies or

prospects, and other similar matters. Statements preceded by,

followed by or that otherwise include the words “believes,”

“expects,” “anticipates,” “intends,” “projects,” “estimates,”

“plans,” “hopes” and similar expressions or future or conditional

verbs such as “will,” “should,” “would,” “may” and “could” are

generally forward-looking in nature and not historical facts,

although not all forward-looking statements include the

foregoing.

These statements are based on management’s

current expectations and assumptions about future events, which are

inherently subject to uncertainties, risks and changes in

circumstances that are difficult to predict, and involve unknown

risks and uncertainties that may individually or materially impact

the matters discussed herein for a variety of reasons that are

outside the control of the Company, including, but not limited to,

the completion of the Company’s Plan of Liquidation and

Dissolution, the use of the proceeds received from the sale of the

Viactiv business, the Company’s decision to continue to fund or

wind-down its operations subsequent to the sale of the Viactiv

business, the sale or other disposition of the Company’s ocular

healthcare business, the exploration, timing and feasibility of

alternatives to the Company’s Plan of Liquidation and Dissolution,

supply chain disruptions, a potential recession and the condition

of the economy in general, the Company’s ability to successfully

market its remaining products and inventory, and the Company’s

ability to maintain compliance with Nasdaq’s continued listing

requirements.

Readers are cautioned not to place undue

reliance on these forward-looking statements, as actual results

could differ materially from those described in the forward-looking

statements contained herein. Readers are urged to read the risk

factors set forth in the Company’s filings with the SEC, which are

available at the SEC’s website (www.sec.gov). The Company disclaims

any intention or obligation to update or revise any forward-looking

statements, whether as a result of new information, future events

or otherwise.

For more information about Guardion Health Sciences,

Inc., Contact:

investors@guardionhealth.comPhone: 1-800 873-5141 Ext 208

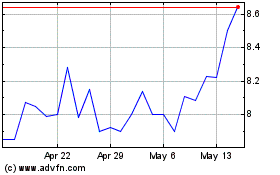

Guardion Health Sciences (NASDAQ:GHSI)

Historical Stock Chart

From Dec 2024 to Jan 2025

Guardion Health Sciences (NASDAQ:GHSI)

Historical Stock Chart

From Jan 2024 to Jan 2025