Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

25 October 2024 - 7:12AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form

6-K

REPORT

OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of October

2024

Commission File Number: 001-34985

Globus Maritime Limited

(Translation of registrant’s

name into English)

c/o Globus

Shipmanagement Corp., 128 Vouliagmenis Avenue, 3rd Floor, Glyfada, Attica, Greece, 166 74

(Address of principal executive

office)

Indicate by check mark whether the registrant files

or will file annual reports under cover of Form 20-F or Form 40-F:

Form 20-F x Form

40-F ¨

INFORMATION CONTAINED IN THIS

FORM 6-K REPORT

Attached to this report on Form

6-K as Exhibit 99.1 is a copy of the press release published by Globus Maritime Limited on October 24, 2024, titled “Globus

Maritime Limited Announces Agreements to Purchase Two Vessels.”

THIS REPORT ON FORM 6-K IS HEREBY INCORPORATED

BY REFERENCE INTO THE COMPANY’S REGISTRATION STATEMENTS: (A) ON FORM F-3 (FILE NO. 333-240042), FILED WITH THE SECURITIES AND

EXCHANGE COMMISSION ON JULY 23, 2020 AND DECLARED EFFECTIVE AUGUST 6, 2020 (B) ON FORM F-3 (FILE NO. 333-239250), FILED WITH THE

SECURITIES AND EXCHANGE COMMISSION ON JULY 31, 2020 AND DECLARED EFFECTIVE AUGUST 6, 2020, AND (C) ON FORM F-3 (FILE NO. 333-273249),

FILED WITH THE SECURITIES AND EXCHANGE COMMISSION ON JULY 14, 2023 AND DECLARED EFFECTIVE ON JULY 26, 2023.

SIGNATURES

Pursuant to the requirements of the

Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly

authorized.

| |

GLOBUS

MARITIME LIMITED |

| |

|

|

| Date: October 24, 2024 |

By: |

/s/ Athanasios Feidakis |

| |

Name: |

Athanasios Feidakis |

| |

Title: |

President, Chief Executive Officer and Chief Financial Officer |

Exhibit 99.1

Globus

Maritime Limited Announces Agreements to Purchase Two Vessels

October

24, 2024 - Glyfada, Greece - Globus Maritime Limited (the “Company” or “Globus”) (NASDAQ: GLBS)

announced today that it has signed, through two separate wholly owned subsidiaries, memoranda of agreement to acquire two Kamsarmax scrubber

outfitted dry bulk vessels (the “Vessels”). One of the Vessels is a 2016-built dry bulk vessel with a carrying capacity

of approximately 81,119 dwt and has a purchase price of $27.5 million, and the other Vessel is a 2014-built dry bulk vessel with a carrying

capacity of approximately 81,817 dwt and has a purchase price of $26.5 million, in each case subject to standard adjustments. An aggregate

of $18.0 million of the purchase price for the 2016-built Vessel will be paid upon its delivery (including the deposit), and the remaining

balance is to be paid in one lump sum without interest no later than one year after the date of the relevant memorandum of agreement.

An aggregate of $17.0 million of the purchase price for the 2014-built Vessel will be paid upon its delivery (including the deposit),

and the remaining balance is to be paid in one lump sum without interest no later than one year after the date of the relevant memorandum

of agreement.

Each

Vessel is owned and agreed to be sold by an entity controlled by the Chairman of the Board of Directors and to which the Chief Executive

Officer is also related, and accordingly the purchase of each Vessel was approved by a committee of the Board of Directors of the Company

comprised solely of independent directors, as well as unanimously by the Company’s Board of Directors.

Each

Vessel is expected to be delivered to the Company during the fourth quarter of 2024 and is subject to standard closing conditions and

requirements. It is expected that the portion of the purchase price to be paid at the delivery will be funded entirely with cash on hand.

The purchase price of each Vessel was based on independent third-party broker valuations.

Following

the successful delivery of both vessels the Company’s fleet will comprise of ten dry bulk carriers with a total carrying capacity

of approximately 734,249 dwt.

About

Globus Maritime Limited

Globus

is an integrated dry bulk shipping company that provides marine transportation services worldwide and presently owns (or charters through

finance leases), operates and manages a fleet of dry bulk vessels that transport iron ore, coal, grain, steel products, cement, alumina

and other dry bulk cargoes internationally. Globus’ subsidiaries own or charter in and operate eight vessels (not including the

Vessels), with a total carrying capacity of 571,313 dwt and a weighted average age of 7.2 years as of October 24, 2024.

Safe

Harbor Statement

This

communication contains “forward-looking statements” as defined under U.S. federal securities laws. Forward-looking

statements provide the Company’s current expectations or forecasts of future events. Forward-looking statements include

statements about the Company’s expectations, beliefs, plans, objectives, intentions, assumptions and other statements that are not

historical facts or that are not present facts or conditions. Words or phrases such as “anticipate,”

“believe,” “continue,” “estimate,” “expect,” “intend,”

“may,” “ongoing,” “plan,” “potential,” “predict,” “project,”

“will” or similar words or phrases, or the negatives of those words or phrases, may identify forward-looking statements,

but the absence of these words does not necessarily mean that a statement is not forward-looking. Forward-looking statements are

subject to known and unknown risks and uncertainties and are based on potentially inaccurate assumptions that could cause actual

results to differ materially from those expected or implied by the forward-looking statements. The Company’s actual results

could differ materially from those anticipated in forward-looking statements for many reasons specifically as described in the

Company’s filings with the Securities and Exchange Commission. Accordingly, you should not unduly rely on these

forward-looking statements, which speak only as of the date of this communication. Globus undertakes no obligation to publicly

revise any forward-looking statement to reflect circumstances or events after the date of this communication or to reflect the

occurrence of unanticipated events. You should, however, review the factors and risks Globus describes in the reports it files from

time to time with the Securities and Exchange Commission.

For

further information please contact:

| Globus

Maritime Limited +30 210 960 8300 |

Capital

Link – New York +1 212 661 7566 |

| Athanasios

Feidakis, CEO |

Nicolas

Bornozis globus@capitallink.com |

| a.g.feidakis@globusmaritime.gr |

|

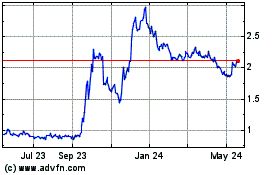

Globus Maritime (NASDAQ:GLBS)

Historical Stock Chart

From Jan 2025 to Feb 2025

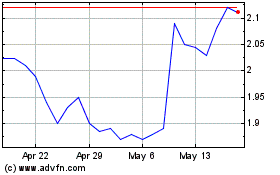

Globus Maritime (NASDAQ:GLBS)

Historical Stock Chart

From Feb 2024 to Feb 2025