Following closing, the combined company will

advance Crescent’s portfolio of precision-engineered biologics to

improve outcomes for patients with solid tumors

Crescent’s lead program CR-001, a tetravalent

PD-1 x VEGF bispecific antibody incorporating the cooperative

binding mechanism underpinning recent immuno-oncology breakthrough,

expected to have preliminary proof of concept data in 2H26

Crescent pipeline also includes two novel

antibody-drug conjugates with topoisomerase inhibitor payloads,

CR-002 and CR-003

Concurrent financing of approximately $200

million anticipated to fund operations through 2027

Companies to hold a conference call on Tuesday

October 29, at 8:00am EDT

GlycoMimetics, Inc. (NASDAQ: GLYC) announced today it has

entered into an acquisition agreement with Crescent Biopharma, Inc.

(“Crescent”), a privately held biotechnology company advancing a

pipeline of oncology therapeutics designed to treat solid tumors.

Upon completion of the transaction, the Company plans to operate

under the name Crescent Biopharma, Inc.

In support of the acquisition, a syndicate of investors led by

Fairmount, Venrock Healthcare Capital Partners, BVF Partners, and a

large investment management firm, with participation from Paradigm

BioCapital, RTW Investments, Blackstone Multi-Asset Investing,

Frazier Life Sciences, Commodore Capital, Perceptive Advisers, Deep

Track Capital, Boxer Capital Management, Soleus, Logos Capital,

Driehaus Capital Management, Braidwell LP, and Wellington

Management, has committed $200 million to purchase GlycoMimetics

common stock and GlycoMimetics pre-funded warrants to purchase its

common stock. The transaction is expected to close in the second

quarter of 2025. The financing is expected to close immediately

following the completion of the transaction. The Company’s cash

balance at closing is anticipated to fund operations through 2027,

including advancement of the Company’s lead program CR-001, a

tetravalent PD-1 x VEGF bispecific antibody, through preliminary

proof of concept clinical data in solid tumor patients expected in

the second half of 2026.

“Crescent was founded to harness recent breakthroughs in

immuno-oncology and antibody-drug conjugates that pave the way for

a next generation of therapies for patients with solid tumors,”

said Jonathan Violin, interim CEO at Crescent and Venture Partner

at Fairmount. “Our lead program CR-001 was precision engineered to

impart a cooperative binding pharmacology for VEGF x PD-1

bispecific blockade; this mechanism recently demonstrated superior

efficacy to the anti-PD1 antibody pembrolizumab in a third party

head-to-head Phase 3 clinical trial. The specific level of

cooperativity engineered into CR-001 reflects a delicate

mechanistic balance, which is essential to our confidence in this

program. This transaction and financing enable a potentially rapid

development path for CR-001, and for the antibody drug conjugate

programs CR-002 and CR-003.”

Crescent is the fifth company to launch with assets discovered

and developed by Paragon Therapeutics. CR-001, a tetravalent PD-1 x

VEGF bispecific antibody, matches the format and pharmacology of

ivonescimab, which delivered superior efficacy compared to the

current market leader pembrolizumab in a large third party Phase 3

trial. In addition to CR-001, Crescent is developing CR-002 and

CR-003, antibody-drug conjugates (ADCs) against undisclosed targets

using topoisomerase inhibitor payloads; ADCs with topoisomerase

inhibitor payloads have shown improved efficacy and safety compared

to ADCs with alternative payloads.

The Company anticipates that the IND for CR-001 will be filed in

4Q25 or 1Q26, and interim Phase 1 data from patients is expected in

2H26. CR-002, Crescent’s first ADC program, is designed to be

best-in-class and is expected to initiate Phase 1 in 2026; the

Company plans to disclose the target for CR-002 as the program

approaches the clinic.

The Company intends to determine potential paths forward for its

late stage clinical candidate, Uproleselan, including by supporting

continued data analyses of Uproleselan from NCI, its corporate

partner for China, Apollomics, and investigator initiated

studies.

“We are confident that our transaction with Crescent represents

a significant opportunity for GlycoMimetics and its stockholders,”

said Harout Semerjian, CEO of GlycoMimetics. “This transaction is

the result of a comprehensive strategic review, and with additional

funding for Crescent’s portfolio of novel biologics, we believe the

company is well-positioned to carry forward the mission of seeking

to improve the lives of patients.”

About the Proposed Transactions

Under the terms of the acquisition agreement, the

pre-acquisition GlycoMimetics stockholders are expected to own

approximately 3.1% of the combined Company and the pre-acquisition

Crescent stockholders (inclusive of those investors participating

in the pre-closing financing) are expected to own approximately

96.9% of the company. The percentage of the company that

GlycoMimetics’s stockholders will own as of the closing of the

acquisition is subject to adjustment based on the amount of

GlycoMimetics’s net cash at the closing date.

The transaction has received approval by the Board of Directors

of both companies and is expected to close in the second quarter of

2025, subject to certain closing conditions, including, among other

things, approval by the stockholders of each company and the

satisfaction of customary closing conditions.

The company will be named Crescent Biopharma, Inc. and be led by

Jonathan Violin, Ph.D., Crescent’s interim Chief Executive Officer,

who will be joined on Crescent’s Board of Directors by Peter

Harwin, Managing Member of Fairmount. Wedbush PacGrow is serving as

strategic advisor and Gibson, Dunn & Crutcher LLP is serving as

legal counsel to Crescent. Jefferies, TD Cowen, Stifel, and LifeSci

Capital are serving as the placement agents to Crescent. Covington

is serving as legal counsel to the placement agents. Lucid Capital

Markets is serving as financial advisor and Sidley Austin is

serving as legal counsel to GlycoMimetics.

Conference Call Details

The companies plan to hold a joint conference call on October

29, 2024 at 8:00 AM EDT to discuss the merger details.

To access the call by phone, please go to this registration link

and you will be provided with dial in details. Participants are

encouraged to connect 15 minutes in advance of the scheduled start

time.

A live webcast of the call will be available on the “Investors"

tab on the GlycoMimetics website. A webcast replay will be

available for 30 days following the call.

About GlycoMimetics

GlycoMimetics is a late clinical-stage biotechnology company

discovering and developing glycobiology-based therapies for

cancers, including AML, and for inflammatory diseases. The

company’s scientific approach is based on an understanding of the

role that carbohydrates play in cell recognition. Its specialized

chemistry platform can be used to discover small molecule drugs,

known as glycomimetics, that alter carbohydrate-mediated

recognition in diverse disease states, including cancers and

inflammation. The company’s goal is to develop transformative

therapies for diseases with high unmet medical need. GlycoMimetics

is headquartered in Rockville, MD in the BioHealth Capital Region.

Learn more at www.glycomimetics.com.

About Crescent Biopharma

Crescent Biopharma is a biotechnology company dedicated to

advancing novel precision engineered molecules targeting validated

biology to advance care for patients with solid tumors. The

company’s pipeline of three programs harnesses proven biology to

accelerate the path to market for potentially best in class

therapeutics. For more information, visit

www.crescentbiopharma.com.

Forward Looking Statements

Certain statements in this press release, other than purely

historical information, may constitute “forward-looking statements”

within the meaning of the federal securities laws, including for

purposes of the safe harbor provisions under the Private Securities

Litigation Reform Act of 1995, concerning GlycoMimetics, Crescent,

the proposed pre-closing financing and the proposed acquisition by

GlycoMimetics of Crescent (collectively, the “Proposed

Transactions”) and other matters. These forward-looking statements

include, but are not limited to, express or implied statements

relating to GlycoMimetics’s and Crescent’s management teams’

expectations, hopes, beliefs, intentions or strategies regarding

the future including, without limitation, statements regarding: the

Proposed Transactions and the expected effects, perceived benefits

or opportunities, including investment amounts from investors and

expected proceeds, and related timing with respect thereto,

expectations regarding or plans for discovery, preclinical studies,

clinical trials and research and development programs, in

particular with respect to CR-001, and any developments or results

in connection therewith, including the target product profile of

CR-001; the anticipated timing of the commencement of and results

from those studies and trials; expectations regarding the use of

proceeds, the sufficiency of post-transaction resources to support

the advancement of Crescent’s pipeline through certain milestones

and the time period over which Crescent’s post-transaction capital

resources will be sufficient to fund its anticipated operations;

the cash balance of the combined entity at closing; expectations

regarding the treatment of solid tumors; and expectations related

to GlycoMimetics’s late stage clinical candidate, Uproleselan. In

addition, any statements that refer to projections, forecasts or

other characterizations of future events or circumstances,

including any underlying assumptions, are forward-looking

statements. The words “opportunity,” “potential,” “milestones,”

“pipeline,” “can,” “goal,” “strategy,” “target,” “anticipate,”

“achieve,” “believe,” “contemplate,” “continue,” “could,”

“estimate,” “expect,” “intends,” “may,” “plan,” “possible,”

“project,” “should,” “will,” “would” and similar expressions

(including the negatives of these terms or variations of them) may

identify forward-looking statements, but the absence of these words

does not mean that a statement is not forward-looking. These

forward-looking statements are based on current expectations and

beliefs concerning future developments and their potential effects.

There can be no assurance that future developments affecting

GlycoMimetics, Crescent or the Proposed Transactions will be those

that have been anticipated. These forward-looking statements

involve a number of risks, uncertainties (some of which are beyond

the control of GlycoMimetics and Crescent) or other assumptions

that may cause actual results or performance to be materially

different from those expressed or implied by these forward-looking

statements. These risks and uncertainties include, but are not

limited to, the risk that the conditions to the closing or

consummation of the Proposed Transactions are not satisfied,

including GlycoMimetics’s failure to obtain stockholder approval

for the proposed merger; the risk that the proposed pre-closing

financing is not completed in a timely manner or at all;

uncertainties as to the timing of the consummation of the Proposed

Transactions and the ability of each of GlycoMimetics and Crescent

to consummate the transactions contemplated by the Proposed

Transactions; risks related to GlycoMimetics’s continued listing on

Nasdaq until closing of the Proposed Transactions and the combined

company’s ability to remain listed following the Proposed

Transactions; risks related to GlycoMimetics’s and Crescent’s

ability to correctly estimate their respective operating expenses

and expenses associated with the Proposed Transactions, as

applicable, as well as uncertainties regarding the impact any delay

in the closing of any of the Proposed Transactions would have on

the anticipated cash resources of the resulting combined company

upon closing and other events and unanticipated spending and costs

that could reduce the combined company’s cash resources; the

failure or delay in obtaining required approvals from any

governmental or quasi-governmental entity necessary to consummate

the Proposed Transactions; the occurrence of any event, change or

other circumstance or condition that could give rise to the

termination of the business combination between GlycoMimetics and

Crescent; the effect of the announcement or pendency of the merger

on GlycoMimetics’s or Crescent’s business relationships, operating

results and business generally; costs related to the merger; as a

result of adjustments to the exchange ratio, Crescent stockholders

and GlycoMimetics stockholders could own more or less of the

combined company than is currently anticipated; the outcome of any

legal proceedings that may be instituted against GlycoMimetics,

Crescent or any of their respective directors or officers related

to the merger agreement or the transactions contemplated thereby;

the ability of GlycoMimetics and Crescent to protect their

respective intellectual property rights; competitive responses to

the Proposed Transactions; unexpected costs, charges or expenses

resulting from the Proposed Transactions; potential adverse

reactions or changes to business relationships resulting from the

announcement or completion of the Proposed Transactions; failure to

realize certain anticipated benefits of the Proposed Transactions,

including with respect to future financial and operating results;

the risk that GlycoMimetics stockholders receive more or less of

the cash dividend than is currently anticipated; legislative,

regulatory, political and economic developments; and those

uncertainties and factors described under the heading “Risk

Factors” and “Business” in GlycoMimetics’s most recent Annual

Report on Form 10-K filed with the SEC on March 27, 2024, as well

as discussions of potential risks, uncertainties, and other

important factors included in other filings by GlycoMimetics from

time to time, any risk factors related to GlycoMimetics or Crescent

made available to you in connection with the Proposed Transactions,

as well as risk factors associated with companies, such as

Crescent, that operate in the biopharma industry. Should one or

more of these risks or uncertainties materialize, or should any of

GlycoMimetics’s or Crescent’s assumptions prove incorrect, actual

results may vary in material respects from those projected in these

forward-looking statements. Nothing in this press release should be

regarded as a representation by any person that the forward-looking

statements set forth herein will be achieved or that any of the

contemplated results of such forward-looking statements will be

achieved. You should not place undue reliance on forward-looking

statements in this press release, which speak only as of the date

they are made and are qualified in their entirety by reference to

the cautionary statements herein. Neither GlycoMimetics nor

Crescent undertakes or accepts any duty to release publicly any

updates or revisions to any forward-looking statements. This press

release does not purport to summarize all of the conditions, risks

and other attributes of an investment in GlycoMimetics or

Crescent.

No Offer or Solicitation

This press release and the information contained herein is not

intended to and does not constitute (i) a solicitation of a proxy,

consent or approval with respect to any securities or in respect of

the Proposed Transactions or (ii) an offer to sell or the

solicitation of an offer to subscribe for or buy or an invitation

to purchase or subscribe for any securities pursuant to the

Proposed Transactions or otherwise, nor shall there be any sale,

issuance or transfer of securities in any jurisdiction in

contravention of applicable law. No offer of securities shall be

made except in accordance with the requirements of the Securities

Act of 1933, as amended, or an exemption therefrom. Subject to

certain exceptions to be approved by the relevant regulators or

certain facts to be ascertained, no public offer will be made

directly or indirectly, in or into any jurisdiction where to do so

would constitute a violation of the laws of such jurisdiction, or

by use of the mails or by any means or instrumentality (including

without limitation, facsimile transmission, telephone and the

internet) of interstate or foreign commerce, or any facility of a

national securities exchange, of any such jurisdiction.

NEITHER THE SEC NOR ANY STATE SECURITIES COMMISSION HAS APPROVED

OR DISAPPROVED OF THE SECURITIES OR DETERMINED IF THIS PRESS

RELEASE IS TRUTHFUL OR COMPLETE.

Important Additional Information about the Proposed

Transaction Will be Filed with the SEC

This press release is not a substitute for the proxy statement

or for any other document that GlycoMimetics may file with the SEC

in connection with the Proposed Transactions. In connection with

the Proposed Transactions between GlycoMimetics and Crescent,

GlycoMimetics intends to file relevant materials with the SEC,

including a proxy statement of GlycoMimetics. GLYCOMIMETICS URGES

INVESTORS AND STOCKHOLDERS TO READ THE PROXY STATEMENT AND ANY

OTHER RELEVANT DOCUMENTS THAT MAY BE FILED WITH THE SEC, AS WELL AS

ANY AMENDMENTS OR SUPPLEMENTS TO THESE DOCUMENTS, CAREFULLY AND IN

THEIR ENTIRETY IF AND WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL

CONTAIN IMPORTANT INFORMATION ABOUT GLYCOMIMETICS, CRESCENT, THE

PROPOSED TRANSACTIONS AND RELATED MATTERS. Investors and

stockholders will be able to obtain free copies of the proxy

statement and other documents filed by GlycoMimetics with the SEC

(when they become available) through the website maintained by the

SEC at www.sec.gov. Stockholders are urged to read the proxy

statement and the other relevant materials when they become

available before making any voting or investment decision with

respect to the Proposed Transactions. In addition, investors and

stockholders should note that GlycoMimetics communicates with

investors and the public using its website

(https://https://ir.glycomimetics.com/investor-relations).

Participants in the Solicitation

GlycoMimetics, Crescent and their respective directors and

executive officers may be deemed to be participants in the

solicitation of proxies from stockholders in connection with the

Proposed Transactions. Information about GlycoMimetics’s directors

and executive officers, including a description of their interests

in GlycoMimetics, is included in GlycoMimetics’s most recent Annual

Report on Form 10-K, including any information incorporated therein

by reference, as filed with the SEC. Additional information

regarding these persons and their interests in the transaction will

be included in the proxy statement relating to the Proposed

Transactions when it is filed with the SEC. These documents can be

obtained free of charge from the sources indicated above.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241029550680/en/

Investor Contact: Argot Partners Leo Vartorella

212-600-1902 Glycomimetics@argotpartners.com

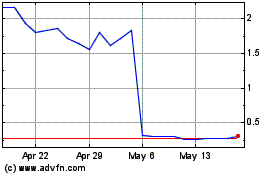

GlycoMimetics (NASDAQ:GLYC)

Historical Stock Chart

From Dec 2024 to Jan 2025

GlycoMimetics (NASDAQ:GLYC)

Historical Stock Chart

From Jan 2024 to Jan 2025