false

0001253689

0001253689

2024-11-07

2024-11-07

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

November 7, 2024

GlycoMimetics, Inc.

(Exact name of Registrant as Specified in Its Charter)

| Delaware |

|

001-36177 |

|

06-1686563 |

(State or Other Jurisdiction of

Incorporation) |

|

(Commission File Number) |

|

(IRS Employer

Identification No.) |

9708 Medical Center Drive

Rockville, MD 20850

(Address of Principal Executive Offices)

(240) 243-1201

(Registrant’s telephone number, including

area code)

N/A

(Former Name or Former Address, if Changed

Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ | Written communications pursuant to Rule 425 under the Securities

Act (17 CFR 230.425) |

| x | Soliciting material pursuant to Rule 14a-12 under the Exchange

Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under

the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under

the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of

the Act:

| Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

| Common Stock, $0.001 par value |

GLYC |

The

Nasdaq Global Market |

Indícate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2

of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 7.01 Regulation

FD Disclosure.

On

November 7, 2024, GlycoMimetics, Inc. (“GlycoMimetics”) and Crescent

Biopharma, Inc. (“Crescent”) updated the investor presentation used by them in connection with the their proposed merger,

which investor presentation is furnished as Exhibit 99.1 hereto and incorporated herein.

No Offer or Solicitation

This Current Report

on Form 8-K and the exhibits filed or furnished herewith are not intended to and do not constitute (i) a solicitation of a proxy, consent

or approval with respect to any securities or in respect of the proposed transaction or (ii) an offer to sell or the solicitation of an

offer to subscribe for or buy or an invitation to purchase or subscribe for any securities pursuant to the proposed transaction or otherwise,

nor shall there be any sale, issuance or transfer of securities in any jurisdiction in contravention of applicable law. No offer of securities

shall be made except by means of a prospectus meeting the requirements of the Securities Act or an exemption therefrom. Subject to certain

exceptions to be approved by the relevant regulators or certain facts to be ascertained, the public offer will not be made directly or

indirectly, in or into any jurisdiction where to do so would constitute a violation of the laws of such jurisdiction, or by use of the

mails or by any means or instrumentality (including without limitation, facsimile transmission, telephone and the internet) of interstate

or foreign commerce, or any facility of a national securities exchange, of any such jurisdiction.

NEITHER

THE SEC NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THE SECURITIES OR DETERMINED IF THIS CURRENT REPORT ON FORM

8-K AND THE EXHIBITS FILED OR FURNISHED HEREWITH ARE TRUTHFUL OR COMPLETE.

Important

Additional Information About the Proposed Transaction Will be Filed with the SEC

This

Current Report on Form 8-K and the exhibits filed or furnished herewith are not substitutes for the Proxy Statement or for any other document

that GlycoMimetics may file with the SEC in connection with the proposed transaction. In connection with the proposed transaction between

GlycoMimetics and Crescent, GlycoMimetics intends to file relevant materials with the SEC, including a proxy statement of GlycoMimetics.

GlycoMimetics URGES INVESTORS AND STOCKHOLDERS TO READ THE PROXY STATEMENT AND ANY OTHER

RELEVANT DOCUMENTS THAT MAY BE FILED WITH THE SEC, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THESE DOCUMENTS, CAREFULLY AND IN THEIR

ENTIRETY IF AND WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT

GlycoMimetics, CRESCENT, THE PROPOSED TRANSACTION AND RELATED MATTERS. Investors and stockholders will be able to obtain free copies

of the Proxy Statement and other documents filed by GlycoMimetics with the SEC (when they become available) through the website maintained

by the SEC at www.sec.gov. In addition, investors and stockholders should note that GlycoMimetics communicates with investors and

the public using its website (www.glycomimetics.com) and the investor relations website (www.glycomimetics.com/investor-relations)

where anyone will be able to obtain free copies of the Proxy Statement and other documents filed by GlycoMimetics with the SEC and stockholders

are urged to read the Proxy Statement and the other relevant materials when they become available before making any voting or investment

decision with respect to the proposed transaction.

Participants in

the Solicitation

GlycoMimetics,

Crescent and their respective directors and executive officers may be deemed to be participants in the solicitation of proxies from stockholders

in connection with the proposed transaction. Information about GlycoMimetics’ directors and executive officers including a description

of their interests in GlycoMimetics is included in GlycoMimetics’ most recent definitive proxy statement, as filed with the SEC

on April 1, 2024. Additional information regarding these persons and their interests in the proposed transaction will be included in the

Proxy Statement relating to the proposed transaction when it is filed with the SEC. These documents can be obtained free of charge from

the sources indicated above.

Item 9.01 Financial Statements and Exhibits.

(d)

Exhibits.

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| |

|

GLYCOMIMETICS, INC. |

| |

|

(Registrant) |

| |

|

|

| |

By: |

/s/ Brian M. Hahn |

| Date: November 7, 2024 |

| Name: Brian M. Hahn |

| |

|

Title: Senior Vice President and Chief Financial Officer |

Exhibit 99.1

November 2024 Crescent Biopharma Overview

2 Disclaimer This presentation is for informational purposes only and only a summary of certain information related to the Company . It does not purport to be complete and does not contain all information that an investor may need to consider in making an investment decision . The information contained herein does not constitute investment, legal, accounting, regulatory, taxation or other advice, and the information does not take into account your investment objectives or legal, accounting, regulatory, taxation or financial situation or particular needs . Investors must conduct their own investigation of the investment opportunity and evaluate the risks of acquiring the Securities based solely upon such investor’s independent examination and judgment as to the prospects of the Company as determined from information in the possession of such investor or obtained by such investor from the Company, including the merits and risks involved . Statements in this presentation are made as of the date hereof unless stated otherwise herein, and neither the delivery of this presentation at any time, nor any sale of Securities, shall under any circumstances create an implication that the information contained herein is correct as of any time subsequent to such date . The Company is under no obligation to update or keep current the information contained in this document . No representation or warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, completeness or correctness of the information or opinions contained herein, and any reliance you place on them will be at your sole risk . The Company, its affiliates and advisors do not accept any liability whatsoever for any loss howsoever arising, directly or indirectly, from the use of this document or its contents, or otherwise arising in connection with the Offering . Forward - Looking Statements Certain statements contained in this presentation that are not descriptions of historical facts are “forward - looking statements . ” When we use words such as “potentially,” “could,” “will,” “projected,” “possible,” “expect,” “illustrative,” “estimated” or similar expressions that do not relate solely to historical matters, we are making forward - looking statements . Forward - looking statements are not guarantees of future performance and involve risks and uncertainties that may cause our actual results to differ materially from our expectations discussed in the forward - looking statements . This may be a result of various factors, including, but not limited to : our management team’s expectations, hopes, beliefs, intentions or strategies regarding the future including, without limitation, statements regarding : the Offering and the transactions contemplated by the Merger Agreement, and the expected effects, perceived benefits or opportunities and related timing with respect thereto, expectations regarding or plans for discovery, preclinical studies, clinical trials and research and development programs and therapies ; expectations regarding the use of proceeds and the time period over which our capital resources will be sufficient to fund our anticipated operations ; and statements regarding the market and potential opportunities for solid tumor treatments and therapies . All forward - looking statements, expressed or implied, included in this presentation are expressly qualified in their entirety by this cautionary statement . You are cautioned not to place undue reliance on any forward - looking statements . Except as otherwise required by applicable law, we disclaim any duty to update any forward - looking statements, all of which are expressly qualified by this cautionary statement, to reflect events or circumstances after the date of this presentation . Industry and Market Data Market and industry data and forecasts used in this presentation have been obtained from independent industry sources as well as from research reports prepared for other purposes . Although we believe these third - party sources to be reliable, we have not independently verified the data obtained from these sources and we cannot assure you of the accuracy or completeness of the data . Forecasts and other forward - looking information obtained from these sources are subject to the same qualifications and uncertainties as the other forward - looking statements in this presentation . Statements as to our market and competitive position data are based on market data currently available to us, as well as management’s internal analyses and assumptions regarding the Company, which involve certain assumptions and estimates . These internal analyses have not been verified by any independent sources and there can be no assurance that the assumptions or estimates are accurate . While we are not aware of any misstatements regarding our industry data presented herein, our estimates involve risks and uncertainties and are subject to change based on various factors . As a result, we cannot guarantee the accuracy or completeness of such information contained in this presentation .

3 Crescent Biopharma aims to advance the next wave of innovation in cancer therapy Potential Indications Stage MoA Program Clinical IND - enabling Discovery NSCLC, other solid tumors YE25 / 1Q26 PD - 1 x VEGF (same cooperative MoA as ivonescimab) CR - 001 1 Solid tumors Mid - 26 Undisclosed #1 (ADC, TopoI payload) CR - 002 Solid tumors Undisclosed #2 (ADC, TopoI payload) CR - 003 Crescent’s pipeline consists of potentially best - in - class therapies for the treatment of solid tumors . • Crescent is the fifth company launched with assets discovered and in - development in - house by Paragon Therapeutics, a leading biotech incubator founded by Fairmount Funds in 2021. • Prior companies founded with Paragon assets have collectively raised >$2B and generated significant value . • ~$200 million financing in October 2024 anticipated to fund operations through 2027. Notes: 1 Anticipated expiration for filed provisional patent is 2045+

4 Crescent is advancing three highly impactful oncology programs with best - in - class potential CR - 001 PD - 1 x VEGF cooperative tetravalent bsAb; same MoA as ivonescimab CR - 002 & CR - 003 ADCs with topoisomerase inhibitor payloads; potentially best - in - class • Two unique, undisclosed targets with significant potential across solid tumors as single agents. • Each has potential to synergize with CR - 001 in combination studies, further driving clinical efficacy. • Both utilize the best - in - modality cytotoxic payload : topoisomerase inhibitor . • CR - 002 IND expected mid - 26 . • Interim PoC data expected in 2027 . • Designed to reproduce ivonescimab’s established pharmacology . • Pipeline in a program opportunity across solid tumor indications, with potential to move to frontline use in the $50B+ PD - (L)1 immunotherapy market. • IND expected YE25 / 1Q26 . • Interim PoC data expected 2H26 . Anti - VEGF Anti - PD - 1 scFvs

5 PD - (L)1 - targeted therapies, annualizing $50B+, have transformed oncology – with Keytruda now the best - selling drug in the world Notes: 1. 5 - year follow up demonstrated mOS of 22.0 vs 10.6 months. NSQ: Non - squamous. NSCLC: Non - small cell lung cancer. mOS: median overall survival. Sources: 2018 Gandhi (NEJM); 2023 Garassino (J Clin Oncol); GlobalData; FactSet; Pembrolizumab FDA Label PD - (L)1 inhibitors have significantly prolonged survival , shifting 1L treatment to immunotherapy PD - (L)1 - targeted therapies are one of the largest drug classes , with Keytruda (pembrolizumab) the dominant player 21 25 29 9 10 11 4 5 4 4 4 0 10 20 30 40 50 $60B anti - PD - (L)1 global sales 3 2022 2023 2024E $38B $45B $51B +33% Keytruda Opdivo Imfinzi Tecentriq Libtayo Bavencio Jemperli Keytruda alone is approved in 20+ oncology indications with expected revenue of ~$30B in 2024 . Pembrolizumab + chemotherapy Chemotherapy 0 18 24 • For example, in 1L NSQ NSCLC, addition of pembrolizumab to chemo significantly improved mOS ( NR vs 11.3 months 1 with a HR of 0.49 ). 100 90 Patients who survived (%) 80 70 60 50 40 30 20 10 Hazard ratio for death, 0.49 (P<0.001) 0 3 6 9 12 15 Months

6 Ivonescimab, a cooperative PD - 1 x VEGF bispecific, doubled progression - free survival vs. Keytruda in a P3 NSCLC trial Notes: HR: hazard ratio. PFS: progression - free survival. AE: adverse event. NSQ: Non - squamous SQ: Squamous. Akeso has licensed ivonescimab to Summit in North America, South America, Europe, Africa, Middle East, and Japan. Akeso maintains rights in Asia (ex - Japan / Middle East) and in Oceania. Sources: 2024 Zhou (WCLC Presentation on HARMONi - 2); Summit Therapeutics; 2018 Paz - Area (NEJM); 2019 Mok (Lancet); 2022 De Castro Jr (J Clin Oncol); Avastin Label Broader efficacy : Ivonescimab demonstrates benefit in patients where anti - PD - (L)1 efficacy has historically been modest (e.g., squamous, PD - (L)1 low ). Ivonescimab is the first drug to demonstrate superiority in PFS over pembrolizumab in a randomized Phase 3 • 1 Ivonescimab’s novel MoA raises the bar on efficacy and safety Squamous Non - squamous PD - L1 high ( TPS ≥50% ) PD - L1 low ( TPS 1 - 49% ) 0.48 0.54 0.46 0.54 HR • 2 Promising safety : Ivonescimab had lower AEs than expected versus anti - VEGF monotherapy . This suggests a differentiated profile driven by cooperativity - driven tissue targeting . Progression - free survival (%) 0 1 2 3 4 5 6 7 8 Time (months) 9 10 11 12 13 14 100 90 80 70 60 50 40 30 20 10 0 Ivonescimab Pembrolizum ab 9 - mo: 40% 9 - mo: 56% Median follow - up: 8.67 mos Pembrolizumab Ivonescimab 5.82 11.14 mPFS, mos 0.51 PFS HR 38.5 50.0 ORR, % Dual blockade of PD - 1 and VEGF through a cooperative bispecific antibody has led to unprecedented clinical results , demonstrating superiority to pembrolizumab… and a $15B+ market cap for ivo’s ex - China sponsor, Summit Therapeutics .

7 CR - 001 Cooperative, tetravalent PD - 1 x VEGF bispecific antibody

8 x Cooperativity : VEGF binding to ivonescimab increases affinity to PD - 1 and vice versa , enhancing both T - cell activation and VEGF - signaling blockade . This helps explain the cross - trial outperformance of ivonescimab vs. an anti - PD - L1 + anti - VEGF combination. x Tumor targeting : PD - 1 arm concentrates VEGF inhibition in the TME, potentially sparing healthy tissue and reducing AEs. Ivonescimab’s novel, cooperative MoA hypothesized to drive enhanced anti - tumor activity while maintaining tolerability Notes: AE: adverse event. TME: Tumor microenvironment Sources: 2023 Zhong (SITC Poster); Summit Therapeutics PD - 1 / PD - L1 interactions and inhibits VEGF VEGF binding increases PD - 1 affinity by ~18x PD - 1 binding increases VEGF affinity by ~4x A B VEGF drives tumor angiogenesis Ivo’s cooperative binding blocks PD - 1 PD - L1 Ivonescimab T cell Tumor VEGF cell dimer and PD - L1 expression suppresses T cells Dual blockade of PD - 1 and VEGF through a novel tetravalent bispecific format with cooperative binding effects has led to unprecedented clinical results in third party trials .

9 CR - 001 is a highly potent PD - 1 x VEGF bsAb designed to recapitulate ivonescimab’s cooperative pharmacology Designed to match ivonescimab PK • Native FcRn binding to match distribution and elimination of ivonescimab Effector - null human IgG Fc • Equivalent to ivonescimab • ADCC carries additional AE risk Highly potent & stable scFvs • Designed to be the best possible anti - PD - 1 epitope / binding domain • Anti - PD - 1s have historically outperformed anti - PD - L1s in meta - analyses of solid tumor studies • Contains proprietary engineering to enable functional and stable scFvs Potential for reduced AEs • Cooperative binding increases anti - VEGF activity in TME , reducing AE risks in healthy tissue • Identical VEGF potency to preserve safety CR - 001 Same design as ivonescimab • Pairs anti - VEGF IgG & anti - PD - 1 scFvs • Avoids risk of alternative, clinically unprecedented constructs (e.g., VEGF trap, anti - PD - L1 IgG, ADCC)

10 CR - 001 replicates ivonescimab’s cooperative effect, with greater binding to and inhibition of PD - 1 signaling in presence of VEGF Notes: Ivonescimab generated internally based on published sequence. PD - 1 / PD - L1 signaling inhibition measured in RLU (relative light units), a measure of luminescence that increases with greater inhibition. PD - 1 binding measured in MFI (mean fluorescence intensity), a measure of fluorescence that increases with binding and is measured via FACS. Sources: Internal data CR - 001 lead, like ivonescimab, is more potent in an NFAT reporter assay in the presence of VEGF … … and also increases PD - 1 binding on PD - 1+ Jurkat cells in the presence of VEGF . CR - 001 lead demonstrates same cooperative effect as ivonescimab across multiple assays.

11 Replicating ivonescimab’s tetravalent format and cooperativity, with stable scFvs, requires complex protein engineering Ivonescimab’s unique structure and geometry – and resulting cooperative function – is challenging to replicate ; alternative constructs risk not reproducing ivonescimab’s superior efficacy and safety in clinical practice. Standard mAbs can be improved with established protein engineering approaches … … but ensuring cooperative effect, stability, and developability of tetravalent PD - (L)1 x VEGF bispecific antibody is more difficult CDRs improved via diversification and/or affinity maturation to maximize potency Fc engineering tunes ADCC, CDC, half - life , etc. IgG format bound to VEGF dimer required to daisy chain ; different potency may alter chaining kinetics and VEGF trap geometry does not work scFv format can require significant engineering to ensure stability Fc silencing helps reduce risk of AEs CR - 001 has novel composition of matter IP related to proprietary, stabilized scFvs Leading anti - PD - 1s are unstable and aggregate in scFv format, potentially hampering developability

12 CR - 001 has potential to transform SoC across a multitude of oncology indications, with numerous first - in - class opportunities Notes: EGFRm = mutant epidermal growth factor receptor. Sources: Keytruda Label; Opdivo Label; Tecentriq Label; Imfinzi Label; Libtayo Label; Bavencio Label; Jemperli Label; Loqtorzi Label; Zynyz Label; Avastin Label; Cyramza Label; Lenvima Label; Votrient Label Anti - VEGF approvals Anti - PD - (L)1 approvals Anti - VEGF and anti - PD(L) - 1 approvals Ongoing / announced global study from Summit or BioNTech GASTROINTESTINAL Colorectal (all comers) Colorectal (MSI - H / dMMR) Gastric / Gastroesophageal junction (GEJ) Primary peritoneal BRAIN Glioblastoma HEMATOLOGICAL Classical Hodgkin lymphoma Primary mediastinal large B - cell lymphoma (PMBCL) LIVER & BILIARY Biliary tract Hepatocellular carcinoma (HCC) SOFT TISSUE Alveolar soft part sarcoma Soft tissue sarcoma TISSUE - AGNOSTIC High microsatellite instability (MSI - H) / deficient DNA mismatch repair (dMMR) High tumor mutational burden (TMB - H) SKIN Basal cell carcinoma Cutaneous squamous cell carcinoma Melanoma Merkel cell carcinoma KIDNEY Renal cell carcinoma (RCC) HEAD & NECK Head & neck squamous cell carcinoma (HNSCC) Nasopharyngeal Thyroid CHEST/THORACIC Esophageal EGFRm non - small cell lung cancer (NSCLC) Non - squamous NSCLC Squamous NSCLC Small cell lung cancer (SCLC) Pleural mesothelioma REPRODUCTIVE Cervical Endometrial Fallopian tube Ovarian (epithelial) Triple negative breast cancer (TNBC) Urothelial

13 Multiple global Phase 2/3s and Phase 3s planned between Summit and BioNTech BNT327 (Global) Development programs across key late - stage competitors include numerous P3s with PFS & OS readouts, paving the way for CR - 001 *Summit has announced P3 in 1L PD - L1+ NSCLC, monotherapy vs. pembro, but has not released trial details. Notes: List of trials is not exhaustive. NSCLC = non - small cell lung cancer; TNBC = triple negative breast cancer; SCLC = small cell lung cancer; NSQ = non - squamous; SQ = squamous. PFS and OS readouts estimated based on PEP (primary endpoints) and completion dates listed on ClinicalTrials.gov. Sources: ClinicalTrials.gov; Company websites; Company presentations Multiple Phase 3s across leading PD - (L)1 x VEGF programs, with similar cooperativity to CR - 001 , should generate a multitude of PFS & OS catalysts for years to come vs. PD - (L)1 comparator Timing Phase Combo Population Indication Program Company 2028 2027 2026 2025 OS readout expected in 2025 3 None 1L PD - L1+ mNSCLC Ivonescimab (China / Australia) OS readout expected in 2025 3 Chemo 1L squamous OS readout expected in 2027 3 Chemo 1L NSQ & SQ mNSCLC Ivonescimab (Global) Timing to be announced 3 None 1L PD - L1+* To be announced To be announced SCLC TNBC NSCLC

14 Parallel clinical development paths offer potential for both first - in - class and lower risk opportunities for CR - 001 Plan to rapidly follow ivonescimab in indications where clinical validation vs. anti - PD - (L)1 is highly differentiating • High conviction that CR - 001 can replicate ivonescimab’s efficacy given similar construct & equivalent MoA . NSCLC TNBC TBD Based on ongoing Phase 3 trials Focus on potential first - in - class opportunities with rapid path to market (i.e., efficient development strategy, anticipated likelihood of PFS and OS success ) • Numerous indications with clinically meaningful anti - PD - (L)1 +/ - VEGF efficacy and potential to combine with chemo / orthogonal MoAs. POTENTIAL INDICATIONS CR - 001 1 2

15 Phase 1 interim proof - of - concept data are a potentially significant value - generating event for CR - 001. • Preliminary data from early Phase 1 cohorts provides substantial validation of program because CR - 001’s structural design and preclinical data are similar to ivonescimab. • Early Phase 1 data, as single agent and in combination with SoC, rapidly enables late - stage development in multiple solid tumor types, unlocking broad first - in - class and fast - follower opportunities . • CR - 001 is markedly differentiated from novel constructs disconnected from ivonescimab’s MoA . Alternative formats may require significantly more patients’ worth of safety and efficacy data in tumor - specific expansion cohorts and/or Phase 2s to establish conviction before initiating Phase 3s. ILLUSTRATIVE CR - 001 Phase 1 data offer potential for early de - risking – a rarity for a solid tumor oncology program Phase 3s (validated indications) Phase 2/3s (first - in - class opportunities) Phase 1 (solid tumor all - comers) CR - 001 IND • Key derisking preliminary data: x PK x Safety x Efficacy (e.g., ORR) YE25 / 1Q26 PoC Interim 2H26 • Higher confidence to fund and accelerate CR - 001 into P3s after P1 interim data, given replication of ivonescimab’s cooperative pharmacology High conviction in CR - 001’s clinical profile can be reached in ~9 - 12 months , offering potential for significant early value inflection .

16 • Anti - PD - L1 IgG , with enhanced ADCC • VEGF trap Only four known constructs with potential to exhibit ivonescimab - like cooperative pharmacology Sources: Internal data; Summit Therapeutics 2023 SITC Poster; BioNTech 2024 ESMO Presentation; LaNova patent filings; ImmuneOnco patent filings; 2017 Lee (Scientific Reports); 2007 Rudge (PNAS) Anti - PD - L 1 VHH - based Anti - PD - 1 VHH - based Anti - PD - 1 scFv - based BNT327 / PM8002 LM - 299 Ivonescimab CR - 001 Program Company Phase 2 (Global) / Phase 3 (China) Phase 1/2 initiation (China) Phase 3 (Global) Preclinical Stage Bevacizumab Bevacizumab Bevacizumab Bevacizumab Anti - VEGF IgG Novel anti - PD - L 1 VHHs Novel anti - PD - 1 VHHs Penpulimab scFvs Anti - PD - 1 scFvs Anti - PD - (L)1 Fc null, to avoid potential AEs Fc null, to avoid potential AEs Fc null, to avoid potential AEs Fc null, to avoid potential AEs Fc function Expected (not disclosed); unclear impact of PD - L1 VHH Expected (not disclosed); unclear impact of VHH structure ض ض Cooperative pharmacology Examples of alternative constructs • Anti - PD - 1 mAb with off - target VEGFR2 binding through same variable domains • Anti - PD - 1 IgG • Novel anti - VEGF VHHs • Inverted format • Bevacizumab • Anti - PD - 1 Fabs • PD - 1 domains attached to IgG N - terminal instead of C - terminal

17 CR - 001 preclinical data reproduces ivonescimab’s breakthrough pharmacology and is rapidly advancing to generate significant value Unprecedented third - party data validates PD - 1 x VEGF cooperativity Transformative MoA for $50B+ market CR - 001’s proprietary engineering is designed to replicate ivonescimab Built by the proven Paragon team CR - 001 is a highly potent PD - 1 x VEGF bsAb reproducing cooperative binding qualities critical to ivonescimab Paragon has a demonstrated track record discovering and developing best - in - class molecules Ivonescimab significantly improved PFS versus pembrolizumab in Phase 3 in 1L NSCLC – the first therapy to do so head - to - head Poised to transform NSCLC standard of care , with broad application across $50B+ anti - PD - (L)1 market

18 CR - 002 & CR - 003 Topoisomerase inhibitor ADCs against validated targets

19 CR - 002 and CR - 003 are potentially best - in - class topoisomerase inhibitor ADCs, with applicability across solid tumors Best - in - modality topoisomerase inhibitor payloads • Topoisomerase inhibitor payloads have consistently demonstrated superior efficacy and safety over microtubule inhibitor payloads • Each ADC is expected to have bystander - killing effect Validated, undisclosed solid tumor ADC targets • Each unique target has potential in multiple solid tumor indications Potential to synergize with CR - 001 and other immunotherapies • Each ADC can be leveraged in combination studies in solid tumors • Multiple indications with ongoing PD - (L)1 x VEGF bispecific development and separate development of ADCs help de - risk clinical path for combinations Targets for CR - 002 and CR - 003 to be disclosed as programs approach IND .

20 ADCs with topoisomerase inhibitor payloads have demonstrated best - in - modality efficacy and safety TopoI payload - based ADCs have demonstrated superior ORR vs. microtubule inhibitor - based ADCs in cross - trial comparisons… Notes: NSCLC = non - small cell lung cancer; GEJ = gastroesophageal junction; A = approved; R = in registration. PN rates are weighted averages, by number of patients, across indications / trials and include PN, PSN, PMN, and PSMN when separately measured; full list of trials and references available on request. Disitamab vedotin is approved in China and in Phase 3 development globally. Sources: Enhertu Label; 2024 Smit (Lancet Onc); Kadcyla Label; 2019 Peters (Clin Cancer Res); 2017 Thuss - Patience (Lancet Onc); 2024 Oaknin (ESMO Pres); 2024 Ahn (JCO); 2018 King (Invest New Drugs) CROSS - TRIAL COMPARISONS … and have shown much lower rates of peripheral neuropathy , a critical AE that can drive dose reductions & discontinuations CR - 002 and CR - 003 utilize the best - in - ADC payload in their potentially best - in - class profiles . 0 20 40 60 80 100 ORR (%) 83% 44% 54% 20% 41% 21% 49% 0% 26% 0% Topoisomerase inhibitor payload Microtubule inhibitor payload Only difference in HER2 ADCs is payload – both use trastuzumab 0 20 40 60 13% PN (all grades, %) 2% 0% 0% 0% 41% 40% 27% 16% 48% Indication Target Breast HER2 ( Enhertu vs. Kadcyla ) NSCLC Gastric / GEJ Ovarian TROP2 ( Dato - DXd vs. PF - 06664178 ) NSCLC Phase Molecule Target A Enhertu HER2 TopoI payload R Dato - DXd TROP2 R Patritumab - DXd HER3 3 Ifinatamab - DXd B7 - H3 2 Raludotatug - DXd CDH6 A Adcetris CD30 MT payload A Padcev Nectin - 4 A Tivdak TF A Kadcyla HER2 3 Disitamab vedotin HER2

21 Corporate

22 Evan Thompson COO Neta Batscha SVP, Strategy & Operations Mike Meehl SVP, Biologics Research Hussam Shaheen Head of Research Jason Oh SVP, Biology Shawn Russell SVP, CMC Jonathan Violin Interim CEO Damon Banks Head of Legal Keri Lantz Head of Finance Peter Harwin Board of Directors Chris Doughty CBO Leadership with deep experience building leading biotechnology companies Partnership with Paragon Therapeutics provides proven expertise in antibody engineering and development

23 26: IND 2H: Initial clinical data YE25 / 1Q CR - 001 (cooperative PD - 1 x VEGF bsAb) Mid - year: IND 2H: DC CR - 002 (undisclosed, ADC #1 with TopoI payload) 1H: DC CR - 003 (undisclosed, ADC #2 with TopoI payload) Multiple P3 trials ongoing or planned (e.g., SCLC, TNBC, NSCLC) , with numerous PFS & OS readouts expected in 2026 and beyond 1H: BNT327 P2/3 EGFRm NSQ mNSCLC interim (China) 1H: Ivo P3 1L SQ mNSCLC interim (China) 2H: Ivo P3 HARMONi - 2 1L mNSCLC OS (China) 2H: BNT327 P2/3 1L ES - SCLC interim (China) 2H: Ivo P3 HARMONi EGFRm NSQ mNSCLC interim (global) 2H: Ivo P3 HARMONi - A EGFRm NSQ mNSCLC completion (China) Key external events Financing expected to fund Crescent programs through key anticipated value - generating catalysts 2026 2025 Notes: mNSCLC = metastatic non - small cell lung cancer; TNBC = triple negative breast cancer; SCLC = small cell lung cancer; ES = extensive stage. NSQ = non - squamous; SQ = squamous; EGFRm = mutant EGFR. Sources: ClinicalTrials.gov; Company websites

24 Estimated capitalization following close of transactions Estimated total shares of common stock of the combined company post - closing 2,081,292,577 Shares on an as - converted basis 64,532,953 • Shares of common stock outstanding GlycoMimetics • Shares of common stock outstanding 105,137,814 Crescent Biopharma • Series A shares 298,298,000 Pre - closing financing 1,339,680,730 • Shares of common stock • Pre - funded warrants 273,643,080 Expected ownership of the combined company 3.1% 96.9%

Thank you

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

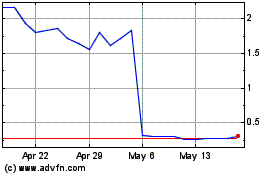

GlycoMimetics (NASDAQ:GLYC)

Historical Stock Chart

From Dec 2024 to Jan 2025

GlycoMimetics (NASDAQ:GLYC)

Historical Stock Chart

From Jan 2024 to Jan 2025