false

0001123494

0001123494

2024-11-07

2024-11-07

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_________________

FORM 8-K

_________________

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

November 7, 2024

_______________________________

HARVARD BIOSCIENCE, INC.

(Exact name of registrant as specified in its charter)

______________________________

| Delaware |

001-33957 |

04-3306140 |

| (State or Other Jurisdiction of Incorporation) |

(Commission File Number) |

(I.R.S. Employer Identification No.) |

84 October Hill Road

Holliston, MA 01746

(Address of Principal Executive Offices) (Zip Code)

(508) 893-8999

(Registrant's telephone number, including area code)

(Former name or former address, if changed since last

report)

____________________________

Check the appropriate box below if the Form 8-K filing is intended to

simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

|

☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

|

☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

|

☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section

12(b) of the Act:

| Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

| Common Stock, $0.01 par value |

HBIO |

The NASDAQ Stock Market |

Indicate by check mark whether the registrant is an emerging growth company

as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934

(§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition.

On November 7, 2024, Harvard Bioscience, Inc. (the

“Company”) issued a press release announcing financial results for the three months ended September 30, 2024, and the details

of a related conference call to be held at 8:00 AM ET on November 7, 2024. The press release is furnished as Exhibit 99.1 and incorporated

herein by reference.

The information in Item 2.02 of this Current Report on Form 8-K and Exhibit

99.1 attached hereto shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934 (the “Exchange

Act”) or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under

the Securities Act of 1933 or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the

registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

HARVARD BIOSCIENCE, INC. |

| |

|

| |

|

| Date: November 7, 2024 |

By: |

/s/ Jennifer Cote |

|

| |

|

Jennifer Cote |

| |

|

Chief Financial Officer |

Exhibit 99.1

Harvard Bioscience Announces Third Quarter 2024 Financial Results

HOLLISTON, Mass., November 7, 2024 (GLOBE NEWSWIRE) -- Harvard Bioscience,

Inc. (Nasdaq: HBIO) (the “Company”) today announced financial results for the third quarter ended September 30, 2024.

Jim Green, Chairman and CEO, said, “Our third quarter

revenues continued to reflect the effects of the challenging market environment. Our migration to a single US enterprise resource planning

system, completed in the third quarter, supports operating efficiencies as well as improvements in inventory and supply chain management

going forward. We have stayed focused on managing costs and have implemented additional cost reduction actions that we expect to result

in incremental quarterly cost savings of $1 million beginning in Q4.”

Green continued, “We’re happy to see expanding

adoption of our new telemetry, neuro-behavior and bioproduction products. We’re especially pleased by the growth of our breakthrough

MeshMEA™ organoid systems, led by early adopters including leading academic researchers, and now CRO and BioPharma customers.”

| Financial Results Summary | |

Three Months Ended September 30, | | |

Nine Months Ended September 30, | |

| (unaudited, $ in millions except per share data) | |

2024 | | |

2023 | | |

2024 | | |

2023 | |

| Revenues | |

$ | 22.0 | | |

$ | 25.4 | | |

$ | 69.6 | | |

$ | 84.1 | |

| Gross margin | |

| 58.1 | % | |

| 58.1 | % | |

| 58.6 | % | |

| 59.2 | % |

| Operating (loss) income (GAAP) | |

$ | (1.9 | ) | |

$ | (0.9 | ) | |

$ | (6.2 | ) | |

$ | 1.6 | |

| Adjusted operating income | |

$ | 0.8 | | |

$ | 1.8 | | |

$ | 2.8 | | |

$ | 9.8 | |

| Net loss (GAAP) | |

$ | (4.8 | ) | |

$ | (1.2 | ) | |

$ | (12.4 | ) | |

$ | (1.6 | ) |

| Diluted loss per share (GAAP) | |

$ | (0.11 | ) | |

$ | (0.03 | ) | |

$ | (0.29 | ) | |

$ | (0.04 | ) |

| Diluted adjusted (loss) earnings per share | |

$ | (0.02 | ) | |

$ | 0.01 | | |

$ | (0.00 | ) | |

$ | 0.11 | |

| Adjusted EBITDA | |

$ | 1.3 | | |

$ | 2.2 | | |

$ | 4.2 | | |

$ | 10.9 | |

| Adjusted EBITDA margin | |

| 6.0 | % | |

| 8.9 | % | |

| 6.0 | % | |

| 13.0 | % |

| Cash flow (used in) provided by operations | |

$ | (0.8 | ) | |

$ | 4.4 | | |

$ | (0.3 | ) | |

$ | 9.7 | |

Third Quarter 2024 Results

For the third quarter of fiscal 2024, the Company reported revenues of

$22.0 million compared to $25.4 million in the third quarter of fiscal 2023. Gross margin for the three months ended September 30, 2024

and 2023 was 58.1% despite the lower revenue in the current year period due to a stronger product mix, offset by lower absorption of

fixed manufacturing costs.

Net loss for the third quarter of 2024 was $(4.8) million compared to

a net loss of $(1.2) million in the third quarter of 2023. The loss for the third quarter of 2024 included a non-cash charge of $1.2

million resulting from the settlement of the Company’s obligations under a defined benefit plan. The prior year period included

a benefit of $1.2 million from a mark-to-market adjustment of marketable securities. Adjusted EBITDA for the third quarter of 2024 was

$1.3 million, compared to $2.2 million in the third quarter of the prior year.

Nine Months Ended September 30, 2024 Results

For the nine months ended September 30, 2024, revenues were

$69.6 million, compared to $84.1 million in the same period in 2023. Gross margin for the nine months ended September 30, 2024 was 58.6%

compared with 59.2% in the comparable period of the prior year.

Net loss for the nine months ended September 30, 2024 was ($12.4)

million compared to a net loss of $(1.6) million in the same period of 2023, primarily due to the impact of lower revenues, partially

offset by reduced operating expenses and cost reduction actions taken earlier this year. Adjusted EBITDA for the nine months ended September

30, 2024 was $4.2 million, compared to adjusted EBITDA of $10.9 million for the comparable period of 2023.

Cash Flows and Liquidity

Cash used in operations was $(0.8) million during the three months ended

September 30, 2024 compared to cash provided by operations of $4.4 million in the same period in 2023. Cash used in operations was $(0.3)

million during the nine months ended September 30, 2024 compared to cash provided by operations of $9.7 million in the same period in

2023.

The Company is currently unable to make additional borrowings under its

revolving credit facility due to the net leverage ratio requirements of its Credit Agreement. Based on its current operating plans, the

Company expects that its available cash and cash generated from operations will be sufficient to finance operations and capital expenditures

for at least the next 12 months.

This press release includes certain financial information presented

on an adjusted, or non-GAAP, basis. For additional information on the non-GAAP financial measures included in this press release, see

“Use of Non-GAAP Financial Information” and “Reconciliation of GAAP to Non-GAAP Financial Measures” below.

2024 Q4 Guidance

Given the challenging market environment, the Company now expects

Q4 2024 revenues of $23 to $26 million. The Company expects Q4 2024 gross margins of approximately 59% to 60% and adjusted EBITDA margin

in the mid-teens.

Webcast and Conference Call Details

In conjunction with this announcement, Harvard Bioscience will

be hosting a conference call and webcast today at 8:00 a.m. Eastern Time. A presentation that will be referenced during the webcast will

be posted to the Company’s Investor Relations website shortly before the webcast begins.

Analysts who would like to join the call and ask a question must register here (https://edge.media-server.com/mmc/p/jadtkmij). Once registered, you will

receive the dial-in numbers and a unique PIN number.

Participants who would like to join the audio-only webcast should

go to our events and presentations on the investor website here (https://edge.media-server.com/mmc/p/i9azz8io).

Use of Non-GAAP Financial Information

In this press release, we have included non-GAAP financial information,

including one or more of adjusted operating income (loss), adjusted operating margin, adjusted net income (loss), adjusted EBITDA, adjusted

EBITDA margin, diluted adjusted earnings (loss) per share, and net debt. We believe that this non-GAAP financial information provides

investors with an enhanced understanding of the underlying operations of the business. For the periods presented, these non-GAAP financial

measures have excluded certain expenses and income resulting from items that we do not believe are representative of the underlying operations

of the business. Items excluded include stock-based compensation, amortization of intangibles related to acquisitions, other operating

expenses, loss on equity securities, income taxes, and the tax impact of the reconciling items. Management believes that this non-GAAP

financial information is important in comparing current results with prior period results and is useful to investors and financial analysts

in assessing the Company’s operating performance.

Non-GAAP historical financial statement information included

herein is accompanied by a reconciliation to the nearest corresponding GAAP measure which is included below in this press release.

With respect to non-GAAP forward-looking measures, we provide

an outlook for adjusted EBITDA margin. Many of the items that we exclude from this forward-looking measure calculation are less capable

of being controlled or reliably predicted by management. These items could cause the forward-looking measures presented in our outlook

statements to vary materially from our GAAP results.

The non-GAAP financial information provided in this press release

should be considered in addition to, not as a substitute for, the financial information provided and presented in accordance with GAAP

and may be different than other companies’ non-GAAP financial information.

About Harvard Bioscience

Harvard Bioscience, Inc. is a leading developer, manufacturer

and seller of technologies, products and services that enable fundamental advances in life science applications, including research,

pharmaceutical and therapy discovery, bio-production and preclinical testing for pharmaceutical and therapy development. Our customers

range from renowned academic institutions and government laboratories to the world’s leading pharmaceutical, biotechnology and

contract research organizations. With operations in the United States, Europe, and China, we sell through a combination of direct and

distribution channels to customers around the world.

For more information, please visit our website

at www.harvardbioscience.com.

Forward-Looking Statements

This document contains forward-looking statements within the

meaning of the federal securities laws, including the Private Securities Litigation Reform Act of 1995. Forward-looking statements may

be identified by the use of words such as “may,” “will,” “expect,” “plan,” “anticipate,”

“estimate,” “intend” and similar expressions or statements that do not relate to historical matters. Forward-looking

statements include, but are not limited to, information concerning expected future financial and operational performance including revenues,

gross margins, earnings, cash and debt position, growth and the introduction of new products, the strength of the Company’s market

position and business model and anticipated macroeconomic conditions. Forward-looking statements are not guarantees of future performance

and involve known and unknown uncertainties, risks, assumptions, and contingencies, many of which are outside the Company’s control.

Risks and other factors that could cause the Company’s actual results to differ materially from those described its forward-looking

statements include those described in the “Risk Factors” section of the Company’s most recently filed Annual Report

on Form 10-K as well as in the Company’s other filings with the Securities and Exchange Commission. Forward-looking statements

are based on the Company’s expectations and assumptions as of the date of this document. Except as required by law, the Company

assumes no obligation to update forward-looking statements to reflect any change in expectations, even as new information becomes available.

| Company Contact: | |

Investors Contact: |

| Jennifer Cote | |

Three Part Advisors |

| Chief Financial Officer | |

Sandy Martin |

| (508) 893-3120 | |

HBIO@threepa.com |

| | |

(214) 616-2207 |

| HARVARD BIOSCIENCE, INC. |

| Consolidated Statements of Operations |

| (unaudited, in thousands, except per share data) |

| | |

| |

| |

| |

|

| | |

Three Months Ended | |

Nine Months Ended |

| | |

September 30, 2024 | |

September 30, 2023 | |

September 30, 2024 | |

September 30, 2023 |

| | |

| |

| |

| |

|

| Revenues | |

$ | 21,970 | | |

$ | 25,363 | | |

$ | 69,579 | | |

$ | 84,097 | |

| Cost of revenues | |

| 9,205 | | |

| 10,636 | | |

| 28,824 | | |

| 34,351 | |

| Gross profit | |

| 12,765 | | |

| 14,727 | | |

| 40,755 | | |

| 49,746 | |

| | |

| | | |

| | | |

| | | |

| | |

| Operating expenses: | |

| | | |

| | | |

| | | |

| | |

| Sales and marketing expenses | |

| 5,518 | | |

| 5,732 | | |

| 16,817 | | |

| 17,888 | |

| General and administrative expenses | |

| 5,041 | | |

| 5,807 | | |

| 16,690 | | |

| 17,494 | |

| Research and development expenses | |

| 2,567 | | |

| 2,760 | | |

| 8,078 | | |

| 8,614 | |

| Amortization of intangible assets | |

| 1,334 | | |

| 1,361 | | |

| 3,998 | | |

| 4,138 | |

| Other operating expenses | |

| 179 | | |

| - | | |

| 1,394 | | |

| - | |

| Total operating expenses | |

| 14,639 | | |

| 15,660 | | |

| 46,977 | | |

| 48,134 | |

| | |

| | | |

| | | |

| | | |

| | |

| Operating (loss) income | |

| (1,874 | ) | |

| (933 | ) | |

| (6,222 | ) | |

| 1,612 | |

| | |

| | | |

| | | |

| | | |

| | |

| Other income (expense): | |

| | | |

| | | |

| | | |

| | |

| Interest expense | |

| (856 | ) | |

| (882 | ) | |

| (2,356 | ) | |

| (2,797 | ) |

| Loss on pension settlement | |

| (1,243 | ) | |

| | | |

| (1,243 | ) | |

| | |

| Gain (loss) on equity securities | |

| - | | |

| 1,208 | | |

| (1,593 | ) | |

| (373 | ) |

| Other (expense) income, net | |

| (518 | ) | |

| 45 | | |

| (841 | ) | |

| 105 | |

| Total other expense | |

| (2,617 | ) | |

| 371 | | |

| (6,033 | ) | |

| (3,065 | ) |

| Loss before income taxes | |

| (4,491 | ) | |

| (562 | ) | |

| (12,255 | ) | |

| (1,453 | ) |

| Income tax expense | |

| 311 | | |

| 677 | | |

| 168 | | |

| 144 | |

| Net loss | |

$ | (4,802 | ) | |

$ | (1,239 | ) | |

$ | (12,423 | ) | |

$ | (1,597 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Loss per common share: | |

| | | |

| | | |

| | | |

| | |

| Basic and diluted | |

$ | (0.11 | ) | |

$ | (0.03 | ) | |

$ | (0.29 | ) | |

$ | (0.04 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Weighted-average common shares: | |

| | | |

| | | |

| | | |

| | |

| Basic and diluted | |

| 43,614 | | |

| 42,688 | | |

| 43,499 | | |

| 42,345 | |

| HARVARD BIOSCIENCE, INC. |

| Condensed Consolidated Balance Sheets |

| (unaudited, in thousands) |

| | |

| |

|

| | |

| |

|

| | |

September 30, 2024 | |

December 31, 2023 |

| Assets | |

| | | |

| | |

| Cash and cash equivalents | |

$ | 4,569 | | |

$ | 4,283 | |

| Accounts receivable, net | |

| 12,831 | | |

| 16,099 | |

| Inventories | |

| 25,990 | | |

| 24,716 | |

| Other current assets | |

| 3,401 | | |

| 3,940 | |

| Total current assets | |

| 46,791 | | |

| 49,038 | |

| Property, plant and equipment | |

| 5,221 | | |

| 3,981 | |

| Goodwill and other intangibles | |

| 69,780 | | |

| 73,101 | |

| Other long-term assets | |

| 9,447 | | |

| 11,246 | |

| Total assets | |

$ | 131,239 | | |

$ | 137,366 | |

| | |

| | | |

| | |

| Liabilities and Stockholders' Equity | |

| | | |

| | |

| Current portion, long-term debt | |

$ | 3,606 | | |

$ | 5,859 | |

| Other current liabilities | |

| 19,145 | | |

| 20,683 | |

| Total current liabilities | |

| 22,751 | | |

| 26,542 | |

| Long-term debt, net | |

| 34,252 | | |

| 30,704 | |

| Other long-term liabilities | |

| 8,914 | | |

| 7,046 | |

| Stockholders’ equity | |

| 65,322 | | |

| 73,074 | |

| Total liabilities and stockholders’ equity | |

$ | 131,239 | | |

$ | 137,366 | |

| HARVARD BIOSCIENCE, INC. |

| Condensed Consolidated Statements of Cash Flows |

| (unaudited, in thousands) |

| | |

| |

| |

| |

|

| | |

Three Months Ended | |

Nine Months Ended |

| | |

September 30, 2024 | |

September 30, 2023 | |

September 30, 2024 | |

September 30, 2023 |

| Cash flows from operating activities: | |

| | | |

| | | |

| | | |

| | |

| Net loss | |

$ | (4,802 | ) | |

$ | (1,239 | ) | |

$ | (12,423 | ) | |

$ | (1,597 | ) |

| Adjustments to operating cash flows | |

| 3,432 | | |

| 2,010 | | |

| 11,480 | | |

| 9,111 | |

| Changes in operating assets and liabilities | |

| 528 | | |

| 3,590 | | |

| 658 | | |

| 2,211 | |

| Net cash (used in) provided by operating activities | |

| (842 | ) | |

| 4,361 | | |

| (285 | ) | |

| 9,725 | |

| | |

| | | |

| | | |

| | | |

| | |

| Cash flows from investing activities: | |

| | | |

| | | |

| | | |

| | |

| Additions to property, plant and equipment | |

| (880 | ) | |

| (217 | ) | |

| (2,343 | ) | |

| (958 | ) |

| Acquisition of intangible assets | |

| (231 | ) | |

| (184 | ) | |

| (454 | ) | |

| (292 | ) |

| Proceeds from sale of product line | |

| - | | |

| - | | |

| - | | |

| 512 | |

| Proceeds from sale of marketable equity securities | |

| - | | |

| - | | |

| 1,919 | | |

| - | |

| Net cash used in investing activities | |

| (1,111 | ) | |

| (401 | ) | |

| (878 | ) | |

| (738 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Cash flows from financing activities: | |

| | | |

| | | |

| | | |

| | |

| Borrowing from revolving line of credit | |

| 3,250 | | |

| 1,000 | | |

| 8,800 | | |

| 3,500 | |

| Repayment of revolving line of credit | |

| - | | |

| (3,000 | ) | |

| (2,550 | ) | |

| (8,450 | ) |

| Repayment of term debt | |

| (1,000 | ) | |

| (750 | ) | |

| (5,023 | ) | |

| (3,341 | ) |

| Payment of debt issuance costs | |

| (161 | ) | |

| | | |

| (161 | ) | |

| - | |

| Proceeds from exercise of employee stock options and purchases | |

| 15 | | |

| - | | |

| 219 | | |

| 724 | |

| Taxes paid related to net share settlement of equity awards | |

| - | | |

| - | | |

| (59 | ) | |

| (451 | ) |

| Net cash provided by (used in) financing activities | |

| 2,104 | | |

| (2,750 | ) | |

| 1,226 | | |

| (8,018 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Effect of exchange rate changes on cash and cash equivalents | |

| 370 | | |

| (194 | ) | |

| 223 | | |

| (137 | ) |

| Increase in cash and cash equivalents | |

| 521 | | |

| 1,016 | | |

| 286 | | |

| 832 | |

| Cash and cash equivalents at the beginning of period | |

| 4,048 | | |

| 4,324 | | |

| 4,283 | | |

| 4,508 | |

| Cash and cash equivalents at the end of period | |

$ | 4,569 | | |

$ | 5,340 | | |

$ | 4,569 | | |

$ | 5,340 | |

| HARVARD BIOSCIENCE, INC. |

| Reconciliation of GAAP to Non-GAAP Financial Measures (unaudited) |

| (in thousands, except per share data and percentages) |

| |

| | |

Three Months Ended | |

Nine Months Ended |

| | |

September 30, 2024 | |

September 30, 2023 | |

September 30, 2024 | |

September 30, 2023 |

| | |

| |

| |

| |

|

| GAAP operating (loss) income | |

$ | (1,874 | ) | |

$ | (933 | ) | |

$ | (6,222 | ) | |

$ | 1,612 | |

| Stock-based compensation | |

| 1,053 | | |

| 1,363 | | |

| 3,379 | | |

| 3,618 | |

| Acquired asset depreciation & amortization | |

| 1,343 | | |

| 1,369 | | |

| 4,017 | | |

| 4,167 | |

| Other operating expenses (1) | |

| 179 | | |

| - | | |

| 1,394 | | |

| - | |

| Other adjustments | |

| 137 | | |

| 42 | | |

| 256 | | |

| 450 | |

| Adjusted operating income | |

$ | 838 | | |

$ | 1,841 | | |

$ | 2,824 | | |

$ | 9,847 | |

| | |

| | | |

| | | |

| | | |

| | |

| Operating margin | |

| (8.5 | %) | |

| (3.7 | %) | |

| (8.9 | %) | |

| 1.9 | % |

| Adjusted operating margin | |

| 3.8 | % | |

| 7.3 | % | |

| 4.1 | % | |

| 11.7 | % |

| | |

| | | |

| | | |

| | | |

| | |

| | |

| | | |

| | | |

| | | |

| | |

| GAAP net loss | |

$ | (4,802 | ) | |

$ | (1,239 | ) | |

$ | (12,423 | ) | |

$ | (1,597 | ) |

| Stock-based compensation | |

| 1,053 | | |

| 1,363 | | |

| 3,379 | | |

| 3,618 | |

| Acquired asset depreciation & amortization | |

| 1,343 | | |

| 1,369 | | |

| 4,015 | | |

| 4,167 | |

| Other operating expenses (1) | |

| 179 | | |

| - | | |

| 1,394 | | |

| - | |

| Pension settlement expense | |

| 1,243 | | |

| - | | |

| 1,243 | | |

| - | |

| Other adjustments | |

| 137 | | |

| 42 | | |

| 256 | | |

| 46 | |

| (Gain) loss on equity securities | |

| - | | |

| (1,208 | ) | |

| 1,593 | | |

| 374 | |

| Income taxes | |

| (214 | ) | |

| 196 | | |

| 377 | | |

| (1,919 | ) |

| Adjusted net (loss) income | |

| (1,061 | ) | |

| 523 | | |

| (166 | ) | |

| 4,689 | |

| Depreciation & amortization | |

| 475 | | |

| 405 | | |

| 1,383 | | |

| 1,054 | |

| Interest and other expense, net | |

| 1,374 | | |

| 837 | | |

| 3,197 | | |

| 3,095 | |

| Adjusted income taxes (2) | |

| 525 | | |

| 481 | | |

| (209 | ) | |

| 2,063 | |

| Adjusted EBITDA | |

$ | 1,313 | | |

$ | 2,246 | | |

$ | 4,205 | | |

$ | 10,901 | |

| Adjusted EBITDA margin | |

| 6.0 | % | |

| 8.9 | % | |

| 6.0 | % | |

| 13.0 | % |

| | |

| | | |

| | | |

| | | |

| | |

| | |

| | | |

| | | |

| | | |

| | |

| Diluted loss per share (GAAP) | |

$ | (0.11 | ) | |

$ | (0.03 | ) | |

$ | (0.29 | ) | |

$ | (0.04 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Diluted adjusted earnings per share | |

$ | (0.02 | ) | |

$ | 0.01 | | |

$ | (0.00 | ) | |

$ | 0.11 | |

| Weighted-average common shares: | |

| | | |

| | | |

| | | |

| | |

| Diluted GAAP | |

| 43,614 | | |

| 42,688 | | |

| 43,499 | | |

| 42,345 | |

| | |

| | | |

| | | |

| | | |

| | |

| Diluted Adjusted | |

| 43,614 | | |

| 44,563 | | |

| 43,499 | | |

| 44,195 | |

| | |

| | | |

| | | |

| | | |

| | |

| (1) | | Other operating expenses for the three months ended September 30, 2024 includes $0.2 million

of restructuring-related charges. Other operating expenses for the nine months ended September 30, 2024 includes a $0.5 million

commission fee paid in connection with the receipt of employee retention credits, a loss of $0.3 million related to an unclaimed property

audit, and $0.6 million of restructuring-related charges. |

| (2) | | Adjusted income taxes includes the tax effect of adjusting for the reconciling items using

the tax rates in the jurisdictions in which the reconciling items arise. |

| | |

| September 30, 2024 | | |

| December 31, 2023 | |

| Debt, including unamortized deferred financing costs | |

$ | 37,858 | | |

$ | 36,563 | |

| Unamortized deferred financing costs | |

| 492 | | |

| 560 | |

| Cash and cash equivalents | |

| (4,569 | ) | |

| (4,283 | ) |

| Net debt | |

$ | 33,781 | | |

$ | 32,840 | |

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

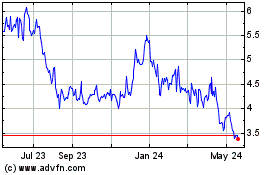

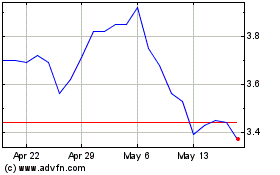

Harvard Bioscience (NASDAQ:HBIO)

Historical Stock Chart

From Oct 2024 to Nov 2024

Harvard Bioscience (NASDAQ:HBIO)

Historical Stock Chart

From Nov 2023 to Nov 2024