Form 424B5 - Prospectus [Rule 424(b)(5)]

08 February 2025 - 8:15AM

Edgar (US Regulatory)

Filed

Pursuant to Rule 424(b)(5)

Registration No. 333-272620

PROSPECTUS

SUPPLEMENT

(To

Prospectus dated June 16, 2023

To

Prospectus Supplement dated November 8, 2024)

Up

to $5,000,000

Common

Stock

Common Stock

Hoth

Therapeutics, Inc.

This

prospectus supplement (“Prospectus Supplement”) amends and supplements the information in the prospectus, dated June 16,

2023, filed as a part of our registration statement on Form S-3 (File No. 333-272620), as supplemented by our

prospectus supplement dated November 8, 2024 (collectively, the “Prior Prospectus”). This prospectus supplement should be

read in conjunction with the Prior Prospectus, and is qualified by reference thereto, except to the extent that the information herein

amends or supersedes the information contained in the Prior Prospectus. This prospectus supplement is not complete without, and may only

be delivered or utilized in connection with, the Prior Prospectus, and any future amendments or supplements thereto.

We

filed the Prior Prospectus to register the offer and sale of our common stock, par value $0.0001 per share, from time to time pursuant

to the terms of that certain At The Market Offering Agreement dated November 8, 2024, or the sales agreement, between H.C. Wainwright &

Co., LLC, or Wainwright, acting as the agent, and us.

Since

our entry into the At The Market Offering Agreement, we have offered and sold 2,042,250 shares of common stock for gross proceeds of

approximately $2,700,000 million pursuant to the At The Market Offering Agreement.

We

are filing this Prospectus Supplement to supplement the Prior Prospectus to increase the aggregate amount we intend to sell pursuant

to the Sales Agreement. As of the date of this Prospectus Supplement, we are offering up to an additional aggregate of $5,000,000 of

our common stock for sale under the At The Market Offering Agreement, not including the shares of common stock previously sold pursuant

to the At The Market Offering Agreement.

As

of the date of this prospectus supplement, the aggregate market value of our common stock held by non-affiliates of our public

float was approximately $29,827,324.80 based on a total number of 13,147,747 shares of common stock outstanding, of which 13,082,160

shares of common stock were held by non-affiliates, at a price of $2.28 per share, the closing sales price of our common stock

on January 7, 2025, which is the highest closing price of our common stock on Nasdaq Capital Market within the prior 60 days. We have

sold approximately $2,700,000 of securities pursuant to General Instruction I.B.6 of Form S-3 during the prior 12-calendar month

period that ends on and includes the date of this prospectus supplement (excluding this offering). Accordingly, based on the foregoing,

we are currently eligible under General Instruction I.B.6 of Form S-3 to offer and sell shares of our Common Stock having an

aggregate offering price of up to approximately $7,242,713.60. Pursuant to General Instruction I.B.6 of Form S-3, in no event

will we sell securities in a public primary offering with a value exceeding one-third of our public float in any 12-month period

so long as our public float remains below $75.0 million.

Our

common stock is listed on the Nasdaq Capital Market under the symbol “HOTH.” On February 4, 2025, the last reported sale

price of our common stock was $1.22 per share.

NEITHER

THE SECURITIES AND EXCHANGE COMMISSION NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THESE SECURITIES OR PASSED

UPON THE ADEQUACY OR ACCURACY OF THIS PROSPECTUS SUPPLEMENT AND THE ACCOMPANYING PROSPECTUS. ANY REPRESENTATION TO THE CONTRARY IS A

CRIMINAL OFFENSE.

H.C.

Wainwright & Co.

The

date of this prospectus supplement is February 7, 2025

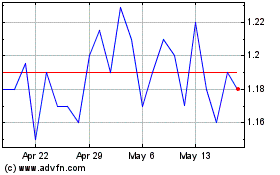

Hoth Therapeutics (NASDAQ:HOTH)

Historical Stock Chart

From Jan 2025 to Feb 2025

Hoth Therapeutics (NASDAQ:HOTH)

Historical Stock Chart

From Feb 2024 to Feb 2025