false

0001711786

0001711786

2025-02-07

2025-02-07

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the

Securities

Exchange Act of 1934

Date

of Report (Date of earliest event reported) February 7, 2025

Hoth

Therapeutics, Inc.

(Exact

name of registrant as specified in its charter)

| Nevada |

|

001-38803 |

|

82-1553794 |

(State

or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(I.

R. S. Employer

Identification No.) |

1177

Avenue of the Americas, 5th Floor, Suite 5066

New

York, NY 10036

(Address

of principal executive offices, including ZIP code)

(646)

756-2997

(Registrant’s

telephone number, including area code)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common

stock, $0.0001 par value |

|

HOTH |

|

The

Nasdaq Stock Market LLC |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☒

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Item

8.01 Other Events.

On

February 7, 2025, Hoth Therapeutics, Inc. (the “Company”) increased the maximum aggregate offering price of the shares of

the Company’s common stock, par value $0.0001 per share (the “Common Stock”) issuable under the At The Market Offering

Agreement (the “Sales Agreement”) with H.C. Wainwright & Co., dated November 8, 2024, to up

to an additional aggregate of $5,000,000, which does not include the approximately $2,700,000 of shares of common stock that were sold

to date pursuant to the Sales Agreement, and filed a prospectus supplement (the “Current

Prospectus Supplement”). A copy of the legal opinion as to the legality of the $5,000,000 of shares of Common Stock issuable under

the Sales Agreement and covered by the Current Prospectus Supplement is filed as Exhibit 5.1 attached hereto.

Item

9.01 Financial Statements and Exhibits.

(d)

Exhibits.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| Date:

February 7, 2025 |

Hoth

Therapeutics, Inc. |

| |

|

| |

/s/

Robb Knie |

| |

Robb

Knie |

| |

Chief

Executive Officer |

Exhibit 5.1

|

|

Sheppard, Mullin, Richter

& Hampton LLP

30 Rockefeller Plaza

New York, New York 10112-0015

212.653.8700 main

212.653.8701 fax

www.sheppardmullin.com |

February 7, 2025

VIA ELECTRONIC MAIL

Hoth Therapeutics, Inc.

590 Madison Ave., 21st Floor

New York, NY 100022

| Re: | At-The-Market Offering pursuant to Registration

Statement on Form S-3 |

Ladies and Gentlemen:

We have acted as counsel to Hoth Therapeutics,

Inc., a Nevada corporation (the “Company”), in connection with the sale through H.C. Wainwright & Co., LLC (the “Manager”)

as the sales agent from time to time by the Company of shares of the common stock of the Company, par value $0.0001 per share (the “Common

Stock”), having an aggregate offering price of up to $5,000,000 (the “Shares”), to be issued pursuant to a registration

statement on Form S-3 (No. 333-272620) filed by the Company with the Securities and Exchange Commission (the “Commission”)

on June 13, 2023 (as amended, the “Registration Statement”), the base prospectus included in the Registration Statement (the

“Base Prospectus”), a prospectus supplement dated November 8, 2024 (the “Prior Prospectus Supplement”) filed with

the Commission pursuant to Rule 424(b) of the Securities Act of 1933, as amended (the “Act”) and a prospectus supplement dated

February 7, 2025, filed with the Commission pursuant to Rule 424(b) of the Act (the “February 2025 Prospectus Supplement,”

together with the Base Prospectus and the Prior Prospectus Supplement, the “Prospectus”), and that certain At-The-Market Sales

Agreement, dated as of November 8, 2024, by and between the Company and the Manager (the “Offering Agreement”).

This opinion is being furnished in connection

with the requirements of Item 601(b)(5) of Regulation S-K under the Act, and no opinion is expressed herein as to any matter pertaining

to the contents of the Registration Statement or the Prospectus, other than as expressly stated herein with respect to the issue of the

Shares. It is understood that this opinion is to be used only in connection with the offer and sale of the Shares while the Registration

Statement is effective under the Act.

In connection with this opinion, we have examined

and relied upon originals or copies, certified or otherwise identified to our satisfaction, of the Registration Statement and the Prospectus,

the Company’s articles of incorporation and bylaws, each as currently in effect, the Agreement, and such records, documents, certificates,

memoranda and other instruments as in our judgment are necessary or appropriate to enable us to render the opinion expressed below. We

have assumed: the genuineness of all signatures, including endorsements; the legal capacity and competency of all natural persons; the

authenticity of all documents submitted to us as originals; the conformity to originals of all documents submitted to us as copies, including

facsimile, electronic, certified or photostatic copies; the authenticity of the originals of all documents submitted to us as copies;

the accuracy, completeness and authenticity of certificates of public officials; and the due authorization, execution and delivery of

all documents by all persons other than the Company where authorization, execution and delivery are prerequisites to the effectiveness

thereof. As to any facts relevant to the opinions stated herein that we did not independently establish or verify, we relied upon statements

and representations of officers and other representatives of the Company and others and of public officials and have not independently

verified such facts.

We express no opinion to the extent that future

issuances of securities of the Company and/or anti-dilution adjustments to outstanding securities of the Company cause the number of shares

of Common Stock outstanding or issuable upon conversion or exercise of outstanding securities of the Company to exceed the number of Shares

then issuable under the Agreement.

Based upon the foregoing and subject to the qualifications

and assumptions stated herein, we are of the opinion that, when the Shares are delivered to and paid for in accordance with the terms

of the Agreement, the Registration Statement and the Prospectus, and when evidence of the issuance thereof is duly recorded in the Company’s

books and records, the Shares will be validly issued, fully paid and non-assessable.

In rendering the foregoing opinion, we assumed

that (i) the Company will comply with all applicable requirements in the Nevada Revised

Statutes (the “NRS”) regarding uncertificated shares, and the transfer agent therefor will register the purchaser

of any uncertificated shares as the registered owner thereof in its stock transfer books and records, (ii) each sale of the Shares will

be duly authorized by the Company’s board of directors or a duly authorized committee thereof in accordance with the NRS, and (iii) upon

the issue of any of the Shares, the total number of shares of Common Stock issued and outstanding will not exceed the total number of

shares of Common Stock the Company is then authorized to issue under its articles of incorporation.

The opinion which we render herein is expressly

limited solely with respect to the laws of the State of Nevada and is based on such laws as in effect on the date hereof. We express no

opinion to the extent that any other laws are applicable to the subject matter hereof and we express no opinion and provide no assurance

with respect to any other laws or as to compliance with any federal or state securities law, rule or regulation.

We hereby consent to the filing of this opinion

with the Commission as an exhibit to the Company’s Current Report on Form 8-K being filed on or about the date hereof and incorporated

by reference into the Registration Statement. We also hereby consent to the reference to our firm in the “Legal Matters” section

in the Prospectus. In giving this consent, we do not thereby admit that we are within the category of persons whose consent is required

under Section 7 of the Act or the General Rules and Regulations under the Act.

This opinion is rendered as of the date first

written above and we disclaim any obligation to advise you of facts, circumstances, events or developments which hereafter may be brought

to our attention and which may alter, affect or modify the opinion expressed herein. Our opinion is expressly limited to the matters set

forth above and we render no opinion, whether by implication or otherwise, as to any other matters relating to the Company, the Shares

or any other agreements or transactions that may be related thereto or contemplated thereby. We are expressing no opinion as to any obligations

that parties other than the Company may have under or in respect of the Shares, or as to the effect that their performance of such obligations

may have upon any of the matters referred to above. No opinion may be implied or inferred beyond the opinion expressly stated above.

| |

Respectfully Submitted, |

| |

|

| |

/s/ Sheppard, Mullin, Richter & Hampton LLP |

| |

|

| |

SHEPPARD, MULLIN, RICHTER & HAMPTON LLP |

v3.25.0.1

Cover

|

Feb. 07, 2025 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Feb. 07, 2025

|

| Entity File Number |

001-38803

|

| Entity Registrant Name |

Hoth

Therapeutics, Inc.

|

| Entity Central Index Key |

0001711786

|

| Entity Tax Identification Number |

82-1553794

|

| Entity Incorporation, State or Country Code |

NV

|

| Entity Address, Address Line One |

1177

Avenue of the Americas

|

| Entity Address, Address Line Two |

5th Floor

|

| Entity Address, Address Line Three |

Suite 5066

|

| Entity Address, City or Town |

New

York

|

| Entity Address, State or Province |

NY

|

| Entity Address, Postal Zip Code |

10036

|

| City Area Code |

646

|

| Local Phone Number |

756-2997

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common

stock, $0.0001 par value

|

| Trading Symbol |

HOTH

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

true

|

| Elected Not To Use the Extended Transition Period |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 3 such as an Office Park

| Name: |

dei_EntityAddressAddressLine3 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

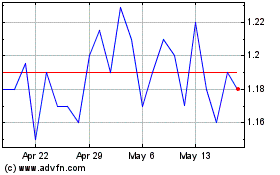

Hoth Therapeutics (NASDAQ:HOTH)

Historical Stock Chart

From Jan 2025 to Feb 2025

Hoth Therapeutics (NASDAQ:HOTH)

Historical Stock Chart

From Feb 2024 to Feb 2025