HealthEquity, Inc. (NASDAQ: HQY) ("HealthEquity" or the "Company"),

the nation's largest health savings account ("HSA") custodian,

today announced its HSAs, HSA Assets and Total Accounts as of its

fiscal year ended January 31, 2025. The Company also affirmed

its guidance for fiscal 2025 and 2026, provided an updated HSA cash

repricing schedule, and announced upcoming events and

presentations.

The total number of HSAs as of January 31, 2025 was 9.9

million, an increase of 14%, from 8.7 million as of

January 31, 2024. The Company closed its fiscal year 2025 with

17.0 million Total Accounts, an increase of 9%, from 15.7 million

as of January 31, 2024. HSA Assets grew to $32.1 billion as of

January 31, 2025, an increase of 27% from $25.2 billion a year

earlier.

"Our ongoing investments in innovations helped Team Purple drive

record results, breaking the one million new HSAs from sales

ceiling and adding nearly $7 billion in HSA Assets in fiscal 2025,"

said Scott Cutler, President and CEO of HealthEquity. "As we launch

into fiscal 2026, we are focused on accelerating and extending our

mission’s reach to empower more healthcare consumers."

Total Accounts (unaudited)

|

(in thousands, except percentages) |

January 31, 2025 |

January 31, 2024 |

% Change |

| HSAs |

9,889 |

8,692 |

14% |

| New HSAs from sales -

Quarter-to-date |

471 |

497 |

(5)% |

| New HSAs from sales -

Year-to-date |

1,040 |

949 |

10% |

| New HSAs from acquisitions -

Year-to-date |

616 |

— |

* |

| HSAs with investments |

753 |

610 |

23% |

| CDBs |

7,144 |

7,006 |

2% |

| Total Accounts |

17,033 |

15,698 |

9% |

| Average Total Accounts -

Quarter-to-date |

16,677 |

15,318 |

9% |

| Average

Total Accounts - Year-to-date |

16,302 |

15,105 |

8% |

| |

|

|

|

* Not meaningful

HSA Assets (unaudited)

|

(in millions, except percentages) |

January 31, 2025 |

|

January 31, 2024 |

|

% Change |

|

HSA cash |

$ |

17,435 |

|

$ |

15,006 |

|

16% |

| HSA investments |

|

14,676 |

|

|

10,208 |

|

44% |

| Total HSA Assets |

|

32,111 |

|

|

25,214 |

|

27% |

| Average daily HSA cash -

Quarter-to-date |

|

16,634 |

|

|

14,210 |

|

17% |

| Average

daily HSA cash - Year-to-date |

|

16,206 |

|

|

14,071 |

|

15% |

| |

|

|

|

|

|

|

|

The following table summarizes the amount of HSA cash expected

to reprice by fiscal year and the respective average annualized

yield as of January 31, 2025:

|

Year ending January 31, (in billions, except

percentages) |

HSA cash expected to reprice |

|

Average annualized yield |

|

2026 |

$ |

2.3 |

|

2.5% |

| 2027 |

|

4.1 |

|

1.9% |

| 2028 |

|

2.1 |

|

4.0% |

| 2029 |

|

1.5 |

|

3.6% |

| Thereafter |

|

6.6 |

|

4.4% |

|

Total (1) |

$ |

16.6 |

|

3.4% |

(1) Excludes $0.8 billion of HSA cash held in

floating-rate contracts as of January 31, 2025.

Business outlook

The Company affirmed its previously provided outlook for the

fiscal year ended January 31, 2025 and the fiscal year ending

January 31, 2026. Please see the Company’s press release dated

December 9, 2024 for details.

Upcoming events and presentations

The Company set the date for reporting its fourth quarter and

fiscal year 2025 results.

| HealthEquity Fourth Quarter and Fiscal Year End

2025 Results Conference Call |

| Date: |

March 18,

2025 |

| Time: |

4:30 p.m. Eastern Time / 2:30 p.m. Mountain Time |

| Dial-In: |

1-844-481-2556 (US and Canada) 1-412-317-0560

(International) |

| Conference ID: |

HealthEquity |

| Webcast: |

ir.healthequity.com |

| |

|

The Company also announced that its management team plans to

present and meet with investors at the following conference:

| Raymond James 46th Annual Institutional Investors

Conference |

|

Location: |

JW Marriott

Orlando Great Lakes |

| Date: |

March 4, 2025 |

| Time: |

1:05 p.m. Eastern Time |

| Webcast: |

None |

| |

|

About HealthEquity

HealthEquity and its subsidiaries administer HSAs and other

consumer-directed benefits for more than 17 million accounts in

partnership with employers, benefits advisors, and health and

retirement plan providers who share our vision of saving and

improving the lives of healthcare consumers. For more information,

visit www.healthequity.com.

Forward-looking statements

This press release contains and incorporates “forward-looking

statements” within the meaning of the “safe harbor” provisions of

the Private Securities Litigation Reform Act of 1995, including but

not limited to, statements regarding our industry, business

strategy, plans, goals and expectations concerning our markets and

market position, product expansion, future operations, expenses and

other results of operations, revenue, margins, profitability,

acquisition synergies, future efficiencies, tax rates, capital

expenditures, liquidity and capital resources and other financial

and operating information. When used in this discussion, the words

“may,” “believes,” “intends,” “seeks,” “aims,” “anticipates,”

“plans,” “estimates,” “expects,” “should,” “assumes,” “continues,”

“could,” “will,” “future” and the negative of these or similar

terms and phrases are intended to identify forward-looking

statements in this press release.

Forward-looking statements reflect our current expectations

regarding future events, results or outcomes. These expectations

may or may not be realized. Although we believe the expectations

reflected in the forward-looking statements are reasonable, we can

give you no assurance these expectations will prove to be correct.

Some of these expectations may be based upon assumptions, data or

judgments that prove to be incorrect. Actual events, results and

outcomes may differ materially from our expectations due to a

variety of known and unknown risks, uncertainties and other

factors. Although it is not possible to identify all of these risks

and factors, they include, among others, risks related to the

following:

- our ability to adequately place and safeguard our custodial

assets, or the failure of any of our depository or insurance

company partners;

- our ability to compete effectively in a rapidly evolving

healthcare and benefits administration industry;

- our dependence on the continued availability and benefits of

tax-advantaged HSAs and other CDBs;

- risks relating to our recent CEO transition;

- the impact of fraudulent account activity on our reputation and

financial results;

- our ability to successfully identify, acquire and integrate

additional portfolio purchases or acquisition targets;

- the significant competition we face and may face in the future,

including from those with greater resources than us;

- our reliance on the availability and performance of our

technology and communications systems;

- recent and potential future cybersecurity breaches of our

technology and communications systems and other data interruptions,

including resulting costs and liabilities, reputational damage and

loss of business;

- the current uncertain healthcare environment, including changes

in healthcare programs and expenditures and related

regulations;

- our ability to comply with current and future privacy,

healthcare, tax, ERISA, investment adviser and other laws

applicable to our business;

- our reliance on partners and third-party vendors for

distribution and important services;

- our ability to develop and implement updated features for our

technology platforms and communications systems; and

- our reliance on our management team and key team members.

For a detailed discussion of these and other risk factors,

please refer to the risks detailed in our filings with the

Securities and Exchange Commission, including, without limitation,

our Annual Report on Form 10-K for the fiscal year ended January

31, 2024, our Quarterly Reports on Form 10-Q for the quarters ended

July 31, 2024, and October 31, 2024, and other periodic and current

reports. Past performance is not necessarily indicative of future

results. We undertake no intention or obligation to update or

revise any forward-looking statements, whether as a result of new

information, future events or otherwise. Forward-looking statements

should not be relied upon as representing our views as of any date

subsequent to the date of this press release.

Investor Relations ContactRichard

Putnam801-727-1000rputnam@healthequity.com

Certain terms

|

Term |

Definition |

| HSA |

A financial account through which

consumers spend and save long-term for healthcare on a

tax-advantaged basis. |

| CDB |

Consumer-directed benefits

offered by employers, including flexible spending and health

reimbursement arrangements (“FSAs” and “HRAs”), Consolidated

Omnibus Budget Reconciliation Act (“COBRA”) administration,

commuter and other benefits. |

| HSA member |

Consumers with HSAs that we

serve. |

| Total HSA Assets |

HSA members’ custodial cash

assets held by our federally insured depository partners and our

insurance company partners. Total HSA Assets also includes HSA

members' investments in mutual funds through our custodial

investment fund partner. |

|

Total Accounts |

The sum of HSAs and CDBs on our platforms. |

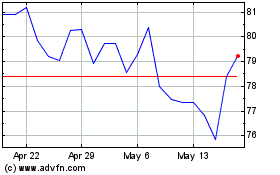

HealthEquity (NASDAQ:HQY)

Historical Stock Chart

From Jan 2025 to Mar 2025

HealthEquity (NASDAQ:HQY)

Historical Stock Chart

From Feb 2024 to Mar 2025