0001428336false00014283362025-01-132025-01-13

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported)

January 13, 2025

| | | | | | | | | | | | | | |

Delaware | | 001-36568 | | 52-2383166 |

(State or other jurisdiction of incorporation or organization) | | (Commission File Number) | | (I.R.S. Employer Identification Number) |

15 West Scenic Pointe Drive

Suite 100

Draper, Utah 84020

(801) 727-1000

(Address, including Zip Code, and Telephone Number, including Area Code, of Registrant’s Principal Executive Offices)

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common stock, par value $0.0001 per share | HQY | The NASDAQ Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 7.01 Regulation FD Disclosure

On January 13, 2025, HealthEquity, Inc. (the "Company") issued a press release, attached as Exhibit 99.1 to this current report on Form 8-K, announcing its estimated year-end sales results for its fiscal year ending January 31, 2025 and that it will discuss these results and estimates during its virtual presentation at the 43rd Annual J.P. Morgan Healthcare Conference on January 15, 2025, at 8:15 AM Pacific Time. An audio webcast of the presentation along with a copy of the Company's presentation material from the conference will be available through the investor page at the Company website: ir.healthequity.com.

The information in Exhibit 99.1 is being furnished to the Securities and Exchange Commission and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as expressly set forth by specific reference in such a filing.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits

| | | | | |

| Exhibit No. | Description |

| 99.1 | |

| 104 | Cover Page Interactive Data File (formatted in Inline XBRL) |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| HEALTHEQUITY, INC. |

| Date: January 13, 2025 | By: | | /s/ James Lucania |

| Name: | | James Lucania |

| Title: | | Executive Vice President and Chief Financial Officer |

HealthEquity Announces Record Year-End HSA Sales Outlook

Presentation at J.P. Morgan Healthcare Conference

Draper, Utah – (GLOBE NEWSWIRE) – January 13, 2025 – HealthEquity, Inc. (NASDAQ: HQY) (“HealthEquity” or the “Company”), the nation’s largest health savings account (“HSA") custodian, today announced estimates of HSAs, HSA Assets and Total Accounts for its fiscal year ending January 31, 2025, reflecting a strong sales year with record New HSAs from Sales and strong custodial HSA Asset growth.

-Estimated HSAs to be approximately 9.8 million by January 31, 2025, up from 8.7 million a year earlier.

-Estimated HSA Assets to be approximately $31 billion, up from $25.2 billion at the end of fiscal year 2024, with approximately $17 billion of HSA Cash. Invested balances included in the estimated assets are subject to market fluctuation.

-Estimated Total Accounts to be approximately 17 million compared to 15.7 million at the end of fiscal year 2024.

Commenting on the estimates, Scott Cutler, President and CEO said, “I am excited to be part of Team Purple, who together with an integrated network of over 200 Network Partners that include health and retirement plan partners, brokers and benefit advisors, delivered strong new logo growth and, nearly 1 million New HSAs from Sales. Combined with strong HSA Asset growth, and Total Account growth, we are well positioned for continued growth in FY26 and beyond.”

HealthEquity will discuss these results and estimates during a presentation by Scott Cutler, President and CEO, Steve Neeleman, Vice Chair and Founder and James Lucania, EVP and CFO, at the 43rd Annual J.P. Morgan Healthcare Conference on Wednesday, January 15, 2025, at 8:15 am Pacific Time in the Elizabethan Room of the St. Francis Hotel.

An audio webcast of the presentation along with a copy of the presentation slides will be available and archived on HealthEquity’s investor relations website at http://ir.healthequity.com.

About HealthEquity

HealthEquity and its subsidiaries administer HSAs and other consumer-directed benefits for more than 16 million accounts in partnership with employers, benefits advisors, and health and retirement plan providers who share our vision of saving and improving the lives of healthcare consumers. For more information, visit www.healthequity.com.

Forward-looking statements

This press release contains “forward-looking statements” within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995, including but not limited to, statements regarding our New HSAs from Sales, HSA Assets, Total Accounts, industry, business strategy, plans, goals and expectations concerning our markets and market position, product expansion, future operations, expenses and other results of operations, revenue, margins, profitability, acquisition synergies, future efficiencies, tax rates, capital expenditures, liquidity and capital resources and other financial and operating information. When used in this discussion, the words “may,” “believes,” “intends,” “seeks,” “aims,” “anticipates,” “plans,” “estimates,” “expects,” “should,” “assumes,” “continues,” “could,”

“will,” “future” and the negative of these or similar terms and phrases are intended to identify forward-looking statements in this press release.

Forward-looking statements reflect our current expectations regarding future events, results or outcomes. These expectations may or may not be realized. Although we believe the expectations reflected in the forward-looking statements are reasonable, we can give you no assurance these expectations will prove to be correct. Some of these expectations may be based upon assumptions, data or judgments that prove to be incorrect. Actual events, results and outcomes may differ materially from our expectations due to a variety of known and unknown risks, uncertainties and other factors. Although it is not possible to identify all of these risks and factors, they include, among others, risks related to the following:

•our ability to adequately place and safeguard our custodial assets, or the failure of any of our depository or insurance company partners;

•our ability to compete effectively in a rapidly evolving healthcare and benefits administration industry;

•our dependence on the continued availability and benefits of tax-advantaged HSAs and other CDBs;

•risks relating to our recent CEO transition;

•our ability to successfully identify, acquire and integrate additional portfolio purchases or acquisition targets;

•the significant competition we face and may face in the future, including from those with greater resources than us;

•our reliance on the availability and performance of our technology and communications systems;

•potential future cybersecurity breaches of our technology and communications systems and other data interruptions, including resulting costs and liabilities, reputational damage and loss of business;

•the current uncertain healthcare environment, including changes in healthcare programs and expenditures and related regulations;

•our ability to comply with current and future privacy, healthcare, tax, ERISA, investment adviser and other laws applicable to our business;

•our reliance on partners and third-party vendors for distribution and important services;

•our ability to develop and implement updated features for our technology platforms and communications systems; and

•our reliance on our management team and key team members.

For a detailed discussion of these and other risk factors, please refer to the risks detailed in our filings with the Securities and Exchange Commission, including, without limitation, our Annual Report on Form 10-K for the fiscal year ended January 31, 2024, our Quarterly Reports on Form 10-Q for the fiscal quarters ended July 31, 2024 and October 31, 2024, and subsequent periodic and current reports. Past performance is not necessarily indicative of future results. We undertake no intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. Forward-looking statements should not be relied upon as representing our views as of any date subsequent to the date of this press release.

Investor Relations Contact:

Richard Putnam

801-727-1000

rputnam@healthequity.com

v3.24.4

Cover Page

|

Jan. 13, 2025 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Jan. 13, 2025

|

| Entity File Number |

001-36568

|

| Entity Registrant Name |

HEALTHEQUITY, INC.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Tax Identification Number |

52-2383166

|

| Entity Address, Address Line One |

15 West Scenic Pointe Drive

|

| Entity Address, Address Line Two |

Suite 100

|

| Entity Address, City or Town |

Draper

|

| Entity Address, State or Province |

UT

|

| Entity Address, Postal Zip Code |

84020

|

| City Area Code |

801

|

| Local Phone Number |

727-1000

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common stock, par value $0.0001 per share

|

| Trading Symbol |

HQY

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0001428336

|

| Amendment Flag |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

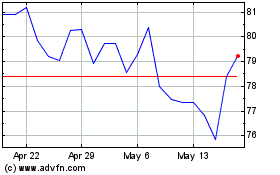

HealthEquity (NASDAQ:HQY)

Historical Stock Chart

From Jan 2025 to Mar 2025

HealthEquity (NASDAQ:HQY)

Historical Stock Chart

From Feb 2024 to Mar 2025