Melt Pharmaceuticals Closes $24 Million Series B Preferred Stock Financing

02 April 2024 - 11:16PM

Business Wire

MELT-300 Pivotal Phase 3 Program Topline

Readout Expected in Q4 2024

Melt Pharmaceuticals, Inc. (“Melt”), a clinical‑stage

pharmaceutical company developing novel approaches for procedural

sedation, today announced the completion of its Series B Preferred

Stock financing of approximately $24 million from new and existing

investors at a pre‑money valuation that increased nearly 150% from

the pre-money valuation for Melt’s Series A Preferred Stock

financing in 2019. The capital raised will primarily support the

further development of MELT-300, including the MELT-300 Phase 3

program. MELT-300, a non-IV, non‑opioid tablet that combines fixed

doses of midazolam (3mg) and ketamine (50mg), is administered

sublingually using Catalent Inc.’s proprietary fast‑dissolving

Zydis® delivery technology to rapidly dissolve the tablet for

absorption across the very thin sublingual mucosa. The MELT-300

Phase 3 program commenced in the first quarter of 2024, with first

patient dosing expected in the second quarter of 2024 and a topline

readout expected in the fourth quarter of 2024.

“Melt is seeking to drive a paradigm shift in procedural

sedation, fulfilling an unmet need to provide a needle- and

opioid-free alternative for procedural sedation, especially in

cataract surgeries, which are estimated at over 4.5 million

procedures in the U.S. As we continue to develop our patented

technologies, we believe we can also impact the more than 100

million short-duration medical procedures nationwide,” said Dr.

Larry Dillaha, Chief Executive Officer of Melt. “If approved, we

expect MELT-300 will enhance the patient’s experience in all sites

of care by offering greater comfort without a needle stick and by

reducing exposure to opioids.

“With this round of financing, we’ve obtained the funding to

further the development of MELT-300, including conducting our

recently commenced Phase 3 program. We are grateful for the ongoing

support from our current investors and are pleased to welcome new

investors to our company. Their shared belief in the vision of

MELT-300 and their confidence in its potential to revolutionize

short-duration procedural sedation is incredibly valuable to

us.”

Newbridge Securities Corporation acted as the exclusive

placement agent for the Series B Preferred Stock Offering.

About Melt Pharmaceuticals

Melt Pharmaceuticals, Inc. is a clinical-stage pharmaceutical

company focused on developing proprietary non-opioid, non-IV,

sedation, and analgesia therapeutics for human medical procedures

in the hospital, outpatient, and in-office settings. Melt intends

to seek regulatory approval through the FDA’s 505(b)(2) regulatory

pathway for its proprietary, patented small-molecule product

candidates, where possible. Melt’s core intellectual property is

the subject of multiple granted patents in North America, Europe,

Asia, and the Middle East. Melt Pharmaceuticals, Inc. is a former

subsidiary of Harrow, Inc. (Nasdaq: HROW) and was carved out as a

separately managed business in 2019. To learn more about Melt,

please visit their website, www.meltpharma.com.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240402844928/en/

Investor Contact: Larry Dillaha, M.D. Chief Executive

Officer ldillaha@meltpharma.com

Media Contact: Deb Holliday Holliday Communications, Inc.

deb@hollidaycommunications.net 412-877-4519

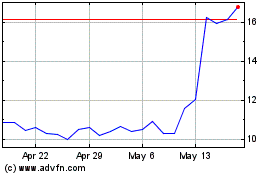

Harrow (NASDAQ:HROW)

Historical Stock Chart

From Jan 2025 to Feb 2025

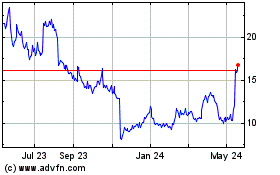

Harrow (NASDAQ:HROW)

Historical Stock Chart

From Feb 2024 to Feb 2025