falseICU MEDICAL INC/DE000088398400008839842025-02-272025-02-27

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported) February 27, 2025

ICU MEDICAL, INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Delaware | | 001-34634 | | 33-0022692 |

(State or other jurisdiction of incorporation) | | (Commission File Number) | | (IRS Employer Identification No.) |

| | | | | | | | | | | | | | | | | | | | |

| 951 Calle Amanecer | , | San Clemente | , | California | | 92673 |

| (Address of principal executive offices) | | (Zip Code) |

(949) 366-2183

Registrant's telephone number, including area code

N/A

(Former name or former address, if changed since last report)

| | | | | | | | |

| Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions: |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol | Name of each exchange on which registered |

| Common stock, par value $0.10 per share | ICUI | The Nasdaq Stock Market LLC |

| (Global Select Market) |

| | | | | | | | | | | | | | |

| Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). |

| Emerging growth company | ☐ | | |

| If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

|

Item 2.02. Results of Operations and Financial Condition

On February 27, 2025, ICU Medical, Inc. issued a press release announcing its financial results for the fourth quarter and fiscal year of 2024. A copy of this press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated in Item 2.02 by reference.

Item 9.01. Financial Statements and Exhibits.

| | | | | | | | |

| (d) | | Exhibits |

| |

| Press release, dated February 27, 2025 announcing ICU Medical, Inc.'s fourth quarter 2024 earnings. |

| 104 | | Cover Page Interactive Data File (the instance document does not appear in the Interactive Data File because its XBRL tags are embedded within the Inline XBRL document) |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | | | | | | | | | | |

| | | | | | |

| | | | | ICU MEDICAL, INC. |

| | | |

| Date: February 27, 2025 | | | | By: | | /s/ Brian M. Bonnell |

| | | | | | Brian M. Bonnell |

| | | | | | Chief Financial Officer and Treasurer |

Exhibit 99.1

ICU Medical Announces Fourth Quarter 2024 Results

and Provides Fiscal Year 2025 Guidance

SAN CLEMENTE, Calif., February 27, 2025 (GLOBE NEWSWIRE) -- ICU Medical, Inc. (Nasdaq:ICUI), a leader in the development, manufacture and sale of innovative medical products, today announced financial results for the quarterly period ended December 31, 2024.

Fourth Quarter 2024 Results

Fourth quarter 2024 revenue was $629.8 million, as compared to $587.9 million in the same period in the prior year. GAAP gross profit for the fourth quarter of 2024 was $227.3 million, as compared to $171.6 million in the same period in the prior year. GAAP gross margin for the fourth quarter of 2024 was 36.1%, as compared to 29.2% in the same period in the prior year. GAAP net loss for the fourth quarter of 2024 was $(23.8) million, or $(0.97) per diluted share, as compared to GAAP net loss of $(17.1) million, or $(0.71) per diluted share, for the fourth quarter of 2023. Adjusted diluted earnings per share for the fourth quarter of 2024 was $2.11 as compared to $1.57 for the fourth quarter of 2023. Adjusted EBITDA was $105.5 million for the fourth quarter of 2024 as compared to $86.3 million for the fourth quarter of 2023.

Adjusted EBITDA and adjusted diluted earnings per share are measures calculated and presented on the basis of methodologies other than in accordance with GAAP. Please refer to the Use of Non-GAAP Financial Information following the financial statements herein for further discussion and reconciliations of these measures to GAAP measures.

Vivek Jain, ICU Medical’s Chief Executive Officer, said, “Fourth quarter results were generally in line with our expectations with the exception of higher IV solutions revenues due to the U.S. market shortage."

Revenues by product line for the three and twelve months ended December 31, 2024 and 2023 were as follows (in millions):

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three months ended

December 31, | | | | Twelve months ended

December 31, | | |

| Product Line | | 2024 | | 2023 | | $ Change | | 2024 | | 2023 | | $ Change |

| Consumables | | $ | 268.1 | | $ | 254.0 | | $ | 14.1 | | $ | 1,038.9 | | $ | 969.1 | | $ | 69.8 |

| Infusion Systems | | 171.7 | | 165.1 | | 6.6 | | 652.4 | | 629.0 | | 23.4 |

| Vital Care* | | 190.0 | | 168.7 | | 21.3 | | 690.7 | | 661.0 | | 29.7 |

| Total** | | $ | 629.8 | | $ | 587.8 | | $ | 42.0 | | $ | 2,382.0 | | $ | 2,259.1 | | $ | 122.9 |

*Vital Care includes Pfizer contract manufacturing revenue of $8.2 million and $46.8 million for the three and twelve months ended December 31, 2024, respectively, as compared to $12.1 million and $45.7 million for the three and twelve months ended December 31, 2023.

** Totals may differ from the income statement due to the rounding of product lines.

Fiscal Year 2025 Guidance

For fiscal year 2025 the Company estimates GAAP net loss to be in the range of $(45) million to $(28) million and GAAP net loss per share estimated to be in the range of $(1.81) to $(1.11).

For the fiscal year 2025, excluding the potential impact from the Company's previously announced IV Solutions joint venture transaction, the Company expects adjusted EBITDA to be in the range of $395 million to $425 million, and adjusted EPS to be in the range of $6.55 to $7.25. The Company anticipates the IV Solutions joint venture will close during the second quarter of 2025 and, if so, is expected to reduce the 2025 adjusted EBITDA guidance by $15 million to $20 million and be neutral to adjusted EPS.

Conference Call

The Company will host a conference call to discuss its fourth quarter 2024 financial results, today at 4:30 p.m. ET (1:30 p.m. PT). The call can be accessed at (800) 445-7795, conference ID "ICUMED". The conference call will be simultaneously available by webcast, which can be accessed by going to the Company's website at www.icumed.com, clicking on the Investors tab, clicking on Event Calendar and clicking on the Webcast icon and following the prompts. The webcast will also be available by replay.

About ICU Medical

ICU Medical (Nasdaq: ICUI) is a global leader in infusion systems, infusion consumables and high-value critical care products used in hospital, alternate site and home care settings. Our team is focused on providing quality, innovation and value to our clinical customers worldwide. ICU Medical is headquartered in San Clemente, California. More information about ICU Medical can be found at www.icumed.com.

Forward-Looking Statements

This press release contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Such statements contain words such as ''will,'' ''expect,'' ''believe,'' ''could,'' ''would,'' ''estimate,'' ''continue,'' ''build,'' ''expand'' or the negative thereof or comparable terminology and may include (without limitation) information regarding the Company's expectations, goals and intentions regarding the future and financial outlook for 2025 and expected impacts from the IV Solutions joint venture. These forward-looking statements are based on management's current expectations, estimates, forecasts and projections about the Company and assumptions management believes are reasonable, all of which are subject to risks and uncertainties that could cause actual results and events to differ materially from those stated in the forward-looking statements. These risks and uncertainties include, but are not limited to: the Company’s ability to compete successfully; decreased demand for the Company's products; costs related to product development; cost volatility or loss of supply of raw materials; inflation, tariffs and foreign currency exchange rates; impacts from global macroeconomic and geopolitical conditions; healthcare costs and reimbursement levels; disruptions at the FDA and other governmental agencies; damage at the Company’s manufacturing or supply facilities; risks associated with the IV Solutions joint venture; and the other important factors described under “Risk Factors” in the Company's Quarterly Reports on Form 10-Q for the quarterly period ended September 30, 2024, as such factors may be updated from time to time in the Company’s reports filed with the SEC, including without limitation its Annual Report on Form 10-K for the fiscal year ended December 31, 2024. Forward-looking statements contained in this press release are made only as of the date hereof, and the Company undertakes no obligation to update or revise the forward-looking statements, whether as a result of new information, future events or otherwise unless required by law.

ICU MEDICAL, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE SHEETS (Unaudited)

(In thousands)

| | | | | | | | | | | |

| | December 31,

2024 | | December 31,

2023 |

| | | | |

| ASSETS | | | |

| CURRENT ASSETS: | | | |

| Cash and cash equivalents | $ | 308,566 | | $ | 254,222 |

| Short-term investment securities | — | | 501 |

| TOTAL CASH, CASH EQUIVALENTS AND SHORT-TERM INVESTMENT SECURITIES | 308,566 | | 254,723 |

| Accounts receivable, net of allowance for doubtful accounts | 182,828 | | 161,566 |

| Inventories | 584,676 | | 709,360 |

| Prepaid income taxes | 11,244 | | 21,983 |

| Prepaid expenses and other current assets | 70,287 | | 73,640 |

| Assets held for sale | 284,382 | | — |

| TOTAL CURRENT ASSETS | 1,441,983 | | 1,221,272 |

| | | |

| PROPERTY, PLANT AND EQUIPMENT, net | 442,746 | | 612,909 |

| OPERATING LEASE RIGHT-OF-USE ASSETS | 53,295 | | 69,909 |

| | | |

| GOODWILL | 1,432,772 | | 1,472,446 |

| INTANGIBLE ASSETS, net | 740,789 | | 870,588 |

| DEFERRED INCOME TAXES | 24,211 | | 37,295 |

| OTHER ASSETS | 68,135 | | 94,020 |

| TOTAL ASSETS | $ | 4,203,931 | | $ | 4,378,439 |

| | | |

| LIABILITIES AND STOCKHOLDERS’ EQUITY | | | |

| CURRENT LIABILITIES: | | | |

| Accounts payable | $ | 148,020 | | $ | 150,030 |

| Accrued liabilities | 306,923 | | 268,215 |

| Current portion of long-term debt | 51,000 | | 51,000 |

| Income tax payable | 17,328 | | 7,714 |

| Contingent earn-out liability | — | | 4,879 |

| Liabilities held for sale | 32,911 | | — |

| TOTAL CURRENT LIABILITIES | 556,182 | | 481,838 |

| | | |

| CONTINGENT EARN-OUT LIABILITY | — | | 3,991 |

| LONG-TERM DEBT | 1,531,858 | | 1,577,770 |

| OTHER LONG-TERM LIABILITIES | 66,745 | | 100,497 |

| DEFERRED INCOME TAXES | 48,814 | | 55,873 |

| INCOME TAX LIABILITY | 35,097 | | 35,060 |

| COMMITMENTS AND CONTINGENCIES | | | |

| STOCKHOLDERS’ EQUITY: | | | |

| Convertible preferred stock, $1.00 par value; Authorized — 500 shares; Issued and outstanding — none | — | | — |

| Common stock, $0.10 par value; Authorized — 80,000 shares; Issued —24,518 and 24,144 shares at December 31, 2024 and December 31, 2023, respectively, and outstanding — 24,517 and 24,141 shares at December 31, 2024 and December 31, 2023, respectively | 2,452 | | 2,414 |

| Additional paid-in capital | 1,412,118 | | 1,366,493 |

| Treasury stock, at cost | (92) | | (262) |

| Retained earnings | 690,158 | | 807,846 |

| Accumulated other comprehensive loss | (139,401) | | (53,081) |

| TOTAL STOCKHOLDERS' EQUITY | 1,965,235 | | 2,123,410 |

| TOTAL LIABILITIES AND STOCKHOLDERS' EQUITY | $ | 4,203,931 | | $ | 4,378,439 |

ICU MEDICAL, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS (Unaudited)

(In thousands, except per share data)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three months ended

December 31, | | Twelve months ended

December 31, |

| 2024 | | 2023 | | 2024 | | 2023 |

| TOTAL REVENUES | $ | 629,805 | | $ | 587,856 | | $ | 2,382,046 | | $ | 2,259,126 |

| COST OF GOODS SOLD | 402,547 | | 416,271 | | 1,557,264 | | 1,519,253 |

| GROSS PROFIT | 227,258 | | 171,585 | | 824,782 | | 739,873 |

| OPERATING EXPENSES: | | | | | | | |

| Selling, general and administrative | 158,849 | | 154,617 | | 638,762 | | 606,693 |

| Research and development | 22,355 | | 22,411 | | 88,615 | | 85,344 |

| Restructuring, strategic transaction and integration | 9,771 | | 10,731 | | 59,840 | | 41,258 |

| Change in fair value of contingent earn-out | (1,408) | | (3,991) | | (5,399) | | (16,247) |

| | | | | | | |

| TOTAL OPERATING EXPENSES | 189,567 | | 183,768 | | 781,818 | | 717,048 |

| INCOME (LOSS) FROM OPERATIONS | 37,691 | | (12,183) | | 42,964 | | 22,825 |

| INTEREST EXPENSE, net | (23,457) | | (24,408) | | (95,753) | | (95,219) |

| OTHER EXPENSE, net | (6,017) | | (90) | | (13,223) | | (5,905) |

| INCOME (LOSS) BEFORE INCOME TAXES | 8,217 | | (36,681) | | (66,012) | | (78,299) |

| (PROVISION) BENEFIT FOR INCOME TAXES | (32,045) | | 19,534 | | (51,676) | | 48,644 |

| NET LOSS | $ | (23,828) | | $ | (17,147) | | $ | (117,688) | | $ | (29,655) |

| NET LOSS PER SHARE | | | | | | | |

| Basic | $ | (0.97) | | $ | (0.71) | | $ | (4.83) | | $ | (1.23) |

| Diluted | $ | (0.97) | | $ | (0.71) | | $ | (4.83) | | $ | (1.23) |

| WEIGHTED AVERAGE NUMBER OF SHARES | | | | | | | |

| Basic | 24,492 | | 24,140 | | 24,388 | | 24,091 |

| Diluted | 24,492 | | 24,140 | | 24,388 | | 24,091 |

ICU MEDICAL, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS (Unaudited)

(In thousands)

| | | | | | | | | | | |

| Twelve months ended

December 31, |

| | 2024 | | 2023 |

| CASH FLOWS FROM OPERATING ACTIVITIES: | | | |

| Net loss | $ | (117,688) | | | $ | (29,655) | |

| Adjustments to reconcile net loss to net cash provided by operating activities: | | | |

| Depreciation and amortization | 219,512 | | | 228,774 | |

| | | |

| Noncash lease expense | 21,344 | | | 21,910 | |

| Provision for doubtful accounts | 5,800 | | | 838 | |

| Provision for warranty, returns and field action | 1,130 | | | 21,582 | |

| Stock compensation | 46,883 | | | 40,563 | |

| Loss on disposal of property, plant and equipment and other assets | 2,522 | | | 2,109 | |

| | | |

| | | |

| Debt issuance costs amortization | 6,807 | | | 6,814 | |

| Change in fair value of contingent earn-out liability | (5,399) | | | (16,247) | |

| | | |

| Usage of spare parts | 18,298 | | | 17,050 | |

| Other | 7,393 | | | 8,066 | |

| Changes in operating assets and liabilities, net of amounts acquired: | | | |

| Accounts receivable | (46,844) | | | 48,635 | |

| Inventories | 16,829 | | | (6,079) | |

| Prepaid expenses and other current assets | (8,829) | | | 11,672 | |

| Other assets | (23,154) | | | (24,695) | |

| Accounts payable | 12,531 | | | (68,301) | |

| Accrued liabilities | 20,668 | | | (14,479) | |

| Income taxes, including excess tax benefits and deferred income taxes | 26,230 | | | (82,356) | |

| Net cash provided by operating activities | 204,033 | | | 166,201 | |

| CASH FLOWS FROM INVESTING ACTIVITIES: | | | |

| Purchases of property, plant and equipment | (79,373) | | | (83,893) | |

| Proceeds from sale of assets | 746 | | | 1,501 | |

| | | |

| Intangible asset additions | (10,833) | | | (9,777) | |

| | | |

| | | |

| Proceeds from sale and maturities of investment securities | 500 | | | 4,222 | |

| Net cash used in investing activities | (88,960) | | | (87,947) | |

| CASH FLOWS FROM FINANCING ACTIVITIES: | | | |

| | | |

| Principal repayments of long-term debt | (51,000) | | | (29,688) | |

| | | |

| Proceeds from exercise of stock options | 10,939 | | | 4,022 | |

| Payments on finance leases | (1,147) | | | (963) | |

| Payments of contingent earn-out liability | (2,600) | | | — | |

| Tax withholding payments related to net share settlement of equity awards | (11,992) | | | (9,350) | |

| Net cash used in financing activities | (55,800) | | | (35,979) | |

| Effect of exchange rate changes on cash | (4,929) | | | 3,163 | |

| NET INCREASE IN CASH AND CASH EQUIVALENTS | 54,344 | | | 45,438 | |

| CASH AND CASH EQUIVALENTS, beginning of period | 254,222 | | | 208,784 | |

| CASH AND CASH EQUIVALENTS, end of period | $ | 308,566 | | | $ | 254,222 | |

Use of Non-GAAP Financial Information

This press release contains financial measures that are not calculated in accordance with U.S. generally accepted accounting principles ("GAAP"). The non-GAAP financial measures should be considered supplemental to, and not as a substitute for, or superior to, financial measures calculated in accordance with GAAP. There are material limitations in using these non-GAAP financial measures because they are not prepared in accordance with GAAP and may not be comparable to similarly titled non-GAAP financial measures used by other companies, including peer companies. Our management believes that the non-GAAP data provides useful supplemental information to management and investors regarding our performance and facilitates a more meaningful comparison of results of operations between current and prior periods. We use non-GAAP financial measures in addition to and in conjunction with GAAP financial measures to analyze and assess the overall performance of our business, in making financial, operating and planning decisions, and in determining executive incentive compensation.

The non-GAAP financial measures include adjusted EBITDA, adjusted revenue, adjusted gross profit, adjusted selling, general and administrative, adjusted research and development, adjusted restructuring, strategic transaction and integration, adjusted change in fair value of contingent earn-out, adjusted income (loss) from operations, adjusted other expense, net, adjusted income (loss) before income taxes, adjusted (provision) benefit for income taxes, adjusted net (loss) income and adjusted diluted (loss) earnings per share, all of which exclude special items because they are highly variable or unusual and impact year-over-year comparisons.

For the three months ended December 31, 2024 and 2023, special items include the following:

Contract manufacturing: We manufacture certain products for Pfizer in accordance with a manufacturing services agreement. We do not include the contract revenue in our adjusted revenue as the commercial relationship under this agreement was originally negotiated contemporaneously with a business combination and is not indicative of a normal market transaction.

Stock compensation expense: Stock-based compensation is generally fixed at the time the stock-based instrument is granted and amortized over a period of several years. The value of stock options is determined using a complex formula that incorporates factors, such as market volatility, that are beyond our control. The value of our restricted stock awards is determined using the grant date stock price, which may not be indicative of our operational performance over the expense period. Additionally, in order to establish the fair value of performance-based stock awards, which are currently an element of our ongoing stock-based compensation, we are required to apply judgment to estimate the probability of the extent to which performance objectives will be achieved. Based on the above factors, we believe it is useful to exclude stock-based compensation in order to better understand our operating performance.

Intangible asset amortization expense: We do not acquire businesses or capitalize certain patent costs on a predictable cycle. The amount of purchase price allocated to intangible assets and the term of amortization can vary significantly and are unique to each acquisition. Capitalized patent costs can vary significantly based on our current level of development activities. We believe that excluding amortization of intangible assets provides the users of our financial statements with a consistent basis for comparison across accounting periods.

Depreciation expense reduction - Assets Held For Sale Classification: Once classified as held for sale, depreciation expense is not recorded for any long-lived assets included in the disposal group even though these assets continue to be utilized in the normal course of business. As such, we adjust for the impact of the discontinuation of depreciation with respect to assets classified as held for sale during the period as these unique transactions may limit the comparability of our ongoing operations with prior and future periods.

Restructuring, strategic transaction and integration: We incur restructuring and strategic transaction charges that result from events, which arise from unforeseen circumstances and/or often occur outside of the ordinary course of our ongoing business. Although these events are reflected in our GAAP financial statements, these unique transactions may limit the comparability of our ongoing operations with prior and future periods.

Change in fair value of contingent earn-out: We exclude the impact of certain amounts recorded in connection with business combinations. We exclude items that are either non-cash or not normal, recurring operating expenses due to their nature, variability of amounts, and lack of predictability as to occurrence and/or timing.

Quality system and product-related remediation: We exclude certain quality system and product-related remediation charges in determining our non-GAAP financial measures as they may limit the comparability of our ongoing operations with prior and future periods and distort the evaluation of our normal operating performance.

Legal settlement: Occasionally, we are involved in legal proceedings that may result in one-time legal settlements. We exclude these settlements as they have no direct correlation to the operation of our ongoing business.

Asset write-offs and similar charges: Occasionally, we may write-off certain assets or we may sell certain assets. We exclude the non-cash gain/loss on the write-off/sale of these assets in determining our non-GAAP financial measures as they may limit the comparability of our ongoing operations with prior and future periods and distort the evaluation of our normal operating performance.

From time to time in the future, there may be other items that we may exclude if we believe that doing so is consistent with the goal of providing useful information to investors and management.

In addition to the above special items, Adjusted EBITDA additionally excludes the following items from net income:

Depreciation expense: We exclude depreciation expense in deriving adjusted EBITDA because companies utilize productive assets of different ages and the depreciable lives can vary significantly resulting in considerable variability in depreciation expense among companies.

Interest, net: We exclude interest in deriving adjusted EBITDA as interest can vary significantly among companies depending on a company's level of income generating instruments and/or level of debt.

Taxes: We exclude taxes in deriving adjusted EBITDA as taxes are deemed to be non-core to the business and may limit the comparability of our ongoing operations with prior and future periods and distort the evaluation of our normal operating performance.

Adjusted Diluted EPS excludes from diluted EPS, net of tax, the special items listed above. The tax effect on the special items is calculated using the specific tax rate applied to each adjustment based on the nature of the item/or the tax jurisdiction in which the item has been recorded. Additionally, adjusted diluted EPS may exclude the income tax impact of certain non-recurring discrete tax items that are not reflective of income tax expense/benefit incurred as a result of current period earnings/ loss, as well as the impact of certain deferred tax valuation allowances when assessed against non-GAAP profitability.

We also present Free cash flow as a non-GAAP financial measure as management believes that this is an important measure for use in evaluating overall company financial performance as it measures our ability to generate additional cash flow from business operations. Free cash flow should be considered in addition to, rather than as a substitute for, net income as a measure of our performance or net cash provided by operating activities as a measure of our liquidity. Additionally, our definition of free cash flow is limited and does not represent residual cash flows available for discretionary expenditures due to the fact that the measure does not deduct the payments required for debt service and other obligations or payments made for business acquisitions. Therefore, we believe it is important to view free cash flow as supplemental to our entire statement of cash flows.

The following tables reconcile our non-GAAP financial measures for the periods presented:

ICU MEDICAL, INC. AND SUBSIDIARIES

Reconciliation of GAAP to Non-GAAP Financial Measures (Unaudited)

(In thousands, except per share data)

| | | | | | | | | | | |

| Adjusted EBITDA |

| Three months ended

December 31, |

| 2024 | | 2023 |

| GAAP net loss | $ | (23,828) | | $ | (17,147) |

| | | |

| Non-GAAP adjustments: | | | |

| Interest, net | 23,457 | | 24,408 |

| Stock compensation expense | 12,517 | | 10,685 |

| Depreciation and amortization expense | 52,993 | | 57,159 |

| Restructuring, strategic transaction and integration | 9,771 | | 10,731 |

| Change in fair value of contingent earn-out | (1,408) | | (3,991) |

| | | |

| Quality system and product-related charges | (32) | | 24,003 |

| Asset write-offs and similar charges | — | | (48) |

| | | |

| Provision (Benefit) for income taxes | 32,045 | | (19,534) |

| Total non-GAAP adjustments | 129,343 | | 103,413 |

| | | |

| Adjusted EBITDA | $ | 105,515 | | $ | 86,266 |

ICU MEDICAL, INC. AND SUBSIDIARIES

Reconciliation of GAAP to Non-GAAP Financial Measures (Unaudited)

(In thousands, except percentages and per share)

The Company’s U.S. GAAP results for the three months ended December 31, 2024 included special items which impacted the U.S. GAAP measures as follows:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Total revenues | Gross profit | Selling, general and administrative | Research and development | Restructuring, strategic transaction and integration | Change in fair value of contingent earn-out | Income from operations | | Income before income taxes | Provision for income taxes | Net (loss) income | Diluted (loss) earnings per share |

| Reported (GAAP) | $ | 629,805 | | $ | 227,258 | | $ | 158,849 | | $ | 22,355 | | $ | 9,771 | | $ | (1,408) | | $ | 37,691 | | | $ | 8,217 | | $ | (32,045) | | $ | (23,828) | | $ | (0.97) | |

| Reported percent of total revenues (or percent of (loss) income before income taxes for benefit (provision) for income taxes) | | 36 | % | 25 | % | 4 | % | 2 | % | — | % | 6 | % | | 1 | % | 390.0 | % | (4) | % | |

| Contract manufacturing | (8,181) | | — | | — | | — | | — | | — | | — | | | — | | — | | — | | |

| Stock compensation expense | — | | 1,721 | | (10,090) | | (706) | | — | | — | | 12,517 | | | 12,517 | | (3,004) | | 9,513 | | 0.39 | |

| Amortization expense | — | | 1,038 | | (32,794) | | — | | — | | — | | 33,832 | | | 33,832 | | (8,220) | | 25,612 | | 1.04 | |

| Depreciation expense reduction - assets held for sale classification | — | | (2,149) | | — | | — | | — | | — | | (2,149) | | | (2,149) | | 516 | | (1,633) | | (0.07) | |

| Restructuring, strategic transaction and integration | — | | — | | — | | — | | (9,771) | | — | | 9,771 | | | 9,771 | | (4,745) | | 5,026 | | 0.20 | |

| Change in fair value of contingent earn-out | — | | — | | — | | — | | — | | 1,408 | | (1,408) | | | (1,408) | | — | | (1,408) | | (0.06) | |

| | | | | | | | | | | | |

| Quality system and product-related remediation | — | | (32) | | — | | — | | — | | — | | (32) | | | (32) | | 36 | | 4 | | — | |

| | | | | | | | | | | | |

| Tax expense from valuation allowance* | — | | — | | — | | — | | — | | — | | — | | | — | | 38,789 | | 38,789 | | 1.57 | |

| | | | | | | | | | | | |

| Adjusted (Non-GAAP)** | $ | 621,624 | | $ | 227,836 | | $ | 115,965 | | $ | 21,649 | | $ | — | | $ | — | | $ | 90,222 | | | $ | 60,748 | | $ | (8,673) | | $ | 52,075 | | $ | 2.11 | |

| Adjusted percent of total revenues (or percent of (loss) income before income taxes for benefit (provision) for income taxes) | | 37 | % | 19 | % | 3 | % | — | % | — | % | 15 | % | | 10 | % | 14.3 | % | 8 | % | |

_______________________

* The Company’s non-GAAP annual effective tax rate is calculated without the tax expense related to the valuation allowance against certain U.S. Federal and State deferred tax assets. The valuation allowance was recorded based on an assessment of available positive and negative evidence, including, predominantly, an estimate that we will be in a three-year cumulative U.S. loss position on a GAAP basis as of December 31, 2024. However, based on the same assessment, including, predominantly, our being, in a three-year cumulative U.S. income position on a non-GAAP basis, which excludes the impact of our non-GAAP adjustments, we concluded that recording a valuation allowance would not have been appropriate for non-GAAP reporting. As a result, the tax expense for the valuation allowance was added back to our calculation of non-GAAP annual effective tax rate.

** Amounts may not foot due to rounding.

ICU MEDICAL, INC. AND SUBSIDIARIES

Reconciliation of GAAP to Non-GAAP Financial Measures (Unaudited)(continued)

(In thousands, except percentages and per share)

The Company’s U.S. GAAP results for the three months ended December 31, 2023 included special items which impacted the U.S. GAAP measures as follows:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Total revenues | Gross profit | Selling, general and administrative | Research and development | Restructuring, strategic transaction and integration | Change in fair value of contingent earn-out | (Loss) income from operations | Other expense, net | (Loss) income before income taxes | Benefit (provision) for income taxes | Net (loss) income | Diluted (loss) earnings per share |

| Reported (GAAP) | $ | 587,856 | | $ | 171,585 | | $ | 154,617 | | $ | 22,411 | | $ | 10,731 | | $ | (3,991) | | $ | (12,183) | | $ | (90) | | $ | (36,681) | | $ | 19,534 | | $ | (17,147) | | $ | (0.71) | |

| Reported percent of total revenues (or percent of (loss) income before income taxes for benefit (provision) for income taxes) | | 29 | % | 26 | % | 4 | % | 2 | % | (1) | % | (2) | % | — | % | (6) | % | 53.3 | % | (3) | % | |

| Contract manufacturing | (12,112) | | — | | — | | — | | — | | — | | — | | — | | — | | — | | — | | |

| Stock compensation expense | — | | 1,732 | | (8,503) | | (450) | | — | | — | | 10,685 | | — | | 10,685 | | (2,564) | | 8,121 | | 0.33 | |

| Amortization expense | — | | — | | (33,255) | | — | | — | | — | | 33,255 | | — | | 33,255 | | (8,139) | | 25,116 | | 1.03 | |

| Restructuring, strategic transaction and integration | — | | — | | — | | — | | (10,731) | | — | | 10,731 | | — | | 10,731 | | (2,589) | | 8,142 | | 0.33 | |

| Change in fair value of contingent earn-out | — | | — | | — | | — | | — | | 3,991 | | (3,991) | | — | | (3,991) | | — | | (3,991) | | (0.16) | |

| | | | | | | | | | | | |

| Quality system and product-related remediation | — | | 24,003 | | — | | — | | — | | — | | 24,003 | | — | | 24,003 | | (5,931) | | 18,072 | | 0.74 | |

| Asset write-offs and similar charges | — | | — | | — | | — | | — | | — | | — | | (48) | | (48) | | — | | (48) | | — | |

| | | | | | | | | | | | |

| Adjusted (Non-GAAP)* | $ | 575,744 | | $ | 197,320 | | $ | 112,859 | | $ | 21,961 | | $ | — | | $ | — | | $ | 62,500 | | $ | (138) | | $ | 37,954 | | $ | 311 | | $ | 38,265 | | $ | 1.57 | |

| Adjusted percent of total revenues (or percent of (loss) income before income taxes for benefit (provision) for income taxes) | | 34 | % | 20 | % | 4 | % | — | % | — | % | 11 | % | — | % | 7 | % | (0.8) | % | 7 | % | |

_____________

* Amounts may not foot due to rounding

ICU MEDICAL, INC. AND SUBSIDIARIES

Reconciliation of Net Cash Provided by Operating Activities to Free Cash Flow (Unaudited)

(In thousands)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three months ended

December 31, | | Twelve months ended

December 31, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Net cash provided by operating activities | $ | 40,192 | | | 91,269 | | | $ | 204,033 | | | $ | 166,201 | |

| Purchase of property, plant and equipment | (24,081) | | | (29,937) | | | (79,373) | | | (83,893) | |

| Proceeds from sale of assets | 51 | | | 20 | | | 746 | | | 1,501 | |

| Free cash flow | $ | 16,162 | | | $ | 61,352 | | | $ | 125,406 | | | $ | 83,809 | |

ICU MEDICAL, INC. AND SUBSIDIARIES

Fiscal Year 2025

Outlook (Unaudited)

(In millions, except per share data)

| | | | | | | | | | | |

| Low End of Guidance | | High End of Guidance |

| GAAP net loss | $ | (45) | | $ | (28) |

| | | |

| Non-GAAP adjustments: | | | |

| Interest, net | 95 | | 95 |

| Stock compensation expense | 54 | | 54 |

| Depreciation and amortization expense | 217 | | 217 |

| Restructuring, strategic transaction and integration | 43 | | 43 |

| Quality and regulatory initiatives and remediation | 50 | | 50 |

| Benefit for income taxes | (19) | | (6) |

| Total non-GAAP adjustments | $ | 440 | | $ | 453 |

| | | |

| Adjusted EBITDA | $ | 395 | | $ | 425 |

| | | |

| | | |

| GAAP loss per share | $ | (1.81) | | $ | (1.11) |

| | | |

| Non-GAAP adjustments: | | | |

| Stock compensation expense | 2.18 | | 2.18 |

| Amortization expense | 5.56 | | 5.56 |

| Restructuring, strategic transaction and integration | 1.73 | | 1.73 |

| Quality and regulatory initiatives and remediation | 2.02 | | 2.02 |

| Depreciation expense reduction - assets held for sale classification | (0.48) | | (0.48) |

| Estimated income tax impact from adjustments | (2.65) | | (2.65) |

| Adjusted earnings per share | $ | 6.55 | | $ | 7.25 |

CONTACT:

ICU Medical, Inc.

Brian Bonnell, Chief Financial Officer

(949) 366-2183

ICR, Inc.

John Mills, Partner

(646) 277-1254

v3.25.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

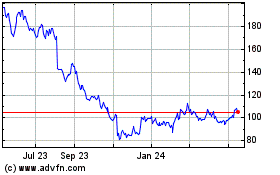

ICU Medical (NASDAQ:ICUI)

Historical Stock Chart

From Jan 2025 to Mar 2025

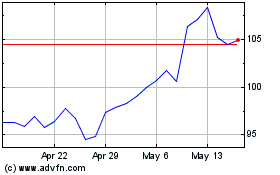

ICU Medical (NASDAQ:ICUI)

Historical Stock Chart

From Feb 2024 to Mar 2025