UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

Form

6-K

REPORT

OF FOREIGN PRIVATE ISSUER

PURSUANT

TO RULE 13a-16 OR 15d-16 UNDER

THE

SECURITIES EXCHANGE ACT OF 1934

For

the Month of February 2025

Commission

File Number: 001-38104

IMMURON

LIMITED

(Name

of Registrant)

Level

3, 62 Lygon Street, Carlton South, Victoria, 3053, Australia

(Address

of principal executive office)

Indicate

by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form

20-F ☒ Form 40-F ☐

Indicate

by check mark whether by furnishing the information contained in this Form, the registrant is also thereby furnishing the information

to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes

☐ No ☒

If

“Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): 82-

IMMURON

LIMITED

EXPLANATORY

NOTE

Immuron

Limited (the “Company”) published one announcement (the “Public Notices”) to the Australian Securities Exchange

on February 28, 2025 titled:

| - | “Appendix

4D and Half Year Report” |

A

copy of the Public Notice is attached as an exhibit to this report on Form 6-K.

This

report on Form 6-K (including the exhibit hereto) shall not be deemed to be “filed” for purposes of the Securities Exchange

Act of 1934, as amended (the “Exchange Act”) and shall not be incorporated by reference into any filing under the Securities

Act of 1933, as amended, except as shall be expressly set forth by specific reference in such filing.

EXHIBITS

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned, thereunto duly authorized.

| |

IMMURON LIMITED |

| |

|

|

| Date: February 28, 2025 |

By: |

/s/ Phillip

Hains |

| |

|

Phillip Hains |

| |

|

Company Secretary |

Exhibit 99.1

Immuron

Limited

Appendix 4D

Half-year report

1. Company details

| Name of entity: |

Immuron Limited |

| ABN: |

80 063 114 045 |

| Reporting period: |

For the period ended 31 December 2024 |

| Previous period: |

For the period ended 31 December 2023 |

2. Results for announcement to the market

| | |

| |

| | |

| |

$ | |

| Revenue from ordinary activities | |

up | |

| 69.6 | % | |

to | |

| 3,994,341 | |

| Loss from ordinary activities after tax attributable to the members of Immuron Limited | |

up | |

| 20.0 | % | |

to | |

| (2,488,819 | ) |

| Loss for the period attributable to the members of Immuron Limited | |

up | |

| 20.0 | % | |

to | |

| (2,488,819 | ) |

3. Net tangible assets

|

| | |

Consolidated | |

| | |

31 December 2024 | | |

31 December 2023 | |

| | |

Cents | | |

Cents | |

| Net tangible asset backing (per share) | |

| 4.46 | | |

| 7.62 | |

The calculation of net tangible assets excludes right-of-use

assets arising from AASB 16 Leases.

4. Explanation of results

An explanation of the key financial elements contributing to

the revenue and result above can be found in the review of operations included within the directors’ report.

5. Distributions

No dividends have been paid or declared by the company for

the current financial period. No dividends were paid for the previous financial period.

6. Changes in controlled entities

There have been no changes in controlled entities during the

period ended 31 December 2024.

7. Details of associates and joint venture entities

| | |

| |

31 December 2024 | | |

31 December 2023 | |

| Name of entity | |

Place of business/country of incorporation | |

% | | |

% | |

| Ateria Health Limited | |

United Kingdom | |

| 23.6 | % | |

| 17.5 | % |

8. Interim review

The financial statements have been reviewed by the group’s

independent auditor without any modified opinion, disclaimer or emphasis of matters.

Immuron

Limited

ABN

80 063 114 045

Interim

financial report

for

the half-year ended 31 December 2024

Immuron

Limited

Contents

31 December 2024

| Review of operations and activities |

2 |

| Directors’ report |

6 |

| Auditor’s independence declaration |

7 |

| Consolidated statement of profit or loss and other comprehensive income |

9 |

| Consolidated statement of financial position |

10 |

| Consolidated statement of changes in equity |

11 |

| Consolidated statement of cash flows |

12 |

| Notes to the consolidated financial statements |

13 |

| Directors’ declaration |

21 |

| Independent auditor’s review report to the members of Immuron Limited |

22 |

This

interim financial report does not include all the notes of the type normally included in an annual financial report. Accordingly, this

report should be read in conjunction with the annual report for the year ended 30 June 2024 and any public announcements made by Immuron

Limited during the interim reporting period in accordance with the continuous disclosure requirements of the Corporations Act 2001.

Immuron

Limited

Review

of operations and activities

31

December 2024

Review

of operations and activities

Key

highlights

| ● | Record

sales of A$4.0 million for HY25, up A$1.6 million on FY24 |

| ● | Immuron

Plans Phase 2 Trial for IMM-529 following FDA review |

| ● | Updated

peak sales US forecast by Lumanity for IMM-529: in C.difficile infection increased from US$93 million to US$400 million following

positive FDA feedback on pre-IND filing |

| ● | Uniformed

Services University Travelan® clinical field trial reaches 100% recruitment |

| ● | Travelan®

(IMM-124E) Phase 2 Clinical Study Report submitted to the FDA |

| ● | Travelan®

(IMM-124E) Phase 2 Clinical Study Statistically Significant Immunology Results |

| ● | Travelan®

(IMM-124E) Phase 2 Clinical Study Statistically Significant Microbiome Responses |

| ● | Immuron

Announces New Research Collaboration targeting Antimicrobial Resistance |

Financial

review

Immuron

Limited has reported a loss for the half-year ended 31 December 2024 of A$2,488,819 (31 December 2023: A$2,073,182).

The

group’s net assets decreased to A$10,339,516 compared with A$12,709,484 at 30 June 2024, including cash reserves of A$7,736,399 (30 June

2024: A$11,657,315).

Revenue

from ordinary activities for the half-year ended 31 December 2024 was A$3,994,341 (31 December 2023: A$2,355,580) for Hyperimmune products.

Gross

profit of A$2,657,049 (31 December 2023: A$1,580,348).

Operating loss of A$2,538,791 (31 December 2023: A$2,020,028).

Record

half yearly sales of A$4.0 million for HY25 up A$1.6 million on HY24

Australia:

Sales of Travelan® increased to AUD $2.9 million in HY25, compared to AUD $1.9 million in HY24. Sales increased by $1.0 million (54%).

USA:

Sales of Travelan® increased to AUD $0.7 million in HY25, compared to AUD $0.5 million in HY24. Sales increased by $0.2 million (52%).

Canada:

Sales of Travelan® increased to AUD $0.4 million in HY25 compared to zero in HY24.

Immuron

submits IMM-529 pre-IND to FDA

Immuron

filed a pre-IND (investigational new drug) application with the United States Food and Drug Administration (FDA) for IMM529. The increased

incidence of antibiotic resistant ‘superbugs’ has amplified the use of broad-spectrum antibiotics worldwide. An unintended

consequence of antimicrobial treatment is disruption of the gastrointestinal microbiota, resulting in susceptibility to opportunistic

pathogens, such as Clostridioides difficile (C. diff). Paradoxically, treatment of Clostridioides difficile infection (CDI) also involves

antibiotic use, and the heavy reliance on antibiotics to control C. diff does not allow for the gut flora to regenerate and predisposes

the patient to relapsing CDI.

C.

diff is currently the most common pathogen in healthcare associated infections and was deemed an urgent threat in the Center for Disease

Control and Prevention’s report on antibiotic resistance threats in the United States (CDC, 2019). CDI affects over 400,000 people

in the US on a yearly basis, contributing to over 30,000 deaths in the US alone annually. This serious health threat has led to an urgent

call for the development of new therapeutics to reduce or replace the use of antibiotics to treat bacterial infections.

To

address this need, Immuron is developing IMM-529 as an adjunctive therapy in combination with standard of care antibiotics for the prevention

and/or treatment of recurrent CDI. IMM-529 antibodies targeting C. diff may help to clear CDI infection and promote a quicker re-establishment

of normal gut flora, providing an attractive oral preventative for recurrent CDI.

Immuron

is collaborating with Dr. Dena Lyras and her team at Monash University, Australia to develop vaccines to produce bovine colostrum-derived

antibodies. Dairy cows were immunised to generate hyperimmune bovine colostrum (HBC) that contains antibodies targeting three essential

C. diff virulence components.

Immuron

Limited

Review

of operations and activities

31

December 2024

IMM-529

targets Toxin B (TcB), the spores and the surface layer proteins of the vegetative cells. This unique 3-target approach has yielded promising

results in pre-clinical infection and relapse models, including (1) Prevention of primary disease (80% P =0.0052); (2) Protection of

disease recurrence (67%, P 0.01) and (3) Treatment of primary disease (78.6%, P0.0001; TcB HBC). Importantly IMM-529 antibodies cross-react

with whole cell lysates of many different human strains of C. diff including hypervirulent strains. To our knowledge, IMM-529 is, to

date, the only investigational drug that has shown therapeutic potential in all three phases of the disease. https://doi.org/10.1038/s41598-017-03982-5

Immuron

achieves record Travelan® sales

| Global |

HY 2025 AUD$4.0

million up 70% on prior comparative period (pcp) |

| |

December 2024 Quarter AUD$2.5

million up 249% on pcp and 70% on prior quarter |

| |

|

| Australia |

HY 2025 AUD$2.9 million

up 54% on pcp |

| |

December 2024 Quarter AUD$1.9

million up 314% on pcp and 83% on prior quarter |

| |

|

| USA |

HY 2025 AUD$0.7 million

up 52% on pcp |

| |

December 2024 Quarter AUD$0.4

million up 65% on pcp; up 58% on prior quarter |

| |

|

| Canada |

HY 2025 AUD$0.4 million;

pcp was zero |

Immuron

provides IMM-124E (Travelan®) Phase 2 additional data analysis of Protective Efficacy

| - | Further

analysis of the Phase 2 Study found that some subjects did not experience any diarrhoea until after antibiotics were administered |

| - | Diarrhoea

could be related to antibiotic administration |

| - | Protective

Efficacy was calculated for the 5-day period post challenge |

| - | There

were 4 subjects in the Travelan® group that did not experience any diarrhoea until antibiotics were administered |

| - | There

was a 43.8% reduction in diarrhoea in the Travelan® group which is approaching statistical significance (p=0.066) |

| - | Analysis

all safety data set (63 subjects) and additional 3 subjects who were not challenged |

| - | Considers

all Adverse Events and number of events over the whole study period pre and post challenge |

| - | Number

of events is reduced in the Travelan® treated group for all organ classes |

Immuron

Announces New U.S. Department of Defense Research Award for Naval Medical Research Command and Walter Reed Army Institute of Research

to advance Travelan®

The

U.S. Department of Defense has funded a new program for the Naval Medical Research Command and Walter Reed Army Institute of Research

to develop enhanced formulations of Travelan® potentially expanding the coverage of the product as a therapeutic against endemic

military relevant diarrheal pathogens. This work will utilize the extensive experience of the U.S. Department of Defense human infectious

disease vaccine programs and will target key protective antigens of the major enteric bacterial pathogens Campylobacter, Shigella and

Enterotoxigenic E. coli strains not present in the current product formulation. Immuron will negotiate a sub award for this new collaboration

with NMRC and WRAIR to advance this research.

Immuron

Plans Phase 2 Trial for IMM-529 following FDA review

Immuron

received favourable feedback from the United States Food and Drug Administration (FDA) on the pre-IND (investigational new drug) information

package to support the clinical development of IMM-529. Following the FDA’s guidance and feedback, the Company now plans to file

an investigational new drug (IND) application for IMM-529 to prevent or treat Clostridioides difficile infection (CDI) during the first

half of 2025, followed by a Phase 2 trial of IMM-529 in individuals with Clostridioides difficile infection.

Immuron

Limited

Review

of operations and activities

31

December 2024

NMRC

Reports Results for Campylobacter Controlled Human Infection Model Study

The

Naval Medical Research Command completed the interim analysis for the clinical evaluation of a new oral therapeutic targeting Campylobacter

and Enterotoxigenic Escherichia coli (ETEC).

Trial

Conclusions:

| - | CampETEC

was well-tolerated |

| - | No

moderate or severe adverse events were reported |

| - | CampETEC

did not significantly prevent campylobacteriosis |

| - | Regimen

dose of CampETEC not enough / too many bacteria in the inoculum |

| - | Targeting

the polysaccharide capsule may not prevent epithelial cell invasion |

Future Direction:

| o | New

vaccine candidates which target Campylobacter (e.g. whole cells and Surface layer proteins of the flagellum, a whip-like appendage that

enables bacterial motility) for the development of HBC |

| - | USD

$2.3 million funding for NMRC and Walter Reed Army Institute of Research (WRAIR) approved by the U.S. |

Department of Defense

| o | This

work will utilize the extensive experience of the US Department of Defense human infectious disease vaccine programs, and one part of

this program will target key protective antigens of the enteric bacterial pathogen campylobacter |

Immuron

CEO provides key updates at 21st Virtual Investor Summit Microcap Event

| - | Travelan®

(IMM-124E) Travelan® Uniformed Services University IMM-124E Phase 4 trial NCT04605783 reaches recruitment of ~90% of 866 participants;

post-conference: 100% recruitment was achieved in February 2025 |

| - | Updated

peak sales US forecast by Lumanity for IMM-529: in C.difficile infection increased from US$93 million to US$400 million following

positive FDA feedback on pre-IND filing |

| - | Travelan®

was the #1 SKU in the Antidiarrheal category across Chemist Warehouse pharmacy in Australia (IQVIA Australia Pharmacy Scan - Antidiarrheal

segment, value sales 4 weeks to 28 September 2024) |

| - | Immuron

achieves record monthly sales in October 2024 of A$1.49 million (unaudited) |

Immuron

Limited

Review

of operations and activities

31

December 2024

Immuron

Announces Travelan® Clinical Trial Update

Travelan®

(IMM-124E) Phase 2 Clinical Study

NCT05933525:

A Randomized, Double-blind, Placebo-controlled Trial Assessing the Efficacy of IMM-124E (Travelan®) in a Controlled Human Infection

Model for Enterotoxigenic Escherichia Coli (ETEC)

Immunology

Statistically

significant lower levels of IgA and IgG were observed for the subjects who received Travelan® compared to those who received

the placebo, which may also reflect levels of exposure to ETEC antigen. Travelan® antibodies target and bind to ETEC antigen in the

gastrointestinal tract, block LPS epitopes and therefore reduce antigen exposure, resulting in lower overall IgA and IgG antibody titers.

Clinical

data also demonstrated there was a statistically significant reduction in the number of colony forming units (CFUs) in

the stools of subjects who received Travelan® (p =0.0121), measured 48 hours post challenge, indicating faster clearance of the challenge

strain from the GI tract.

Microbiome

Participants

in the Travelan® group have a more stable gastrointestinal microbiota over the treatment time period when compared with the Placebo

group. Alpha diversity, a measurement of the richness (how many different species) and evenness (abundance or number of different species)

revealed that the Travelan group had improved richness and Shannon diversity results compared to the Placebo group. The data indicated

a difference in the richness in the diversity of certain species rather than just the abundance or number of bacterial species between

the two groups.

Statistically

significant differences were identified between the two treatment groups in the Beta diversity tests (number of species and abundance).

The relative abundance results revealed that the Travelan group had increased levels of beneficial bacteria such as Akkermansia and Faecalibacterium.

The differential abundance results confirmed increases in Agathobaculum, Slackia the Eubacterium eligens group, and the Eubacterium siraeum

group; and decreases in Rumminococcus and Bacteroides. The abundance data indicates a possible link between the species of bacteria associated

with reduced inflammation.

This

study data implies that Travelan® appears to aid in the reduction and clearance over time of pathological ETEC bacteria, by shortening

the recovery period after ETEC challenge. The mechanism indicates there is an increase in the propagation of bacteria associated with

decreases in inflammation and repairing the intestinal lining. Further investigation into this association is required to fully understand

the benefits of Travelan® on the gut microbiome.

Immuron

Announces New Research Collaboration targeting Antimicrobial Resistance

Immuron

announced a new research collaboration with Monash University. The major objective of this research collaboration is to develop new therapeutic

drug candidates which target antimicrobial resistant pathogens. This work will utilize the Immuron technology platform, and the extensive

experience of the Biomedicine Discovery Institute research team lead by Professor Dena Lyras.

The

first project proposal will focus on the underlying mechanisms which bacteria utilise to share and transfer their DNA. A process which

can rapidly alter the functional capacity and characteristics of a bacterium, resulting in the emergence of antimicrobial resistance

(AMR) with the aim to develop broad spectrum therapeutic drug products.

The

second project proposal will specifically target Vancomycin-resistant enterococci (VRE) and as the name suggests VRE are bacteria that

are resistant to the antibiotic vancomycin. VRE are opportunistic nosocomial pathogens that have emerged as a major healthcare problem

worldwide. The two most clinically significant enterococci, Enterococcus faecalis and Enterococcus faecium, are associated with a range

of nosocomial infections in elderly and immunosuppressed patients. VRE complicates outcomes for at-risk patients, increasing their risk

of developing subsequent infections and/or transmitting VRE to other patients. VRE colonisation has been associated with an increased

risk of bacteremia, infections at other body sites and can also lead, in severe cases, to mortality.

The

global market for antibiotics is projected to reach $57.0 billion by 2026 with a compound annual growth rate (CAGR) of 4.0%. The rising

prevalence of drug-resistant infections, including VRE, is expected to drive the demand for new and innovative treatments in this space.

Immuron

Limited

Directors'

report

31

December 2024

The

directors present their report, together with the financial statements, on the consolidated entity (referred to hereafter as the ‘group’)

consisting of Immuron Limited (referred to hereafter as the ‘company’ or ‘parent entity’) and the entities it controlled at the end of,

or during, the period ended 31 December 2024.

Directors

The

following persons were directors of Immuron Limited during the whole of the financial period and up to the date of this report, unless

otherwise stated:

Mr Paul Brennan, Independent Non-Executive Chairman

Mr Daniel Pollock, Independent Non-Executive Director

Prof. Ravi Savarirayan, Independent Non-Executive Director

Dr. Jeannette Joughin, Independent Non-Executive Director

Principal

activities

We

are a commercial and clinical-stage biopharmaceutical company with a proprietary technology platform focused on the development and commercialisation

of a novel class of specifically targeted polyclonal antibodies in the treatment of diseases associated with the gastrointestinal tract.

We believe that we can address this significant unmet medical need. Our polyclonal antibodies are orally active and offer localised delivery

within the gastrointestinal (“GI”) tract. As our products do not cross from the gut into the bloodstream, they potentially

offer much improved safety and tolerability, without sacrificing efficacy. We currently market our flagship commercial products Travelan®

and Protectyn® in Australia, both products are listed medicines on the Australian Register for Therapeutic Goods. Travelan® is

an over-the-counter product indicated to reduce the risk of traveller’s’ diarrhoea and is sold in pharmacies throughout Australia.

Protectyn® is currently sold online and in health practitioner clinics and is marketed as an immune supplement to help maintain a

healthy digestive function and liver. We also market Travelan® in Canada where it is licensed as a natural health product indicated

to reduce the risk of traveller’s’ diarrhoea, and presently market Travelan® in the U.S. as a dietary supplement for digestive

tract protection.

We

believe that our lead drug candidates, currently in clinical development have the potential to transform the existing treatment paradigms

for Enterotoxigenic Escherichia coli (ETEC) infections, traveller’s’ diarrhoea and for Clostridioides difficile infections.

Review

of operations

Information

on the financials and operations of the group and its business strategies and prospects is set out in the review of operations and activities

on pages 2 to 5 of this interim financial report.

Auditor’s

independence declaration

A

copy of the auditor’s independence declaration as required under section 307C of the Corporations Act 2001 is set out immediately after

this directors’ report.

This report is made in

accordance with a resolution of directors, pursuant to section 306(3)(a) of the Corporations Act 2001.

On behalf of the directors

|

|

Mr Paul Brennan

Independent Non-Executive Chairman

28 February 2025 |

|

| |

Grant

Thornton Audit Pty Ltd

Level 22 Tower 5

Collins Square

727 Collins Street

Melbourne VIC 3008

GPO Box 4736

Melbourne VIC 3001

T +61 3 8320 2222 |

Auditor’s

Independence Declaration

To

the Directors of Immuron Limited

In

accordance with the requirements of section 307C of the Corporations Act 2001, as lead auditor for the review of Immuron Limited

for the half-year ended 31 December 2024. I declare that, to the best of my knowledge and belief, there have been:

| a | no

contraventions of the auditor independence requirements of the Corporations Act 2001 in relation to the review; and |

| b | no

contraventions of any applicable code of professional conduct in relation to the review. |

Grant

Thornton Audit Pty Ltd

Chartered Accountants

T

S Jackman

Partner

– Audit & Assurance

Melbourne, 28 February 2025

www.grantthornton.com.au

ACN-130

913 594

Grant

Thornton Audit Pty Ltd ACN 130 913 594 a subsidiary or related entity of Grant Thornton Australia Limited ABN 41 127 556 389 ACN 127

556 389. ‘Grant Thornton’ refers to the brand under which the Grant Thornton member firms provide assurance, tax and advisory

services to their clients and/or refers to one or more member firms, as the context requires. Grant Thornton Australia Limited is a member

firm of Grant Thornton International Ltd (GTIL). GTIL and the member firms are not a worldwide partnership. GTIL and each member firm

is a separate legal entity. Services are delivered by the member firms. GTIL does not provide services to clients. GTIL and its member

firms are not agents of, and do not obligate one another and are not liable for one another’s acts or omissions. In the Australian

context only, the use of the term ‘Grant Thornton’ may refer to Grant Thornton Australia Limited ABN 41 127 556 389 ACN 127

556 389 and its Australian subsidiaries and related entities. Liability limited by a scheme approved under Professional Standards Legislation.

Immuron

Limited

Consolidated

statement of profit or loss and other comprehensive income

For

the period ended 31 December 2024

| | |

| | |

Consolidated | |

| | |

| | |

31 December | | |

31 December | |

| | |

Note | | |

2024 | | |

2023 | |

| | |

| | |

$ | | |

$ | |

| | |

| | |

| | |

| |

| Revenue from contracts with customers | |

| 2 | | |

| 3,994,341 | | |

| 2,355,580 | |

| Cost of goods sold | |

| | | |

| (1,337,292 | ) | |

| (775,232 | ) |

| Gross profit | |

| | | |

| 2,657,049 | | |

| 1,580,348 | |

| Other income | |

| 3 | | |

| 572,150 | | |

| 2,485,353 | |

| Other gains/(losses) | |

| | | |

| 74,088 | | |

| (750,560 | ) |

| Total other income including gains/(losses) | |

| | | |

| 646,238 | | |

| 1,734,793 | |

| Expenses | |

| | | |

| | | |

| | |

| General and administrative expenses | |

| | | |

| (2,257,765 | ) | |

| (1,949,230 | ) |

| Research and development expenses | |

| | | |

| (1,982,138 | ) | |

| (2,653,086 | ) |

| Selling and marketing expenses | |

| | | |

| (1,602,175 | ) | |

| (732,853 | ) |

| Operating loss | |

| | | |

| (2,538,791 | ) | |

| (2,020,028 | ) |

| Finance income | |

| | | |

| 53,993 | | |

| 153,508 | |

| Finance expenses | |

| | | |

| (4,021 | ) | |

| (4,007 | ) |

| Share of loss from equity accounted associate | |

| 12 | | |

| - | | |

| (202,655 | ) |

| Loss before income tax expense | |

| | | |

| (2,488,819 | ) | |

| (2,073,182 | ) |

| Income tax expense | |

| | | |

| - | | |

| - | |

| Loss after income tax expense for the period attributable to the members of Immuron Limited | |

| | | |

| (2,488,819 | ) | |

| (2,073,182 | ) |

| Other comprehensive income/(loss) | |

| | | |

| | | |

| | |

| Items that may be reclassified subsequently to profit or loss | |

| | | |

| | | |

| | |

| Exchange differences on translation of foreign operations (expense)/income | |

| | | |

| (13,608 | ) | |

| 4,441 | |

| Other comprehensive (loss)/income for the period | |

| | | |

| (13,608 | ) | |

| 4,441 | |

| Total comprehensive loss for the period | |

| | | |

| (2,502,427 | ) | |

| (2,068,741 | ) |

| Loss per share for profit attributable to the ordinary equity holders of the company: | |

| | |

Cents | | |

Cents | |

| Basic earnings per share | |

| 13 | | |

| (1.09 | ) | |

| (0.91 | ) |

| Diluted earnings per share | |

| 13 | | |

| (1.09 | ) | |

| (0.91 | ) |

The

above consolidated statement of profit or loss and other comprehensive income should be read in conjunction with the accompanying notes

Immuron

Limited

Consolidated

statement of financial position

As

at 31 December 2024

| | |

| | |

Consolidated | |

| | |

| | |

31 December | | |

30 June | |

| | |

Note | | |

2024 | | |

2024 | |

| | |

| | |

$ | | |

$ | |

| Assets | |

| | |

| | |

| |

| Current assets | |

| | |

| | |

| |

| Cash and cash equivalents | |

| | | |

| 7,736,398 | | |

| 11,657,315 | |

| Trade and other receivables | |

| 4 | | |

| 2,241,336 | | |

| 1,387,573 | |

| Inventories | |

| | | |

| 1,516,761 | | |

| 1,584,608 | |

| Other current assets | |

| | | |

| 260,850 | | |

| 96,841 | |

| Total current assets | |

| | | |

| 11,755,345 | | |

| 14,726,337 | |

| Non-current assets | |

| | | |

| | | |

| | |

| Property, plant and equipment | |

| | | |

| 135,180 | | |

| 154,347 | |

| Inventories | |

| | | |

| 279,229 | | |

| 669,285 | |

| Total non-current assets | |

| | | |

| 414,409 | | |

| 823,632 | |

Total

assets | |

| | | |

| 12,169,754 | | |

| 15,549,969 | |

| | |

| | | |

| | | |

| | |

| Liabilities | |

| | | |

| | | |

| | |

| Current liabilities | |

| | | |

| | | |

| | |

| Trade and other payables | |

| | | |

| 1,287,603 | | |

| 2,135,852 | |

| Employee benefits | |

| | | |

| 397,945 | | |

| 522,571 | |

| Other current liabilities | |

| | | |

| 43,182 | | |

| 40,556 | |

| Total current liabilities | |

| | | |

| 1,728,730 | | |

| 2,698,979 | |

| Non-current liabilities | |

| | | |

| | | |

| | |

| Employee benefits | |

| | | |

| 9,073 | | |

| 8,605 | |

| Other non-current liabilities | |

| | | |

| 92,435 | | |

| 132,941 | |

| Total non-current liabilities | |

| | | |

| 101,508 | | |

| 141,546 | |

| | |

| | | |

| | | |

| | |

Total

liabilities | |

| | | |

| 1,830,238 | | |

| 2,840,525 | |

| | |

| | | |

| | | |

| | |

| Net assets | |

| | | |

| 10,339,516 | | |

| 12,709,444 | |

| | |

| | | |

| | | |

| | |

| Equity | |

| | | |

| | | |

| | |

| Issued capital | |

| 5 | | |

| 88,587,043 | | |

| 88,504,043 | |

| Reserves | |

| 6 | | |

| 2,249,821 | | |

| 3,173,797 | |

| Accumulated losses | |

| | | |

| (80,497,348 | ) | |

| (78,968,396 | ) |

| Total equity | |

| | | |

| 10,339,516 | | |

| 12,709,444 | |

The

above consolidated statement of financial position should be read in conjunction with the accompanying notes

Immuron

Limited

Consolidated

statement of changes in equity

For

the period ended 31 December 2024

| | |

Issued

capital | | |

Reserves | | |

Accumulated

losses | | |

Total equity | |

| Consolidated | |

$ | | |

$ | | |

$ | | |

$ | |

| | |

| | |

| | |

| | |

| |

| Balance at 1 July 2023 | |

| 88,436,263 | | |

| 3,235,969 | | |

| (72,055,396 | ) | |

| 19,616,836 | |

| | |

| | | |

| | | |

| | | |

| | |

| Loss after income tax expense for the period | |

| - | | |

| - | | |

| (2,073,182 | ) | |

| (2,073,182 | ) |

| Other comprehensive income | |

| - | | |

| 4,441 | | |

| - | | |

| 4,441 | |

| Total comprehensive income/(loss) for the period | |

| - | | |

| 4,441 | | |

| (2,073,182 | ) | |

| (2,068,741 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Transactions with members in their capacity as members: | |

| | | |

| | | |

| | | |

| | |

| Options and warrants issued/expensed (net of adjustments) | |

| - | | |

| (21,580 | ) | |

| - | | |

| (21,580 | ) |

| Balance at 31 December 2023 | |

| 88,436,263 | | |

| 3,218,830 | | |

| (74,128,578 | ) | |

| 17,526,515 | |

| | |

Issued

capital | | |

Reserves | | |

Accumulated

losses | | |

Total equity | |

| Consolidated | |

$ | | |

$ | | |

$ | | |

$ | |

| | |

| | |

| | |

| | |

| |

| Balance at 1 July 2024 | |

| 88,504,043 | | |

| 3,173,797 | | |

| (78,968,396 | ) | |

| 12,709,444 | |

| | |

| | | |

| | | |

| | | |

| | |

| Loss after income tax expense for the period | |

| - | | |

| - | | |

| (2,488,819 | ) | |

| (2,488,819 | ) |

| Other comprehensive loss for the period | |

| - | | |

| (13,608 | ) | |

| - | | |

| (13,608 | ) |

| Total comprehensive loss for the period | |

| - | | |

| (13,608 | ) | |

| (2,488,819 | ) | |

| (2,502,427 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Transactions with members in their capacity as members: | |

| | | |

| | | |

| | | |

| | |

| Expired options (Note 6) | |

| - | | |

| (959,867 | ) | |

| 959,867 | | |

| - | |

| Options and Warrants expensed (Note 6) | |

| - | | |

| 48,303 | | |

| - | | |

| 48,303 | |

| Exercise of Performance rights (Note 6) | |

| 83,000 | | |

| (83,000 | ) | |

| - | | |

| - | |

| Issue of Performance Rights (Note 6) | |

| - | | |

| 84,196 | | |

| - | | |

| 84,196 | |

| Balance at 31 December 2024 | |

| 88,587,043 | | |

| 2,249,821 | | |

| (80,497,348 | ) | |

| 10,339,516 | |

The

above consolidated statement of changes in equity should be read in conjunction with the accompanying notes

Immuron

Limited

Consolidated

statement of cash flows

For

the period ended 31 December 2024

| | |

Consolidated | |

| | |

31 December | | |

31 December | |

| | |

2024 | | |

2023 | |

| | |

$ | | |

$ | |

| Cash flows from operating activities | |

| | |

| |

| Receipts from customers (inclusive of GST) | |

| 3,678,705 | | |

| 2,227,615 | |

| Payments to suppliers (inclusive of GST) | |

| (7,980,132 | ) | |

| (6,332,678 | ) |

| Australian R&D tax incentive refund | |

| - | | |

| 395,002 | |

| Grants received from government and non-government sources | |

| 308,043 | | |

| 1,706,225 | |

| | |

| | | |

| | |

| Net cash used in operating activities | |

| (3,993,384 | ) | |

| (2,003,836 | ) |

| | |

| | | |

| | |

| Cash flows from investing activities | |

| | | |

| | |

| Interest received | |

| 53,993 | | |

| 153,508 | |

| | |

| | | |

| | |

| Net cash from investing activities | |

| 53,993 | | |

| 153,508 | |

| | |

| | | |

| | |

| Cash flows from financing activities | |

| | | |

| | |

| Principal elements of lease payments | |

| (37,880 | ) | |

| (19,163 | ) |

| Interest and other costs of finance paid | |

| (4,021 | ) | |

| (4,007 | ) |

| | |

| | | |

| | |

| Net cash used in financing activities | |

| (41,901 | ) | |

| (23,170 | ) |

| | |

| | | |

| | |

| Net decrease in cash and cash equivalents | |

| (3,981,292 | ) | |

| (1,873,498 | ) |

| Cash and cash equivalents at the beginning of the financial period | |

| 11,657,315 | | |

| 17,159,764 | |

| Effects of exchange rate changes on cash and cash equivalents | |

| 60,375 | | |

| (72,804 | ) |

| | |

| | | |

| | |

| Cash and cash equivalents at the end of the financial period | |

| 7,736,398 | | |

| 15,213,462 | |

The

above consolidated statement of cash flows should be read in conjunction with the accompanying notes

Immuron

Limited

Notes

to the consolidated financial statements

31

December 2024

1.

Segment and revenue information Description of segments and principle activities

The

group has identified its operating segments based on the internal reports that are reviewed and used by the executive management team

in assessing performance and determining the allocation of resources.

Management

considers the business from both a product and a geographic perspective and has identified two reportable segments:

| ● |

Research

and development (R&D): income and expense directly attributable to the group’s R&D projects performed

in

Australia and United States. |

| |

|

| ● |

Hyperimmune products:

income and expenses directly attributable to Travelan and Protectyn activities which occur predominantly in Australia, the Unites

States and Canada. |

Segment

results

| Consolidated entity | |

Research and | | |

Hyperimmune | | |

| | |

| |

| 31 December 2024 | |

development | | |

products | | |

Corporate | | |

Total | |

| | |

$ | | |

$ | | |

$ | | |

$ | |

| Hyperimmune products revenue | |

| - | | |

| 3,994,341 | | |

| - | | |

| 3,994,341 | |

| Cost of sales of goods | |

| - | | |

| (1,337,292 | ) | |

| - | | |

| (1,337,292 | ) |

| Gross profit | |

| - | | |

| 2,657,049 | | |

| - | | |

| 2,657,049 | |

| | |

| | | |

| | | |

| | | |

| | |

| Other income | |

| 562,628 | | |

| 9,522 | | |

| - | | |

| 572,150 | |

| Other gains/(losses) – net | |

| - | | |

| - | | |

| 74,088 | | |

| 74,088 | |

| | |

| | | |

| | | |

| | | |

| | |

| General and administrative expenses/adjustments | |

| - | | |

| - | | |

| (2,257,765 | ) | |

| (2,257,765 | ) |

| Research and development expenses | |

| (1,982,138 | ) | |

| - | | |

| - | | |

| (1,982,138 | ) |

| Selling and marketing expenses | |

| - | | |

| (1,602,175 | ) | |

| - | | |

| (1,602,175 | ) |

| Operating profit/(loss) | |

| (1,419,510 | ) | |

| 1,064,396 | | |

| (2,183,677 | ) | |

| (2,538,791 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Finance income | |

| - | | |

| - | | |

| 53,993 | | |

| 53,993 | |

| Finance costs | |

| - | | |

| - | | |

| (4,021 | ) | |

| (4,021 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Share of loss from equity accounted associate | |

| - | | |

| - | | |

| - | | |

| - | |

| Profit/(loss) for the period | |

| (1,419,510 | ) | |

| 1,064,396 | | |

| (2,133,705 | ) | |

| (2,488,819 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Assets | |

| | | |

| | | |

| | | |

| | |

| Segment assets | |

| 1,060,582 | | |

| 2,944,262 | | |

| 8,164,910 | | |

| 12,169,754 | |

| Total assets | |

| 1,060,582 | | |

| 2,944,262 | | |

| 8,164,910 | | |

| 12,169,754 | |

| | |

| | | |

| | | |

| | | |

| | |

| Liabilities | |

| | | |

| | | |

| | | |

| | |

| Segment liabilities | |

| 772,144 | | |

| 358,880 | | |

| 699,214 | | |

| 1,830,238 | |

| Total liabilities | |

| 772,144 | | |

| 358,880 | | |

| 699,214 | | |

| 1,830,238 | |

Immuron

Limited

Notes

to the consolidated financial statements

31

December 2024

1. Segment and revenue information (continued)

| Consolidated entity | |

Research and | | |

Hyperimmune | | |

| | |

| |

| 31 December 2023 | |

development | | |

products | | |

Corporate | | |

Total | |

| | |

$ | | |

$ | | |

$ | | |

$ | |

| Hyperimmune products revenue | |

| - | | |

| 2,355,580 | | |

| - | | |

| 2,355,580 | |

| Cost of sales of goods | |

| - | | |

| (775,232 | ) | |

| - | | |

| (775,232 | ) |

| Gross profit | |

| - | | |

| 1,580,348 | | |

| - | | |

| 1,580,348 | |

| | |

| | | |

| | | |

| | | |

| | |

| Other income | |

| 2,478,366 | | |

| 6,987 | | |

| - | | |

| 2,485,353 | |

| Other gains/(losses) – net | |

| - | | |

| - | | |

| (750,560 | ) | |

| (750,560 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| General and administrative expenses/adjustments | |

| - | | |

| 233 | | |

| (1,949,463 | ) | |

| (1,949,230 | ) |

| Research and development expenses | |

| (2,653,086 | ) | |

| - | | |

| - | | |

| (2,653,086 | ) |

| Selling and marketing expenses | |

| - | | |

| (732,853 | ) | |

| - | | |

| (732,853 | ) |

| Operating profit/(loss) | |

| (174,720 | ) | |

| 854,715 | | |

| (2,700,023 | ) | |

| (2,020,028 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Finance income | |

| - | | |

| - | | |

| 153,508 | | |

| 153,508 | |

| Finance costs | |

| - | | |

| - | | |

| (4,007 | ) | |

| (4,007 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Share of loss from equity accounted associate | |

| - | | |

| - | | |

| (202,655 | ) | |

| (202,655 | ) |

| Profit/(loss) for the period | |

| (174,720 | ) | |

| 854,715 | | |

| (2,753,177 | ) | |

| (2,073,182 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Assets | |

| | | |

| | | |

| | | |

| | |

| Segment assets | |

| 445,996 | | |

| 2,715,183 | | |

| 16,721,537 | | |

| 19,882,716 | |

| Total assets | |

| 445,996 | | |

| 2,715,183 | | |

| 16,721,537 | | |

| 19,882,716 | |

| | |

| | | |

| | | |

| | | |

| | |

| Liabilities | |

| | | |

| | | |

| | | |

| | |

| Segment liabilities | |

| 220,791 | | |

| 1,170,374 | | |

| 965,036 | | |

| 2,356,201 | |

| Total liabilities | |

| 220,791 | | |

| 1,170,374 | | |

| 965,036 | | |

| 2,356,201 | |

2. Revenue from contract with customers

The

group derives revenue from the transfer of hyperimmune products at a point in time in the following major product lines and geographical

regions:

| | |

Travelan | | |

Travelan | | |

Travelan | | |

Protectyn | | |

| |

| | |

Australia | | |

United states | | |

Canada | | |

Australia | | |

Total | |

| Consolidated - 31 December 2024 | |

$ | | |

$ | | |

$ | | |

$ | | |

$ | |

| Segment revenue | |

| 2,858,265 | | |

| 731,213 | | |

| 376,406 | | |

| 28,457 | | |

| 3,994,341 | |

| Revenue from external customers | |

| 2,858,265 | | |

| 731,213 | | |

| 376,406 | | |

| 28,457 | | |

| 3,994,341 | |

| | |

Travelan | | |

Travelan | | |

Travelan | | |

Protectyn | | |

| |

| | |

Australia | | |

United states | | |

Canada | | |

Australia | | |

Total | |

| Consolidated - 31 December 2023 | |

$ | | |

$ | | |

$ | | |

$ | | |

$ | |

| Segment revenue | |

| 1,853,048 | | |

| 481,920 | | |

| - | | |

| 20,612 | | |

| 2,355,580 | |

| Revenue from external customers | |

| 1,853,048 | | |

| 481,920 | | |

| - | | |

| 20,612 | | |

| 2,355,580 | |

Immuron

Limited

Notes

to the consolidated financial statements

31

December 2024

| | |

Consolidated | |

| | |

31 December

2024 | | |

31 December

2023 | |

| | |

$ | | |

$ | |

| Australian R&D tax incentive refund | |

| 292,212 | | |

| 219,609 | |

| MTEC R&D grant | |

| 146,252 | | |

| 2,258,757 | |

| HJF R&D grant | |

| 124,164 | | |

| - | |

| Other income | |

| 9,522 | | |

| 6,987 | |

| | |

| 572,150 | | |

| 2,485,353 | |

| 4. | Trade

and other receivables |

| | |

Consolidated | |

| | |

31 December

2024 | | |

30 June

2024 | |

| | |

$ | | |

$ | |

| Current assets | |

| | |

| |

| Trade receivables | |

| 1,185,501 | | |

| 607,436 | |

| Less: Allowance for expected credit losses | |

| (37,229 | ) | |

| (16,233 | ) |

| | |

| 1,148,272 | | |

| 591,203 | |

| | |

| | | |

| | |

| Australian R&D tax incentive refund | |

| 1,060,582 | | |

| 768,370 | |

| Other grants | |

| - | | |

| 28,000 | |

| Other receivables | |

| 32,482 | | |

| - | |

| Total trade and other receivables | |

| 2,241,336 | | |

| 1,387,573 | |

Classification

as trade receivables

Trade

receivables are amounts due from customers for goods sold or services performed in the ordinary course of business. They are generally

due for settlement within 30 days and therefore are all classified as current. Trade receivables are recognised initially at the amount

of consideration that is unconditional unless they contain significant financing components, when they are recognised at fair value.

The group holds the trade receivables with the objective to collect the contractual cash flows and therefore measures them subsequently

at amortised cost using the effective interest method.

| 5. | Equity

securities issued |

| | |

Consolidated | |

| | |

31 December

2024 | | |

30 June

2024 | | |

31 December

2024 | | |

30 June

2024 | |

| | |

Shares | | |

Shares | | |

$ | | |

$ | |

| Ordinary shares - fully paid | |

| 229,145,429 | | |

| 227,998,346 | | |

| 88,587,043 | | |

| 88,504,043 | |

Movements

in ordinary shares:

| Details | |

Date | |

Shares | | |

$ | |

| Balance | |

1 July 2024 | |

| 227,998,346 | | |

| 88,504,043 | |

| Issue of shares on the exercise of performance rights at $0.0 per share. (2024-10-07) | |

| |

| 1,147,083 | | |

| 83,000 | |

| Balance | |

31 December 2024 | |

| 229,145,429 | | |

| 88,587,043 | |

Rights

of each type of share

Ordinary

shares entitle the holder to participate in dividends and the proceeds on winding up of the company in proportion to the number of shares

held. On a show of hands every holder of ordinary shares present at a meeting or by proxy, is entitled to one vote upon a poll every

holder is entitled to one vote per share held. The ordinary shares have no par value.

Immuron

Limited

Notes

to the consolidated financial statements

31

December 2024

| | |

Consolidated | |

| | |

31 December

2024 | | |

30 June

2024 | |

| | |

$ | | |

$ | |

| Foreign currency reserve | |

| 100,868 | | |

| 114,476 | |

| Share-based payments reserve | |

| 2,148,953 | | |

| 3,059,321 | |

| | |

| 2,249,821 | | |

| 3,173,797 | |

Movements

in reserves

Movements

in each class of reserve during the current financial period are set out below:

| | |

Share-based | | |

Foreign

currency | | |

| |

| | |

payments | | |

translation | | |

Total | |

| Consolidated | |

$ | | |

$ | | |

$ | |

| | |

| | |

| | |

| |

| Balance at 1 July 2024 | |

| 3,059,321 | | |

| 114,476 | | |

| 3,173,797 | |

| Currency Translation Differences | |

| - | | |

| (13,608 | ) | |

| (13,608 | ) |

| | |

| | | |

| | | |

| | |

| Transactions with owners in their capacity as owners | |

| | | |

| | | |

| | |

| Expired options | |

| (959,867 | ) | |

| - | | |

| (959,867 | ) |

| Options and warrants expensed | |

| 48,303 | | |

| - | | |

| 48,303 | |

| Issue of performance rights (note 7) | |

| 84,196 | | |

| - | | |

| 84,196 | |

| Exercise of Performance rights | |

| (83,000 | ) | |

| - | | |

| (83,000 | ) |

| | |

| | | |

| | | |

| | |

| Balance at 31 December 2024 | |

| 2,148,953 | | |

| 100,868 | | |

| 2,249,821 | |

| (i) | Nature

and purpose of reserves |

Share-based

payments:

The

share-based payment reserve records items recognised as expenses on valuation of share options and warrants issued to key management

personnel, other employees and eligible contractors.

Foreign

currency translation:

Exchange

differences arising on translation of foreign controlled entities are recognised in other comprehensive income as described in note and

accumulated in a separate reserve within equity.

Movements

in options and warrants

| | |

Number of | | |

| |

| Details | |

options and

rights | | |

$ | |

| Balance as at 1 July 2024 | |

| 15,194,959 | | |

| 3,059,321 | |

| Options expired 13 November 2024 at $0.12 | |

| (7,900,000 | ) | |

| (948,000 | ) |

| Options expired 16 July 2024 at $0.1022 | |

| (116,120 | ) | |

| (11,867 | ) |

| Options issue 18 November 2024 at $0.13 (note 7) | |

| 1,000,000 | | |

| 10,973 | |

| Options issue 18 November 2024 at $0.145 (note 7) | |

| 2,000,000 | | |

| 30,814 | |

| Expense for previously issued options | |

| - | | |

| 6,516 | |

| Performance rights issue (note7) | |

| 5,386,810 | | |

| 84,196 | |

| Exercise of performance rights | |

| (1,147,083 | ) | |

| (83,000 | ) |

| Balance as at 31 December 2024 | |

| 14,418,566 | | |

| 2,148,953 | |

The

cumulative amount is reclassified to profit or loss when the net investment is disposed of.

Immuron

Limited

Notes

to the consolidated financial statements

31

December 2024

Performance

rights:

Performance

rights which can be settled in shares, were granted to key management personnel and employees during the period. The expense for the

period ended 31 December 2024 was $84,196. The performance rights are based on non- market weighted key performance indicators (KPls)

and have been expensed over the service period, based on the probability the KPls being achieved. The performance rights are expected

to vest between one and four years.

Options:

Options

were approved at the Annual General Meeting, held on 18 November 2024 for Prof. Ravi Savarirayan and Mr. Daniel Pollock of 1,000,000

each. The option exercise price is $0.145 and they have an expiry date of 20 August 2028. The expense for the period was $30,814.

Options

were granted to Dr. Jeanette Joughin on 18 June 2024 but were subject to shareholder approval obtained on 18 November 2024. The expense

of $10,973 recorded in the period includes an adjustment for the revised estimate of fair value on the grant date of 18 November 2024.

Fair

value is determined using the Black-Scholes option pricing model that takes into account the exercise price, term of the award, security

price at grant date, expected volatility, expected dividend yield and the risk-free interest rate.

The

model inputs for the options granted during the period:

| Grant date | |

Expiry

date | |

Exercise

price ($A) | | |

No. of

options | | |

Share

price at

grant date | | |

Expected

volatility | | |

Dividend

yield | | |

Risk-free

interest

rate | | |

Fair value

at grant

date per

option | |

| 18-NOV-24 | |

20-AUG-28 | |

$ | 0.145 | | |

| 2,000,000 | | |

$ | 0.078 | | |

| 88.65 | % | |

| 0.00 | % | |

| 4.09 | % | |

$ | 0.035 | |

| 18-NOV-24 | |

19-JUN-28 | |

$ | 0.13 | | |

| 1,000,000 | | |

$ | 0.078 | | |

| 88.65 | % | |

| 0.00 | % | |

| 4.09 | % | |

$ | 0.035 | |

The

group had no contingent liabilities at 31 December 2024. (30 June 2024 : $nil)

| 9. | Events

after the reporting period |

On

8 January 2025 Immuron raised $225,471 through an At The Market Facility comprising 2,579,760 shares at an issue price of $0.0874 per

share.

On

15 January 2025 Immuron raised $152,603 through an At The Market Facility comprising 1,801,680 shares at an issue price of $0.0847 per

share.

No

other matter or circumstance has arisen since 31 December 2024 that has significantly affected, or may significantly affect the group’s

operations, the results of those operations, or the group’s state of affairs in future financial years.

| 10. | Related

party transactions |

| a) | Subsidiaries

and associates |

Interests

in subsidiaries and associates are set out in note 11 and 12 respectively.

Immuron

Limited

Notes

to the consolidated financial statements

31

December 2024

| 10. | Related

party transactions (continued) |

| b) | Transactions

with other related parties |

The

following transactions occurred with related parties:

| | |

Consolidated | |

| | |

31 December

2024 | | |

31 December

2023 | |

| | |

$ | | |

$ | |

| Purchases of goods and services | |

| | |

| |

| Purchases of various goods and services from entities controlled by key management personnel | |

| - | | |

| 52,989 | |

| Options and warrants expense (note 6) | |

| 48,303 | | |

| 8,921 | |

| Options issued in the period | |

| - | | |

| (30,501 | ) |

| Performance bonuses to key management personnel (i) | |

| 92,538 | | |

| 124,416 | |

| Issue of performance rights (note 6) | |

| 84,196 | | |

| - | |

| Exercise of performance rights (note 6) | |

| (83,000 | ) | |

| - | |

(i)

Performance bonuses relate to key management personnel short term incentive plan for the period ended 31 December 2024.

| 11. | Interest

and other entities |

a)

Material subsidiaries

The

group’s principal subsidiaries at 31 December 2024 are set out below. Unless otherwise stated, they have share capital consisting

solely of ordinary shares that are held directly by the group, and the proportion of ownership interests held equals the voting rights

held by the group. The country of incorporation or registration is also their principal place of business.

| | |

| |

Ownership interest by the group | |

| Name of entity | |

Principal place of business /

Country of incorporation | |

31 December

2024 | | |

31 December

2023 | |

| | |

| |

| % | | |

| % | |

| Immuron Inc. | |

United States | |

| 100 | % | |

| 100 | % |

| Immuron Canada Limited | |

Canada | |

| 100 | % | |

| 100 | % |

| Anadis EPS Pty Ltd | |

Australia | |

| 100 | % | |

| 100 | % |

Immuron

Limited

Notes

to the consolidated financial statements

31

December 2024

| 12. | Interests

in associates |

Immuron

has a 23.6% interest in Ateria Health Limited (Ateria). The investment was impaired to nil during the 2024 financial year and there has

been no changes to this in the period ended 31 December 2024.

| | |

| |

Ownership interest | |

| Name of entity | |

Principal place of business /

Country of incorporation | |

31 December

2024 | | |

31 December

2023 | |

| | |

| |

% | | |

% | |

| Ateria Health Limited | |

United Kingdom | |

| 23.60 | % | |

| 17.50 | % |

Ateria

was impaired to NIL during the prior financial year.

Summarised

financial information for associates

| | |

Consolidated | |

| | |

31 December

2024 | | |

31 December

2023 | |

| | |

$ | | |

$ | |

| Share of loss for the period | |

| - | | |

| (202,655 | ) |

The

carrying amount of investment in associate is zero, therefore no share of the loss has been recognised for 31 December 2024.

13. Loss per share

| | |

Consolidated | |

| | |

31 December

2024 | | |

31 December

2023 | |

| | |

$ | | |

$ | |

| Loss after tax for the period attributable to members | |

| (2,488,819 | ) | |

| (2,073,182 | ) |

| | |

Number | | |

Number | |

| Weighted average number of ordinary shares used in calculating basic and dilutive loss per share | |

| 228,528,248 | | |

| 227,798,346 | |

| | |

| 228,528,248 | | |

| 227,798,346 | |

The

group is currently in a loss making position and thus the impact of any potential shares is concluded as anti-dilutive which includes

the group’s options and warrants. Treasury shares are excluded from the calculation of weighted average number of ordinary shares.

Immuron

Limited

Notes

to the consolidated financial statements

31

December 2024

14.

Basis of preparation of half-year report

This

consolidated interim financial report for the half-year reporting period ended 31 December 2024 has been prepared in accordance with

Accounting Standard AASB 134 Interim Financial Reporting and the Corporations Act 2001.

The

consolidated financial statements of the Immuron Limited group also comply with International Financial Reporting Standards (IFRS) as

issued by the International Accounting Standards Board (IASB).

These

consolidated financial statements do not include all the notes of the type normally included in an annual financial report. Accordingly,

this report is to be read in conjunction with the annual report for the year ended 30 June 2024 and any public announcements made by

Immuron Limited during the interim reporting period in accordance with the continuous disclosure requirements of the Corporations Act

2001.

Material

Accounting Policy Information

The

accounting policies adopted are consistent with those of the previous financial year and corresponding interim reporting period, unless

otherwise stated. The Interim Financial Statements have been approved and authorised for issue by the board on 28 February 2025.

(a)

Going Concern

For

the half year ended 31 December 2024, the Company incurred a loss after income tax of $2,488,819 (31 December 2023: $2,073,182). Net

cash outflow from operations was $3,993,384 (31 December 2023: $2,003,836).

The

Company expects to continue to incur losses and cash outflows for the foreseeable future as it continues research and development exploiting

its technology platform and continues to expand commercial operations for the promotion and distribution of Hyperimmune products and

future market opportunities.

The

Company had $7,736,398 cash and cash equivalents as at 31 December 2024. During January 2025: (1) Immuron received $768,433 from the

Australian Taxation Office, and (2) raised $378,074 via its At the Market facility (“ATM”).

Note

1 (Segment and revenue information) shows Hyperimmune products (primarily Travelan®) commercialisation generated an operating profit

for the half year ended 31 December 2024 of $1,064,396 (31 December 2023: $854,715) up 25% on the prior comparative period. One of the

KPIs referenced in Note 7 (Share-based payments) is a Long Term Incentive (“LTI”) target of achieving breakeven Earnings

Before Interest Tax and Research & Development Income/Expense (EBITRD) through increasing operating profits generated from commercial

operations.

On

July 3, 2024, Immuron announced that H.C. Wainwright & Co,, LLC will provided up to approximately US$2 million of funding via an

ATM. Immuron utilised this ATM in January 2025 taking advantage of higher than typical trading volumes on Nasdaq and prices in excess

of the ASX equivalent at the time. The balance of this ATM remains available to Immuron should the Company require additional funding.

The

Directors share the view that based on outflow of cash for operations for the half year ended 31 December 2024, its existing cash reserves,

forecast product sales and a historically proven ability to raise funds from both existing shareholders and equity markets, the Company

will be able to fund operations for at least the next 12 months. The financial statements have therefore been prepared on a going concern

basis.

Immuron

Limited

Notes

to the consolidated financial statements

31

December 2024

In

the directors’ opinion:

| ● | the

attached financial statements and notes comply with the Corporations Act 2001, Australian Accounting Standard AASB 134 ‘Interim

Financial Reporting’, the Corporations Regulations 2001 and other mandatory professional reporting requirements; |

| ● | the

attached financial statements and notes give a true and fair view of the group’s financial position as at 31 December 2024 and

of its performance for the financial period ended on that date; and |

| ● | there

are reasonable grounds to believe that the company will be able to pay its debts as and when they become due and payable. |

Signed in accordance with

a resolution of directors made pursuant to section 303(5)(a) of the Corporations Act 2001.

On behalf of the directors

|

|

| Mr Paul Brennan |

|

| Independent Non-Executive Chairman |

|

| |

|

| 28 February 2025 |

|

| |

Grant Thornton Audit Pty Ltd |

| |

Level 22 Tower 5

Collins Square

727 Collins Street

Melbourne VIC 3008

GPO Box 4736

Melbourne VIC 3001

T +61 3 8320 2222 |

Independent

Auditor’s Review Report

To the Members of Immuron Limited

Report on the half-year

financial report

Conclusion

We have reviewed the accompanying half-year financial

report of Immuron Limited (the Company) and its subsidiaries (the Group), which comprises the consolidated statement of financial position

as at 31 December 2024, and the consolidated statement of profit or loss and other comprehensive income, consolidated statement of changes

in equity and consolidated statement of cash flows for the half-year ended on that date, including material accounting policy information,

other selected explanatory notes, and the directors’ declaration.

Based on our review, which is not an audit, we have

not become aware of any matter that makes us believe that the accompanying half-year financial report of Immuron Limited does not comply

with the Corporations Act 2001 including:

| a | giving a true and fair view of the Group’s financial position

as at 31 December 2024 and of its performance for the half-year ended on that date; and |

| b | complying with Accounting Standard AASB 134 Interim Financial

Reporting and the Corporations Regulations 2001. |

Basis for Conclusion

We conducted our review in accordance with ASRE 2410

Review of a Financial Report Performed by the Independent Auditor of the Entity. Our responsibilities are further described in

the Auditor’s Responsibilities for the Review of the Financial Report section of our report. We are independent of the Company

in accordance with the auditor independence requirements of the Corporations Act 2001 and the ethical requirements of the Accounting

Professional and Ethical Standards Board’s APES 110 Code of Ethics for Professional Accountants (including Independence Standards)

(the Code) that are relevant to our audit of the annual financial report in Australia. We have also fulfilled our other ethical responsibilities

in accordance with the Code.

www.grantthornton.com.au

ACN-130 913 594

Grant

Thornton Audit Pty Ltd ACN 130 913 594 a subsidiary or related entity of Grant Thornton Australia Limited ABN 41 127 556 389 ACN 127

556 389. ‘Grant Thornton’ refers to the brand under which the Grant Thornton member firms provide assurance, tax and advisory

services to their clients and/or refers to one or more member firms, as the context requires. Grant Thornton Australia Limited is a member

firm of Grant Thornton International Ltd (GTIL). GTIL and the member firms are not a worldwide partnership. GTIL and each member firm

is a separate legal entity. Services are delivered by the member firms. GTIL does not provide services to clients. GTIL and its member

firms are not agents of, and do not obligate one another and are not liable for one another’s acts or omissions. In the Australian

context only, the use of the term ‘Grant Thornton’ may refer to Grant Thornton Australia Limited ABN 41 127 556 389 ACN 127

556 389 and its Australian subsidiaries and related entities. Liability limited by a scheme approved under Professional Standards Legislation.

Directors’

responsibility for the half-year financial report

The

Directors of the Company are responsible for the preparation of the half-year financial report that gives a true and fair view in accordance

with Australian Accounting Standards and the Corporations Act 2001 and for such internal control as the Directors determine is

necessary to enable the preparation of the half-year financial report that gives a true and fair view and is free from material misstatement,

whether due to fraud or error.

Auditor’s

responsibility for the review of the financial report

Our

responsibility is to express a conclusion on the half-year financial report based on our review. We conducted our review in accordance

with Auditing Standard on Review Engagements ASRE 2410 Review of a Financial Report Performed by the Independent Auditor of the Entity,

in order to state whether, on the basis of the procedures described, we have become aware of any matter that makes us believe that the

half year financial report is not in accordance with the Corporations Act 2001 including giving a true and fair view of the Group’s

financial position as at 31 December 2024 and its performance for the half-year ended on that date, and complying with Accounting Standard

AASB 134 Interim Financial Reporting and the Corporations Regulations 2001.

A

review of a half-year financial report consists of making enquiries, primarily of persons responsible for financial and accounting matters,

and applying analytical and other review procedures. A review is substantially less in scope than an audit conducted in accordance with

Australian Auditing Standards and consequently does not enable us to obtain assurance that we would become aware of all significant matters

that might be identified in an audit. Accordingly, we do not express an audit opinion.

Grant

Thornton Audit Pty Ltd

Chartered Accountants

T

S Jackman

Partner

– Audit & Assurance

Melbourne, 28 February 2025

| |

Grant Thornton Audit Pty Ltd |

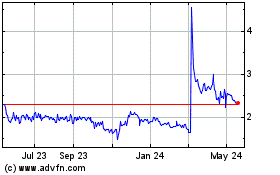

Immuron (NASDAQ:IMRN)

Historical Stock Chart

From Feb 2025 to Mar 2025

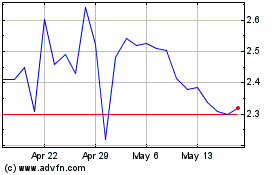

Immuron (NASDAQ:IMRN)

Historical Stock Chart

From Mar 2024 to Mar 2025